Professional Documents

Culture Documents

Ward Busn460 Financial Analysis Project Week 3 8 12

Uploaded by

api-255829805Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ward Busn460 Financial Analysis Project Week 3 8 12

Uploaded by

api-255829805Copyright:

Available Formats

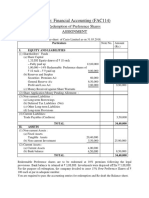

BUSN460 Individual Financial Analysis Project

Student Name:

Instructions:

Go to the CanGo intranet found in the Report Guide tab under Course Home

Use the financial statements from the most recent year to fill in the table below.

You may find some formulae calling for an average, e.g., average inventory, average receivables.

Because we only have the Balance sheet for one year, you can only use the one year number not an average.

Assume interest expense is $0.00

Be careful of the Debt equity ratio. The review covers debt asset ratio as an example of how to calculate ratios and that is different from debt equity ratio,

and that is different from the debt equity ratio so think about how you calculate the debt equity ratio using the debt asset ratio as an example.

Be sure to cite your references

Green boxes to be filled in by instructor

Ratio Formula (express the ratio

in words)

Detailed calculation (actual

numbers from financial

statements used for the

calculation)

Final number

(final result of

the detailed

calculation)

Example: Term A/Term B (Term A

divided by Term B)

1000/2000 .50

Efficiency Ratio:

Receivables

Turnover

Net Sales/Average Gross

Receivables 50,000,000/31,120,000 1.6

Grade for above

Efficiency Ratio:

Inventory

Turnover

Cost of Goods Sold/Average

Inventory 9,000,000/32,000,000 0.28

Grade for above

Financial

Leverage Ratio:

Debt/Equity Ratio Total Debt/Total Equity 57,400,000/141,000,000 0.4

Grade for above

Liquidity Ratio:

Current Ratio

Current Assets/Current

Liabilities 202,900,000/37,500,000 5.4

Grade for above

Liquidity Ratio:

Quick Ratio

Cash + Marketable Securities

+ Accounts

Receivable/Current Liabilities

20,900,000 + 117,000,000 +

32,120,000/37,500,000 4.5

Grade for above

Liquidity: Working

Capital

Current Assets-Current

Liabilities 202,900,000 - 37,500,000 165,400,000

Grade for above

Profitability Ratio:

Return on Assets

Net Income/(Beginning

Assets + Ending Assets)/2

5,486,000/(170,020,000 +

235,900,000)/2 0.03

Grade for above

Profitability Ratio:

Return on Sales Net Income/Net Sales 5,486,000/50,000,000 0.11

Grade for above

Total Earned

Points

Credit Research Foundation. (1999). Ratios and Formulas in Customer Financial Analysis. Retrieved March 21, 2014, from CRF:

http://www.crfonline.org/orc/cro/cro-16.html

Because we only have the Balance sheet for one year, you can only use the one year number not an average.

Be careful of the Debt equity ratio. The review covers debt asset ratio as an example of how to calculate ratios and that is different from debt equity ratio,

and that is different from the debt equity ratio so think about how you calculate the debt equity ratio using the debt asset ratio as an example.

Explanation of why ratio is important Earned points

(up to 3 points

per "box"/cell)

Instructor feedback

This is the explanation of the role of this ratio and why it is important 3

Indicates the liquidity of the company's receivables.

0.0

Indicates the liquidity of the inventory.

0.0

Indicates how well creditors are protected in case of the company's

insolvency

0.0

Provides an indication of the liquidity of the business by comparing the

amount of current assets to current liabilities.

0.0

A measurement of the liquidity position of the business. The quick ratio

compares the cash plus cash equivalents and accounts receivable to the

current liabilities.

0.0

Working capital compares current assets to current liabilities, and serves

as the liquid reserve available to satisfy contingencies and uncertainties.

A high working capital balance is mandated if the entity is unable to

borrow on short notice. The ratio indicates the short-term solvency of a

business and in determining if a firm can pay its current liabilities when

due.

0.0

Measures the company's ability to utilize its assets to create profits.

0.0

A measure of net income dollars generated by each dollar of sales

0.0

0.0

Credit Research Foundation. (1999). Ratios and Formulas in Customer Financial Analysis. Retrieved March 21, 2014, from CRF:

http://www.crfonline.org/orc/cro/cro-16.html

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- C05 Revenue Recognition - Percentage Completion AccountingDocument16 pagesC05 Revenue Recognition - Percentage Completion AccountingBrooke CarterNo ratings yet

- Solution Manual For Case Studies in Finance 8th BrunerDocument13 pagesSolution Manual For Case Studies in Finance 8th BrunerDerekWrightjcio100% (33)

- Sample FsDocument3 pagesSample FsLocel Maquiran LamosteNo ratings yet

- From NetDocument51 pagesFrom NetAsma ShoaibNo ratings yet

- Discussion 1 Second Sem .PDF-1Document11 pagesDiscussion 1 Second Sem .PDF-1Io Aya100% (2)

- Ch.12 - 13ed Fin Planning & ForecastingDocument46 pagesCh.12 - 13ed Fin Planning & ForecastingAhmedShujaNo ratings yet

- ASE 3902 - IAS - Revised Syllabus - Answers To Specimen Paper 2008 16307Document8 pagesASE 3902 - IAS - Revised Syllabus - Answers To Specimen Paper 2008 16307WinnieOngNo ratings yet

- Principles of Accounting (Grade-XI) : Welcome To You in Global College of ManagementDocument57 pagesPrinciples of Accounting (Grade-XI) : Welcome To You in Global College of ManagementNirajan Jaiswal KalwarNo ratings yet

- Instapdf - in Accounting Ratios Class 12 All Formulas 176Document18 pagesInstapdf - in Accounting Ratios Class 12 All Formulas 176Subhavi DikshitNo ratings yet

- Assignment# 3: Submitted byDocument14 pagesAssignment# 3: Submitted byHassan AwaisNo ratings yet

- Polaroid Corporation ENGLISHDocument14 pagesPolaroid Corporation ENGLISHAtul AnandNo ratings yet

- FAC114 Financial Accounting Redemption of Preference SharesDocument4 pagesFAC114 Financial Accounting Redemption of Preference SharesDhairya ShahNo ratings yet

- Jawaban Kiesso2Document9 pagesJawaban Kiesso2harryirawanaNo ratings yet

- Accounting Principle Kieso 8e - Ch04Document45 pagesAccounting Principle Kieso 8e - Ch04Sania M. JayantiNo ratings yet

- m2.2f Diy MCQ Answer KeyDocument6 pagesm2.2f Diy MCQ Answer KeyaapNo ratings yet

- Entrepreneurship: Question and Answer BookDocument79 pagesEntrepreneurship: Question and Answer Bookbacktrx100% (1)

- Acca Fa M3 PDFDocument14 pagesAcca Fa M3 PDFtommydunkNo ratings yet

- Actg1 - Chapter 3Document37 pagesActg1 - Chapter 3Reynaleen Agta100% (1)

- Parto and Sule Merger Financial StatementsDocument11 pagesParto and Sule Merger Financial StatementsYhogan JayaNo ratings yet

- Partnership Operation: Learning Module 3Document23 pagesPartnership Operation: Learning Module 3Nico Angeles MenesesNo ratings yet

- Simbol TradingDocument25 pagesSimbol TradingEmman ElagoNo ratings yet

- Consolidate Banking SistemDocument104 pagesConsolidate Banking SistemandreeavasiuNo ratings yet

- Cooler Times Engineering Services Business PlanDocument43 pagesCooler Times Engineering Services Business PlanVictor korirNo ratings yet

- ARTS CPA Review Multiple Choice ProblemsDocument3 pagesARTS CPA Review Multiple Choice ProblemsRuffa Mae MaldoNo ratings yet

- Tugas 2 - AKL 1Document2 pagesTugas 2 - AKL 1Geroro D'PhoenixNo ratings yet

- Chapter-3Document30 pagesChapter-3Catherine Rivera100% (1)

- 05 Fisher Account 5e v1 PPT ch05Document60 pages05 Fisher Account 5e v1 PPT ch05yuqi liuNo ratings yet

- Analyzing Financial Statements and Calculating Key RatiosDocument10 pagesAnalyzing Financial Statements and Calculating Key RatiosJustin David SanducoNo ratings yet

- FAR Diagnostic ExamDocument7 pagesFAR Diagnostic ExamDaniel Huet0% (1)

- Coffee Shop Business Plan SummaryDocument14 pagesCoffee Shop Business Plan Summarymeenuchoudharyoffice100% (1)