Professional Documents

Culture Documents

Preface

Uploaded by

Arpit GuptaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Preface

Uploaded by

Arpit GuptaCopyright:

Available Formats

ACKNOWLEDGEMENT

The completion of any task is the reward to not only persons actively involved

in accomplishing it, but also to the people involved in inspiring, guiding and

helping those people. We take the opportunity here to thank all those who are

helping us in this project, without which this indeed, would have been, a

mammoth task. Yet, this project wouldnt have been possible without the

unrelenting care and support of many people. A Project is never the sole

product of a person whose name has appeared on the cover. Even the best

effort may not prove successful without guidance.

We owe our deepest gratitude to Mr. S.P Tripathi for giving us an ample

opportunity to carry out this Project.

Thanking you,

Arpit Gupta

PREFACE

With the rapid globalization of the Indian economy, enterprises are facing with

ever changing competitive environment. Enterprises are adopting strategies

aimed at developing competitive advantage based on enhanced customer value

in terms of product differentiation, quality, speed, service and costs. In the post

liberalization era, with the deregulation of Indian economy, the financial service

sector witnessing a complete metamorphosis and technology is playing a very

significant role in this record. Over the last decade India has been one of the

fastest adopters of information technology, particularly because of its capability

to provide software solution to organizations around the world. This capability

has provided a tremendous impetuous to the domestic banking industry in India

to deploy the latest in technology, particularly in the Internet banking and e-

commerce arenas. Banks are growing in size by mergers and acquisitions,

which have been driven by communication and technology. Technology is

playing a major role in increasing the efficiency, courtesy and speed of

customer service. It is said to be the age of E-banking. An Online Banking user

is expected to perform at least one of the following transactions online:

1. Checking account balance

2. Transaction

3. Paying bills

4. Transferring funds between accounts

5. Calculate EMI and Loan interests

From a banks perspective, using the Internet is more efficient than using other

distribution mediums because banks are looking for an increased customer base.

Using multiple distribution channels increases effective market coverage by

enabling different products to be targeted at different demographic segments.

Also Banks cannot risk losing customers to competitors within the aggressive

competition in the banking industry around the world. Moreover Internet

delivery offers customized service to suit the needs and the likes of each user.

Mass customization happens effectively through Online Banking. It reduces

cost and replaces time spent on routine errands with spending time on business

errands. Online Banking means less staff members, smaller infrastructure

demands, compared with other banking channels. From the customers

perspective, Online Banking provides a convenient and effective way to manage

finances that is easily accessible 24 hours a day, seven days a week. In addition

information is up to date. Nevertheless Online Banking has disadvantages for

banks like how to work the technology, set-up cost, legal issues, and lack of

personal contact with customers. And for customers there are security and

privacy issues.

INDEX

S.NO. PARTCULAR PAGE NO.

Certificate

Acknowledgement

Preface

i

ii

iii

1.

Project introduction

1.1 Purpose of document

1.2 Scope of developments

1.3 Overview

1.4 Business context

1-4

1

2

2

4

2. General Description

2.1 Product function

2.2 User problem statement

2.3 User objectives

5-6

5

5

6

3. System Analysis

3.1 Functional requirement

3.1.1 System requirement

3.1.2 Program requirement

3.1.3 Stability & speed

3.2 Feasibility study

3.2.1 Operational

3.2.2 Technical

3.2.3 Economic

6-26

9

10

10

10

10

17

18

26

4. System Design

4.1 Scope

4.2 Database design

4.3 Data flow diagram (DFD)

4.4 Entity relationship diagram(E-R diagram)

4.5 UML Diagram

4.6 Module description

26-38

27

27

32

36

37

38

5. Interface requirement

5.1 Graphical interface

5.2 Command line interface

5.3 Hardware interface

5.4 Software interface

40-41

40

40

40

41

6. Performance requirement 42-44

7. Non functional attributes

7.1 Security

7.2 Reliability

7.3 Maintainability

7.4 Portability

7.5 Reusability

7.6 Resource utilization

7.7 Stable and speed efficiency

44-46

44

44

44

45

45

45

46

8. Security

8.1 Description

8.2 Technical issues

8.3 Cost and schedule

8.4 Risk

47-48

47

47

47

48

Annexure A- Screenshots

Annexure B- Sample Coding

50-59

60-68

9. Reference & Appendices 69

10. Conclusion 70

You might also like

- Introduction of E CommerceDocument2 pagesIntroduction of E CommerceAkanksha KadamNo ratings yet

- Online Banking Project ReportDocument27 pagesOnline Banking Project ReportruPAM DeyNo ratings yet

- Project AcknowledgementDocument2 pagesProject AcknowledgementTanzila Mulla100% (2)

- Project Report On Online BankingDocument24 pagesProject Report On Online BankingDrSanjeev K Chaudhary100% (3)

- Online Banking Services Icici BankDocument51 pagesOnline Banking Services Icici BankMubeenNo ratings yet

- Financial Services Industry FutureDocument3 pagesFinancial Services Industry FutureVickySalve0% (1)

- Online Banking IIDocument54 pagesOnline Banking IINitin SharmaNo ratings yet

- Black Book ProjectDocument23 pagesBlack Book ProjectAtharv KoyandeNo ratings yet

- A Study On E-Banking Services of Axis Bank LTD: Submitted ToDocument12 pagesA Study On E-Banking Services of Axis Bank LTD: Submitted ToNavyug NavNo ratings yet

- Online Banking RevolutionDocument24 pagesOnline Banking RevolutionAxE GhostNo ratings yet

- Online Banking Services Icici BankDocument10 pagesOnline Banking Services Icici BankMohmmedKhayyumNo ratings yet

- QestionnaireDocument4 pagesQestionnairePreet AmanNo ratings yet

- MJ Customer Satisfaction of BSNL ProductsDocument97 pagesMJ Customer Satisfaction of BSNL ProductsMOHIT KASHYAP100% (1)

- A Project On Internet BankingDocument90 pagesA Project On Internet BankingSahana P RaoNo ratings yet

- Alternate Revenue Sources Bank IDBI BankDocument35 pagesAlternate Revenue Sources Bank IDBI Bankalkanm75060% (5)

- Internet BankingDocument67 pagesInternet BankingRaj Kumar0% (2)

- QuestionaireDocument4 pagesQuestionaireBhargavChaudhariNo ratings yet

- Karan Khanna - B.com Hons - Online BankingDocument81 pagesKaran Khanna - B.com Hons - Online BankingMd SaquibNo ratings yet

- Internet Banking Project DocumentationDocument24 pagesInternet Banking Project Documentationani_198883% (75)

- Project On E-BankingDocument58 pagesProject On E-BankingNirmal78% (55)

- Personal LoanDocument31 pagesPersonal LoanAravindVenkatraman100% (1)

- E Banking ReportDocument40 pagesE Banking ReportVansh Patel100% (2)

- QUESTIONAIREDocument3 pagesQUESTIONAIREsunny12101986No ratings yet

- A Report onE-BankingDocument123 pagesA Report onE-Bankingsachin91% (74)

- Customer Perception Towards Internet Banking PDFDocument17 pagesCustomer Perception Towards Internet Banking PDFarpita waruleNo ratings yet

- Internet Banking in SBIDocument66 pagesInternet Banking in SBIsejal kasalkar50% (2)

- E BankingDocument10 pagesE BankingsureshsusiNo ratings yet

- E-Banking Services Provided by SBT to CustomersDocument50 pagesE-Banking Services Provided by SBT to CustomerskomalpreetdhirNo ratings yet

- Customer Satisfaction in Public and Private Sector BanksDocument43 pagesCustomer Satisfaction in Public and Private Sector BanksAnkit Tiwari50% (2)

- A Study On Consumer Perception Towards Mobile Banking Services of State Bank of IndiaDocument45 pagesA Study On Consumer Perception Towards Mobile Banking Services of State Bank of IndiaVijaya Anandhan100% (1)

- Questionnaire On Digital BankingDocument2 pagesQuestionnaire On Digital BankingRohit Shrigadi100% (2)

- Questionnaire Survey For Digital Banking: Name: Bank A/c: A/c Type: A) Current A/c B) Savings A/c C) Salary A/cDocument4 pagesQuestionnaire Survey For Digital Banking: Name: Bank A/c: A/c Type: A) Current A/c B) Savings A/c C) Salary A/cDigwendra kumarNo ratings yet

- E-Banking in India: Sandeep ParmarDocument44 pagesE-Banking in India: Sandeep ParmarVikas SoodNo ratings yet

- Online BankingDocument31 pagesOnline BankingRavi Kashyap506No ratings yet

- E Banking QuestionaireDocument28 pagesE Banking Questionaireletter2lalNo ratings yet

- Sample QuestionnaireDocument4 pagesSample QuestionnaireAnonymous F17qIBHxNo ratings yet

- Customer Awareness and Preference Towards E-Banking Services of Banks (A Study of SBI)Document10 pagesCustomer Awareness and Preference Towards E-Banking Services of Banks (A Study of SBI)aurorashiva1No ratings yet

- E BankingDocument74 pagesE BankingKritika Shiva100% (1)

- Questionnaire On Internet BankingDocument4 pagesQuestionnaire On Internet Bankingcena2115No ratings yet

- A B C D of E-BankingDocument75 pagesA B C D of E-Bankinglove tannaNo ratings yet

- Innovative Products in BankingDocument5 pagesInnovative Products in BankingmamunnnNo ratings yet

- Project Report: Online BankingDocument38 pagesProject Report: Online BankingRoshan ShawNo ratings yet

- Executive Summary of e BankingDocument24 pagesExecutive Summary of e BankingKiranShetty0% (1)

- A Project Report On: E-BankingDocument25 pagesA Project Report On: E-Bankinganami11No ratings yet

- Internet Banking IntroductionDocument4 pagesInternet Banking Introductionaihjaaz a71% (7)

- Executive SummaryDocument51 pagesExecutive SummaryDhawal TankNo ratings yet

- A Study On CMS in Personal LoanDocument83 pagesA Study On CMS in Personal LoanPallavi Pallu100% (1)

- Internet BankingDocument38 pagesInternet Bankingsonalikhande100% (1)

- Project Report: Proforma 1Document51 pagesProject Report: Proforma 1Pretty AngelNo ratings yet

- SBI Internet BankingDocument21 pagesSBI Internet BankingHiteshwar Singh Andotra60% (5)

- Limitations of E-Banking: Security, Cost, AwarenessDocument1 pageLimitations of E-Banking: Security, Cost, AwarenessanithapblNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Rouble Banking ProjectDocument92 pagesRouble Banking Projectrouble_paulNo ratings yet

- BT ProjectDocument15 pagesBT ProjectSneha KshatriyaNo ratings yet

- Report of Online Banking SystemDocument70 pagesReport of Online Banking SystemHarikesh Shakya85% (126)

- Internet Banking and Mobile Banking - Safe and Secure BankingDocument99 pagesInternet Banking and Mobile Banking - Safe and Secure BankingRehanCoolestBoy0% (1)

- Pt. Deen Dayal Upadhyay Management College Meerut: "Online Banking System"Document21 pagesPt. Deen Dayal Upadhyay Management College Meerut: "Online Banking System"ROHIT YADAVNo ratings yet

- BIKRAM - Digital Banking-1Document86 pagesBIKRAM - Digital Banking-1Anand GuptaNo ratings yet

- Impact of E-Banking Services Provided by United Bank of Inda To Its CustomersDocument66 pagesImpact of E-Banking Services Provided by United Bank of Inda To Its Customerssohinee_deyNo ratings yet

- A Study On Significance of Digitization in Banking ServicesDocument4 pagesA Study On Significance of Digitization in Banking ServicesInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Intranet Messenger: BY Arpit Gupta Nitin Kumar Tarun ChaudharyDocument8 pagesIntranet Messenger: BY Arpit Gupta Nitin Kumar Tarun ChaudharyArpit GuptaNo ratings yet

- Intranet Messenger: Arpit Gupta (1005210014) Nitin Kumar (1005210035) Tarun Chaudhary (1005210052)Document10 pagesIntranet Messenger: Arpit Gupta (1005210014) Nitin Kumar (1005210035) Tarun Chaudhary (1005210052)Arpit GuptaNo ratings yet

- Android TutorialDocument5 pagesAndroid TutorialArpit GuptaNo ratings yet

- Cloud Computing On MobileDocument23 pagesCloud Computing On MobileArpit GuptaNo ratings yet

- Cloud Cube Model v1.0: Selecting Cloud Formations For Secure CollaborationDocument7 pagesCloud Cube Model v1.0: Selecting Cloud Formations For Secure CollaborationRich HintzNo ratings yet

- Cleaning Krisbow 2013 (Low Res) 2Document12 pagesCleaning Krisbow 2013 (Low Res) 2Andres Agung PerdanaNo ratings yet

- Rajib Mall Lecture NotesDocument97 pagesRajib Mall Lecture NotesAnuj Nagpal100% (1)

- DTMF Proximity DetectorDocument1 pageDTMF Proximity DetectorAlagappan ArunachalamNo ratings yet

- BIT3251 BIT3251 BIT3251 BIT3251 應用指南 應用指南 應用指南 應用指南: Beyond Innovation TechnologyDocument10 pagesBIT3251 BIT3251 BIT3251 BIT3251 應用指南 應用指南 應用指南 應用指南: Beyond Innovation TechnologyHamza AbbasiNo ratings yet

- 1 s2.0 S0950061822007966 MainDocument20 pages1 s2.0 S0950061822007966 MainmohammadNo ratings yet

- iPLON India SolutionsDocument4 pagesiPLON India Solutionssudhirm16No ratings yet

- cGMP ChecklistDocument31 pagescGMP ChecklistWerner Schrammel100% (1)

- IEEEtran HOWTO PDFDocument28 pagesIEEEtran HOWTO PDFMario CruzNo ratings yet

- 13.2EN Funds-Flow-Analysis Final V1-1 PDFDocument2 pages13.2EN Funds-Flow-Analysis Final V1-1 PDFvishnupriyaNo ratings yet

- 1st Term Exam Part 2 - QSDocument10 pages1st Term Exam Part 2 - QSMark Anthony TajonNo ratings yet

- Insulation TheoryDocument1 pageInsulation TheoryhatemNo ratings yet

- Keystone Owners Manual 2019 PDFDocument104 pagesKeystone Owners Manual 2019 PDFBreNo ratings yet

- Hydran 201ti Gea12933 HRDocument2 pagesHydran 201ti Gea12933 HRlxd.hepNo ratings yet

- Types of Wind Turbines - Horizontal Axis and Vertical Axis ComparedDocument1 pageTypes of Wind Turbines - Horizontal Axis and Vertical Axis Comparedmendhi123No ratings yet

- Approved List of Manufacturers: Line Pipes (Carbon/Alloy Steel)Document4 pagesApproved List of Manufacturers: Line Pipes (Carbon/Alloy Steel)Sourav Kumar GuptaNo ratings yet

- Strategic Control ProcessDocument18 pagesStrategic Control ProcessMudassir IslamNo ratings yet

- AGA3Document1 pageAGA3Alan BkNo ratings yet

- EY Tax Administration Is Going DigitalDocument12 pagesEY Tax Administration Is Going DigitalVahidin QerimiNo ratings yet

- 0751 VICTAULIC in Mechanical PipingDocument17 pages0751 VICTAULIC in Mechanical PipingsyafiqNo ratings yet

- Form-HSE-TMR-006 Compressor, Genzet, Water Jet InspectionDocument2 pagesForm-HSE-TMR-006 Compressor, Genzet, Water Jet Inspectionkenia infoNo ratings yet

- 3D PrintingDocument32 pages3D Printing9700216256No ratings yet

- GRT8100 Product Guide Imperial PDFDocument32 pagesGRT8100 Product Guide Imperial PDFSijumon sijuNo ratings yet

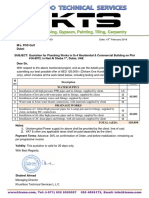

- KTS Quotation Meidan Building Plumbing Works PDFDocument1 pageKTS Quotation Meidan Building Plumbing Works PDFShakeel Ahmad100% (1)

- What is a Gear Motor? - An In-Depth GuideDocument15 pagesWhat is a Gear Motor? - An In-Depth GuidePuneet KumarNo ratings yet

- UDRPDocument10 pagesUDRPDomainNameWire100% (1)

- PT Indofood CBP Sukses Makmur TBKDocument1 pagePT Indofood CBP Sukses Makmur TBKAmadeus CocaNo ratings yet

- Techsheet ZerowasteDocument2 pagesTechsheet ZerowastesunillimayeNo ratings yet

- Animal-Cube-Puzzle I e LTR PDFDocument3 pagesAnimal-Cube-Puzzle I e LTR PDFJose Oswaldo Sierra MatheusNo ratings yet

- Marina Pier Repair Nasugbu BatangasDocument28 pagesMarina Pier Repair Nasugbu BatangasDennis SagaoNo ratings yet

- Prac Lesson Plan Primary MathematicsDocument9 pagesPrac Lesson Plan Primary Mathematicsapi-293527475No ratings yet