Professional Documents

Culture Documents

Tax Syllabus

Uploaded by

TalhakgsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Syllabus

Uploaded by

TalhakgsCopyright:

Available Formats

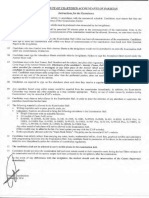

Intermediate Examination Taxation

Module C

PAPER C 7: Taxation (100 marks)

Objective

The aim of this paper is to develop basic knowledge and understanding in the core areas of Income

Tax and its chargeability as envisaged in the Income Tax Ordinance 2001 and the Income Tax Rules

2002 (relevant to the syllabus), Sales Tax Act 1990 and the Sales Tax Rules (relevant to the syllabus).

Indicative Grid

Syllabus Content Area Weightage

1. Income Tax

a. Basic concepts of taxation 15

b. Heads of income, Computation of income,

Determination of tax liability

40

c. Types of persons and their taxation

10

d. Procedures and Administration

e. Income Tax Rules 2002

10

2. Sales Tax

Prescribe chapters of Sales Tax Act and Rules.

25

Total 100

The weightages given above are for guidance purposes only and some deviations in setting of

papers could be expected.

Note:

a. Finance Act / Ordinance, Notifications and circulars issued within a period of less than 4

months from the date of examination shall not be tested

b. Chapters, Parts and Divisions not mentioned here specifically are excluded from the syllabus.

However, it is clarified to eliminate any ambiguity that if only a chapter is mentioned it includes

all parts and if only a part is mentioned it includes all divisions.

c. The weightages given above are for guidance purposes only and some deviations in setting of

papers could be expected.

d. Students are not expected to remember the tax rates. Same if applicable shall be given in the

question paper.

The Institute of Chartered Accountants of Pakistan

26

Intermediate Examination Taxation

Contents:

1. Income Tax Ordinance 2001

a Basi c concepts of taxati on

i. Chapter I Preliminary (concepts of terms defined)

ii. Chapter II Charge of tax (excluding section 7)

iii. Chapter IV Common rules (Part I & II)

b. Heads of i ncome, Computati on of income, Determinati on of tax liability

i. Chapter III Tax on taxable income (excluding Sec

29A, 30 & 31)

ii. Chapter IX Minimum tax

iii. Chapter X Part V Advance tax and deduction of tax at source

iv. Chapter XII Transitional Advance Tax provisions

c. Types of persons and their taxation

i. Chapter V Part I Central concepts

ii. Chapter V Part II - Div I Individuals

iii. Chapter V Part III Association of persons

iv. Chapter VII Part II Taxation of foreign-source income of

residents

d. Procedures and Administrati on

i. Chapter X Part I Returns

ii. Chapter X Part II Assessments

iii. Chapter X Part III Appeals including Alternative Dispute Resolution

iv. Chapter X Part IV Collection and recovery of tax (Sections 137 to 140)

v. Chapter X Part VIII Audit (Section 177)

vi. Chapter XI Part I Administration General (excluding section 224 to 227)

e. Income Tax Rul es 2002

The rules related to the above chapters of the Income Tax Ordinance 2001 shall also be examined

2. Sales Tax Act 1990

i. Chapter I Preliminary (concepts of terms defined)

ii. Chapter II Scope and payment of tax

iii. Chapter III Registration

iv. Chapter IV Book keeping and invoicing requirements

v. Chapter V Returns

vi. The following rules (excluding annexure and forms) of the Sales Tax Rules 2006 related to

the relevant chapters of the Sales Tax Act may be examined. Rules other than the following

shall not be examined at this stage:

w Chapter I Registration, Voluntary registration and De-registration

w Chapter II Filing of returns

w Chapter III Credit and Debit Note and Destruction of Goods

w Chapter IV Apportionment of Input Tax

The Institute of Chartered Accountants of Pakistan

27

Intermediate Examination Taxation

Recommended Reading

PAPER C 7: Taxation

Book Name & Author

1. Complete Income Tax Law by S. A. Salam.

2. Law & Practice of Income tax by

About the Book

Bare Act, Rules, Notifications; Circulars etc. on

syllabus topics are included in these books with

Dr. Ikram-ul-Haq.

brief explanations.

3. Sales Tax Ready Reference by S. A.Salam.

4. Synopsis of taxation by Mirza Munawar

Hussain.

5. Pakistan income tax law Principles and

Bare Act, Rules, Notifications; Circulars etc. on

syllabus topics are included in the book with

brief explanations.

These books are very useful for understanding

practical application of taxation.

Practice by Mian Safiullah & Kashif Aziz

J ahangiri.

6. Khalid Petiwalas Notes Income Tax and

Sales Tax.

The book provides summarized notes to the

students which will help them at the time of

revision. The book also includes practical

Questions and original income tax ordinance

and rules & sales tax act and rules.

The Institute of Chartered Accountants of Pakistan

28

}

}

You might also like

- Public Finance and Taxation - 1 Nbaa Cpa-1Document265 pagesPublic Finance and Taxation - 1 Nbaa Cpa-1Osmund100% (1)

- HR Audit CaseDocument9 pagesHR Audit CaseAnkit JainNo ratings yet

- AM01 Syllabus (2016) : AccountingDocument11 pagesAM01 Syllabus (2016) : AccountingMiriam RapaNo ratings yet

- Sahil Adeem - Neurology of EmotionsDocument28 pagesSahil Adeem - Neurology of EmotionsTalhakgs100% (32)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Shipping Bill of LadingDocument1 pageShipping Bill of LadingdonsterthemonsterNo ratings yet

- Income Tax Vol-2 48th EditionDocument540 pagesIncome Tax Vol-2 48th EditionVipul VatsNo ratings yet

- Work Sample - M&A Private Equity Buyside AdvisingDocument20 pagesWork Sample - M&A Private Equity Buyside AdvisingsunnybrsraoNo ratings yet

- Creative Accounting, Fraud and International Accounting ScandalsFrom EverandCreative Accounting, Fraud and International Accounting ScandalsRating: 5 out of 5 stars5/5 (1)

- Final Test Pre-IntermediateDocument5 pagesFinal Test Pre-Intermediatebulajica100% (5)

- Product DiffrentiationDocument26 pagesProduct Diffrentiationoptimistic07100% (1)

- BusinesstaxationDocument3 pagesBusinesstaxationAqeel AlviNo ratings yet

- Tax Revision KitDocument260 pagesTax Revision KitEvans Lelach63% (16)

- Examiner Tips For ASA Level Chemistry 9701 FINALDocument6 pagesExaminer Tips For ASA Level Chemistry 9701 FINALFred H Halder67% (3)

- Difference Between Basel 1 2 and 3 - Basel 1 Vs 2 Vs 3Document8 pagesDifference Between Basel 1 2 and 3 - Basel 1 Vs 2 Vs 3Sonaal GuptaNo ratings yet

- MBA4F2 Tax ManagementDocument2 pagesMBA4F2 Tax Managementbs_sharathNo ratings yet

- 1 - Patent - Intro & Requirements - Novelty-Non ObviousnessDocument58 pages1 - Patent - Intro & Requirements - Novelty-Non ObviousnessBernard Nii Amaa100% (2)

- Product Portfolio AnalysisDocument30 pagesProduct Portfolio AnalysisShakti Dash25% (4)

- Module C & D SyllabusDocument20 pagesModule C & D Syllabusonthelinealways100% (1)

- Sure Shot Guide To Become A CA PDFDocument22 pagesSure Shot Guide To Become A CA PDFnavya sruthiNo ratings yet

- Accounting Standards and Corporate ReportingDocument7 pagesAccounting Standards and Corporate ReportingSaiprasad D DoddaiahNo ratings yet

- FA2Document3 pagesFA2fzh_caNo ratings yet

- Sem 3 Taxation - 2Document5 pagesSem 3 Taxation - 2Nidhip ShahNo ratings yet

- Accounting for Taxes on Income StandardDocument18 pagesAccounting for Taxes on Income StandardVikas TirmaleNo ratings yet

- DTaxation PDFDocument808 pagesDTaxation PDFcoolmanzNo ratings yet

- Applied Indirect TaxationDocument349 pagesApplied Indirect TaxationVijetha K Murthy100% (1)

- C AE26 MODULE 2 Tax Laws and Tax AdministrationDocument6 pagesC AE26 MODULE 2 Tax Laws and Tax AdministrationBaek hyunNo ratings yet

- ICAB Professional Level Syllabus Weight Based Tax Planning & Compliance QUESTION & ANSWER BANKDocument206 pagesICAB Professional Level Syllabus Weight Based Tax Planning & Compliance QUESTION & ANSWER BANKSaiful Islam MozumderNo ratings yet

- Ctp-Session PlanDocument8 pagesCtp-Session PlanNikhil BalanaNo ratings yet

- Acc 423 Advanced TaxationDocument50 pagesAcc 423 Advanced Taxationkajojo joyNo ratings yet

- MGT 503 Lec 01Document16 pagesMGT 503 Lec 01bc180202357 BADAR FARIDNo ratings yet

- GST 7th Edition PDFDocument366 pagesGST 7th Edition PDFUtkarshNo ratings yet

- PGDTDocument68 pagesPGDTFahmi AbdullaNo ratings yet

- Course Outline. (Fall 2014)Document5 pagesCourse Outline. (Fall 2014)Anonymous zg5uGfJ97No ratings yet

- Corporate Tax Management EDU MBA Summer 2020Document100 pagesCorporate Tax Management EDU MBA Summer 2020Foyez HafizNo ratings yet

- Final Level Advanced Taxation 2: ObjectiveDocument5 pagesFinal Level Advanced Taxation 2: Objectiveadibahhanaffi01No ratings yet

- 2006 - TAX101 - Phil Tax System & Income TaxDocument7 pages2006 - TAX101 - Phil Tax System & Income Taxhappiness12340% (1)

- TAX2601 LU2 2024Document11 pagesTAX2601 LU2 2024Jason MphaphuliNo ratings yet

- CPA Uganda Syllabus Financial AccountingDocument150 pagesCPA Uganda Syllabus Financial Accountingathancox5837100% (1)

- CPA Paper 6Document20 pagesCPA Paper 6sanu sayed100% (1)

- Icaew Cfab Pot 2019 SyllabusDocument10 pagesIcaew Cfab Pot 2019 SyllabusAnonymous ulFku1vNo ratings yet

- Direct Tax - 2011Document494 pagesDirect Tax - 2011vinagoyaNo ratings yet

- GST Book 6th Edition CDocument438 pagesGST Book 6th Edition CUtkarsh100% (1)

- COURSE OUTLINE SPRING-2020 - Zonaira Shehper - Audit and TaxationDocument6 pagesCOURSE OUTLINE SPRING-2020 - Zonaira Shehper - Audit and TaxationNoor FatimaNo ratings yet

- Tax Management WFHDocument2 pagesTax Management WFHSalimNo ratings yet

- Bac Iv Law Course Taxation IiDocument168 pagesBac Iv Law Course Taxation IiGilbert SanoNo ratings yet

- Income Tax and GST Course ObjectivesDocument2 pagesIncome Tax and GST Course Objectivesbs_sharathNo ratings yet

- VAT Assessment and Collection Challenges in Akaki KalityDocument21 pagesVAT Assessment and Collection Challenges in Akaki KalityFilmawit MekonenNo ratings yet

- Draft Exam Practice Kit For CA Professional Level Tax Planning & Compliance Covering Finance Act 2018Document303 pagesDraft Exam Practice Kit For CA Professional Level Tax Planning & Compliance Covering Finance Act 2018Optimal Management Solution100% (1)

- Icwai: The Institute of Cost and Works Accountants of India (ICWAI)Document12 pagesIcwai: The Institute of Cost and Works Accountants of India (ICWAI)mknatoo1963No ratings yet

- IV. Accounting and Auditing StandardsDocument14 pagesIV. Accounting and Auditing StandardsLan TranNo ratings yet

- CH 10Document6 pagesCH 10Cris LuNo ratings yet

- Direct Tax Corporate Tax Interview QuestionsDocument9 pagesDirect Tax Corporate Tax Interview Questionsanjali aggarwalNo ratings yet

- Lesson 2 Tax Accounting PrinciplesDocument39 pagesLesson 2 Tax Accounting PrinciplesakpanyapNo ratings yet

- Technician Syllabuses 1Document76 pagesTechnician Syllabuses 1angaNo ratings yet

- Taxation Laws - IDocument5 pagesTaxation Laws - IAadya AmbasthaNo ratings yet

- Law of Direct TaxationDocument4 pagesLaw of Direct TaxationAshwanth M.SNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Stage-3 S-301 - Financial AccountingDocument9 pagesInstitute of Cost and Management Accountants of Pakistan Stage-3 S-301 - Financial AccountingRehan RaufNo ratings yet

- Paper 4: Taxation: Level of Knowledge: Working Knowledge ObjectivesDocument2 pagesPaper 4: Taxation: Level of Knowledge: Working Knowledge ObjectivesHemaNo ratings yet

- Income Tax Act Revised Edition 2008 PDFDocument130 pagesIncome Tax Act Revised Edition 2008 PDFShafii Sigera0% (1)

- Accountants' Reports On Profit Forecasts: Regulation and PracticeDocument23 pagesAccountants' Reports On Profit Forecasts: Regulation and PracticeProf Niamh M. BrennanNo ratings yet

- Accounting Standards CommitteeDocument127 pagesAccounting Standards CommitteeJay PandeyNo ratings yet

- 2 Advanced Stage TAX Module Outline Sept 2018Document5 pages2 Advanced Stage TAX Module Outline Sept 2018Aniss1296No ratings yet

- Financial and Accounting Guide for Not-for-Profit OrganizationsFrom EverandFinancial and Accounting Guide for Not-for-Profit OrganizationsNo ratings yet

- The Seven Stages of Nafs PDFDocument5 pagesThe Seven Stages of Nafs PDFFazal Ahmed ShaikNo ratings yet

- FBR Transfers 19 Senior Tax OfficersDocument4 pagesFBR Transfers 19 Senior Tax OfficersTalhakgsNo ratings yet

- CFAP-MSA-Instruction (Winter 2019)Document1 pageCFAP-MSA-Instruction (Winter 2019)TalhakgsNo ratings yet

- Textile Industry GuidelineDocument24 pagesTextile Industry GuidelineTalhakgsNo ratings yet

- PakAccountantJan Mar2017Document72 pagesPakAccountantJan Mar2017TalhakgsNo ratings yet

- Textile Industry GuidelineDocument24 pagesTextile Industry GuidelineTalhakgsNo ratings yet

- Illigal Occupation of JunagadhDocument43 pagesIlligal Occupation of JunagadhTalhakgsNo ratings yet

- ASA Level Physics TipsDocument5 pagesASA Level Physics TipsTalhakgsNo ratings yet

- Tata Consultancy Services LimitedDocument4 pagesTata Consultancy Services LimitedPRITEENo ratings yet

- Caribou Stew RecipeDocument4 pagesCaribou Stew RecipeNunatsiaqNewsNo ratings yet

- MC ElroyDocument2 pagesMC ElroyTanmay DastidarNo ratings yet

- ACC 403 Final ExamDocument5 pagesACC 403 Final ExamSanada YukimuraNo ratings yet

- Supply Chain Re-Engineering Saves Elizabeth Arden $180MDocument6 pagesSupply Chain Re-Engineering Saves Elizabeth Arden $180MjaveriaNo ratings yet

- Lion Air ETicket (IIZKUK) - NataliaDocument2 pagesLion Air ETicket (IIZKUK) - NataliaNatalia LeeNo ratings yet

- White Rust Removal and PreventionDocument17 pagesWhite Rust Removal and PreventionSunny OoiNo ratings yet

- Bicol Region As One of The Hot Spot For Cacao IndustryDocument10 pagesBicol Region As One of The Hot Spot For Cacao IndustryPlantacion de Sikwate0% (1)

- Your Electronic Ticket Receipt-32Document2 pagesYour Electronic Ticket Receipt-32LuluNo ratings yet

- The Copperbelt University BS 361: Entrepreneurship Skills: Lecture 2C: Business Startups K. Mulenga June, 2020Document40 pagesThe Copperbelt University BS 361: Entrepreneurship Skills: Lecture 2C: Business Startups K. Mulenga June, 2020Nkole MukukaNo ratings yet

- OCTG Imports InvestigationDocument226 pagesOCTG Imports Investigation69ika100% (1)

- Economic Structure of Tourism and Hospitality in AustraliaDocument6 pagesEconomic Structure of Tourism and Hospitality in AustraliaAnjali DudarajNo ratings yet

- Founders Pie Calculator FinalDocument3 pagesFounders Pie Calculator FinalAbbas AliNo ratings yet

- Port Pricing Final PresentationDocument13 pagesPort Pricing Final PresentationRomnic CagasNo ratings yet

- Ms ASE20104Document16 pagesMs ASE20104Aung Zaw HtweNo ratings yet

- Quiz - Act 07A: I. Theories: ProblemsDocument2 pagesQuiz - Act 07A: I. Theories: ProblemsShawn Organo0% (1)

- BMW Case StudyDocument3 pagesBMW Case StudyPrerna GoelNo ratings yet

- Chapter - IDocument65 pagesChapter - Iarjunmba119624No ratings yet

- CapbudhintDocument3 pagesCapbudhintImran IdrisNo ratings yet

- Suggested Readings:: Fragasso, P. M., & Israelsen, C. L. (2010) - Your Nest Egg Game Plan: How To Get YourDocument3 pagesSuggested Readings:: Fragasso, P. M., & Israelsen, C. L. (2010) - Your Nest Egg Game Plan: How To Get YourLisa BlairNo ratings yet

- Price/BV (X) 1.46 Ev/Ebitda (X) 6.76 0.81: Ratio 2016-17 2017-18 2018-19Document2 pagesPrice/BV (X) 1.46 Ev/Ebitda (X) 6.76 0.81: Ratio 2016-17 2017-18 2018-19Pratik ChourasiaNo ratings yet

- Keep Your Liquids On The Proper Flight Path: The New Security RegulationsDocument2 pagesKeep Your Liquids On The Proper Flight Path: The New Security RegulationsChai YawatNo ratings yet