Professional Documents

Culture Documents

Managerial Accounting

Uploaded by

Luân ChâuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Managerial Accounting

Uploaded by

Luân ChâuCopyright:

Available Formats

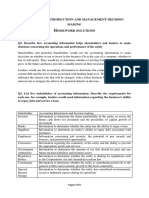

MANAGERIAL

ACCOUNTING

QUESTIONS & ANSWERS

TASK 1: CVP analysis

Angie Silva recently opened The Sandal Shop, a store that specializes in fashionable sandals.

Angie has just received a degree in business and she anxious to apply the principles she has

learned to her business. In time, she hope to open a chain of sandal shops. As a first step, she

has prepared the following analysis for her new store:

Sales price per pair of sandals $40

Variable costs per pair of sandals 16

Contribution margin per pair of sandals 24

Fixed costs per year

Building rental $15,000

Equipment depreciation 7,000

Selling 20,000

Administrative 18,000

Total fixed costs $60,000

Required:

1) How many pairs of sandals must be sold each year to break even? What does this

represent in total sales dollars?

2) Angie has decided that she must earn at least $18,000 in the first year to justify her

time and effort. How many pairs of sandals must be sold to reach this target profit?

3) Angie now has two salespersons working in store - one full time and one part time.

It will cost her an additional $8,000 per year to convert the part-time position to a full-time

position. Angie believes that the change would bring in an additional $25,000 in sales each

year. Should she convert the position?

4) Refer to the original data and ignore the proposition in question c. During the first

year, the store sold only 3,000 pairs of sandals.

a) Prepare the income statement in a contribution format for the Sandal Shops first

year.

b) What is the stores degree of operating leverage?

c) Angie is confident that with a more intense sales effort and with a more creative

advertising she can increase sales by 50% next year? What would be the expected

percentage increase in net operating income?

TASK 2 - Integration of the Sales, Production and Direct Materials Budgets

Milo company manufactures beach umbrellas. The company is preparing detailed budgets for

the third quarter and has assembled the following information to assist in the budget preparation:

a) The Marketing Department has estimated sales units as follows for the reminder of the

year:

J uly 30,000

August 70,000

September 50,000

October 20,000

November 10,000

December 10,000

The selling price of the beach umbrellas is $12 per unit.

b) All sales are on account. Based on past experience, sales are collected in the following

pattern:

30% in the month of sale

65% in the month following sale

5% uncollectible

Sales for J une totaled $300,000.

c) The company maintains finished goods inventories equal to 15% of the following

months sales. This requirement will be met at the end of J une.

d) Each beach umbrellas requires 4 feet of Gilden, a material that is sometimes hard to

acquire. Therefore, the company requires that the ending inventory of Gilden be equal to

50% of the following months production needs. The inventory of Gilden on hand at the

beginning and end of the quarter will be:

J une 30 72,000 feet

September 30 ? feet

e) Gilden costs $0.80 per foot. One-half of a months purchases of Gilden is paid for in the

month of purchase; the remainder is paid for in the following month. The accounts payable

on J uly 1 for Purchases of Gilden during J une will be $76,000.

Required:

a. Prepare a sales budget, by month and in total, for the third quarter. (Show your

budget in both units and sales dollars.) Also prepare a schedule of expected cash

collections, by month and in total, for the third quarter.

b. Prepare a production budget for each of the months J uly, August, September, and

October.

c. Prepare a direct materials budget, by month and in total, for the third quarter. Also

prepare a schedule of expected cash disbursements, by month and in total, for the third

quarter.

TASK 3: Flexible budget and flexible budget performance report

Tohono Companys 2012 master budget included the following fixed budget report. It is based

on an expected production and sales volume of 20,000 units.

3

TOHONO COMPANY

Fixed budget report

For year ended December 31, 2012

Sales $ 3,000,000

Cost of goods sold

Direct materials $1,200,000

Direct labor 260,000

Machinery repair (Variable cost)

57,000

Depreciation-Machinery 250,000

Utilities (25% is variable cost) 200,000

Plant manager salaries 140,000 2,107,000

Gross profit 893,000

Selling expenses

Packaging 80,000

Shipping 116,000

Sales salary (fixed annual amount) 160,000 356,000

General and administrative expenses

Advertising 81,000

Salaries 241,000

Entertainment expenses 90,000 412,000

Net income $ 125,000

Required:

1) Prepare flexible budgets for the company at sales volumes of 18,000 and 24,000 units.

[10 marks]

2) The actual income statement for 2012 follows.

TOHONO COMPANY

Income Statement

For year ended December 31, 2012

Sales $ 3,648,000

Cost of goods sold

Direct materials $1,400,000

Direct labor 360,000

Machinery repair (Variable cost)

60,000

Depreciation-Machinery 250,000

Utilities (25% is variable cost) 218,000

Plant manager salaries 155,000 2,443,000

4

Gross profit 1,205,000

Selling expenses

Packaging 90,000

Shipping 124,000

Sales salary (fixed annual amount) 162,000 376,000

General and administrative expenses

Advertising 104,000

Salaries 232,000

Entertainment expenses 100,000 436,000

Net income $ 393,000

a) Prepare a flexible budget performance report for 2012

b) Analyze and interpret both the sale variance and direct materials variance.

TASK 4: Analysis of special orders

Windmire Company manufactures and sells to local wholesalers approximately 300,000 units

per month at a sales price of $4 per unit. Monthly costs for the production and sale of this

quantity follow

Direct materials $ 384,000

Direct labor 96,000

Overhead 288,000

Selling expenses 120,000

Administrative expenses 80,000

Total costs and expenses $ 968,000

A new out-of-state distributor has offered to buy 50,000 units next month for $3.44 each. A

study of costs of this new business reveals the following:

Direct material costs are 100% variable.

Per unit direct labor costs for the additional units would be 50% higher than normal

because their production would require one-and-a-half overtime pay to meet the

distributors deadline.

25% of the normal annual overhead costs are fixed at any production level from 250,000

to 400,000 units. The remaining 75% is variable with volume.

Accepting the special order could involve no additional selling expenses.

5

Accepting the special order could increase administrative expenses by a $4,000 fixed

amount.

Required:

1) What are the relevant costs and benefits of the two alternatives (Accept or reject the

special order?

2) Should management accept the order? Explain by analyzing 2 alternatives on a unit

basis.

3) Prepare a three-column comparative income statement that shows the following:

Monthly operating income without the special order (column 1)

Monthly operating income received from the special order only (column 2)

Combined monthly operating income from normal business and the new business (column 3).

4) What qualitative factors should Windmire Company consider?

5) Assume that the new customer wants to buy 150,000 units instead of 50,000 units - it

will only buy 150,000 units or none and will not take a partial order. Without any

computations, how does this change your answer in question a?

1

Chau Trieu Luan | tireuluan@gmail.com

Task 1: CVP analysis

1/ How many pairs of sandals must be sold each year to break even? What does this

represent in total sales dollars?

Break even point in units =Fixed cost/price variable cost =60,000/(40-16) =2,500

pairs of sandals

Break even point in sale dollars =Break even point in units x price =2,500 x 40 =

$100,000

2/ Angie has decided that she must earn at least $18,000 in the first year to justify

her time and effort. How many pairs of sandals must be sold to reach this target

profit?

Pairs of sandals to reach this target profit =(Fixed cost +target profits)/(price variable

cost) =(60,000 +18,000)/(40-16) =3,250 pairs of sandals

3/ Angie now has two salespersons working in store one full time and one part

time. It will cost her an additional $8,000 per year to convert the part-time position

to a full-time position. Angie believes that the change would bring in an additional

$25,000 in sales each year. Should she convert the position?

Contribution margin ratio =unit contribution margin/price =24/40 =0.60

Cost her $8,000 per year to convert the labor, that means the cost is added to fixed cost.

Additional operating income =25,000 x 0.60 8,000 =$7,000

She should convert the part-time position to a full-time position.

2

Chau Trieu Luan | tireuluan@gmail.com

4/ Refer to the original data and ignore the proposition in question 3. During the

first year, the store sold only 3,000 pairs of sandals.

a) Prepare the income statement in a contribution forma for the Sandal Shops first year.

b) What is the stores degree of operating leverage?

c) Angie is confident that with a more intense sale effort and with a more creative

advertising she can increase sales by 50% next year? What would be the expected

percentage increase in net operating income?

a/ Income statement in a contribution format:

THE SANDAL SHOP

Income Statement

Total sales $120,000

Variable costs 48,000

Contribution margin 72,000

Fixed costs per year 60,000

Operating income $12,000

b/ Degree of operating leverage:

DOL =Total contribution margin/Operating income =72,000/12,000 =6 times

3

Chau Trieu Luan | tireuluan@gmail.com

c/ The expected percentage increase in net operating income?

Additional operating income =Sales increase x DOL =50% x 6 =300%

Task 2 Integration of the Sales, Production and Direct Materials

Budgets

a/ Prepare a sales budget, by month and in total, for the third quarter.

(Show your budget in both units and sales dollars.) Also prepare a schedule of

expected cash collections, by month and in total, for the third quarter.

With the given data, we have a sales budget as below:

MILO COMPANY

Sales Budget

For Quarter 3

Jul Aug Sep Quarter 3

Sales unit 30,000 70,000 50,000 150,000

Unit price $12 $12 $12 $12

Total sales in dollar $60,000 $840,000 $600,000 $1,800,000

4

Chau Trieu Luan | tireuluan@gmail.com

The schedule of expected cash collections

MILO COMPANY

Expected Cash Collection

For Quarter 3

Jul Aug Sep Quarter 3

Sales in dollar $360,000 $840,000 $600,000 $1,800,000

Sales in Jun

65% 195,000 195,000

Sales in Jul

30% 108,000 108,000

65% $234,000 $234,000

Sales in Aug

30% $252,000 $252,000

65% $546,000 $546,000

Sales in Aug

30% $180,000 $180,000

Total cash collection $303,000 $486,000 $726,000 $1,515,000

5

Chau Trieu Luan | tireuluan@gmail.com

b/ Prepare a production budget for each of the months July, August, September,

and October.

MILO COMPANY

Production budget

From Jul to Oct

Jul Aug Sep Oct

Sales unit 30,000 70,000 50,000 20,000

Ending goods inventory 10,500 7,500 3,000 1,500

Total needed 40,500 77,500 53,000 21,500

Beginning goods inventory 4,500 10,500 7,500 3,000

Required production 36,000 67,000 45,500 18,500

6

Chau Trieu Luan | tireuluan@gmail.com

c/ Prepare a direct materials budget, by month and in total, for the third quarter.

Also prepare a schedule of expected cash disbursements, by month and in total, for

the third quarter.

MILO COMPANY

Direct Material Budget

For Quarter 3

Jul Aug Sep Quarter 3

Required production 36,000 67,000 45,500 148,500

Gilden per unit (feet) 4 4 4 4

Production needed 144,000 268,000 182,000 594,000

Ending inventory 134,000 91,000 37,000 37,000

Total needed 278,000 359,000 219,000 631,000

Beginning inventory 72,000 134,000 91,000 72,000

Materials needed 206,000 225,000 128,000 559,000

Cost per feet $0.80 $ 0.80 $0.80 $0.80

Total material cost $164,800 $180,000 $102,400 $447,200

7

Chau Trieu Luan | tireuluan@gmail.com

MILO COMPANY

Expected Cash Disbursement

For Quarter 3

Jul Aug Sep Quarter 3

Total material cost $164,800 $180,000 $102,400 $447,200

Payable (Jul 1) 76,000 76,000

Pay in Jul

50% 82,400 82,400

50% 82,400 82,400

Pay in Aug

50% 90,000 90,000

50% 90,000 90,000

Pay in Jul

50% 51,200 51,200

Total disbursement $158,400 $172,400 $141,200 $472,000

8

Chau Trieu Luan | tireuluan@gmail.com

TASK 3: Flexible budget and flexible budget performance report

1/ Prepare flexible budgets for the company at sales volumes of 18,000 and 24,000

units.

TOHONO

Flexible Budgets

For Year 2012

Revenue/

Cost formula

Planning

budget

Flexible budget

Sales units 20,000 18,000 24,000

Revenue ($150q) $3,000,000 $2,700,000 $3,600,000

COGS

Direct materials 60 1,200,000 1,080,000 1,440,000

Direct labor 13 260,000 234,000 312,000

Machinery repaired (VC) 2.85 57,000 51,300 68,400

Depreciation machinery 250,000 250,000 250,000

Utilities (2.5q+$150,000) 200,000 195,000 210,000

Plan manager salary 140,000 140,000 140,000

Total COGS 2,107,000 1,950,300 2,420,400

9

Chau Trieu Luan | tireuluan@gmail.com

Gross profit 893,000 749,700 1,179,600

Selling expenses

Packaging 4 80,000 72,000 96,000

Shipping 5.8 116,000 104,400 139,200

Sales salary (fixed annual) 160,000 160,000 160,000

Total Selling expense 356,000 336,400 395,200

General & administrative expenses

Advertising 81,000 81,000 81,000

Salary 241,000 241,000 241,000

Entertainment 90,000.00 90,000 90,000

Total General & administrative expenses 412,000 412,000 412,000

Net income $125,000 $1,300 $372,400

10

Chau Trieu Luan | tireuluan@gmail.com

2/ Prepare a flexible budget performance report for 2012

TOHONO

Flexible Budget Performance Report

For Year 2012

Actual

results

Spending

Variances

Flexible

budget

Activity

Variances

Planning

budget

Sales units 24,000 24,000 20,000

Revenue $3,648,000 $48,000 F $3,600,000 $600,000 F $3,000,000

COGS

Direct materials 1,400,000 (40,000) F 1,440,000 240,000 U 1,200,000

Direct labor 360,000 48,000 U 312,000 52,000 U 260,000

Machinery repaired 60,000 (8,400) F 68,400 11,400 U 57,000

Depreciation 250,000 - 250,000 - 250,000

Utilities 218,000 8,000 U 210,000 10,000 U 200,000

Manager salary 155,000 15,000 U 140,000 - 140,000

Total COGS 2,443,000 22,600 U 2,420,400 313,400 U 2,107,000

Gross profit 1,205,000 25,400 F 1,179,600 286,600 F 893,000

11

Chau Trieu Luan | tireuluan@gmail.com

Selling expense

Packaging 90,000 (6,000) F 96,000 16,000 U 80,000

Shipping 124,000 (15,200) F 139,200 23,200 U 116,000

Sales salary 162,000 2,000 U 160,000 - 160,000

Sub total 376,000 (19,200) F 395,200 39,200 U 356,000

General & administrative expenses

Advertising 104,000 23,000 U 81,000 - 81,000

Salary 232,000 (9,000) F 241,000 - 241,000

Entertainment 100,000 10,000 U 90,000 - 90,000

Sub total 436,000 24,000 U 412,000 - 412,000

Net income $393,000 $20,600 F $372,400 $247,400 F $125,000

12

Chau Trieu Luan | tireuluan@gmail.com

Analyze and interpret both the sale variance and direct materials variance:

The sale variance:

Actual quantity

x

Actual price

(24,000 x $152)

Actual quantity

x

Standard price

(24,000 x $150)

Standard quantity

x

Standard price

(20,000 x $150)

$3,648,000 $3,600,000 $3,000,000

Price variance Quantity variance

$48,000 Favorable $600,000 Favorable

Total variance is $648,000 Favorable

Sales variance analysis can help company to explain revenues and realize problems

between actual and budget results so that company can do better in sales growths.

There are many factors can affect to sales revenues such as sales price, production

variance, product mix, promotion programs, market share, economic environment.

Price variance is $48,000 favorable with the same of quantity of 24,000 units sold, just

differentiated by the actual unit price. Quantity variance is $600,000 Favorable due to the

same as planned or standard quantity with the standard price applied.

13

Chau Trieu Luan | tireuluan@gmail.com

The direct material variance:

Actual quantity

x

Actual price

(24,000 x $58.33)

Actual quantity

x

Standard price

(24,000 x $60)

Standard quantity

x

Standard price

(20,000 x $60)

$1,400,000 $1,440,000 $1,200,000

Price variance Quantity variance

$40,000 Favorable $240,000 Unfavorable

Total variance is $200,000 Unfavorable

The price variance is calculated on the entire quantity purchased. The unit actual price is

just $58.33 saving $1.7 each material. So TOHONO Company has a price variance of

$40,000 Favorable.

The quantity variance is calculated only on the quantity used. Here TOHONO company

used 24,000 units instead it should use 20,000 units, so it spent more than its standard

quantity that having a quantity variance of $240,000 Unfavorable.

The main responsibility for price variance is purchasing managers, or purchasing agents,

and here they have done a good role to make a price variance of $40,000 Favorable.

The main responsibility for quantity variance is production managers, and they are

responsible for efficiency of production.

14

Chau Trieu Luan | tireuluan@gmail.com

TASK 4: Analysis of special orders

1/ What are the relevant costs and benefits of the two alternatives (Accept or reject

the special order?

The relevant costs:

If accepting the order, Windmire will have relevant costs as below.

- Direct material costs

- Direct labor costs; it will be increased by 50% more than normal due to over

time payment

- Overhead costs 75%; the overhead cost is divided by two parts: 25% fixed and

75% variable

- Administrative expenses; increase fixed amount of $4,000 for the special order

Windmires benefits of the two alternatives as below:

Accept Reject Differentiated

Sales $172,000 $0 $172,000

Direct materials (64,000) 0 (64,000)

Direct labor (24,000) 0 (24,000)

Overhead 75% (36,000) 0 (36,000)

Administrative expenses (4,000) 0 (4,000)

Income increase $44,000 $0 $44,000

As calculation, if the special order is accepted, the sales will be increased $44,000. In

conclusion, Windmire should accept the special order.

15

Chau Trieu Luan | tireuluan@gmail.com

2/ Should management accept the order? Explain by analyzing 2 alternatives on a

unit basis.

Unit cost table:

Accept Reject Differentiated

Sales $3.44 $0 $3.44

Direct materials (1.28) 0 (1.28)

Direct labor (0.48) 0 (0.48)

Overhead 75% (0.72) 0 (0.72)

Administrative expenses (0.08) 0 (0.08)

Income increase $0.88 $0 $0.88

Differentiated unit cost is $0.88, and the special order of 50,000 units, so Windmire will

increase income of 50,000 x 0.88 =$44,000. Windmires management should accept the

order.

3/ Prepare a three-column comparative income statement that shows the following:

Monthly operating income without the special order (column 1)

Monthly operating income received fromthe special order only (column 2)

Combined monthly operating income fromnormal business and the new business

(column 3).

16

Chau Trieu Luan | tireuluan@gmail.com

WINDMIRE COMPANY

Monthly Income Statement

Normal Special order Normal & Special order

Sales revenue $1,200,000 $172,000 $1,372,000

Variable cost

Direct materials 384,000 64,000 448,000

Direct labor 96,000 24,000 120,000

Overhead (Variable 75%) 216,000 36,000 252,000

Total variable expense 696,000 124,000 820,000

Contribution margin 504,000 48,000 552,000

Fixed cost

Selling expenses 120,000 120,000

Administrative expenses 80,000 4,000 84,000

Overhead (Fixed 25%) 72,000 72,000

Total fixed expense 272,000 4,000 276,000

Net income $232,000 $44,000 $276,000

17

Chau Trieu Luan | tireuluan@gmail.com

4/ What qualitative factors should Windmire Company consider?

Special order decisions are made only if it maximizes operating income. Like all short-

run decisions, Windmires special order decision should conform with its strategic plan

and tactical objectives.

- Net income must be positive and reasonable to win the special order and makes

stakeholders satisfied.

- Windmire should check if the order is believable.

- Windmire should consider the special order as a good opportunity to expand the

business and the distributor has ability to maintain the order in long term.

- Capacity of resources that Windmire can meet the special order on time and the

assured quality of products.

- The period of the special order is in peak or low seasons.

- Consider if the special order can affect sales revenue in terms of marketing-mix,

promotional program, price strategy, distribution, etc.

- Attitude and morality of the manpower is also considered as producing more

products for the special order.

- Have a closed look at competitors on the distributors special order.

5/ Assume that the new customer wants to buy 150,000 units instead of 50,000 units

it will only buy 150,000 units or none and will not take a partial order.

Without any computations, how does this change your answer in question 1?

If the customer wants to buy 150,000 units that means total produced units needed is

450,000 units, the management board needs to consider its capacity and fixed cost range

18

Chau Trieu Luan | tireuluan@gmail.com

because usually they just produce and sell 300,000 units, but now one time order needed

450,000 may be over its capacity and exceeds the fixed cost range. So the answers are:

1/ Their factorys capacity is not able to produce 450,000 units, so they should refuse the

order;

2/ And if the capacity can cover the unit amount, so they need to re-calculate cost and

profits because they will face a new fixed cost range, and if the still get profits at a certain

level, they can accept the order. Otherwise they have to refuse the order.

--- The end ---

You might also like

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Solutions Manual to Accompany Introduction to Quantitative Methods in Business: with Applications Using Microsoft Office ExcelFrom EverandSolutions Manual to Accompany Introduction to Quantitative Methods in Business: with Applications Using Microsoft Office ExcelNo ratings yet

- Management AccountingDocument21 pagesManagement AccountingbelladoNo ratings yet

- Rule of MultiplicationDocument23 pagesRule of MultiplicationbheakantiNo ratings yet

- Activity-Based CostingDocument24 pagesActivity-Based CostingAmrit PatnaikNo ratings yet

- SMChap 007Document86 pagesSMChap 007Huishan Zheng100% (5)

- Chapter 5Document25 pagesChapter 5A DaffaNo ratings yet

- Managerial Accounting PDFDocument20 pagesManagerial Accounting PDFMister GamerNo ratings yet

- Short-Run Decision Making and CVP AnalysisDocument43 pagesShort-Run Decision Making and CVP AnalysisHy Tang100% (1)

- Managerial and Cost Accounting Exercises IVDocument28 pagesManagerial and Cost Accounting Exercises IVAleko tamiruNo ratings yet

- Cost and Management Accounting - Course OutlineDocument9 pagesCost and Management Accounting - Course OutlineJajJay100% (1)

- Accounting and Financial Management Study NotesDocument72 pagesAccounting and Financial Management Study NotesShani BitonNo ratings yet

- Chitra de Silva PDFDocument268 pagesChitra de Silva PDFRamadona SimbolonNo ratings yet

- MBA 504 Ch4 SolutionsDocument25 pagesMBA 504 Ch4 SolutionsPiyush JainNo ratings yet

- Managerial Accounting by James Jiambalvo: Standard Costs and Variance AnalysisDocument31 pagesManagerial Accounting by James Jiambalvo: Standard Costs and Variance AnalysisRatnesh SinghNo ratings yet

- Operations ResearchDocument35 pagesOperations ResearchFida Al HasanNo ratings yet

- ACCT 311 - Chapter 5 Notes - Part 1Document4 pagesACCT 311 - Chapter 5 Notes - Part 1SummerNo ratings yet

- Job Costing Chapter 20 SummaryDocument43 pagesJob Costing Chapter 20 SummaryJitender RawatNo ratings yet

- Module 1 - Introduction and Management Decision Making - Homework SolutionsDocument4 pagesModule 1 - Introduction and Management Decision Making - Homework SolutionsAbelNo ratings yet

- Management & Cost Accounting, Unit 1Document20 pagesManagement & Cost Accounting, Unit 1JITIN01007No ratings yet

- Cost-Volume-Profit AnalysisDocument50 pagesCost-Volume-Profit AnalysisMarkiesha StuartNo ratings yet

- Corporate Finance Assignment PDFDocument13 pagesCorporate Finance Assignment PDFسنا عبداللهNo ratings yet

- Applied Corporate Finance TVM Calculations and AnalysisDocument3 pagesApplied Corporate Finance TVM Calculations and AnalysisMuxammil IqbalNo ratings yet

- ABC Costing Helps Astro Boy Co. Decision MakingDocument3 pagesABC Costing Helps Astro Boy Co. Decision MakingDaiannaNo ratings yet

- Title of Degree Program: Defination of Credit Hours: Degree Plan: Prerequisites: Course Offered: Course TtleDocument5 pagesTitle of Degree Program: Defination of Credit Hours: Degree Plan: Prerequisites: Course Offered: Course TtleHoundsterama50% (2)

- 7 Costing Formulae Topic WiseDocument86 pages7 Costing Formulae Topic WiseHimanshu Shukla100% (1)

- Article Review On: Profitable Working Capital Management in Industrial Maintenance CompaniesDocument5 pagesArticle Review On: Profitable Working Capital Management in Industrial Maintenance CompaniesHabte DebeleNo ratings yet

- Valuation of EquityDocument14 pagesValuation of EquityJarna MehtaNo ratings yet

- The duel between Mercedes and TeslaDocument17 pagesThe duel between Mercedes and TeslaAyan DasNo ratings yet

- 14e GNB ch01 SMDocument7 pages14e GNB ch01 SMOmerGull100% (1)

- Absorption Costing WorksheetDocument10 pagesAbsorption Costing WorksheetFaizan ChNo ratings yet

- SMCCCD - Chapter 6 - Cost-Volume-Profit RelationshipsDocument8 pagesSMCCCD - Chapter 6 - Cost-Volume-Profit RelationshipsJames CrombezNo ratings yet

- Managerial Economics - NotesDocument69 pagesManagerial Economics - NotesR.T.IndujiNo ratings yet

- ABC Costing System Vs TraditionalDocument6 pagesABC Costing System Vs TraditionalRyan Corde50% (2)

- Advanced Cost Accounting-FinalDocument154 pagesAdvanced Cost Accounting-FinalThilaga SenthilmuruganNo ratings yet

- The Future of Operations ManagementDocument1 pageThe Future of Operations Managementhadi_friendNo ratings yet

- Introduction To Management AccountingDocument55 pagesIntroduction To Management AccountingUsama250100% (1)

- Activity Based Managament Very UsefulDocument24 pagesActivity Based Managament Very UsefulDamascene SwordNo ratings yet

- Absorption Costing (Or Full Costing) and Marginal CostingDocument11 pagesAbsorption Costing (Or Full Costing) and Marginal CostingCharsi Unprofessional BhaiNo ratings yet

- Ch. 15 Capital StructureDocument69 pagesCh. 15 Capital StructureScorpian MouniehNo ratings yet

- New Castle Case Study SolutionDocument5 pagesNew Castle Case Study Solutionsani0250% (2)

- Activity Based Costing: A Tool for Decision MakingDocument20 pagesActivity Based Costing: A Tool for Decision MakingImmanuel Sultan Simanjuntak100% (2)

- Cost AccountingDocument55 pagesCost Accountinghimanshugupta6100% (2)

- Chapter 9 Mini Case WACCDocument7 pagesChapter 9 Mini Case WACCMike HaiNo ratings yet

- Chapter 12 SolutionsDocument29 pagesChapter 12 SolutionsAnik Kumar MallickNo ratings yet

- MBA Financial Management CourseworkDocument26 pagesMBA Financial Management CourseworkbassramiNo ratings yet

- Optimal Transportation ModelDocument25 pagesOptimal Transportation ModelBehrooz DwazzaNo ratings yet

- Problem Solving ApproacDocument70 pagesProblem Solving ApproacAbhishek Pratap SinghNo ratings yet

- Ratio AnalysisDocument33 pagesRatio AnalysisJhagantini PalaniveluNo ratings yet

- The Utease CorporationDocument8 pagesThe Utease CorporationFajar Hari Utomo0% (1)

- Measuring Performance of Responsibility CentersDocument30 pagesMeasuring Performance of Responsibility CentersRajat SharmaNo ratings yet

- AKMY 6e ch01 - SMDocument20 pagesAKMY 6e ch01 - SMSajid AliNo ratings yet

- Cost Accounting IIDocument62 pagesCost Accounting IIShakti S SarvadeNo ratings yet

- OR Problems (All Topics) Linear Programming FormulationDocument24 pagesOR Problems (All Topics) Linear Programming FormulationHi HuNo ratings yet

- ADL 56 Cost & Management Accounting 2V3Document20 pagesADL 56 Cost & Management Accounting 2V3Deepesh100% (1)

- Solution Manual For Book CP 4Document107 pagesSolution Manual For Book CP 4SkfNo ratings yet

- Production And Operations Management A Complete Guide - 2020 EditionFrom EverandProduction And Operations Management A Complete Guide - 2020 EditionNo ratings yet

- Inventory valuation Complete Self-Assessment GuideFrom EverandInventory valuation Complete Self-Assessment GuideRating: 4 out of 5 stars4/5 (1)

- Car BuyingDocument93 pagesCar BuyingLuân ChâuNo ratings yet

- Lessons 01-Material ManagementDocument10 pagesLessons 01-Material ManagementLuân ChâuNo ratings yet

- Managerial EconomicsDocument9 pagesManagerial EconomicsLuân ChâuNo ratings yet

- Examples For Michael Porter's Three Generic StrategiesDocument19 pagesExamples For Michael Porter's Three Generic StrategiesLuân Châu75% (4)

- The Facility Manager's HandbookDocument362 pagesThe Facility Manager's HandbookLuân Châu100% (14)

- Lesson 01Document17 pagesLesson 01mavericksailorNo ratings yet

- Lesson 02-Risk ManagementDocument17 pagesLesson 02-Risk ManagementLuân ChâuNo ratings yet

- Rob Stokes-eMarketing The Essential Guide To Online Marketing-Quirk Emarketing (2008)Document189 pagesRob Stokes-eMarketing The Essential Guide To Online Marketing-Quirk Emarketing (2008)iarinadem2011100% (1)

- EconometricsDocument692 pagesEconometricsLuân ChâuNo ratings yet

- Presentation That Make Miliion$Document257 pagesPresentation That Make Miliion$Luân ChâuNo ratings yet

- Car Buying PDFDocument93 pagesCar Buying PDFLuân ChâuNo ratings yet

- Human Resource Accounting-FinalDocument20 pagesHuman Resource Accounting-FinalLikitha T AppajiNo ratings yet

- Banking ProjectDocument82 pagesBanking ProjectJemini Patil76% (17)

- (Group Project - Marketing Plan) Group 10Document21 pages(Group Project - Marketing Plan) Group 10Tghusna FatmaNo ratings yet

- Business Permit and Licensing Services - MainDocument7 pagesBusiness Permit and Licensing Services - MainMecs NidNo ratings yet

- Accounting Term PaperDocument22 pagesAccounting Term PaperZaharatul Munir Sarah50% (4)

- Autopilot Money Plus Extra Profit With Shopify MethodDocument5 pagesAutopilot Money Plus Extra Profit With Shopify Methodamodu oluNo ratings yet

- Fee BookDocument1 pageFee Bookrajsinghpro3425No ratings yet

- ShoeDocument8 pagesShoeIlham Anugraha PramudityaNo ratings yet

- City Bank Annual Report 2021Document478 pagesCity Bank Annual Report 2021Shadat Rahman 1731419No ratings yet

- Pecking Order TheoryDocument2 pagesPecking Order TheorymavimalikNo ratings yet

- Quiz 4Document2 pagesQuiz 4Romell Ambal Ramos100% (1)

- Porter's Generic Competitive Strategies and Its Influence On The Competitive AdvantageDocument10 pagesPorter's Generic Competitive Strategies and Its Influence On The Competitive AdvantageKomal sharmaNo ratings yet

- Kurt Salmon Etude Digital Pharma - WEB-VersionDocument32 pagesKurt Salmon Etude Digital Pharma - WEB-VersionainogNo ratings yet

- ISOM 2700 - Operations ManagementDocument29 pagesISOM 2700 - Operations ManagementLinh TaNo ratings yet

- Topic 3 Product DesignDocument19 pagesTopic 3 Product Designjohn nderituNo ratings yet

- TEXCHEM AnnualReport2014Document146 pagesTEXCHEM AnnualReport2014Yee Sook YingNo ratings yet

- Shahid KhanDocument3 pagesShahid KhanNaveed Abdul WaheedNo ratings yet

- Marketing Research and Decision Making - ScenarioDocument1 pageMarketing Research and Decision Making - ScenarioMichelle WongNo ratings yet

- Salesforce RFP for Energy Project ManagementDocument14 pagesSalesforce RFP for Energy Project ManagementDoddy PrimaNo ratings yet

- Case KokaDocument6 pagesCase KokaLora Hasku0% (1)

- L6 Interpreting FlowchartDocument28 pagesL6 Interpreting FlowchartRykkiHigajVEVONo ratings yet

- Exclusions From Gross IncomeDocument63 pagesExclusions From Gross IncomegeorgeNo ratings yet

- CIF ICPO To XXXXXXXXXXXXXXXXXXXXX TemplateDocument3 pagesCIF ICPO To XXXXXXXXXXXXXXXXXXXXX Templatevijaykumarbhattad100% (5)

- Substantive Procedures (1-Page Summary)Document2 pagesSubstantive Procedures (1-Page Summary)Alizeh IfthikharNo ratings yet

- Policy Ambivalence Hinders India's Manufacturing GoalsDocument5 pagesPolicy Ambivalence Hinders India's Manufacturing GoalsRuby SinglaNo ratings yet

- NPTEL Assign 5 Jan23 Behavioral and Personal FinanceDocument9 pagesNPTEL Assign 5 Jan23 Behavioral and Personal FinanceNitin Mehta - 18-BEC-030No ratings yet

- Top reasons to invest in Oracle EPM Cloud for operational efficiencyDocument3 pagesTop reasons to invest in Oracle EPM Cloud for operational efficiencyemedinillaNo ratings yet

- Platform Brand - AlbumDocument25 pagesPlatform Brand - AlbumSimon GlennNo ratings yet

- Calculus For Bus and Econ Sample PDFDocument5 pagesCalculus For Bus and Econ Sample PDFWade GrayNo ratings yet

- Kp6424 HRM Chapter 2 - Job AnalysisDocument45 pagesKp6424 HRM Chapter 2 - Job AnalysisFatma AzuraNo ratings yet