Professional Documents

Culture Documents

New Microsoft Word Document

Uploaded by

Ranjan Kumar0 ratings0% found this document useful (0 votes)

21 views25 pagesTerm

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTerm

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views25 pagesNew Microsoft Word Document

Uploaded by

Ranjan KumarTerm

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 25

SWOT Analysis.

SWOT Analysis is a strategic planning method used to evaluate the Strengths,

Weaknesses, Opportunities, and Threats involved in a project or in a business

venture. It involves specifying the objective of the business venture or project and

identifying the internal and eternal factors that are favorable and unfavorable to

achieving that objective. The techni!ue is credited to Albert "umphrey, #ho led a

convention at Stanford $niversity in the %&'(s and %&)(s using data from

*ortune +(( companies.

A SWOT analysis must first start #ith defining a desired end state or objective. A

SWOT analysis may be incorporated into the strategic planning model. Strategic

,lanning, including SWOT and S-A. analysis, has been the subject of much

research.

Strengths/ attributes of the person or company that is helpful to achieving the

objective.

Weaknesses/ attributes of the person or company that is harmful to achieving

the objective.

Opportunities/ eternal conditions that is helpful to achieving the objective.

Threats/ eternal conditions #hich could do damage to the objective.

SWOT Analysis of HSBC.

Strengths.

0anagement of the bank has been empo#ered #ith appropriate finance and

business decision making authorities as per the guidelines of 1angladesh

1ank.

1usiness plan of the bank provides for the #orking platform embodying the

gro#th aspect, profitability, risk appetite, capital management etc.

1ank has also formed a 1asel 2 II implementation committee to oversee the

implementation of this ne# risk management avenue of the banking business.

"S1- 1ank being a responsible corporate citi3en and a dynamic financial

institution has created value in line #ith its mission to be the best performing

bank in the country.

1ank as an institution is #oven in to the socio4economic fabric involving

numerous sector of the society #hich together is identified as stakeholders of

a bank.

1ank follo#s a #ell defined strategy and plan to mobili3e resources such as

deposits and borro#ings besides the capital.

The bank maintains an optimum trade 2 off bet#een li!uidity and profitability.

Weaknesses.

While it5s a national bank engaged in different kinds of banking business, it

faces a stiff challenge to brand itself like other big names in our banking

sector.

It faces a gigantic problem of ecess li!uidity #hich arises due to improper

planning for investment.

It doesn5t have a consistent dividend policy #hich sometimes discourages its

investors.

Opportunities.

*reedom granted by 1angladesh 1ank to charge discriminatory interest rates

on various accounts.

While many multinational banks are running scared of 0iddle46ast region.

"o#ever7 current situation provides opportunities to a fast bank like A1 1ank.

8overnment5s commitment to and undertaking of necessary measures to

discourage loan default.

In addition to 0iddle46ast, there are several other emerging economies in

Asia #hich provides same opportunities for "S1-.

"S1- can offset its ecess li!uidity problems by investing in these

economies.

1y the grace of ne# technology, the plastic money 9both credit and debit

cards: is no# very popular.

Threats.

The gro#ing stiff competition in the banking sector has become a threat for its

survival.

Attempts to integrate ne# technological dimensions have to face tremendous

challenges of technological ill effects7 for eample latest email viruses.

Some sectors in 1angladesh economy haven5t yet sho#n encouraging signs

of gro#th.

The instability in our political scenario is al#ays a potential threat for any

business particularly banking sector.

-ompetition among banks has resulted in snatching a#ay of good customers.

SWOT Analysis of Standard Chartered Bank.

Strengths.

Through re4structuring and strengthening of training program, Standard

-hartered 1ank ;imited has developed a #ell4educated and eperienced

#orking force that can carry out the 1ank to#ards its goal.

Implementation of 1AS6; II policy on capital ade!uacy is going to have an

unprecedented impact in the operation of bank.

Top managers of the 1ank are visionary and innovative.

Standard -hartered 1ank has plans for sustainability in its approach to

diversify its line of banking business.

The bank has ade!uate physical facilities and #ell decorated offices and

branches for its employees to #ork for its clients.

Standard -hartered 1ank is dominating the major portion of the 6port4Import

1usiness in the country and earning a huge foreign echange.

Weaknesses.

1ank is facing ecess li!uidity and its no# hard to invest.

Some of the directors are not visionary.

The overhead ependiture of the 1ank is too high for #hich it becomes

difficult to achieve its target perfectly.

Internal influence of the directors and eecutives in Standard -hartered 1ank

is too high. This is creating problems in implementing strategies.

A huge number of employees are cash based among top4level officers.

Opportunities.

The supportive monetary conditions prevalent in *< (& #ill be continued in

*< %( to cushion domestic economic activities against likely shocks from the

ongoing global do#nturn and to restore investment momentum.

-ommitments in -orporate Social =esponsibilities ensures enhancements in

business conduct.

8ro#th prospects in the global investment banking.

*reedom granted by 1angladesh 1ank to charge discriminatory interest rates

on various accounts.

"igh epectations of business gro#th in the year >(%( means higher

profitability.

1angladesh 1ank5s role in ensuring dynamic banking business.

Threats.

Again the increased stiff competition among the banks in banking sector has

generated many problems for banks.

?olatility of financial markets.

Some strict government regulations.

Slo# gro#th in industriali3ation.

=ecession in economy as a result of regional geo4political instability.

Security risk of individual accounts.

SWOT Analysis of Dutch-Bangla Bank Liited.

Strengths.

@11; is a corporate citi3en. The stakeholders, as a #hole help, direct and

monitor the 1ank to perform its operations in an effective #ay to create and

maimi3e value for the economy.

0anagement is al#ays focused on taking appropriate measures to maimi3e

value for bank5s stakeholders and to increase its contribution to the economy

and society in a sustainable #ay.

=isk is managed to ensure !uality and value of assets and uninterrupted

operations. It usually involves managing credit risk, operational risks and

market risk.

@11; maintains ade!uate capital and capital ade!uacy ratio 2 cushion to

absorb the unforeseen shocks.

@11;5s dividend policy is designed in a #ay to ensure sustainable gro#th of

the 1ank #ith strong capital ade!uacy ratio #hich must maimi3e the value of

shareholders.

@11; etends technology driven services to its customers at affordable cost.

Its AT0 service has attracted many customers due to its vast number of

location.

Weaknesses.

;arge bonuses for @irectors have attracted un#anted attention from

commentators, and it has been speculated that the bank5s reluctance to take

financing from the 1angladesh government is because that #ould end its

autonomy #ith regard to bonuses.

Services provided at some offices located in other districts have generated

controversy7 especially S06 1anking.

Some of the directors are not visionary. Therefore7 @11; sometimes faces

lack of proper planning in some of its activities.

Opportunities.

*reedom granted by 1angladesh 1ank to charge discriminatory interest rates

on various accounts.

The bank5s strategy is to offer a full portfolio of services nation#ide, providing

a #ide range of cross4selling opportunities.

8overnment5s commitment to and undertaking of necessary measures to

discourage loan default.

1y the grace of ne# technology, the plastic money 9both credit and debit

cards: is no# very popular.

@11; can turn its #eakness in S06 1anking into one of its strength because

of ne# S06 banking friendly regulations by the government.

Threats.

0any private commercial banks are operating in the industry. So, the

competition is too high.

Other private banks are taking a#ay the eperienced bankers from @11;. It5s

a huge threat for @11;

=ecession in economy as a reaction to the ongoing recession around the

developed #orld.

Slo# pace of industriali3ation in some sectors.

$ndue political and o#ner group pressure in snatching loan.

Ongoing political unrest bet#een t#o major political parties.

SWOT Analysis of B!AC Bank.

Strengths.

1=A- 1ank5s epanded business during the year7 the bank epanded the

hori3on of its business operations7 establishing ne# branches, introducing

brokerage business, epanding its AT0 net#ork and broadening its retail line

of products.

The capital ade!uacy as per 1asel II of the 1ank is %(.(% percent, #hich is

above the stipulated rate of A percent.

Its aim to assist lo# income earning people by providing loan facilities to

establish fisheries, poultry farms, small and cottage industries, village

transport and small engineering #orkshops has met #ith huge success.

1=A- 1ank introduced Islamic 1anking alongside the conventional banking

in >((A to give its clients total satisfaction and freedom to choose

The steady progress of 1=A- 1ank in its line of businesses is a testimony of

the 1ank5s creativity, commitment and care for stakeholders.

Weaknesses.

@isbursement of industrial loans by the bank is slo# due to some internal

problems of management.

6penses incurred during the banking business by 1=A- 1ank increase

>).%' during the last financial year.

Some of the top 2 level managers are not interested in bank5s gro#th.

1=A- 1ank needs to #ork more progressively on agricultural finance and

poverty mitigation.

1ank must maintain an optimum level of li!uidity through appropriate money

market operations.

Opportunities.

@espite many challenges, the opportunities are ample for the 1ank to operate

in international market.

*urther consolidation provided by the government has meant more freedom

and liberty for 1=A- 1ank to flourish its business.

8overnment5s commitment to and undertaking of necessary measures to

discourage loan default.

-ountry #ide boom in property business has resulted in more potential

people interested to seek home loans.

Threats.

;ucrative offers by other banks encourage eperienced bankers to s#itch to

other banks.

This problem has its roots in stiff competition among banks in banking sector

of 1angladesh.

$ndue political and o#ner group pressure in snatching loan.

,olitical unrest.

SWOT Analysis of "astern Bank Liited.

Strengths.

@iversified products, 9consumer finance, retail banking products and services,

investment banking, commercial banking, asset management, trade finance,

e4commerce products and services, private banking:.

.ation#ide infrastructure.

1ank business sustenance from the community in #hich it operates through

principle of respect of society.

6astern 1ank has ensured its fast gro#ing banking business through

ade!uate capital management. As on B%

st

@ecember >((&, 1ank5s Authori3ed

-apital #as TC %(,((( million #hile its ,aid up -apital reached TC B,D>>.'D

million.

.ecessary initiatives taken by the bank to enhance 1ank5s operational

efficiency and profit amid global economic recession, ever4increasing

competitive environment and rising customer epectation.

=isk management activities are ensured #ith an eye to securing the

soundness of operations and enhancing profitability.

Weaknesses.

Some of the complicated financial products.

@ebt obligations related to asset backed securities in the financial market.

Euestionable !uality of customer services.

Some of the bank services are not customi3ed.

Opportunities.

8ood market reputation, #hich is vital to ensure high profitability.

,rograms to issue =ight Shares and to enhance 1ank5s Supplementary

-apital in future.

Already good standing in the >(%(, #hich ensures promising years ahead.

*uturistic programs to consolidate the previous progress.

*urther epansion of product line.

*urther development of cross4selling strategies

Threats.

The financial market environment appears challenging for banking business.

0ay lose ground on competitors #ithout product development.

"igh street bankFs .et operations leading the field.

-onsolidation in the financial services industry.

"igh attrition in investment banking sector.

BC# $atri%

The 1-8 matri 9aka 1.-.8. analysis, 1-84matri, 1oston 1o, 1oston 0atri,

1oston -onsulting 8roup analysis: is a chart that had been created by 1ruce

"enderson for the 1oston -onsulting 8roup in %&'A to help corporations #ith

analy3ing their business units or product lines. This helps the company allocate

resources and is used as an analytical tool in brand marketing, product

management, strategic management, and portfolio analysis.

BC# $atri% of Hongkong and Shanghai Banking

Corporation&HSBC'.

The Hongkong and Shanghai Banking Corporation Liited 9-hinese:

is a global financial services corporation head!uartered in ;ondon, $nited

Cingdom.As of >(%(, it is both the #orldFs largest banking and financial services

group and the #orldFs Ath largest company according to a composite measure by

*orbes maga3ine."S1- #as founded as The "ongkong and Shanghai 1anking

-orporation and "ong Cong served as the bankFs head!uarters until %&&> #hen

it moved to ;ondon as a condition of completing the ac!uisition of 0idland 1ank

and as the handover of "ong CongFs sovereignty approached.Today, #hilst no

single geographical area dominates the groupFs earnings, "ong Cong still

continues to be a significant source of its income. =ecent ac!uisitions and

epansion in -hina are returning "S1- to part of its roots. "S1- has an

enormous operational base in Asia and significant lending, investment, and

insurance activities around the #orld. The company has a global reach and

financial fundamentals matched by fe# other banking or financial multinationals..

Although "S1- only commenced operation in 1angladesh in %&&', the 1ank has

!uickly made its presence felt in the local market. *rom the >)th position in >((B,

"S1- is no# one of five largest private banks in the country. As a full service

international bank, "S1- offer competitive pricing and efficient eecution. "S1-

provide a #ide range of treasury, loans, markets, payments and cash

management, and trade and supply chain services. "S1- have advisory

capabilities for clients #ishing to investGoperate in 1angladesh. 1ond issuance

capabilities are also being developed.

The companyFs business ranges from the traditional "igh Street roles of personal

finance and commercial banking, to corporate and investment banking, private

banking and global banking. It is the largest bank in "ong Cong #ith branches

and offices throughout the Asia ,acific region including other countries around

the #orld.

$aintaining Ade(uate Capital.

-apital ade!uacy is the measure of the financial strength and sustainability of a

bank. -apital Ade!uacy =ation 9-A=: determines the capacity of the 1ank in

terms of meeting the time liabilities and other risks such as credit risks, market

risks etc. It is the policy of "S1- to maintain ade!uate capital as a cushion for

potential losses to absorb unforeseen eventualitiesGshocks, to ensure long term

sustainability and gro#th of the 1ank to endure and enhance shareholders value.

At the end of >((&, 1ank5s total capital reached at Taka %,()&.(> -rore as

against Taka )DB.&A -rore on B% @ecember >((A.

The -A= against -ore -apital #as %%.A%H in >((& and the Supplementary

-apital #as %.&)H. So, the -A= #as %%.A%H as compared to %(.((H -AT set

by the 1angladesh 1ank.

Higher )rofit and #ro*th.

"S1-, despite the challenges of >((& faced by the financial sector in

1angladesh, #as able to achieve a remarkable gro#th in most business

segments to the credit of all concerned in management and in the policy making

arena. The net profit in >((& gre# by D'H over >((A. .et Assets ?alue 9.A?: of

"S1- stood at Taka %,((& crore in >(& #hich is +(H higher than >((A. 6arning

per share 96,S: stood at Taka %B%.%B end >(& #hich #as Taka A&.)> in >((A

i.e. a gro#th of D'H.

It is important to note that 1ank5s total assets stands at Taka %(,'&% crore end

>((& #hich #as at Taka A,D(+ crore in >((A meaning a gro#th of >)H.

Operating profit of "S1- in >((& registered a gro#th of B+H over >((A. ;oans

ratio in >((& stood at >(&DH #hich #as B.BAH in >((A. -lassified ;oans in A1

1ank stands >.)+H end >((& #hile it #as >.&&H in >((A.

De+elopent of Huan !esource.

"S1- is fully committed to developing human resources as a crucial par to of the

1ank5s development. .o product etension can be sustained #ithout a motivated

and a professionally competent team under the current competitive environment.

In the year >((&, the 1ank has conducted continuous skill development training

on its ne#ly established Training -entre. It has substantially increased training of

personnel for attending courses in foreign institutions. In >((&, the 1ank has

given training to B,%)) persons on headcount #ith total D',>D> hours of training

i.e. on average each participant received %D.++ hours of training. This #ill be

continued #ith added enthusiasm.

The above illustrated indicators mention that the business of "S1- has gro#n

substantially over the years. Therefore7 it is logical to conclude that "S1- falls

under the STAR category of 1-8 0atri.

BC# $atri% of Standard Chartered Bank

Standard -hartered 1ank has been launched by a group of successful

entrepreneurs #ith recogni3ed standing in the society. The management of the

1ank consists of a team led by senior bankers #ith decades of eperience in

international markets. The senior management team is ably supported by a

group of professionals many of #hom have eposure in the international market.

In the year >((B the 1ank again came to the limelight #ith oversubscription of

the Initial ,ublic Offering of the shares of the 1ank, #hich #as a record 9++

times: in our capital marketFs history and its shares commands respectable

premium.

The asset and liability gro#th has been remarkable. S-1 has been actively

participating in the local money market as #ell as foreign currency market #ithout

eposing the 1ank to vulnerable positions. The 1ankFs investment in Treasury

1ills and other securities #ent up noticeably opening up opportunities for

enhancing income in the contet of a regime of gradual interest rate decline.

Standard -hartered 1ank started its service #ith a vision to serve people #ith

modern and innovative banking products and services at affordable charge.

1eing parallel to the cutting edge technology the 1ank is offering online banking

#ith added delivery channels like AT0, Tele4banking, S0S and .et 1anking.

And as part of the bankFs commitment to provide all modern and value added

banking service in keeping #ith the very best standard in a globali3e #orld.

Higher )rofit and #ro*th.

@uring the year >((&, 1ank has accelerated its business significantly7 deposits

gre# by >&H, advances by >'H, and operating profit by B)H. The bank has

epanded its presence at eight ne# locations in different parts of the country.

International trade is one of the main sources of 1ank5s earnings. In the year

>((&, the import business of the bank gre# by B>H and eport business by >BH

and in#ard by BDH. These gro#ths contributed significantly to earn fees income

and echange gain for the 1ank.

In the year >((&, the bank established A ne# branches7 epanded its o#n AT0

net#ork from %A to B(. 6pansion also took place in the areas of S06

operations, retail financing and credit card. The Off4Shore banking unit is no#

fully operational dealing beyond the boundaries of the country.

Capital $anageent.

It is important to note that 1angladesh 1ank has directed the commercial banks

to follo# the 1AS6; II capital re!uirement from first !uarter of >(%(. The S-1

has complied the re!uirement #ithout any restructure of capital and issuance of

bond. *or the year >((&, the board of directors has recommended a dividend of

D(H for the shareholders in the form of stock dividend. This recommendation #ill

raise the paid up capital to Taka B,((B million and total capital to Taka +,+BA

million. The capital ade!uacy ratio of the bank as per 1AS6; I stands at %>.>)H

and as per 1AS6; II the ratio is %(.(%H.

It is important to note that the gro#th of 1ank Asia #ill be maintained in near

future, therefore it is safe to declare S-1 as STAR in the 1-8 0atri.

BC# $atri% of Dutch-Bangla Bank Liited

@utch41angla 1ank ;imited 9the 1ank, @11;: is a scheduled joint venture

commercial bank bet#een local 1angladeshi parties spearheaded by 0

Sahabuddin Ahmed 9*ounder I -hairman: and the @utch company *0O. @11;

#as established under the 1ank -ompanies Act %&&% and incorporated as a

public limited company under the -ompanies Act %&&D in 1angladesh #ith the

primary objective to carry on all kinds of banking business in 1angladesh. @11;

commenced formal operation from June B, %&&'. The 1ank is listed #ith the

@haka Stock 6change ;imited and -hittagong Stock 6change ;imited.

@11; is most #idely recogni3ed for its donations to social causes and its IT

investment 9largest AT0 net#ork:. "o#ever it has recently stated that it #ill stop

epansion on its AT0 net#ork as the current numbers have eceeded demand

and hence diminishing returns 9if any:. Although it is #idely believed it is a loss4

makingGsubsidi3ed unit #hich @11; rationali3es as !uasi -S=.

The bank is often collo!uially referred to as K@11;K, K@utch 1anglaK and K@utch

1angla 1ankK.

On the digital day 9%(G%(G%(:, the @11; inaugarated its 9digital: %(((th AT0 at

the factory premises of the 8laoSmithCline, -hittagong.

1anks that have signed agreements to share @11;Fs AT0 net#ork 9as of 0ay

>((&:/

-itibank 9locally kno#n as K-itibank .AK:

Standard -hartered 1ank 9S-1:

-ommercial 1ank of -eylon

0utual Trust 1ank

1ank Asia

.ational -redit and -ommerce 1ank ;imited 9.-- 1ank:

,rime 1ank

$nited -ommercial 1ank ;imited 9$-1;:

Southeast 1ank ;imited 9S61;:

The -ity 1ank 9locally kno#n as K-ity 1ankK to differentiate bet#een K-itibank

.AK:

*irst Security 1ank

Trust 1ank

0ercantile 1ank

E4-ash net#ork 1anks 9%. Janata 1ank >. 6astern 1ank B. I*I- 1ank D. A1

1ank +. Shahjalal Islami 1ank '. 1asic 1ank ). Jamuna 1ank A. 0ercantile

1ank &. .ational 1ank %(. .ational -redit and -ommerce 1ank %%. ,ubali

1ank %>. Sonali 1ank %B. Trust 1ank %D. $ttara 1ank %+. State 1ank of India

%'. The -ity 1ank %). Social Islami 1ank:

@haka 1ank

6LI0 1ank

Higher profit gro*th.

@espite generally slo#er business activities in the country, @11; #as successful

in achieving substantial gro#th in business and profit during the year >((&. The

deposits of the 1ank increased by B%.DH, loans and advances increased by

%'.%H, #hile import and eport business increased by >(.)H and >.)H

respectively. @uring the year >((&, operating profit increased by B&.BH and net

profit after ta increased by BA.+H from Taka A>%.) million to Taka %,%B).)

million.

Status of deposit and ad+ances.

The deposit gre# by Taka %',>%>.& million 9B%.DH: in >((& from Taka +%,+)+.)

million to Taka '),)AA.+ million. As a result, #eighted average cost of fund

declined to '.+BH from ).''H in >((&.

;oans and advances stood at Taka DA,D%(.& million 9%'.%H: at the end of year

>((& from Taka D%,'&A.B million in >((A. -lassified loan as percentage of

portfolio decreased from B.>)H in >((A to >.D'H in >((&.

Strong Capital Ade(uacy !atio $aintained.

@11;5s regulatory capital as on @ecember B%, >((& stood at Taka +,A&&.A

million. As on @ecember B%, >((&, -apital Ade!uacy =atio #as %%.+&H under

1asel I as against 1angladesh 1ank5s minimum re!uirement of %(H. The Tier4>

capital #as further strengthened by revaluation of held to maturity and held for

trading securities of the 1ank that #as transferred to e!uity #hich contributed

Taka >&.( million to Tier4> capital. *ifity percent 9+(H: of revaluation reserve

against held to maturity and held for trading securities is considered as

supplementary capital 9Tier > caital: by 1angladesh 1ank.

Custoer Ser+ices and Online Banking.

@11; continued to be a customer focused, need based and solution4driven

1ank. 1ank5s products and services are strongly supported by IT infrastructure

and online banking facilities, #hich are upgraded and epanded on a continuous

basis. B+( units if AT0 #ere installed in >((& to increase the number of AT0

units to )((. @11; is providing any branch anytime banking services to clients

>D hours a day and B'+ days a year.

All the above mentioned indicators sho# positive signs of @11; business over

the years. With all these, #e can easily put @11; as STAR in the 1-8 0atri.

BC# $atri% of B!AC Bank Liited

1=A- 1ank ;imited #as established in %&&+ #ith a dream and a vision to

become a pioneer banking institution of the country and contribute significantly to

the gro#th of the national economy. The 1ank #as established by leading

business personalities and eminent industrialists of the country #ith stakes in

various segments of the national economy. The incumbent -hairman of the 1ank

is 0uhammad A. 9=umee: Ali, *-A, a professional -hartered Accountant. 0r. 0.

A. Cashem a member of the 1oard and 0r. <ussuf Abdullah "arun #ere past

,residents of the *ederation of 1angladesh -hamber of -ommerce and

Industries 9*1--I:.

1=A- 1ank is run by a team of efficient professionals. They create and generate

an environment of trust and discipline that encourages and motivates everyone in

the 1ank to #ork together for achieving the objectives of the 1ank. The culture of

maintaining congenial #ork 4 environment in the 1ank has further enabled the

staff to benchmark themselves better against management epectations. A

commitment to !uality and ecellence in service is the hallmark of their identity.

1=A- 1ank takes pride for bringing #omen into the banking profession in a

significant number for gender e!uality. At present, B>H of 1=A- 1ank

employees are #omen that #ill rise to D+H over the net five years.

Higher )rofit and #ro*th.

@espite the adversities and competition, 1=A- 1ank earned an operating profit if

Taka D,'%D.'' million in >((& as against last year5s operating profit of Taka

B,(%>.+A million. The 1ank posted a gro#th of +B.%AH in operating income.

@uring the year, 1ank5s net profit stood at Taka %,A)(.%& million #hich is

%%(.A(H higher than the net profit of Taka AA).>D million earned by the bank in

the previous year.

@eposits, the 1ank5s life4blood, stood at Taka &',''&.(+ million #hile its loans

and advances #hich are its heart4beat, stood at Taka )),D&).+) million as on B%s

@ecember >((&. In the year under revie#, the 1ank conducted eport of Taka

D',)>D.D) million, import business for Taka '&,+A>.&> million, guarantee

business for Taka %%,&%'.)D million and in#ard remittance business of Taka

>B,A((.(( million.

Capital.

The Authori3ed -apital of the 1ank #as Taka %(,(((.(( million and ,aid4up

-apital #as Taka B,D>>.'D million as of @ecember B%, >((&. The -apital and

=eserve of the 1ank in >((& stood at Taka &,&>).%' million compared to Taka

),'+).(% million of the previous year sho#ing an increase of >&.'+H.

Capital Ade(uacy !atio.

The 1ank maintained a capital ade!uacy ratio of %%.)> percent of the risk4

#eighted assets as on @ecember B%, >((& as against re!uirement of %( percent

as set by 1angladesh 1ank under 1asel 2 I reporting.

As all the above mentioned indicators illustrate a promising future ahead for the

1=A- 1ank ;imited, #e can put it under the category of CASH COW in 1-8

0atri.

BC# $atri% of "astern Bank Liited

1angladesh economy has been eperiencing a rapid gro#th since the F&(s.

Industrial and agricultural development, international trade, inflo# of epatriate

1angladeshi #orkersF remittance, local and foreign investments in construction,

communication, po#er, food processing and service enterprises ushered in an

era of economic activities. $rbani3ation and lifestyle changes concurrent #ith the

economic development created a demand for banking products and services to

support the ne# initiatives as #ell as to channeli3e consumer investments in a

profitable manner. A group of highly acclaimed businessmen of the country

grouped together to responded to this need and established 6astern 1ank

;imited in the year %&&+.

The 1ank #as incorporated as a public limited company under the -ompanies

Act. %&&D. The 1ank started its commercial operation on July (+, %&&+ #ith an

authori3ed capital of Tk. %,((( million and paid up capital of Tk. %(( million. The

paid up capital of the 1ank stood at Tk >,'+&,+&),)'B as on 0arch B%, >(%(. The

total e!uity 9capital and reserves: of the 1ank as on 0arch B%, >(%( stood at Tk

',(B',B'A,)+D.

The 1ank has +D 1ranches, D S06 Service -enters, + -0S $nits, > Offshore

1anking $nit across the country and a #ide net#ork of correspondents all over

the #orld. The 1ank has plans to open more 1ranches in the current fiscal year

to epand the net#ork.

The 1ank offers the full range of banking and investment services for personal

and corporate customers, backed by the state2of2the4art technology and a team

of highly motivated ,rofessionals.

As an integral part of our commitment to 6cellence in 1anking, 6astern 1ank

no# offers the full range of real4time online banking services through its all

1ranches, AT0s and Internet 1anking -hannels.

6astern 1ank ;td. is the preferred choice in banking for friendly and personali3ed

services, cutting edge technology, tailored solutions for business needs, global

reach in trade and commerce and high yield on investments.

Capital $anageent.

The paid4up capital of the 1ank amounted to Taka >,%>A million as of B%

@ecember >((&. ,aid4up capital increased by Taka %&D million 9bonus share of

>((A: in >((&. The statutory reserve also increased by Taka D>) million during

the year by transferring >(H of pre4ta profit as per -ompanies Act %&&%. The

total shareholders5 e!uity 9capital I reserve: of the 1ank as at the end of

@ecember >((& stood at Taka D,&'+.'A million including sponsor capital of Taka

%,%&> million.

According to 1alance Sheet >((&, capital ade!uacy ratio #as e!uivalent to

%%.B%H of =isk Weighted Assets against %%.ADH of >((A.

,ncrease in )rofit.

1ank registered an operating profit of Taka >,A%( million in >((& compared to

Taka >,+BB million in >((A making a gro#th of %%H. The net profit of 1ank as of

B% @ecember >((& stood at Taka &+& million compared to previous year5s Taka

AB& million making a gro#th of %DH. 6arning per share 96,S: #as Taka D+.(& in

>((& compared to Taka B&.D> in >((A.

With the help of above mentioned indicators, the 1ank is categori3ed as Cash

Cow in the 1-8 0atri because of the slo# pace of gro#th in some of its

business segments.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Uttara BankDocument108 pagesUttara BankShariful Islam JoyNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Thesis Report Part 1Document10 pagesThesis Report Part 1Ranjan KumarNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Uttara BankDocument108 pagesUttara BankShariful Islam JoyNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Uttara BankDocument108 pagesUttara BankShariful Islam JoyNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

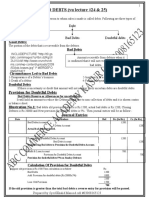

- Financial Analysis Model: Income StatementDocument3 pagesFinancial Analysis Model: Income StatementRanjan KumarNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Introduction (Part One)Document8 pagesIntroduction (Part One)Ranjan KumarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- City BankDocument57 pagesCity BankRanjan Kumar100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Accounts Term PaperDocument16 pagesAccounts Term PaperRanjan KumarNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Bangladesh Public Service Commission: 33rd BCS Examination 2012Document1 pageBangladesh Public Service Commission: 33rd BCS Examination 2012Ranjan KumarNo ratings yet

- Chapter: One: 1.1 Background of The Study. 1.2 MethodologyDocument27 pagesChapter: One: 1.1 Background of The Study. 1.2 MethodologyRanjan KumarNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Corporate Social Responsibility and Profitability: A Case Study On Dutch Bangla Bank LTDDocument11 pagesCorporate Social Responsibility and Profitability: A Case Study On Dutch Bangla Bank LTDRanjan KumarNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Corporate Social Responsibility Practices and Private Commercial Banks: A Case Study On BangladeshDocument6 pagesCorporate Social Responsibility Practices and Private Commercial Banks: A Case Study On Bangladeshmrahman4310No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Part 1Document11 pagesPart 1Ranjan KumarNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Financial Analysis Model: Income StatementDocument3 pagesFinancial Analysis Model: Income StatementRanjan KumarNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Financial Analysis Model: Income StatementDocument3 pagesFinancial Analysis Model: Income StatementRanjan KumarNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- University of Rajshahi: Accounting CycleDocument8 pagesUniversity of Rajshahi: Accounting CycleRanjan KumarNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Chapter 4DFDocument12 pagesChapter 4DFRanjan KumarNo ratings yet

- New Microsoft Office Word DocumentDocument3 pagesNew Microsoft Office Word DocumentRanjan KumarNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- IFIC Annual Report 2011Document238 pagesIFIC Annual Report 2011SafiqHasanNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bangladesh Bank Prudential Regulations GuideDocument37 pagesBangladesh Bank Prudential Regulations GuideRanjan KumarNo ratings yet

- Practice of Real Recruitment Test 01Document20 pagesPractice of Real Recruitment Test 01Ranjan KumarNo ratings yet

- Readymade Garments 1Document133 pagesReadymade Garments 1Ranjan KumarNo ratings yet

- Apr 292009 BRPD 05 eDocument1 pageApr 292009 BRPD 05 eRanjan KumarNo ratings yet

- Topic 6 - Concepts of National Income (Week5)Document52 pagesTopic 6 - Concepts of National Income (Week5)Wei SongNo ratings yet

- Black Money-Part-1Document9 pagesBlack Money-Part-1silvernitrate1953No ratings yet

- Q1 Exports: Bed Wear Cotton ClothDocument10 pagesQ1 Exports: Bed Wear Cotton ClothSaqib RehanNo ratings yet

- 45 Profit and Loss AccountDocument15 pages45 Profit and Loss AccountJitender Gupta100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Hapter 13: © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/SteinbartDocument32 pagesHapter 13: © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/SteinbartSone VipgdNo ratings yet

- New Challenges For Wind EnergyDocument30 pagesNew Challenges For Wind EnergyFawad Ali KhanNo ratings yet

- TomT Stock Market Model October 30 2011Document20 pagesTomT Stock Market Model October 30 2011Tom TiedemanNo ratings yet

- Problem 16.2 Nikken Microsystems (B)Document2 pagesProblem 16.2 Nikken Microsystems (B)Julie SpringNo ratings yet

- So Ordered.: Velasco, JR., Peralta, Mendoza and Sereno, JJ.Document25 pagesSo Ordered.: Velasco, JR., Peralta, Mendoza and Sereno, JJ.RomNo ratings yet

- Major Role and Goal of IFI's: Financial Institution International Law International InstitutionsDocument4 pagesMajor Role and Goal of IFI's: Financial Institution International Law International Institutionslordnikon123No ratings yet

- CIR vs. Shinko Elec. Industries Co., LTDDocument5 pagesCIR vs. Shinko Elec. Industries Co., LTDPio Vincent BuencaminoNo ratings yet

- Bclte Part 2Document141 pagesBclte Part 2Jennylyn Favila Magdadaro96% (25)

- Account Statement: MR - Shyamal Kumar ChatterjeeDocument2 pagesAccount Statement: MR - Shyamal Kumar ChatterjeeBikram ChatterjeeNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Global interstate system and institutionsDocument4 pagesGlobal interstate system and institutionsravelyn bresNo ratings yet

- Meralco Securities Pipeline Subject to Realty TaxDocument2 pagesMeralco Securities Pipeline Subject to Realty TaxMariano RentomesNo ratings yet

- AFAR Self Test - 9001Document5 pagesAFAR Self Test - 9001King MercadoNo ratings yet

- Evaluating Credit WorthinessDocument4 pagesEvaluating Credit WorthinessHazyan HamdanNo ratings yet

- Corporate Law Firm Headquartered in Lahore PakistanDocument6 pagesCorporate Law Firm Headquartered in Lahore PakistanRana EhsanNo ratings yet

- Bachan Das - Banking Final ProjectDocument27 pagesBachan Das - Banking Final ProjectbachandasNo ratings yet

- Micro Insurance HDocument46 pagesMicro Insurance HNirupa KrishnaNo ratings yet

- PWC Offshore WindDocument20 pagesPWC Offshore WindChubakabarabakaNo ratings yet

- Kuwait's Flag and Its Historical MeaningsDocument10 pagesKuwait's Flag and Its Historical Meaningsrichmond maganteNo ratings yet

- Workshop 5 Labour Market and The Distribution of IncomeDocument5 pagesWorkshop 5 Labour Market and The Distribution of IncomeEcoteach09No ratings yet

- Salary Slip MayDocument1 pageSalary Slip MayselvaNo ratings yet

- The Self Help Group Approach in AfghanisDocument78 pagesThe Self Help Group Approach in AfghanisFrozan RajabiNo ratings yet

- MGT 101 SampleDocument9 pagesMGT 101 SampleWaleed AbbasiNo ratings yet

- Meridan Golf and Sports Was Formed On July 1 2014Document1 pageMeridan Golf and Sports Was Formed On July 1 2014Hassan JanNo ratings yet

- Wa0022.Document37 pagesWa0022.karishmarakhi03No ratings yet

- 211 - F - Bevcon Wayors-A Study On Financial Cost Efficiency at Bevcon WayorsDocument70 pages211 - F - Bevcon Wayors-A Study On Financial Cost Efficiency at Bevcon WayorsPeacock Live ProjectsNo ratings yet

- Soy Flour Project Report SummaryDocument8 pagesSoy Flour Project Report SummaryAkhilesh KumarNo ratings yet

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)