Professional Documents

Culture Documents

Case Study 1 Fin745

Uploaded by

nieyootCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study 1 Fin745

Uploaded by

nieyootCopyright:

Available Formats

INDIVIDUAL ASSIGNMENT

CASE STUDY 1

MANAGERIAL FINANCE (FIN 745)

PREPARED BY:

NURUL ANIYYAH MD ISA

2013881164

BM7002DF

SUBMITTED TO:

PROFESSOR DR CATHERINE S F HO

SUBMISSION DATE:

21

st

APRIL 2014

QUESTION 1

RATIO ANALYSIS OF UNIVERSAL OFFICE FURNISHINGS

1.0 LIQUIDITY

Liquidity ratio refers to firms ability to pay its short term obligation. In 2009, the current

ratio of Universal Office Furnishing is 1.55 but then the ratio decline in 2010 to 1.29. The

highest current ratio experienced by the firm for period 2009-2012 is in 2011 which is 1.69.

However, the current ratio of firm decreases to 1.34 in 2012. Overall, liquidity ratio of firm

shows fluctuation trend but the firm able to maintain a level that is relatively consistent with

the industry average in 2012. Thus, the firms liquidity seems to be good.

2.0 ACTIVITY

Activity ratio measures how efficiently firm operates along a variety of dimensions such as

inventory management, disbursements and collections. In 2009, the inventory turnover of

Universal Office Furnishing is 15.25 times and increases to 17.17 times in 2010. The firms

inventory turnover declined slightly in 2011 but the firm manages to improve back their

inventory level in 2012. Generally, the trend of inventory turnover for the firm is increasing

year by year which means the firm has strong sales performance and less cash the firm has

tied up in inventory. In term of receivable turnover, the firm has reasonably stable trend and

succeeded to perform at a level above industry average over the 2009-2012 periods. It shows

the firms extension of credit and collection of account receivables is efficient. Universal

Office Furnishings total asset turnover signifies the improvement in the efficiency of total

asset utilization between 2009 and 2012.

3.0 LEVERAGE

Universal Office Furnishings indebtedness increased over the 2010-2011 period which

indicates the firm has high financial leverage. Even though this increase in the debt ratio

could be signal firm to reduce dependency on firms creditor in generating profit but the

firms debt ratio is still below industry average of 2012. Besides that, the firm is also able to

meet interest and fixed payment obligations from 2009 till 2012 and if compared with the

industry average, the firms time interest earned ratio is much better. In general, Universal

Office Furnishings leverage seems to be good.

4.0 PROFITABILITY

Profitability ratios measure the income or operating success of a company for a given period

of time. Based on the financial ratios provided, Universal Office Furnishing has enjoyed

remarkable growth. The firms net profit margin is increases from 6.6% to 8.0% in 2009 and

2011. In year 2012, the net profit margin of the and marginally declined to 7.2%. The firms

return on assets, return on equity also behaved much as its net profit margin did over 2009-

2011 period. Both return on assets and return on equity of Universal Office Furnishing

decreases to 14.8% and 47.4% respectively in 2012. Although 2012 was an off year, it

appears that the firms net profit margin, return on assets and return on equity was better than

the average company in the industry.

5.0 MARKET VALUE

Market value ratios give insight into how investors in the marketplace feel the firm is doing in

term of risk and return. Investors have greater confidence in 2012 than in the previous 3 years

as reflected in the price/earnings ratio. This ratio is also above the industry average which

indicates the investors have greater confidence in the firms future performance since they are

willing to pay more for each dollar of a firms earning compared to prior year. The firms

price to book value ratio has increased from 2009-2011 period but in 2012, the ratio decrease

in small amount. Although the price to book value ratio decrease in 2012 but it remains above

the average firm in its industry. This implies that investors are positive about the firms future

performance and expect earn high future return as compensation for the firms above-average

risk. In short, the firm has shown good performance in 2012 and previous years.

6.0 STRENGTHS & WEAKNESSES

The firm has stable liquidity performance and was efficient in managing its overall companys

activity. The firm also might not have a problem to meet its obligation and enjoy sustainable

growth since the firm has higher profitability and lower financial leverage compared to

industry. Apart from that, the firms earning per share is increasing over the years which can

attract investors to invest in the company. The investors also have greater confidence in the

firms future performance as reflected in firms price/earnings ratio.

In contrast, the firm only manages to collect their receivables between 39 days to 43 days.

Although the firms receivable turnover is higher than industry average, it only beneficial to

the firm if the firms credit term is more than 40 days. If Universal Office Furnishing extends

30-day credit terms to customers, 39 days to 43 days collection period signify a poorly

managed credit or collection department. The debt equity ratio of the firm also could hurt the

firms performance since it increasing in the beginning before declined in year 2012. Even

though the firms leverage is below industry average, the firm has to cautiously choosing their

capital structure in order to minimize financial risk.

QUESTION 2

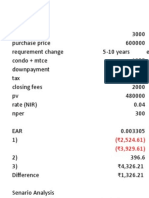

You plan to purchase a house for $250,000 and make a 10% down payment. At 9%, what is

the difference between the monthly payments under a) a 30 year loan and b) a 15 year loan?

c) How much interest is saved under the 15 year loan?

Formula:

CF = (PV r) [1 - 1/ (1 + r)

n

]

Where CF = Cash Flow

PV = Present Value of Money

r = Interest rate per period

n = Total number of payments or periods

Solution:

a) 30 year loan

PV = $250, 000- (0.1 $250,000)

= $225,000

r = 9% annually 12 months

= 0.75% monthly

n = 30 years 12

= 360 periods

CF = ($225,000 0.0075) [1 - 1/ (1 + 0.0075)

360

]

= $1,810.40

b) 15 year loan

PV = $250, 000- (0.1 $250,000)

= $225,000

r = 9% annually 12 months

= 0.75% monthly

n = 15 years 12

= 180 periods

CF = ($225,000 0.0075) [1 - 1/ (1 + 0.0075)

180

]

= $2,282.10

c) How much interest is saved under the 15 year loan?

15 year loan 30 year loan

Total paid

= $2,282.10 180

= $410,778

= $1,810.40 360

= $651,744

Total interest saved

under 15 year loan

= $651,744 - $410,778

= $240,966

QUESTION 3

You take a conventional fixed rate mortgage to purchase a house for $350,000. What is your

monthly payment in the terms of the loan are 9% over 30 years?

Formula:

CF = (PV r) [1 - 1/ (1 + r)

n

]

Where CF = Cash Flow

PV = Present Value of Money

r = Interest rate per period

n = Total number of payments or periods

Solution:

PV = $350,000

r = 9% annually 12 months

= 0.75% monthly

n = 30 years 12

= 360 periods

CF = ($350,000 0.0075) [1 - 1/ (1 + 0.0075)

360

]

= $2, 816.18

QUESTION 4

You plan to save $100 per month for the next 5 years. a) At 3% compounded monthly, how

much will you have accumulated at the end of the next 5 year period? b) How much

difference does it make if the payments are made at the beginning of the period rather that at

the end?

Solution:

a) At 3% compounded monthly, how much will you have accumulated at the end of the

next 5 year period?

Formula:

FV

a

= CF [{(1 + r)

n

-1}/ r]

Where FV

a

= Future Value Annuity

CF = Cash Flow

r = Interest rate per period

n = Total number of payments or periods

CF = $100 per month

r = 3% monthly

n = 5 years 12

= 60 periods

FV

a

= $100 [{(1 + 0.03)

60

-1}/ 0.03]

= $16, 305.34

b) How much difference does it make if the payments are made at the beginning of the

period rather that at the end?

Formula:

FV

a

= CF [{(1 + r)

n

-1}/ r] (1 + r)

Where FV

a

= Future Value Annuity

CF = Cash Flow

r = Interest rate per period

n = Total number of payments or periods

CF = $100 per month

r = 3% monthly

n = 5 years 12 months

= 60 periods

FV

a

= $100 [{(1 + 0.03)

60

-1}/ 0.03] (1 + 0.03)

= $16, 794, 50

Difference = $16, 794, 50 - $16, 305.34

= $489.16

QUESTION 5

You want to retire in 30 years at age 60. a) Assuming you can earn an annual rate of return of

9%, how much do you need to invest each month until retirement to accumulate $1,000,000

by age 60? b) Assuming the same return and a life expectancy of 80 years, how much can

you withdraw each month from your $1,000,000 retirement fund starting 30 days after you

turn 60?

0 years 9% 30 years 9% 50 years

Solution:

a) Assuming you can earn an annual rate of return of 9%, how much do you need to

invest each month until retirement to accumulate $1,000,000 by age 60?

Formula:

FV

a

= CF [{(1 + r)

n

-1}/ r]

Where FV

a

= Future Value Annuity

CF = Cash Flow

r = Interest rate per period

n = Total number of payments or periods

FV

a

= $1,000,000

r = 9% annually 12 months

= 0.75%

n = 30 years 12 months

= 360 periods

$1,000,000 = CF [{(1 + 0.0075)

360

-1}/ 0.0075]

$1,000,000 = CF $1,830.74

CF = $1,000,000/$1,830.74

= $546.23

b) Assuming the same return and a life expectancy of 80 years, how much can you

withdraw each month from your $1,000,000 retirement fund starting 30 days after you

turn 60?

Formula:

PV

a

= CF/r 1- [1/ (1 + r)

n

]

Where PV

a

= Present Value Annuity

CF = Cash Flow

r = Interest rate per period

n = Total number of payments or periods

PV

a =

$1,000,000

r = 9% annually 12 months

= 0.75%

n = 20 years 12 months

= 240 periods

$1,000,000 = CF/0.0075 1- [1/ (1 + 0.0075)

240

]

$1,000,000 = CF/0.0075 0.8336

CF = ($1,000,000/0.8336) 0.0075

= $8,997.26

You might also like

- Dani IFM AssignmentDocument9 pagesDani IFM AssignmentdanielNo ratings yet

- Maria FinalDocument8 pagesMaria FinalrideralfiNo ratings yet

- Business FinanceDocument221 pagesBusiness FinanceMatthew GonzalesNo ratings yet

- Rate of Return InflationDocument12 pagesRate of Return InflationShreya SinglaNo ratings yet

- Financial Management FM 1: Introduction & Time Value of MoneyDocument20 pagesFinancial Management FM 1: Introduction & Time Value of MoneyharryworldNo ratings yet

- Introduction To Financial Management FIN 254 (Assignment) Spring 2014 (Due On 24th April 10-11.00 AM) at Nac 955Document10 pagesIntroduction To Financial Management FIN 254 (Assignment) Spring 2014 (Due On 24th April 10-11.00 AM) at Nac 955Shelly SantiagoNo ratings yet

- Operating Margin RatioDocument9 pagesOperating Margin RatiorideralfiNo ratings yet

- 1349 1Document6 pages1349 1Noaman AkbarNo ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisBharatsinh SarvaiyaNo ratings yet

- Time Value of MoneyDocument37 pagesTime Value of MoneyDarrell PhilipNo ratings yet

- Corporate Finance: Operating vs Financial LeverageDocument13 pagesCorporate Finance: Operating vs Financial LeverageSubhana NasimNo ratings yet

- MAS 2 Quiz#1Document9 pagesMAS 2 Quiz#1PRINCESS HONEYLET SIGESMUNDONo ratings yet

- Term Paper - Accounting and FinanceDocument3 pagesTerm Paper - Accounting and FinanceJayNo ratings yet

- Tutorial 12Document72 pagesTutorial 12Irene WongNo ratings yet

- Corporate finance assignment questionsDocument11 pagesCorporate finance assignment questionsShamsul HaqimNo ratings yet

- Corporate Finance 2022 AnswerDocument11 pagesCorporate Finance 2022 AnswerSagar JindalNo ratings yet

- Data, Analysis and Findings: Tata MotorsDocument24 pagesData, Analysis and Findings: Tata MotorsAjoy MahajanNo ratings yet

- Profitability Ratios: Return On Asset (ROA)Document11 pagesProfitability Ratios: Return On Asset (ROA)Saddam Hossain EmonNo ratings yet

- Test Your Knowledge - Ratio AnalysisDocument29 pagesTest Your Knowledge - Ratio AnalysisMukta JainNo ratings yet

- Financial Ratio Analysis and InterpretationTITLEDocument4 pagesFinancial Ratio Analysis and InterpretationTITLEReymilyn Sanchez78% (9)

- Ratio AnalysisDocument16 pagesRatio AnalysisAbdul RehmanNo ratings yet

- Financial Statements and Ratio Analysis ExplainedDocument5 pagesFinancial Statements and Ratio Analysis Explainedhana osmanNo ratings yet

- Solution:: Operating Profit RatioDocument8 pagesSolution:: Operating Profit RatioMuhammad DaniSh ManZoorNo ratings yet

- Seminar 4 DCF Valuation, NPV, and Other Investment RulesDocument79 pagesSeminar 4 DCF Valuation, NPV, and Other Investment RulesPoun GerrNo ratings yet

- Reasons For Collapse of BanksDocument25 pagesReasons For Collapse of BanksMichael VuhaNo ratings yet

- A. Ratios Caculation. 1. Current Ratio For Fiscal Years 2017 and 2018Document6 pagesA. Ratios Caculation. 1. Current Ratio For Fiscal Years 2017 and 2018Phạm Thu HuyềnNo ratings yet

- Financial Statement and Comparative Analysis at Idbi Federal Insurance Co LTDDocument17 pagesFinancial Statement and Comparative Analysis at Idbi Federal Insurance Co LTDManikanthBhavirisettyNo ratings yet

- Sraw-The Final Clash: ANSWER: 200,000Document13 pagesSraw-The Final Clash: ANSWER: 200,000John Philip Abrigo CondeNo ratings yet

- Financial Anlysis of FFC For InvestorsDocument7 pagesFinancial Anlysis of FFC For InvestorsAli KhanNo ratings yet

- Management Advisory Services: ReviewerDocument17 pagesManagement Advisory Services: ReviewerMarc Anthony Max MagbalonNo ratings yet

- Business Finance Solved MCQ'sDocument21 pagesBusiness Finance Solved MCQ'srao mustafaNo ratings yet

- Integrated Case 4-26Document6 pagesIntegrated Case 4-26Cayden BrookeNo ratings yet

- AXIS Bank AnalysisDocument44 pagesAXIS Bank AnalysisArup SarkarNo ratings yet

- Lecture Time Value of MoneyDocument44 pagesLecture Time Value of MoneyAdina MaricaNo ratings yet

- Cases in Finance - FIN 200Document3 pagesCases in Finance - FIN 200avegaNo ratings yet

- Ratio AnalysisDocument10 pagesRatio AnalysisJuhi TiwariNo ratings yet

- Financial Ratio AnalysisDocument42 pagesFinancial Ratio Analysisfattiq_1No ratings yet

- Module 1 - Time Value of Money Handout For LMS 2020Document8 pagesModule 1 - Time Value of Money Handout For LMS 2020sandeshNo ratings yet

- FM CHAPTER 3 THREE. PPT SlidesDocument84 pagesFM CHAPTER 3 THREE. PPT SlidesAlayou TeferaNo ratings yet

- 03 CH03Document41 pages03 CH03Walid Mohamed AnwarNo ratings yet

- LONG TERM INVESTMENT DECISIONS: TIME VALUE OF MONEY (TVM) REPORTDocument7 pagesLONG TERM INVESTMENT DECISIONS: TIME VALUE OF MONEY (TVM) REPORTMary Ann MarianoNo ratings yet

- Expected Questions of FIN 515Document8 pagesExpected Questions of FIN 515Mian SbNo ratings yet

- Financial Accounting Week 11Document28 pagesFinancial Accounting Week 11Nashmia KhurramNo ratings yet

- Solutions: First Group Moeller-Corporate FinanceDocument13 pagesSolutions: First Group Moeller-Corporate Financelefteris82No ratings yet

- Report Fin GroupDocument10 pagesReport Fin GroupFATIMAH ZAHRA BINTI ABDUL HADI KAMELNo ratings yet

- BBF201 041220233 Ca1Document9 pagesBBF201 041220233 Ca1SO CreativeNo ratings yet

- Analysis Far (Unit)Document5 pagesAnalysis Far (Unit)Asfatin AmranNo ratings yet

- Valuation: Future Growth and Cash FlowsDocument12 pagesValuation: Future Growth and Cash FlowsAnshik BansalNo ratings yet

- Factors Determining Optimal Capital StructureDocument26 pagesFactors Determining Optimal Capital StructureSudipta BanerjeeNo ratings yet

- GR12 Business Finance Module 9-10Document7 pagesGR12 Business Finance Module 9-10Jean Diane JoveloNo ratings yet

- What Is A BudgetDocument3 pagesWhat Is A BudgetKarla OñasNo ratings yet

- Financial analysis of Reliance Media Works reveals declining performanceDocument25 pagesFinancial analysis of Reliance Media Works reveals declining performanceAmrita HaldarNo ratings yet

- Midterm Project URC Group 3FM2Document14 pagesMidterm Project URC Group 3FM2YunieNo ratings yet

- Analysis On Nestlé Financial Statements 2017Document8 pagesAnalysis On Nestlé Financial Statements 2017Fred The FishNo ratings yet

- Understanding Time Value of MoneyDocument10 pagesUnderstanding Time Value of MoneyMansi SrivastavaNo ratings yet

- Time Value of Money ExplainedDocument17 pagesTime Value of Money ExplainedShantam RajanNo ratings yet

- Time Value of MoneyDocument24 pagesTime Value of MoneySXCEcon PostGrad 2021-23No ratings yet

- mb0045 FinancialManagementDocument9 pagesmb0045 FinancialManagementSaravanan VelayuthamNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- SEC Personal Financial PlanningDocument13 pagesSEC Personal Financial PlanningJagriti100% (3)

- Engineering Economics: CEN (C) 2022 Jubail Industrial College 1Document28 pagesEngineering Economics: CEN (C) 2022 Jubail Industrial College 1ram uoNo ratings yet

- Fundamentals of Corporate Finance 3rd Edition Parrino Solutions Manual DownloadDocument47 pagesFundamentals of Corporate Finance 3rd Edition Parrino Solutions Manual DownloadSamuel Hobart100% (23)

- Discounted Measure of Cost and Benefit and Preparation of Cash FlowDocument43 pagesDiscounted Measure of Cost and Benefit and Preparation of Cash FlowHassan GilaniNo ratings yet

- Financial Planning Project ReportDocument79 pagesFinancial Planning Project ReportDeep Shah83% (12)

- Interest Rate Risk and Time Value of MoneyDocument33 pagesInterest Rate Risk and Time Value of MoneyNoel GatbontonNo ratings yet

- Business FinanceDocument4 pagesBusiness FinanceMAk KhanNo ratings yet

- Capital Budgeting Quiz 1: Multiple ChoiceDocument7 pagesCapital Budgeting Quiz 1: Multiple ChoiceMark Jesus Aristo100% (1)

- Ee Assignment No. 1Document3 pagesEe Assignment No. 1Umar JuttNo ratings yet

- ch02 - Financial Planning Skills-Tb - Mckeown - 2eDocument18 pagesch02 - Financial Planning Skills-Tb - Mckeown - 2e李佳南No ratings yet

- Time Value of MoneyDocument3 pagesTime Value of MoneyDuncan MstarNo ratings yet

- MG6863 - ENGINEERING ECONOMICS - Question BankDocument19 pagesMG6863 - ENGINEERING ECONOMICS - Question BankSRMBALAANo ratings yet

- Annuity CalculatorDocument26 pagesAnnuity Calculatorapi-439109335No ratings yet

- EXAM 1 Econ 1Document1 pageEXAM 1 Econ 1June CostalesNo ratings yet

- RBI Grade B 2019 Exam: Dates, Eligibility, SyllabusDocument28 pagesRBI Grade B 2019 Exam: Dates, Eligibility, SyllabusjyottsnaNo ratings yet

- Principles of Finance - 2101Document14 pagesPrinciples of Finance - 2101Noel MartinNo ratings yet

- Module 6.1 Group 2Document51 pagesModule 6.1 Group 2Bernadette MendozaNo ratings yet

- R05 Time Value of Money IFT Notes PDFDocument28 pagesR05 Time Value of Money IFT Notes PDFAbbas0% (1)

- Ross FCF 11ce IM Ch05Document10 pagesRoss FCF 11ce IM Ch05Jeffrey O'LearyNo ratings yet

- Time Value of MoneyDocument21 pagesTime Value of MoneyKatarame LermanNo ratings yet

- CH 06Document80 pagesCH 06ชัยยศ โชติ100% (1)

- 4-Time Value of Money Business Finance 1Document39 pages4-Time Value of Money Business Finance 1faizy24No ratings yet

- Compiled Copy of AssignmentDocument38 pagesCompiled Copy of AssignmentsrivastavajiteshNo ratings yet

- Time Value of Money The Buy Versus Rent Decision - SolutionDocument5 pagesTime Value of Money The Buy Versus Rent Decision - Solutioncpsoni62% (13)

- The Risk-Return Tradeoff Is The Principle That Potential Return Rises With An Increase in RiskDocument5 pagesThe Risk-Return Tradeoff Is The Principle That Potential Return Rises With An Increase in Riskjoshua0% (1)

- ch06 Time Value of MoneyDocument44 pagesch06 Time Value of MoneyMortarezNo ratings yet

- BFD NotesDocument84 pagesBFD NotesFarukh NaveedNo ratings yet

- RBI Grade B 2019 Notification and Exam DatesDocument28 pagesRBI Grade B 2019 Notification and Exam DatesjyottsnaNo ratings yet

- Financial Management - Model Questions Subject Code: Mb0045 BOOK ID: (B1134) Second Semester Section A - 1 MarkDocument13 pagesFinancial Management - Model Questions Subject Code: Mb0045 BOOK ID: (B1134) Second Semester Section A - 1 MarkYash koradiaNo ratings yet

- FNCE101 wk02Document43 pagesFNCE101 wk02Ian ChengNo ratings yet