Professional Documents

Culture Documents

Truong Tan Trung - FA 2011 B 56

Uploaded by

Ryan Cheung0 ratings0% found this document useful (0 votes)

15 views12 pagesCorporate Governance

Original Title

Truong Tan Trung_ FA 2011 B 56

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCorporate Governance

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views12 pagesTruong Tan Trung - FA 2011 B 56

Uploaded by

Ryan CheungCorporate Governance

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 12

1

CORPORATE GOVERNANCE IN HONG KONG

A GENERAL VIEW

Truong Tan Trung

Vietnamese - German University

tantrung2811@gmail.com

06/06/2014

2

Table of content

Table of content .................................................................................................................... 2

List of Abbreviations .............................................................................................................. 3

I/Introduction ......................................................................................................................... 4

II/Overview ............................................................................................................................ 4

III/Corporate Governance Practices ...................................................................................... 6

1/ Boards of Directors ........................................................................................................ 6

2/Remuneration of directors and senior management ....................................................... 6

3/Accountability and audit .................................................................................................. 7

4/Delegation by the board of directors ............................................................................... 7

a/Management functions ................................................................................................ 7

b/Board Committees ...................................................................................................... 7

5/Communication with shareholders .................................................................................. 8

6/Company Secretary ........................................................................................................ 8

IV/Hong Kong Corporate Governance Status ........................................................................ 8

V/Conclusion ......................................................................................................................... 9

Bibliography ........................................................................................................................ 11

3

List of Abbreviations

CEO Chief Executive Officer

HKSA Hong Kong Society of Accountants

HKSE Hong Kong Stock Exchange

HWL Hutchison Whampoa Limited

INEDs Independent Non-executive Directors

NEDs Non-executive Directors

UK United Kingdom

US United States

4

I/Introduction

Corporate governance is defined as overall control of activities in a corporation that

involves the formulation of corporate objectives, strategies, and plans and the proper

management structure in order to be responsible to its various stakeholders (Steiner and

Steiner, 2006)

1

. Without the right corporate governance, many collapses happened to even

the enormous companies in the world like Baring Banks (1995), Enron (2000), Parmalat

(2003) (Mallin, 2010)

2

.

Before 1997, Hong Kong was a colony of the British Empire and inherited the governance

structure of the West. It brought to a difference between Hong Kong and other countries in

Asia by the appliance of corporate governance regime prior to the financial crisis in 1997.

With that, Hong Kong was not suffer much damage to their businesses (Simon S.M.Ho,

2003)

3

.

This paper will give the insight information about Hong Kong corporate governance. First,

the writer will say about the overview of Hong Kong corporate governance and then discuss

generally about practices of Hong Kong corporate governance. Lastly, the case about good

corporate governance company and the comments on Hong Kong will be presented to show

the status of Hong Kong corporate governance.

II/Overview

According to Tricker, in Hong Kong, corporate governance is a fascinating melange of

Anglo American and Asian ideas.

4

. Also from a research of Simon S.M.Ho (2003), he said:

At a country level, Hong Kong adopts the US/UK model to some extent, as its legal and

accounting systems are similar to the British model and its market regulatory framework to

1

Steiner, John F., and George A. Steiner. Business, Government, and Society: A Managerial

Perspective. New York: McGraw Hill/Irwin, 2006. 597. Print.

2

Mallin, Christine A. "1/Introduction." Corporate Governance. Oxford: Oxford UP, 2010. N. pag. Print.

3

Ho, Simon S.M, PhD. Corporate Governance in Hong Kong: Key Problems and Prospects. Working

paper. 2nd ed. Hong Kong: Chinese U of Hong Kong, 2003. Social Science Research Network

Electronic Paper Collection. Web. 3 June 2014. <http://ssrn.com/abstract=440924>.

4

Tricker, R. Ian. "17/Corporate Governance Around The World." Corporate Governance: Principles,

Policies, and Practices. 2nd ed. Oxford: Oxford UP, 2009. 457. Print.

5

the American model. At the corporate level, the Family Control Model is dominant.

5

. In

Anglo American side which Hong Kong corporate governance inherited, we can see a stable

common law legal system and independent judiciary, active advocacy of improved corporate

governance by regulators, international accounting standards, good overall standard on a

global basis and a trend of improvement, and leadership in Asia. These five observations is

concluded by Standard and Poors (2002) (data taken from the report of Simon S.M.Ho,

2003)

6

. Nevertheless, because of being a territory in Asia, Hong Kong also share the norm to

have large proportion of companies are owned by families. HKSAs Corporate Governance

Working Group (CGWG) reported that over 70% of Hong Kong listed companies were

controlled by a family or an individual (Hong Kong Society of Accountants, 1996)

7

. Not only

that, in 2002, 33 listed companies were controlled by ten wealthiest families in Hong Kong

with a total market value at 31 Dec 2002 of HK$933 billion (approx US$120 billion) (data

extracted from Adrian Lei and Frank Songs working paper, 2005)

8

. As the government of

Hong Kong acknowledge about the tradition in its companies, they have tried to establish a

good corporate governance that work well along with family firms. According to Donald

Tsang (1999), a former financial secretary, our aim is to establish Hong Kong as a paragon

of corporate governance, ensuring that those investments in Hong Kong are afforded the best

protection and that our listed companies are managed with excellence, complying with the

highest international standards including those related to risk management and disclosure of

information

9

. Therefore, in 2002, Hong Kong is ranked in second place out of ten East Asian

countries in quality of corporate governance and transparency by Political and Economic

Risk Consultancy

10

.

5

Ho, Simon S.M, PhD. Corporate Governance in Hong Kong: Key Problems and Prospects. Working

paper. 2nd ed. Hong Kong: Chinese U of Hong Kong, 2003. Social Science Research Network

Electronic Paper Collection. Web. 3 June 2014. <http://ssrn.com/abstract=440924>.

6

Ho, Simon S.M, PhD. Corporate Governance in Hong Kong: Key Problems and Prospects. Working

paper. 2nd ed. Hong Kong: Chinese U of Hong Kong, 2003. Social Science Research Network

Electronic Paper Collection. Web. 3 June 2014. <http://ssrn.com/abstract=440924>

7

Hong Kong Society of Accountants, Hong Kong Accountants Special Issue on Corporate

Governance, September/October 1996.

8

Lei, Adrian C.H, and Frank M. Song. Corporate Governance, Family Ownership, and Firm

Valuations in Emerging Markets: Evidence from Hong Kong Panel Data. Working paper. N.p.: n.p.,

2005. SSRN. Web. 3 June 2014. <http://ssrn.com/abstract=1100710>.

9

Ho, Simon S.M, PhD. Corporate Governance in Hong Kong: Key Problems and Prospects. Working

paper. 2nd ed. Hong Kong: Chinese U of Hong Kong, 2003. Social Science Research Network

Electronic Paper Collection. Web. 3 June 2014. <http://ssrn.com/abstract=440924>

10

ibid

6

III/Corporate Governance Practices

To ensure the best practices for corporate governance, Hong Kong Stock Exchange (HKSE)

published the Code on Corporate Governance Practices (the Code)

11

on 30th January, 2004

which includes 5 sections: Directors (1), Remuneration of directors and senior management

(2), Accountability and audit (3), Delegation by the board of directors (4), Communication

with shareholders (5) and Company Secretary (6)

1/ Boards of Directors

There are many provisions about this sections of Code on Corporate Governance Practices.

Therefore, to simplify, Deloitte

12

made a summary of the code. Based on Deloitte summary,

the Code required each board of directors has executives and non-executive directors. In

order to maintain the fairness, to stop the major owners from manipulating the decisions of

the company to exploit the benefits as expense of minority shareholders, every board of

directors of a listed company must have at least one-third

13

of it fill with independent non-

executive directors (which can be call as INEDs) (Note). INEDs is required to have

obligations like other executive directors. Not only that, the Code also made clear that

chairman and chief executive officer (CEO) cant not be the same person due to a need of

clear division of the responsibilities of the management of the board and the day-to-day

management of the company's business. Moreover, board meetings should be held at least

four times a year at approximately quarterly intervals.

2/Remuneration of directors and senior management

To avoid managers and directors taking advantage from unreveal compensations, a code

about this was established. The general idea of this code provisions is to disclose all the

information related to remuneration for directors and managers in a company.

14

11

Look up the Code Provisions and Principles at "Corporate Governance." Hong Kong Exchange

Stock, 2013. Web. 4 June 2014.

<https://www.hkex.com.hk/eng/exchange/corpgov/Documents/compliance_checklist.pdf>.

12

"Hong Kong SAR." Center for Corporate Governance. Deloitte Touche Tohmatsu, n.d. Web. 06

June 2014. <http://www.corpgov.deloitte.com/site/ChinaEng/hongkong-governance-profile/>.

13

Amendment in Code Provision. "HKEx News Release." HKEx, 28 Oct. 2011. Web. 6 June 2014.

<https://www.hkex.com.hk/eng/newsconsul/hkexnews/2011/111028news.htm>.

14

Based on the Principles of Remuneration in Code on Corporate Governance, Hong Kong

7

3/Accountability and audit

The collapse of one of the top ten US Fortune in 2000, Enron due to the lack of effective

auditing was a huge shock to the financial world. (Mallin, 2010)

15

Therefore, to prevent the

similar case to happen, HKSE required each company to follow their instructions in 3

aspects:

financial reporting - to present a balanced, clear and comprehensible assessment of

the companys performance, position and prospects

16

internal controls - to safeguard shareholders investment and the issuers assets

17

Audit Committee - to oversight financial reporting, monitor accounting policies,

oversight any external auditors, regulatory compliance, and discuss about risk

management policies with management. (Investopedia)

18

4/Delegation by the board of directors

We approach this section by considering its principles to have a general idea about the

delegation by the board of directors

a/Management functions

An issuer should have a formal schedule of matters specifically reserved for board approval.

The board should give clear directions to management on the matters that must be approved

by it before decisions are made on the issuers behalf.

19

b/Board Committees

Board committees should be formed with specific written terms of reference which deal

clearly with their authority and duties

20

15

Mallin, Christine A. "1/Introduction." Corporate Governance. Oxford: Oxford UP, 2010. N. pag. Print.

16

Based on the Principles of Accountability and audit in Code on Corporate Governance, Hong

Kong, HKEx

17

ibid

18

"Audit Committee Definition | Investopedia." Investopedia. Investopedia, n.d. Web. 04 June 2014.

<http://www.investopedia.com/terms/a/audit-committee.asp>.

19

Principles of Delegation by board of directors in Code on Corporate Governance, Hong Kong,

HKEx

20

ibid

8

5/Communication with shareholders

In modern corporations, it is really important to know how treat the shareholders. However,

in Hong Kong, family owned companies is a trend. Therefore, this code is established to

maintain the effective communication and somehow protect the minority shareholders.

21

6/Company Secretary

The company secretary plays an important role in supporting the board by ensuring good

information flow within the board and that board policy and procedures are followed. The

company secretary is responsible for advising the board through the chairman and/or the

chief executive on governance matters and should also facilitate induction and professional

development of directors.

22

IV/Hong Kong Corporate Governance Status

Hong Kong government tries its best to maintain the good corporate governance. Hong Kong

Stock Exchange made amends on the Corporate Governance Code and Listing Rules

frequently from 2004 till now. The latest amends were published in 2011

23

. Not only the

government knows that good corporate governance makes the financial markets better but

companies also acknowledges that high quality corporate governance will increase the firms

value in the perspective of investors, especially when most firms in Hong Kong is ownership

concentrated. Moreover, a data collected from Simon report shows that, Standard and Poors

indicates that investors are willing to pay a premium for shares in well- governed

companies

24

.

For examples, Hutchison Whampoa Limited (HWL), a Hong Kong based Fortune Global

500 firm and also owned and managed by a well-known family group in Hong Kong. Li Ka-

shing, one of the top 20 billionaires in the world (Forbes)

25

. Although HWL has a

concentration in ownership, it still disclose all the information for users needs. Not only that,

21

Based on Principles of Communication with shareholders in Code on Corporate Governance,

Hong Kong, HKEx

22

Principles of Company Secretary in Code on Corporate Governance, Hong Kong, HKEx

23

"HKEx News Release." HKEx, 28 Oct. 2011. Web. 6 June 2014.

<https://www.hkex.com.hk/eng/newsconsul/hkexnews/2011/111028news.htm>.

24

Ho, Simon S.M, PhD. Corporate Governance in Hong Kong: Key Problems and Prospects. Working

paper. 2nd ed. Hong Kong: Chinese U of Hong Kong, 2003. Social Science Research Network

Electronic Paper Collection. Web. 3 June 2014. <http://ssrn.com/abstract=440924>

25

"Li Ka-Shing." Forbes. Forbes Magazine, n.d. Web. 06 June 2014.

<http://www.forbes.com/profile/li-ka-shing/>.

9

the board structures of this company also has the good governance. The board of directors in

HWL consists of 15 directors, including Li Ka-shing and his elder son, the group managing

director, deputy group managing director, group finance director, 3 executive directors, 6

independent non-executive directors (more than one-third of the board) and 1 non-executive

director (Based on the interim report 2013 of HWL)

26

.

However, there are still cases that some companies use some loopholes or secretly going

against the rules by using fraud or bribing. In a recent interview

27

by China Money Network

with Bing Ling, a portfolio manager at Hong Kong-based US$1.4 billion-under-management

hedge fund, he said that from his experience and observation, there was still so many

accounting abuse in even large companies (Hong Kong) due to the fact that there was no

strong forces to go against those companies. He also criticized the Hong Kong Stock

Exchange with the relaxed attempt to deal with independent directors rules. Not only that,

with more than seventy-five per cent of listed companies are domiciled outside of Hong

Kong and are not subject to some relevant local laws (Simon S.M.Ho, 2003)

28

, it is hard for

Hong Kong governors to deal with the violations in these companies.

This points out that the corporate governance in Hong Kong still has many to improve though

it is good compared to other Asian countries as stated in (II).

V/Conclusion

Corporate governance has been becoming the focus of regulators, shareholders and various

stakeholders in the world (Chau & Leung, 2006)

29

. Hong Kong, like other Asian countries,

has a paradigmatic feature of organisational form, the family (ownership concentration)

firms (Hubert Shea, 2008)

30

, which made many difficult in corporate governance. However,

26

Interim Report. Rep. Hong Kong: HWL, 2013. Web. 6 June 2014.

<http://202.66.146.82/listco/hk/hutchison/interim/2013/intrep.pdf>.

27

Lin, Bing. "Bing Lin: Accounting Abuse Among Listed Chinese Companies Still Widespread."

Interview. China Money Network. China Money Podcast, 16 Apr. 2014. Web. 6 June 2014.

<http://www.chinamoneynetwork.com/2014/04/16/bing-lin-accounting-abuse-among-listed-chinese-

companies-still-widespread>.

28

Ho, Simon S.M, PhD. Corporate Governance in Hong Kong: Key Problems and Prospects. Working

paper. 2nd ed. Hong Kong: Chinese U of Hong Kong, 2003. Social Science Research Network

Electronic Paper Collection. Web. 3 June 2014. <http://ssrn.com/abstract=440924>

29

Chau, Gerald, and Patrick Leung. "The Impact of Board Composition and Family Ownership on

Audit Committee Formation: Evidence from Hong Kong." Journal of International Accounting, Auditing

and Taxation 15.1 (2006): 1-15. Web.

30

Shea, Hubert. "Corporate Governance and Social Responsibility of Family Firms in Hong Kong: A

Case Study of Hutchison Whampoa Limited (HWL)." SSRN. N.p., n.d. Web. 3 June 2014.

<http://ssrn.com/abstract=935101>.

10

Hong Kong made its governance better by improve their corporate governance frequently. It

even applied the US/UK market model into its corporate governance rules. This made

corporate governance in Hong Kong better than many countries in Asia. Nevertheless, Hong

Kong still has to put more effort in order to made it better.

11

Bibliography

"Audit Committee Definition | Investopedia." Investopedia. Investopedia. Web. 04 June

2014. <http://www.investopedia.com/terms/a/audit-committee.asp>.

Chau, Gerald, and Patrick Leung. "The Impact of Board Composition and Family

Ownership on Audit Committee Formation: Evidence from Hong Kong." Journal of

International Accounting, Auditing and Taxation 15.1 (2006): 1-15. Web.

"Corporate Governmance." Hong Kong Exchange Stock, 2013. Web. 4 June 2014.

<https://www.hkex.com.hk/eng/exchange/corpgov/Documents/compliance_checklist.pdf

>.

"HKEx News Release." HKEx, 28 Oct. 2011. Web. 6 June 2014.

<https://www.hkex.com.hk/eng/newsconsul/hkexnews/2011/111028news.htm>.

Ho, Simon S.M, PhD. Corporate Governance in Hong Kong: Key Problems and

Prospects. Working paper. 2nd ed. Hong Kong: Chinese U of Hong Kong, 2003. Social

Science Research Network Electronic Paper Collection. Web. 3 June 2014.

<http://ssrn.com/abstract=440924>.

"Hong Kong SAR." Center for Corporate Governance. Deloitte Touche Tohmatsu. Web.

06 June 2014. <http://www.corpgov.deloitte.com/site/ChinaEng/hongkong-governance-

profile/>.

Interim Report. Rep. Hong Kong: HWL, 2013. Web. 6 June 2014.

<http://202.66.146.82/listco/hk/hutchison/interim/2013/intrep.pdf>.

Lei, Adrian C.H, and Frank M. Song. Corporate Governance, Family Ownership, and

Firm Valuations in Emerging Markets: Evidence from Hong Kong Panel Data. Working

paper. 2005. SSRN. Web. 3 June 2014. <http://ssrn.com/abstract=1100710>.

12

"Li Ka-Shing." Forbes. Forbes Magazine. Web. 06 June 2014.

<http://www.forbes.com/profile/li-ka-shing/>.

Lin, Bing. "Bing Lin: Accounting Abuse Among Listed Chinese Companies Still

Widespread." Interview. China Money Network. China Money Podcast, 16 Apr. 2014.

Web. 6 June 2014. <http://www.chinamoneynetwork.com/2014/04/16/bing-lin-

accounting-abuse-among-listed-chinese-companies-still-widespread>.

Mallin, Christine A. "1/Introduction." Corporate Governance. Oxford: Oxford UP, 2010.

Print.

Shea, Hubert. "Corporate Governance and Social Responsibility of Family Firms in

Hong Kong: A Case Study of Hutchison Whampoa Limited (HWL)." SSRN. Web. 3 June

2014. <http://ssrn.com/abstract=935101>.

Steiner, John F., and George A. Steiner. Business, Government, and Society: A

Managerial Perspective. New York: McGraw Hill/Irwin, 2006. 597. Print.

Tricker, R. Ian. "17/Corporate Governance Around The World." Corporate Governance:

Principles, Policies, and Practices. 2nd ed. Oxford: Oxford UP, 2009. 457. Print.

You might also like

- Wipro e GreenDocument146 pagesWipro e GreenRyan CheungNo ratings yet

- Easy and Accurate Reports Using XL Reporter in SAP Business OneDocument4 pagesEasy and Accurate Reports Using XL Reporter in SAP Business OnerajubhaleraoNo ratings yet

- Consolidation in SapDocument3 pagesConsolidation in SapDurga Tripathy DptNo ratings yet

- Interview Questions and Answers For SAP Project ImplementationDocument8 pagesInterview Questions and Answers For SAP Project ImplementationRyan CheungNo ratings yet

- B1 90 GlossaryDocument130 pagesB1 90 GlossarywoerjwerNo ratings yet

- 'Grexit' - Who Would Pay For ItDocument8 pages'Grexit' - Who Would Pay For Itvidovdan9852No ratings yet

- Menu - Legend Lounge - Hi Tea & Ice-CreamDocument15 pagesMenu - Legend Lounge - Hi Tea & Ice-CreamRyan CheungNo ratings yet

- Menu - Legend Lounge - Drink ListDocument7 pagesMenu - Legend Lounge - Drink ListRyan CheungNo ratings yet

- Financial Accounting TFIN 50_1 SummaryDocument30 pagesFinancial Accounting TFIN 50_1 SummaryssvaasanNo ratings yet

- Hello and Welcome To This Overview Session On SAP Business One Release 9.1Document42 pagesHello and Welcome To This Overview Session On SAP Business One Release 9.1rossloveladyNo ratings yet

- B1 91 Production EnhancementDocument38 pagesB1 91 Production EnhancementRyan CheungNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- TESCO - The Customer Relationship Management ChampionDocument8 pagesTESCO - The Customer Relationship Management ChampionBulbul JainNo ratings yet

- Condo Concepts GuideDocument3 pagesCondo Concepts GuideChris Quijano AyadeNo ratings yet

- List of Investment Banks-UKDocument5 pagesList of Investment Banks-UKnnaemekenNo ratings yet

- Classification of PropertyDocument6 pagesClassification of Propertyroansalanga100% (1)

- CH 5 QuizDocument4 pagesCH 5 QuizwsviviNo ratings yet

- Swot Analysis Pomelo JamDocument4 pagesSwot Analysis Pomelo JamCHANA ARIELA MAGNONo ratings yet

- Babele - Intrapreneurship White Paper - 201905061343462149 PDFDocument27 pagesBabele - Intrapreneurship White Paper - 201905061343462149 PDFram kesavanNo ratings yet

- GemsDocument65 pagesGemssaopaulo100% (2)

- Essays On The Economics of Two-Sided Markets - Economics, Antitrust and StrategyDocument14 pagesEssays On The Economics of Two-Sided Markets - Economics, Antitrust and StrategyGlobalEcon100% (1)

- NCLT Court - III Cause List On 25.08.2023Document7 pagesNCLT Court - III Cause List On 25.08.2023Bhavik SaliaNo ratings yet

- Rilannualreport200708 124781519046 Phpapp02Document204 pagesRilannualreport200708 124781519046 Phpapp02radhikagupta2912No ratings yet

- 6572beeb1353b - Tea Stall 2Document11 pages6572beeb1353b - Tea Stall 2Prashant Sunali C'naNo ratings yet

- Stages of Development: Dr. Shahid AliDocument37 pagesStages of Development: Dr. Shahid Alishahid aliNo ratings yet

- SMEs Guide to IFRS for SMEsDocument130 pagesSMEs Guide to IFRS for SMEsDharren Rojan Garvida AgullanaNo ratings yet

- Chapter 1 - Introduction To Records ManagementDocument7 pagesChapter 1 - Introduction To Records ManagementNorazliah EenNo ratings yet

- Acc Assignment FMDocument66 pagesAcc Assignment FMram_prabhu003No ratings yet

- Compañia General de Tabacos de Filipinas vs. City of Manila DigestDocument1 pageCompañia General de Tabacos de Filipinas vs. City of Manila DigestKrizzia Gojar100% (1)

- Bece 15 em PDFDocument10 pagesBece 15 em PDFSiva SankarNo ratings yet

- Performance Management Systems in Law FirmsDocument1 pagePerformance Management Systems in Law FirmsAnkit JainNo ratings yet

- VERITAS Storage Foundation 5.0 For Linux - FundamentalsDocument400 pagesVERITAS Storage Foundation 5.0 For Linux - FundamentalsMaria Ghazalia CameroonNo ratings yet

- LMIS AbstractDocument2 pagesLMIS AbstractAdnanRifqyGhiffarinNo ratings yet

- Becoming Demand Driven Key ServicesDocument2 pagesBecoming Demand Driven Key ServicesJose Lara100% (1)

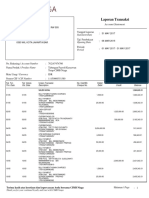

- Kepada / To Laporan Transaksi Account StatementDocument3 pagesKepada / To Laporan Transaksi Account StatementBulir SenjaNo ratings yet

- Final COP-Section 1Document86 pagesFinal COP-Section 1Arbaz KhanNo ratings yet

- Word Note Aurora Textile Case Zinser 351Document6 pagesWord Note Aurora Textile Case Zinser 351alka murarka100% (1)

- ICMA Questions Apr 2011Document55 pagesICMA Questions Apr 2011Asadul HoqueNo ratings yet

- SamsungCase QuestionsDocument2 pagesSamsungCase QuestionsBas SchaikNo ratings yet

- Calculating airline costs and how routes profitability is determinedDocument3 pagesCalculating airline costs and how routes profitability is determinedNeetesh KumarNo ratings yet

- BFC Employment Application Form Bahrain - Docx2 15 2Document4 pagesBFC Employment Application Form Bahrain - Docx2 15 2Abbas Ali100% (1)

- CHAP 1summary - introBADocument2 pagesCHAP 1summary - introBAThuần Nguyễn NgọcNo ratings yet