Professional Documents

Culture Documents

Corporate Finance

Uploaded by

navnitafunCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Finance

Uploaded by

navnitafunCopyright:

Available Formats

Private and Confidential Not for Circulation

2

Discussion topics

Time Value of Money

Present Value of a single cash flow

Present Value of multiple cash flows

Annuity

Perpetuity

Analysis of Loan

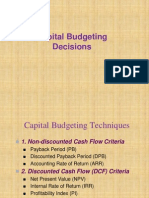

Capital Budgeting

Capital Budgeting Evaluation Process

Payback period (PB)

Discounted payback period (DPB)

Net present value (NPV)

Internal rate of return (IRR)

Profitability Index (PI)

To sum up..

C

o

r

p

o

r

a

t

e

F

i

n

a

n

c

e

Time Value of Money

When we say that money has time value, we mean that a dollar today is worth more than a

dollar next year.

If you have a dollar today, you can earn interest on it and have more than a dollar next year

Present Value of a single cash flow

Present Value of multiple cash flows

Private and Confidential Not for Circulation

3

C

o

r

p

o

r

a

t

e

F

i

n

a

n

c

e

n

1

2

2

1

1

) 1 (

(

) 1 (

...

) 1 ( ) 1 (

t

t

t

n

n

k

CF

k

CF

k

CF

k

CF

PV

1

1

) 1 ( k

CF

PV

Time Value of Money

Principle of Financial Equivalence

We know the future value of US$200 at the end of two years, at 10% annual interest is US$242. What

does this mean?

If the interest rate in the economy was 10% and ignore risk, which one will you select?

Answer will be indifferent?

Frequency of compounding

Yearly / Quarterly / Monthly compounding

Continuous compounding

Private and Confidential Not for Circulation

4

C

o

r

p

o

r

a

t

e

F

i

n

a

n

c

e

Time Value of Money .. contd

Annuity

An Annuity is a bunch of structured payments or equal payments made regularly, like every month or

every year

Private and Confidential Not for Circulation

5

C

o

r

p

o

r

a

t

e

F

i

n

a

n

c

e

Lump sum

payment

?

US$50,000

per year

for the

next 22

years

You won a

lottery worth

US$1,000,000

Which one will

you select?

Time Value of Money .. contd

Perpetuity

A perpetuity is a special kind of annuity - it has an infinite number of cash flows, all of the same dollar

amount. Thus, it is an annuity that never ends!

Will you choose to receive an annual payment of US$30,000 forever instead of the Lump sum payment?

Analysis of Loan (worksheet Time Value of Money)

Suppose you take a loan of Rs1.5mn from ICICI Bank for doing your MBA from IIM Ahmedabad. Term of

the loan is 5 years. What is the monthly payment that you will need to make?

Private and Confidential Not for Circulation

6

C

o

r

p

o

r

a

t

e

F

i

n

a

n

c

e

Introduction to Capital Budgeting

Capital budgeting is an investment decision-making process to evaluate whether a project is

worth undertaking

Capital budgeting is basically concerned with the justification of capital expenditures

What is the overall aim of capital budgeting?

Private and Confidential Not for Circulation

7

C

o

r

p

o

r

a

t

e

F

i

n

a

n

c

e

Maximize

Shareholders Wealth

Capital

Budgeting

A Strategic investment decision

Large investment with returns

over a period of time

Investment may take place over

a period of time

Motivation

Replacement

Expansion

Modernization

R&D

Most

important?

Location

Infrastructure

Labor

Cash flows

Capital Budgeting Evaluation Tools

Capital budgeting evaluation tools

Private and Confidential Not for Circulation

8

C

o

r

p

o

r

a

t

e

F

i

n

a

n

c

e

Capital

Budgeting

Tools

Payback

period

Discount

payback

period

Net

present

value

Internal

rate of

return

Modified

internal

Rate of

return

Profit

Index

Eq.

Annual

Cost

Best

Method?

Capital Budgeting Evaluation Tools

What provides a good decision making?

Decision rule should be based upon cash flow

Should discount cash flows appropriately taking into account the time value of money

Opportunity cost of capital should take into account the risk inherent in the project

Should incorporate all the incremental cash flows attributable to the project

Private and Confidential Not for Circulation

9

C

o

r

p

o

r

a

t

e

F

i

n

a

n

c

e

Capital Budgeting - Payback period

Payback period is defined as the number of years before the cumulative cash inflows equal

the initial outlay

Provides a rough idea of how long invested capital is at risk

Calculating payback period

Payback rule ignores all cash flows after the cutoff date

Payback rule gives equal weight to all cash flows before the cutoff date

Private and Confidential Not for Circulation

10

C

o

r

p

o

r

a

t

e

F

i

n

a

n

c

e

Capital Budgeting - Payback period

Decision rule

Payback benchmark payback, Accept the project

Payback benchmark payback, Reject the project

Calculate the payback period for Project A and Project B

Private and Confidential Not for Circulation

11

C

o

r

p

o

r

a

t

e

F

i

n

a

n

c

e

year the during flow cash

t ered unre year beginning

erery re full years period Payback

_ _ _ _

cos _ cov _ _

cov _ _ _

Years (t) Project A Project B

0 (3,000) (2,000)

1 1,800 200

2 1,000 600

3 800 1,000

4 200 2,000

Capital Budgeting - Payback period .. contd

Calculate the cumulative net cash flow (NCF) at the end of each time period.

Payback will occur when the cumulative NCF equal zero

Payback period A = 2 + (200/800) = 2.25 years

Payback period B = 3 + (200/2000) = 3.10 years

Private and Confidential Not for Circulation

12

C

o

r

p

o

r

a

t

e

F

i

n

a

n

c

e

Years (t) year 0 year 1 year 2 year 3 year 4

Project A Net cash flow (3,000) 1,800 1,000 800 200

Cumulative NCF (3,000) (1,200) (200) 600 800

Project B Net cash flow (2,000) 200 600 1,000 2,000

Cumulative NCF (2,000) (1,800) (1,200) (200) 1,800

Capital Budgeting - Payback period .. contd

Discounted payback period

Drawback of the previous method is that it ignores time value of money

Use discounted cash flows rather than raw cash flows

Example: In the previous question use 10% as the discount rate

Payback period A and B increases to 2.89years and 3.41years, respectively

Private and Confidential Not for Circulation

13

C

o

r

p

o

r

a

t

e

F

i

n

a

n

c

e

Years (t) year 0 year 1 year 2 year 3 year 4

Project A Net cash flow (3,000) 1,800 1,000 800 200

Discounted NCF (3,000) 1,636 826 601 137

Cumulative DNCF (3,000) (1,364) (537) 64 200

Project B Net cash flow (2,000) 200 600 1,000 2,000

Cumulative NCF (2,000) 182 496 751 1,366

Cumulative DNCF (2,000) (1,818) (1,322) (571) 795

Capital Budgeting - Net present value (NPV)

Three points to remember about NPV

A dollar today is worth more than the dollar tomorrow

A safe dollar is worth more than a risky one

We can add present value of all individual cash flows of the project

Sum of the PVs of all cash inflows and outflows of a project

Private and Confidential Not for Circulation

14

C

o

r

p

o

r

a

t

e

F

i

n

a

n

c

e

n

1

2

2

1

1

0

) 1 (

(

) 1 (

...

) 1 ( ) 1 (

t

t

t

n

n

k

CF

k

CF

k

CF

k

CF

CF NPV

Capital Budgeting - Net present value (NPV)

Also NPV is defined as present value of incremental benefits LESS present value of

incremental costs

In the example used for payback, calculate the NPV of Project A and Project B

Which project should be selected when (1) Both projects are independent (2) Mutually Exclusive

Independent projects: Accept if NPV>0; Both project A and project B should be selected

Mutually exclusive projects: Choose the one with higher NPV, as long as NPV>0; Project B

Private and Confidential Not for Circulation

15

C

o

r

p

o

r

a

t

e

F

i

n

a

n

c

e

Years (t) year 0 year 1 year 2 year 3 year 4

Project A Net cash flow (3,000) 1,800 1,000 800 200

Discounted NCF (3,000) 1,636 826 601 137

NPV 200

Project B Net cash flow (2,000) 200 600 1,000 2,000

Cumulative NCF (2,000) 182 496 751 1,366

NPV 795

Capital Budgeting - Internal rate of return (IRR)

Defined as the rate of return that equates the present value of the projects estimated cash

inflows with the present value of the projects costs

PV (inflows) = project cost in present value terms

Also defined as the discount rate that sets the NPV of a project to zero is the projects IRR

To calculate the IRR, we may use the trial-and-error method

Private and Confidential Not for Circulation

16

C

o

r

p

o

r

a

t

e

F

i

n

a

n

c

e

n

1

2

2

1

1

0

) 1 (

(

) 1 (

...

) 1 ( ) 1 (

0

t

t

t

n

n

IRR

CF

IRR

CF

IRR

CF

IRR

CF

CF NPV

Capital Budgeting - Internal rate of return (IRR)

IRR Acceptance Criteria

Independent Projects: IRR > Cost of Capital (hurdle rate), accept the project

Independent Projects: IRR < Cost of Capital (hurdle rate), reject the project

Mutually Exclusive Project, rank all projects for which IRR hurdle rate

Continuing with our earlier example, compute the IRR for Project A and Project B

Recommend acceptance under the assumption that projects are (1) independent (2) mutually exclusive

Private and Confidential Not for Circulation

17

C

o

r

p

o

r

a

t

e

F

i

n

a

n

c

e

IRR (Project A) = 14.1%

IRR (Project B) = 22.4%

4 3 2 1

) 1 (

200

) 1 (

800

) 1 (

1000

) 1 (

1800

3000 0

A A A A

IRR IRR IRR IRR

4 3 2 1

) 1 (

2000

) 1 (

1000

) 1 (

600

) 1 (

200

2000 0

B B B B

IRR IRR IRR IRR

Capital Budgeting Profitability Index

When funds are limited, we must pick the project that offer the highest net present value per

dollar of initial outlay Profitability Index

Calculation of Profitability Index

Which of the following will you select if you have a budget of US$12mn

Private and Confidential Not for Circulation

23

C

o

r

p

o

r

a

t

e

F

i

n

a

n

c

e

0

CF

NPV

PI

Project Year 0 Year 1 Year 2 NPV @ 10% Profitability Index

A (12) 30 5 18 1.5

B (7) 5 20 13 1.8

C (5) 5 15 11 2.2

Capital Budgeting Profitability Index

PI and NPV can give conflicting signals when a firm is choosing between projects

Which of the following will be selected if the firm can raise only US$12mn for investment

each of Year 0 and Year 1

Profitability Index cannot cope with cases in which two projects are mutually exclusive or in

which one project is dependent on another

Private and Confidential Not for Circulation

24

C

o

r

p

o

r

a

t

e

F

i

n

a

n

c

e

Project Year 0 Year 1 Year 2 NPV @ 10% Profitability Index

A (12) 30 5 18 1.5

B (7) 5 20 13 1.8

C (5) 5 15 11 2.2

D (35) 50 10 0.3

You might also like

- Capital Budgeting TechniquesDocument41 pagesCapital Budgeting TechniquesTONITONo ratings yet

- CF-PGPM-session 9.Document29 pagesCF-PGPM-session 9.Aman PratikNo ratings yet

- CBT With Sensitivity (Class) PDFDocument10 pagesCBT With Sensitivity (Class) PDFMahmudur RahmanNo ratings yet

- Capital Budgeting DecisionsDocument44 pagesCapital Budgeting Decisionsarunadhana2004No ratings yet

- Capital Budgeting MaterialDocument64 pagesCapital Budgeting Materialvarghees prabhu.sNo ratings yet

- 4 Assignment 7 PDFDocument3 pages4 Assignment 7 PDFasmelash gideyNo ratings yet

- Capital Budgeting-Investment Decision CriteriaDocument57 pagesCapital Budgeting-Investment Decision CriteriaSheila ArjonaNo ratings yet

- Financial Management Capital Budgeting Methods NPV IRR PaybackDocument46 pagesFinancial Management Capital Budgeting Methods NPV IRR Paybackj787No ratings yet

- Capital Budgeting TechniquesDocument21 pagesCapital Budgeting TechniquesMishelNo ratings yet

- Capital Budgeting TechniquesDocument21 pagesCapital Budgeting Techniquesmusa_scorpionNo ratings yet

- Corporate Finance Weight: 10 %Document182 pagesCorporate Finance Weight: 10 %FengboNo ratings yet

- Evaluation of Financial Feasibility of CP OptionsDocument35 pagesEvaluation of Financial Feasibility of CP OptionsInamulla KhanNo ratings yet

- CAPITAL BUDGETING TECHNIQUESDocument25 pagesCAPITAL BUDGETING TECHNIQUESBeby AnggytaNo ratings yet

- Investment DecDocument29 pagesInvestment DecSajal BasuNo ratings yet

- Capital Bugeting TechniquesDocument14 pagesCapital Bugeting TechniquesShujja Ur Rehman TafazzulNo ratings yet

- Capital Budgeting DecisionsDocument36 pagesCapital Budgeting DecisionsPrashant SharmaNo ratings yet

- Capital Budgeting DecisionsDocument50 pagesCapital Budgeting DecisionspiyushNo ratings yet

- Finance Acumen For Non FinanceDocument55 pagesFinance Acumen For Non FinanceHarihar PanigrahiNo ratings yet

- Capital BudgetingDocument33 pagesCapital BudgetingRashika JainNo ratings yet

- Financial ModelingDocument37 pagesFinancial ModelingSofoniasNo ratings yet

- Unit Iv: Capital BudgetingDocument35 pagesUnit Iv: Capital BudgetingDevyansh GuptaNo ratings yet

- Chapter # 07: Long Term Investment and Capital BudgetingDocument73 pagesChapter # 07: Long Term Investment and Capital BudgetingshakilhmNo ratings yet

- Lecture 4-Capital BudgetingDocument38 pagesLecture 4-Capital BudgetingadmiremukureNo ratings yet

- EBF 2054 Capital BudgetingDocument48 pagesEBF 2054 Capital BudgetingizzatiNo ratings yet

- Capital BudgetingDocument27 pagesCapital BudgetingDilu - SNo ratings yet

- Lecture 28-31capital BudgetingDocument68 pagesLecture 28-31capital BudgetingNakul GoyalNo ratings yet

- Ch20 - Guan CM - AISEDocument38 pagesCh20 - Guan CM - AISEIassa MarcelinaNo ratings yet

- PA Chapter 5Document4 pagesPA Chapter 5Abrha636No ratings yet

- Fnce 220: Business Finance: Lecture 6: Capital Investment DecisionsDocument39 pagesFnce 220: Business Finance: Lecture 6: Capital Investment DecisionsVincent KamemiaNo ratings yet

- FM Unit 8 Lecture Notes - Capital BudgetingDocument4 pagesFM Unit 8 Lecture Notes - Capital BudgetingDebbie DebzNo ratings yet

- Capital Budgeting Technique: Md. Nehal AhmedDocument25 pagesCapital Budgeting Technique: Md. Nehal AhmedZ Anderson Rajin0% (1)

- Chapter Four: Investment/Project Appraisal - Capital BudgetingDocument40 pagesChapter Four: Investment/Project Appraisal - Capital BudgetingMikias DegwaleNo ratings yet

- 4-Capital Budgeting TechniquesDocument20 pages4-Capital Budgeting TechniquesnoortiaNo ratings yet

- Capital Budgeting SxukDocument10 pagesCapital Budgeting Sxuk10.mohta.samriddhiNo ratings yet

- Chapter 9Document44 pagesChapter 9Phạm Thùy DươngNo ratings yet

- Capital BudgetingDocument36 pagesCapital BudgetingTakreem AliNo ratings yet

- Capital Budgeting - Part 1Document6 pagesCapital Budgeting - Part 1Aurelia RijiNo ratings yet

- Capital Budgeting Techniques PDFDocument21 pagesCapital Budgeting Techniques PDFAvinav SrivastavaNo ratings yet

- IPE 209: Engineering Economy: Investment Analysis (IA) /capital Budgeting Decision (CBD)Document33 pagesIPE 209: Engineering Economy: Investment Analysis (IA) /capital Budgeting Decision (CBD)Naymul HasanNo ratings yet

- Capital Budgeting Techniques for Evaluating Investment ProjectsDocument42 pagesCapital Budgeting Techniques for Evaluating Investment ProjectsMikiyas SeyoumNo ratings yet

- Financial Management 4Document41 pagesFinancial Management 4geachew mihiretu0% (1)

- Capital BudgetingDocument16 pagesCapital Budgetingrizman2004No ratings yet

- Capital Budgeting DecisionsDocument30 pagesCapital Budgeting Decisionskd231No ratings yet

- Financial Project Evaluation CriteriaDocument7 pagesFinancial Project Evaluation CriteriamuhammednurNo ratings yet

- Session 5-Some Alternative Investment RulesDocument30 pagesSession 5-Some Alternative Investment RulesHằng NgôNo ratings yet

- 6 - Chapter Six - Project AppraisalDocument31 pages6 - Chapter Six - Project AppraisalmeseretNo ratings yet

- Hong Kong Baptist NiversityDocument48 pagesHong Kong Baptist NiversityWang Hon YuenNo ratings yet

- CAPITAL BUDGETING METHODS EXPLAINED: NPV, IRR, PAYBACK PERIOD & ACCOUNTING RATE OF RETURNDocument38 pagesCAPITAL BUDGETING METHODS EXPLAINED: NPV, IRR, PAYBACK PERIOD & ACCOUNTING RATE OF RETURNshazlina_liNo ratings yet

- Chapter 7 The Analysis of Investment ProjectsDocument41 pagesChapter 7 The Analysis of Investment ProjectsHùng PhanNo ratings yet

- CAPITAL BUDGETING EVALUATION TECHNIQUES: KEY METHODS FOR APPRAISING INVESTMENT PROPOSALSDocument55 pagesCAPITAL BUDGETING EVALUATION TECHNIQUES: KEY METHODS FOR APPRAISING INVESTMENT PROPOSALSClash RoyaleNo ratings yet

- SFM FinDocument159 pagesSFM FinAakashNo ratings yet

- BCC B Capital InvestmentDocument12 pagesBCC B Capital InvestmentNguyen Thi Tam NguyenNo ratings yet

- Capital BudgetingDocument5 pagesCapital Budgetingshafiqul84No ratings yet

- Dba 302 Accounting Rate of Return, NPV and Irr PresentationsDocument12 pagesDba 302 Accounting Rate of Return, NPV and Irr Presentationsmulenga lubembaNo ratings yet

- CAPBUDGETINGfinalDocument68 pagesCAPBUDGETINGfinalmeowgiduthegreatNo ratings yet

- 308 CH 13 NotesDocument10 pages308 CH 13 NotesRayan LahlouNo ratings yet

- 3210AFE Week 5Document64 pages3210AFE Week 5Jason WestNo ratings yet

- Chapter-Five: Capital Budgeting DecisionDocument50 pagesChapter-Five: Capital Budgeting DecisionGizaw BelayNo ratings yet

- CHAPTER 9 - Investment AppraisalDocument37 pagesCHAPTER 9 - Investment AppraisalnaurahimanNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Fraud Risk ManagementDocument82 pagesFraud Risk ManagementdigitalbooksNo ratings yet

- What Is LLPDocument25 pagesWhat Is LLPnavnitafunNo ratings yet

- India Fraud Survey 2012Document96 pagesIndia Fraud Survey 2012Rupesh KadamNo ratings yet

- Team ViewerDocument60 pagesTeam ViewernavnitafunNo ratings yet

- Reverse Mortgage LoanDocument20 pagesReverse Mortgage LoannavnitafunNo ratings yet

- Reverse Mortgage Lenders 2Document21 pagesReverse Mortgage Lenders 2navnitafunNo ratings yet

- T.Y.B.A.F Direct Taxes "Income Tax" Assessment Year 2010-11Document9 pagesT.Y.B.A.F Direct Taxes "Income Tax" Assessment Year 2010-11navnitafunNo ratings yet

- Implementation of EU Directives On Work-Life Balance and On Transparent and Predictable Working ConditionsDocument38 pagesImplementation of EU Directives On Work-Life Balance and On Transparent and Predictable Working ConditionsAdelina Elena OlogeanuNo ratings yet

- Turnaround ManagementDocument14 pagesTurnaround ManagementAlkaNo ratings yet

- MSC Chain of Custody Standard - Default Version v5 0Document20 pagesMSC Chain of Custody Standard - Default Version v5 0Daniel PintoNo ratings yet

- Ms. Swati - PPT - HRM - HR Analytics - PGDM - 2019 - Week 2 Session 1 - 30th March 2020Document54 pagesMs. Swati - PPT - HRM - HR Analytics - PGDM - 2019 - Week 2 Session 1 - 30th March 2020AnanyaNo ratings yet

- Business Permit and Licensing Services - MainDocument7 pagesBusiness Permit and Licensing Services - MainMecs NidNo ratings yet

- Order 105826Document2 pagesOrder 105826Binay SahooNo ratings yet

- CRM Project PlanDocument12 pagesCRM Project Planwww.GrowthPanel.com100% (5)

- BUS 206 Final Project Guidelines and Rubric PDFDocument7 pagesBUS 206 Final Project Guidelines and Rubric PDFTrish FranksNo ratings yet

- Organizational Skills: Keterampilan BerorganisasiDocument13 pagesOrganizational Skills: Keterampilan BerorganisasiMohd NajibNo ratings yet

- The British Computer Society: The Bcs Professional Examinations BCS Level 5 Diploma in ITDocument4 pagesThe British Computer Society: The Bcs Professional Examinations BCS Level 5 Diploma in ITOzioma IhekwoabaNo ratings yet

- ShoeDocument8 pagesShoeIlham Anugraha PramudityaNo ratings yet

- Role of the Sleeping PartnerDocument15 pagesRole of the Sleeping PartnerKhalid AsgherNo ratings yet

- Building 101 - RFIsDocument4 pagesBuilding 101 - RFIspeters sillieNo ratings yet

- Store Sales 2011Document72 pagesStore Sales 2011Parveen NadafNo ratings yet

- Fi HR Integration PDFDocument2 pagesFi HR Integration PDFBrentNo ratings yet

- Ease of Doing BusinessDocument16 pagesEase of Doing BusinessNathaniel100% (1)

- Employee STSFCTNDocument3 pagesEmployee STSFCTNMitali KalitaNo ratings yet

- HRM Chapter 6Document42 pagesHRM Chapter 6AgatNo ratings yet

- Chapter 1: The Problem and Its BackgroundDocument3 pagesChapter 1: The Problem and Its BackgroundPatricia Anne May PerezNo ratings yet

- CEO Office StrategyDocument3 pagesCEO Office Strategymanjuhm1707licNo ratings yet

- IT Strategy For BusinessDocument37 pagesIT Strategy For Businesssaurabh_1886No ratings yet

- Report On Financial Ratio Analysis Of: Section: 01Document25 pagesReport On Financial Ratio Analysis Of: Section: 01Meher AfrozNo ratings yet

- Buscmb - 3Rd FQ: How Much Is The Translated Profit or Loss?Document16 pagesBuscmb - 3Rd FQ: How Much Is The Translated Profit or Loss?melody gerongNo ratings yet

- To Be Discussed Final ExaminationDocument11 pagesTo Be Discussed Final ExaminationRenz CastroNo ratings yet

- Banking Sector Overview: Definitions, Regulation, FunctionsDocument39 pagesBanking Sector Overview: Definitions, Regulation, FunctionsDieu NguyenNo ratings yet

- Sean Vosler Matt Clark (PDFDrive)Document80 pagesSean Vosler Matt Clark (PDFDrive)RadwinNo ratings yet

- EStmtPrintingServlet 3Document5 pagesEStmtPrintingServlet 3Ahmad Al FaizNo ratings yet

- Ethical Obligations and Decision Making in Accounting: Text and Cases Fifth EditionDocument174 pagesEthical Obligations and Decision Making in Accounting: Text and Cases Fifth EditionMERB Tzy0% (1)

- DFS AgMechanization Aug2017Document69 pagesDFS AgMechanization Aug2017KaziNasirUddinOlyNo ratings yet

- Enterprise Data Management Data Governance PlanDocument36 pagesEnterprise Data Management Data Governance PlanSujin Prabhakar89% (9)