Professional Documents

Culture Documents

2012 ECON 1203 S1 Solutions

Uploaded by

Wayne ZhuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2012 ECON 1203 S1 Solutions

Uploaded by

Wayne ZhuCopyright:

Available Formats

ECON 1203/ECON 2292 BUSINESS & ECONOMIC STATISTICS

Final examination - Semester 1 2012

General comments:

Do not penalize differences due to rounding error

Penalize initial errors but not later incorrect answers that are conditionally correct

Question 1 [12 marks in total]

(i) [2 marks] The distribution of distances would need to have been

symmetric (mean equal to median), unimodal and bell shaped.

(ii) [2 marks] ~(50,000, 12, 000

2

)

(34000 < < 56000) =

16000

12000

< <

6000

12000

= (1.33 < < .5) = 0.4082 +0.1915 = 0.5997

(iii) [2 marks]:

( < ) = <

50000

12000

= 0.05

50000

12000

= 1.645

= 50,000 1.645 12000 = 30260

( > ) = >

50000

12000

= 0.10

50000

12000

= 1.285

= 50,000 +1.285 12000 = 65,420

[1 mark each. Use of approximate percentiles from normal tables also acceptable.]

(iv) [4 marks] = 64 ; = 0.025 = 46,000

We wish to test

0

: = 50,000;

1

: < 50,000

Hence under the null hypothesis

~(50,000,12000

2

/64) and rejection region is:

=

50000

12000/8

<

0.025

= 1.96

or <

=

0

0.025

= 50000 1.96 1500 = 47,060

Since =

4600050000

1500

= 2.67 <

0.025

= 1.96 or 46,000 < 47,060

we reject the null hypothesis and conclude there is evidence to suggest the new

procedures have been effective.

[1 mark each for correct sampling distribution; hypotheses; decision rule; and

conclusion.]

2

(v) [2 marks] Since we have a large sample of 64 it is not necessary to rely on the

underlying population distribution of distances travelled being normal. Instead we

can invoke the Central Limit Theorem which states that with a sufficiently large

sample size the sample mean is approximately normal with mean equal to the

population mean and variance equal to the population variance divided by the

sample size. This holds irrespective of the underlying population distribution that

our samples are drawn from.

[Need to mention CLT holds irrespective of the underlying population distribution to

get full marks.]

3

Question 2 [9 marks in total]

(i) [1 mark] P(Partner) = 195/371 = 0.526

(ii) [1 mark] P(Female|Partner) = 13/195 = 0.067

(iii) [2 marks] If P(Partner|Female) < P(Partner|Male) as it is here; i.e.

P(Partner|Female) = 13/74 = 0.176 and P(Partner|Male) = 182/297= 0.613

then variables are not expected be independent as independence requires

P(Partner|Female) = P(Partner|Male) = P(Partner).

However, the dependence could be attributed to some confounding factors that are

related to gender but that have not been accounted for in this bivariate

relationship.

[1 mark each for why dependence is indicated & the threat to this conclusion]

(iv) [5 marks]

H0: Gender and partner status are independent;

H1: Gender and partner status are not independent

The test statistic will be distributed

2

with (2-1)(2-1) = 1 degree of freedom and

the decision rule will be to reject if

2

>

0.01,1

2

= 6.6349.

Male Female Totals

Associate 115

(140.89)

61

(35.11)

176

Partner 182

(156.11)

13

(38.89)

195

Totals 297 74 371

* Values in brackets are expected outcomes under independence

The test statistic is

2

=

(115 140.89)

2

140.89

+

(182 156.11)

2

156.11

+

(61 35.11)

2

35.11

+

(13 38.89)

2

38.89

= 4.758 +4.294 +19.091 +17.236 = 45.379

As

2

= 45.379 > 6.6349 we reject the null and hence conclude that there is

evidence that gender and partner status are not independent.

[1 mark each for correct hypotheses; decision rule; 2 marks for test statistic & 1 mark

for conclusion]

4

Question 3 [13 marks in total]

(i) [4 marks] H0: p = 0.5; H1: p > 0.5

Decision rule: Reject H0 if > 0.55

As n = 100 is large assume the normal approximation to the binomial:

~(,

(1)

)

The implied significance level is:

= ( > 0.55| = 0.5) =

>

0.55 0.5

0.5 0.5

100

= ( > 1) = 0.1587

[1 mark for each for hypotheses, mentioning normal approximation to the binomial,

the sampling distribution & .]

(ii) [2 marks] =

60

100

= 0.6 > 0.55

Hence according to managements decision rule there is sufficient evidence to

reject the null hypothesis and proceed with the introduction of the new upgrade.

[1 mark for each for the point estimate & the test outcome.]

(iii) [2 marks] A Type II error would occur here if the null hypothesis of 50% of

customers being willing to pay was not rejected when in fact the percentage of

customers willing to pay was in fact greater than 50%.

( ) = ( < 0.55| = 0.54) =

<

0.55 0.54

0.54 0.46

100

= ( < 0.2) = 0.5793

[1 mark for each for explanation (must be in terms of current problem & not just a

generic definition) & Type II error.]

(iv) [3 marks]

A 99% confidence interval for population proportion p is:

/2

(1 )

0.6 2.575 0.049 (0.474, 0.726)

5

The CI includes 0.5 and so if this was the basis for the test there would be

insufficient evidence to reject the null hypothesis.

Naturally the use of a CI implies a two-tailed test whereas we used a one-tailed test

previously but the main difference is the much smaller significance level being

used with the CI in comparison with before. A smaller significance level implies a

wider CI.

[1 mark each for CI, interpretation & reason for difference (either reason is

acceptable).]

(v) [2 marks]

CI width is:

2

2

(1 )

0.08 1.96

0.25

0.04

1.96 0.25

0.04

2

Hence n=600.25 or n=601 and the firm would have needed to interview far more

customers than the 100 they actually interviewed.

If the confidence level is changed to 0.8 the above method remains the same except

that the critical value changes from 1.96 to 1.285 and n=258, still much more than

the 100 used.

Note that before sampling takes place p would be unknown to management and so

p=0.5 has been assumed.

[1 mark for each n.]

6

Question 4 [15 marks in total]

(i) [2 marks]

1 is the population parameter that represents by how much income changes as

age increases by one year or it is the slope of the population regression line

representing the relationship between income and age. Because 0 is the

population mean income for men aged zero it is not a parameter of interest:

(| = 0) =

0

[1 mark for each for interpretation. Must be in terms of population parameters and

not estimates to get full marks.]

(ii) [3 marks] As the estimate of 1 is 892.1 income for this group of men is

predicted to increase on average by $892.1 for each extra year. This effect is

significantly different from zero because the test statistic, 14.44 is greater in

absolute value than say the critical value of 2.576 if we chose a significance level of

say 0.01, (or p-value is 0.0000 and hence < typical choices of significance level such

as 0.01).

Normal critical values have been used because the large sample size allows us to

confidently invoke the central limit theorem and assume normality for the test

statistic.

[1 mark for each for interpretation, assumption and test]

(iii) [2 marks] The P-value reported by EXCEL is that for testing H0: i = 0 versus H1:

i 0. For the intercept have:

P-value = 2xP(| b0 | > 9.43x2637.4) = 0.0000

at any significance level greater than 0.00000 and hence at conventional choices

such as 0.01 or 0.05 we would reject H0 and conclude that the coefficient is

significantly different from zero.

[1 mark each for explanation and interpretation]

(iv) [3 marks] The standard error is the standard error of the estimate (or

regression) which is the estimate of the standard deviation of the disturbance in

the regression model. R Square is the regression R

2

; the proportion of total

variation in the dependent variable explained by the regression. The value of 0.035

only 3.5% of the variation in the income is explained by the explanatory

variable age and hence the fit is not very good.

[1 mark each for definitions and interpretation]

7

(v) [1 mark] The simple correlation between income and age is positive because the

slope coefficient is positive. As the R

2

= 0.035 we know the correlation while

positive is not very large and in fact the simple correlation, r=0.187. (As R

2

= r

2

in

simple linear regression.)

[Sufficient to say the correlation is small and positive for the full mark]

(vi) [1 mark] An unbiased estimator is one whose expectation equals the parameter it

is estimating. Here that means for the OLS estimator b1:

E(b1) = 1

(vii) [2 marks] Education and gender are two independent variables likely to explain

some of the variation in income. In order to better isolate the impact of age on

income, free from these two possible confounding variables, they have controlled

for their effect by making the sample homogenous in terms of education and

gender.

(viii) = 24874.4 +892.1 70 = $87,321.4

We know from the formula for the forecast interval that the interval is wider; the

larger is the estimated standard deviation of the disturbance (the standard error of

the estimate) and the further away from the sample mean that we predict. Here we

have seen that the model does not fit well and hence the standard error of the

estimate is large and also were predicting for a 70 year old which is outside the

sample and hence very far from the sample mean age.

[1 mark each for the calculation and for one of the two reasons why the prediction is

likely to be inaccurate.]

8

Question 5 [11 marks in total]

(i) [2 marks] A comparison of the sample means of HRINCOME does not control for

other confounding factors that might impact of hourly income; i.e. it might be a

biased estimate of the difference due solely to gender.

While the difference in means is large in an economic sense the difference might

not be statistically significant. Without further information we cant determine this.

[2 marks for either explanation]

(ii) [3 mark] H0: 4 = 0; H1: 4 < 0

Given the large sample size we can invoke the central limit theorem and assume

normality for the test statistic. Using say =0.05 the rejection region is t-stat<-

1.645 and as t-stat=-0.06 we cannot reject the null hypothesis that 4 = 0; i.e. there

is insufficient evidence to indicate the presence of discrimination on the basis of

gender after having controlled for other factors affecting incomes.

Alternatively note that reported P-value of 0.955 and hence for a one sided test the

P-value is 0.478 > 0.05 and again we do not reject the null hypothesis that 4 = 0.

[1 mark each for hypotheses (should be one-sided), decision rule (including CLT

justification) and conclusion.]

(iii) [3 marks] The coefficient estimate for 1 is 1.948 with an associated t-stat=5.38

and p-value=0.000.

The estimate indicates that for every extra year of experience the average hourly

income increases by $1.948 holding all other factors constant. That this is a

positive impact is as expected; more experienced lawyers are expected to be paid

more.

The effect is statistically significant. Because p-value=0.000, the null hypothesis of

no impact would be rejected at all significance levels greater than 0.0005.

In terms of economic significance, an increase of $1.948 per hour per extra year

seems like a reasonably large amount compared to sample averages representing

an increase of either 3.3%, compared with $59 for males; or 5.7% compared with

$34 for females. Alternatively 13-14 years experience approximately equates to the

difference associated with being a partner (1.948 13 26.564).

[1 mark each for interpretation, statistical significance and something sensible for

economic significance with the emphasis on understanding that it is distinct from

statistical significance.]

9

(iv) [2 marks] H0: 3 = 0; H1: 3 >0

Using =0.01 the rejection region is t-stat>2.325 and the t-stat=3.69. Thus we

reject the null hypothesis that 3 =0. Alternatively the p-value for the 2-tailed test is

< 0.0005 and hence the p-value for the one-tailed test (which is half the 2-tailed p-

value) is <0.01 and again we reject the null hypothesis.

[1 mark each for test statistic and conclusion.]

(v) [1 mark] Predicted hourly income with EXP=10, SIZE=20, PARTNER=0, FEMALE=0,

is given by.

= 1.058 +1.948 10 +0.268 20 = $25.898

You might also like

- Statistics and ProbabilityDocument7 pagesStatistics and ProbabilityAlesya alesyaNo ratings yet

- Chapter 5: Statistical Aspects of Regression: and Are Only Estimates of andDocument21 pagesChapter 5: Statistical Aspects of Regression: and Are Only Estimates of andhirenbbbNo ratings yet

- A Review of Basic Statistical Concepts: Answers To Problems and Cases 1Document94 pagesA Review of Basic Statistical Concepts: Answers To Problems and Cases 1Terry ReynaldoNo ratings yet

- Statistics for Management II Group Assignment (2)Document8 pagesStatistics for Management II Group Assignment (2)Desale chaliNo ratings yet

- Exercise 1:: Chapter 3: Describing Data: Numerical MeasuresDocument11 pagesExercise 1:: Chapter 3: Describing Data: Numerical MeasuresPW Nicholas100% (1)

- Test1 AnswersDocument7 pagesTest1 Answerstal1997No ratings yet

- Chapter 7 TriolaDocument28 pagesChapter 7 TriolaMonita RiskiNo ratings yet

- Final Exam ReviewDocument6 pagesFinal Exam Reviewgunjand1994No ratings yet

- FRM Quantitative Analysis Test 1 SolutionsDocument4 pagesFRM Quantitative Analysis Test 1 SolutionsConradoCantoIIINo ratings yet

- Tugas 1 EkmanDocument8 pagesTugas 1 EkmanTata Winda LesmanaNo ratings yet

- Estimating Population VariancesDocument17 pagesEstimating Population VariancesRossel Jane CampilloNo ratings yet

- Introductory Econometrics Week 2 Key ConceptsDocument7 pagesIntroductory Econometrics Week 2 Key ConceptsIndri Br SitumorangNo ratings yet

- ExercisesDocument37 pagesExercisesdarwin_hua100% (1)

- Exercises Chapter 2Document8 pagesExercises Chapter 2Zyad SayarhNo ratings yet

- Problem Set 6 Answers Provides Insights into Law School Salaries, Stock Returns, and Effects of SmokingDocument15 pagesProblem Set 6 Answers Provides Insights into Law School Salaries, Stock Returns, and Effects of Smokingchan chadoNo ratings yet

- Cheat Sheet For Test 4 UpdatedDocument8 pagesCheat Sheet For Test 4 UpdatedKayla SheltonNo ratings yet

- Statbis TutorDocument7 pagesStatbis TutorFidelis Permana SidiNo ratings yet

- Assignment 2Document8 pagesAssignment 2yasir.queriesNo ratings yet

- QTA InterpretationDocument17 pagesQTA InterpretationMuhammad HarisNo ratings yet

- Sales Experience vs Sales VolumeDocument3 pagesSales Experience vs Sales VolumeSara VoyseyNo ratings yet

- Chapter 1 - Solutions of ExercisesDocument4 pagesChapter 1 - Solutions of ExercisesDanyValentinNo ratings yet

- MATH 533 Part C - Regression and Correlation AnalysisDocument9 pagesMATH 533 Part C - Regression and Correlation AnalysisCatherine MurphyNo ratings yet

- Chapter 12 Solutions Develop Your Skills 12.1Document30 pagesChapter 12 Solutions Develop Your Skills 12.1gainesboroNo ratings yet

- Statistics - AssignmentDocument14 pagesStatistics - AssignmentRavinderpal S Wasu100% (1)

- Review Final ExDocument20 pagesReview Final ExNguyet Tran Thi Thu100% (1)

- ISOM4520 Sample Midterm Examination SolutionDocument10 pagesISOM4520 Sample Midterm Examination SolutionAlessia YangNo ratings yet

- Estimating Single Population Parameters: ExercisesDocument17 pagesEstimating Single Population Parameters: ExercisesAhmad MalakNo ratings yet

- Quantitative MethodsDocument3 pagesQuantitative MethodsOKbroNo ratings yet

- Workshop 06 - S1 - 2020 - Solutions For Business StatisticsDocument6 pagesWorkshop 06 - S1 - 2020 - Solutions For Business StatisticsKrithik MehtaNo ratings yet

- Module 4.1 Point and Interval EstimatesDocument4 pagesModule 4.1 Point and Interval EstimatesCharity Quintana VillaplanaNo ratings yet

- hw2 Spring2023 Econ3005 SolutionDocument10 pageshw2 Spring2023 Econ3005 SolutionSwae LeeNo ratings yet

- StockWatson Econ CH04Document27 pagesStockWatson Econ CH04Mohamed ZaidiNo ratings yet

- Hypothesis Testing and Regression AnalysisDocument4 pagesHypothesis Testing and Regression Analysiskajani nesakumarNo ratings yet

- Confidence Intervals for Grade 11 StatisticsDocument20 pagesConfidence Intervals for Grade 11 StatisticsDECEDERIO CANDOLENo ratings yet

- 1Document5 pages1AmalAbdlFattahNo ratings yet

- Chapter 10 SolutionsDocument22 pagesChapter 10 SolutionsGreg100% (1)

- 4818 Exam2aDocument5 pages4818 Exam2aMaliha JahanNo ratings yet

- Lecture 2bDocument37 pagesLecture 2bQinxin XieNo ratings yet

- Biostatistics Assignment OneDocument6 pagesBiostatistics Assignment OneMwila AngelesNo ratings yet

- 03 Statistical Inference v0 1 28052022 091609amDocument18 pages03 Statistical Inference v0 1 28052022 091609amSaif ali KhanNo ratings yet

- Assignment 1 Renhe LiDocument13 pagesAssignment 1 Renhe Liwilliamli7711No ratings yet

- Chapter 7-Exercises SolutionsDocument5 pagesChapter 7-Exercises SolutionslamakadbeyNo ratings yet

- Practice solutionsDocument4 pagesPractice solutionsBro GawdNo ratings yet

- PracticeDocument3 pagesPracticeflathogathNo ratings yet

- The Chi Square TestDocument57 pagesThe Chi Square TestLavlesh UpadhyayNo ratings yet

- BBM203 - Kierrtana - 071190094Document11 pagesBBM203 - Kierrtana - 071190094kierrtanaNo ratings yet

- Statistical Analysis: Session 2: Measures of Central TendencyDocument41 pagesStatistical Analysis: Session 2: Measures of Central Tendencypriyankamodak100% (1)

- PracticeFinalExamQuestions 2 2020winter AnswerDocument4 pagesPracticeFinalExamQuestions 2 2020winter AnswerCHARLES DARWIN GAINNo ratings yet

- Applied Statistical Methodology For Research BusinessDocument11 pagesApplied Statistical Methodology For Research BusinessBrian JerryNo ratings yet

- Business SolutionsDocument227 pagesBusiness Solutionsoykubayraktar100% (6)

- Revision_sheet_Chapter_19__MS_Document54 pagesRevision_sheet_Chapter_19__MS_annaninaibNo ratings yet

- Reading 3 Statistical Measures of Asset Returns - AnswersDocument32 pagesReading 3 Statistical Measures of Asset Returns - Answersmenexe9137No ratings yet

- Extra Exercises - Introductory StatisticsDocument8 pagesExtra Exercises - Introductory Statisticsworks.aliaazmiNo ratings yet

- Econometrics AssignmentJagrit2Document11 pagesEconometrics AssignmentJagrit2Jagrit AnandNo ratings yet

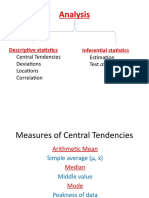

- Analysis: Descriptive Statistics Inferential StatisticsDocument56 pagesAnalysis: Descriptive Statistics Inferential StatisticsNeelakandanNo ratings yet

- 3 ProblemsDocument56 pages3 ProblemsNeelakandanNo ratings yet

- Edu 2014 Spring MLC Ques SolDocument56 pagesEdu 2014 Spring MLC Ques SolSarosh Gangnam SohailNo ratings yet

- NFL Passing Regression AnalysisDocument4 pagesNFL Passing Regression AnalysisMisbah MirzaNo ratings yet

- Solutions Manual to accompany Introduction to Linear Regression AnalysisFrom EverandSolutions Manual to accompany Introduction to Linear Regression AnalysisRating: 1 out of 5 stars1/5 (1)

- Pubs Ceccato Gis Remote SensingDocument16 pagesPubs Ceccato Gis Remote SensingKlinik FiraraNo ratings yet

- Point to Point Microwave Transmission Planning and DesignDocument81 pagesPoint to Point Microwave Transmission Planning and Designkarwan chawmar100% (1)

- 3710 8RDocument162 pages3710 8Rnjslater100% (1)

- Climate Risk ManagementDocument33 pagesClimate Risk ManagementMohd Sabbir Zaman100% (1)

- Thomalla 2006Document10 pagesThomalla 2006Dwi RahmawatiNo ratings yet

- Job Risk Assesment OfftakeDocument7 pagesJob Risk Assesment OfftakeIhwan Asrul100% (1)

- Time Series QuestionsDocument9 pagesTime Series Questionsakriti_08100% (1)

- Growth PredictionDocument101 pagesGrowth PredictionKristty Magallanes100% (1)

- Drying Crystallization SucroseDocument6 pagesDrying Crystallization SucrosemarcogiuliettiNo ratings yet

- Resume Most Recent16Document3 pagesResume Most Recent16api-284282962No ratings yet

- Action Verbs GuideDocument25 pagesAction Verbs GuideTumur BataaNo ratings yet

- Simple Linear Regression AnalysisDocument21 pagesSimple Linear Regression AnalysisJoses Jenish SmartNo ratings yet

- DANH SÁCH TOÀN BỘ 620 ĐỘNG TỪ BẤT QUY TẮCDocument26 pagesDANH SÁCH TOÀN BỘ 620 ĐỘNG TỪ BẤT QUY TẮCnguyenngockhanh_91No ratings yet

- Multiple Choice Test BankDocument10 pagesMultiple Choice Test BankSoumitra ChakrabortyNo ratings yet

- Passage Plan From Tokyo To San - FranciscoDocument21 pagesPassage Plan From Tokyo To San - FranciscoNitin Saxena100% (1)

- Advanced Machine DesignDocument20 pagesAdvanced Machine DesignamitNo ratings yet

- The Berg Timer, Its History and CalculationDocument21 pagesThe Berg Timer, Its History and CalculationsUPRAKASHNo ratings yet

- Decision Making PPTDocument36 pagesDecision Making PPTzainabNo ratings yet

- Burning Man 2011 Worksheet Determination of NEPA Adequacy (DNA)Document16 pagesBurning Man 2011 Worksheet Determination of NEPA Adequacy (DNA)BURNcastNo ratings yet

- EndeDocument8 pagesEndeandyNo ratings yet

- WEATHERDocument12 pagesWEATHERMartaNo ratings yet

- Little Field Report 1Document2 pagesLittle Field Report 1Alibaba Lalala100% (1)

- Responses To Discussions and Commentar - 2020 - International Journal of ForecasDocument7 pagesResponses To Discussions and Commentar - 2020 - International Journal of ForecascrackendNo ratings yet

- Ar2017weather PDFDocument144 pagesAr2017weather PDFbuzzzNo ratings yet

- Meteorology For PPL Pilots Edition 2 2019 13022019Document162 pagesMeteorology For PPL Pilots Edition 2 2019 13022019hai_khtn100% (1)

- Science 4 Q4 W4 Day 1 4 1Document76 pagesScience 4 Q4 W4 Day 1 4 1LigieNo ratings yet

- FIRESCOPE - Guidance On Wildland Urban Interface (WUI) Structure ProtectionDocument17 pagesFIRESCOPE - Guidance On Wildland Urban Interface (WUI) Structure ProtectionRamblingChiefNo ratings yet

- List of Irregular VerbsDocument14 pagesList of Irregular VerbsPato MirandaNo ratings yet

- R Help 6 Correlation and RegressionDocument5 pagesR Help 6 Correlation and RegressionAnnaNo ratings yet

- Revised Chapter 9Document25 pagesRevised Chapter 9Shahadat HossainNo ratings yet