Professional Documents

Culture Documents

Acctg Prob

Uploaded by

Francisco MarvinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acctg Prob

Uploaded by

Francisco MarvinCopyright:

Available Formats

Accounting at MacCloud Winery

Mike MacCloud had worked in the operations side of a winery for several years.

Having built a strong knowledge of the art of making wine, he had decided to create his

own wine label (i.e., brand). For his label, he planned to grow all of his own grapes. He

had identified an ideal plot of five acres of land in northern California that had most

recently been used to grow soybeans. His initial plans were to lease a nearby building to

use as a winery (i.e., a place for processing grapes and fermenting and aging his wine).

However, Mike hoped someday to build his own winery and thus would only plant on

four acres of land. Mike agreed to lease the building for 10 years at $5,000 per year. It

was estimated that the building was worth $32,000 and had a 30-year economic life. The

lease contract Mike signed did not mention any bargain purchase option or that Mike

might assume ownership of the leased building. The interest rate Mike received on his

personal bank account was 5%. When Mike started the business, he opened a checking

and savings account for MacCloud Wines Inc. that paid 6% annual interest. The annual

interest rate the bank charged was 10%.

Mike purchased the five acres of land for $250,000. To finance the transaction,

Mike borrowed $180,000 from the bank to be repaid $10,000 annually and a lump sum at

the end of three years. In addition, Mike bought from Australia special grapevines at a

cost of $10,000 per acre. The transportation costs totaled $2,500. Once Mike had the

grapevines, he hired extra help to plant the vines at a cost of $2,000 per acre.

While vines might produce a limited amount of grapes during the first five

growing seasons, the young vine grapes could not be used for wine (or any other

commercial purpose). Although Mike would not use these grapes, he would need to

spend $1,000 per acre per each of the five years to fertilize and water the vines. If this

were not done, the vines would not produce high-quality grapes in the future.

Beginning in the sixth growing season the vines would bear a full crop of high-

quality grapes. Some vines continued to produce at this level until their 100

th

growing

season. However, generally production began to decline after the 75

th

growing season.

Once production declined, the land would be replanted with a new set of vines.

Interestingly, many experts believed that grapes from old growth vines (for the type of

vines Mike was planting, a vine was old growth after it had been planted 50 or more

growing seasons) made a higher-quality wine. Once the vines began to produce high-

quality grapes, Mike would need to spend $1,500 per acre per year for fertilizing and

water. If he did not provide these nutrients, the grapes produced that year would not be of

high enough quality to produce wine. However, this would not affect the ability of the

vines to produce high- quality grapes in the future.

Beginning with the first harvest, Mike planned to mature his wine in expensive

oak barrels imported from France, which he believed were required for the production of

above-average quality wine. Each barrel would be used for a period of up to five years to

mature the better-quality wine. Thereafter, the barrel would be used on a one-year-cycle

basis to mature the vineyards lower-quality wines. At the end of 15 years, the barrel

would be sold as raw material to a manufacturer of charcoal chips for outdoor grills.

Cheaper locally procured barrels with an average expected useful life of 10 years would

be used to mature lower-quality wines. At the end of their useful life these barrels would

also be sold to a charcoal-chip manufacturer.

Questions with Answers:

1. Should the leased building be accounted for as an asset? Should the agreement to

pay lease rentals be recorded as a liability? Justify your answers. Do not refer to

any FASB rules on this issue.

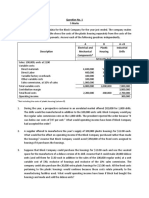

2. Record the journal entries to account for the bank loan for all three years. Assume

the loan was made at the beginning of year one and repaid at the end of year three.

Assume all interest payments are made on an annual basis. The $10,000 per year

payment is to reduce the loans principal.

3. Applying the principles of accrual accounting, how should Mike treat the

expenditures for the land, vines, vine planting, fertilizing, and water? Be specific

regarding the treatment over time, including amounts, and the rationale for the

treatments.

4. Without changing your answers to the above questions, consider the following

facts:

Mikes greatest concern is that his vines will contract Phylloxera disease,

Black Goo syndrome, or Pierces disease. While these conditions do not kill the

vines immediately, they reduce production of quality grapes by approximately

50%. Further, the vines generally die approximately 10 years after contracting the

condition. While Mike will probably be able to avoid Phylloxera by planting

genetically treated vines, incidents of Black Goo and Pierce disease have been

increasing over the last several years and are most dangerous to vines that are less

than three years old.

How should the potential for vine disease be reflected in the financial

statements if the vines have not been diagnosed with any of the diseases? Does

this change if the vines are diagnosed with one of the diseases? Be specific

regarding any amounts and the rationale for these treatments.

5. How should Mike account for the oak barrels?

6. How would the transactions in Question 3 and the bank loan be recorded in the

winerys indirect statement of cash flows?

Financial Performance Reporting

The Financial Accounting Standards Boards (FASB) Financial Performance

Reporting by Business Enterprises project may change the form and content,

classifications and aggregations, and display of specified items and summarized amounts

on the face of all basic financial statements. An important result of this project may be

that net income would be eliminated as an income statement item. It would be replaced

by comprehensive income. Currently, comprehensive income plays little, if any, role in

equity valuations.

The projects goal is to

Improve the quality of information displayed in financial statements so that

statement users can better evaluate an enterprises performance.

Ensure that sufficient information is contained in financial statements to permit

calculation of key financial measures used by investors and creditors.

In the interest of global convergence of accounting principles, the FASB is

working closely on this project with the International Accounting Standards

Board (IASB), which has a similar project underway with the United Kingdoms

Accounting Standards Board. The FASB and IASB have tentatively decided on a

similar objective for the new statementto enhance the predictive feedback value

of the information that is presented in a statement of comprehensive income.

Comprehensive Income

The FASBs Concept Statement No. 6 defines comprehensive income. It states:

Comprehensive income is the change in equity of a business enterprise during a period

from transactions and other events and circumstances from nonowner sources. It includes

all changes in equity during a period except those resulting from investments by owners

and distributions to owners.

The FASB in SFAS 130, Comprehensive Income, required companies to

display in their financial statements total comprehensive income and its components in

either an income statement-type format (Table A) or in a changes-in-equity format

(Table B). Most companies have elected to use the changes in equity format.

SFAS 130s operational definition of comprehensive income is net income plus

other comprehensive income. Other comprehensive income consists of those accounting

items that are direct debits or credits to owners equity that do not involve transactions

with owners, such as foreign currency translation gains and losses and unrealized gains or

losses on marketable securities classified as available-for-sale.

IASB

The IASB is ahead of the FASB in its financial performance reporting project. To

guide its deliberations, the IASB has tentatively agreed on the following five principles:

Principle 1 A performance statement should be able to distinguish the return on

total capital employed from the return on equity.

Principle 2 Components of gains and losses should be reported gross unless they

give little information with respect to future income.

Principle 3 Income and expenses resulting from the remeasurement of an asset or

liability should be reported separately. (Remeasurement refers to gains and expenses

arising from the revision of estimates embedded in the carrying values of assets and

liabilities.)

Principle 4 A performance statement should identify gains and losses where the

change in economic value does not arise in the period in which it is reported.

Principle 5 Within the prescribed format and without the use of proscribed

subtotals, the performance statement should allow reporting in the form of:

i. Information on the entity as a whole, analyzed by nature or function;

ii. The activities in (i) disaggregated by business segments (geographic or

product- based);

iii. Additional distinctions according to managerial discretion.

The IASBs proposed format for the financial performance statement reporting

comprehensive income is shown in Table C. It is based on Principle 3.

To illustrate further the IASBs approach and Principle 3, the components of financial

performance relating to pension costs would be reported using the Table C format as

follows:

(i) Operating, Column 1service cost

(ii) Operating, Column 2actuarial gains and losses relating to changes in

assumptions about future cash outflows

(iii) Financing, Column 1interest cost, expected return on assets

(iv) Financing, Column 2actuarial gains and losses relating to return on assets

and changes in discount rate assumptions

Other Possible Approaches

The FASB is studying the IASBs tentative comprehensive income statement

format for possible adoption. In addition to the separation by functional classification, the

FASB has directed its staff to explore the possibility of further separating the information

in the statement of comprehensive income. Several possible approaches for separation

being explored are:

a. Separating transactions with third parties from all other transactions and

events.

b. Separating cash measurements, accrual measurements, and fair-value

measurements.

c. Separating transactions and events driven by historical cost principles from

transactions and events driven by fair value or remeasurement principles.

d. Separating income and expenses resulting from the remeasurement of an

asset or liability from all other income and expenses (the current IASB

approach).

e. Some other approach.

Timetable

The FASBs objective is to issue in 2003 an Exposure Draft relating to the

reporting of items of revenue, expense, gains, and losses in a statement of comprehensive

income.

Questions with Answers:

1. Where in the IASBs proposed Statement of Financial Performance would you

display the following?

o Tangible fixed assetsdepreciation, impairments, gains or losses on

disposal and revaluations (permitted under International Financial

Reporting Standards)

o Investment propertiesrent and revaluations

o Goodwillimpairments

o Inventorysales and impairments

o Investments in equity securitiestotal value change

o Financial assets and liabilities held for tradingtotal value changes

o Foreign exchangegains and losses

o Nonequity financial assets and liabilitiesinterest income and expenses

o Provisionsinitial recognition, subsequent interest costs, remeasurements

due to changes in the original estimates

o Extraordinary itemsinfrequent and unusual items

2. What is your appraisal of the IASBs Statement?

3. Does the Statement satisfy the FASB projects goals?

4. How might equity investors use this Statement?

5. What changes to the Statement would you propose?

You might also like

- Republic Act No 6809 Age of Majority 18Document1 pageRepublic Act No 6809 Age of Majority 18Adrianne BenignoNo ratings yet

- Business Management - AssignmentDocument8 pagesBusiness Management - AssignmentHeavenlyPlanetEarth100% (6)

- Multi Tenant NNN LeaseDocument25 pagesMulti Tenant NNN LeaseTheoNo ratings yet

- Foreclosure Procedures in TennesseeDocument6 pagesForeclosure Procedures in TennesseeLuis A del MazoNo ratings yet

- Digest - Sps. Tio vs. Bpi (Foreclosure) Jan 2019Document1 pageDigest - Sps. Tio vs. Bpi (Foreclosure) Jan 2019Sam LeynesNo ratings yet

- Drafting of Legal DocumentsDocument18 pagesDrafting of Legal DocumentsKailash Kashwani100% (1)

- Basic Accounting Reviewer (Corpo)Document30 pagesBasic Accounting Reviewer (Corpo)Maestro Jay71% (7)

- Case Analysis Chemical BankDocument11 pagesCase Analysis Chemical BankYogeshPrakash100% (2)

- MM PropositionDocument61 pagesMM PropositionVikku AgarwalNo ratings yet

- Berkshire Hathway - Conclusions From LettersDocument8 pagesBerkshire Hathway - Conclusions From LettersAnonymous yjwN5VAjNo ratings yet

- Bausch N LombDocument3 pagesBausch N LombRahul SharanNo ratings yet

- Chataux Margaux Business CaseDocument37 pagesChataux Margaux Business Caserohit goswamiNo ratings yet

- CH 05Document25 pagesCH 05Ahmed Al EkamNo ratings yet

- Finance Project Rubric 2023Document7 pagesFinance Project Rubric 2023Xansos0% (1)

- Finacc PolymediaDocument5 pagesFinacc PolymediaFrancisco MarvinNo ratings yet

- Chapter 12, Problem 29C: Sell or Process Further DecisionDocument5 pagesChapter 12, Problem 29C: Sell or Process Further DecisionMaritza Aulia ShakiraniNo ratings yet

- Problem 1:: Problems & SolutionsDocument12 pagesProblem 1:: Problems & SolutionsFrancisco MarvinNo ratings yet

- Arnab Roy-BUS 505 - Class AssignmentDocument5 pagesArnab Roy-BUS 505 - Class AssignmentAmmer Yaser MehetanNo ratings yet

- Legal Ethics Case Digest on Negligence and Duty of LawyersDocument11 pagesLegal Ethics Case Digest on Negligence and Duty of LawyersFrancisco MarvinNo ratings yet

- Fiat Mio: Prototype Created With Open Innovation and CrowdsourcingDocument5 pagesFiat Mio: Prototype Created With Open Innovation and CrowdsourcingsherNo ratings yet

- WineryDocument12 pagesWineryRaam PrakashNo ratings yet

- Cashflow Lifetime Options NucleonDocument2 pagesCashflow Lifetime Options NucleonRitik MaheshwariNo ratings yet

- GROUP 3 - Pablo Gil - Case Study 1Document12 pagesGROUP 3 - Pablo Gil - Case Study 1Pablo GilNo ratings yet

- Amazon Fresh 5Document7 pagesAmazon Fresh 5Hammad Ali100% (1)

- Answer To The Question No: 1: Accounting at Maccloud WineryDocument5 pagesAnswer To The Question No: 1: Accounting at Maccloud WineryAmmer Yaser MehetanNo ratings yet

- Amazon FreshDocument28 pagesAmazon FreshDivin KumarNo ratings yet

- ACD Distribution Case AnalysisDocument2 pagesACD Distribution Case AnalysisAyush RaiNo ratings yet

- Case Study of Scientific GlassDocument6 pagesCase Study of Scientific GlassT/ROXNo ratings yet

- Accounting at MacCloud and Financial ReportingDocument3 pagesAccounting at MacCloud and Financial Reportingvivek1119100% (1)

- MicroFridge meets student needs for fresh food storage in dormsDocument3 pagesMicroFridge meets student needs for fresh food storage in dormsMIHIR PATILNo ratings yet

- ACT201 Case StudyDocument6 pagesACT201 Case StudyShimulAhmedNo ratings yet

- Case 14-1 MacCloudDocument2 pagesCase 14-1 MacCloudvivek1119100% (2)

- Ylarde vs. Aquino Case Digest 163 SCRA 697 FactsDocument1 pageYlarde vs. Aquino Case Digest 163 SCRA 697 FactsFrancisco MarvinNo ratings yet

- Ylarde vs. Aquino Case Digest 163 SCRA 697 FactsDocument1 pageYlarde vs. Aquino Case Digest 163 SCRA 697 FactsFrancisco MarvinNo ratings yet

- Accounting for leased building, bank loan, land purchase, vines and disease risksDocument3 pagesAccounting for leased building, bank loan, land purchase, vines and disease risksFrancisco MarvinNo ratings yet

- Batson InternationalDocument26 pagesBatson InternationalYashovardhanKanodiaNo ratings yet

- Case 14-4 Accounting at MacCloud WineryDocument4 pagesCase 14-4 Accounting at MacCloud WineryPriya Darshini50% (2)

- Robert Mondavi & The Wine IndustryDocument6 pagesRobert Mondavi & The Wine Industryআবদুল্লাহ আল মাহমুদ100% (2)

- Victoria ChemicalsDocument10 pagesVictoria Chemicalshookemvic67% (3)

- Accounting at MacCloud and Financial ReportingDocument3 pagesAccounting at MacCloud and Financial Reporting0p00No ratings yet

- Accounting DecissionsDocument20 pagesAccounting Decissionsjcabrera87No ratings yet

- AMAZON FRESH-case AnalysisDocument1 pageAMAZON FRESH-case AnalysisAkanksha SinhaNo ratings yet

- Describe The Problems That Amazon Faced During The 2013 Holiday SeasonDocument8 pagesDescribe The Problems That Amazon Faced During The 2013 Holiday SeasonAbdullah Fahim NabizadaNo ratings yet

- Electronic Arts in Online Gaming PDFDocument7 pagesElectronic Arts in Online Gaming PDFvgNo ratings yet

- Lawsuit and bond discount accounting questionsDocument2 pagesLawsuit and bond discount accounting questionsPatrick HariramaniNo ratings yet

- HANDSTAR INC Case AnalysisDocument9 pagesHANDSTAR INC Case AnalysisAkash Kumar SuryawanshiNo ratings yet

- Sprint Nextel Merger AnalyzedDocument21 pagesSprint Nextel Merger Analyzedandryharyanto100% (9)

- 'Benecol Case Study by DawoodDocument3 pages'Benecol Case Study by DawooddawoodbalochNo ratings yet

- Kodak case shows challenges of digital disruptionDocument13 pagesKodak case shows challenges of digital disruptionBrenda LunaNo ratings yet

- Financial Policy at Apple (2013): Analysis and RecommendationsDocument1 pageFinancial Policy at Apple (2013): Analysis and RecommendationsSylvieNo ratings yet

- Case Solution of Target Corporation Capital Budgeting Harvard Publishing Case StudyDocument2 pagesCase Solution of Target Corporation Capital Budgeting Harvard Publishing Case Studyalka murarka59% (17)

- Chotukool SubmissionDocument8 pagesChotukool SubmissionLife After BookNo ratings yet

- B2B Marketing CMR Enterprises: B.Sai Ram Susheel - 190103044 Section - BDocument2 pagesB2B Marketing CMR Enterprises: B.Sai Ram Susheel - 190103044 Section - BrakeshNo ratings yet

- Bulter Lumber CaseDocument3 pagesBulter Lumber CaseSwarna RSNo ratings yet

- BA 141 THU Case 2 PaperDocument10 pagesBA 141 THU Case 2 PaperLance EstopenNo ratings yet

- Hilton Case1Document2 pagesHilton Case1Ken KandellNo ratings yet

- Gitman CH 14 15 QnsDocument3 pagesGitman CH 14 15 QnsFrancisCop100% (1)

- Week 1 ICA - 2019 - Time Value of MoneyDocument2 pagesWeek 1 ICA - 2019 - Time Value of MoneyMira0% (1)

- Kim FullerDocument3 pagesKim FullerVinay GoyalNo ratings yet

- Analyse The Structure of The Personal Computer Industry Over The Last 15 YearsDocument7 pagesAnalyse The Structure of The Personal Computer Industry Over The Last 15 Yearsdbleyzer100% (1)

- E-Business Hitesh Dudani 407Document9 pagesE-Business Hitesh Dudani 407Hitesh DudaniNo ratings yet

- 4.1. ProblemsDocument4 pages4.1. ProblemsTitikshya SahooNo ratings yet

- Project Status Reporting - V5Document14 pagesProject Status Reporting - V5Talks of MindsNo ratings yet

- Amazon Whole Foods MergerDocument13 pagesAmazon Whole Foods MergerAnonymous Xdwc17a33% (3)

- On June 1 You Begin An Ocean Tour Business For PDFDocument1 pageOn June 1 You Begin An Ocean Tour Business For PDFhassan taimourNo ratings yet

- ConAgra Processes Beef Cattle ProductsDocument13 pagesConAgra Processes Beef Cattle ProductsMawaz Khan MirzaNo ratings yet

- Om-07-Dtipd Case Study - HecDocument13 pagesOm-07-Dtipd Case Study - HecNandha KumarNo ratings yet

- Chapter 8 Long Lived Assets - SolutionsDocument102 pagesChapter 8 Long Lived Assets - SolutionsKate SandersNo ratings yet

- AgLend Lesson6Document11 pagesAgLend Lesson6asdfgh12344321No ratings yet

- Starting a Norton Vineyard Business in VirginiaDocument57 pagesStarting a Norton Vineyard Business in VirginiaAnonymous gnGxwilWzNo ratings yet

- Feasibility of A Co-Operative Winery: Phil Kenkel, Rodney B. Holcomb, and Amanda HillDocument17 pagesFeasibility of A Co-Operative Winery: Phil Kenkel, Rodney B. Holcomb, and Amanda HillJhoann CanenciaNo ratings yet

- Cir V Mobil (Francisco) DoctrineDocument3 pagesCir V Mobil (Francisco) DoctrineFrancisco MarvinNo ratings yet

- Increased by Percentage 19.8% 26.8% 30.45%Document1 pageIncreased by Percentage 19.8% 26.8% 30.45%Francisco MarvinNo ratings yet

- Crim 2 - First CasesDocument37 pagesCrim 2 - First CasesFrancisco MarvinNo ratings yet

- Agency For Vol Recit 020214Document9 pagesAgency For Vol Recit 020214Francisco MarvinNo ratings yet

- Tan V Del RosarioDocument1 pageTan V Del RosarioFrancisco MarvinNo ratings yet

- Evidence - Cases For Recit 132Document9 pagesEvidence - Cases For Recit 132Francisco MarvinNo ratings yet

- G.R. No. 85279Document13 pagesG.R. No. 85279JP TolNo ratings yet

- MIAA v. Court of Appeals IssueDocument3 pagesMIAA v. Court of Appeals IssueFrancisco MarvinNo ratings yet

- NCC Chapter 2Document3 pagesNCC Chapter 2Francisco MarvinNo ratings yet

- Southern Cross Cement Corporation VDocument1 pageSouthern Cross Cement Corporation VFrancisco MarvinNo ratings yet

- MorganDocument3 pagesMorganFrancisco MarvinNo ratings yet

- Evidence and Intent Determine Crime in Rape and Robbery CaseDocument6 pagesEvidence and Intent Determine Crime in Rape and Robbery CaseFrancisco MarvinNo ratings yet

- Gillette Case Study Turnaround PlanDocument7 pagesGillette Case Study Turnaround PlanFrancisco MarvinNo ratings yet

- Filipina Sy V. Ca and Fernando Sy - FranciscoDocument5 pagesFilipina Sy V. Ca and Fernando Sy - FranciscoFrancisco MarvinNo ratings yet

- Bates VDocument1 pageBates VFrancisco MarvinNo ratings yet

- Case Doctrines in Labor Relations: Kiok Loy v. NLRCDocument24 pagesCase Doctrines in Labor Relations: Kiok Loy v. NLRCFrancisco MarvinNo ratings yet

- Mallari VDocument4 pagesMallari VFrancisco MarvinNo ratings yet

- Manpri CaseDocument6 pagesManpri CaseFrancisco MarvinNo ratings yet

- Ethics Doctrines FinalDocument60 pagesEthics Doctrines FinalFrancisco MarvinNo ratings yet

- Indivisibility & Indivisible Obligation Solidarity & Solidarity ObligationDocument2 pagesIndivisibility & Indivisible Obligation Solidarity & Solidarity ObligationFrancisco MarvinNo ratings yet

- PCL Enforces Continuous Improvement StrategiesDocument7 pagesPCL Enforces Continuous Improvement StrategiesFrancisco MarvinNo ratings yet

- People vs Lase 219 SCRA 584 DigestDocument7 pagesPeople vs Lase 219 SCRA 584 DigestFrancisco MarvinNo ratings yet

- MPDocument7 pagesMPFrancisco MarvinNo ratings yet

- North-South Airline Group 5-1Document13 pagesNorth-South Airline Group 5-1Francisco Marvin100% (1)

- Steps in Hypothesis Test For A Significant Regression ModelDocument1 pageSteps in Hypothesis Test For A Significant Regression ModelFrancisco MarvinNo ratings yet

- Parlor GamesDocument1 pageParlor GamesFrancisco MarvinNo ratings yet

- Affidavit (Antonio)Document1 pageAffidavit (Antonio)Anonymous VgZb91pLNo ratings yet

- Accounting For Hire Purchase and Instalment SystemDocument16 pagesAccounting For Hire Purchase and Instalment SystemRAMEEZ. ANo ratings yet

- Letter of Explanation 35Document1 pageLetter of Explanation 35Nahiduzzaman NahidNo ratings yet

- C14 - Tutorial Answer PDFDocument5 pagesC14 - Tutorial Answer PDFJilynn SeahNo ratings yet

- Hindalco Case StudyDocument21 pagesHindalco Case StudyShrey KashyapNo ratings yet

- Financial Accounting For Bhu B.com Entrance TestDocument55 pagesFinancial Accounting For Bhu B.com Entrance TestfiscusNo ratings yet

- Investor / Analyst Presentation (Company Update)Document48 pagesInvestor / Analyst Presentation (Company Update)Shyam SunderNo ratings yet

- LNL Iklcqd /: Page 1 of 3Document3 pagesLNL Iklcqd /: Page 1 of 3Kundan KumarNo ratings yet

- MCCH Construction Services: Project: MC-18-022 (Masville, Paranaque) Period CoveredDocument1 pageMCCH Construction Services: Project: MC-18-022 (Masville, Paranaque) Period CoveredChester VitugNo ratings yet

- KD Chem Pharma - Proforma InvoiceDocument1 pageKD Chem Pharma - Proforma InvoiceJOYSON NOEL DSOUZANo ratings yet

- Ursa Minor-Course CurriculumDocument14 pagesUrsa Minor-Course CurriculumArvi SunNo ratings yet

- Evolution of Financial Service Sector in IndiaDocument47 pagesEvolution of Financial Service Sector in IndiaGauravSingh0% (1)

- Partial Income Statement For Manufacturing CompanyDocument1 pagePartial Income Statement For Manufacturing CompanyMary50% (2)

- Contract For Booking With Hair & Makeup I Do: Wedding DayDocument4 pagesContract For Booking With Hair & Makeup I Do: Wedding Daymichelle sadieNo ratings yet

- Benefits of Wage Earners ActivityDocument1 pageBenefits of Wage Earners ActivityReizel Jane PascuaNo ratings yet

- HDFC Life Insurance Company LTD.: VisionDocument4 pagesHDFC Life Insurance Company LTD.: VisionCOOK EAT REPEATNo ratings yet

- Investments: Learning ObjectivesDocument52 pagesInvestments: Learning ObjectivesElaine LingxNo ratings yet

- COL Calculator TemplateDocument145 pagesCOL Calculator TemplateGerardBalosbalosNo ratings yet

- PROJECT REPORT ON AViva LIFE INSURANCEDocument62 pagesPROJECT REPORT ON AViva LIFE INSURANCEMayank100% (12)

- Assignment 2 Section 2 Fall 2015 - 2016Document10 pagesAssignment 2 Section 2 Fall 2015 - 2016Aboubakr SoultanNo ratings yet

- Obligations of Banks and Parties Under Letters of CreditDocument11 pagesObligations of Banks and Parties Under Letters of CreditGhatz CondaNo ratings yet

- Foreign Currency Accounts ICICI BankDocument13 pagesForeign Currency Accounts ICICI BankbahlkartikNo ratings yet