Professional Documents

Culture Documents

Mega Product Budgets for Raw Materials, Labour, Sales

Uploaded by

aloy1574167Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mega Product Budgets for Raw Materials, Labour, Sales

Uploaded by

aloy1574167Copyright:

Available Formats

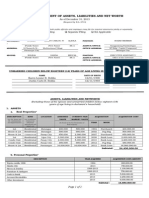

1. Smart Pvt Ltd manufactures a product called Mega using three different raw materials.

The product

details are as follows.

Selling price per unit LKR.50,000

Material X 3kgs material price LKR.700per kg

Material Y 2kgs material price LKR.1000 per kg

Material Z 4kgs material price LKR.900 per kg

Direct labour 8hours labour rate LKR1600 per hour

The company is in the process of preparing its budgets for next year and made the following estimates.

Demand for product Mega from January to April

January February March April

400 units 300 units 600 units 450 units

The companys inventory policy is to hold stocks of finished goods at the end of each month equal to

50% of the following months sales demand, and it is expected that the finished goods stock at the start

of the budget period will meet this requirement.

Quality standards require that at the end of the production process the final output is tested against

standards and it is usual for 10% of those tested to be faulty. It is impossible to rectify these faulty units

due to the nature of final product.

Expected raw material inventory levels as of 1 January.

Material X 1000 kgs

Material Y 400 kgs

Material Z 600 kgs

Inventory levels are to be increased by 20% in January, and then remain at their new level for the

foreseeable future.

Labour is paid on an hourly rate based on attendance. In addition to the unit direct labour hours shown

above, 20% of attendance time is spent on tasks which support production activity.

Requirements: prepare the following budgets for the quarter from January to March inclusive.

1. Sales budget in quantity and value;

2. Production budget in unit;

3. Raw material usage budget in kgs;

4. Raw material purchases budget in kgs and value;

5. Labour requirements budget in hours and value.

2. Hash makes two products P1 and P2. Sales for next year are budgeted at 5,000 units of P1 and

1,000 units of P2. Planned selling prices are LKR 230 and LKR 300 respectively.

Hash expects to have the following opening inventory and required closing inventory levels of finished

products:

P1 Units P2 Units

Opening inventory 100 50

Required closing inventory 1,100 50

Each product goes through two production processes, whittling and fettling. Budgeted production data

for the products are as follows:

Finished products: P1 P2

Raw materials X: Kilos per unit 12 12

Raw materials Y: Kilos per unit 6 8

Direct labour Hours per unit 8 12

Machine hours per unit: Whittling 5 8

Machine hours per unit: fettling 3 4

Raw material inventories Raw material

X Y

Opening inventory (Kilos) 5,000 5,000

Planned closing inventory (Kilos) 6,000 1,000

Standard rates and prices:

Direct labour rate per hour LKR 7

Material X purchase price per kilo LKR 2

Material Y purchase price per kilo LKR 5

You should assume that the following production overhead absorption rates have already been

established:

Production overhead absorption rates

Variable LKR 1 per direct labour hour

Fixed LKR 8 per direct labour hour

Budgeted administration and marketing overheads are LKR 225,000.

The opening statement of financial position is expected to be as follows:

LKR LKR

Noncurrent assets

950,000

Inventory 66,000

Trade receivables 260,000

Cash 25,000

351,000

Trade payables 86,000

Other Short -term liabilities 24,000

110,000

Net current assets

241,000

Net assets

1,191,000

Non-current assets in the statement of financial position are expected to increase by LKR 40,000, but no

change is expected in trade receivable, trade payable and other short term liabilities.

There are no plans at this stage to raise extra capital by issuing new shares or obtaining new loans.

The company currently has an overdraft facility of LKR 300,000 with its bank.

Required:

For the budget period, prepare

a) A sales budget

b) A production budget in units

c) Material usage and purchase budget

d) A direct labour cost budget

e) A machine utilization budget

f) A production cost budget

g) A budgeted income statement

h) A budgeted statement of financial position (or balance sheet) as at the end of the period

You might also like

- BCG MatrixDocument3 pagesBCG MatrixRabbiya irfan100% (2)

- Insteel Wire Products Abm at Andrews Year of ABC AnalysisDocument15 pagesInsteel Wire Products Abm at Andrews Year of ABC AnalysisASHUTOSH SHARMANo ratings yet

- Capital Budgeting AnalysisDocument6 pagesCapital Budgeting AnalysisSufyan Ashraf100% (1)

- D.U. Singer Hospital Products Project PlanDocument14 pagesD.U. Singer Hospital Products Project Planbalramkinage100% (3)

- Ch13 Exercise+9Document1 pageCh13 Exercise+9Ashley WilkeyNo ratings yet

- Https Doc 0k 0s Apps Viewer - GoogleusercontentDocument4 pagesHttps Doc 0k 0s Apps Viewer - GoogleusercontentAnuranjan Tirkey0% (1)

- Problem Set 2 3 4 Or-2Document5 pagesProblem Set 2 3 4 Or-2Ryan Jeffrey Padua Curbano100% (1)

- 1321691530financial AccountingDocument21 pages1321691530financial AccountingMuhammadOwaisKhan0% (1)

- MECH 6076 Quiz II Supply Chain Modeling and OptimizationDocument3 pagesMECH 6076 Quiz II Supply Chain Modeling and OptimizationCostina Luc0% (1)

- Boylston Shoe ShopDocument2 pagesBoylston Shoe ShopClaire Marie ThomasNo ratings yet

- Q No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyDocument3 pagesQ No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyMuneeb Qureshi0% (1)

- Group 6 - Aggregate Plan - Report - WordDocument11 pagesGroup 6 - Aggregate Plan - Report - WordNguyễn Bích NgọcNo ratings yet

- Safety Inventory and Availability Problem SetDocument2 pagesSafety Inventory and Availability Problem SetachalbaNo ratings yet

- Lamson Operation ManagementDocument1 pageLamson Operation ManagementkencanasaktiNo ratings yet

- IFA1ESMHDocument52 pagesIFA1ESMHAditya Rvp ShahNo ratings yet

- Assigment 6 - Managerial Finance Capital BudgetingDocument5 pagesAssigment 6 - Managerial Finance Capital BudgetingNasir ShaheenNo ratings yet

- Quiz 2Document6 pagesQuiz 2Mukund AgarwalNo ratings yet

- 68957Document9 pages68957Mehar WaliaNo ratings yet

- Pom Inventory ProblemsDocument8 pagesPom Inventory ProblemsSharath Kannan0% (2)

- Assignment #3 - MRP Calculation: Part A 1 2 3 4 5 6Document2 pagesAssignment #3 - MRP Calculation: Part A 1 2 3 4 5 6jigar kanjani0% (1)

- MICRO ASS 1 Eco 401Document3 pagesMICRO ASS 1 Eco 401Uroona MalikNo ratings yet

- Assignment MRPDocument5 pagesAssignment MRPKhánh Linh NguyễnNo ratings yet

- SCM ReportDocument12 pagesSCM ReportFurqan MahmoodNo ratings yet

- Possible Causes of VariancesDocument4 pagesPossible Causes of VariancesBahulu Berinti 'Arashi0% (1)

- Activity Based CostingDocument13 pagesActivity Based CostingSudeep D'SouzaNo ratings yet

- Master Budget Assignment CH 9Document4 pagesMaster Budget Assignment CH 9api-240741436No ratings yet

- IBA Second Term Exam (A) Spring 2016 Financial ManagementDocument6 pagesIBA Second Term Exam (A) Spring 2016 Financial ManagementHaneefa Soomro0% (1)

- sportstuff.comDocument3 pagessportstuff.comRanjitha KumaranNo ratings yet

- Current Problems of Corporate Sector of PakistanDocument5 pagesCurrent Problems of Corporate Sector of Pakistanaliasif198No ratings yet

- Guidelines for Phase 1 Business Case SubmissionDocument1 pageGuidelines for Phase 1 Business Case SubmissionPraveen VermaNo ratings yet

- Ilide - Info Review Qs PRDocument93 pagesIlide - Info Review Qs PRMobashir KabirNo ratings yet

- Aggregate Planning (Chapter 8-9) : Demand ForecastDocument8 pagesAggregate Planning (Chapter 8-9) : Demand ForecastФилипп СибирякNo ratings yet

- Aggregate Production Planning for Switchgear ManufacturerDocument14 pagesAggregate Production Planning for Switchgear ManufacturerDebayan GhoshNo ratings yet

- A Capacity Planning Assignment 2016 Bassam Senior Modified SolutionDocument10 pagesA Capacity Planning Assignment 2016 Bassam Senior Modified SolutionAhmad Ayman FaroukNo ratings yet

- LPP FormulationDocument15 pagesLPP FormulationGaurav Somani0% (2)

- Multinational Capital Budgeting Inputs and ExampleDocument14 pagesMultinational Capital Budgeting Inputs and ExampleAminul Islam AmuNo ratings yet

- Activity Based Costing ExampleDocument3 pagesActivity Based Costing ExampleViji LakshmiNo ratings yet

- Managerial EconomicsDocument3 pagesManagerial EconomicsWajahat AliNo ratings yet

- GBAT9114 POM SampleExam PDFDocument3 pagesGBAT9114 POM SampleExam PDFSehabom Geberhiwot100% (1)

- Home Assignment - RevisedDocument4 pagesHome Assignment - RevisedLê Quỳnh Anh100% (1)

- 11 7Document2 pages11 7Mesut SarıtemurNo ratings yet

- Absor Pvt. LTDDocument4 pagesAbsor Pvt. LTDsam50% (2)

- Funtime Inc Manufactures Video Game Machines Market SaturatiDocument2 pagesFuntime Inc Manufactures Video Game Machines Market SaturatiAmit PandeyNo ratings yet

- Pakistan: Form Cp-02 Water and Power Development Authority Abridged Conditions of SupplyDocument8 pagesPakistan: Form Cp-02 Water and Power Development Authority Abridged Conditions of Supplyیاسین اختر اعوانNo ratings yet

- Analyze Earth Mover, Spectrometer, and Machine Replacement ProjectsDocument2 pagesAnalyze Earth Mover, Spectrometer, and Machine Replacement ProjectsDanang0% (2)

- Lecture: 6, and 7 Chapter - 5 Process CostingDocument25 pagesLecture: 6, and 7 Chapter - 5 Process CostingYasir Saeed AfridiNo ratings yet

- Human Resource Management: Textile Institue of PakistanDocument19 pagesHuman Resource Management: Textile Institue of PakistanSaba FatmiNo ratings yet

- Inventory ProblemsDocument4 pagesInventory ProblemsPulkit AggarwalNo ratings yet

- Taguchi'S Quality Loss FunctionDocument17 pagesTaguchi'S Quality Loss FunctionAvi Barua100% (1)

- Lecture 10: MRP & JIT Lecture 10: MRP & JIT: Material Requirements Planning Material Requirements PlanningDocument5 pagesLecture 10: MRP & JIT Lecture 10: MRP & JIT: Material Requirements Planning Material Requirements PlanningCharles BinuNo ratings yet

- FM - Assessment 2 - Case Study-Working CapitalDocument2 pagesFM - Assessment 2 - Case Study-Working CapitalAnimesh kumarNo ratings yet

- Qadri Group PDFDocument19 pagesQadri Group PDFAhmed NiazNo ratings yet

- Case Problem 3 Production Scheduling With Changeover CostsDocument3 pagesCase Problem 3 Production Scheduling With Changeover CostsSomething ChicNo ratings yet

- Example 4Document3 pagesExample 4dimash209100% (1)

- New Microsoft Office Word DocumentDocument5 pagesNew Microsoft Office Word DocumentTariq RahimNo ratings yet

- MCS MatH QSTN NewDocument7 pagesMCS MatH QSTN NewSrijita SahaNo ratings yet

- Budgeting QuestionsDocument8 pagesBudgeting QuestionsumarNo ratings yet

- Assignment 3 - Budgeting-1Document8 pagesAssignment 3 - Budgeting-1Hafsa Hayat0% (1)

- Unit V Budgetory ControlDocument16 pagesUnit V Budgetory ControlShobha AkulaNo ratings yet

- 2.guess Questions - Problems - QuestionsDocument34 pages2.guess Questions - Problems - QuestionsKrishnaKorada67% (9)

- Research PublicationsDocument1 pageResearch Publicationsaloy1574167No ratings yet

- OutlineDocument3 pagesOutlinealoy1574167No ratings yet

- Request for 2 days casual leave in August 2023Document1 pageRequest for 2 days casual leave in August 2023aloy1574167No ratings yet

- Questions. Barnd EquityDocument5 pagesQuestions. Barnd EquityAloyNireshNo ratings yet

- Research PublicationsDocument1 pageResearch Publicationsaloy1574167No ratings yet

- 70237153Document18 pages70237153aloy1574167No ratings yet

- Joint Venture - Unlocked EditableDocument18 pagesJoint Venture - Unlocked Editablealoy1574167No ratings yet

- OBDocument21 pagesOBaloy1574167No ratings yet

- Joint VentureDocument2 pagesJoint Venturealoy1574167No ratings yet

- Joint Venture - UnlockedDocument17 pagesJoint Venture - Unlockedaloy1574167No ratings yet

- The Impact of Brand Equity On Purchase Intention and Brand Preference-The Moderating Effects of Country of Origin ImageDocument7 pagesThe Impact of Brand Equity On Purchase Intention and Brand Preference-The Moderating Effects of Country of Origin Imagen_srinivas09No ratings yet

- Aeb15 Irm Afm v3Document5 pagesAeb15 Irm Afm v3aloy1574167No ratings yet

- History of US GAAP and IFRS ConvergenceDocument1 pageHistory of US GAAP and IFRS Convergencealoy1574167No ratings yet

- Celebrity BrandingDocument13 pagesCelebrity BrandingBrijesh BaghelNo ratings yet

- Operations Strategy Analysis of Sampath BankDocument20 pagesOperations Strategy Analysis of Sampath Bankaloy157416767% (6)

- Operations Strategy Analysis of Sampath BankDocument20 pagesOperations Strategy Analysis of Sampath Bankaloy157416767% (6)

- Firm Size and Profitability: A Study of Listed Manufacturing Firms in Sri LankaDocument8 pagesFirm Size and Profitability: A Study of Listed Manufacturing Firms in Sri Lankaaloy1574167No ratings yet

- Firm Size and Profitability: A Study of Listed Manufacturing Firms in Sri LankaDocument8 pagesFirm Size and Profitability: A Study of Listed Manufacturing Firms in Sri Lankaaloy1574167No ratings yet

- Linear Programming FinalffwffDocument1 pageLinear Programming Finalffwffaloy1574167No ratings yet

- Office 2010Document1 pageOffice 2010aloy1574167No ratings yet

- University of Jaffna-Sri Lanka Department of AccountingDocument1 pageUniversity of Jaffna-Sri Lanka Department of Accountingaloy1574167No ratings yet

- Nonparametric CorrelationsDocument18 pagesNonparametric Correlationsaloy1574167No ratings yet

- Mrs.P.Muraleetharan Personal File 2014: ACC 3235: Advanced Business Accounting Mr.S.BalaputhiranDocument1 pageMrs.P.Muraleetharan Personal File 2014: ACC 3235: Advanced Business Accounting Mr.S.Balaputhiranaloy1574167No ratings yet

- Mintzberg Managerial Roles NotesDocument4 pagesMintzberg Managerial Roles Notesaloy1574167No ratings yet

- NSB Internet Banking Service GuideDocument5 pagesNSB Internet Banking Service GuideSadeep Madhushan50% (2)

- Car Repair Workshop Overhead Analysis SheetDocument1 pageCar Repair Workshop Overhead Analysis Sheetaloy1574167No ratings yet

- Mintzberg's Management Roles Identifying The Roles Managers PlayDocument6 pagesMintzberg's Management Roles Identifying The Roles Managers Playaloy1574167No ratings yet

- This Study Investigates Working Capital PolicyDocument1 pageThis Study Investigates Working Capital Policyaloy1574167No ratings yet

- Computing Additional Profit (LKR)Document2 pagesComputing Additional Profit (LKR)aloy1574167No ratings yet

- Analysis of Financial Performance of SbiDocument5 pagesAnalysis of Financial Performance of SbiMAYANK GOYALNo ratings yet

- Mortage Meaning and Kinds of Mortgage: Central University of South Bihar GAYA-823001Document5 pagesMortage Meaning and Kinds of Mortgage: Central University of South Bihar GAYA-823001CHANDAN KUMARNo ratings yet

- Go.353 DT 04.12.2010 - Procedure For Claiming Family PensionDocument6 pagesGo.353 DT 04.12.2010 - Procedure For Claiming Family PensionNarasimha Sastry33% (3)

- SMEDA Rose WaterDocument20 pagesSMEDA Rose WaterZaid AhmadNo ratings yet

- General Credit Corporation v. Alsons DevelopmentDocument5 pagesGeneral Credit Corporation v. Alsons DevelopmentbearzhugNo ratings yet

- Development proposal for office & apartment blocks in Ampang, Kuala LumpurDocument16 pagesDevelopment proposal for office & apartment blocks in Ampang, Kuala Lumpursongkk100% (1)

- CMS Report 3Document6 pagesCMS Report 3RecordTrac - City of OaklandNo ratings yet

- Catch The WaveDocument71 pagesCatch The WaveAlis SemeniucNo ratings yet

- Individual Pret Contract TermsDocument5 pagesIndividual Pret Contract TermsAlinadozpNo ratings yet

- Axis Bank CMS Guide - Cash Management Services OverviewDocument23 pagesAxis Bank CMS Guide - Cash Management Services Overviewsanjay_sbi100% (1)

- Leverage and Pip ValueDocument4 pagesLeverage and Pip ValueSanjayNo ratings yet

- Luzon Steel Corporation vs. SiaDocument8 pagesLuzon Steel Corporation vs. SiaAnonymous WDEHEGxDhNo ratings yet

- MRT7 - Concession AgreementDocument95 pagesMRT7 - Concession AgreementRomeo Santos Mandinggin100% (2)

- SECURITIES FIRM V. TRADERDocument8 pagesSECURITIES FIRM V. TRADERIyahNo ratings yet

- Ackman's Letter To PWC Regarding HerbalifeDocument52 pagesAckman's Letter To PWC Regarding Herbalifetheskeptic21100% (1)

- The Future of Notarization Is OnlineDocument14 pagesThe Future of Notarization Is OnlineForeclosure FraudNo ratings yet

- Why do Scherer and Palazzo (2011) argue that there is an increasingly public role for private business firms? What are some of the advantages vs. the disadvantages of firms adopting a stronger ‘public role’ e.g. in administration of public goods and services?Document14 pagesWhy do Scherer and Palazzo (2011) argue that there is an increasingly public role for private business firms? What are some of the advantages vs. the disadvantages of firms adopting a stronger ‘public role’ e.g. in administration of public goods and services?Smriti TalrejaNo ratings yet

- MODULE 1 Lecture Notes (Jeff Madura)Document4 pagesMODULE 1 Lecture Notes (Jeff Madura)Romen CenizaNo ratings yet

- What Is LAFDocument3 pagesWhat Is LAFTaruna JunejaNo ratings yet

- Mcom Part2 FinalDocument45 pagesMcom Part2 FinalRahul SosaNo ratings yet

- Frequently Asked Questions UP Provident FundDocument2 pagesFrequently Asked Questions UP Provident FundPam Otic-ReyesNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument3 pagesSworn Statement of Assets, Liabilities and Net WorthJf ManejaNo ratings yet

- Berar Finance LimitedDocument9 pagesBerar Finance LimitedKamlakar AvhadNo ratings yet

- Franchise MacdonaldDocument5 pagesFranchise MacdonaldrahulvjainNo ratings yet

- Law On Credit Transactions-GuarantyDocument3 pagesLaw On Credit Transactions-GuarantyBea ChristineNo ratings yet

- Certificate of DepositsDocument6 pagesCertificate of DepositsYhus MirandaNo ratings yet

- CLASS X - CHAPTER 3. Notes - MONEY AND CREDITDocument5 pagesCLASS X - CHAPTER 3. Notes - MONEY AND CREDITSlick Life VlogsNo ratings yet

- How To Pledge Shares of StocksDocument3 pagesHow To Pledge Shares of StocksMarlon TabilismaNo ratings yet

- Capital StructureDocument24 pagesCapital StructureshimulNo ratings yet

- Zimbabwe School Exams Council Management of Business Paper 1Document4 pagesZimbabwe School Exams Council Management of Business Paper 1Panashe MusengiNo ratings yet