Professional Documents

Culture Documents

General Journal

Uploaded by

Zaheer Ahmed Swati100%(2)100% found this document useful (2 votes)

7K views11 pagesSolution Work Book

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSolution Work Book

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

100%(2)100% found this document useful (2 votes)

7K views11 pagesGeneral Journal

Uploaded by

Zaheer Ahmed SwatiSolution Work Book

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 11

Wor kbook

zaheerswati@ciit.net.pk General Journal (Solved)

26

Unit 3

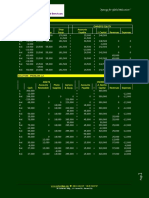

GJ # 3.1 On April 01, 2008 Anees stared business with Rs. 100,000 and other transactions for the month as follows.

2. Purchase Furniture for Cash Rs. 7,000.

8. Purchase Goods for Cash Rs. 2,000 and for Credit Rs. 1,000 from Khalid Retail Store.

14. Sold Goods to Khan Brothers Rs. 12,000 and Cash Sales Rs. 5,000.

18. Owner withdrew of worth Rs. 2,000 for personal use.

22. Paid Khalid Retail Store Rs. 500.

26. Received Rs. 10,000 fromKhan Brothers.

30. Paid Salaries Expense Rs. 2,000 and Rent Expense Rs. 3,000.

General Journal

Date Account Title and Explanations Ref

Amount (Rs)

Debit Credit

2008

April

1 Cash 100,000

Owners Equity_ Anees 100,000

(Started business with cash)

2 Furniture 7,000

Cash 7,000

(Purchase furniture for cash)

8 Purchases 3,000

Cash 2,000

Account Payable_ Khalid Retail Store 1,000

(Purchase good on cash and credit)

14 Cash 5,000

Account Receivables_ Khan Brothers 12,000

Sales 17,000

(Cash and Credit Sales recorded)

18 Drawing 2,000

Cash 2,000

(Owner withdrew for personal use)

22 Account Payable_ Khalid Retail Store 500

Cash 500

(Paid credit to Khalid Retail Store)

26 Cash 10,000

Account Receivable_ Khan Brothers 10,000

(Receive cash fromcredit customer)

30 Salaries Expense 2,000

Rent Expense 3,000

Cash 5,000

(Paid expenses)

Total Rs. 144,500 Rs. 144,500

Wor kbook

zaheerswati@ciit.net.pk General Journal (Solved)

27

Unit 3

GJ # 3.2 Mr. Naveed Khan is sole owner of business. He has been started business since 1990 in Karachi. Following

are transaction of Naveeds business for the month of August 2007.

3. Reinvestment in the shape of Cash Rs. 80,000 and Furniture Rs. 20,000.

5. Cash Sales Rs. 10,000 and on account Sales Rs. 12,000.

6. Bought goods fromAhmed Co. Rs. 60,000 paid Rs. 15,000 cash and remaining Note payable pay with in 30 days.

9. Purchase Office Equipment fromAli Malik & Sons worth Rupees Rs. 99,000, a cash down payment of Rs. 19,000 and

balance will be paid by four instalments, first due on 30 August.

21. Goods return by credit customer of worth Rs. 12,000.

30. Paid first instalment of Rs. 20,000.

General Journal

Date Account Title and Explanations Ref

Amount (Rs.)

Debit Credit

2007

Aug. 3 Cash 80,000

Furniture 20,000

Owners Equity_ Naveed Khan 100,000

(Reinvest by owner in the business)

5 Cash 10,000

Account Receivable 12,000

Sales 22,000

(Cash and Credit Sales)

6 Purchases 60,000

Cash 15,000

Note Payable_ Ahmed Co. 45,000

(Purchases by cash and credit fromAhmed)

9 Office Equipment 99,000

Cash 19,000

Account Payable_ Malik & Sons 80,000

(Purchase O. equipment on instalments by A. Malik)

21 Sales Return 12,000

Account Receivable 12,000

(Goods return by credit customer)

30 Account Payable_ Malik & Sons 20,000

Cash 20,000

(Paid 1

st

instalment to Ali Malik & Sons)

Total

Rs. 313,000 Rs. 313,000

Wor kbook

zaheerswati@ciit.net.pk General Journal (Solved)

28

Unit 3

GJ # 3.3On March 2009, a merchandise trader ABC, starts wholesaling business. Following transactions as follows

1. A merchant started business with capital of Rs. 15,000 and Land worth Rs. 10,000.

8. Bought goods from Bilal and Friends Rs. 1,000 and by cash from XYZ Co. Rs 2,000.

13. Sold goods to Rehman & sons Rs. 1,500 and sale by cash Rs. 5,000.

17. Gave away charity of cash Rs. 50 and merchandising worth Rs. 30.

21. Paid Bilal and Friends cash Rs. 975; discount received Rs. 25.

28. Received cash fromRehman & Sons Rs. 1,450; allowed himdiscount of Rs. 50.

General Journal

Date Account Title and Explanations Ref

Amount (Rs.)

Debit Credit

2009

March 1 Cash 15,000

Land 10,000

Owners Equity_ ABC 25,000

(Owner started business by assets)

8 Purchases 3,000

Account Payable_ Bilal and Friends 1,000

Cash 2,000

(Purchases by cash and by credit)

13 Account Receivable_ Rehman & sons 1,500

Cash 5,000

Sales 6,500

(Purchases by cash and Credit fromAhmed)

17 Charity 80

Cash 50

Purchases 30

(Charity by cash and by goods)

21 Account Payable_ Bilal and Friends 1,000

Cash 975

Discount 25

(Discount received and liability payoff)

28 Cash 1,450

Discount 50

Account Receivable_ Rehman & sons 1,500

(Account receivable realized and discount allowed)

Total Rs. 37,080 Rs. 37,080

Wor kbook

zaheerswati@ciit.net.pk General Journal (Solved)

29

Unit 3

GJ # 3.4 Goodwood Marine is a boat repair yard. During August 2009, its transactions included the following

03. Loan taken fromHabib Bank Ltd. of Rs. 25,000. Rs. 20,000 withdrawn for business and remaining in the bank account.

06. Paid rent for the month of August Rs. 4,400 and accrued rent expenses was Rs. 600.

12. At request of Kiwi Insurance, Inc, made repairs on boat of J on Seaways. Sent bill for Rs. 5,620 for services rendered to

Kiwi Insurance Inc. (credit Repair Service Revenue).

18. Made repairs to boat of Dennis Copper and collected in full the charge of Rs. 2,830.

20. Placed Advertisement in The Dawn to be published in August 23 at a cost of 165, payment to be made within 30 days.

25. Received a check for 5,620 fromKiwi Insurance Inc representing collection of the receivable of August 12.

30. Sent check to The Dawn in payment of the liability incurred on August 20.

General Journal

Date Account Title and Explanations Ref

Amount (Rs.)

Debit Credit

2009

Aug. 3

Cash 20,000

Bank 5,000

Bank Loan 25,000

(Bank loan liability has been taken)

6 Rent Expenses 5,000

Cash 4,400

Rent Payable 600

(Rent Expenses paid and outstanding)

12 Account Receivable_ Kiwi Insurance Inc. 5,620

Repair Service Revenue 5,620

(Sent bill to customer)

18 Cash 2,830

Repair Service Revenue 2,830

(Repair services received by cash)

20 Advertisement Expenses 165

Advertisement Payable_ The Dawn 165

(Advertisement Expenses incurred but not paid)

25 Bank 5,620

Account Receivable_ Kiwi Insurance Inc. 5,620

(Receivable collected by bank)

30 Advertisement Payable_ The Dawn 165

Bank 165

(Paid liability by bank)

Total Rs. 44,400 Rs. 44,400

Wor kbook

zaheerswati@ciit.net.pk General Journal (Solved)

30

Unit 3

GJ # 3.5 1

st

January, 2010, a trader started business other transactions for the month of June as follows

02. Purchased from Kareemgoods of list price of Rs. 6,000 subject to 10% trade discount by cash.

04. Sold goods to Din Muhammad Rs. 800 and cash sales of Rs. 200.

10. Distributed goods worth Rs. 200 as free samples and goods taken away by the proprietor for personal use Rs. 100.

12. Received discount Rs 20 and Commission Rs 500.

17. Goods returned by Din Muhammad Rs. 200 and payment other outstanding amount.

24. Furniture lost by fire of worth Rs. 500.

30. Bad Debts during the period was Rs.100.

General Journal

Date Account Title and Explanations Ref

Amount (Rs.)

Debit Credit

2010

Jun 2

Purchases 5,400

Cash 5,400

(Cash purchases and trade discount)

4 Account Receivable_ Din Muhammad 800

Cash 200

Sales 1,000

(Cash and credit sales)

10 Free Sample 200

Drawing 100

Purchases 300

(Free sample and drawing through purchases)

12 Cash 520

Discount 20

Commission 500

(Other income in terms of discount and commission)

17 Return Inward 200

Cash 600

Account Receivable_ Din Muhammad 800

(Sales return and received other amount by customer)

24 Lost by Fire 500

Furniture 500

(Furniture lost by fire)

30 Bad Debts 100

Account Receivable 100

(Bad Debts are recorded)

Total Rs. 8,620 Rs. 8,620

Wor kbook

zaheerswati@ciit.net.pk General Journal (Solved)

31

Unit 3

GJ # 3.6 Rahim and company started business with capital of Rs. 40,000 and Inventory of worth Rs. 5,000.

2009

October 03 Purchased Inventory fromAli Ltd. of worth Rs. 2,000 on account; terms being 2/10- n/30

08 Sold inventory at price equal to Rs. 4,000 costing Rs. 2,500 by cash transaction

16 Defective material returns to Ali Ltd. of worth Rs. 300

18 Purchased Inventory fromAhmed Ltd. of worth Rs. 1,000 on account; terms being 2/15- n/30

23 Paid Rs. 1,500 for 3

rd

January credit transaction and full amount to Ahmed Ltd.

28 Inventory sold to Jamil for Rs. 3,500 costing Rs. 2,800

General Journal

Date Account Title and Explanations Ref

Amount (Rs.)

Debit Credit

2009

Oct 1

Cash 40,00

Inventory 5,000

Owners Equity 45,000

(Started business with cash and inventory)

3 Inventory 2,000

Account Payable_ Ali Ltd. 2,000

(Credit Purchase of inventory with credit terms)

8 Cash 4,000

Inventory 2,500

Profit and Loss 1,500

(Sales of inventory and profit recognition)

16 Account Payable_ Ali Ltd. 300

Inventory 300

(Defective inventory return to vendor)

18 Inventory 1,000

Account Payable_ Ahmed Ltd. 1,000

(Credit Purchase of inventory with credit terms)

23 Account Payable_ Ali Ltd. 1,500

Account Payable_ Ahmed Ltd. 1,000

Discount 20

Cash 2,480

(Payment of liabilities and earn discount)

28 Account Receivable_ Jamil 3,500

Inventory 2,800

Profit and Loss 7,00

(Credit sales of inventory and recording of profit )

Total Rs. 58,300 Rs. 58,300

Wor kbook

zaheerswati@ciit.net.pk General Journal (Solved)

32

Unit 3

GJ # 3.7 Record the following transaction in General Journal as July, 2009

01. Starts a business by opening a bank account with Rs. 50,000 and petty cash of worth Rs. 10,000.

06. Buys stationary fromInk stores valued at Rs. 700. It expects to pay for the stationary in a months time.

09. Goods purchase of worth Rs. 10,000 by cash and trade discount received 10%.

11. Unearned sales of Rs. 3,200 earned during the July.

17. Made sales of worth totalling Rs. 1,800. Collected 400 by bank balance due with in 30 days in terms of Note.

24. Paid Salaries Expenses of Rs. 1,200; Rent Expenses of Rs. 1,400 and Carriage Expense are outstanding Rs. 2,400.

29. Sold Goods to Ahmed Ali on cash Rs. 4,000 with 10% trade discount.

General Journal

Date Account Title and Explanations Ref

Amount (Rs.)

Debit Credit

2009

July 1

Bank 50,000

Cash 10,000

Owners Equity 60,000

(Started business with bank and cash)

6 Stationery 700

Account Payable_ Ink stores 700

(Credit Purchase of stationery)

9 Purchases 9,000

Cash 9,000

(Purchases with trade discount on cash)

11 Unearned Sales 3,200

Sales 3,200

(Unearned sales now earned)

17 Note Receivable 1,400

Bank 400

Sales

1,800

(Cash and credit sales)

24 Salaries Expenses 1,200

Rent Expenses 1,400

Carriage Expenses 2,400

Cash 2,600

Carriage Payable 2,400

(Expenses paid and incurred liability)

29 Cash 3,600

Sales 3,600

(Cash sales subject to trade discount )

Total Rs. 83,300 Rs. 83,300

Wor kbook

zaheerswati@ciit.net.pk General Journal (Solved)

33

Unit 3

GJ # 3.8 During April 2009, following transactions were completed by business.

4. Cash received customer billed earlier Rs. 14,000.

5. Paid advance rent for six months of Rs. 6,000.

7. Received advance payment fromcustomers Rs. 1,200, services will be provided in August.

11. Services revenue of worth Rs. 3,200 now earned which had received in advance

14. Rs. 1,000 cash was loan to ABC Co. evidenced by note receivable.

17. Billed customer for services provided Rs. 3,000.

24. Rs. 10,000 borrowed from local bank and signed a note payable.

27. Owner draws out Rs. 100 fromthe business bank account for his own use.

General Journal

Date Account Title and Explanations Ref

Amount (Rs.)

Debit Credit

2009

July 4

Cash 14,000

Account Receivable 14,000

(Cash received fromcustomers)

5 Prepaid Rent 6,000

Cash 6,000

(Advance rent paid)

7 Cash 1,200

Unearned Services Revenue 1,200

(Payment received in advance by clients)

11 Unearned Services Revenue 3,200

Services Revenue 3,200

(Unearned services revenue now earned)

14 Note Receivable_ ABC Co. 1,000

Cash 1,000

(Loan granted to ABC company by note)

17 Account Receivable 3,000

Services Revenue 3,000

(Billed to customer)

24 Cash 1,000

Note Payable 1,000

(Obtained loan from bank by note payable)

27 Drawing 100

Bank 100

(Owner personal withdrawal by bank )

Total Rs. 29,500 Rs. 29,500

Wor kbook

zaheerswati@ciit.net.pk General Journal (Solved)

34

Unit 3

GJ # 3.9 Pass the following transaction in the book of original entry for XYZ business for year 2010.

Jan 1 Customer check Rs. 7,000 was dishonoured and return unpaid by the company bank and credit sales Rs. 5,000.

9 Charged interest on capital Rs. 1,000 and reinvestment of capital by owner of worth Rs. 3,000.

11 Goods return by credit customer of Rs. 4,000 and cash customer of worth Rs. 2,000.

17 Write off Depreciation of Machinery was Rs. 5,000 by using cost method and Rs. 4,000 by using (WDM).

24 Goods costing Rs. 500 was taken away by the proprietor and goods donated to charities Rs. 1,000.

29 Interest accrued on bill payable during the month was Rs. 1,000 and interest expense paid Rs. 1,500.

General Journal

Date Account Title and Explanations Ref

Amount (Rs.)

Debit Credit

2010

Jan 1

Account Receivable (7,000 +5,000) 12,000

Bank 7,000

Sales

(Check dishonoured and credit sales recorded)

5,000

9 Interest on Capital 1,000

Cash 3,000

Owners Equity 4,000

(Interest on capital and introduced capital)

11 Return Inward (4,000 +2,000) 6,000

Account Receivable 4,000

Cash 2,000

(Sales return by credit and cash customers)

17 Depreciation Expense_ Machinery (5,000 +4,000) 9,000

Accumulated Depreciation_ Machinery 5,000

Machinery 4,000

(Depreciation recording by cost and WDM)

24 Drawing 500

Charity 1,000

Purchases (500 +1,000) 1,500

(Goods withdrawn and give as charity)

29 Interest Expenses (1,000 +1,500) 2,500

Interest Payable 1,000

Cash 1,500

(Interest Liability and portion paid)

Total Rs. 35,000 Rs. 35,000

Wor kbook

zaheerswati@ciit.net.pk General Journal (Solved)

35

Unit 3

GJ # 3.10 Record the following economic events in the book of prime entry for Star business for year 2010.

Feb 2. Merchandise return to supplier Rs. 5,000 so reduces liability and return to cash vendor of Rs. 3,000.

5. Replenished inventory for Rs. 6,000 cash and paid Insurance expenses Rs. 500.

12. Interest on drawing charged Rs. 8,000.

16. Receive cash fromMr. Farooq Rs. 6,000 and sold merchandise to Mr. Zamir by cash Rs. 3,000.

23. Received dividend on securities by bank of Rs. 1,500 and sold marketable securities of Rs, 8,000 by cash.

27. Sales goods for Rs. 30,000 (cost 20,000).

General Journal

Date Account Title and Explanations Ref

Amount (Rs.)

Debit Credit

2010

Jan 2

Account Payable 5,000

Cash 3,000

Purchase Return

(Goods return to credit and cash customers)

8,000

5 Inventory 6,000

Insurance Expense 500

Cash 6,500

(Bought inventory and paid expenses)

12 Owner Equity 8,000

Interest on Drawing 8,000

(Interest on drawing is recorded)

16 Cash (6,000 +3,000) 9,000

Account Receivable_ Farooq 6,000

Sales 3,000

(Receivable realized and cash sales)

23 Bank 1,500

Cash 8,000

Dividend 1,500

Marketable Securities 8,000

(Dividend received and securities sold)

27 Cash 30,000

Inventory 20,000

Profit and Loss 10,000

(Sold inventory and earned profit)

Total Rs. 71,000 Rs. 71,000

Wor kbook

zaheerswati@ciit.net.pk General Journal (Solved)

36

Unit 3

GJ # 3.11 On 1st April, 2010 a Company started business with Inventory valued at Rs. 85,000, placed Cash Rs. 65,000

in a business Bank Account and Marketable Securities of worth Rs. 10,000.

03 Purchase Inventory of Rs. 5,000 paid cash Rs. 1,000 by check and promising the rest on a Note Payable.

14 Sale of marketable securities that cost Rs. 5,000 for Rs. 6,500

25 Note Payable paid Rs. 2,000 and interest expense Rs. 2,500 both expenses by bank.

29 Old machinery sales of worth Rs. 17,000 whose book value was Rs. 20,000

General Journal

Date Account Title and Explanations Ref

Amount (Rs.)

Debit Credit

2010

April 1 Inventory 85,000

Bank 65,000

Marketable Security 10,000

Owners Equity 160,000

(Reinvest by owner in the business)

3 Inventory 5,000

Cash 1,000

Note Payable 4,000

(Purchases of inventory)

14 Cash 6,500

Marketable Security 5,000

Capital Gain 1,500

(Sale of marketable securities and earn gain)

25 Note Payable 2,000

Interest Expense 2,500

Bank 4,500

(Payments by bank)

29 Cash 17,000

Capital Loss 3,000

Machinery 20,000

(Old machinery sales and sustain loss)

Total

Rs. 189,500 Rs. 189,500

You might also like

- Name:John Michael Najarro Course&Year: BSBA 1 Date: 10/7/20: Colegio de Santa Rita de San Carlos, IncDocument3 pagesName:John Michael Najarro Course&Year: BSBA 1 Date: 10/7/20: Colegio de Santa Rita de San Carlos, IncRod Najarro100% (1)

- MM Company Adjusted Trial BalanceDocument22 pagesMM Company Adjusted Trial BalanceKianJohnCentenoTurico100% (2)

- Unit # 9 Books of AccountsDocument81 pagesUnit # 9 Books of AccountsZaheer Ahmed SwatiNo ratings yet

- Accounting 1 ModuleDocument97 pagesAccounting 1 ModuleAnalie Cabanlit100% (3)

- Alam FinalDocument34 pagesAlam FinalZaheer Ahmed SwatiNo ratings yet

- Expand Market Reach Accounts ReceivableDocument2 pagesExpand Market Reach Accounts ReceivableCristaiza R. Dumpit100% (1)

- AAPL DCF ValuationDocument12 pagesAAPL DCF ValuationthesaneinvestorNo ratings yet

- Jordan River LaundryDocument4 pagesJordan River Laundryidk irdkNo ratings yet

- Dec 31 Interest Expense 4,000 Interest Payable 4,000Document2 pagesDec 31 Interest Expense 4,000 Interest Payable 4,000Glecy AdrianoNo ratings yet

- 5 Adjusting Entries For Prepaid ExpenseDocument4 pages5 Adjusting Entries For Prepaid Expenseapi-299265916No ratings yet

- Chapter 4Document38 pagesChapter 4Haidee Sumampil67% (3)

- Adjustments journal entriesDocument7 pagesAdjustments journal entriesZaheer Ahmed SwatiNo ratings yet

- Manarang Auto Repair Shop Journal by The Month of January 2019Document9 pagesManarang Auto Repair Shop Journal by The Month of January 2019Renz MoralesNo ratings yet

- Order in The Matter of Pancard Clubs LimitedDocument84 pagesOrder in The Matter of Pancard Clubs LimitedShyam SunderNo ratings yet

- Dr. Who Clinic Journal EntriesDocument18 pagesDr. Who Clinic Journal EntriesJasmine P. Manlungat - EMERALDNo ratings yet

- 2016 Jan 1 Cash Computer Equipment Lok, Capital: General Journal Date ParticularsDocument25 pages2016 Jan 1 Cash Computer Equipment Lok, Capital: General Journal Date ParticularsMoon Binn100% (2)

- Rudolf Lee C. Mangaliag 12 Abm Am2: 1) Presented Below Is The Bank Statement of Gold Bank For The Month of MarchDocument4 pagesRudolf Lee C. Mangaliag 12 Abm Am2: 1) Presented Below Is The Bank Statement of Gold Bank For The Month of MarchKhriza Joy Salvador100% (1)

- University of Cebu senior high school department compilation notesDocument8 pagesUniversity of Cebu senior high school department compilation notesAndra FleurNo ratings yet

- Jordan River Laundry Chart of AccountsDocument2 pagesJordan River Laundry Chart of AccountsRey Luna100% (1)

- Working Capital Management of Nepal TelecomDocument135 pagesWorking Capital Management of Nepal TelecomGehendraSubedi70% (10)

- ABM Fundamentals of ABM 1 Module 12 Accounting Cycle of A Merchandising BusinessDocument16 pagesABM Fundamentals of ABM 1 Module 12 Accounting Cycle of A Merchandising BusinessMariel Santos67% (3)

- Journalize the above transactions in the general journal of Bert PhotographyDocument24 pagesJournalize the above transactions in the general journal of Bert PhotographyManuel Panotes Reantazo50% (2)

- Niko Ong Art Gallery WorksheetDocument20 pagesNiko Ong Art Gallery WorksheetIL Mare50% (2)

- Types of Account Titles UsedDocument48 pagesTypes of Account Titles UsedKrung KrungNo ratings yet

- Problem Set 2Document3 pagesProblem Set 2Angelito Eclipse100% (2)

- ACCOUNTING PROBLEMS SOLUTIONSDocument31 pagesACCOUNTING PROBLEMS SOLUTIONSJanna GunioNo ratings yet

- MOA BlankDocument4 pagesMOA Blankclarisa mangwagNo ratings yet

- Ac Smart CTG 1 Activity 2Document6 pagesAc Smart CTG 1 Activity 2Smart GeraldezNo ratings yet

- SRCBAI ABM1 Q3M10 Merchandising Concern Part1Document14 pagesSRCBAI ABM1 Q3M10 Merchandising Concern Part1Jaye RuantoNo ratings yet

- Chapter 08Document26 pagesChapter 08Dan ChuaNo ratings yet

- Fabm1 Preparing Adjusting EntriesDocument19 pagesFabm1 Preparing Adjusting EntriesVenice0% (1)

- Accounting I: Jordan River Laundry Service TransactionsDocument1 pageAccounting I: Jordan River Laundry Service TransactionsMikaela Jean63% (8)

- Lesson 9.4 Adjusting EntriesDocument36 pagesLesson 9.4 Adjusting EntriesDanica Medina50% (2)

- Sicat Financial Planning Consultant General Journal December, 2020Document3 pagesSicat Financial Planning Consultant General Journal December, 2020Madelyn SolesNo ratings yet

- ROCO - SCI Unit TestDocument9 pagesROCO - SCI Unit TestRaymond Roco100% (1)

- Debit AccountancyDocument33 pagesDebit AccountancyJuancho Miguel0% (1)

- Name: - Date: - Grade Level & SectionDocument11 pagesName: - Date: - Grade Level & SectionCynthia Santos100% (1)

- Accounting Fundamentals 1 Learning Activity SheetsDocument95 pagesAccounting Fundamentals 1 Learning Activity SheetsCHRISTINE JOY BONDOC100% (1)

- Module 7Document8 pagesModule 7Charissa Jamis ChingwaNo ratings yet

- Accounting Online Activity No. 02Document4 pagesAccounting Online Activity No. 02nilo bia57% (7)

- Assignment November11 KylaAccountingDocument2 pagesAssignment November11 KylaAccountingADRIANO, Glecy C.No ratings yet

- Matapang Computer Repairs Journal Entries For The Month Ended February 29,2016 Date Account Title & Explanation Debit CreditDocument4 pagesMatapang Computer Repairs Journal Entries For The Month Ended February 29,2016 Date Account Title & Explanation Debit CreditAaroneZulueta50% (4)

- Journalizing and posting laundry business transactionsDocument1 pageJournalizing and posting laundry business transactionsSteve Duty50% (4)

- CAT 1 Module 1 SolutionsDocument21 pagesCAT 1 Module 1 SolutionsKizyll0% (1)

- Tuttie Bee Cargo Services 2012 Transactions and Financial StatementsDocument1 pageTuttie Bee Cargo Services 2012 Transactions and Financial StatementsAngelito Eclipse0% (2)

- Accounting for Niko Ong Art GalleryDocument5 pagesAccounting for Niko Ong Art GalleryMia Casas80% (5)

- FAR Chapter4 FinalDocument43 pagesFAR Chapter4 FinalPATRICIA COLINANo ratings yet

- Fundamentals of Accountancy Business Management 2: Learning PacketDocument33 pagesFundamentals of Accountancy Business Management 2: Learning PacketArjae Dantes50% (2)

- ClassificationDocument2 pagesClassificationKate ParanaNo ratings yet

- B.1 Directions: Prepare Journal Entries For The Following Transactions Using A Periodic Inventory SystemDocument4 pagesB.1 Directions: Prepare Journal Entries For The Following Transactions Using A Periodic Inventory SystemJestine AlcantaraNo ratings yet

- Fundamentals of ABM 1 Accounting CycleDocument47 pagesFundamentals of ABM 1 Accounting CycleHarrold HarryNo ratings yet

- Show That The Accounting Equation Is Satisfied After Taking Into Consideration Each of The Following Transactions in The Books of MRDocument3 pagesShow That The Accounting Equation Is Satisfied After Taking Into Consideration Each of The Following Transactions in The Books of MRLysss Epssss0% (2)

- Customer Relationship Report Demo RevisedDocument16 pagesCustomer Relationship Report Demo RevisedLaila Mae PiloneoNo ratings yet

- Financial Accounting and Reporting: Exercise 1Document6 pagesFinancial Accounting and Reporting: Exercise 1Lenneth MonesNo ratings yet

- Book 1Document6 pagesBook 1ItsRenz YTNo ratings yet

- Law Firm Chart of AccountsDocument2 pagesLaw Firm Chart of AccountsKaye Villaflor17% (6)

- Acc and BMDocument8 pagesAcc and BMShawn Mendez100% (1)

- Topic: Accounting Cycle of A Service BusinessDocument5 pagesTopic: Accounting Cycle of A Service BusinessJohn Rey BusimeNo ratings yet

- (Transaction # 1Document3 pages(Transaction # 1Caryl May Esparrago MiraNo ratings yet

- Drill ABMDocument1 pageDrill ABMGeorge Gonzales78% (23)

- Chapter 3statement of Changes in EquityDocument14 pagesChapter 3statement of Changes in EquityKyla DizonNo ratings yet

- Example of BookkepingDocument8 pagesExample of BookkepingMathew Visarra0% (1)

- Ocean Laundry Shop Journal Entries & Trial BalanceDocument45 pagesOcean Laundry Shop Journal Entries & Trial BalanceRachellyn Limentang100% (1)

- Week 4 5 ULOb Lets Check Activity 1 SolutionDocument3 pagesWeek 4 5 ULOb Lets Check Activity 1 Solutionemem resuentoNo ratings yet

- S. Roces Answer To Journal EntryDocument4 pagesS. Roces Answer To Journal EntryChoco LebbyNo ratings yet

- Xi Accountancy 80 Marks General InstructionsDocument5 pagesXi Accountancy 80 Marks General InstructionsJash ShahNo ratings yet

- 11th Com DepreciationDocument4 pages11th Com DepreciationObaid KhanNo ratings yet

- Class 11 Accounts Half Yearly SPDocument9 pagesClass 11 Accounts Half Yearly SPRakesh AgarwalNo ratings yet

- Aneela Turnitin Originality ReportDocument18 pagesAneela Turnitin Originality ReportZaheer Ahmed SwatiNo ratings yet

- AminaDocument45 pagesAminaZaheer Ahmed SwatiNo ratings yet

- Adil RasheedDocument26 pagesAdil RasheedZaheer Ahmed SwatiNo ratings yet

- Bank Alfalah Report AnalysisDocument25 pagesBank Alfalah Report AnalysisZaheer Ahmed SwatiNo ratings yet

- Ahmer Report FinaldsfdfDocument55 pagesAhmer Report FinaldsfdfZaheer Ahmed SwatiNo ratings yet

- Amina Qadir Turnitin Originality ReportDocument16 pagesAmina Qadir Turnitin Originality ReportZaheer Ahmed SwatiNo ratings yet

- Alam Turnitin Originality ReportcxcDocument16 pagesAlam Turnitin Originality ReportcxcZaheer Ahmed SwatiNo ratings yet

- Adil RasheedDocument26 pagesAdil RasheedZaheer Ahmed SwatiNo ratings yet

- Ahmer Report FinaldsfdfDocument55 pagesAhmer Report FinaldsfdfZaheer Ahmed SwatiNo ratings yet

- 1st Draft DFDFDocument66 pages1st Draft DFDFZaheer Ahmed SwatiNo ratings yet

- Adil Rasheed Turnitin Originality ReportDocument13 pagesAdil Rasheed Turnitin Originality ReportZaheer Ahmed SwatiNo ratings yet

- Ajab Turnitin Originality ReportDocument10 pagesAjab Turnitin Originality ReportZaheer Ahmed SwatiNo ratings yet

- Page LayoutDocument6 pagesPage LayoutZaheer Ahmed SwatiNo ratings yet

- Hazard Assessment and Mitigation Report for Abbottabad DistrictDocument14 pagesHazard Assessment and Mitigation Report for Abbottabad DistrictZaheer Ahmed SwatiNo ratings yet

- Table of Contents For Finance InternshipDocument3 pagesTable of Contents For Finance InternshipZaheer Ahmed SwatiNo ratings yet

- Zaheer Ahmed Swati: Writing Style / SkillDocument3 pagesZaheer Ahmed Swati: Writing Style / SkillZaheer Ahmed SwatiNo ratings yet

- CH 5Document12 pagesCH 5Zaheer Ahmed SwatiNo ratings yet

- Internship Report On MCB Bank: Submitted By: Muhammad Yasir Registration # FA05-BBA-106Document1 pageInternship Report On MCB Bank: Submitted By: Muhammad Yasir Registration # FA05-BBA-106Zaheer Ahmed SwatiNo ratings yet

- CGSDocument11 pagesCGSZaheer Ahmed SwatiNo ratings yet

- Internship Report On MCB Bank 3Document68 pagesInternship Report On MCB Bank 3Zaheer Ahmed SwatiNo ratings yet

- 25Document11 pages25Zaheer Ahmed SwatiNo ratings yet

- Building70,000Creditor40,000Capital94,00017,00022,00070,00040,00094,00017,00022,00070,00040,00094,00017,00022,00070,00015,00094,00017,00022,00070,00015,00094,00017,00022,00070,00015,00094,00017Document11 pagesBuilding70,000Creditor40,000Capital94,00017,00022,00070,00040,00094,00017,00022,00070,00040,00094,00017,00022,00070,00015,00094,00017,00022,00070,00015,00094,00017,00022,00070,00015,00094,00017Zaheer Ahmed SwatiNo ratings yet

- Work Book Unit 9 (Unsolved) : I Have Enough Money To Last Me The Rest of My Life, Unless I Buy SomethingDocument1 pageWork Book Unit 9 (Unsolved) : I Have Enough Money To Last Me The Rest of My Life, Unless I Buy SomethingZaheer Ahmed SwatiNo ratings yet

- Worksheet and Closing Financial StatementsDocument1 pageWorksheet and Closing Financial StatementsZaheer Ahmed SwatiNo ratings yet

- 25Document11 pages25Zaheer Ahmed SwatiNo ratings yet

- Work Book Unit 10 (Unsolved) : Hard Work Never Killed Anybody, But Why Takes A Chance?Document1 pageWork Book Unit 10 (Unsolved) : Hard Work Never Killed Anybody, But Why Takes A Chance?Zaheer Ahmed SwatiNo ratings yet

- Work Book Unit 7 Solved Adjusted Trial BalanceDocument1 pageWork Book Unit 7 Solved Adjusted Trial BalanceZaheer Ahmed SwatiNo ratings yet

- Umw 2015 PDFDocument253 pagesUmw 2015 PDFsuhaimiNo ratings yet

- MoneyDocument2 pagesMoney09-Nguyễn Hữu Phú BìnhNo ratings yet

- Experienced Sales and Marketing Professional Seeking New OpportunitiesDocument2 pagesExperienced Sales and Marketing Professional Seeking New OpportunitiesAshwini KumarNo ratings yet

- Presentation of Expertise Training CourseDocument74 pagesPresentation of Expertise Training CourseOmnia HassanNo ratings yet

- Merchant and Investment BankingDocument22 pagesMerchant and Investment BankingAashiNo ratings yet

- Accounting For Decision MakersDocument33 pagesAccounting For Decision MakersDuminiNo ratings yet

- MGEB05-Assignment-2 (Fall-2019)Document20 pagesMGEB05-Assignment-2 (Fall-2019)Macharia Ngunjiri0% (1)

- Major types of Retail Lending and Consumer Credit AnalysisDocument12 pagesMajor types of Retail Lending and Consumer Credit AnalysisGooby PlsNo ratings yet

- Annual Report 2016 2017 PDFDocument176 pagesAnnual Report 2016 2017 PDFTasnim Tasfia SrishtyNo ratings yet

- PopulationDocument22 pagesPopulationInam Ul HaqNo ratings yet

- Is Services India's Growth EngineDocument42 pagesIs Services India's Growth EngineDivya SreenivasNo ratings yet

- Govt Sr. Sec School Dilod Hathi, Atru Baran: Income Tax Calculation (Ga-55) 2021-22Document8 pagesGovt Sr. Sec School Dilod Hathi, Atru Baran: Income Tax Calculation (Ga-55) 2021-22Nitesh YNo ratings yet

- Urban Economics Problem Set #2 Due Thursday, Oct 15, 11pm, ONLY ONLINE at NYU ClassesDocument4 pagesUrban Economics Problem Set #2 Due Thursday, Oct 15, 11pm, ONLY ONLINE at NYU ClassesBhavik ModyNo ratings yet

- Auditing and The Public Accounting ProfessionDocument12 pagesAuditing and The Public Accounting ProfessionYebegashet AlemayehuNo ratings yet

- Department of Labor: DekalbDocument58 pagesDepartment of Labor: DekalbUSA_DepartmentOfLabor50% (2)

- Role of The Construction Industry in Economic Development of TurkmenistanDocument8 pagesRole of The Construction Industry in Economic Development of TurkmenistanekakNo ratings yet

- Calculate Arb's investment income from Tee CorpDocument7 pagesCalculate Arb's investment income from Tee CorpYOHANNES WIBOWONo ratings yet

- Role of Commercial BanksDocument10 pagesRole of Commercial BanksKAAVIYAPRIYA K (RA1953001011009)No ratings yet

- Impacts of The COVID-19 Pandemic On Food Trade in The CommonwealthDocument32 pagesImpacts of The COVID-19 Pandemic On Food Trade in The CommonwealthTú NguyễnNo ratings yet

- Aerospace Quality Assurance & Certification (ANT402) : Topic: Concept of Zero DefectDocument5 pagesAerospace Quality Assurance & Certification (ANT402) : Topic: Concept of Zero DefectKriti GuptaNo ratings yet

- Green Resorts Promote SustainabilityDocument2 pagesGreen Resorts Promote SustainabilitySheryl ShekinahNo ratings yet

- Principlesofmarketing Chapter2 170810162334Document67 pagesPrinciplesofmarketing Chapter2 170810162334PanpanpanNo ratings yet

- Executive Master in Health AdministrationDocument3 pagesExecutive Master in Health Administrationapi-87967494No ratings yet

- Harmonisation of Accounting StandardsDocument157 pagesHarmonisation of Accounting StandardsMusab AhmedNo ratings yet

- Solution To Worksheet - Modified-2Document25 pagesSolution To Worksheet - Modified-2Mohammed Saber Ibrahim Ramadan ITL World KSANo ratings yet