Professional Documents

Culture Documents

Auditing II Midterm Test

Uploaded by

partnerinChristOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Auditing II Midterm Test

Uploaded by

partnerinChristCopyright:

Available Formats

Rachel N.

Davies (091257)

Accounting 406 Section 1

Auditing II Midterm Test Answers

Direction: Please answer the 30 midterm exam questions below and send email

to testfocus12@gmail.com Note: the test worth 30points; 1pt. each. Underline

the best answer(s) of your choice. Email of midterm is to be send From

Wednesday 4PM to Thursday 4PM. (June 18-19). Email after this period will not

be allowed.

1. Which of the following phrases is found in the definition of internal

control?

a. Objectiveness and consistency in financial re porting.

b. Consistency and effectiveness of operations.

c. Effectiveness and efficiency of operations.

d. Reliability and consistency of financial reporting.

2. Which one of the following is a factor of control environment as a

component of internal control?

a. Changes in the organizations regulatory or operating environment.

b. Human resource policies and practices of management.

c. Information processing in the control environment.

d. Separate evaluations of control environment activities.

3. All of the following are components of internal control except

a. Information and communication

b. Monitoring

c. Reliability of financial reporting

d. Risk assessment

4. One component of internal control is risk assessment. Which one of the

following is least likely to occur regarding risk assessment?

a. Changes in the organizations regulatory or operating environment.

b. Human resource policies and practices of management.

c. Information processing in the control environment.

d. Separate evaluations of control environment activities.

5. From the auditors point of view the following factors might be indicative

of increased financial reporting risk for an organization except:

a. Rapid growth of the organization.

b. Adoption of new accounting principles or changing accounting

principles.

c. Assignment of authority and responsibility.

d. Implementation of a new or modified information system.

6. One of the elements of internal control is Control activities. Which of the

following is a factor of control activities?

a. Changes in the organizations regulatory or operating environment.

b. Human resource policies and practices of management.

c. Information processing in the control environment.

d. Separate evaluations of control environment activities.

7. A sufficient understanding of internal control is to be obtained to plan the

audit and to determine the nature, timing, and extent of the tests to be

performed. This standard is:

a. Standard of reporting.

b. Standard of fieldwork.

c. General standards

d. Professional standard.

8. Monitoring is one element of internal control. Which one of the following is

least likely to occur for monitoring:

a. Maintaining the custody over assets.

b. Reviewing organization ethic, integrity and responsibility

c. Reviewing management reports and consideration of policies

d. Reviewing the reasonableness of management reports

9. In every engagement the auditors must obtain an understanding of internal

control sufficient to plan the audit. This understanding should include

knowledge about the design of relevant controls and whether they have

been placed in operation by the entity. In planning the audit, that

knowledge is used to:

a. Segregate duties within the organization

b. Identify types of potential misstatements.

c. Review the reasonableness of transactions.

d. Maintain the custody over the organization operations.

10. An organizations accounting information system consists of the methods

and records established to record, process, summarize, and report an

entitys transactions and to maintain accountability for the related assets,

liabilities, and equity. Accordingly, an accounting information system

should:

a. Identify types of potential misstatements

b. Consider factors that affect the risk of material misstatement

c. Identify and record all valid transactions

d. Design substantive tests.

11. In obtaining an understanding of the clients accounting information

system and the related control activities, auditors generally find it useful to

divide the control system into its major:

a. Transaction cycle.

b. Accounting cycle

c. Processing cycle

d. Control cycle

12. While obtaining an understanding of internal control, the auditors may

also obtain evidence about the operating effectiveness of various controls.

Operating effectiveness of the control deals with which of the following?

a. How a control is designed.

b. Segregate duties within the organization

c. How a control is applied.

d. Identify types of potential misstatements.

13. The traditional method of describing internal control is to fill in

standardized:

a. Internal control form.

b. Internal control walk-through form.

c. Internal control flow chart.

d. Internal control questionnaire.

14. The audit procedures used to test the effectiveness of internal control

include all of the following except:

a. Inquires of appropriate client personnel.

b. Performance of the controls.

c. Application of control activities.

d. Observation of the application of controls.

15. An audit test that address the accuracy of financial statement amounts is:

a. Substantive test.

b. Trial test

c. Test of controls.

d. Substantial test.

16. If the independent auditors conclude that the internal auditors work is

relevant and that it would be efficient to consider it, they assess the----------

------------------and--------------------------of the internal audit staff, and

evaluate the quality of the work.

a. Competence and consistency.

b. Objectivity and techniques

c. Competence and objectivity.

d. Techniques and competence.

17. Which one of following would be least likely to be considered an objective

of internal control?

a. Checking the accuracy and reliability of accounting data.

b. Encouraging the adherence to managerial policies.

c. Detecting management fraud.

d. Safeguarding assets.

18. When a CPA decides that the work performed by internal auditors may

have an effect on the nature, timing, and extent of the CPAs procedures,

the CPA should:

a. Consider the organization level to which the internal auditors report

the results of their work.

b. Review the internal auditors work.

c. Consider the qualifications of the internal audit staff.

d. Review the training program of the internal audit staff.

19. Effective internal control in a small company that has an insufficient

number of employees to permit proper separation of responsibilities can be

improved by:

a. Employment of temporary personnel to aid in the separation of duties.

b. Direct participation by the owner in key recordkeeping and control

activities.

c. Delegation to each employee of full, clear-cut responsibility for a separate

major transaction cycle.

d. Engaging a CPA to perform monthly write-up work.

20. Of the following statements about internal control, which one is not valid?

a. No one person should be responsible for the custody and the recording

of an asset.

b. Transactions must be properly authorized before such transactions are

processed.

c. Because of the cost-benefit relationship, a client may apply controls on

a test basis.

d. Controls reasonably ensure that collusion among employees cannot

occur.

21. Proper segregation of functional responsibilities calls for separation of the:

a. Authorization, recordkeeping, and custodial functions.

b. Receiving, Shipping, and custodial function.

c. Authorization, execution, and payment functions.

d. Authorization, approval, and execution functions.

22. Computer programs designed to perform a specific data processing task,

such as payroll processing, statement of accounts processing and voucher

processing is termed as:

a. Operating system

b. System software

c. Application software

d. Batch process software

23. Computer systems differ as to their characteristics. A computer system,

regardless of its size, may possess one or more of the following elements

except:

a. Window processing.

b. Batch processing.

c. End users computing.

d. Computer networks

24. In a computer system a master file for example of accounts receivable is an

application data file, maintained by the accounts receivable unit that

contains customer account activity for a period of time and Information

about each customer is found within:

a. Batch processing.

b. Application software.

c. Database storage.

d. Online capabilities.

25. In a computer environment one method used by internal and external

auditors to test and monitor controls in data processing applications is

termed as:

a. integrated test facility

b. integrated test control

c. integrated test technique

d. integrated test application

26. When the clients computer system is relatively simple and produces hard-

copy documents, records, the auditors may decide that it is efficient to

access control risk at, or near, the maximum and bypass the computer.

Using this approach, the auditors will test transactions and balances

manually. This technique is termed as:

a. Auditing around the computer.

b. Auditing near the computer.

c. Auditing at the computer.

d. Auditing along the computer.

27. One application of computer audit software is to verify the reliability of the

clients computer programs through a process termed as:

a. Sequence simulation.

b. Parallel simulation.

c. Selective simulation.

d. Audit simulation.

28. For substantive tests audit software may be used to rearrange the data in a

format more useful to the auditors, compare the data to other files, make

computations, and select random samples. The application of this nature

include all of the following except:

a. Comparing data on separate files.

b. Selecting audit samples.

c. Rearranging data and performing analyses.

d. Self-checking separate files.

29. The auditors have sampled 50 accounts from a population of 1,000 account

receivable. The sample items have a mean book value of $200 and a mean

audited value of $203. The book value in the population is $198,000. What

is the estimated audited value of the population using the mean-per-unit

method?

a. $198,000.

b. $200,000.

c. $203,000.

d. $201,000.

30. Using the same facts as in question 36, what is the estimated audited value

of the population using the difference method?

a. $198,000.

b. $200,000.

c. $203,000.

d. $201,000.

You might also like

- Module 2 - Audit of Transaction CyclesDocument10 pagesModule 2 - Audit of Transaction CyclesJesievelle Villafuerte NapaoNo ratings yet

- Philippine School of Business Administration: Auditing (Theoretical Concepts)Document5 pagesPhilippine School of Business Administration: Auditing (Theoretical Concepts)John Ellard M. SaturnoNo ratings yet

- Aud Theo Reviewer - Audit PlanningDocument7 pagesAud Theo Reviewer - Audit PlanningNicole AutrizNo ratings yet

- PFRS 3 - Business Combination PDFDocument2 pagesPFRS 3 - Business Combination PDFMaria LopezNo ratings yet

- Errors and Irregularities in The Transaction CycleDocument22 pagesErrors and Irregularities in The Transaction CycleVatchdemonNo ratings yet

- JEE (Advanced) 2015 - A Detailed Analysis by Resonance Expert Team - Reso BlogDocument9 pagesJEE (Advanced) 2015 - A Detailed Analysis by Resonance Expert Team - Reso BlogGaurav YadavNo ratings yet

- Nursing: Student Name Affiliation Course Instructor Due DateDocument8 pagesNursing: Student Name Affiliation Course Instructor Due DateHAMMADHRNo ratings yet

- Detail Requirements Spreadsheet SampleDocument53 pagesDetail Requirements Spreadsheet SampleChinh Lê ĐìnhNo ratings yet

- Auditing CIS Environment Chap 1Document2 pagesAuditing CIS Environment Chap 1Michelle AnnNo ratings yet

- QuizDocument13 pagesQuizPearl Morni AlbanoNo ratings yet

- DLL W11 MilDocument4 pagesDLL W11 MilRICKELY BANTANo ratings yet

- Instructions:: University of San Jose-Recoletos Online Class For The School Year 2020-2021 2 Semester ACTIVITY 03 (A03)Document7 pagesInstructions:: University of San Jose-Recoletos Online Class For The School Year 2020-2021 2 Semester ACTIVITY 03 (A03)Leila OuanoNo ratings yet

- Midterms Quiz 1 GdocsDocument41 pagesMidterms Quiz 1 GdocsIris FenelleNo ratings yet

- Audit Planning Chapter 5Document6 pagesAudit Planning Chapter 5威陈No ratings yet

- Course Description:: Using Open-Ended Tools in Facilitating Language LearningDocument7 pagesCourse Description:: Using Open-Ended Tools in Facilitating Language LearningLemuel Aying50% (2)

- Completion of Audit Quiz ANSWERDocument9 pagesCompletion of Audit Quiz ANSWERJenn DajaoNo ratings yet

- Final Exam-Auditing Theory 2015Document16 pagesFinal Exam-Auditing Theory 2015Red YuNo ratings yet

- Auditing fraud risk factors and responsibilitiesDocument2 pagesAuditing fraud risk factors and responsibilitiesnhbNo ratings yet

- Chapter 10: Auditing Cash and Marketable SecuritiesDocument24 pagesChapter 10: Auditing Cash and Marketable SecuritiesMerliza JusayanNo ratings yet

- Test Bank Management 8th Edition BatemanDocument40 pagesTest Bank Management 8th Edition BatemanIris DescentNo ratings yet

- Acctg 16a - Final ExamDocument4 pagesAcctg 16a - Final ExamMary Grace Castillo AlmonedaNo ratings yet

- CMPC312 QuizDocument19 pagesCMPC312 QuizNicole ViernesNo ratings yet

- Accounting Research EssayDocument4 pagesAccounting Research EssayInsatiable LifeNo ratings yet

- Closing Entries - Branchbooks: (Branch Books) Home OfficeDocument2 pagesClosing Entries - Branchbooks: (Branch Books) Home OfficeUnknown 01No ratings yet

- Audit Process and Financial Statement AuditingDocument8 pagesAudit Process and Financial Statement AuditingAlexis Erica Bansuan OvaloNo ratings yet

- Psa 401Document5 pagesPsa 401novyNo ratings yet

- Notes On Responsibility AccountingDocument6 pagesNotes On Responsibility AccountingFlorie-May GarciaNo ratings yet

- Lesson 6 Philippine Standards On Quality Control PDFDocument17 pagesLesson 6 Philippine Standards On Quality Control PDFazmyla fullonNo ratings yet

- Chapter 04 AnsDocument4 pagesChapter 04 AnsDave Manalo100% (1)

- Transaction CyclesDocument2 pagesTransaction CyclesAdan NadaNo ratings yet

- BSA 3202 Topic 2 - Joint ArrangementsDocument14 pagesBSA 3202 Topic 2 - Joint ArrangementsjenieNo ratings yet

- CH 09Document10 pagesCH 09Ali Abed0No ratings yet

- Interactive Model of An EconomyDocument142 pagesInteractive Model of An Economyrajraj999No ratings yet

- Form of A List of Risks Exercise People With An Extensive Knowledge of The Program or Process That Will Be Analyzed To Use A Prepared ListDocument4 pagesForm of A List of Risks Exercise People With An Extensive Knowledge of The Program or Process That Will Be Analyzed To Use A Prepared ListKeanne ArmstrongNo ratings yet

- editedQUIZ CHAPTER-6 FINANCIAL-ASSETSDocument3 pageseditedQUIZ CHAPTER-6 FINANCIAL-ASSETSanna mariaNo ratings yet

- Chapter 2 The Risk of FraudDocument49 pagesChapter 2 The Risk of FraudcessbrightNo ratings yet

- A5 PPE Lapsing ScheduleDocument21 pagesA5 PPE Lapsing ScheduleMa. BeatriceNo ratings yet

- CHAPTER 6 Auditing-Theory-MCQs-by-Salosagcol-with-answersDocument2 pagesCHAPTER 6 Auditing-Theory-MCQs-by-Salosagcol-with-answersMichNo ratings yet

- Mikong Due MARCH 30 Hospital and HmosDocument6 pagesMikong Due MARCH 30 Hospital and HmosCoke Aidenry SaludoNo ratings yet

- Cpale RRL Approved 4Document33 pagesCpale RRL Approved 4Naruto UzumakiNo ratings yet

- Auditing 1 Final Chapter 10Document7 pagesAuditing 1 Final Chapter 10PaupauNo ratings yet

- Risk-Based Internal Auditing and Identifying Operational RisksDocument5 pagesRisk-Based Internal Auditing and Identifying Operational RisksMaricar PinedaNo ratings yet

- AGS CUP 6 Auditing Final RoundDocument19 pagesAGS CUP 6 Auditing Final RoundKenneth RobledoNo ratings yet

- AE8 - Group1 - Chapter 1 With COMMENTSDocument11 pagesAE8 - Group1 - Chapter 1 With COMMENTSadarose romaresNo ratings yet

- Keme Chap 4Document5 pagesKeme Chap 4Melissa Kayla Maniulit100% (1)

- m6 Practice Set Attempt 1Document15 pagesm6 Practice Set Attempt 1RAY NICOLE MALINGINo ratings yet

- Accounting Gov ReviewerDocument20 pagesAccounting Gov ReviewerShane TorrieNo ratings yet

- Quiz 3 - Business Combination and Consolidated Financial StatementsDocument3 pagesQuiz 3 - Business Combination and Consolidated Financial StatementsMaria LopezNo ratings yet

- Bustamante, Jilian Kate A. (Activity 3)Document4 pagesBustamante, Jilian Kate A. (Activity 3)Jilian Kate Alpapara BustamanteNo ratings yet

- Why Is Planning An Audit Important?Document5 pagesWhy Is Planning An Audit Important?panda 1No ratings yet

- Handout 1 - Nonprofit Organizations - RevisedDocument10 pagesHandout 1 - Nonprofit Organizations - RevisedPaupauNo ratings yet

- Final 2 2Document3 pagesFinal 2 2RonieOlarteNo ratings yet

- Psa 600Document9 pagesPsa 600Bhebi Dela CruzNo ratings yet

- Cebu CPAR Mandaue City FINAL PREBOARD EXAMINATION AUDITING PROBLEMSDocument9 pagesCebu CPAR Mandaue City FINAL PREBOARD EXAMINATION AUDITING PROBLEMSLoren Lordwell MoyaniNo ratings yet

- Adjusting journal entries for prepaid expensesDocument5 pagesAdjusting journal entries for prepaid expensesEizzel SamsonNo ratings yet

- Chapter 5-Statement of Cash Flows and Articulation: Multiple ChoiceDocument39 pagesChapter 5-Statement of Cash Flows and Articulation: Multiple ChoiceLeonardoNo ratings yet

- Successor Auditor ResponsibilitiesDocument5 pagesSuccessor Auditor ResponsibilitiesVergel MartinezNo ratings yet

- Chapter I Iii Revision 115Document49 pagesChapter I Iii Revision 115Jamie Rose AragonesNo ratings yet

- CH 6 Audit of Conversion CycleDocument24 pagesCH 6 Audit of Conversion CyclerogealynNo ratings yet

- Auditing and Assurance Services ReviewDocument22 pagesAuditing and Assurance Services ReviewLouie de la TorreNo ratings yet

- Installment SalesDocument6 pagesInstallment SalesMarivic C. VelascoNo ratings yet

- Saint Paul School of Business and Law Accounting 17ND Final ExamDocument14 pagesSaint Paul School of Business and Law Accounting 17ND Final ExamKristinelle AragoNo ratings yet

- Quiz On Entity's Environment and Internal ControlDocument5 pagesQuiz On Entity's Environment and Internal ControlTrisha Mae AlburoNo ratings yet

- Quizzer 6Document6 pagesQuizzer 6CriscelNo ratings yet

- 5890 Take Home Test 2Document10 pages5890 Take Home Test 2biwithse7enNo ratings yet

- Morning Sleepiness Among College Students: Surprising Reasons For Class-Time PreferenceDocument4 pagesMorning Sleepiness Among College Students: Surprising Reasons For Class-Time PreferenceElijah NyakundiNo ratings yet

- English Teaching Methods ExamDocument1 pageEnglish Teaching Methods ExamNicoleta Maria MoisinNo ratings yet

- Avoid the 10 biggest mistakes in process modelingDocument9 pagesAvoid the 10 biggest mistakes in process modelingOrlando Marino Taboada OvejeroNo ratings yet

- TESOL Methodology MOOC Syllabus: Course Dates: January 27 - March 2, 2020Document7 pagesTESOL Methodology MOOC Syllabus: Course Dates: January 27 - March 2, 2020Younus AzizNo ratings yet

- BUS 102 Fundamentals of Buiness II 2022Document4 pagesBUS 102 Fundamentals of Buiness II 2022Hafsa YusifNo ratings yet

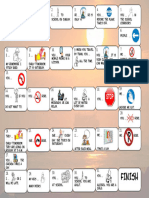

- Modal verbs board gameDocument1 pageModal verbs board gameEmmaBordetNo ratings yet

- Evidence-Based Guideline Summary: Evaluation, Diagnosis, and Management of Facioscapulohumeral Muscular DystrophyDocument10 pagesEvidence-Based Guideline Summary: Evaluation, Diagnosis, and Management of Facioscapulohumeral Muscular DystrophyFitria ChandraNo ratings yet

- Detailed Lesson Plan I. Objectives A. Content StandardDocument5 pagesDetailed Lesson Plan I. Objectives A. Content StandardGephelyn GordonNo ratings yet

- Outlining Academic Texts and Reading StrategiesDocument17 pagesOutlining Academic Texts and Reading Strategiesjohanna patayecNo ratings yet

- FS 1 Module NewDocument64 pagesFS 1 Module Newtkm.panizaNo ratings yet

- CourseWork ID GreenwichDocument2 pagesCourseWork ID GreenwichQuinny TrầnNo ratings yet

- CRC Certification Guide201107Document39 pagesCRC Certification Guide201107Natalie CNo ratings yet

- PRE SCHOOL BTHO FEE 2022 - LatestDocument1 pagePRE SCHOOL BTHO FEE 2022 - LatestWira Hazwan RosliNo ratings yet

- HG Las Q1 W3 Hawking RamosDocument4 pagesHG Las Q1 W3 Hawking RamosSecond SubscriberNo ratings yet

- Pitagan discusses media, eLearning, 21st century learningDocument34 pagesPitagan discusses media, eLearning, 21st century learningReymond CuisonNo ratings yet

- Exam Success in Economics IGCSEDocument212 pagesExam Success in Economics IGCSEayomiposi 2712No ratings yet

- Bayambang Millenilas Challenge 2021 Narrative ReportDocument7 pagesBayambang Millenilas Challenge 2021 Narrative ReportMichael Louie IglesiasNo ratings yet

- AUTONOMOUS B.Tech EEE R20 Course StructureDocument8 pagesAUTONOMOUS B.Tech EEE R20 Course StructureNanda Kumar EnjetiNo ratings yet

- Workbook Unit 4Document1 pageWorkbook Unit 4BridgethNo ratings yet

- KSU Philosophy of Education Course SyllabusDocument12 pagesKSU Philosophy of Education Course SyllabusmelchieNo ratings yet

- HBET1303Document216 pagesHBET1303Tce ShikinNo ratings yet

- How School Funding WorksDocument20 pagesHow School Funding WorksCarolyn UptonNo ratings yet

- AssignmentDocument3 pagesAssignmentNeha Singhal50% (2)

- Math 120 Past Exam QuestionsDocument199 pagesMath 120 Past Exam Questions19cerena03No ratings yet