Professional Documents

Culture Documents

P&L Account

Uploaded by

Rajneesh SehgalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

P&L Account

Uploaded by

Rajneesh SehgalCopyright:

Available Formats

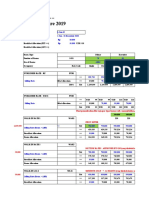

CHANDRA PROTECO LIMITED

Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

[400100] Disclosure of general information about company

Unless otherwise specified, all monetary values are in INR

01/04/2011

to

31/03/2012

01/04/2010

to

31/03/2011

Name of company CHANDRA PROTECO LIMITED

Corporate identity number U27109WB2004PLC100708

Permanent account number of entity AACCC5301K

Address of registered office of company

2B GRANT LANE R NO 35

2NDFLOOR KOLKATA West

Bengal INDIA 700012

Type of industry

Co mme r c i a l a n d

Industrial

Date of board meeting when final accounts were approved 16/04/2012

Period covered by financial statements 01-04-2011 To 31-03-2012 01-04-2010 To 31-03-2011

Date of start of reporting period 01/04/2011 01/04/2010

Date of end of reporting period 31/03/2012 31/03/2011

Nature of report standalone consolidated Standalone

Content of report Statement of Profit & Loss

Description of presentation currency INR

Level of rounding used in financial statements Actual

Date from which register of members remained closed 27/09/2012

Date till which register of members remained closed 29/09/2012

Total number of product or service category 1

Description of principal product or services category copper conductors

Disclosure of principal product or services [Table] ..(1)

Unless otherwise specified, all monetary values are in INR

Types of principal product or services [Axis] Column 1

01/04/2011

to

31/03/2012

Disclosure of general information about company [Abstract]

Disclosure of principal product or services [Abstract]

Disclosure of principal product or services [LineItems]

Product or service category (ITC 4 digit) code 7403

Description of product or service category Copper

Turnover of product or service category 460,77,38,368.15

Highest turnover contributing product or service (ITC 8 digit) code 74031100

Description of product or service copper conductors

Unit of measurement of highest contributing product or service MT

Turnover of highest contributing product or service 460,77,38,368.15

Quantity of highest contributing product or service in UoM [pure] 10,525.471

2

CHANDRA PROTECO LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

[100200] Statement of profit and loss

Unless otherwise specified, all monetary values are in INR

01/04/2011

to

31/03/2012

01/04/2010

to

31/03/2011

Statement of profit and loss [Abstract]

Disclosure of revenue from operations [Abstract]

Disclosure of revenue from operations for other than finance company

[Abstract]

Revenue from sale of products 623,99,28,798.59 406,03,01,413

Revenue from sale of services 0 0

Excise duty 46,47,82,531 29,86,54,931

Total revenue from operations other than finance company 577,51,46,267.59 376,16,46,482

Total revenue from operations 577,51,46,267.59 376,16,46,482

Other income 2,46,24,408.39 65,99,122.2

Total revenue 579,97,70,675.98 376,82,45,604.2

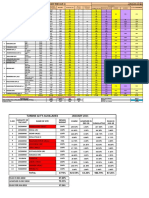

Expenses [Abstract]

Cost of materials consumed 460,77,38,368.15 306,31,30,358.41

Changes in inventories of finished goods, work-in-progress and

stock-in-trade

13,89,02,981.82 -7,66,05,215.95

Employee benefit expense 5,62,46,012 3,60,61,781

Finance costs 40,67,29,534.39 24,89,32,242

Depreciation, depletion and amortisation expense [Abstract]

Depreciation expense 7,88,12,701.37 4,04,14,453.66

Total depreciation, depletion and amortisation expense 7,88,12,701.37 4,04,14,453.66

Other expenses 21,12,35,905.18 20,24,14,712.63

Total expenses 549,96,65,502.91 351,43,48,331.75

Total profit before prior period items, exceptional items, extraordinary

items and tax

30,01,05,173.07 25,38,97,272.45

Total profit before extraordinary items and tax 30,01,05,173.07 25,38,97,272.45

Total profit before tax 30,01,05,173.07 25,38,97,272.45

Tax expense [Abstract]

Current tax 6,65,87,708 5,95,18,630

Total tax expense 6,65,87,708 5,95,18,630

Total profit (loss) for period from continuing operations 23,35,17,465.07 19,43,78,642.45

Total profit (loss) for period before minority interest 23,35,17,465.07 19,43,78,642.45

Total profit (loss) for period 23,35,17,465.07 19,43,78,642.45

Earnings per equity share [Abstract]

Basic earning per equity share [INR/shares] 15.52 [INR/shares] 12.92

Diluted earnings per equity share [INR/shares] 0 [INR/shares] 0

Basic earning per equity share before extraordinary items [INR/shares] 15.52 [INR/shares] 12.92

Nominal value of per equity share [INR/shares] 10 [INR/shares] 10

3

CHANDRA PROTECO LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

[300500] Notes - Subclassification and notes on income and expenses

Unless otherwise specified, all monetary values are in INR

01/04/2011

to

31/03/2012

01/04/2010

to

31/03/2011

Subclassification and notes on income and expense explanatory [TextBlock]

Disclosure of revenue from sale of products [Abstract]

Revenue from sale of products [Abstract]

Revenue from sale of products, gross 623,99,28,798.59 406,03,01,413

Total revenue from sale of products 623,99,28,798.59 406,03,01,413

Disclosure of revenue from sale of services [Abstract]

Revenue from sale of services [Abstract]

Other allowances deductions on revenue from sale of services 0 0

Total revenue from sale of services 0 0

Disclosure of other income [Abstract]

Interest income [Abstract]

Interest income on current investments [Abstract]

Interest on other current investments 0 0

Total interest income on current investments 0 0

Interest income on long-term investments [Abstract]

Interest on other long-term investments 0 0

Total interest income on long-term investments 0 0

Total interest income 0 0

Dividend income [Abstract]

Dividend income current investments [Abstract]

Dividend income current investments from others 0 0

Total dividend income current investments 0 0

Dividend income long-term investments [Abstract]

Dividend income long-term investments from others 0 0

Total dividend income long-term investments 0 0

Total dividend income 0 0

Other non-operating income [Abstract]

Miscellaneous other non-operating income 2,46,24,408.39 65,99,122.2

Total other non-operating income 2,46,24,408.39 65,99,122.2

Total other income 2,46,24,408.39 65,99,122.2

Disclosure of finance cost [Abstract]

Interest expense [Abstract]

Interest expense long-term loans [Abstract]

Interest expense long-term loans, banks 40,67,29,534.39 24,89,32,242

Total interest expense long-term loans 40,67,29,534.39 24,89,32,242

Total interest expense 40,67,29,534.39 24,89,32,242

Total finance costs 40,67,29,534.39 24,89,32,242

Employee benefit expense [Abstract]

Salaries and wages 5,19,44,229 3,34,15,707

Contribution to provident and other funds [Abstract]

Contribution to provident and other funds for others 10,10,251 5,92,337

Total contribution to provident and other funds 10,10,251 5,92,337

Staff welfare expense 13,11,893 10,93,479

Other employee related expenses 19,79,639 9,60,258

Total employee benefit expense 5,62,46,012 3,60,61,781

Breakup of other expenses [Abstract]

Consumption of stores and spare parts 1,54,28,934 1,50,49,656

Power and fuel 6,00,92,389.86 4,09,56,177.44

Rent 54,89,427 18,93,438

Repairs to building 78,78,270 56,80,272

Repairs to machinery 1,19,95,093 1,60,33,914

Insurance 30,40,291.2 38,14,171.5

Rates and taxes excluding taxes on income [Abstract]

Provision wealth tax 0 0

Total rates and taxes excluding taxes on income 0 0

4

CHANDRA PROTECO LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Research development expenditure 2,75,885 2,02,043

Subscriptions membership fees 52,615 98,605

Electricity expenses 35,56,506 19,48,173

Telephone postage 25,43,386.59 25,64,290.83

Printing stationery 7,61,490 7,10,424

Information technology expenses 1,59,819 3,14,383

Travelling conveyance 1,61,04,320.47 87,92,129.68

Catering canteen expenses 10,70,006 6,44,754

Entertainment expenses 4,22,823 1,51,368

Legal professional charges 14,71,532 44,89,268.24

Vehicle running expenses 3,08,905 5,30,505

Safety security expenses 19,16,482 13,88,622

Directors sitting fees 0 0

Managerial remuneration [Abstract]

Remuneration to directors [Abstract]

Salary to directors 1,19,00,000 84,00,000

Total remuneration to directors 1,19,00,000 84,00,000

Total managerial remuneration 1,19,00,000 84,00,000

Donations subscriptions 66,000 1,05,854

Books periodicals 9,450 13,374

Seminars conference expenses 24,16,355 17,50,738

Guest house expenses 9,90,425 10,19,752.93

Advertising promotional expenses 88,205 65,000

Secondary packing expenses 1,75,53,565 3,49,44,419.75

Cost repairs maintenance other assets 9,60,560 3,50,505

Cost information technology [Abstract]

Cost communication connectivity 0 0

Total cost information technology 0 0

Cost insurance 0 0

Cost transportation [Abstract]

Cost freight 2,81,41,914 2,15,88,353

Cost other transporting 46,55,055 1,54,82,481

Total cost transportation 3,27,96,969 3,70,70,834

Cost technical services 43,98,754 19,16,289

Provision bad doubtful debts created 0 0

Provision bad doubtful loans advances created 0 0

Write-off assets liabilities [Abstract]

Miscellaneous expenditure written off [Abstract]

Other miscellaneous expenditure written off 3,99,929 3,99,929

Total miscellaneous expenditure written off 3,99,929 3,99,929

Bad debts written off 0 0

Bad debts advances written off 0 0

Other assets written off 0 0

Liabilities written off 0 0

Total write-off assets liabilities 3,99,929 3,99,929

Loss on disposal of intangible asset 0 0

Loss on disposal, discard, demolishment and destruction of depreciable

tangible asset

0 0

Payments to auditor [Abstract]

Payment for audit services 2,00,000 1,00,000

Total payments to auditor 2,00,000 1,00,000

Miscellaneous expenses 68,87,518.06 1,10,15,822.26

Total other expenses 21,12,35,905.18 20,24,14,712.63

Current tax [Abstract]

Current tax pertaining to current year 6,65,87,708 5,95,18,630

Total current tax 6,65,87,708 5,95,18,630

5

CHANDRA PROTECO LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

[300600] Notes - Additional information statement of profit and loss

Unless otherwise specified, all monetary values are in INR

01/04/2011

to

31/03/2012

01/04/2010

to

31/03/2011

Additional information on profit and loss account explanatory [TextBlock]

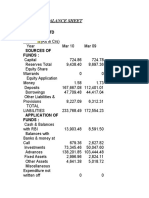

Changes in inventories of finished goods 98,82,233.82 -2,94,02,268.97

Changes in inventories of work-in-progress 12,90,20,748 -4,72,02,946.98

Total changes in inventories of finished goods, work-in-progress and

stock-in-trade

13,89,02,981.82 -7,66,05,215.95

Value of imports of raw materials 23,07,61,511.56 1,36,73,636

Value of imports of components and spare parts 33,57,570 54,66,345.24

Value of imports of capital goods 1,98,33,262.88 68,54,58,703.96

Total value of imports calculated on CIF basis 25,39,52,344.44 70,45,98,685.2

Expenditure on other matters 25,39,52,344.44 70,45,98,203.2

Total expenditure in foreign currency 25,39,52,344.44 70,45,98,203.2

Final dividend remitted in foreign currency 11,61,805 0

Total amount of dividend remitted in foreign currency 11,61,805 0

Total number of non-resident shareholders [pure] 1 [pure] 1

Total number of shares held by non-resident shareholders on which

dividends were due

[shares] 14,22,830 [shares] 9,00,780

Year to which dividends relate 2009-10,2010-11 NA

FOB value of manufactured goods exported 133,70,26,203.14 99,63,87,155.44

Total earnings on export of goods calculated on FOB basis 133,70,26,203.14 99,63,87,155.44

Total earnings in foreign currency 133,70,26,203.14 99,63,87,155.44

Domestic sale manufactured goods 490,29,02,595.45 306,39,14,257.56

Total domestic turnover goods, gross 490,29,02,595.45 306,39,14,257.56

Export sale manufactured goods 133,70,26,203.14 99,63,87,155.44

Total export turnover goods, gross 133,70,26,203.14 99,63,87,155.44

Total revenue from sale of products 623,99,28,798.59 406,03,01,413

Total revenue from sale of services 0 0

[200800] Notes - Disclosure of accounting policies, changes in accounting policies and estimates

Unless otherwise specified, all monetary values are in INR

01/04/2011

to

31/03/2012

Disclosure of accounting policies, change in accounting policies and

changes in estimates explanatory [TextBlock]

Textual information (1)

[See below]

Disclosure of accounting policies explanatory [TextBlock]

Textual information (2)

[See below]

Changes in accounting estimate and accounting policy explanatory

[TextBlock]

NO CHANGE

6

CHANDRA PROTECO LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Textual information (1)

Disclosure of accounting policies, change in accounting policies and changes in estimates explanatory [Text Block]

Schedule ?19? of Significant Accounting Policies and Notes to the Accounts for the year ended March 31, 2012

I. Schedules ?1? to ?19? form an integral part of the Balance Sheet and the Profit and Loss Account.

II. Significant Accounting Policies:

Accounting Policies not specifically stated otherwise are consistent and in consonance with generally accepted accounting principles.

Basis of Accounting

The financial statements are prepared under historical cost convention and as a going concern and on accrual basis of accounting, in accordance

with the generally accepted accounting principles, accounting standards issued by the Institute of Chartered Accountants of India, as applicable,

and the relevant provisions of the Companies Act, 1956.

Fixed Assets

Fixed Assets are recorded at the original cost of acquisition including taxes, duties and other incidental expenses related to acquisition,

installation/erection/ commissioning of the concerned asset and Preoperative Expenses. In case of revaluation of land (fixed assets), the cost as

determined by the valuer is considered in the accounts and differential transferred to Revaluation reserve.

Inventories

Raw materials, consumables, Work in progress, Packing Materials and Finished Goods are valued at lower of cost or net realizable value on the

First in First out basis of stock valuation. Cost of raw material excludes excise duty available for Cenvat Credit; and for the purpose of Finished

Goods include all expenses.

7

CHANDRA PROTECO LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Revenue Recognition

Sales include excise duty and are net of rebates and sales tax. Sales in the domestic market as well as export are recognized at the time of dispatch

of materials to the buyers. Interest and Other Income is accounted for on accrual basis.

.

Cont__2

:2:

Depreciation

Depreciation on Fixed Assets has been provided on Straight Line Method (SLM) at the rates and in the manner provided in Schedule XIV of the

Companies Act, 1956.

Contingent Liabilities

Contingent Liabilities are determined on the basis of available information and are disclosed by way of a note to the accounts.

8

CHANDRA PROTECO LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Borrowing cost

Borrowing costs are recognized as expense in the period in which these are incurred.

Foreign Exchange Transactions

Transactions in foreign currencies are recorded at the exchange rates prevailing at the date of the transactions.

Taxation

Provision for Current Tax is made based on the liability computed in accordance with relevant tax rates and tax laws.

Deferred Tax is recognized, subject to the consideration of prudence, on timing differences, being the difference between taxable incomes and

accounting income that originate in one period and are capable of reversal in one or more subsequent period.

9

CHANDRA PROTECO LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Textual information (2)

Disclosure of accounting policies explanatory [Text Block]

Schedule ?19? of Significant Accounting Policies and Notes to the Accounts for the year ended March 31, 2012

I. Schedules ?1? to ?19? form an integral part of the Balance Sheet and the Profit and Loss Account.

II. Significant Accounting Policies:

Accounting Policies not specifically stated otherwise are consistent and in consonance with generally accepted accounting principles.

Basis of Accounting

The financial statements are prepared under historical cost convention and as a going concern and on accrual basis of accounting, in accordance

with the generally accepted accounting principles, accounting standards issued by the Institute of Chartered Accountants of India, as applicable,

and the relevant provisions of the Companies Act, 1956.

Fixed Assets

Fixed Assets are recorded at the original cost of acquisition including taxes, duties and other incidental expenses related to acquisition,

installation/erection/ commissioning of the concerned asset and Preoperative Expenses. In case of revaluation of land (fixed assets), the cost as

determined by the valuer is considered in the accounts and differential transferred to Revaluation reserve.

Inventories

Raw materials, consumables, Work in progress, Packing Materials and Finished Goods are valued at lower of cost or net realizable value on the

First in First out basis of stock valuation. Cost of raw material excludes excise duty available for Cenvat Credit; and for the purpose of Finished

Goods include all expenses.

10

CHANDRA PROTECO LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Revenue Recognition

Sales include excise duty and are net of rebates and sales tax. Sales in the domestic market as well as export are recognized at the time of dispatch

of materials to the buyers. Interest and Other Income is accounted for on accrual basis.

.

Cont__2

:2:

Depreciation

Depreciation on Fixed Assets has been provided on Straight Line Method (SLM) at the rates and in the manner provided in Schedule XIV of the

Companies Act, 1956.

Contingent Liabilities

Contingent Liabilities are determined on the basis of available information and are disclosed by way of a note to the accounts.

11

CHANDRA PROTECO LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Borrowing cost

Borrowing costs are recognized as expense in the period in which these are incurred.

Foreign Exchange Transactions

Transactions in foreign currencies are recorded at the exchange rates prevailing at the date of the transactions.

Taxation

Provision for Current Tax is made based on the liability computed in accordance with relevant tax rates and tax laws.

Deferred Tax is recognized, subject to the consideration of prudence, on timing differences, being the difference between taxable incomes and

accounting income that originate in one period and are capable of reversal in one or more subsequent period.

[300100] Notes - Revenue

Unless otherwise specified, all monetary values are in INR

01/04/2011

to

31/03/2012

01/04/2010

to

31/03/2011

Disclosure of revenue explanatory [TextBlock]

Textual information (3)

[See below]

Textual information (4)

[See below]

Textual information (3)

Disclosure of revenue explanatory [Text Block]

Revenue Recognition

Sales include excise duty and are net of rebates and sales tax. Sales in the domestic market as well as export are recognized at the time of dispatch

of materials to the buyers. Interest and Other Income is accounted for on accrual basis.

12

CHANDRA PROTECO LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

Textual information (4)

Disclosure of revenue explanatory [Text Block]

Revenue Recognition

Sales include excise duty and are net of rebates and sales tax. Sales in the domestic market as well as export are recognized at the time of dispatch

of materials to the buyers. Interest and Other Income is accounted for on accrual basis.

[201200] Notes - Employee benefits

Unless otherwise specified, all monetary values are in INR

01/04/2011

to

31/03/2012

01/04/2010

to

31/03/2011

Disclosure of employee benefits explanatory [TextBlock]

Textual information (5)

[See below]

Description of fact that multi-employer plan is defined benefit

plan but accounted as defined contribution plan

na NA

Description of reason why sufficient information is not

available to account for multi-employer plan as defined benefit

plan

NA NA

Description of information about surplus or deficit of multi-employer

plan

NA NA

Description of basis used to determine surplus or deficit of

multi-employer plan

NA NA

Description of implications of surplus or deficit on multi-employer

plan for enterprise

NA NA

Textual information (5)

Disclosure of employee benefits explanatory [Text Block]

Particulars of employees who are in receipt of :-

(a) remuneration of not less than Rs. 24,00,000/- per annum and who are employed throughout the accounting period Rs. 84,00,000.00 (previous

year 84,00,000)

(b) remuneration of not less than Rs. 2,00,000/- per month and who are employed for part of the year Rs. 35,00,00,000.00l (Previous Year Nil)

13

CHANDRA PROTECO LIMITED Standalone Statement of Profit & Loss for period 01/04/2011 to 31/03/2012

[300300] Notes - Earnings per share

Unless otherwise specified, all monetary values are in INR

01/04/2011

to

31/03/2012

01/04/2010

to

31/03/2011

Disclosure of earnings per share explanatory [TextBlock]

Adjustments of numerator to calculate basic earnings per share [Abstract]

Profit (loss) for period 23,35,17,465.07 19,43,78,642.45

Adjustments of numerator to calculate diluted earnings per share [Abstract]

Profit (loss) for period 23,35,17,465.07 19,43,78,642.45

[300700] Notes - Director remuneration and other information

Disclosure of directors and remuneration to directors [Table] ..(1)

Unless otherwise specified, all monetary values are in INR

Directors [Axis] Column 1 Column 2 Column 3

01/04/2011

to

31/03/2012

01/04/2011

to

31/03/2012

01/04/2011

to

31/03/2012

Disclosure of directors and remuneration to directors [Abstract]

Disclosure of directors and remuneration to directors [LineItems]

Name of director APARNA GUPTA MUKUL GUPTA

JAGDISH KUMAR

KESARWANI

Director identification number of director 00127607 00125788 00141394

Date of birth of director 02/05/1968 13/08/1964 04/11/1948

Designation of director Whole-time director Managing director Whole-time director

Qualification of director B.Com,MBA(Finance)

BE,PGD in micro

alloying non ferro

metel

M.Tech

Shares held by director [shares] 5,900 [shares] 91,125 [shares] 94,025

Director remuneration [Abstract]

Salary to director [Abstract]

Basic pay director 24,00,000 60,00,000 35,00,000

Total salary to director 24,00,000 60,00,000 35,00,000

Total director remuneration 24,00,000 60,00,000 35,00,000

You might also like

- IC Department Budget Template 8540Document3 pagesIC Department Budget Template 8540romeo cubeNo ratings yet

- Financial Report of HotelDocument28 pagesFinancial Report of HotelShandya MaharaniNo ratings yet

- OE Inventory-Quarterly Report FormatDocument46 pagesOE Inventory-Quarterly Report FormatMohd Shafiq Husin TutorNo ratings yet

- Annual Leave Request FormDocument1 pageAnnual Leave Request FormRoberto LucianaNo ratings yet

- Instructions - General: The StructureDocument37 pagesInstructions - General: The StructureNiraamaya RetreatsNo ratings yet

- Annex III. Budget For The Action Total Project Budget Project Budget Per Year 1Document30 pagesAnnex III. Budget For The Action Total Project Budget Project Budget Per Year 1juneluNo ratings yet

- Cost Control ReportDocument9 pagesCost Control Reportsohail2006No ratings yet

- A Game of Thrones: George RR MartinDocument6 pagesA Game of Thrones: George RR MartinRavi ShankarNo ratings yet

- 02.hotel Initial - Revenue Projection - Revised IDocument145 pages02.hotel Initial - Revenue Projection - Revised Ianon_843580047No ratings yet

- Exceed Hospitality Profile PDFDocument34 pagesExceed Hospitality Profile PDFRadinal50% (2)

- Oursuite:Daily Activity Report/Time Record: Hourly RegularDocument2 pagesOursuite:Daily Activity Report/Time Record: Hourly RegularSandipan BasuNo ratings yet

- 5.04 Job Descriptions - Engineering 44 PagesDocument4 pages5.04 Job Descriptions - Engineering 44 PagesorientalhospitalityNo ratings yet

- 5-Star Hotel ChecklistDocument77 pages5-Star Hotel ChecklistsherryNo ratings yet

- Agreement Between Client and Architect for Tokyo ProjectDocument3 pagesAgreement Between Client and Architect for Tokyo ProjectAnup Sahani100% (1)

- Publishers DetailDocument1 pagePublishers DetailRajneesh SehgalNo ratings yet

- Ensure Accurate Hotel Income AuditingDocument10 pagesEnsure Accurate Hotel Income AuditingikennaNo ratings yet

- EXCEL-P&L Mid MonthDocument2 pagesEXCEL-P&L Mid Monthrutley1No ratings yet

- Confidential Salary Adjustment LetterDocument2 pagesConfidential Salary Adjustment LetteralexwhitemeNo ratings yet

- Annual Report (Gulf Hotels Group)Document63 pagesAnnual Report (Gulf Hotels Group)Ye Wint AungNo ratings yet

- Manager DutiesDocument2 pagesManager DutiesHusam MohamedNo ratings yet

- A Rate StructureDocument12 pagesA Rate StructureAmeen IbraheemNo ratings yet

- Performance Evaluation Sheet 360 Degree FeedbackDocument2 pagesPerformance Evaluation Sheet 360 Degree FeedbackSyaiful ArifinNo ratings yet

- Travel Order FormDocument1 pageTravel Order FormJack SprwNo ratings yet

- Pre-opening finance checklistDocument3 pagesPre-opening finance checklistQasimNo ratings yet

- Fish Culture Y4Document136 pagesFish Culture Y4KèlǐsītǎnKǎPáng100% (1)

- Scope of Work Template 01Document2 pagesScope of Work Template 01voru89100% (1)

- Sales Break-Even CalculationDocument5 pagesSales Break-Even CalculationTaranum RandhawaNo ratings yet

- Project Organisation Structure HotelDocument1 pageProject Organisation Structure HotelNguyen Chi ThanhNo ratings yet

- Exit InterviewDocument8 pagesExit InterviewArkananta Kenzie WicaksonoNo ratings yet

- Assignment 01 2018 Financial Analysis HotelDocument6 pagesAssignment 01 2018 Financial Analysis HotelEllie NguyenNo ratings yet

- Lecture 9-EVENT BUDGETDocument19 pagesLecture 9-EVENT BUDGETAlbina AbilkairNo ratings yet

- A. Booking and Reservation: B. Cancellations and No-ShowsDocument3 pagesA. Booking and Reservation: B. Cancellations and No-ShowsCinthy GuintoNo ratings yet

- Inventory+7 31 13Document4 pagesInventory+7 31 13agrawaln3No ratings yet

- List of Pigment PlayersDocument20 pagesList of Pigment PlayersRajneesh Sehgal100% (2)

- Om - Monthly ReportDocument81 pagesOm - Monthly ReportRajeshbabhu Rajeshbabhu100% (1)

- Menu Engineering Worksheet Restoran: Westaurant: Periode: JANUARI - DESEMBER 2016Document10 pagesMenu Engineering Worksheet Restoran: Westaurant: Periode: JANUARI - DESEMBER 2016Gilbert SilitongaNo ratings yet

- Pre Opening TransitionDocument28 pagesPre Opening TransitionWaristha Idyzapril AnunpattanaNo ratings yet

- Exhibit J Examples of Ff&E and Os&EDocument10 pagesExhibit J Examples of Ff&E and Os&ERafiek ZaherNo ratings yet

- Petty Cash SummaryDocument7 pagesPetty Cash SummaryLukman HakimNo ratings yet

- 090 IT Consultant ScopeDocument4 pages090 IT Consultant ScopeĐức Huấn ĐỗNo ratings yet

- NGOs Contract - Room OnlyDocument2 pagesNGOs Contract - Room OnlyLuon AnchamnanNo ratings yet

- Hand Over Check ListDocument3 pagesHand Over Check Listkrvprasad100% (1)

- Adhesive Companies ListDocument3 pagesAdhesive Companies ListRajneesh SehgalNo ratings yet

- Creating Early Learning Environments PDFDocument25 pagesCreating Early Learning Environments PDFkrisnahNo ratings yet

- Fo SopDocument14 pagesFo SopKallepalli Jagannadha SastryNo ratings yet

- Acctg Cash003 5-15 - Drop LogDocument1 pageAcctg Cash003 5-15 - Drop LogDebbie LangolfNo ratings yet

- Hotel Construction Schedule 111Document5 pagesHotel Construction Schedule 111Alex AbrhaNo ratings yet

- Time Sheet For Daily Work at MCS-TB1 2016Document5 pagesTime Sheet For Daily Work at MCS-TB1 2016Roland NicolasNo ratings yet

- ControllingDocument8 pagesControllingAnjo Pasiolco Canicosa100% (2)

- Limiting and Excess Reactants Lesson PlanDocument3 pagesLimiting and Excess Reactants Lesson Planapi-316338270100% (3)

- Private Equity Investment 2010-16Document48 pagesPrivate Equity Investment 2010-16Rajneesh SehgalNo ratings yet

- Operations Management Dr. Loay Salhieh Case Study #1: Students: Hadil Mosa Marah Akroush Mohammad Rajab Ousama SammawiDocument6 pagesOperations Management Dr. Loay Salhieh Case Study #1: Students: Hadil Mosa Marah Akroush Mohammad Rajab Ousama SammawiHadeel Almousa100% (1)

- Pharma CompaniesDocument62 pagesPharma CompaniesRajneesh SehgalNo ratings yet

- Microsoft Word - IPA Membership Directory PDFDocument38 pagesMicrosoft Word - IPA Membership Directory PDFRajneesh SehgalNo ratings yet

- Oper ManDocument38 pagesOper ManDiane UyNo ratings yet

- TUNE HOTEL - Sample ProjectDocument13 pagesTUNE HOTEL - Sample ProjectJulius Fernan Vega100% (1)

- Hotel Equipment Services for New ProjectsDocument11 pagesHotel Equipment Services for New ProjectsBarry SwaynNo ratings yet

- Administration & Logistic ManagerDocument2 pagesAdministration & Logistic ManagerFahad KhanNo ratings yet

- Daily Construction Inspection Report TemplateDocument2 pagesDaily Construction Inspection Report TemplateAbigail100% (1)

- Daily LogDocument1 pageDaily LogTarun MaudgalyaNo ratings yet

- Hotel Budget 8mths Forecast 09Document1 pageHotel Budget 8mths Forecast 09James WarrenNo ratings yet

- 002 - Application Form ARYADUTTADocument5 pages002 - Application Form ARYADUTTAAchmad radiusNo ratings yet

- Progress Report of Jan 2011Document2 pagesProgress Report of Jan 2011Rajesh Peddiboyena100% (1)

- Krezly Azelle Cyrizze P. Guillaron Hm303 Front Office ManagerDocument3 pagesKrezly Azelle Cyrizze P. Guillaron Hm303 Front Office ManagerJoanna Marie Panganiban Macalinao100% (1)

- Hotel's Room RateDocument9 pagesHotel's Room RatebeeanaclarissaNo ratings yet

- Assignment-Week7Document1 pageAssignment-Week7Mirna D. OjedaNo ratings yet

- Balance Sheet: JK Cement LTDDocument3 pagesBalance Sheet: JK Cement LTDHimanshu SharmaNo ratings yet

- PCR# Project: MDC CatarmanDocument54 pagesPCR# Project: MDC CatarmanA.J. ArellanoNo ratings yet

- Project Status Report Template-AdvancedDocument3 pagesProject Status Report Template-AdvancedSaikumar SelaNo ratings yet

- Uniform Order FormDocument1 pageUniform Order FormnicksneelNo ratings yet

- Hotel Project DocumentationDocument59 pagesHotel Project DocumentationAmol KambleNo ratings yet

- PNL 2011Document7 pagesPNL 2011Sneha KhuranaNo ratings yet

- VLCC Profit Loss 2012 PDFDocument45 pagesVLCC Profit Loss 2012 PDFAnkit SinghalNo ratings yet

- Ayurvedic Company BrandsDocument1 pageAyurvedic Company BrandsRajneesh SehgalNo ratings yet

- 01 Perfectpac (Annual Report 2013 2014)Document40 pages01 Perfectpac (Annual Report 2013 2014)Rajneesh SehgalNo ratings yet

- PMNRF NumberDocument1 pagePMNRF NumberRajneesh SehgalNo ratings yet

- Ayurvedic Company BrandsDocument1 pageAyurvedic Company BrandsRajneesh SehgalNo ratings yet

- CDH ShareholdingDocument1 pageCDH ShareholdingRajneesh SehgalNo ratings yet

- Flavours and Fragrances-Indian MarketDocument1 pageFlavours and Fragrances-Indian MarketRajneesh SehgalNo ratings yet

- WWW - Mca.gov - in DCAPortalWeb Dca DocumentsViewActionDocument11 pagesWWW - Mca.gov - in DCAPortalWeb Dca DocumentsViewActionRajneesh SehgalNo ratings yet

- Annual Return Susruta 2012Document6 pagesAnnual Return Susruta 2012Rajneesh SehgalNo ratings yet

- Gulf Oil ReportDocument100 pagesGulf Oil ReportRajneesh SehgalNo ratings yet

- Share Holding PatternDocument7 pagesShare Holding PatternRajneesh SehgalNo ratings yet

- Vip Ar 2010-11Document92 pagesVip Ar 2010-11Rajneesh SehgalNo ratings yet

- Bright Future for India's LED Lighting IndustryDocument12 pagesBright Future for India's LED Lighting IndustryRajneesh SehgalNo ratings yet

- Share Holding PatternDocument7 pagesShare Holding PatternRajneesh SehgalNo ratings yet

- Ip AddressDocument1 pageIp AddressRajneesh SehgalNo ratings yet

- Something About UsDocument18 pagesSomething About UsFercho CarrascoNo ratings yet

- Real Estate Marketing Agent Registration Form: Important InstructionsDocument7 pagesReal Estate Marketing Agent Registration Form: Important InstructionsAshok KumarNo ratings yet

- Jharkhand VAT Rules 2006Document53 pagesJharkhand VAT Rules 2006Krushna MishraNo ratings yet

- Assignment 3-WEF-Global Competitive IndexDocument3 pagesAssignment 3-WEF-Global Competitive IndexNauman MalikNo ratings yet

- Ward A. Thompson v. City of Lawrence, Kansas Ron Olin, Chief of Police Jerry Wells, District Attorney Frank Diehl, David Davis, Kevin Harmon, Mike Hall, Ray Urbanek, Jim Miller, Bob Williams, Craig Shanks, John Lewis, Jack Cross, Catherine Kelley, Dan Ward, James Haller, Dave Hubbell and Matilda Woody, Frances S. Wisdom v. City of Lawrence, Kansas Ron Olin, Chief of Police David Davis, Mike Hall, Jim Miller, Bob Williams, Craig Shanks, John L. Lewis, Jack Cross, Kevin Harmon, Catherine Kelley, Dan Ward and James Haller, Jr., 58 F.3d 1511, 10th Cir. (1995)Document8 pagesWard A. Thompson v. City of Lawrence, Kansas Ron Olin, Chief of Police Jerry Wells, District Attorney Frank Diehl, David Davis, Kevin Harmon, Mike Hall, Ray Urbanek, Jim Miller, Bob Williams, Craig Shanks, John Lewis, Jack Cross, Catherine Kelley, Dan Ward, James Haller, Dave Hubbell and Matilda Woody, Frances S. Wisdom v. City of Lawrence, Kansas Ron Olin, Chief of Police David Davis, Mike Hall, Jim Miller, Bob Williams, Craig Shanks, John L. Lewis, Jack Cross, Kevin Harmon, Catherine Kelley, Dan Ward and James Haller, Jr., 58 F.3d 1511, 10th Cir. (1995)Scribd Government DocsNo ratings yet

- Fuzzy Logic - Wikipedia PDFDocument69 pagesFuzzy Logic - Wikipedia PDFannie joseNo ratings yet

- Sarawak Energy FormDocument2 pagesSarawak Energy FormIvy TayNo ratings yet

- CFA三级百题 答案Document163 pagesCFA三级百题 答案vxm9pctmrrNo ratings yet

- FeistGorman - 1998-Psychology of Science-Integration of A Nascent Discipline - 2Document45 pagesFeistGorman - 1998-Psychology of Science-Integration of A Nascent Discipline - 2Josué SalvadorNo ratings yet

- SWSP6033 00 2022T3 V1.0-1Document14 pagesSWSP6033 00 2022T3 V1.0-1ayman.abaidallah1990No ratings yet

- Fundamentals of Accounting - I FinallDocument124 pagesFundamentals of Accounting - I Finallyitbarek MNo ratings yet

- Dy Keng vs. International LaborDocument9 pagesDy Keng vs. International LaborDani McstNo ratings yet

- Syntax - English Sentence StructureDocument2 pagesSyntax - English Sentence StructurePaing Khant KyawNo ratings yet

- Multigrade Teaching NotesDocument4 pagesMultigrade Teaching Notesqw938No ratings yet

- StructDocument2 pagesStructandriessebastianNo ratings yet

- V-AMP3: User ManualDocument19 pagesV-AMP3: User Manualnutmeg_kickerNo ratings yet

- Trends Interiors Architecture Fashion Lifestyle: 6 Spring 2013 Collector's EditionDocument116 pagesTrends Interiors Architecture Fashion Lifestyle: 6 Spring 2013 Collector's EditionFernanda RaquelNo ratings yet

- Fluid MechanicsDocument46 pagesFluid MechanicsEr Suraj Hulke100% (1)

- Kelainan Morfologi EritrositDocument19 pagesKelainan Morfologi EritrositAdel shbelNo ratings yet

- Bhagavad Gita: Chapter 18, Verse 47Document3 pagesBhagavad Gita: Chapter 18, Verse 47pankaj kararNo ratings yet

- An Empirical Study of Car Selection Factors - A Qualitative & Systematic Review of LiteratureDocument15 pagesAn Empirical Study of Car Selection Factors - A Qualitative & Systematic Review of LiteratureadhbawaNo ratings yet

- Credit Card Statement: Payment Information Account SummaryDocument4 pagesCredit Card Statement: Payment Information Account SummaryShawn McKennanNo ratings yet

- 1 PPT - Pavement of Bricks and TilesDocument11 pages1 PPT - Pavement of Bricks and TilesBHANUSAIJAYASRINo ratings yet