Professional Documents

Culture Documents

Net Sales Gross Sales - (Returns and Allowances)

Uploaded by

kanchanagrawal910 ratings0% found this document useful (0 votes)

45 views11 pagesvault finance

Original Title

Vault Notes

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentvault finance

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

45 views11 pagesNet Sales Gross Sales - (Returns and Allowances)

Uploaded by

kanchanagrawal91vault finance

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 11

Accrual accounting recognizes revenues as earned when sales are

transacted, regardless of when the company actually receives

payment. Likewise, expenses are recognized when they are incurred

rather than when the actual payment is made. In contrast, cash

accounting recognizes revenues as earned only when payment is

received and recognizes expenses as costs only when cash is actually

paid out.

Net sales = Gross sales - (Returns and Allowances)

Some firms also offer sales discounts for large volume purchases - in

such cases, these are also netted out of gross sales. ften returns and

allowance num!ers are estimates. If actual returns turn out to !e less

than estimated returns, a credit is made to net sales during the next

accounting period. If, however, actual returns turn out to !e greater

than estimated returns, the allowance account should !e increased

during the next accounting period to reflect this fact.

"ost of goods sold - #henever a product is manufactured or sold,

certain direct costs are incurred. $hese costs are designated on the

income statement as cost of goods sold, or "%S. &or a retail

company, direct costs are simply the cost of materials purchased for

resale. &or a manufacturing company, direct costs can also include

la!or costs, manufacturing overhead, and depreciation expenses

associated with production. Since service companies incur few direct

costs, their income statements usually do not include cost of goods

sold.

Cost of goods sold = Beginning inventory + Materials purchases - Ending inventory.

Operating expenses - perating expenses are expenses other than

cost of goods sold that a company incurs in the normal course of

!usiness. $hese include items such as management salaries,

advertising expenditures, repairs and maintenance costs, research and

development expenditures, lease payments, and general and

administrative expenses. $his latter category includes everything from

salaries of office staff to paper clips. As mentioned a!ove, for a

manufacturer, depreciation expense is considered as a cost of goods

sold' for a retailer, depreciation is included in operating expenses.

$he top line refers to a company(s gross sales or revenues.

)et income divided !y the num!er of common shares outstanding is

referred to as earnings per share, or *+S. $his value represents the

profit earned for each share of stock. $he current market price of the

stock divided !y *+S is called a +,* ratio. Analysts often consider *+S

and +,* ratios to !e important indicators of a firm-s current and

potential future performance.

11. What is your investing strategy?

Different investors have different strategies. Some look for undervalued

stocks, others for stocks with growth potential and yet others for stocks with

steady performance. A strategy could also be focused on the long-term or

short-term, and be more risky or less risky.

12. o! has your portfolio perfor"ed in the last five years?

If you dont have a portfolio, start a mock one using ahoo! "inance. Also, if you think you are

going to say it has outperformed the S#$ each year, you better be well prepared to e%plain why

you think this happened.

1#. $f you read that a given "utual fund has achieved %& percent returns

last year' !ould you invest in it?

ou should look for more information, as past performance is not

necessarily an indicator of future results. &ow has the overall market done'

&ow did it do in the years before' (hy did it give )* percent returns last

year' +an that strategy be e%pected to work continuously over the ne%t five

to ,* years'

1(. )ou are on the *oard of directors of a co"pany and o!n a significant

chun+ of the co"pany. ,he CE-' in his annual presentation' states that

the co"pany.s stoc+ is doing !ell' as it has gone up 2& percent in the last

12 "onths. $s the co"pany.s stoc+ in fact doing !ell?

Another trick stock -uestion that you should not answer too -uickly. "irst,

ask what the .eta of the company is. /0emember, the .eta represents the

volatility of the stock with respect to the market.1 If the .eta is , and the

market /i.e. the Dow 2ones Industrial Average1 has gone up 3) percent, the

company actually has not done too well compared to the broader market.

1%. Which do you thin+ has higher gro!th potential' a stoc+ that is

currently trading at /2 or a stoc+ that is trading at /0&?

4his -uestion tests your fundamental understanding of a stocks value. 4he

short answer to the -uestion is, 5It depends.6 (hile at first glance it may

appear that the stock with the lower price has more room for growth, price

does not tell the entire picture. Suppose the 78 stock has , billion shares

outstanding. 4hat means it has 78 billion market cap, hardly a small cap

stock. 9n the flip side, if the 7:* stock has 8*,*** shares gives it a market

cap of 7,,8**,***, and hence it is e%tremely small and is probably seen as

having higher growth potential. 1enerally' high gro!th potential has little

to do !ith a stoc+2s price' and has "ore to do !ith it2s operations and

revenue prospects.

Forward rates

4hese are agreed-upon interest rates for a bond to be issued in the future. "or

e%ample, the one year forward rate for a five-year ;.S. 4reasury note represents the interest

forward rate on a five-year 4-note that will be issued

one year from now /and that will mature si% years from now1. 4his

5forward6 rate changes daily <ust like the rates of already-issued bonds. It is

essentially based on the markets e%pectation of what the interest rate a year

from now will be, and can be calculated using the rates of current bonds.

some amount of inflation /usually around , to 8 percent1 is a sign of a healthy economy. If the

economy is healthy and the stock market is growing, consumer spending increases. 4his means

that people are buying more goods, and by conse-uence, more goods are in demand. =o inflation

means that you do not have a robust economy > that there is no competitive demand for goods.

In general, a positive economic event /such as a decrease in unemployment, greater consumer

confidence, higher personal income, etc.1 drives up inflation over the long term /because there are

more people working, there is more money to be spent1, which drives up interest rates, which

causes a decrease in bond prices.

When should a co"pany issue de*t instead of issuing e3uity?

"irst, a company needs a steady cash flow before it can consider issuing debt

/otherwise, it can -uickly fall behind interest payments and eventually see

its assets sei?ed1. 9nce a company can issue debt, it should almost always

prefer issuing debt to issuing e-uity.

@enerally, if the e%pected return on e-uity is higher than the e%pected return

on debt, a company will issue debt. "or e%ample, say a company believes

that pro<ects completed with the 7, million raised through either an e-uity

or debt offering will increase its market value from 7A million to 7,*

million. It also knows that the same amount could be raised by issuing a 7,

million bond that re-uires 73**,*** in interest payments over its life. If the

company issues e-uity, it will have to sell 8* percent of the company, or 7,

millionB7) million /7) million is the new value of the company after the

capital infusion1. 4his would then grow to 8* percent of 7,* million, or 78

million. 4hus, issuing the e-uity will cost the company 7, million /78

million - 7, million1. 4he debt, on the other hand, will only cost 73**,***.

4he company will therefore choose to issue debt in this case, as the debt is

cheaper than the e-uity.

Also, interest payments on bonds are ta% deductible. A company may also

wish to issue debt if it has ta%able income and can benefit from ta% shields.

"inally, issuing debt sends a -uieter message to the market regarding a

companys cash situation.

0. $f you *elieve interest rates !ill fall' !hich should you *uy4 a 1&-year

coupon *ond or a 1&-year 5ero coupon *ond?

4he ,*-year ?ero coupon bond. A ?ero coupon bond is more sensitive to

changes in interest rates than an e-uivalent coupon bond, so its price will

increase more if interest rates fall.

6. Which is ris+ier4 a #&-year coupon *ond or a #&-year 5ero coupon

*ond?

A3*-year ?ero coupon bond. &eres whyC A coupon bond pays interest semiannually, then pays the

principal when the bond matures /after 3* years, in this case1. A?ero coupon bond pays no interest,

but pays one lump sum upon

maturity /after 3* years, in this case1. 4he coupon bond is less risky because

you receive some of your money back before over time, whereas with a ?ero

coupon bond you must wait 3* years to receive any money back. /Another

answerC 4he ?ero coupon bond is more risky because its price is more

sensitive to changes in interest rates.1

12. Why can inflation hurt creditors?

If you are a creditor lending out money at a fi%ed rate, inflation cuts into the percentage that you

are actually making. If you lend out money at D percent a year, and inflation is ) percent, you are

only really clearing 8 percent.

1#. o! !ould the follo!ing scenario affect the interest rates4 the

7resident is i"peached and convicted.

(hile it cant be said for certain, chances are that these kind of events will

lead to fears that the economy will go into recession, so the "ed would want

to balance those fears by lowering interest rates to e%pand the economy.

10. o! !ould you value a perpetual 5ero coupon *ond?

4he value will be ?ero. A ?ero coupon doesnt pay any coupons, and if that

continues on perpetually, when do you get paid' =ever > so it aint worth

nothing!

16. 8et.s say a report released today sho!ed that inflation last "onth !as very lo!.

o!ever' *ond prices closed lo!er. Why "ight this happen?

.ond prices are based on e%pectations of future inflation. In this case, you

can assume that traders e%pect future inflation to be higher /regardless of the

report on last months inflation figures1 and therefore they bid bond prices

down today. /A report which showed that inflation last month was benign

would benefit bond prices only to the e%tent that traders believed it was an

indication of low future inflation as well.1

19. $f the stoc+ "ar+et falls' !hat !ould you e:pect to happen to *ond

prices' and interest rates?

ou would e%pect that bond prices would increase and interest rates would

"all.

1;. $f une"ploy"ent is lo!' !hat happens to inflation' interest rates'

and *ond prices?

Inflation goes up, interest rates also increase, and bond prices decrease.

2&. What is a *ond2s <)ield to Maturity=?

AbondEs yield to maturity is the yield that would be reali?ed through coupon

and principal payments if the bond were to be held to the maturity date. If

the yield is greater than the current yield /the couponBprice1, it is said to be

selling at a discount. If the yield is less than the current yield, it is said to

be selling at a premium.

C>??E@C$EAC

Apot e:change rate4 4he price of one currency relative to another, i.e., the

number of one currency you can buy using another currency. /4he e%change

rate people commonly talk about is actually the spot e%change rate.1

Bor!ard e:change rate4 4he prices of currencies at which they can be

bought and sold for future delivery

Example: Lets say that today the one-month forward rate for British pound

is $1.562! the three-month rate is $1.5625! and the one-year rate is

$1.561. "hese represent the pri#es at whi#h the mar$et %&uyers and sellers'

would a(ree %today' to ex#han(e #urren#ies one month! three months! or a

year from now.

In this e%ample, the dollar is said to be trading at a one-month forward

discount, because you can get fewer pounds for the dollar in the future than

you can today. Alternately, the dollar is trading at a forward premium for a

three-month or one-year period, because you can get more pounds for the

dollar in the future than you can today.

So !hat deter"ines the rate at !hich dollars and pounds' or dollars and *aht'

or *aht and rou*les are e:changed? 4he perfect market e%change rate

between two currencies is determined primarily by two factorsC the interest rates in the t!o

countries and the rates of inflation in the t!o countries.

&owever, in the real world, governments of many countries regulate the

e%change rate to control growth and investment of foreign capital in the

economy. Fconomists believe that such artificial controls are the main

reason currencies fall so drastically sometimes.

$f the interest rate of a foreign country relative to the ho"e country goes up, the home

currency weakens. In other words, it takes more of the home currency to buy the same amount of

foreign currency. /=oteC (e are talking here about the real interest rate, or the interest rate after

inflation. After all, if interests rates and inflation were to go up by the same amount, the effect on

the countrys currency would generally be a wash, of no net effect.1

Explanation4 (hen interest rates in a country rise, investments held in that

countrys currency /for e%ample, bank deposits, bonds, +Ds, etc.1 will earn

a higher rate of return. 4herefore, when a countrys interest rates rise, money

and investments will tend to flow to that country, driving up the value of its

currency

Influence of Inflation on Foreign Exchange

If the inflation in the foreign country goes up relative to the home currency,

the foreign currency devalues or weakens relative to the home currency. In

other words, it takes less of the home currency to buy the same amount of

foreign currency.

Example: Let us say that at the &e(innin( of the year! sil)er #osts $1!5**+l&

in the ,.-. and .1!***+l& in the ,./. 0t the same time it ta$es $1.5 to &uy

.1. Let us now assume that inflation in the ,./. is at 1* per#ent while that

in the ,.-. is at * per#ent. 0t the end of the year! the sil)er still #osts

$1!5**+l& in the ,.-.! &ut it #osts pounds .1!1** in ,./. &e#ause of inflation.

Be#ause of the ,./.s hi(her inflation rate! the British pound will wea$en

relati)e to the dollar %so that! for example! it may ta$e $1.16 to &uy .1'.

0d)an#ed Explanation: Gets say again that at the beginning of the year,

silver costs 7,,)**Blb in the ;.S. and H,,***Blb in the ;.I. At the same time,

it takes 7,.) to buy H,. Get us now assume that inflation in the ;.I. is at ,*

percent while inflation in the ;.S. is at * percent.

At the end of the year, the silver still costs 7,,)**Blb in the ;.S., but it costs

H,,,**Blb in the ;.I. because of inflation. If the e%change rate were to

remain the same, people would start buying silver in the ;.S., selling it in

the ;.I., and converting their money back to dollars, thus making a tidy

profit. In other words, if you had 7,,)**, you would buy a pound of silver

in ;.S., sell it in the ;.I. for H,,,** at the end of the year, convert the

.ritish pounds into dollars at 7,.)BH,, thus receiving 7,,:)*. "or each pound

of silver with which you did this, you would make a neat profit of 7,)*.

Capital Market Equilibrium

4he principle of capital market e-uilibrium /+JF1 states that there should

be e-uilibrium in the currency markets all over the world so that there is no

arbitrage opportunity in shifting between two currencies.

The three factors

4hese three factors > interest rates, inflation, and the principle of capital

market e-uilibrium > govern the valuation of various currencies. .ecause

the ;.S. dollar is generally considered the worlds most stable currency, it is

the widely accepted basis for foreign e%change valuation. 9ther currencies

that are considered stable are the 2apanese yen and the Furo.

Exchange Rate Effects on Earnings

+ompanies that do business abroad are e%posed to currency risk. "or e%ample, if a ;.S. company

that manufactures goods in the ;.S. sells them in Fngland, its -uarterly earnings will fluctuate

based on fluctuating dollar pound e%change rates.

If the dollar weakens /i.e., one dollar can buy fewer pounds1, the companys

earnings will increase because when the pounds earned by selling the product are sent back to the

;.S., they will be able to buy more dollars. If the dollar strengthens, then the earnings will go

down.

Effect of Exchange Rates on Interest Rates and Inflation

A weak dollar means that the prices of imported goods will rise when

measured in ;.S. dollars /i.e., it will take more dollars to buy the same

good1. (hen the prices of imported goods rise, this contributes to higher

inflation, which also raises interest rates. +onversely, a strong dollar means

that the prices of imported goods will fall, which will lower inflation /which

will lower interest rates1. 4he following table summari?es the relationship

between interest rates, inflation, and e%change rates.

A note on devaluation

;nder a fi%ed-e%change-rate system in which e%change rates are changed only by official

government action, a weakening of the currency is called Devaluation. A strengthening of the

currency under fi%ed e%change rates is called revaluation, rather than appreciation.

#. $f the >.A. dollar !ea+ens' should interest rates generally rise' fall or

stay the sa"e?

0ise. A weak dollar means that the prices of imported goods will rise when

measured in ;.S. dollars /i.e., it will take more dollars to buy the same

good1. 0ising prices of imported goods contributes to higher inflation, which

raises interest rates.

(. $f >.A. inflation rates fall' !hat !ill happen to the relative strength of

the dollar?

It will strengthen.

%. $f the interest rate in Bra5il increases relative to the interest rate in

the >.A.' !hat !ill happen to the e:change rate *et!een the Bra5ilian

real and the >.A. dollar?

4he real will strengthen relative to the dollar.

0. $f inflation rates in the >.A. fall relative to the inflation rate in ?ussia'

!hat !ill happen to the e:change rate *et!een the dollar and the rou*le?

4he dollar will strengthen relative to the rouble

6. What is the difference *et!een currency devaluation and currency

depreciation?

Devaluation occurs in a fi%ed-e%change-rate system and is usually fi%ed as

a function of @overnment policy, while depreciation occurs when a country

allows its currency to move according to the international currency

e%change market.

CE?$DE,$DEA F -7,$-@A

(ell, there is an entire market > called the options market > that helps these

transactions go through. "or every option holder there must be an option

seller. 4his seller is often referred to as the writer of the option. So selling a

put option is called writing a put. Anyone who owns the underlying asset,

such as an individual or a mutual fund > can write options.

Options Pricing

4here are at least si% factors that affect the value of an optionC the stock

price, e%ercise price, the volatility of the stock price, the time to e%piration,

the interest rate and the dividend rate of the stock.

7rice of underlying security4 If an option is purchased at a fi%ed e%ercise

price, and the price of the underlying stock increases, the value of a call

option increases. +learly, if you have the option to buy I.J stock at 7,**,

the value of your option will increase with any increase in stock priceC

from 7K) to 7,**, from 7,** to 7,*), from 7,*) to 7,*:, etc. /4he value

of a put option in this scenario decreases.1

L E:ercise G<stri+eHI price4 +all options can be bought at various e%ercise

prices. "or e%ample, you can buy an option to buy stock in I.J at 7,**,

or you can buy an option to buy stock in I.J at 7,,*. 4he higher the

e%ercise price, the lower the value of the call option, as the stock price has

to go up higher for you to be in the money. /&ere, the value of the put

option increases, as the stock price does not need to fall as low.1

L Dolatility of underlying security4 4he option value increases if the

volatility of the underlying stock increases. 4he reason this potential upside increases the options

value is that the downside loss that you can incur is fi%ed. ou have the option to e%ercise and not

the obligation to buy at 7,**.

,i"e to e:piration4. 4he more time the holder has to e%ercise the option,

the more valuable the option.

$nterest rates4 If interest rates are higher, the e%ercise price has a lower

present value. 4his also increases the value of the call option.

L Cividends4 A higher dividend rate policy of the company means that out

of the total e%pected return on the stock, some is being delivered in the

form of dividends. 4his means that the e%pected capital gain of the stock

will be lower, and the potential increase in stock price will be lower.

&ence, larger dividend pay outs lower the call value.

"utures differ from other forwards in the fact that they are li-uid, standardi?ed, traded on an

e%change, and their prices are settled at the end of each trading day.

CE?$DE,$DEA4

Bor!ard' Butures' -ption' A!ap

A swap is an e%change of future cash flows. 4he most popular forms include

foreign e%change swaps and interest rate swaps.

#. Aay $ hold a put option on Microsoft stoc+ !ith an e:ercise price of

/0&' the e:piration date is today' and Microsoft is trading at /%&. E*out

ho! "uch is "y put !orth' and !hy?

our put is worth about 7,*, because today, you can sell a share of stock for

7:*, and buy it for 7)*. /If the e%piration date were in the future, the option

6. Why do interest rates "atter !hen figuring the price of options?

.ecause of the ever-important concept of net present value, all else being

e-ual, higher interest rates lower the value of call options.

ME?1E?A F ECJ>$A$,$-@A4

Types of buyers

4here are two main categories of buyers of companiesC strategic *uyers and

financial *uyers. Strategic buyers are corporations who want to ac-uire

another company for strategic business reasons. "inancial buyers are buyers

who want to ac-uire another company purely as a financial investment.

(ho will pay more for a companyC strategic buyers or financial buyers'

=ine times out of ten, a strategic buyer will pay more than a financial buyer.

Stock Swaps vs. Cash ffers

.ankers and finance officials at companies have a couple of financing

options when they consider how to structure a mergerC a stock swap or a cash

deal. Stock swaps occur more often when there is a strong stock market, because companies with a

high market capitali?ation can ac-uire companies with that more valuable stock.

!ender ffers

4ender offers are associated with hostile takeovers. In a tender offer, the

hostile ac-uirer renders a tender offer for the publics stock at a price higer

than the current market in an attempt to gather a controlling interest in

/ma<ority ownership of1 a company.

You might also like

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Wall Street Playboys IB Interview GuideDocument5 pagesWall Street Playboys IB Interview GuideJack JacintoNo ratings yet

- Intelligent Investing ChecklistDocument136 pagesIntelligent Investing Checklistamaresh gautamNo ratings yet

- Excel FunctionsDocument13 pagesExcel Functionsfhlim2069No ratings yet

- FRM Practice Exam 2011Document125 pagesFRM Practice Exam 2011pradeep johnNo ratings yet

- Basic of Accounting Principles PDFDocument23 pagesBasic of Accounting Principles PDFMani KandanNo ratings yet

- Sample Option ContractDocument9 pagesSample Option ContractChris Ce100% (1)

- Stock-Picking Strategies - Introduction - Investopedia2Document5 pagesStock-Picking Strategies - Introduction - Investopedia2Rishikesh DevaneNo ratings yet

- Vault-Finance Practice GuideDocument126 pagesVault-Finance Practice GuideMohit Sharma100% (1)

- Time Value of Money - Financial ManagementDocument8 pagesTime Value of Money - Financial Managementkamdica100% (2)

- What is a bonus share issueDocument22 pagesWhat is a bonus share issuecutie_pixieNo ratings yet

- Financial Statement Analysis Problem SolutionsDocument35 pagesFinancial Statement Analysis Problem SolutionsMaria Younus78% (9)

- The Importance of Book ValueDocument4 pagesThe Importance of Book ValuelowbankNo ratings yet

- Financial Planning and Forecasting SolutionsDocument57 pagesFinancial Planning and Forecasting Solutionspepe100% (1)

- A Sample Go Kart Business Plan TemplateDocument15 pagesA Sample Go Kart Business Plan TemplateMahirezqiNo ratings yet

- Option Strategist 4 1 16Document10 pagesOption Strategist 4 1 16api-313709130No ratings yet

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- Quantitative Easing (QE) Is An UnconventionalDocument16 pagesQuantitative Easing (QE) Is An Unconventionalkanchanagrawal91No ratings yet

- Spouses Gulla vs. Heirs of AlejandroDocument13 pagesSpouses Gulla vs. Heirs of AlejandroJewel Ivy Balabag DumapiasNo ratings yet

- Kane Jim 03 Trading ABCD PatternsDocument159 pagesKane Jim 03 Trading ABCD Patternsnanda kumar89% (9)

- Wolf Bytes 20: Equity Research-AmericasDocument20 pagesWolf Bytes 20: Equity Research-Americasvouzvouz7127No ratings yet

- Discounting Cash FlowDocument9 pagesDiscounting Cash FlowBhavinRamaniNo ratings yet

- The Digital Marketing Revolution Module 1Document122 pagesThe Digital Marketing Revolution Module 1Nguyen Thi Nhung (K16HL)No ratings yet

- Dynamics of ValueDocument8 pagesDynamics of ValueHardik GoriNo ratings yet

- Berkshire Reports PDFDocument146 pagesBerkshire Reports PDFjohnthomastNo ratings yet

- Slingshot StrangleDocument3 pagesSlingshot Strangleprivatelogic100% (1)

- Forex Gold Investor: User GuideDocument28 pagesForex Gold Investor: User GuideNovica SladojeNo ratings yet

- Mentoring Session 4, Day 1: 24 May 2021 Trading IdeasDocument11 pagesMentoring Session 4, Day 1: 24 May 2021 Trading Ideaslakshmipathihsr64246No ratings yet

- SAP Guide of Long Term PlanningDocument21 pagesSAP Guide of Long Term PlanningDario Franco100% (1)

- Insurance LawDocument110 pagesInsurance LawfarhatxdaNo ratings yet

- Steps For Fundamental AnalysisDocument7 pagesSteps For Fundamental AnalysisRaghav SagarNo ratings yet

- Summary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingFrom EverandSummary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingNo ratings yet

- Decision Making by Individuals and FirmsDocument37 pagesDecision Making by Individuals and FirmsAhmed MahmoudNo ratings yet

- 04 the Value of Common StocksDocument10 pages04 the Value of Common Stocksddrechsler9No ratings yet

- Ahmed Elsayad Finance Q + A's 2008 To August 2017Document20 pagesAhmed Elsayad Finance Q + A's 2008 To August 2017MoatasemMadianNo ratings yet

- Finance: The Cost of EquityDocument5 pagesFinance: The Cost of EquityBenjamin ChikeNo ratings yet

- Stock Market TermsDocument20 pagesStock Market TermsAbhijit ModakNo ratings yet

- Report On Dividend PolicyDocument21 pagesReport On Dividend PolicyMehedi HasanNo ratings yet

- Financial Planning Chapter 18 Key ConceptsDocument8 pagesFinancial Planning Chapter 18 Key ConceptsSamantha Marie ArevaloNo ratings yet

- Profitability vs liquidity: Why cash flow matters more than profitsDocument5 pagesProfitability vs liquidity: Why cash flow matters more than profitsEdu TainmentNo ratings yet

- How Do You Value A Company?Document3 pagesHow Do You Value A Company?Sumit DaniNo ratings yet

- 3.1. Problem Statement: Supply DemandDocument29 pages3.1. Problem Statement: Supply DemandAysha LipiNo ratings yet

- Vagh's Guide PDFDocument50 pagesVagh's Guide PDFDownloadingeverydayNo ratings yet

- Commonly Used Ratios I. LiquidityDocument7 pagesCommonly Used Ratios I. LiquidityJohn Lexter GravinesNo ratings yet

- Factors Affecting Equity Beta, Systematic vs Unsystematic RiskDocument37 pagesFactors Affecting Equity Beta, Systematic vs Unsystematic RiskMoatasemMadianNo ratings yet

- Cfa Level 2 - Test Bank With SolutionsDocument14 pagesCfa Level 2 - Test Bank With SolutionsAditya BajoriaNo ratings yet

- Analysis of Financial Statements: Answers To End-Of-Chapter QuestionsDocument15 pagesAnalysis of Financial Statements: Answers To End-Of-Chapter QuestionsAditya R HimawanNo ratings yet

- Introduction To Stock ValuationDocument22 pagesIntroduction To Stock ValuationManash SharmaNo ratings yet

- Understanding the Price-Earnings Ratio (P/E RatioDocument4 pagesUnderstanding the Price-Earnings Ratio (P/E RatioulandteNo ratings yet

- Thumb For Acceptable Values Are: Current Ratio (2:1), Quick Ratio (1:1)Document4 pagesThumb For Acceptable Values Are: Current Ratio (2:1), Quick Ratio (1:1)Sehrish SiddiquiNo ratings yet

- FinShiksha - Some Common Interview QuestionsDocument12 pagesFinShiksha - Some Common Interview QuestionskaranNo ratings yet

- Integrated Case 3-20Document5 pagesIntegrated Case 3-20Cayden BrookeNo ratings yet

- DCF in Depth Calculate The Revenue Growth Rate: Forecasting Free Cash FlowsDocument5 pagesDCF in Depth Calculate The Revenue Growth Rate: Forecasting Free Cash FlowsJustBNo ratings yet

- Chapter 04Document32 pagesChapter 04Phuong TrangNo ratings yet

- Relationship Between Required Rate of Return, Coupon Rate and Bond ValueDocument4 pagesRelationship Between Required Rate of Return, Coupon Rate and Bond ValueYuvraj SinghNo ratings yet

- Paper CostcoDocument4 pagesPaper CostcoDhe SagalaNo ratings yet

- Capital & RevenueDocument14 pagesCapital & RevenueNeha KumariNo ratings yet

- Evaluating PerformanceDocument16 pagesEvaluating PerformancemehdiNo ratings yet

- 4.dividend DecisionsDocument5 pages4.dividend DecisionskingrajpkvNo ratings yet

- Key Ratios For Picking Good Stocks: 1. Ploughback and ReservesDocument6 pagesKey Ratios For Picking Good Stocks: 1. Ploughback and ReservesAnonymous YkDJkSqNo ratings yet

- EV The Price of A BusinessDocument11 pagesEV The Price of A BusinessseadwellerNo ratings yet

- Understanding Intrinsic Value - An Introduction To Islamic FinanceDocument7 pagesUnderstanding Intrinsic Value - An Introduction To Islamic FinanceecsudcaNo ratings yet

- Where Do You See This?: What Does Leverage Mean?Document6 pagesWhere Do You See This?: What Does Leverage Mean?abhijeet1828No ratings yet

- Financial Ratios and Quality IndicatorsDocument7 pagesFinancial Ratios and Quality IndicatorsSanny MostofaNo ratings yet

- Cheat SheetDocument6 pagesCheat Sheetm parivahanNo ratings yet

- Net Block DefinitionsDocument16 pagesNet Block DefinitionsSabyasachi MohapatraNo ratings yet

- Determining Share Prices: Stock Share Financial Ratios Earnings YieldDocument8 pagesDetermining Share Prices: Stock Share Financial Ratios Earnings Yieldapi-3702802No ratings yet

- Annual Turnover Is A Term Used When Describing The Amount of Securities Removed From ADocument6 pagesAnnual Turnover Is A Term Used When Describing The Amount of Securities Removed From AElitsa DermendzhiyskaNo ratings yet

- 25 MBA Finance Interview QuestionsDocument23 pages25 MBA Finance Interview QuestionsArpit MalviyaNo ratings yet

- Cost of Debt: 1. Dividend Price ApproachDocument5 pagesCost of Debt: 1. Dividend Price ApproachdianaNo ratings yet

- Required Rate of ReturnDocument4 pagesRequired Rate of ReturnGladys Shen AgujaNo ratings yet

- 1determine A FirmDocument50 pages1determine A FirmCHATURIKA priyadarshaniNo ratings yet

- RatioDocument5 pagesRatiomob1022No ratings yet

- MBA - Operating Cycle and Bond PricingDocument8 pagesMBA - Operating Cycle and Bond PricingAntony Joseph PrabakarNo ratings yet

- Answer 1 - (A)Document7 pagesAnswer 1 - (A)Bhawna TiwariNo ratings yet

- Average Cost of FundsDocument4 pagesAverage Cost of Fundsraiden6263No ratings yet

- New Microsoft Office Word DocumentDocument50 pagesNew Microsoft Office Word Documentkanchanagrawal91No ratings yet

- The Hindu Review August 2017Document23 pagesThe Hindu Review August 2017kanchanagrawal91No ratings yet

- University Topper ListDocument51 pagesUniversity Topper Listkanchanagrawal91No ratings yet

- 5 6285132145987944451Document7 pages5 6285132145987944451kanchanagrawal91No ratings yet

- LIFE INSURANCE PRINCIPLESDocument9 pagesLIFE INSURANCE PRINCIPLESMadz MadrastoNo ratings yet

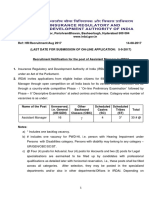

- IRDA Recruitment Assistant Managers 2017 - Official NotificationDocument28 pagesIRDA Recruitment Assistant Managers 2017 - Official NotificationKshitija100% (1)

- AccountingDocument3 pagesAccountingkanchanagrawal91No ratings yet

- Feel GoodDocument1 pageFeel Goodkanchanagrawal91No ratings yet

- Event Management - II (Case Study)Document22 pagesEvent Management - II (Case Study)swathrav100% (1)

- Ibps RRB (Group - A Officers) ExamDocument33 pagesIbps RRB (Group - A Officers) ExamSrinivas GoudNo ratings yet

- TISS Sample Paper - MA Part 1 & 2 Combined - 2009-11Document56 pagesTISS Sample Paper - MA Part 1 & 2 Combined - 2009-11bhustlero0oNo ratings yet

- Support Material On Writing Skills - For XAT, TISS, FMS EtcDocument54 pagesSupport Material On Writing Skills - For XAT, TISS, FMS EtcakashNo ratings yet

- Event Management - II (Case Study)Document22 pagesEvent Management - II (Case Study)swathrav100% (1)

- OSI 7 Layers Reference Model For Network CommunicationDocument18 pagesOSI 7 Layers Reference Model For Network Communicationkanchanagrawal91No ratings yet

- DebateDocument8 pagesDebatekanchanagrawal91No ratings yet

- Brutal SCDocument22 pagesBrutal SCbestboy_vijayNo ratings yet

- Brutal SCDocument22 pagesBrutal SCbestboy_vijayNo ratings yet

- Derivatives Risk Management GuideDocument26 pagesDerivatives Risk Management GuideAsħîŞĥLøÝå60% (5)

- The Dark Side of ValuationDocument63 pagesThe Dark Side of ValuationMiguel Vega OtinianoNo ratings yet

- Shadin 91053 Operation ManualDocument36 pagesShadin 91053 Operation Manualmglem100% (1)

- Formulas For Math 423 Final ExamDocument3 pagesFormulas For Math 423 Final ExamJake FeldmanNo ratings yet

- SC upholds Sandiganbayan rulings on coconut levy casesDocument231 pagesSC upholds Sandiganbayan rulings on coconut levy casesRebecca Chan100% (1)

- Starbucks' Phenomenal Growth and Howard Schultz's Vision to Expand the Company NationallyDocument23 pagesStarbucks' Phenomenal Growth and Howard Schultz's Vision to Expand the Company NationallyMohit MakkerNo ratings yet

- Private Equity Real Estate: NorthfieldDocument26 pagesPrivate Equity Real Estate: NorthfieldchrisjohnlopezNo ratings yet

- Annual Statement: 1 July 2021 - 30 June 2022Document6 pagesAnnual Statement: 1 July 2021 - 30 June 2022Thong THAONo ratings yet

- Alchian's Theory of Cost as a Logical Implication of ChoiceDocument28 pagesAlchian's Theory of Cost as a Logical Implication of ChoiceGuilherme MartheNo ratings yet

- Exotic Options PDFDocument2 pagesExotic Options PDFJoseph0% (2)

- Bachelor ThesisDocument41 pagesBachelor ThesisRoberto MachadoNo ratings yet

- NYIF Investment Banking Certification Program BrochureDocument18 pagesNYIF Investment Banking Certification Program BrochureChristian Ezequiel ArmenterosNo ratings yet

- Issue of Debentures Collage SPCC Term 2Document4 pagesIssue of Debentures Collage SPCC Term 2Taaran ReddyNo ratings yet

- Fairway Group Holdings Corp - Form S-1A (Apr-04-2013)Document327 pagesFairway Group Holdings Corp - Form S-1A (Apr-04-2013)gtg414gNo ratings yet

- Stock Market (NIFTY) Forecasting Using Machine Learning Analysis On Option ChainDocument4 pagesStock Market (NIFTY) Forecasting Using Machine Learning Analysis On Option ChainNaresh BabuNo ratings yet

- VNACS Final Case ReportDocument9 pagesVNACS Final Case ReportVikram Singh TomarNo ratings yet

- MKT610 Assignment No. 2Document3 pagesMKT610 Assignment No. 2Adnan YounasNo ratings yet