Professional Documents

Culture Documents

Application For Taxpayer Identification Number (TIN)

Uploaded by

iamjan_1010 ratings0% found this document useful (0 votes)

88 views5 pagesSole tax requirements

Original Title

Sole

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSole tax requirements

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

88 views5 pagesApplication For Taxpayer Identification Number (TIN)

Uploaded by

iamjan_101Sole tax requirements

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

Application for Taxpayer Identification Number (TIN)

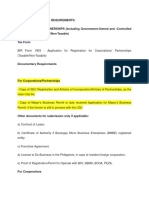

CORPORATIONS/PARTNERSHIPS (Including Government-Owned and -Controlled Corporations)

(Taxable /Non-Taxable)

Tax Form

BIR Form 1903 - Application for Registration for Corporations/ Partnerships (Taxable/Non-Taxable)

Documentary Requirements

For Corporations/Partnerships

Copy of SEC Registration and Articles of Incorporation/Articles of Partnerships, as the case

may be;

Copy of Mayors Business Permit or duly received Application for Mayors Business Permit, if

the former is still in process with the LGU

Other documents for submission only if applicable:

a) Contract of Lease;

b) Certificate of Authority if Barangay Micro Business Enterprises (BMBE) registered entity;

c) Franchise Agreement;

d) License to Do Business in the Philippines, in case of resident foreign corporation;

e) Proof of Registration/Permit to Operate with BOI, SBMA, BCDA, PEZA.

For Cooperatives

Copy of Cooperative Development Authority (CDA) Certificate of Registration and Articles of

Cooperation;

For GAIs, GOCCs and LGUs

Copy of the Unit or Agency's Charter

For Home Owner's Association

Copy of Certificate of Registration issued by Housing and Land Use Regulatory Board (HLURB)

and Articles of Association;

In the case of registration of branch/facility type:

a) Copy of the COR of the Head office for facility type to be used by the Head office and COR of the

branch for facility types to be used by a particular branch;

b) Mayors Permit or duly received Application for Mayors Business Permit, if the former is not yet

available; and

c) Contract of Lease, if applicable.

Documentary Requirements for new application of Authority to Print

BIR form 1906 together with the following:

- Job order

- Final & clear sample of Principal & Supplemenatary Receipts/Invoices

Documentary Requirements for new Registration of Books of Accounts

New sets of books of accounts

Procedures

a) Accomplish BIR Form 1903 and submit the same together with the documentary requirements

to the RDO having jurisdiction over the place where the head office and branch, respectively.

b) Pay the Annual Registration Fee (P500.00) at the Authorized Agent Banks (AABs) of the

concerned RDO.

c) Pay Documentary Stamp Tax (DST) (loose DST / BIR Form 2000* for DST on Contract of Lease,

etc). Present proofs of payment.

d) Submit requirements for ATP and registration of books of accounts.

e) Attend the taxpayers initial briefing to be conducted by the RDO concerned for new registrants

in order to apprise them of their rights and duties/responsibilities.

f) The RDO shall then issue the Certificate of Registration (Form 2303) together with the Ask for

Receipt notice, Authority to Print and Books of Accounts.

Deadline

Corporations and their branches shall accomplish and file the application on or before the

commencement of business, it shall be reckoned from the day when the first sale transaction

occured or within thirty (30) calendar days from the issuance of Mayor's Permit/PTR by LGU, or

Certificate of Registration issued by the Securities and Exchange Commission (SEC), whichever comes

earlier

In the case of corporations (Taxable or Non-taxable) where documentary stamp tax (DST) is

required to be paid within five (5) days after the close of the month, BIR Registration shall be done

on or before payment of DST due

Partnerships, Associations, Cooperatives, Government Agencies and Instrumentalities (GAIs)

shall accomplish and file the application before or upon filing of any applicable tax return, statement

or declaration as required by the Code, as amended

Registration of Books & Accounts

CORPORATIONS/PARTNERSHIPS

Newly-Registered (In General)

Tax Form

BIR Form 1903 - Application for Registration for Corporations/Partnerships (Taxable/Non-Taxable)

Including GAIs And LGUs

Documentary Requirements

a) Permanently bound books of accounts for registration/stamping or the bound journals and/or

ledgers;

b) Proof of Payment of Annual Registration Fee (BIR Form 0605) current year.

Procedures

a) Submit duly accomplished BIR Form 1903 at the RDO or concerned office under the Large

Taxpayer Service having jurisdiction over the place where the head office and branch is located,

respectively; and

b) Present the manual books of accounts at the RDO or concerned office under the Large

Taxpayer Service where the place of business is located for Stamping and registration purposes.

Deadline

Newly registered taxpayers shall present the manual books of accounts before use to the RDO or

concerned office under the Large Taxpayer Service where the place of business is located for

approval and registration.

As a general rule, registration of books of accounts shall be simultaneous with the issuance of

Certificate of Registration and approved Authority to Print.

Subsequent Registration of Books/Renewal (In General)

Tax Form

BIR Form 1905 - Application For Registration Information Update

Documentary Requirements

a) Photocopy of the first page of the previously registered books;

b) Bound journals and/or ledgers;

c) Proof of Payment Annual Registration Fee (BIR Form 0605) current year.

Procedure

a) Submit duly accomplished BIR Form 1905 at the RDO or concerned office under the Large

Taxpayer Service having jurisdiction over the place where the head office and branch is located,

respectively; and

b) Present the manual books of accounts at the RDO or concerned office under the Large

Taxpayer Service where the place of business is located for Stamping and registration purposes.

Deadline

The registration of a new set of manual books of accounts shall only be at the time when the pages

of the previously registered books have all been already exhausted, provided, that the portions

pertaining to a particular year should be properly labeled or marked by taxpayer. This means that it

is not necessary for a taxpayer to register/stamp a new set of manual books of accounts each and

every year.

Note: With the implementation of the E-Commerce Law, the requirement of binding and stamping

of computerized books of accounts and/or receipts and invoices generated by a duly approved CAS

shall no longer be necessary, provided that:

Soft copy of the computerized books of accounts and other accounting records/documents in

Text File format shall be made available in:

- CD ROM (Read Only)

- Electronically archived information

A duly notarized certification in the form of an affidavit ascertaining/attesting the accuracy of

the number of receipts and invoices used during the year and soft copy of books of accounts and

other accounting records/documents in Text File Format stamped received within thirty days (30)

from the close of taxable year.

CLOSURE

APPLICATION FOR CLOSURE OF BUSINESS/CANCELLATION OF TIN

A. Venue

RDO where TIN is registered.

B. BIR Form

BIR FORM 1905 - Application for Registration Information Update for Updating / Cancellation of

Registration / Cancellation of TIN / New Copy of TIN Card / New Copy of Certificate of Registration

C. Documentary Requirements

1. Notice of closure or cessation of business;

2. Notice of Death and Death Certificate, in case of death of an individual;

3. Estate Tax Return of the decedent, if applicable;

4. List of ending inventory of goods, supplies, including capital goods;

5. Inventory of unused sales invoices/official receipts (SI/OR);

6. Unused sales invoices/official receipts and all other unutilized accounting forms (e.g., vouchers,

debit/credit memos, delivery receipts, purchase orders, etc.) shall be physically submitted to the

RDO where the Head Office is registered or where the Authority to Print (ATP) was secured;

7. All business notices and permits as well as the COR shall be surrendered for cancellation;

8. Other documents necessary to support the changes applied for.

D. Procedures

III. Dissolution, Merger or Consolidation of Juridical Persons

1. All taxpayers who filed for cancellation of registration due to closure/cessation or termination

of business, except for branches, shall be subjected to immediate investigation by the BIR office

concerned to determine the taxpayers tax liabilities.

2. For juridical persons, the TIN shall be cancelled at the time of the dissolution, merger or

consolidation resulting to termination of their corporate existence through the eventual cancellation

of their registration with the BIR.

In case of business merger or consolidation, the TIN of the dissolved juridical persons shall be tagged

with Ceased/Dissolved status. If one of the parties survives, its TIN must be retained, however if a

new corporation shall be established, a new TIN shall be issued to such new juridical entity.

3. The BIR district office of the HO of the dissolved entity shall inform all the other BIR district

office, where the branches are registered, of the closure/cessation of the business.

4. To avoid generation of stop filer cases, the BIR district office, upon complete submission by the

taxpayer of the requirements shall:

a. End date the tax types of the taxpayer;

b. Destroy/shred in the presence of the taxpayer or his authorized representative, the unutilized

SI/ORs and other accounting forms by cutting them crosswise and lengthwise at the middle thereof

so that the same shall be divided into four (4), ensuring that the same will no longer be used as

originally intended; and

c. Return to the taxpayer the destroyed/shredded SI/ORs and other accounting forms for burning

and/or proper disposition.

d. The BIR distinct office shall issue a Tax Clearance to the taxpayer applying for cancellation of TIN

within ten (10) days from termination of its investigations and/or full settlement of the taxpayers

liabilities, if applicable

You might also like

- Requirements and Procedure For BIR RegDocument3 pagesRequirements and Procedure For BIR ReglifemandrinkNo ratings yet

- Bir COR Application RequirementsDocument3 pagesBir COR Application RequirementsJaemar FajardoNo ratings yet

- Application For Closure of Business/Cancellation of Tin A. VenueDocument9 pagesApplication For Closure of Business/Cancellation of Tin A. VenueMa. Roa DellomasNo ratings yet

- Taxpayer InformationDocument2 pagesTaxpayer InformationLecel LlamedoNo ratings yet

- txtn502 Part2Document21 pagestxtn502 Part2Sandra Mae Cabuenas100% (1)

- TAX BRIEFING-NEW RegistrantsDocument57 pagesTAX BRIEFING-NEW RegistrantsPcl Nueva Vizcaya100% (3)

- Notes On Registration of Book of AccountsDocument3 pagesNotes On Registration of Book of AccountsDenzel Edward CariagaNo ratings yet

- BIR - Registration of Book of AccountsDocument1 pageBIR - Registration of Book of AccountstemporiariNo ratings yet

- Primary Registration Index For Application For Taxpayer Identification Number (TIN)Document43 pagesPrimary Registration Index For Application For Taxpayer Identification Number (TIN)Chit ComisoNo ratings yet

- Index For Application For Registration UpdateDocument14 pagesIndex For Application For Registration UpdateMelvin AndresNo ratings yet

- BIRDocument111 pagesBIRAllied RandzNo ratings yet

- Tax LawDocument58 pagesTax LawChit ComisoNo ratings yet

- TAX 103-Topic 1 - Registration & EBIR FormsDocument11 pagesTAX 103-Topic 1 - Registration & EBIR Formsmarialynnette lusterioNo ratings yet

- Application For Registration UpdateDocument15 pagesApplication For Registration UpdateMcrislbNo ratings yet

- Revenue Memorandum 23-2012Document2 pagesRevenue Memorandum 23-2012Ruth CepeNo ratings yet

- BIR Registration Guide for Tax ProfessionalsDocument95 pagesBIR Registration Guide for Tax ProfessionalsKristofer DomagosoNo ratings yet

- Closure of Business With BirDocument2 pagesClosure of Business With Birjohn allen MarillaNo ratings yet

- Corporation - BIR Registration Process in The PhilippinesDocument4 pagesCorporation - BIR Registration Process in The PhilippinesPineNo ratings yet

- Registration Requirements Books AccountsDocument3 pagesRegistration Requirements Books AccountsCkey ArNo ratings yet

- Awareness On Business Registration, Invoicing and BookkeepingDocument70 pagesAwareness On Business Registration, Invoicing and BookkeepingRonald Allan Valdez Miranda Jr.No ratings yet

- Dissolution of Comp. Docs - Requirements.sss .Bir .Pagibig - LguDocument2 pagesDissolution of Comp. Docs - Requirements.sss .Bir .Pagibig - Lgujaciem100% (1)

- Application For Closure of BusinessDocument3 pagesApplication For Closure of BusinessmkabNo ratings yet

- BIR Webinar on Primary Registration and Bookkeeping for New Business RegistrantsDocument107 pagesBIR Webinar on Primary Registration and Bookkeeping for New Business RegistrantsEdward Gan100% (1)

- March 2021 Research On Individuals Engaged in BusinessDocument4 pagesMarch 2021 Research On Individuals Engaged in BusinessJewelyn CioconNo ratings yet

- EO 98 - How To Apply TINDocument7 pagesEO 98 - How To Apply TINPeterSalas100% (1)

- BIR RegistrationDocument3 pagesBIR Registrationcara sophiaNo ratings yet

- Bir Atp MemoDocument10 pagesBir Atp Memobge5No ratings yet

- Legal AspectsDocument11 pagesLegal AspectsIsaiah CruzNo ratings yet

- Application For Registration Update - Bureau of Internal RevenueDocument14 pagesApplication For Registration Update - Bureau of Internal RevenueKristarah HernandezNo ratings yet

- 1901 For Self-Employed, Professional, & Single ProprietorshipDocument11 pages1901 For Self-Employed, Professional, & Single ProprietorshipbirtaxinfoNo ratings yet

- Investment Requirements For A Food Truck BusinessDocument10 pagesInvestment Requirements For A Food Truck BusinessYna Paulite100% (1)

- Taxation For Construction IndustryDocument32 pagesTaxation For Construction IndustryFrances Marie TemporalNo ratings yet

- Closure of BusinessDocument9 pagesClosure of BusinessAnonymous uMI5BmNo ratings yet

- BirDocument6 pagesBirbge5No ratings yet

- An Easy Guide To Taxation For Startup EntrepreneursDocument16 pagesAn Easy Guide To Taxation For Startup EntrepreneursChristine P. ToledoNo ratings yet

- Closure and RegistrationDocument3 pagesClosure and RegistrationMa. Roa DellomasNo ratings yet

- Government Accounting ManualDocument10 pagesGovernment Accounting ManualRyan DberkyNo ratings yet

- Taxation Laws - Ms. de CastroDocument54 pagesTaxation Laws - Ms. de CastroCC100% (1)

- POGO licensees BIR clearance requirementsDocument2 pagesPOGO licensees BIR clearance requirementsAceGun'nerNo ratings yet

- Basic Requirements For New Applicants and For Bmbes Applying For Renewal of RegistrationDocument1 pageBasic Requirements For New Applicants and For Bmbes Applying For Renewal of RegistrationReyLouiseNo ratings yet

- Dissolution of A CorporationDocument8 pagesDissolution of A Corporationggsteph100% (1)

- Capital Gains Tax LAW 101Document41 pagesCapital Gains Tax LAW 101Chit ComisoNo ratings yet

- Steps in Registering Sole ProprietorshipDocument5 pagesSteps in Registering Sole ProprietorshipMarjorie Treceñe AlconesNo ratings yet

- BIR Registration GuideDocument2 pagesBIR Registration GuideDanhilson VivoNo ratings yet

- Steps and Requirements For Registering With The BIRDocument2 pagesSteps and Requirements For Registering With The BIRDonita Maigue RocasNo ratings yet

- Application For Closure of BusinessDocument2 pagesApplication For Closure of BusinessallanNo ratings yet

- BIR Registration Requirements for IndividualsDocument19 pagesBIR Registration Requirements for IndividualsKristarah HernandezNo ratings yet

- RMC No 37-2016Document6 pagesRMC No 37-2016sandra100% (1)

- BMBE SeminarDocument60 pagesBMBE SeminarBabyGiant LucasNo ratings yet

- 31.it Ain't Over Till They Say So - cpc.03!27!08Document3 pages31.it Ain't Over Till They Say So - cpc.03!27!08yemaymaNo ratings yet

- Basic Requirements and Procedure in Registering A Sole Proprietor BusinessDocument4 pagesBasic Requirements and Procedure in Registering A Sole Proprietor BusinessAyumi Xuie MontefalcoNo ratings yet

- Registration, Taxation & Accounting Compliance of Construction IndustryDocument52 pagesRegistration, Taxation & Accounting Compliance of Construction IndustryJohn Erick FernandezNo ratings yet

- How To Close A Business in The PhilippinesDocument2 pagesHow To Close A Business in The PhilippinesMary Rose Ann CalambasNo ratings yet

- Application For Closure of BusinessDocument3 pagesApplication For Closure of BusinessNorberto Cercado50% (2)

- Steps in Transfer of TitleDocument2 pagesSteps in Transfer of TitleApril Joy Ortilano- CajiloNo ratings yet

- Closing A Business-DtiDocument4 pagesClosing A Business-DtiSimon WolfNo ratings yet

- For Amo WebinarsDocument79 pagesFor Amo WebinarsLiezl Tizon ColumnasNo ratings yet

- STEP 1: Determine Which Classification You Belong: B. Corporati Ons and PartnershipsDocument4 pagesSTEP 1: Determine Which Classification You Belong: B. Corporati Ons and PartnershipsMaridel Mugot-DuranNo ratings yet

- AMENDED REVENUE REGULATION ON PRIMARY REGISTRATION, UPDATES AND CANCELLATION (39 CHARACTERSDocument127 pagesAMENDED REVENUE REGULATION ON PRIMARY REGISTRATION, UPDATES AND CANCELLATION (39 CHARACTERSDa Yani ChristeeneNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Sol Man - MC VatDocument9 pagesSol Man - MC Vatiamjan_101No ratings yet

- Test 1 - Donor'S Tax Theory: Answer: DDocument11 pagesTest 1 - Donor'S Tax Theory: Answer: DIan Nicole EnriquezNo ratings yet

- Sol Man - MC PTXDocument5 pagesSol Man - MC PTXiamjan_101No ratings yet

- CH 14Document49 pagesCH 14iamjan_101No ratings yet

- Partnership essentials under 40 charsDocument26 pagesPartnership essentials under 40 charskat perezNo ratings yet

- Ampongan Chap 1Document2 pagesAmpongan Chap 1iamjan_101No ratings yet

- Chapter 17 Local TaxDocument4 pagesChapter 17 Local TaxjhienellNo ratings yet

- Chapter 2 - Transfer Taxes and Basic Succession2013Document6 pagesChapter 2 - Transfer Taxes and Basic Succession2013iamjan_10150% (4)

- Sol Man 6Document2 pagesSol Man 6iamjan_101No ratings yet

- Sol Man 10Document3 pagesSol Man 10iamjan_101No ratings yet

- Chapter 1 To 4Document27 pagesChapter 1 To 4Karla Barbacena100% (1)

- Sol Man 7Document7 pagesSol Man 7iamjan_101No ratings yet

- Sol Man 9Document4 pagesSol Man 9iamjan_101No ratings yet

- Business and Transfer Taxation by Valencia and Roxas-Solution ManualDocument4 pagesBusiness and Transfer Taxation by Valencia and Roxas-Solution ManualFiona Manguerra81% (32)

- Chapter 8-1. ProblemsDocument10 pagesChapter 8-1. Problemsiamjan_101No ratings yet

- Chapt 12+Income+Tax+ +corporations2013fDocument15 pagesChapt 12+Income+Tax+ +corporations2013fLouie De La Torre100% (4)

- Chapter 4 discussion questions and problemsDocument4 pagesChapter 4 discussion questions and problemsiamjan_1010% (1)

- Ampongan Chap 4Document1 pageAmpongan Chap 4iamjan_101No ratings yet

- Chapt-6 FB Tax2013fDocument9 pagesChapt-6 FB Tax2013fJhenil U. Lopez100% (2)

- Ampongan Chap 3Document4 pagesAmpongan Chap 3iamjan_101No ratings yet

- Succession and will discussion questionsDocument1 pageSuccession and will discussion questionsiamjan_101No ratings yet

- Chap 1 Gen. Prin 2013Document3 pagesChap 1 Gen. Prin 2013Quennie Jane Siblos100% (6)

- Chapt 7+Dealings+in+Prop2013fDocument15 pagesChapt 7+Dealings+in+Prop2013fMay May100% (3)

- Ampongan Chap 1Document2 pagesAmpongan Chap 1iamjan_101No ratings yet

- Chapt 11+Income+Tax+ +individuals2013fDocument13 pagesChapt 11+Income+Tax+ +individuals2013fiamjan_10180% (15)

- Chap 3 Concepts of Income2013Document8 pagesChap 3 Concepts of Income2013Quennie Jane Siblos100% (1)

- Calculating Trend Percentages for Assets of ABC LtdDocument2 pagesCalculating Trend Percentages for Assets of ABC LtdSaravananSrvnNo ratings yet

- GianforteDocument4 pagesGianforteM Ariful Islam JesunNo ratings yet

- AF301 Final Exam Semester 2, 2014Document8 pagesAF301 Final Exam Semester 2, 2014Anonymous 9dEMgo0No ratings yet

- Trading Strategy: Morning NoteDocument6 pagesTrading Strategy: Morning Notenagaraja h iNo ratings yet

- Membership Interest Purchase AgreementDocument7 pagesMembership Interest Purchase Agreementjth2698No ratings yet

- Investment Analysis and Portfolio Management OutlineDocument6 pagesInvestment Analysis and Portfolio Management OutlineHuan EnNo ratings yet

- Enron PaperDocument24 pagesEnron PaperJoshy_29100% (1)

- C12 - Mutual Funds and ETFDocument40 pagesC12 - Mutual Funds and ETFTrần Minh PhươngNo ratings yet

- Bharati Vidyapeeth Deemed University, Pune: Institute of Management andDocument32 pagesBharati Vidyapeeth Deemed University, Pune: Institute of Management andLainious Rai50% (2)

- Hannans Annual Report 2008Document68 pagesHannans Annual Report 2008Hannans Reward LtdNo ratings yet

- Introduction to Accounting and Bookkeeping ConceptsDocument80 pagesIntroduction to Accounting and Bookkeeping ConceptsCristian RenatusNo ratings yet

- Academic Qualifications: Contact: +91 9163060425 E-Mail: Diveshp2013@email - Iimcal.ac - inDocument1 pageAcademic Qualifications: Contact: +91 9163060425 E-Mail: Diveshp2013@email - Iimcal.ac - insupriyaJNo ratings yet

- Florete vs. Florete (2016)Document2 pagesFlorete vs. Florete (2016)mjpjore60% (5)

- Uy V BuenoDocument6 pagesUy V BuenoMiguelNo ratings yet

- My Trading Diary 2010Document10 pagesMy Trading Diary 2010bokugrahamNo ratings yet

- Bir Form 2307Document2 pagesBir Form 2307Dave Pagara100% (4)

- Pooled Investment ProcessDocument34 pagesPooled Investment ProcessanoopbopteNo ratings yet

- Modes of Collaboration Between Banks and NBFC'sDocument9 pagesModes of Collaboration Between Banks and NBFC'sRami ReddyNo ratings yet

- Glaski v. Bank of America, JP Morgan ChaseDocument29 pagesGlaski v. Bank of America, JP Morgan ChaseMike MaunuNo ratings yet

- Memorandum: Helsinki Capital PartnersDocument34 pagesMemorandum: Helsinki Capital PartnersKhanSameeKhanNo ratings yet

- Kos PembangunanDocument7 pagesKos Pembangunansyenfiq97No ratings yet

- BBDC Elearning PDFDocument100 pagesBBDC Elearning PDFlakshmipathihsr64246100% (1)

- Tax Issues in M A PDFDocument56 pagesTax Issues in M A PDFKhushboo GuptaNo ratings yet

- Bajaj Capital Wealthprenuer Internship InductionDocument15 pagesBajaj Capital Wealthprenuer Internship Inductionharshita khadayteNo ratings yet

- 1 - ch09 Inventory Edit ALTAF Ringkas PDFDocument20 pages1 - ch09 Inventory Edit ALTAF Ringkas PDFRina Agustina ManikNo ratings yet

- 15 - Investments - TheoryDocument8 pages15 - Investments - TheoryROMAR A. PIGANo ratings yet

- Airline Capital Structure: One Parameter in TheDocument26 pagesAirline Capital Structure: One Parameter in Thedavidmarganti100% (1)

- Procedure for Initial Public Offering (IPODocument26 pagesProcedure for Initial Public Offering (IPOShweta GuptaNo ratings yet

- 3 - 1-Asset Liability Management PDFDocument26 pages3 - 1-Asset Liability Management PDFAlaga ZelkanovićNo ratings yet