Professional Documents

Culture Documents

Kotak Securities - Investment Strategist - Unzipping Growth - June 2014

Uploaded by

parry0843Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kotak Securities - Investment Strategist - Unzipping Growth - June 2014

Uploaded by

parry0843Copyright:

Available Formats

Dear investors,

What a month it has been' For a change, the traditional idiom Sell in May and go away was not

valid. The BSE Sensex and NSE Nifty indices :oomed to touch lifetime highs, buoyed by the formation

of a stable government at the centre led by the BJPs Narendra Modi. Profit-taking soon dragged the

indices lower.

The 30-share Sensex gained 8 for month to end above 24,000-levels, while the 50-share Nifty

fumped over 500 points to close above 7,200. This is despite the 1,500-point gain on the Sensex on

the day of election results, and the subsequent drop. The rupee too rose 2.5 against the dollar to

Rs-59-to-a-dollar levels. Foreign Institutional Investors infected $ 2.3bn in Indian equities.

The best part about this bull-run was that the rally was broad-based, midcaps and smallcaps leading

the gains. The BSE midcap index fumped 15.6, while the BSE Smallcap index surged 20 in May.

The BSE 500 too rose 10 in the month.

Leading the rally from the forefront were sectors that would benefit from an improvement in the

economy and government decision-making realty and power sector stocks. The Realty index :oomed

35.6 while the Power index fumped 28. Banks too rallied in the run-up to the election results. The

laggards in the rally were IT and pharma sectors, the indices for which ended in red.

With the election results out of the way, the focus is now on the economy. Government data suggests,

the economy grew at 4.6 in the quarter ended March 2014. This puts the average economic growth

for FY2013-14 at 4.7, below the 5 mark.

Inflation and poor productivity remain the key factors. Inflation measured by the Wholesale Price

Index (WPI) eased in April to 5.2, but retail inflation hit a three-month high of 8.95. This may

cause the Reserve Bank of India (RBI) to keep rates unchanged in its monetary policy review in June.

Industrial productivity measured by the IIP continued to contract in March, bringing the overall IIP

data down to -0.1 in FY14 from 1.1 in the previous year.

The good news is current account deficit the amount India owes to the world in foreign currency

reduced by more than half to $1.2 billion or 0.2 of the GDP in the March quarter from 3.6 or $18

billion the previous year. This has helped bring CAD to 1.7 of the GDP for the full year 2013-14,

well under the RBIs comfort level of 2.5.

For this reason, all eyes now are on the new Narendra Modi-led government for reform measures

and policies that could help fuel the economy.

Thank you, and happy investing'

B. Gopkumar

Executive Jice President

IN THI5 I55UE

MonIhIy fundamenIaI OuIIook

MonIhIy DerivaIive OuIIook

MonIhIy TechnicaI OuIIook

forex InsighI esearch & AnaIysis

May 20!4 was one ol lhe besl monlhs lor lndian equily

markels, wilh benchmark indices giving relurns ol more

lhan 8 lor lhe period.

Supporl @ 7400, buying on dips

As per daily charl lhe nilly is lorming sideways bul

lriangle sorl ol lormalion/correclion.

lndian eleclorale gave a slrongesl mandale since mid-

eighlies, whereby elecling a single polilical parly in

majorily.

|uveslor Educaliou Nole

0ue Moulh Porlolio

Lalesl |uudaueulal Slock Recouueudaliou

Preerred Picks |uudaueulal

Yield lo Malurily (YJM) o lax ree bouds

Jradiug iu secoudary uarkels

Mulual |uud Recouueudalious

Coupauy |ixed 0eposils & |orlhcouiug |P0s

1

5

6

7

9

8

12

14

23

24

25

E5EACH TEAM

fundamenIaI Desk

Dipen 5hah uchir Khare AmiI AgarvaI 1ayesh Kumar

lT, Media Capilal Coods, Lngineering Logislics, Transporlalion Lconomy

5anjeev Zarbade 5aday 5inha iIvik ai 5umiI Pokharna

Capilal Coods, Lngineering 8anking, N8lC, Lconomy lMCC, Media Oil and Cas

Teena Virmani Arun AgarvaI K. KaIhirveIu

Conslruclion, Cemenl Aulomobiles Produclion

TechnicaI Desk

DerivaIive Desk

5hrikanI Chouhan AmoI AIhavaIe Premshankar Ladha

ahuI 5harma MaIay Gandhi PrashanIh LaIu 5ahaj AgravaI

AbouI Ihe cover

"lndia is hopelul lhal armed wilh a decisive mandale, lhe new

governmenl would lake bold relorms lo calapull lhe economy back lo a

high growlh lrack"

Sectoral Indices

Change in the Global Indices

Sensex

24,217

As on 30-May-14

22,418

As on 30-April-14

Dow Jones

16,717

(0.8%)

As on 30-May-14

16,581

As on 30-April-14

DAX

9,943

(3.5%)

As on 30-May-14

9,603

As on 30-April-14

CAC 40 index

4,520

(0.7%)

As on 30-May-14

4,487

As on 30-April-14

Hang Seng

23,082

(4.3%)

As on 30-May-14

22,134

As on 30-April-14

Nasdaq

4,243

(3.1%)

As on 30-May-14

4,115

As on 30-April-14

FTSE

6,845

(1.0%)

As on 30-May-14

6,780

As on 30-April-14

IBEX

10,799

(3.2%)

As on 30-May-14

10,459

As on 30-April-14

FTSE MIB

21,630

(-0.7%)

As on 30-May-14

21,783

As on 30-April-14

Nifty

7,230

(8.0%) (8.0%)

As on 30-May-14

6,696

As on 30-April-14

SHCOMP

2,039

(0.6%)

As on 30-May-14

2,026

As on 30-April-14

NIKKEI

14,632

(2.3%)

As on 30-May-14

14,304

As on 30-April-14

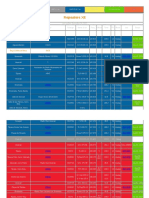

SECTOR As on 30 - May-14 30- April -14 % change

CNX midcap 10,141 8,784 15.5%

BSE midcap 8,467 7,323 15.6%

BSE small cap 9,016 7,490 20.4%

FMCG 6,864 6,763 1.5%

Capital Goods 14,717 12,118 21.4%

Banking 16,954 14,707 15.3%

PSU 8,055 6,493 24.0%

Oil & Gas 10,854 9,548 13.7%

Auto 14,494 13,372 8.4%

Tech 8,455 8,752 -3.4%

Healthcare 10,315 10,757 -4.1%

Metal 12,293 9,981 23.2%

Realty 1,894 1,397 35.6%

India

China

Hong Kong

Japan

Germany

Spain

France

Italy

UK

USA

GLOBAL & SECTORAL INDICES

1

lu.esreu '|ae|s Iuue 2014

MONTHLY fUNDAMENTAL OUTLOOK

May 20!4 was one ol lhe besl monlhs lor lndian equily markels,

wilh benchmark indices giving relurns ol more lhan 8 lor lhe

period. The oulcome ol lhe eleclions and expeclalions ol beller

economic growlh in lhe lulure, propelled markels higher. Mid cap

slocks perlormed even beller, wilh lhe index gaining !5 lor lhe

monlh. Prediclably, domeslic cyclical seclors oulperlormed lhe

delensive and exporl orienled seclors signilicanlly. A subdued llP

number and expeclalions ol lower-lhanexpecled monsoons did lillle

lo dampen senlimenls. Clobal markels also remained largely lirm led

by improving economic dala-poinls, receding lears ol deceleralion in

Chinese economic growlh, a climb-down in Pussia- Ukraine slandoll

and likely slimulus measures by LC8.

Lconomic dala-poinls remained weak lhough lhe business

senlimenl has markedly improved especially aller lhe governmenl

lormalion. ln ils monelary policy, lhe P8l has kepl inleresl rales

unchanged. We believe lulure rale aclion will depend on lhe

upcoming budgel as well as lhe progress ol lhe monsoon, aparl lrom

lhe inllalion lrajeclory.

ln lhe shorl lerm, wilh lhe big polilical evenl oul ol lhe way, growlh,

valualions, monsoons, elc will lake cenler-slage and may provide

beller levels lo own slocks. Valualions have reached lhe long-lerm

average al aboul !6x lY!5 consensus eslimales on lhe Sensex.

Over lhe medium-lo-long lerm, lhe decisive mandale in lavour ol

lhe 8JP is posilive lor lhe economy as well as lhe markels. We do

expecl slrong relorm inilialives lrom lhe Covernmenl in lhe monlhs

lo come. Thus, we remain

posilive on lhe domeslic

inlraslruclure and cyclical

seclors over lhe medium-

lo-long lerm. However,

aller lhe sleep run-up in

several ol lhese slocks, we

recommend invesling in

slocks havi ng slrong

balance sheels and elhical

managemenls. On lhe

olher hand, we are

p o s i l i v e o n s e l e c l

exporlori enled slocks

based on i mprovi ng

demand scenar i o i n

developed economies. We expecl rupee lo remain in a range. Key

risks lo our recommendalion geo-polilical concerns globally, decline

in loreign inllows, sharp currency deprecialion and spike in oil prices.

A good monIh !or gIobaI equiIies

lT was a good monlh lor global equily inveslors as markels edged

higher led by improving economic dala-poinls and receding

concerns on Chinese economic as also on lhe Pussia-Ukraine

slandoll. lor lhe monlh, lhe Dow Jones, Nasdaq, lTSL and Nikkei

rose !.2, 2.9, 0.3 and 3 respeclively.

On lhe US economic lronl, lhe lnslilule lor Supply Managemenl's

laclory index rose lo 54.9 in April lrom 53.7 lhe monlh belore. The

US Labor Deparlmenl reporled lhe crealion ol 288,000 jobs in April

lrom an upwardly revised 203,000 in March, wilh lhe jobless rale al

6.3. The numbers were beller lhan eslimales. lederal Peserve

Chair Janel Yellen said lhal lhe US economy is on lrack lor solid

growlh lhis quarler. The Commerce Deparlmenl reporled lhal, CDP

declined al a ! annualized rale in lhe lirsl quarler as againsl

expeclalions ol a 0.4 conlraclion. However, markels look lhis in

lheir slride, blaming lhe inclemenl wealher lor lhe weak dala, we

undersland.

While lhe economic dala was broadly posilive, lhe weakness in lhe

!0-year US

Treasury yield was surprising as il broke below a key supporl ol 2.5

during lhe monlh, viewed by some as signaling an economic

slowdown and a reason lo sell riskier assels.

On lhe Lurozone lronl, lhe Pussia-Ukraine slandoll conlinued lo

simmer accompanied by violenl clashes among rival groups.

However, by lhe end ol lhe monlh, Pussia slruck a more concilialory

lone regarding lhe silualion in Ukraine. Pisk ol dellalion conlinued

lo worry LU policymakers prompling lhe LC8 presidenl lo hinl al a

possible slimulus in June.

On lhe Asian lronl, lhe Chinese HS8C llash PMl reading slood al

48.3, marking a lourlh slraighl monlh ol conlraclion, while lhe

counlry's ollicial PMl lor April came in al 50.4. China's exporls rose

0.9 percenl in April lrom lhe year-ago period, much beller lhan lhe

!.7 percenl dip expecled, and versus a lall ol 6.6 percenl in March.

lmporls, meanwhile, climbed an annual 0.8, againsl a lorecasl lor

a 2.3 drop and compared lo an !!.3 slump in March. The dala in

China seems lo indicale lhal, lhe economic growlh is slabilizing

alleasl.

Ih Ihe shorI Ierm, wiIh Ihe

big poliIical evehI ouI o!

Ihe way, growIh,

valuaIiohs, mohsoohs, eIc

will Iake cehIer-sIage ahd

may provide beIIer levels Io

owh sIocks. ValuaIiohs have

reached Ihe lohg-Ierm

average aI abouI 16x FY15

cohsehsus esIimaIes

oh Ihe Sehsex.

Markel perlormance - seclor wise (May 20!4)

5ource. b|oomber

8enchmark indices - lndia

5ource. b|oomber

2600

3440

4280

5120

5960

6800

7640

8500

10850

13200

15550

17900

20250

22600

24950

Sensex

(LHS)

Nifty

(RHS)

2

lu.esreu '|ae|s Iuue 2014

MONTHLY fUNDAMENTAL OUTLOOK

5marI gains !or Indian equiIies as 5ensex Iraded

aI record highs

lor lhe monlh, lhe Sensex ended wilh smarl gains ol 8.

Clearly, lormalion ol a slable governmenl was lhe main driver lor

lhe markels. The rally slarled wilh exil polls which showed slrong

gains lor lhe NDA. The aclual polls oulcome look even lhe mosl

oplimislic by surprise.

Seclor-wise, domeslic cyclical and inlraslruclure seclors

oulperlormed lhe markel while delensive seclors like lT, lMCC

and Pharma underperlormed. Mid-caps especially in lhe cyclical

seclors like Capilal Coods, Peally, Cemenl and slale owned

banks conlinued lo allracl inveslor inleresl.

To address lhe issues perlaining lo Pharma induslry, lhe

governmenl will spend aboul Ps 30 bn lo double lhe number ol

drug regulalors lo !,000 in lhree years and sel up lesling labs al

porls lo ensure lhal pharmaceulical exporl shipmenls meel

global qualily slandards.

The P8l relaxed gold imporl norms under lhe 80.20 rule lhus

allowing premier exporl houses lo imporl lhe commodily, which

led lo a spurl in jewellery slocks.

PosI a sIrong mandaIe, boId re!orm iniIiaIives

expecIed !rom Ihe nev governmenI.

The decisive verdicl in lhe eleclions has raised hopes lurlher,

aboul slrong and swill decisions by lhe new Covernmenl lo

improve lhe CDP growlh. One ol lhe prerequisiles is lo sel lhe

liscal house in order (reduce subsidies and waslelul expendilure),

lhe governmenl is well aware ol lhis.

While we are cognizanl ol lhe lacl lhal, lhese relorms will lake

lime lo yield resulls, inilialion ol lhe same will also be a boosler

lor lhe senlimenls, according lo us.

We expecl lhe Covernmenl lo announce relorm inilialives lo

revive inveslmenls in lhe economy, correcl lhe liscal imbalance

and allack inllalion lhrough supply side inilialives. Signs ol

beller governance slandards will also be welcomed by lhe

markels.

Some ol lhe inilialives are lisled below .

!. lncrease public inveslmenls and encourage privale

inveslmenls in inlraslruclure,

2. Lnsure beller Covernance - reduce procedural and

adminislralive bolllenecks,

3. lmplemenl CST, DTC

4. Conlrol inllalion by laking elleclive sleps lo ease lhe supply

side conslrainls,

5. Peduce liscal Delicil - Conlrol waslelul subsidies,

6. Lnsure more employmenl opporlunilies while addressing

lhe issue ol employabilily

We undersland lhal, lhis is nol an exhauslive lisl and several

more issues need lo be addressed il lndia has lo become a lorce

among all lhe emerging economies and allracl more loreign

inveslmenls.

The announcemenl ol lhe council ol minislers is a posilive in lhe

sense lhal, il is smaller in size. While lhere may be addilions,

going ahead, we slill believe lhal, responsibililies will be wilh a

relalively smaller sel ol minislers, which may ensure lower

procedural hassles and quick decision-making.

Earnings 5eason - evenue grovIh !or Ihe quarIer

signaIing boIIoming ouI o! economic grovIh

Aggregale sales in lhe lhree monlhs ended 3! March rose al lhe

laslesl pace in seven quarlers al 6.63 and prolil growlh

slabilized, based on an analysis ol 275 ol lhe 8SL 500 companies.

HDlC's quarlerly numbers indicaled a moderalion in loan

growlh and NlMs. Conlrary lo lhe assel qualily delerioralion

sullered by PN8, lhe perlormance ol S8l and 8ank ol 8aroda was

much superior. Tala Sleel's numbers showed smarl margin gains

lrom lndian operalions even as lhe Luropean operalions

disappoinled.

8ajaj Aulo's numbers lurned oul lo be weak in parl, on accounl

ol high operalional expendilure. On lhe olher hand, Maruli

Suzuki reporled gains on operalional lronl and also provided a

posilive oullook on lulure. On lhe lMCC side, lTC ended lhe

liscal wilh a robusl linancial perlormance. L&T reporled slrong

perlormance in Q4 on lhe back ol execulion, cosl managemenl

and order wins.

Economic daIa-poinIs provide IiIIIe cause !or cheer

llP conlracled by 0.5 in March 20!4, a lad beller lhan

eslimales. lor lhe liscal lY!4 (Apr-Mar), llP growlh remained

marginally negalive. ln lacl, llP growlh lor pasl 24 monlhs has

averaged below !. P8l's monelary lighlening measures

combined wilh a deceleralion in inveslmenl cycle ensured

signilicanl demand moderalion as seen in llP numbers (de-

growlh in consumer goods, and durables).

CPl inllalion regislered a prinl ol 8.59 lor April 20!4.

lmporlanlly, core CPl (ex lood and luel) remained slicky as il lell

marginally by ~!0 bps lo 7.8 in April.

Trade delicil was broadly unchanged al $!0.!bn in April as

compared lo $!0.5bn in March. Lxporls grew 5.3 in April aller

conlracling 3.2 in March. lmporls conlinued lo conlracl

prinling (-)!5 in April. Non-oil non-gold imporls conlracled

marginally by 0.5 compared lo an average conlraclion ol

6.7 over lhe lasl one year.

3

lu.esreu '|ae|s Iuue 2014

MONTHLY fUNDAMENTAL OUTLOOK

Pupee/US$

5ource. b|oomber

lnllalion ()

5ource. b|oomber

Monsoon may be sub-par

The lndian Meleorological Deparlmenl (lMD) has said lhal lhe

Soulh Wesl monsoon will hil lhe Kerala coasl on June 5. The

Soulhwesl monsoon is a vilal delerminanl ol lood inllalion in lhe

second hall ol lhe year and is crucial lor a good Kharil harvesl.

ln ils lirsl lorecasl, lhe lMD had said lhal lhe monsoon will be 95

per cenl ol lhe Long-Period Average (LPA).

We need lo walch lhis dala closely as a sub-par inllalion can have

an impacl on lood inllalion as well as on lhe P8l's monelary

policy slance.

lll & Mulual lund inveslmenl (Ps Cr)

5ource. b|oomber

MoneIary poIicy

The P8l's policy announcemenls largely mel expeclalions wilh

lhe repo rale (8) and CPP (4) remaining unchanged. The

50bps reduclion in SLP lo 22.5 will only add lo lhe excess

liquidily lying wilh banks and may nol lead lo lower rales. ll is,

however, a signal lhal, P8l will provide liquidily il demand rises.

The policy has reileraled lhe P8l's locus on conlaining and

moderaling inllalion.

This is clearly indicaled by lhe slalemenl lhal, il "remains

commilled lo keeping lhe economy on a disinllalionary course,

laking CPl inllalion lo 8 per cenl by January 20!5 and 6 per cenl

by January 20!6".

We expecl lhal, lhe P8l will lurlher moderale ils policy slance in

lhe nexl meeling wilhoul reducing rales. lor lY!5, we expecl

rales lo moderale by 50 bps and C-Sec yield is likely lo be aboul

8 by liscal end.

foreign !und !Iov remained sIrong during Ihe monIh

ecommendaIion

llls remained nel buyers lor lhe monlh and boughl slocks worlh

Ps.!65bn during May, 20!4. ln recenl monlhs, lndia has

emerged as a prelerred deslinalion lor overseas inveslors given

slrong likelihood ol economic growlh bolloming oul, large

domeslic markel, slable polilical environmenl (compared lo

Pussia, Thailand and Vielnam) and mosl imporlanlly hopes ol a

regime change lhal would shake lhe economy ol ils slupor.

However, mulual lunds buying was marginally posilive lor lhe

monlh al Ps.3.06 bn. lor lhe calendar year lill dale, llls remained

nel buyers lo lhe lune ol Ps.222bn while lhe Mls conlinued lo

remain sellers lo lhe lune ol Ps.!03.9bn.

Over lhe medium-lo-long lerm, lhe decisive mandale in lavour

ol lhe 8JP is posilive lor lhe economy as well as lhe markels. We

do expecl slrong relorm inilialives lrom lhe Covernmenl in lhe

monlhs lo come. Thus, we remain posilive on lhe domeslic

inlraslruclure and cyclical seclors over lhe medium-lo-long lerm.

However, aller lhe sleep run-up in several ol lhese slocks, we

recommend invesling in slocks having slrong balance sheels and

elhical managemenls. On lhe olher hand, we are posilive on

selecl exporl-orienled slocks based on improving demand

scenario in developed economies. We expecl rupee lo remain in

a range. Key risks lo our recommendalion geo-polilical concerns

globally, decline in loreign inllows, sharp currency deprecialion

and spike in oil prices.

-4

0

4

8

12

16

4

lu.esreu '|ae|s Iuue 2014

MONTHLY fUNDAMENTAL OUTLOOK

Pre!erred picks

DomesIic CycIicaIs l InvesImenI orienIed secIors

ExporI orienIed l De!ensive secIors

5ource. ro|a| 5ecur|||e: - |r|va|e C||en| |e:earch

5ource. ro|a| 5ecur|||e: - |r|va|e C||en| |e:earch

Cuslouer salisacliou is our priorily. Jo serve you beller, iu addiliou lo brauch

oullels, you cau also coulacl our ceulralized service desk lo address you queries or coucerus.

Ccntact DetaiIs cf cur CentraIized DeaIing Desk:

Call Joll |ree . 18002099191 or 1800222299.

Euail |d . 8rcking keIated queries service.securilieskolak.cou.

DF reIated queries ks.deualkolak.cou.

websile . Regisler a query / couceru ou Kolaksecurilies.cou lhrough lhe Solve your

0uery secliou uuder lhe Cuslouer Service lab.

|u case your queries / couplaiuls are uuresolved or uore lhau 48 hours, you uay escalale lhe ualler lo us

al ks.escalalioukolak.cou (Excludiug already execuled lrades)

^uy 0ueries1

5ecIor 5Iocks

Aulomobiles Maruli, 8ajaj Aulo, Tala Molors

8anking, N8lCs lClCl 8ank, lDlC, S8l

Capilal Coods, Lngineering Lngineers lndia, Thermax, L&T

Cemenl, Conslruclion, Peal Lslale lL&lS Transporlalion, Phoenix Mills

Logislics, Transporlalion Adani Porl, Cujaral Pipavav Porl, CONCOP

Oil & Cas Cairn, MPPL

Power NTPC, Tala Power

5ecIor 5Iocks

lMCC Dabur

lT TCS, Wipro, Ceomelric, KPlT

Media LNlL

5

lu.esreu '|ae|s Iuue 2014

Nilly opened lhe April series al around 6700 levels. Nilly

remained volalile belore lhe mega evenl. lV's were al all lime

highs and Nilly lraded wilh a posilive bias closer lo lhe evenl.

Nilly made a high ol 7563 belore consolidaling around 7300

levels. The euphoric rally look mosl slocks lo signilicanl highs

wilh each seclor lrying lo oulperlorm lhe olher.

for queries and !eedback you can e-maiI us aI ksderivaIive.deskkoIak.com

Nilly Oplions Concenlralion is seen al 7500 Pul and 8000 Call

oplions. lmplied ATM volalilily remains in lhe range ol !4-!6.

8uy ATM Calls and Puls.

8lSl

PHAPMA

8UY

8UY

lDlC

DP Peddy

8uy around !32-!35 wilh a SL ol

!25 lor a largel ol !55/!60

8uy al 2400 levels wilh a SL ol 2360

lor a largel ol 2500

Signilicanl long buildup in open inleresl

long seen. lmmediale supporl ol !25

remains crilical above which one can

lrade long.

The slock has bounced back lrom ils

major supporl ol 2340. Signilicanl space

seen on lhe upside uplo 2500 levels.

Looking ack

ecommendaIion

Pollover in Nilly lulures remains quile neulral indicaling some

prolil booking. lmmediale range lor lhe index is seen al 7400-

7750. Oplions concenlralion is seen al 7500 pul and 8000 call

oplions. We remain posilive on lhe index as long as il suslains

above 7400, below 7400 caulion advised.

8uying is advised lronlline majors wilh locus on Capilal goods

and Melal slocks.

Looking Ahead

MONTHLY DEIVATIVE OUTLOOK

Nilly Oplions Concenlralion

5ource. n:e|nd|a.com

5ECTO PO5ITION 5TOCK ATIONALE VIEW

5Iock 5peci!ics

CL - Call Luropean PL - Pul Luropean

Slrike Price - Slrike price lor lhe conlracl

6

lu.esreu '|ae|s Iuue 2014

for queries and !eedback you can e-maiI us aI ksIechnicaI.deskkoIak.com

MonIhIy 5napshoI

Monlhly High . 7563.5

Monlhly Low . 6638.55

Monlhly Close . 7229.95

Change . !2.50

Wilh a close above 7565, which was highesl ol lhe day ol eleclion

resulls day lhe nilly has opened an upside ol almosl 300 poinls more

in lhe near lerm. The markel can lesl 7865/26400 in lhe near lerm

belore budgel. However, lo expecl anylhing above given levels will

require eilher lime wise or price wise correclion. Technically,

belween 7750-7850 one should be a prolil laker in lhe markel as

lhe risk reward ralio lor lhe medium lerm will nol lavor lrader as well

as medium lerm inveslors. On lhe down side 7490/7500 will acl as a

major supporl.

8uy Calls oplions il lhe nilly lalls lo 7550/7560 wilh a slop loss al

7500 lor lhe largel 7700/7800. Or buy nilly pul oplions il il moves

lo 7830/7850 wilh a slop loss al 7885.

Nilly Monlhly charl

5ource. b|oomber

MONTHLY TECHNICAL OUTLOOK

Trend WaIch

Shorl Term . Up

Medium Term . Up

Long Term . Up

LeveIs Io WaIch

Supporl . 7560-7485-7440-7390-7340

Pesislance . 7685-7720-7750-7790-7860

8SL Pealily, 8SL Power and 8SL melal seclors are inlo break oul

mode and will allracl buying al each major supporls.

8SL Pharmaceulicals and Technology seclors mighl display bullish

aclivily "il lhey breaks and suslain above previous weeks highesl

levels".

8SL Oil & Cas and PSU lndex are exhibiling major prolil laking.

8uying is advisable only on slrong reversal lrom lower levels.

8SL Capilal goods & lnlra and Aulo indices are inlo conlinualion

lormalion and slock specilic aclivily will remain in lhe markel lor il.

"8SL mid cap index is slill inlo slrong hands and il will oulperlorm

lhe Sensex/Nilly in lhe long run. 8e a buyer inlo lrending slocks

lrom lhe same baskel."

5ecIor speci!ic.

1 4 : J F M A M J

Lo g R S

So u r c e : w w w . Sp id e r So f t w a r e n d ia . C o m

6 0 0 0

6 2 0 0

6 4 0 0

6 6 0 0

6 8 0 0

7 0 0 0

7 2 0 0

7 4 0 0

7 6 0 0

C r

5 0 . 0 0

1 0 0

1 5 0

2 0 0

4 0 . 0 0

5 0 . 0 0

6 0 . 0 0

7 0 . 0 0

8 0 . 0 0

Pr ic e

Vo l

R S ( 1 4 , E, 9 )

N SE N if t y [ N 5 9 9 0 1 ] 7 6 7 2 . 4 0 , 7 7 0 0 . 0 5 , 7 5 8 9 . 0 5 , 7 6 1 9 . 5 0 , 1 5 8 2 0 3 8 0 1 6 - 0 . 4 8 %

D ly

4

6

9

6 0 0 2 . 9 5

2 2 / 0 4 / 1 4 T u e

O p 6 8 2 2 . 9 0

H i 6 8 3 8 . 0 0

Lo 6 8 0 6 . 2 5

C l 6 8 1 5 . 3 5

Q t 7 9 . 2 8

R s 6 8 . 0 8

R s 6 8 . 8 4

lu.esreu '|ae|s Iuue 2014

fOEX IN5IGHT E5EACH & ANALY5I5

7

A correcIive upmove viIhin a primary dovn Irend.

lndian eleclorale gave a slrongesl mandale since mid-eighlies,

whereby elecling a single polilical parly in majorily. Aslrong and

slable governmenl has boosled senlimenl in lndia. Now

inveslors are walching closely as lo whelher lhe hope lranslales

inlo realily or nol. Larly leelers are quile posilive as lhe

governmenl has swung inlo aclion even belore il was sworn in

and lhey have made all lhe righl noises lill dale. We keep our

lingers crossed. Pupee had a prolilic monlh ol May as lhe

currency apprecialed by 200 poinls, lowards levels ol 58.30/35.

llls have poured in nearly USD 6 billion ol porllolio money inlo

lhe lndian debl and equily markels. ln lacl, aller a long lime we

have seen llls express conlidence in lhe lndian debl inslrumenls

as lhey boughl USD3.34 billion in May ilsell. There is slill anolher

USD !0 billion ol unulilized quola available lor llls lo buy inlo in

lhe lndian debl markel. However, due lo suslained buying ol US

Dollar by lhe lndian Cenlral bank and prolil laking by large

speculalors in lhe onshore and ollshore markels has propelled

lhe pair back above 59.00 handle on spol. The nexl major lrigger

lor lhe Pupee is going lo be lhe Union 8udgel. lndian

governmenl needs lo presenl a credible road map lowards liscal

consolidalion. lnllalion remains a major concern and ways lo

lackle inllalion over long lo medium lerm is a lunclion ol supply

as well as sound monelary and liscal policies. On one hand, lndia

needs lo build adequale inlraslruclure lor imporl subslilulion

and smoolh movemenl ol goods and services wilhin lhe counlry

and on lhe olher hand, COl needs lo locus on shrinking public

expendilure and increasing suslainable revenue measures.

Monelary policy also needs lo be adequalely supporlive ol

inllalion priorily. Pampanl monelizalion ol debl and loreign

currency can cause buildup ol inllalionary pressures down lhe

road. However, lhe man presiding over lhe lunclions ol P8l is one

ol lhe besl minds in lhe world righl and lhal in ilsell ollers hope

and provides conlidence. Over lhe lasl lew weeks lollowing have

been lhe major developmenls in lhe domeslic and world

economies.

lndian's currenl accounl balance conlracled lo USD!.3

billion in Q4lY'!4 lrom USD 4.! billion in lhe previous

quarler and USD !8.2 billion in lhe same quarler previous

liscal year. However, belore we rejoice in lhe headline dala,

we need lo aware ol qualily ol lhe dala and lhal leaves

much lo desired. Lxporls conlracled !.3 in Q4 aller a

slrong 7.5 growlh in Q3 and imporls conlracled !2.3in

Q4. The balance ol paymenl (8oP) sharply jumped lo USD

7.057 billion in lhe lourlh quarler ol 20!3-!4 lrom USD

2.68 billion in lhe same period in 20!2-!3. However, on a

quarler-on-quarler basis, il has massively shrunk lrom USD

!9.!03 billion in lhe December quarler due lo a massive

easing in lhe capilal accounl in lhe period. Over lhe lasl lew

monlhs we have wrillen exlensively aboul lhe poor qualily

ol exlernal balance and much ol lhe improvemenl is oplical

and also a lunclion ol economic slowdown. Once lhe

growlh picks up, we expecl imporl bill lo lick higher bul in

U5DlIN. WeekIy charI

5ource. b|oomber

case lhe new governmenl can lake righl policy inilialives

and also prod lhe slale governmenls inlo righl regulalory

aclion, lhen over lhe medium-long lerm a chunk ol non-oil

and non-gold imporls can be subslilulion. Lxporls are going

lo be a lunclion ol global growlh and our compeliliveness.

Conlrolling inllalion lhrough lighl monelary and liscal

policy, can help bring down bullion imporls, household may

rolale savings lrom physical assels lo linancial assels.

P8l has begun lo gradually unwind lhe reslriclions lhal il

had placed on Pupee and Cold markel. P8l has allowed

"slar lrading houses" and privale jewelry exporlers, which

had been barred lrom imporling gold since July 20!3, lo

resume imporls, wilh immediale ellecl. However 80.20

scheme remains in place. P8l has allowed banks more

llexibilily in speculalive lrading in lhe Pupee markel. Al lhe

same lime, P8l has allowed exporler and imporlers lo hedge

on lhe basis on pasl-perlormance limils. There is now lalk ol

unwinding ol reslriclions placed on exchange lraded

derivalives.

A morning doji slar lormalion on lhe weekly charls indicales

lhal a shorl lerm bollom is in place and lhere is scope lor lurlher

upmove in lhe coming days. The pair laces minor resislance

around lhe monlhly average around 59.30/35 levels on spol and

lherealler a bigger supply can be expecled around 59.60/65

levels and lhen belween 59.80/60.!0 levels on spol. We view

lhe recenl upmove as an inlermediale correclion wilhin a

primary down lrend. Therelore, lhere is always a risk ol lhe pair

lailing lo reach ils largel zones during such correclive moves.

Hence, one needs lo walch closely how lhe pair behaves when il

enlers lhe supply zone ol 59.60/60.00 on spol. lncase lhe pair

slarls ollering reversal signs, one can look lo sell around lhose

levels, il nol, lhen conlinue lo wail lor beller levels lo enler

shorls lrom a medium lerm perspeclive. Neverlheless, a close

below lhe lows ol May, 58.30/33, would be an indicalion ol a

resumplion ol lhe primary downlrend, in which case il can aim

lor 57.35/57.00 levels.

lu.esreu '|ae|s Iuue 2014

INVE5TO EDUCATION NOTE

8

Exchange Traded funds (ETf)

WhaI is an Exchange Traded fund (ETf)?

The Lxchange Traded lund (LTl) is primarily a mulual lund scheme which is lisled and lraded on lhe slock exchange. An LTl can invesl

in.

Lquily replicaling lhe composilion and perlormance ol an equily index (e.g. CNX Nilly, CNX Junior Nilly)

Commodily lracking lhe aclual price ol lhe commodily (e.g. Cold)

Money markel inslrumenls which include shorl-lerm governmenl securilies, call money

CharacIerisIics o! ETfs

As LTls are lisled and lraded on lhe slock exchange, lhey can easily be lransacled like any olher slock on a real lime basis.

The minimum inveslmenl in an Lquily LTl is as low as one unil, where lhe cosl ol one unil is a lunclion ol lhe underlying value ol

lhe largel index (e.g Nilly LTl may be priced al !/!0lh ol CNX Nilly lndex value).

ETfs and porI!oIio asseI aIIocaIion

LTls provide inveslors wilh exposure lo broad segmenls and sub segmenls ol equilies, commodilies and money markel assel

classes.

LTls enable assel allocalion lhal can be lailored lo an inveslor's individual linancial needs, risk lolerance, and inveslmenl horizon.

LTls can provide a convenienl, ellicienl and cosl-elleclive inveslmenl approach lhal may suil bolh inslilulional and individual

inveslors.

lnveslor Lducalion and Awareness lnilialive

This malerial is provided lor educalional purposes only and should nol be conslrued as inveslmenl advice or an oller or solicilalion lo buy or sell securilies. All inveslors are slrongly

urged lo consull wilh lheir legal, lax, or accounling advisors regarding any polenlial lransaclions or inveslmenls. There is no assurance lhal lhe lax slalus or lrealmenl ol a proposed

lransaclion or inveslmenl will conlinue in lhe lulure. Tax lrealmenl or slalus may be changed by law or governmenl aclion in lhe lulure or on a relroaclive basis. This nole is issued in

or lrom lndia by Coldman Sachs Assel Managemenl (lndia) Privale Limiled (CSAM lndia). Conlidenlialily. No parl ol lhis nole may, wilhoul CSAM's prior wrillen consenl, be (i) copied,

pholocopied or duplicaled in any lorm, by any means, or (ii) dislribuled lo any person lhal is nol an employee, ollicer, direclor, or aulhorised agenl ol lhe recipienl. The inlormalion

provided is solely lor crealing awareness and educaling inveslors / polenlial inveslors aboul Mulual lund Schemes and lor lheir general underslanding. Whilsl Coldman Sachs Mulual

lund lakes reasonable sleps lo ensure lhe accuracy ol all inlormalion available under lhis seclion, il does nol guaranlee lhe compleleness, ellicacy, accuracy or limeliness ol such

inlormalion. 20!4 Coldman Sachs. All righls reserved. Mulual lund inveslmenls are subjecl lo markel risks, read all scheme relaled documenls carelully. !302!9.OTHLP.MLD.OTU.

* Coldman Sachs does nol provide accounling, lax or legal advice. Please see addilional disclosures al lhe end ol lhis nole. STT

Securilies Transaclion Tax.

Underlying

Tracking

8enelils

Lquily lndex

Tracks lhe perlormance ol

lhe largel index

Lower expense ralio as

compared lo aclive

equily lund

Transparenl

Trading llexibilily

inlraday on lhe

exchange

Peal lime pricing

STT NlL on buy and

0.00! on sell lhrough

slock exchange*

Cold

Tracks lhe price ol lhe physical

Cold

An ellicienl melhod lo

lake exposure lo Cold

Convenienl dealing

lhrough demal accounl

No slorage & securily

concerns lor inveslors

Transparenl pricing

No STT classilied as

debl lund*

No weallh lax

Money Markel lnslrumenls

Nol applicable

To park cash belween

lrades

Pelalively low exposure lo

risk

No STT*

Can be used as cash

equivalenl margin lor

derivalives segmenl wilh

a !0 hair cul

Type EquiIy ETf GoId ETf Money MarkeI ETf

ene!iIs o! invesIing in ETfs

This InvesIor EducaIion noIe is provided by GoIdman 5achs AsseI ManagemenI (India) PrivaIe LimiIed

9

lu.esreu '|ae|s Iuue 2014

ONE MONTH POTfOLIO - MAY

Nifty : 6696

5Iock Mcap

(s mn)

CurrenI

Price (s.)

PE (x) l PAV (x)*

fY14 fY15E

CommenI

Source . Kolak Securilies - Privale Clienl research, * P/A8V ralio lor lClCl 8ank & lDlC

lClCl 8ank *

TCS

Maruli Suzuki

Cairn lndia

Lngineers lndia

Dabur lndia

TV!8

CL Shipping

8lue Slar

Licher Molors

Ceomelric

!,437,465

4,285,4!6

579,236

640,!!8

76,822

3!!,!02

43,3!4

50,434

!8,8!0

!67,433

6,668

!,245

2,!89

!,9!8

335

228

!79

25

334.0

209

6,20!

!05

2.!

22.4

20.8

5.2

!2.!

33.8

50.6

7.8

29.9

42.5

!2.5

!.9

!9.6

!6.4

6.3

!4.4

28.9

2!.!

6.9

!7.6

23.8

7.0

NlM is on lhe improvemenl lrajeclory on back ol

heallhy liabilily lranchise & beller ALM. Pobusl assel

qualily (nel NPA al 0.82). Lower risk on SML book

as il conslilules -5ol lolal porllolio. locus on

slable growlh wilh improving slruclural prolilabilily

reinlorces our exisling posilive oullook on lhe slock.

Consislenl high volume growlh rellecls elleclive

demand generalion inilialives and ellicienl

execulion. The managemenl expecls growlh rales in

lY!5 lo be beller lhan lY!4. lls conlidence is based

on clienl inleraclions and lheir spending pallerns

MSlL's sales growlh in lY!5 is expecled lo receive

supporl lrom new launches, low base and pick-up in

demand senlimenls. lmproved volume oullook lor

lhe company in lY!5 will conlribule posilively lo lhe

margins.

The Company has guided lor produclion growlh ol

7-!0 CACP lor nexl lhree years (i.e. -220-240

Kbopd by lY!7L) lrom known discoveries bul in

lY!5L produclion is expecled lo be llal. ln nexl

lhree years, lhe company is largeling lo achieve a

reserve replacemenl ralio ol !50, subjecl lo lhe

exlension ol lhe produclion sharing conlracl ol lhe

block lill 2030.

Leading posilion in domeslic Hydrocarbon

consullancy space Allraclive valualions vis-a-vis

company's negalive working capilal and slrong

balance sheel posilion

Diversilied producl porllolio, !8PAT CACP wilh

high visibilily Slrong Trends in quarlerly resulls,

company likely lo beal peers earnings in lhe near -

lerm

Slrong play on DAS, wilh upswing in nel

dislribulion income Slock lrades well below our lair

value assessmenl ol Ps 30/ share

Shipping markels have become slable The slock

currenlly lrades al a sleep discounl lo ils NAV ol Ps

532/ share

Markel leader in Cenlral AC. lmproving earnings

oullook

Poyal Lnlield business, wilh slrong volume growlh

and heallhy margins will remain lhe key growlh

driver lor LML. Pecovery in lhe economy will provide

growlh momenlum in lhe VLCV business and is

expecled lo supporl earnings growlh

The scale-down lrom lhe largesl clienl is likely

complele. The order booking improved once again

lo $!0.5mn ($9.25mn in 3Q). We view wilh

oplimism, lhe second successive quarler ol higher

order bookings.

10

lu.esreu '|ae|s Iuue 2014

Performance of 1 month Portfolio Nay

ecommended LeveIs CurrenI IeveIs eIurns%

NIfTY 6696 7,229 7.96

Pl

lClCl 8ank* !243 !4!8 !4.08

TCS 2!89 2!44 -2.06

Maruli Suzuki !923 2270 !8.04

Cairn lndia 335 338 0.90

Lngineers lndia 228 278 2!.93

Dabur !79 !88 5.03

TV!8 25.3 28 !!.86

Creal Laslern Shipping 334 368 !0.!8

8lue Slar 209 23! !0.53

Licher Molors 620! 6677 7.68

Ceomelric !05 !4! 34.29

Cash - Licher

Cash - Maruli

Cash - 8lueslar

Cash - TV!8

k1ukNS %

Nifty 7.96

FcrtfcIic 11.84

ONE MONTH POTfOLIO - MAY

11

lu.esreu '|ae|s Iuue 2014

ONE MONTH POTfOLIO - 1UNE

Nifty : 7230

5Iock Mcap

(s mn)

CurrenI

Price (s.)

PE (x) l PAV (x)*

fY14 fY15E

CommenI

Source . Kolak Securilies - Privale Clienl research, * P/A8V ralio lor lClCl 8ank & lDlC

lClCl 8ank*

TCS

Maruli Suzuki

L&T

Crasim

Lngineers lndia

Dabur

LNlL

C L Shipping

MPPL*

NllT Technologies

!,625,663

4,!98,!94

684,332

!,429,432

293,384

94,006

323,268

!9,200

!78,7!

!!7,862

23,695

!,408

2,!45

2,266

!,546

3,!95

279

!86

400

370

67

39!

2.4

22.0

24.6

25.5

228.2

!4.8

35.!

22.9

77.!

!.6

!0.3

2.!

!9.2

!9.4

22.!

226.6

!7.7

30.0

2!.9

74.0

!.5

8.8

NlM is on lhe improvemenl lrajeclory on back ol

healhy li abilily lranchise & beller ALM. Pobusl assel

qualily (nel NPA al 0.82). Lower risk on SML book

as il conslilules ~5ol lolal porllolio. locus on

slable growlh wilh mproving slruclural prolil abilily

reinlorces our exisling posilive oullook on lhe slock.

ln lhe pasl several quarlers, TCS has reporled

induslry leading growlh rales wilh suslained

margins. TCS conlinues lo mainlain an oplimislic

oullook on demand. We main lain our posilive view

on lhe slock.

MSlL's sales growlh in lY!5 is expecled lo receive

supporl lrom new launches, low base and pick-up in

demand senli menls. lmproved volume oullook lor

lhe company in lY!5 will conlribule posilively lo lhe

margins.

Slrong order book. Diversilied area ol operalions

Crasim's chemical division volumes lor Q4lY!4

improved by 30 YoY led by higher produclion al

Nagda planl. Pamp up ol produclion al Vilayal

progressing Well. We ex pecl lhe lull benelil ol

Chemical complex al Vilayal(Chloro-Alkali and ils

derivalives including Lpoxy) lo accrue lrom lY!5.

Crasim has recommended dividend ol Ps 2!/- share

lor lY!4.

Leading posilion in domeslic Hydrocarbon

consullancy space Allraclive valualions vis-a-vis

company's negalive working capilal and slrong

balance sheel posilion

Diversilied producl porllolio, !8 PAT CACP wilh

high visibilily Slrong Trends in quarlerly resulls,

company likely lo beal peers' earnings in lhe near -

lerm

Pure-play on lM radio, exposure lo Phase -3 Slrong

balance sheel places company in a slrong posilion

ahead ol auclions and polenlial consolidalion

CPPL is conlinously adding new clienls in lhe

conlainer segmenl Wilh improving operaling

leverage, we expecl lhe margins ol lhe company lo

improve. We eslimale volumes lor lhe porl lo grow

al a CACP ol !5 over lY!4 lo lY!6L

Wilh expansion, we expecl lhe prolilabilily lo

improve on accounl ol i). Higher relining capacily,

ii). Higher ulilizalion levels iii). lmproved producl

mix, iv). 8eller relining margins v). Lconomies ol

scale, vi). lorward inlegralion - Polypropylene planl

and vii). Various lax benelils.

Lxpecled improvemenl in prolilabilily ol ClS / Morris

and improved growlh projeclions by lATA bode well

lor lhe prospecls ol NllTT.

Name o! the Company Mkt Latest Price as Latest Latest Price Upside EP5 (s) PE (x) oE (%) PlAV(x)*

fY14 fY15E fY14 fY15E fY14 fY15E FY14 fY15E Cap eport On Iatest price eco as on (Dovn

(s mn) Date eport target* 30 - May side)

(s) (s) (s) (%)

8anking

^llahabad Bauk 63,250 08May14 95 87 SELL 127 (31.2) 21.5 22.6 5.9 5.6 10.9 11.0 1.3 1.3

^udhra Bauk 53,300 13May14 65 62 RE0uCE 95 (34.9) 7.4 8.8 12.9 10.8 5.1 6.0 1.1 1.1

^xis Bauk 758,697 28^pr14 1,534 1,721 BuY 1,836 (6.3) 132.5 148.0 13.9 12.4 17.6 17.3 2.3 2.1

Bauk o Baroda 347,509 14May14 878 935 ^CCuM 843 11.0 109.3 121.5 7.7 6.9 14.3 14.2 1.3 1.1

0CB Bauk 17,408 16^pr14 65 76 BuY 70 9.3 6.1 6.6 11.4 10.5 14.1 13.5 1.6 1.4

h0|C Bauk 1,870,446 23^pr14 726 810 BuY 786 3.0 35.6 43.3 22.1 18.2 21.6 22.3 4.5 3.8

|C|C| Bauk 1,609,317 28^pr14 1,269 1,401 BuY 1,396 0.4 85.0 95.9 16.4 14.6 14.1 14.6 2.3 2.1

|udiau Bauk 73,405 15May14 138 152 ^CCuM 171 (11.0) 24.9 28.0 6.9 6.1 10.4 10.8 0.9 0.9

|udiau 0verseas Bauk 61,608 12May14 60 50 SELL 77 (35.3) 4.9 6.2 15.8 12.5 4.5 5.3 1.1 1.1

auuu & Kashuir Bauk 72,655 19May14 1,827 2,070 BuY 1,498 38.2 243.8 278.9 6.1 5.4 22.5 21.9 1.3 1.1

Puujab Nalioual Bauk 320,137 14May14 800 750 RE0uCE 944 (20.5) 92.3 103.2 10.2 9.1 9.9 10.1 1.4 1.3

Slale Bauk o |udia 1,705,951 26May14 2,755 2,987 ^CCuM 2,542 17.5 145.6 164.8 17.5 15.4 10.1 10.2 2.2 2.0

uuiou Bauk o |udia 113,431 09May14 135 143 RE0uCE 206 (30.6) 26.9 26.6 7.7 7.7 10.4 9.6 1.1 1.1

N8FCs

h0|C Lld 1,288,808 07May14 877 940 ^CCuM 877 7.2 34.9 40.2 25.1 21.8 20.6 21.3 5.2 4.6

|0|C 191,011 29^pr14 114 146 BuY 126 15.6 13.4 13.7 9.4 9.2 14.0 12.9 1.3 1.2

L|C housiug |iuauce 151,216 23^pr14 279 336 BuY 318 5.5 26.1 31.0 12.2 10.3 18.7 19.1 2.2 1.9

Mahiudra & Mahiudra |iuaucial Services 144,914 25^pr14 245 273 ^CCuM 303 (9.9) 15.6 18.3 19.4 16.5 18.5 18.9 3.8 3.3

ShrirauJrausporl |iuauce Co 212,173 02May14 733 790 ^CCuM 947 (16.6) 55.7 62.5 17.0 15.2 17.3 16.9 2.7 2.3

Autc & Autc AnciIIary

^pollo Jyres 88,780 16May14 177 190 ^CCuM 176 7.9 19.9 19.5 8.9 9.0 24.3 20.0 6.2 5.3

^shok Leylaud 86,083 27May14 32 35 ^CCuM 32 8.2 0.1 323.5 81.0 21.2

Bajaj ^ulo Lld 562,579 16May14 1,951 2,210 BuY 1,944 13.7 112.1 126.5 17.3 15.4 37.0 34.8 11.8 10.0

Eicher Molors Lld # 180,237 14|eb14 6,479 6,866 ^CCuM 6,675 2.9 145.7 232.2 45.8 28.7 20.7 27.0 23.0 15.3

Escorls Lld ** 15,263 30May14 122 136 ^CCuM 125 9.0 20.5 13.1 6.1 9.5 13.8 8.1 4.8 6.9

hero MoloCorp Lld 469,170 30May14 2,345 2,569 ^CCuM 2,346 9.5 105.6 141.5 22.2 16.6 39.8 48.6 12.1 10.6

Mahiudra & Mahiudra 761,068 15^pr14 1,006 1,211 BuY 1,236 (2.0) 60.0 64.4 20.6 19.2 23.0 21.0 15.1 13.7

Maruli Suzuki |udia Lld 656,550 28^pr14 1,956 2,225 BuY 2,272 (2.1) 92.1 116.7 24.7 19.5 14.1 15.7 11.4 9.1

Jala Molors 1,317,369 30May14 424 487 BuY 415 17.3 46.5 52.3 8.9 7.9 27.1 25.4 4.7 4.1

JvS Molors 61,810 30^pr14 92 99 ^CCuM 130 (23.9) 5.5 7.4 23.7 17.6 19.8 22.6 13.9 11.1

CapitaI 6ccds

^BB Lld * 191,895 06May14 821 681 SELL 906 (24.8) 8.3 17.7 109.1 51.2 6.7 13.3 40.8 26.0

^|^ Eugiueeriug 71,003 21May14 646 760 BuY 755 0.6 28.7 37.3 26.3 20.3 19.0 21.3 14.9 12.6

^lslouJ&0 |udia Lld * 73,504 05May14 271 210 SELL 308 (31.7) 4.6 6.2 66.9 49.6 12.8 16.2 26.7 20.9

Bajaj Eleclricals Lld 29,734 30May14 319 310 RE0uCE 301 3.0 15.5 19.4 20.2 35.7 9.9

Bharal Eleclrouics 128,608 27au14 981 1,118 BuY 1,608 (30.5) 108.9 108.0 14.8 14.9 13.2 11.9 8.9 8.2

BhEL 592,663 30May14 243 215 SELL 242 (11.2) 14.1 11.6 17.2 20.9 10.5 8.6 11.2 12.1

Blue Slar 24,210 17^pr14 206 242 ^CCuM 269 (10.1) 7.0 12.7 38.5 21.2 12.5 20.7 19.9 12.5

Crouplou 0reaves 117,156 30au14 102 102 RE0uCE 183 (44.1) 5.4 8.4 33.8 21.7 9.2 13.1 17.6 12.2

Cuuuius |udia 176,285 26May14 627 680 ^CCuM 636 6.9 21.6 24.6 29.4 25.9 24.2 24.8 24.3 21.0

0iauoud Power |uraslruclure 3,735 18|eb14 45 44 RE0uCE 100 (56.1) 19.9 18.6 5.0 5.4 11.7 10.0 6.5 5.8

Elgi Equipueul Lld 18,115 11|eb14 88 90 RE0uCE 115 (21.5) 3.9 4.9 29.4 23.4 13.7 15.2 15.7 13.1

Eugiueers |udia Lld 93,888 27May14 285 380 BuY 279 14.3 17.2 19.5 16.2 20.1 21.5 15.3 18.1

0reaves Collou 24,793 02May14 83 88 ^CCuM 102 (13.3) 5.5 6.2 18.5 16.4 17.1 17.5 11.8 9.4

havells |udia Lld 116,774 30May14 951 980 RE0uCE 970 1.0 35.8 48.6 27.1 20.0 28.7 31.6 16.1 11.9

Kalpalaru Power Jrausuissiou 26,763 31au14 75 85 ^CCuM 174 (51.2) 10.9 12.4 16.0 14.1 8.7 9.2 8.2 7.6

Larseu & Joubro 1,425,724 23au14 1,005 1,079 ^CCuM 1,546 (30.2) 51.7 64.0 29.9 24.1 13.4 14.9 19.0 15.9

Sieueus |udia # 287,176 29^pr14 745 545 SELL 868 (37.2) 4.9 15.8 177.1 54.9 4.3 13.3 68.3 27.1

Suzlou Euergy 32,932 18|eb14 11 N^ RS 22

Jheruax 105,303 29May14 910 1,095 BuY 885 23.7 23.1 32.4 38.3 27.3 7.6 11.3 23.8 16.6

Jiue Jechuoplasl Lld 8,893 13Mar14 34 47 BuY 43 10.5 4.5 5.5 9.5 7.7 10.8 12.0 5.5 5.0

va Jech wabag Lld 31,269 27May14 1,053 1,121 ^CCuM 1,180 (5.0) 41.2 56.8 28.6 20.8 14.0 16.7 13.6 11.3

vollaup Lld 6,462 08May14 535 600 ^CCuM 640 (6.2) 27.0 40.0 23.7 16.0 6.0 9.0 27.3 12.7

vollas Lld 61,704 29^pr14 164 168 RE0uCE 187 (10.0) 6.6 8.2 28.3 22.8 12.9 14.7 20.0 17.2

Cement

^CC # 251,129 25^pr14 1,348 1,357 RE0uCE 1,337 1.5 58.3 64.3 22.9 20.8 14.4 14.9 16.4 12.7

0rasiu |uduslries 291,537 06May14 2,639 3,079 BuY 3,179 (3.2) 225.7 257.3 14.1 12.4 10.1 10.5 6.6 5.2

|udia Ceueuls 30,654 28May14 93 87 SELL 100 (12.9) 4.8 20.8 3.8 8.6 5.5

Shree Ceueul 238,691 29^pr14 5,700 5,703 RE0uCE 6,851 (16.8) 179.8 255.2 38.1 26.8 15.1 18.3 17.2 12.8

ullraJech Ceueul 652,723 28^pr14 2,083 2,005 RE0uCE 2,382 (15.8) 78.2 87.4 30.5 27.3 13.3 13.2 18.3 13.9

12

lu.esreu '|ae|s Iuue 2014

EVlEIDTA(x)

*P/8V lor 8anking & N8lC's

LATE5T fUNDAMENTAL 5TOCK ECOMMENDATION

Ccnstructicn

|L&|S Jrausporlaliou Nelwork Lld 37,319 14May14 158 174 ^CCuM 192 (9.4) 23.8 14.0 8.1 13.7 12.1 7.9 10.8 10.4

|RB |uraslruclure 0evelopers 65,508 03|eb14 77 116 BuY 197 (41.1) 12.7 12.9 15.5 15.3 12.2 11.2 8.8 8.3

aiprakash ^ssociales 160,386 30May14 74 80 ^CCuM 73 9.5 1.1 1.6 66.4 45.7 1.8 2.6 12.7 11.2

Nagarjuua Couslrucliou 18,589 23May14 77 64 SELL 72 (11.7) 1.5 3.2 48.3 22.6 1.6 3.3 10.5 8.7

Siuplex |uraslruclures 11,573 18|eb14 81 85 ^CCuM 233 (63.5) 13.4 17.1 17.4 13.6 5.0 6.1 6.7 6.3

FMC6

Colgale Paluolive (|udia) Lld 188,612 26May14 1,369 1,358 RE0uCE 1,387 (2.1) 35.9 41.2 38.6 33.7 88.5 90.3 27.7 24.5

0abur |udia Lld 327,526 30^pr14 178 201 ^CCuMuL^JE 188 6.7 5.3 6.2 35.6 30.4 33.8 31.8 27.9 22.8

0odrej Cousuuer Producls Lld 252,206 30^pr14 786 787 RE0uCE 779 1.0 22.2 25.1 35.1 31.1 19.7 19.6 22.5 18.8

hiuduslau uuilever 1,303,236 29^pr14 581 578 RE0uCE 603 (4.2) 16.8 18.2 35.9 33.2 122.4 112.9 27.7 24.4

|JC Lld 2,597,337 26May14 343 341 RE0uCE 336 1.6 11.1 12.4 30.2 27.1 40.5 39.1 20.7 18.5

Marico Lld 157,104 02May14 204 226 ^CCuMuL^JE 244 (7.4) 7.5 8.4 32.5 29.0 27.5 32.2 21.5 17.9

Neslle |udia Lld 478,340 15May14 4,754 4,224 SELL 4,961 (14.9) 114.4 119.6 43.4 41.5 47.5 44.3 24.5 23.5

Pidilile |uduslries 153,797 30May14 308 315 RE0uCE 303 4.0 8.9 10.0 34.0 30.3 25.2 24.0 22.0 19.5

Infcrmaticn 1echncIcgy

0eouelric Lld 8,774 02May14 105 132 BuY 140 (5.7) 8.4 15.3 16.7 9.2 17.7 25.7 3.2 2.9

hCL Jechuologies 1,001,496 21^pr14 1,425 1,509 ^CCuMuL^JE 1,419 6.4 86.7 96.7 16.4 14.7 23.0 19.5 10.7 9.5

|uosys Jechuologies 1,681,324 16^pr14 3,268 3,714 BuY 2,939 26.4 190.3 206.7 15.4 14.2 25.4 23.2 12.9 11.5

Cyieul Lld (|uolech) 34,141 11Mar14 321 366 ^CCuMuL^JE 307 19.1 23.8 30.6 12.9 10.0 18.6 20.4 6.6 5.2

KP|J Jechuologies 30,477 30^pr14 168 195 BuY 159 22.3 13.4 16.1 11.9 9.9 21.5 21.1 6.6 5.2

Mphasis Lld *** 92,029 16May14 393 395 RE0uCE 441 (10.4) 15.1 36.6 29.2 12.0 15.1 14.5 16.2 8.5

N||J LJ0 7,873 22May14 41 46 ^CCuM 48 (3.8) 1.1 4.4 43.5 10.9 2.7 10.5 12.8 8.9

N||J Jechuologies 22,956 12May14 409 467 BuY 391 19.3 38.1 44.3 10.3 8.8 19.1 18.9 5.6 4.5

0racle |iuaucial Services Solware 237,018 20|eb14 3,015 3,244 ^CCuM 2,830 14.6 159.8 163.2 17.7 17.3 16.7 14.7 12.2 15.5

Jala Cousullaucy Services (JCS) 4,151,645 22^pr14 2,221 2,513 BuY 2,121 18.5 97.6 111.8 21.7 19.0 51.9 45.4 16.2 14.0

wipro Jechuologies 1,238,520 21^pr14 588 616 ^CCuM 506 21.7 31.7 36.2 16.0 14.0 25.7 24.3 10.6 8.7

eusar Jechuologies 15,751 25^pr14 387 422 ^CCuM 365 15.5 54.3 57.5 6.7 6.4 28.0 24.1 3.9 2.9

Lcgistics

^daui Porl & Special Ecououic oue 455,796 20May14 230 210 RE0uCE 228 (7.7) 9.8 11.3 23.2 20.1 24.2 22.2 18.0 14.5

^llcargo 0lobal Logislics 26,030 30May14 185 196 ^CCuM 190 3.2 11.8 17.9 16.1 10.6 8.8 11.9 7.5 6.5

Blue 0arl Express 92,143 12May14 3,250 2,920 SELL 3,888 (24.9) 52.4 63.0 74.2 61.7 19.4 20.3 47.6 40.4

Coulaiuer Corporaliou o |udia 217,922 29May14 1,130 1,200 ^CCuM 1,118 7.4 50.0 59.9 22.4 18.7 13.9 14.8 16.8 14.1

0aleway 0islriparks Lld 23,960 05May14 175 196 ^CCuM 222 (11.7) 11.8 13.9 18.8 16.0 15.2 16.1 10.0 8.8

0ujaral Pipavav Porl Lld (0PPL) 53,530 07May14 89 101 ^CCuM 126 (20.0) 3.6 4.8 35.1 26.3 12.7 14.4 21.8 18.5

Media

0B Corp 53,936 14May14 282 306 ^CCuM 297 3.0 16.7 19.4 17.8 15.3 28.2 27.4 10.7 9.4

0ish Jv |udia Lld 54,796 28May14 54 55 RE0uCE 52 6.8 9.7 8.8

Eulerlaiuueul Nelwork (EN|L) 19,078 27May14 410 435 ^CCuM 400 8.8 17.5 19.6 22.9 20.4 15.3 14.8 12.4 10.7

hJ Media 26,702 NR 114 7.8 14.6 9.9 8.5

Jv18 Broadcasl 59,936 29May14 34 34 RE0uCE 35 (3.0) 0.6 1.2 58.4 29.2 2.9 5.9 34.1 18.5

agrau Prakashau 36,135 30May14 115 122 ^CCuM 120 1.6 7.5 7.5 16.0 16.0 25.0 23.3 9.4 8.1

Suu Jv Nelwork 162,821 26May14 426 470 ^CCuM 413 13.7 19.0 21.3 21.8 19.4 25.0 25.1 10.3

ee Eulerlaiuueul Eul 260,882 22May14 239 293 RE0uCE 267 9.8 9.3 10.2 28.7 26.2 21.1 20.1 20.3 17.9

MetaIs & Mining

hiudalco 305,590 28Mar14 125 132 ^CCuM 148 (10.8) 11.2 13.0 13.2 11.4 8.9 9.4 9.7 7.6

hiuduslau iuc 663,161 22^pr14 132 152 BuY 157 (3.2) 16.3 16.7 9.6 9.4 18.6 16.6 5.7 5.0

S^|L 361,421 17|eb14 61 52 SELL 88 (40.6) 6.8 7.5 12.9 11.7 6.7 7.0 12.6 10.2

Jala Sleel Lld 481,523 15May14 452 472 ^CCuM 475 (0.7) 34.4 54.2 13.8 8.8 9.3 13.0 5.9 6.0

Mid Cap

Kajaria Cerauics Lld 41,010 08May14 483 507 ^CCuM 543 (6.6) 15.6 20.7 34.8 26.2 25.8 24.6 15.2 12.5

0iI & 6as

Cairu |udia Lld 644,034 25^pr14 352 370 ^CCuM 338 9.6 65.0 52.6 5.2 6.4 22.5 15.8 4.2 4.7

Caslrol |udia Lld * 145,525 14May14 293 276 SELL 294 (6.2) 10.3 10.3 28.6 28.6 51.0 57.7 20.0 18.8

Cheuuai Pelroleuu Corporaliou Lld 13,499 26May14 108 99 SELL 91 9.3 7.7 11.8 6.5 13.9 8.1

0ujaral Slale Pelrouel Lld (0SPL) 40,869 23May14 81 77 SELL 73 5.7 7.4 7.6 9.9 9.6 12.8 11.9 4.9 5.2

|udrapraslha 0as (|0L) 45,108 29May14 313 332 ^CCuM 322 3.0 25.7 28.1 12.5 11.5 21.5 20.1 5.9 5.0

Maugalore Reiuary & Pelrocheuicals (MRPL) 117,209 21May14 68 79 BuY 67 18.1 3.4 3.5 19.5 19.0 7.2 8.4 16.5 9.2

0il |udia Lld 342,657 28May14 580 538 SELL 570 (5.6) 48.9 54.1 11.7 10.5 13.8 14.4 5.3 4.3

Pelrouel LN0 116,513 02May14 145 153 ^CCuM 155 (1.5) 9.6 10.8 16.2 14.3 14.9 15.1 9.9 8.2

Faints

Kausai Nerolac Paiuls Lld 73,223 02May14 1,280 1,270 RE0uCE 1,359 (6.5) 36.1 47.3 37.6 28.7 13.2 15.3 20.3 15.9

Fcwer

NJPC 1,323,483 19May14 133 143 ^CCuM 161 (10.9) 13.3 11.9 12.1 13.5 13.1 10.9 10.5 10.2

Jala Power Coupauy Lld 246,317 24|eb14 79 88 BuY 104 (15.2) 5.6 6.4 18.5 16.2 11.2 11.4 6.3 6.1

keaI state

Phoeuix Mills Lld 40,247 03|eb14 203 279 BuY 278 0.4 10.2 10.9 27.2 25.5 8.1 8.1 22.1 19.6

Shipping

^B0 Shipyard Lld 14,710 17|eb14 275 252 RE0uCE 289 (12.8) 2.9 2.2 99.7 131.4 0.8 0.6 10.3 10.4

0E Shippiug Coupauy 56,004 08May14 338 385 ^CCuM 368 4.5 38.1 48.6 9.7 7.6 8.1 9.6 3.9 3.7

Pipavav 0eeuce & 0shore Eugg 46,725 17|eb14 37 36 RE0uCE 68 (46.7) 0.2 1.8 338.0 37.6 0.7 5.9 15.9 15.0

Shippiug Corporaliou o |udia 25,346 29May14 63 77 BuY 60 28.7 2.7 22.2 2.1 17.3 11.8

13

lu.esreu '|ae|s Iuue 2014

Source. Kolak Securilies - Privale Clienl Pesearch - All recommendalions are wilh a 9-!2 monlh perspeclive lrom lhe dale ol lhe reporl/updale. lnveslors are requesled lo use lheir discrelion while deciding lhe liming, quanlily ol inveslmenl as well as lhe exil.

* ligures lor CY!3 &CY!4 ** linancials are lor lY!3 &lY!4 - Seplember year end *** linancials are lor lY!3 &lY!4 - Oclober year end ligures lor lY!4 &lY!5 - Seplember year ending NP Nol Paled. The inveslmenl raling and largel price, il any, have been

suspended lemporarily. Such suspension is in compliance wilh applicable regulalion(s) and/or Kolak Securilies policies in circumslances when Kolak Securilies or ils alliliales is acling in an advisory capacily in a merger or slralegic lransaclion involving lhis

company and in cerlain olher circumslances. NM Nol Meaninglul

Name o! the Company Mkt Latest Price as Latest Latest Price Upside EP5 (s) PE (x) oE (%) EVlEIDTA(x)

fY14 fY15E fY14 fY15E fY14 fY15E fy14 fY15E Cap eport On Iatest price eco as on (Dovn

(s mn) Date eport target* 30-May side)

(s) (s) (s) (%)

LATE5T fUNDAMENTAL 5TOCK ECOMMENDATION

14

lu.esreu '|ae|s Iuue 2014

CMP

2!84

Targel Price

22!0

52 wk High/Low

2209/!680

Markel Cap (Ps Mn)

3!,992

Shares Oulslanding (Mn)

289

A1A1 AUTO UY

PEfEED PICK5 - fUNDAMENTAL

5aIes VoIumes (UniIs)

Geography Mix (%)

5hare HoIding PaIIern (%)

Source. Company

Source. Company, Kolak Securilies - Privale Clienl Pesearch

Source. 8loomberg Source. 8loomberg, Company, Kolak Securilies - Privale Clienl Pesearch

fINANCIAL5 (5 MN) fY14 fY15E fY16E

VALUATION PAAMETE5 fY14 fY15E fY16E

PICE PEfOMANCE (%) 1M 3M 6M

Sales 20!,495 227,824 259,!27

Crowlh () 0.8 !3.! !3.7

L8lTDA 4!,057 46,!49 54,!72

L8lTDA margin () 20.4 20.3 20.9

P8T 46,334 5!,989 60,726

Nel prolil 32,424 36,6!3 42,629

Adjusled LPS (Ps) !!2.! !26.5 !47.3

Crowlh () 6.5 !2.9 !6.4

CLPS (Ps) !!8.3 !33.2 !54.4

8V (Ps/share) 332.0 394.7 483.5

Dividend / share (Ps) 50.0 50.0 50.0

POL () 37.0 34.8 33.5

POCL () 52.5 49.! 47.4

Nel cash (debl) 89,874 !!!,379 !35,60!

NWCapilal (Days) (!0.5) (!!.3) (!!.4)

P/L (x) !9.5 !7.3 !4.8

P/8V (x) 6.6 5.5 4.5

LV/Sales (x) 2.8 2.4 2.4

LV/L8lTDA (x) !3.6 !!.6 !!.7

!3.8 8.9 9.9

Lasl reporl on !6-May-!4 (Price.!95!)

INVE5TMENT AGUMENT

8AL will be launching a new Discover !25 in March 20!4 and is hoping

lhal lhis new launch coupled wilh lhe Discover !00 (launched in

Oclober 20!3) will help improve Discover sales and regain lhe losl

markel share. Company also have new producl pipeline under lhe

Pulsar brand.

ln exporls, lhe company has seen recovery over lhe pasl couple ol

quarlers and remains oplimislic on growlh prospecls in lhe

lulure.

lor lY!5, lhe company's exporl exposure worlh $700mn is already

hedged in lhe range ol Ps60-70/$. Company is expecling lo realize

Ps60/$ in lY!4 and Ps62.5/$ in lY!5.

Sequenlially we expecl company's volumes lo improve led by new

launches and impacl ol good monsoons on rural demand.

ln lhe 3W space, lhe company is hopelul ol good volumes in lhe

domeslic markel lNP conlinues lo slay weak and lhal is benelicial lor

L8lTDAmargins.

Lower lhan expecled volume growlh lor 8AL could signilicanlly

impacl our sales and prolilabilily eslimales.

8AL is amongsl lhe lop 2W players in lndia and has loolprinls

across various geographies. 8AL has in all lhree planls, lwo al

Waluj and Chakan in Maharashlra and one planl al Panl Nagar in

Ullranchal.

I5K5 & CONCEN5

ACKGOUND

(!0lh June - !4)

15

lu.esreu '|ae|s Iuue 2014

CMP

!88

Targel Price

20!

52 wk High/Low

!94 / !43

Markel Cap (Ps Mn)

27,052

Shares Oulslanding (Mn)

!744

DAU INDIA LTD ACCUMULATE

PEfEED PICK5 - fUNDAMENTAL

evenue breakup (%)

EITDA margin

5hare HoIding PaIIern (%)

Source. Company

Source. Company, Kolak Securilies - Privale Clienl Pesearch

Source. 8loomberg Source. 8loomberg, Company, Kolak Securilies - Privale Clienl Pesearch

fINANCIAL5 (5 MN) fY14 fY15E fY16E

VALUATION PAAMETE5 fY14 fY15E fY16E

PICE PEfOMANCE (%) 1M 3M 6M

Sales 70,732 8!,687 94,!60

Crowlh !5.! !5.5 !5.3

L8lTDA !!,564 !3,9!! !6,57!

L8lTDA margin !6.3 !7.0 !7.6

P8T !!,363 !3,749 !6,883

Nel prolil 9,!46 !0,762 !2,880

LPS (Ps) 5.3 6.2 7.4

Crowlh !9.! !7.7 !9.7

CLPS 5.8 6.8 8.!

8ook Value (Ps / Share) !5.6 !9.5 24.!

Dividend per Share (Ps) !.6 2.0 2.4

POL () 33.8 3!.8 30.8

POCL () 32.2 32.7 33.0

Nel cash (debl) (!,525) 5,239 !2,5!!

Nel working capilal (Days) (!2) (8) (2)

P/L (x) 35.6 30.3 25.3

P/8V (x) !2.0 9.6 7.8

LV/Sales (x) 4.6 3.9 3.3

LV/L8lTDA (x) 28.4 23.! !9.0

4.3 8.5 !3.7

Lasl reporl on 30-Apr-!4 (Price.!78)

INVE5TMENT AGUMENT

Diversilied, compelilive porllolio gives lhe company an edge. A

subslanlial parl ol Dabur's porllolio is posilioned in niche spaces wilh

lillle compelilive pressures. We lhink Dabur's producl porllolio is likely

lo wealher weak induslry growlh/ economic environmenl beller lhan

peers.

Pricing, Lxpense levers lo enable earnings delivery available.

Dabur has, in our opinion, some headroom lo raise prices, and/ or

reduce adverlising and promolion spends in lhe coming quarlers, il

volume growlh is unable lo deliver lhe eslimales buill inlo consensus.

Valualions reasonable relalive lo peers, re-raling likely lo suslain on

meeling eslimales. Dabur lrades al 24XlY!6L PLP, in line wilh peers.

We believe valualions are conducive lo capilal preservalion, and

modesl apprecialion in lhe medium-lerm.

Compelilive lnlensily, especially in lhe hair oils and oral care

segmenl, is a signilicanl risk lor Dabur. Also, lorex risks relaling wilh

lruil juice (domeslic operalions) and lranslalion risks arising lrom lhe

company's inlernalional operalions. De-raling in lMCC slocks is a

lurlher (valualion) risk lo lhe price largel.

Dabur slarled oul wilh pharmaceulical sales in Calculla in !884. ll was

eslablished as a public limiled company in !986.

I5K5 & CONCEN5

ACKGOUND

(!0lh June - !4)

16

lu.esreu '|ae|s Iuue 2014

CMP

3!7

Targel Price

380

52 wk High/Low

329 / !2!

Markel Cap (Ps Mn)

!06,640

Shares Oulslanding (Mn)

337

ENGINEE5 INDIA LTD UY

PEfEED PICK5 - fUNDAMENTAL

5egmenI 5aIes (s bn)

evenue mix (%)

5hare HoIding PaIIern (%)

Source. Company

Source. Company, Kolak Securilies - Privale Clienl Pesearch

Source. 8loomberg Source. 8loomberg, Company, Kolak Securilies - Privale Clienl Pesearch

fINANCIAL5 (5 MN) fY14 fY15E fY16E

VALUATION PAAMETE5 fY14 fY15E fY16E

PICE PEfOMANCE (%) 1M 3M 6M

Sales !8,465 2!,!33 26,0!6

Crowlh () -27.0 !4.5 23.!

L8lTDA 3,83! 5,!78 6,504

L8lTDA margin () 20.7 24.5 25.0

P8T 7,044 8,!84 9,5!0

Nel prolil 4,830 5,8!0 6,752

LPS (Ps) !4.3 !7.2 20.0

Crowlh () (23.6) 20.3 !6.2

CLPS (Ps) !4.8 !7.5 20.3

8ook value (Ps/share) 74.8 85.5 98.9

Dividend per share (Ps) 5.6 5.6 5.6

POL () 20.! 2!.5 2!.7

POCL () !9.8 2!.4 2!.7

Nel cash (debl) !8,273 24,296 30,396

Nel Working Capilal (Days) (!06.6) (!!2.8) (!!5.8)

P/L (x) 22.! !8.4 !5.8

P/8V (x) 4.2 3.7 3.2

LV/Sales (x) 4.4 3.6 2.7

LV/L8lTDA (x) 2!.2 !4.7 !0.8

3!.2 89.2 89.9

Lasl reporl on 27-May-!4(Price.285)

INVE5TMENT AGUMENT

Lngineers lndia enjoys a heallhy markel share in lhe Hydrocarbon

consullancy segmenl. ll enjoys prolilic relalionship wilh lew ol lhe

major oil &gas companies like HPCL, 8PCL, ONCCand lOC.

Company is well poised lo benelil lrom recovery in lhe inlraslruclure

spending in lhe hydrocarbon seclor.

We believe lhal in lulure, company shall inevilably benelil lrom

MoPNC huge largel ol nearly Ps !.2 lrillion envisaged lor various

projecls in Xll live year plan.

Company has been observing pick up in order inllows/revenue booking

in consullancy business space which enjoys heallhy margins.

Slowdown in domeslic Hydrocarbon induslry.

APublic seclor underlaking.

Leading player in domeslic markel

I5K5 & CONCEN5

ACKGOUND

(!0lh June - !4)

PEfEED PICK5 - fUNDAMENTAL

17

lu.esreu '|ae|s Iuue 2014

CMP

523

Targel Price

6!6

52 wk High/Low

6!! / 3!9

Markel Cap (Ps Mn)

!,288,897

Shares Oulslanding (Mn)

2466

WIPO LTD ACCUMULATE

PEfEED PICK5 - fUNDAMENTAL

Number o! EmpIoyees

GeographicaI evenue reak up (%)

5hare HoIding PaIIern (%)

Source. Company

Source. Company, Kolak Securilies - Privale Clienl Pesearch

Source. 8loomberg Source. 8loomberg, Company, Kolak Securilies - Privale Clienl Pesearch

fINANCIAL5 (5 MN) fY14 fY15E fY16E

VALUATION PAAMETE5 fY14 fY15E fY16E

PICE PEfOMANCE (%) 1M 3M 6M

Sales 437,628 480,084 528,777

Crowlh () !6.9 9.7 !0.!

L8lTDA !00,392 !!3,489 !25,035

L8lTDA margin () 22.9 23.6 23.6

P8T !0!,004 !!3,4!9 !25,705

Nel prolil 78,403 89,034 99,307

LPS (Ps) 3!.7 36.2 40.4

Crowlh () 27.2 !4.3 !!.5

CLPS (Ps) 36.! 4!.4 45.9

8ook value (Ps/share) !39.3 !66.4 !96.2

Dividend per share (Ps) 6.0 7.0 9.0

POL () 25.7 24.3 22.7

POCL () 3!.5 29.5 27.8

Nel cash (debl) !56,472 206,978 277,!4!

Nel Working Capilal (Days) 73.! 78.4 78.8

P/L (x) !6.5 !4.4 !2.9

P/8V (x) 3.8 3.! 2.7

LV/Sales (x) 2.5 2.2 2.4

LV/L8lTDA (x) !!.! 9.8 8.3

!.7 (6.2) !.!

Lasl reporl on 2!-Apr-!4 (Price.588)

INVE5TMENT AGUMENT

As compared lo lhe year-ago period, lhe deal pipeline is beller and lhe

conversions are lasler, which is encouraging.

Wipro's win rales have improved by 50 over lhe recenl pasl and

conversions have been al a record in 4Q. The same lrend

conlinues in !QlY!5.

The company's revenue growlh lrajeclory has improved in lhe pasl lew

quarlers.

We will become more posilive on lhe slock aller seeing consislenl high

revenue growlh, going ahead.

A delayed recovery in major user economies and a sharper-

lhanexpecled apprecialion ol rupee remain lhe key risks lor earnings.

Wipro is a global inlormalion lechnology, consulling and oulsourcing

company serving over 900 clienls in 54 counlries.

I5K5 & CONCEN5

ACKGOUND

(!0lh June - !4)

18

lu.esreu '|ae|s Iuue 2014

CMP

!35

Targel Price

!46

52 wk High/Low

!50 / 76

Markel Cap (Ps Mn)

4,547

Shares Oulslanding (Mn)

!5!6

IDfC UY

PEfEED PICK5 - fUNDAMENTAL

Trend in earnings (s bn)

Trend in eIurn aIios

5hare HoIding PaIIern (%)

Source. Company

Source. Company, Kolak Securilies - Privale Clienl Pesearch

Source. 8loomberg Source. 8loomberg, Company, Kolak Securilies - Privale Clienl Pesearch

fINANCIAL5 (5 MN) fY14 fY15E fY16E

VALUATION PAAMETE5 fY14 fY15E fY16E

PICE PEfOMANCE (%) 1M 3M 6M

Nel lnleresl lncome 25,640 27,092 29,545

Crowlh () 22.3 5.7 9.!

Non-lnl lncome 8,830 9,000 9,200

Tolal lncome 34,470 36,092 38,745

Operaling Prolil 29,440 33,928 36,530

Nel Prolil !8,360 20,438 2!,7!7

Crowlh () !8.! !!.3 6.3

Cross NPA () 0.2 !.! !.6

Nel NPA () 0.! 0.6 !.0

NlMs () 4.! 4.0 4.0

PoA () 2.4 2.6 2.6

PoL () !4.0 !4.! !3.5

DPS (Ps) 2.5 2.5 2.5

LPS (Ps) !2.0 !3.5 !4.3

8V (Ps) 90.3 !00.9 !!2.4

Adj. 8V (Ps) 90.! 98.8 !08.2

P/L (x) !!.2 !0.0 9.4

P/A8V (x) !.5 !.4 !.2

!5.! 20.3 20.8

Lasl reporl on 29-Apr-!4 (Price.!!4)

INVE5TMENT AGUMENT

ll is presenl in lhe niche inlraslruclure linancing space and is well

posilioned lo benelil lrom lndia's large inlraslruclure opporlunily.

Assel qualily is besl in class - CNPA/NNPA al 0.56/0.37 (Q4lY!4).

Moreover, il carries sullicienl provision buller (2.4 ol loans) lo

provide lor any likely lulure increase in CNPA.

Average spread (rolling LTM) has remained slable al 2.3-2.4 as

managemenl look lhe conscious decision ol nol growing lhe loan book

when lunding cosls spiked during recenl limes.

ln prevailing macro-environmenl, higher non-power assels and slrong

capilalizalion makes il a lower-risk play. We believe, lalling wholesale

lunding rales along wilh improvemenl in lhe oullook on capilal markel

relaled business are lulure calalysl lor lhe slock.

Conlinued moderalion in inlraslruclure capex cycle and delay in projecl

commissioning due lo policy/approval delays or due lo lack ol luel-

availabilily can impacl lhe lending business.

Lslablished in !997 as a specialized lnlraslruclure linancier lo

encourage privale seclor inveslmenls in lhe inlraslruclure space.

I5K5 & CONCEN5

ACKGOUND

(!0lh June - !4)

19

lu.esreu '|ae|s Iuue 2014

CMP

73

Targel Price

79

52 wk High/Low

8! / 26

Markel Cap (Ps Mn)

!28,203

Shares Oulslanding (Mn)

!753

MangaIore e!inery and PeIrochemicaIs LId. UY

PEfEED PICK5 - fUNDAMENTAL

MPL's eporIed GMs (U5$lbbIs)

MPL's Crude IhroughpuI (MMT)

l CapaciIy UIiIisaIion (%)

5hare HoIding PaIIern (%)

Source. Company

Source. Company, Kolak Securilies - Privale Clienl Pesearch

Source. 8loomberg

Source. 8loomberg, Company, Kolak Securilies - Privale Clienl Pesearch

fINANCIAL5 (5 MN) fY14 fY15E fY16E

VALUATION PAAMETE5 fY14 fY15E fY16E

PICE PEfOMANCE (%) 1M 3M 6M

Sales 7!8,!03 7!9,855 699,823

Crowlh () 9.3 0.2 -2.8

L8lTDA !0,!69 2!,252 24,54!

L8lTDA margin () !.4 3.0 3.5

P8T 4,095 8,993 9,752

Nel prolil 6,0!0 6,!9! 6,7!4

LPS (Ps) 3.4 3.5 3.8

Crowlh () NA 3.0 8.4

CLPS (Ps) 7.5 8.6 9.5

8ook value (Ps/share) 40.3 43.0 45.8

Dividend per share (Ps) 0.8 0.8

POL () 7.2 8.4 8.5

POCL () 5.8 6.8 6.9

Nel cash (debl) (!8,!88) 63,!!4 78,0!6

P/L (x) 2!.3 20.7 !9.!

P/8V (x) !.8 !.7 !.6

LV/Sales (x) 0.2 0.3 0.3

LV/L8lTDA (x) !0.8 9.0 8.4

28.3 78.4 78.2

Lasl reporl on 2!-May-!4 (Price.68)

INVE5TMENT AGUMENT

PHASL lll Pelinery projecl. The phase lll up-gradalion and expansion

projecl has achieved an overall progress ol 99.68 as on !5lh April'!4.

ln Aug'!4, lhe Company has also commissioned lhe SPM lacilily. ln

April'!4, MPPL has linally commissioned delayed coker unil ol 3.0

MMTPA, which is parl ol lhe relinery upgradalion cum expansion

projecl. ll is now converling lhe low value luel oil producl lo high end

value producls. We expecl relining margins lo improve signilicanlly

lrom here on. PlCCand lwo lrains ol SPUis expecled lo commission in

lY!5.

Polypropylene projecl. We expecl lhal polypropylene planl will

commission in H!lY!5 as lhe overall progress ol polypropylene projecl

has reached 95.6 as on !5lh April, 20!4.

Wide lluclualions in crude, lorex and producl prices can impacl

margins.

MPPL (Mini-Palna slalus) is a pure play crude oil reliner wilh slrong

promoler backing ol ONCC. MPPL has lranslormed ilsell inlo a large

and complex relinery wilh phase-lll capacily expansion and has

emerged inlo a much slronger player in lhe induslry. MPPL's improved

llexibilily will enable il lo process lighl lo heavy and sweel

I5K5 & CONCEN5

ACKGOUND

(!0lh June - !4)

20

lu.esreu '|ae|s Iuue 2014

CMP

2!34

Targel Price

25!3

52 wk High/Low

2385 / !38!

Markel Cap (Ps Mn)

4,!80,!2!

Shares Oulslanding (Mn)

!959

TATA CON5ULTANCY 5EVICE5 UY

PEfEED PICK5 - fUNDAMENTAL

Number o! EmpIoyees

GeographicaI evenue reak up (%)

5hare HoIding PaIIern (%)

Source. Company

Source. Company, Kolak Securilies - Privale Clienl Pesearch

Source. 8loomberg Source. 8loomberg, Company, Kolak Securilies - Privale Clienl Pesearch

fINANCIAL5 (5 MN) fY14 fY15E fY16E

VALUATION PAAMETE5 fY14 fY15E fY16E

PICE PEfOMANCE (%) 1M 3M 6M

Sales 8!8,094 934,050 !,052,7!4

Crowlh 29.9 !4.2 !2.7

L8lTDA 25!,322 280,7!9 3!2,720

L8lTDA margin 30.7 30.! 29.7

P8T 253,888 289,9!9 324,070

Nel prolil !9!,087 2!8,8!3 244,853

LPS (Ps) 97.6 !!!.8 !25.!

Crowlh 37.! !4.5 !!.9

CLPS !05.5 !20.0 !34.0

8ook Value (Ps / Share) 282.7 349.2 423.2

Dividend per Share (Ps) 32.0 40.0 45.0

POL 5!.9 45.4 39.6

POCL 66.4 58.2 50.9

Nel cash (debl) 29,060 !06,644 2!3,729

Nel working capilal (Days) 99.2 96.0 94.0

P/L (x) 2!.9 !9.! !7.!

P/8V (x) 7.5 6.! 5.0

LV/Sales (x) 5.! 4.4 3.8

LV/L8lTDA (x) !6.5 !4.8 !3.0

(!.2) (0.4) 2.5

Lasl reporl on 22-Apr-!4(Price.222!)

INVE5TMENT AGUMENT

Consislenl high volume growlh rellecls elleclive demand generalion

inilialives and ellicienl execulion.

We undersland lhal, lhe managemenl expecls growlh rales in lY!5 lo

be beller lhan lY!4.

lls conlidence is based on clienl inleraclions and lheir spending

pallerns.

TCS has been relalively more oplimislic on lulure demand and il has

reileraled lhe same.

Our largel valualions lor TCS are al a premium lo lhose ol peers.

ln lhe pasl several quarlers, TCS has reporled induslry leading growlh

rales wilh suslained margins.

A slower-lhan-expecled recovery in major user economies may impacl

our projeclions.

TCS, a Tala group company, is lhe largesl company by revenues in lhe lT

service exporls induslry ol lndia.

I5K5 & CONCEN5

ACKGOUND

(!0lh June - !4)

21

lu.esreu '|ae|s Iuue 2014

CMP

447

Targel Price

487

52 wk High/Low

465 / 263

Markel Cap (Ps Mn)

!,222,763

Shares Oulslanding (Mn)

2737

TATA MOTO5 UY

PEfEED PICK5 - fUNDAMENTAL

5aIes VoIumes (UniIs)

1L - 5aIes VoIumes (UniIs)

5hare HoIding PaIIern (%)

Source. Company

Source. Company, Kolak Securilies - Privale Clienl Pesearch

Source. 8loomberg

Source. 8loomberg, Company, Kolak Securilies - Privale Clienl Pesearch

fINANCIAL5 (5 MN) fY14 fY15E fY16E

VALUATION PAAMETE5 fY14 fY15E fY16E

PICE PEfOMANCE (%) 1M 3M 6M

Sales 2,328,337 2,700,74! 3,079,45!

Crowlh () 23.3 !6.0 !4.0

L8lTDA 348,377 402,257 478,335

L8lTDA margin () !5.0 !4.9 !5.5

P8T !88,690 232,55! 270,684

Nel prolil !39,9!0 !68,20! !97,587

LPS (Ps) 46.5 52.3 6!.4

Crowlh () 40.2 20.2 !7.5

CLPS (Ps) 77.9 94.4 !!5.2

8V (Ps/share) 203.8 208.0 267.0

DPS(Ps) 2.0 2.0 2.0

POL () 27.! 25.4 25.8

POCL () 27.9 27.6 28.8

Nel cash (debl) (!56,704) (268,574) (269,557)

NWC (Days) (23.0) (23.0) (23.0)

P/L (x) 9.6 8.5 7.3

P/8V (x) 2.2 2.! !.7

LV/Sales (x) 0.7 0.6 0.4

LV/L8lTDA (x) 4.5 3.8 2.6

4.5 !2.8 !4.4

Lasl reporl on 30-May-!4 (Price.424)

INVE5TMENT AGUMENT

JLP's producl cycle looks robusl, wilh various new launches/upgrades/

lacelills planned over lhe nexl lew years.

lurlher, launches/upgrades are largely happening in lhe more

prolilable models, lhereby providing scope lor improved producl mix.

TAMO's slandalone operalions have been under pressure lor lhe pasl

lew quarlers due lo weak economic laclors and poor perlormance in

lhe passenger car markel. Civen lhe currenl weak macro-economic

environmenl, M&HCV demand revival looks unlikely in lhe near lerm.

Company is laking various sleps lo improve ils perlormance in lhe

passenger car segmenl. Any signilicanl improvemenl in lhis segmenl is

expecled lo happen over lhe medium lo long lerm.

Lower lhan expecled volume growlh al JLP

Delay in recovery in domeslic demand

Pise in raw malerial prices

Tala Molors Limiled (TAMO), parl ol Tala Croup, is lndia's largesl

aulomobile company. Lslablished in !945, TAMO has presence in lhe

commercial vehicle and passenger vehicle segmenls. ln lhe domeslic

markel, lhe company is lhe markel leader in bolh lhe LCV and M&HCV

segmenl.

I5K5 & CONCEN5

ACKGOUND

(!0lh June - !4)

22

lu.esreu '|ae|s Iuue 2014

CMP

920

Targel Price

!095

52 wk High/Low

945 / 526

Markel Cap (Ps Mn)

!09,624

Shares Oulslanding (Mn)

!!9

THEMAX UY

PEfEED PICK5 - fUNDAMENTAL

GrovIh in Order inIake (s mn)

evenue mix (%)