Professional Documents

Culture Documents

Protacio v. Laya Mananghaya

Uploaded by

Irish Asilo Pineda0 ratings0% found this document useful (0 votes)

628 views4 pagesLAW

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLAW

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

628 views4 pagesProtacio v. Laya Mananghaya

Uploaded by

Irish Asilo PinedaLAW

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

(Management Prerogative)

G.R. No. 168654 March 25, 2009

ZAYBER JOHN B. PROTACIO, Petitioner, vs. LAYA MANANGHAYA & CO. and/or MARIO MANANGHAYA,

Respondents

TINGA, J.:

FACTS:

Respondent KPMG Mananghaya & Co. hired petitioner Zayber John B. Protacio as Tax Manager in 1996.

He was subsequently promoted as Senior Tax Manager then as Tax Principal in 1 October 1997.

However, petitioner resigned effective 30 September 1999. On 1 December 1999, petitioner sent a

letter to responded firm demanding the immediate payment of his 13

th

month pay, the cash

commutation of his leave credits and the issuance of his 1999 Certificate of Income Tax Withheld on

Compensation. He sent two more demand letters for the payment of his reimbursement claims under

pain of a legal action.

Respondent firm failed to act upon the demand letters. Thus, on 15 December 1999, petitioner filed

before the NLRC a complaint for the non-issuance of petitioners W-2 tax form for 1999 and the non-

payment of the following benefits: 1) cash equivalent of petitioners leave credits in the amount of

P55,467.60; 2) proportionate 13

th

month pay for 1999; 3) reimbursement claims of P19,012; and 4) lump

sum pay for the FY 1999 of P674,756.7. He also sought moral and exemplary damages and attorneys

fees.

During the pendency of the case, respondent firm on three occasions sent check payments to petitioner

in the following amounts: 1) P17,250 13

th

month pay; 2) P54,824.18 cash equivalent of his leave credits

and reimbursement claims; and 3) P10,762.57 refund of taxes withheld on his vacation leave credits.

Petitioner acknowledged the receipt of the 13

th

month pay but disputed the computation of the cash

value of his vacation leave credits and reimbursement claims.

The Labor Arbiter rendered a decision, ordering respondent to pay complainant the following: P12,681

reimbursement claims; P28,407.08 for underpayment of cash equivalent of the unused leave credits;

P573,000 year-end lump sum payment for 1999, and; 10% of total judgment awards way of attorneys

fees.

The Labor Arbiter held that the respondent firm had erroneously based the computation of the cash

equivalent of the leave credits on a basic pay of P61,000. He held that evidence showed that petitioners

monthly basic salary was P95,000 inclusive of the other benefits that were deemed included and

integrated in the basic salary and that respondent firm had computed petitioners 13

th

month pay based

on a monthly basic pay of P95,000, thus the cash commutation of the leave credits should also be based

on this figure.

The Labor Arbiter also ruled that petitioner was entitled to a year-end payment of P573,000 on the basis

of the company policy of granting yearly lump sum payments to petitioner during all the years of service

and that respondent firm had failed to give petitioner the same benefit for 1999 without any

explanation.

Respondent firm appealed to the NLRC which rendered a judgment affirming its earlier ruling with the

modification that complainant is only entitled to receive P2,301 as reimbursement claims. The award of

P12,681 was set aside for lack of basis while affirming the findings on the issues of lump sum payments

and cash equivalents of leave credits. After being denied by NLRC its petition for reconsideration,

respondent elevated the matter to the Court of Appeals.

The CA further reduced total money award to petitioner to P2,301 for reimbursement claims,

P9,8012.83 for underpayment of cash equivalent of unused leave credits, and P10,000 attorneys fees.

With respect to the award of the year-end lump sum, the CA held that while the lump sum payment

which petitioner was entitled, the payment thereof was contingent upon the financial position of the

firm. Petitioner brought the matter to the Supreme Court.

ISSUE:

Whether or not petitioner is entitled to the year-end lump sum as part of his compensation package.

RULING:

The evidence on record establishes that aside from the basic monthly compensation, petitioner received

a yearly lump sum amount during the first two years of his employment, with payments made to him

after the annual net incomes of the firm had been determined. Thus, the amounts thereof varied and

were dependent on the firms cash position and financial performance. In one of the letters of

Mananghaya to petitioner, the amount was referred to as petitioners share in the incentive

compensation program.

While the amount was drawn from the annual net income of the firm, the distribution to non-partners

of employees of the firm was not a profit-sharing arrangement contrary to CAs finding. The payment to

non-partners like the petitioner was discretionary on the part of the chairman and managing chairman

coming from their authority to fix compensation of any employee based on a share in the partnerships

net income. The distribution being merely discretionary, the year-end lump sum payment may properly

be considered as a year-end bonus or incentive. Contrary to petitioners claim, the granting of the year-

end lump sum amount was payable only after the firms annual net income and cash position were

determined.

A bonus is a gratuity, or act of liberality of the giver. It is something given in addition to what is

ordinarily received by or strictly due the recipient. A bonus is granted and paid to an employee for his

industry and loyalty which contributed to the success of the employers business and made possible the

realization of profits. Generally, a bonus is not a demandable and enforceable obligation. It is so only

when it is made part of the wage or salary or compensation. When considered as part of the

compensation and therefore demandable and enforceable, the amount is usually fixed. If the amount

would be dependent upon the realization of profits, the bonus is also not demandable and enforceable.

Thus, petitioners claim that the year-end lump sum represented the balance of his total compensation

package is incorrect. The fact remains that the amount paid to petitioner on the two occasions varied

and were always dependent upon the firms financial position.

In Philippine Duplicators, Inc. v. NLRC, the Court held that if the bonus is paid only if profits are realized

or a certain amount of productivity achieved, it cannot be considered part of wages. Only when the

employer promises and agrees to give without any conditions imposed for its payment, does the bonus

become part of the wage.

The granting of the bonus is basically a management prerogative which cannot be enforced upon the

employer who may not be obliged to assume the onerous burden of granting bonuses or other benefits

aside from the employees basic salaries or wages. Respondents had consistently maintained that

petitioner was not entitled to the bonus as a matter of right. The payment of the year-end lump sum

bonus based upon the firms productivity or the individual performance of tis employees was well within

respondent firms prerogative. Thus, respondent was also justified in declining to give the bonus to

petitioner on account of the latters unsatisfactory performance. The granting of the year-end lump sum

bonus was discretionary and conditional, thus, petitioner may not question the basis for the granting of

a mere privilege.

The monthly compensation of P71,250 used as base figure by the CA is totally without basis. As correctly

held by the Labor Arbiter and the NLRC, the evidence on record reveals that petitioner was receiving a

monthly compensation of P95,000 consisting of a basic salary of P61,000, advance incentive pay of

P15,000, transportation allowance of P15,000, and representation allowance of P4,000, totalling to

P95,000 and are all deemed part of petitioners monthly compensation package, and as such, should be

the basis in the cash commutation of his leave credits. These allowances were customarily furnished by

respondent firm and regularly received by the petitioner on top of the basic monthly pay of P61,000.

Moreover, respondent firms act of paying petitioner a 13

th

month pay at the rate of P95,000 was as

admission that petitioners basic monthly salary was P95,000.

The Court was also perplexed on the use of the CA, the Labor Arbiter and the NLRC of a 30-working day

divisor instead of 26 days which petitioner insists and which even the respondent firm used in the cash

commutation of leave credits. The reliance of CA on Section 2, Rule IV, Book III of the Implementing

Rules of Labor Code in using the 30-day working divisor is inapplicable to the instant case because it

referred to the computation of holiday pay for monthly-paid employees.

Thus, with a monthly compensation of P95,000 and using a 26-working day divisor, petitioners daily

rate is P3,653.85. Based on this rate, petitioners cash equivalent of his leave credits of 23.5 is

P85,865.48. Since he has already received the amount of P46,009.67, a balance of P39,855.80 remains

payable to petitioner.

Wherefore, the instant petition for review on certiorari is partly granted. The Decision of the CA is

affirmed with the modification that respondents are liable for the underpayment of the cash equivalent

of petitioners leave credits in the amount of P39,855.80.

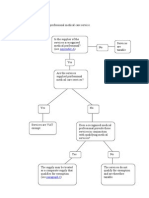

Protacio KPMG LA NLRC CA SC

13

TH

mo-pay P71,250 (based

on P95K rate)

Cash equivalent of

leave credits (23.5)

55,467.6 54,824.18 (of

w/c P46,009.67

cash equiv. of

leave credits)

10,762.57

(refund)

28,407.08

(95K/30days x

23.5-

46,009.67)

Affirmed

LA

9,802.83

(71,250/30 day-

divisorx23.5-

46,009.67)

39,855.8 (95K/26

days x 23.5 =

85,865.48-

46,009.67)

Reimbursement

claims

19,012.0 12,681 2,301 Affirmed NLRC Affirmed CA

Year-end lump sum 674,756.7 X 573,000 Affirmed

LA

X Affirmed CA

Exemplary damages/

Atty.s fees

10% of total

award

10K Affirmed CA

You might also like

- Diamond Farms employer statusDocument2 pagesDiamond Farms employer statusCamille GrandeNo ratings yet

- ER-EE Relationship in Yamaha Mechanic CaseDocument2 pagesER-EE Relationship in Yamaha Mechanic CaseKrizzia GojarNo ratings yet

- Insurance Law Key ConceptsDocument5 pagesInsurance Law Key ConceptsMarc GelacioNo ratings yet

- Medical Jurisprudence 2013 SyllabusDocument13 pagesMedical Jurisprudence 2013 SyllabusEdlyn Favorito RomeroNo ratings yet

- Ramirez Vs PolysonDocument2 pagesRamirez Vs PolysonRoland OliquinoNo ratings yet

- Gibbs vs. CIR and CTA rules on prescription of tax claimsDocument2 pagesGibbs vs. CIR and CTA rules on prescription of tax claimsIrish Asilo PinedaNo ratings yet

- Abbott Laboratories VS AlcarazDocument1 pageAbbott Laboratories VS AlcarazMay ChanNo ratings yet

- 174 Master Iron Labor Union V NLRC (TIGLAO)Document2 pages174 Master Iron Labor Union V NLRC (TIGLAO)Angelo TiglaoNo ratings yet

- ETPI's obligation to grant bonusesDocument3 pagesETPI's obligation to grant bonuseslovesresearchNo ratings yet

- Financial Statement AnalysisDocument79 pagesFinancial Statement Analysissrinivas68No ratings yet

- Hippocratic OathDocument1 pageHippocratic OathkaliyasaNo ratings yet

- On-Balance Volume (OBV) DefinitionDocument11 pagesOn-Balance Volume (OBV) Definitionselozok1No ratings yet

- Future Generali India: IND-0208352-01-R-1Document2 pagesFuture Generali India: IND-0208352-01-R-1SamaNo ratings yet

- Wage Distortion Case DigestDocument2 pagesWage Distortion Case Digestmilleran100% (1)

- American Wire & Cable Daily Rated Employees Union v. American Wire & Cable Co and Court of AppealsDocument2 pagesAmerican Wire & Cable Daily Rated Employees Union v. American Wire & Cable Co and Court of AppealsFoxtrot Alpha100% (1)

- Rules On DNA EvidenceDocument2 pagesRules On DNA EvidenceNilsy YnzonNo ratings yet

- Reyes Vs NLRCDocument2 pagesReyes Vs NLRCBenitez GheroldNo ratings yet

- 5.6.a Philippine Duplicators, Inc VS NLRCDocument2 pages5.6.a Philippine Duplicators, Inc VS NLRCRochelle Othin Odsinada Marqueses100% (1)

- 988 Del Rio Vs DPODocument1 page988 Del Rio Vs DPOerica pejiNo ratings yet

- Tryco Employees' Transfer DisputeDocument10 pagesTryco Employees' Transfer DisputeArah Salas PalacNo ratings yet

- Metro Bank vs. NLRC DigestDocument2 pagesMetro Bank vs. NLRC DigestChantal Evanne CastañedaNo ratings yet

- Norkis Trading V GniloDocument2 pagesNorkis Trading V GniloIrish Asilo PinedaNo ratings yet

- Francisco V NLRCDocument3 pagesFrancisco V NLRCEmmanuel OrtegaNo ratings yet

- Chavez vs NLRC G.R. No. 146530Document2 pagesChavez vs NLRC G.R. No. 146530Lizzy LiezelNo ratings yet

- Hacienda Bino v. CuencaDocument3 pagesHacienda Bino v. CuencaPretzel TsangNo ratings yet

- PBCOM Vs NLRCDocument3 pagesPBCOM Vs NLRCmamp05100% (1)

- 100 Jisscor Independent Union v. Torres (Villarama)Document1 page100 Jisscor Independent Union v. Torres (Villarama)Binkee VillaramaNo ratings yet

- Pollo Vs DavidDocument4 pagesPollo Vs DavidIrish Asilo PinedaNo ratings yet

- Iran Vs NLRCDocument2 pagesIran Vs NLRCSuho KimNo ratings yet

- National Sugar Refineries Corporation vs. NLRC on Supervisory Employees' BenefitsDocument2 pagesNational Sugar Refineries Corporation vs. NLRC on Supervisory Employees' BenefitsAlexylle Garsula de ConcepcionNo ratings yet

- PCI AUTOMATION CENTER, INC. vs. NLRCDocument3 pagesPCI AUTOMATION CENTER, INC. vs. NLRCJomarco SantosNo ratings yet

- TENAZAS Vs R Villegas TaxiDocument2 pagesTENAZAS Vs R Villegas TaxiJanet Tal-udan100% (2)

- Meralco v NLRC - Indirect Employer Solidary LiabilityDocument3 pagesMeralco v NLRC - Indirect Employer Solidary LiabilityPeter Joshua Ortega100% (1)

- 12 Swedish Match Philippines Inc. vs. The Treasurer of The City of ManilaDocument2 pages12 Swedish Match Philippines Inc. vs. The Treasurer of The City of ManilaIrene Mae GomosNo ratings yet

- Caong Vs RegualosDocument5 pagesCaong Vs RegualosIrish Asilo PinedaNo ratings yet

- Philippine Duplicators V NLRCDocument2 pagesPhilippine Duplicators V NLRCKatrina Janine Cabanos-ArceloNo ratings yet

- JRC vs NLRC ruling on holiday pay for hourly paid facultyDocument1 pageJRC vs NLRC ruling on holiday pay for hourly paid facultypja_14No ratings yet

- P.I. Manufacturing v. P.I. Manufacturing UnionDocument2 pagesP.I. Manufacturing v. P.I. Manufacturing UnionTeff QuibodNo ratings yet

- Manila Electric Company Vs Quisumbing 2000Document3 pagesManila Electric Company Vs Quisumbing 2000Gillian Caye Geniza Briones100% (2)

- Sampaguita+Garments+Corp+v+NLRC+ +digestDocument2 pagesSampaguita+Garments+Corp+v+NLRC+ +digestJay KobNo ratings yet

- Penaranda vs. Baganga Plywood CorpDocument2 pagesPenaranda vs. Baganga Plywood CorpZaira Gem GonzalesNo ratings yet

- Universal Corn Products v NLRC | Christmas Bonus Dispute ResolvedDocument2 pagesUniversal Corn Products v NLRC | Christmas Bonus Dispute ResolvedglainarvacanNo ratings yet

- General Milling vs. ViajarDocument3 pagesGeneral Milling vs. ViajarIrish Asilo Pineda100% (2)

- Union of Filipro Employees v. VivarDocument2 pagesUnion of Filipro Employees v. Vivaronlineonrandomdays60% (5)

- Hanjin V IbanezDocument2 pagesHanjin V IbanezJoshua Pielago100% (1)

- Moises de Leon vs. NLRC DigestDocument2 pagesMoises de Leon vs. NLRC DigestKarla Marxielle GulanesNo ratings yet

- #Toyota Motor Phils. v. NLRCDocument5 pages#Toyota Motor Phils. v. NLRCKareen BaucanNo ratings yet

- 12 Meteoro at Al Vs Creative Creatures IncDocument5 pages12 Meteoro at Al Vs Creative Creatures IncBryne BoishNo ratings yet

- Oman Issues Executive Regulations for Income Tax LawDocument44 pagesOman Issues Executive Regulations for Income Tax LawavineroNo ratings yet

- Royal Plant Union Vs Coca ColaDocument1 pageRoyal Plant Union Vs Coca Colapja_14100% (1)

- Framanlis Farms v. Hon Minister of Labor RedigestedDocument2 pagesFramanlis Farms v. Hon Minister of Labor RedigestedMarichu Castillo Hernandez100% (1)

- 02 Archilles V NLRC (Tiglao)Document2 pages02 Archilles V NLRC (Tiglao)Angelo TiglaoNo ratings yet

- 28 San Miguel Brewery Sales Force Union (PTGWO) V OpleDocument1 page28 San Miguel Brewery Sales Force Union (PTGWO) V OplePaolo Miguel Arquero100% (1)

- Acuña vs CA (2006) Ruling on Overseas Workers' ClaimsDocument2 pagesAcuña vs CA (2006) Ruling on Overseas Workers' ClaimsGui Esh100% (1)

- 150 Trans-Asia v. NLRCDocument2 pages150 Trans-Asia v. NLRCIldefonso HernaezNo ratings yet

- Temic Automotive Phils. vs. Temic Automotive Phils. Inc. Employee Union-FFWDocument2 pagesTemic Automotive Phils. vs. Temic Automotive Phils. Inc. Employee Union-FFWtalla aldover100% (4)

- Norkis Trading V BuenavistaDocument2 pagesNorkis Trading V BuenavistaPatrick To100% (1)

- RENATO REAL, Petitioner, SANGU PHILIPPINES, INC. And/ or KIICHI ABE, RespondentsDocument2 pagesRENATO REAL, Petitioner, SANGU PHILIPPINES, INC. And/ or KIICHI ABE, Respondentsjed_sindaNo ratings yet

- Chapter 08 Auditor's Legal LiabilityDocument20 pagesChapter 08 Auditor's Legal LiabilityRichard de LeonNo ratings yet

- Coca Cola Bottlers Phil vs. Del VillarDocument1 pageCoca Cola Bottlers Phil vs. Del VillarPrincess M. SantiagoNo ratings yet

- Meralco Vs NLRCDocument2 pagesMeralco Vs NLRCDyan LazoNo ratings yet

- Aklan Electric Cooperative Incorporated v. NLRCDocument2 pagesAklan Electric Cooperative Incorporated v. NLRCheinnah100% (2)

- Fonterra Brands v. Largado & EstrelladoDocument4 pagesFonterra Brands v. Largado & EstrelladoBananaNo ratings yet

- Jaguar Security's cross-claim against client Delta MillingDocument3 pagesJaguar Security's cross-claim against client Delta Millingnoonalaw100% (1)

- Chavez V NLRCDocument2 pagesChavez V NLRCFayda Cariaga100% (2)

- Manila Memorial Park Vs Ezard LluzDocument4 pagesManila Memorial Park Vs Ezard LluzJMANo ratings yet

- Court rules workers entitled to SSS coverageDocument1 pageCourt rules workers entitled to SSS coverageanjbonifacioNo ratings yet

- Echo 2000 Commercial Corp V Obrero-Filipino Echo-2000 DigestDocument2 pagesEcho 2000 Commercial Corp V Obrero-Filipino Echo-2000 DigestJhuneNo ratings yet

- Arica Vs NLRC DigestDocument1 pageArica Vs NLRC DigestPaolo Adalem0% (1)

- LRTA V Bienvenido CarlosDocument3 pagesLRTA V Bienvenido CarlosYaneeza MacapadoNo ratings yet

- A Soriano Aviation Vs Employees AssociationDocument3 pagesA Soriano Aviation Vs Employees AssociationRon AceroNo ratings yet

- SC rules tailors paid by results entitled holiday payDocument1 pageSC rules tailors paid by results entitled holiday payVanya Klarika Nuque100% (1)

- Union vs. VivarDocument2 pagesUnion vs. VivarKê MilanNo ratings yet

- Protacio v. KPMG (Revised)Document3 pagesProtacio v. KPMG (Revised)Nin BritanucciNo ratings yet

- 2012 Labor Relations CasesDocument147 pages2012 Labor Relations CasesVin BautistaNo ratings yet

- LyricsDocument9 pagesLyricsIrish Asilo PinedaNo ratings yet

- Consti 2 - Finals ReviewerDocument28 pagesConsti 2 - Finals ReviewerIrish Asilo PinedaNo ratings yet

- Santiago A. Del Rosario, Et Al., vs. Honorable Alfredo Bengzon, G.R. No. 88265, December 21, 1989Document7 pagesSantiago A. Del Rosario, Et Al., vs. Honorable Alfredo Bengzon, G.R. No. 88265, December 21, 1989Irish Asilo PinedaNo ratings yet

- Labor Stadards Report - Sec. 14, 15, 16Document7 pagesLabor Stadards Report - Sec. 14, 15, 16Irish Asilo PinedaNo ratings yet

- R.A. 10590 - Oversees Voting Act of 2013Document5 pagesR.A. 10590 - Oversees Voting Act of 2013Irish Asilo PinedaNo ratings yet

- Labor Stadards Report - Sec. 14, 15, 16Document7 pagesLabor Stadards Report - Sec. 14, 15, 16Irish Asilo PinedaNo ratings yet

- Garcia-Rueda vs. Pascasio, G.R. No. 118141, September 5, 1997Document7 pagesGarcia-Rueda vs. Pascasio, G.R. No. 118141, September 5, 1997Irish Asilo PinedaNo ratings yet

- Chapter 14 Market DevelopmentDocument30 pagesChapter 14 Market Developmentپایگاه اطلاع رسانی صنعتNo ratings yet

- Code of Ethics Medical ProfessionDocument8 pagesCode of Ethics Medical ProfessionAustin CharlesNo ratings yet

- Lright To Refuse TreatmentDocument7 pagesLright To Refuse TreatmentSam de la CruzNo ratings yet

- Bill of Rights ConstitutionDocument3 pagesBill of Rights ConstitutionSam de la CruzNo ratings yet

- Republic Act No 8344Document6 pagesRepublic Act No 8344Sam de la CruzNo ratings yet

- 8 Arco Metal Vs SamahanDocument7 pages8 Arco Metal Vs SamahanIrish Asilo PinedaNo ratings yet

- Elmer Vs Rural BankDocument1 pageElmer Vs Rural BankIrish Asilo PinedaNo ratings yet

- Labor Law Non-Diminution of Benefits. (T) He Principle Against Diminution of Benefits Is Applicable OnlyDocument2 pagesLabor Law Non-Diminution of Benefits. (T) He Principle Against Diminution of Benefits Is Applicable OnlyIrish Asilo PinedaNo ratings yet

- LyricsDocument9 pagesLyricsIrish Asilo PinedaNo ratings yet

- BISIGDocument2 pagesBISIGIrish Asilo PinedaNo ratings yet

- Oblicon Codal ReviewerDocument9 pagesOblicon Codal ReviewerLoris Marriel VillarNo ratings yet

- Ipra LawDocument9 pagesIpra LawIrish Asilo PinedaNo ratings yet

- Medical Services AppendixcDocument1 pageMedical Services AppendixcIrish Asilo PinedaNo ratings yet

- 4 Vergara Vs Coca ColaDocument7 pages4 Vergara Vs Coca ColaaiceljoyNo ratings yet

- MAS-06 Operational BudgetingDocument7 pagesMAS-06 Operational BudgetingKrizza MaeNo ratings yet

- Alluvial Capital Management Q2 2021 Letter To PartnersDocument8 pagesAlluvial Capital Management Q2 2021 Letter To Partnersl chanNo ratings yet

- Teamwork For Ibl1201Document16 pagesTeamwork For Ibl1201Thanh Phat Nguyen MyNo ratings yet

- Diminishing MusharakahDocument45 pagesDiminishing MusharakahIbn Bashir Ar-Raisi0% (1)

- MIS Closing - SAPDocument4 pagesMIS Closing - SAPcasantosh8No ratings yet

- UG BCom Pages DeletedDocument22 pagesUG BCom Pages DeletedVijeta SinghNo ratings yet

- La Demanda Contra Loma NegraDocument30 pagesLa Demanda Contra Loma NegraGuillermo Pereira PoizónNo ratings yet

- Past ExamDocument11 pagesPast Exammohamed.shaban2533No ratings yet

- TPA Deals Only With Immovable Property'Document17 pagesTPA Deals Only With Immovable Property'Prachi Verma0% (1)

- Effectiveness of Monetary Policy in Algeria (2000-2015Document16 pagesEffectiveness of Monetary Policy in Algeria (2000-2015zaka ricoseNo ratings yet

- Indebted Isko: Philippine CollegianDocument12 pagesIndebted Isko: Philippine CollegianPhilippine CollegianNo ratings yet

- Mahusay Acc227 Module 4Document4 pagesMahusay Acc227 Module 4Jeth MahusayNo ratings yet

- Conceptual Framework and Accounting Standards: College of Business Administration Final Examination in (ACCN03B)Document4 pagesConceptual Framework and Accounting Standards: College of Business Administration Final Examination in (ACCN03B)Gianna Gracelyn G GeronimoNo ratings yet

- Keynesian is-LM ModelDocument45 pagesKeynesian is-LM ModelNorsurianaNo ratings yet

- Sentença ACP 0800224-44 - 2013 - 8 - 01 - 0001Document120 pagesSentença ACP 0800224-44 - 2013 - 8 - 01 - 0001IsaacBenevidesNo ratings yet

- Macondray & Co. vs EustaquioDocument6 pagesMacondray & Co. vs EustaquioGericah RodriguezNo ratings yet

- PRINCIPLES OF APPRAISAL PRACTICE AND CODE OF ETHICSDocument20 pagesPRINCIPLES OF APPRAISAL PRACTICE AND CODE OF ETHICSnaren_3456No ratings yet

- Account Determination MM en USDocument81 pagesAccount Determination MM en USkamal_dipNo ratings yet

- Blank IM DraftDocument37 pagesBlank IM DraftSachinNo ratings yet

- Problem Set5 KeyDocument7 pagesProblem Set5 Keygorski29No ratings yet

- Own Mock QualiDocument10 pagesOwn Mock QualiDarwin John SantosNo ratings yet

- Trend Analysis Balance SheetDocument4 pagesTrend Analysis Balance Sheetrohit_indiaNo ratings yet

- Financial Markets Seminar 2 ExercisesDocument2 pagesFinancial Markets Seminar 2 Exercises小廷No ratings yet