Professional Documents

Culture Documents

Best Company, Inc.: LASE 1.4

Uploaded by

davidwijaya1986Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Best Company, Inc.: LASE 1.4

Uploaded by

davidwijaya1986Copyright:

Available Formats

LASE 1.

4

ZZZZ BEST

COMPANY, INC.

On May 19, 1987, a short article in The Wall Street Journal reported that ZZZZ Best

Company, Inc., of Reseda, California, had signed a contract for a $13.8 million in-

surance restoration project. This project was just the most recent of a series of

large restoration jobs obtained by ZZZZ Best (pronounced zee best) Company.

Locatedin the SanFernando Valley of southernCalifornia, ZZZZ Best had begun

operations in the fall of 1982 as a small, door-to-door carpet cleaning operation.

Under the direction of Barry Minkow, the ambitious sixteen-year-old who

founded the company and initially operated it out of his parents garage, ZZZZ

Best experienced explosive growth in both revenues and profits during the first

several years of its existence. In the three-year period from 1984 to 1987, the com-

panys net income surged from less than $200,000 to more than $5 millionon reve-

nues of $50 million.

When ZZZZ Best went public in 1986, Minkow and several of his close associ-

ates became multimillionaires overnight. By the late spring of 1987, Minkows

stock in the company had a market value exceeding $100 million, and the total

market value of ZZZZ Best surpassed $200 million. The youngest chief executive

officer in the nation~enjoyed the good life, which included an elaborate home in

an exclusive suburb of Los Angeles and a fire-engine red Ferrari. Minkows

charm and entrepreneurial genius made him a sought-after commodity on the

television talk show circuit and caused the print and visual media to tout him as

an example of what Americas youth could attain if they would only apply them-

selves. During an appearance on The Oprah Winfrey Show in April 1987, Minkow

exhorted his peers with evangelistic zeal to Think big, be big and encouraged

them to adopt his personal motto, The sky is the limit.

Less than two years after his appearance on The Oprah Winfrey Show, Barry

Minkow began serving a twenty-five-year prison sentence. Tried and convicted

on fifty-seven counts of securities fraud, Minkow had been exposed as a fast-

talking con artist who bilked his closest friends and Wall Street out of millions of

dollars. Federal prosecutors estimate that, at a minimum, Minkow cost investors

and creditors $100 million. The company that Minkow founded was, in fact, an

elaborate Ponzi scheme. The reportedprofits of the firm were nonexistent and the

Al

SECTION ONE COMPREI~ENSIvE CASES

huge restoration contracts, imaginary. As one journalist reported, rather than

building a corporation, Minkow constructed a hologram of a corporation. In July

1987, just three months after the companys stock had reached a market value of

$220 million, an auction of its assets netted only $62,000. -

Unlike most financial frauds, the ZZZZ Best scam was perpetrated under the

watchful eye of the Securities and Exchange Commission (SEC). The scrutiny of

the SEC. one of the largest Wall Street brokerage houses, a large and reputable

West Coast law firm that served as the companys general counsel, and an inter-

national public accounting firm had failed to uncover Minkows daring scheme.

Ultimately, the persistence of an indignant homemaker who had been bilked out

of a few hundred dollars by ZZZZ Best resulted in Minkow being exposed as a

fraud.

How a teenage flimflam artist could make a mockery of the complex regula-

tory structure that oversees the U.S. securities markets was the central question

posed by a congressional subcommittee that investigated the ZZZZ Best debacle.

Representative John D. Dingell, chairman of the U.S. House Committee on

Energy and Commerce, pointed out, The ZZZZ Best prospectus told the public

that revenues and earnings from insurance restoration contracts were skyrocket-

ing but did not reveal that the contracts were completely fictitious. Where were

the independent auditors and the others that are paid to alert the public to fraud

and deceit?

1 Like many other daring financial frauds, the ZZZZ Best scandal

caused Congress to reexamine and modify the maze of rules that regulate finan-

cial reporting and serve as the foundation of the U.S. system of corporate over-

sight. However, Daniel Akst, a reporter for The Wall Street Journal who played a

large role in exposing Minkow, suggests that another ZZZZ Best is inevitable:

Changing the accounting rules and securities laws will help, but every now and

then a Barry Minkow will come along, and ZZZZ Best will happen again. Such

frauds are in the natural order of things, I suspect, as old and enduring as human

needs.2

THE EARLY HISTORY OF ZZZZ BEST COMPANY

Barry Minkow was introduced to the carpet cleaning industry at the age of twelve

by his mother, who helped make ends meet by working as a telephone solicitor

for a small carpet cleaning firm. Although the great majority of companies in the

carpet cleaning industry are legitimate, the nature of the business attracts a dis-

proportionate number of seedy characters. There are essentially no barriers to

entry: no licensing requirements, no apprenticeships to be served, and only a

minimal amount of start-up capital needed. A sixteen-year-old youth with a dri-

vers license can easily become what industry insiders refer to as a rug sucker,

which is exactly what Minkow did whenhe founded ZZZZ Best Company.

1 . This and all subsequent quotations, unless indicated otherwise, were taken from the follow-

ing source: U.S. Congress, House, Subcommittee on Oversight and Investigations of the

Committee on Energy and Commerce, Failure of ZZZZ Best Co. (Washington, D.C.: U.S.

Government Printing Office, 1988).

2. D. Akst, Wonder Boy, Barry MinkowThe Kid Who Swindled Wall Street (New York: Scribner,

1990), 271.

Minkow quickly recognized that carpet cleaning was a difficult way to earn a

livelihood. The ease of entry into the field meant that cutthroat competition was

prevalent within the industry. Customer complaints, bad checks, and nagging

vendors demanding payment complicated the young entrepreneurs life. Within

months of striking out on his own, Minkow faced the ultimate nemesis of the

small businessperson: a shortage of working capital. Because of his age and the

fact that ZZZZ Best was only marginally profitable, local banks refused to loan

him money. Ever resourceful, the brassy teenager came up with his own innova-

tive ways to finance his business: check kiting, credit card forgeries, and the stag-

ing of thefts to fleece his insurance company. Minkows age and personal charm

allowed him to escape relatively unscathed from his earlybrushes with the law

that resulted from his creative financing methods. The ease with which the sys-

tem could be beaten encouraged him to exploit it on a broader scale.

Throughout his short business career, Minkow realized the benefits of having

an extensive social network of friends and acquaintances. Many of these relation-

ships he developed and cultivated at a swanky Los Angeles health club. Soon

after becoming a friend of Tom Padgett, an insurance claims adjuster, Minkow de-

vised a scheme to exploit that friendship. Minkow promised to pay Padgett $100

per week if he would simply confirm over the telephone to banks and any other

interested third parties that Minkows company was the recipiefit of occasional

insurance restoration contracts. Ostensibly, these contracts had been obtained by

Minkow to clean and do minor remodeling work on properties damaged by fire,

storms, or other catastrophes. The gullible Padgett was led to believe that the sole

purpose of such confirmations was to allow Minkow to circumvent much of the

bureaucratic red tape in the insurance industry.

From this beginning, theZZ Best fraud blossomed. Initially, the insurance

restoration work, which was totally fictitious, was a small sideline that Minkow

used to generate paper profits and revenues to convince bankers to loan him

money. Minkows phony financial statements served their purpose, and he ex-

panded his operations by opening several carpet cleaning outlets across the San

Fernando Valley Minkow soon realized that there was no need to tie his future to

the cutthroat carpet cleaning industry when he could literally dictate the size and

profitability of his insurance restoration business.Within a short period of time,

insurance restoration, rather than carpet cleaning, became the major source of

revenue appearing on the ZZZZ Best income statements.

Minkows the sky is the limit philosophy drove him tobe evenmore innova-

tive. The charming young entrepreneur began using his phony financial state-

ments to entice wealthy individuals in his ever-expanding social network to

invest in ZZZZ Best. Eventually, Minkow recognized that the ultimate scam

would be to take his company public, a move that would allow him to tap the

bank accounts of investors nationwide.

GOING PUBLIC WITH ZZZZ BEST

The decision to take ZZZZ Best public meant that Minkow no longer was able

to completely control his firms financial disclosures. Registering with the SEC

required auditors, investment bankers, and outside attorneys to peruse the

ZZZZ Best financial statements. Federal securities laws impose a due diligence

SECTION ONE COMPREHENSIVE CASES

obligation on these parties; that is, under the federal securities laws, parties asso-

ciated with a securities registration statement must attempt to determine that the

information therein is materially accurate. ZZZZBest was first subjected to afull-

scope independent audit of its financial statements for the twelve months ~ended

April 30, 1986. George Greenspan, the sole practitioner who performed that audit,

confirmed the existence of ZZZZ Bests major insurance restoration contracts by

contacting Tom Padgett, the principal officer of Interstate Appraisal Services,

which reportedly contracted the jobs out toZZZZ Best. By this time, Padgett was

an active and willing participant in Minkows fraudulent schemes. Minkow had

established Interstate Appraisal Services and Assured Property Management for

the sole purpose of generatingfake insurance restoration contracts for ZZZZ Best.

According to Greenspans testimony before the congressional subcommittee

that investigated the ZZZZ Best scandal, he not only confirmed the existence of

the insurance restoration jobs but also obtained and reviewed copies of all key

documents regarding those jobs. In addition, Greenspan performed various ana-

lytical procedures to determine that the companys key financial ratios were in

line with industry averages. However, Greenspan did not inspect any of the in-

surance restoration sites. The congressional subcommittee was surprised, if not

alarmed, that he had not personally visited at least a few of the job sites.

CONGRESSMAN LENT: Mr. Greenspan, I am interested in the SEC Form 5-1 that

ZZZZ Best Company filed with the SEC. . . . You say in that report that you

made your examination in accordance with generally accepted auditing stan-

dards and accordingly included such tests of the accounting records and other

auditing procedures as we consider necessary in the circumstances. . . . You

dont say in that statement that you made any personal on-site inspections.

MR. GREENSPAN: Its not required. Sometimes you do; sometimes you dont. I

was satisfied that thesejobs existed and I was satisfied from at least six differ-

ent sources, including payment for the job. What could you want better than

that?

CONGRESSMAN LENT: Your position is that you are an honest and reputable ac-

countant.

MR. GREENSPAN: Yes, sir.

C O N G R E S S M A N LENT: You were as much a victim as some of the investors in this

company?

MR. GREENSPAN: I was a victim all right.... I am as much aghast as anyone. And

every night I sit down and say, why didnt I detect this damned fraud.

RETENTION OF ERNST & WHINNEY BY ZZZZ BEST

Shortly after Greenspan completed his audit of ZZ.ZZ Bests April 30, 1986, fi-

nancial statements, Minkow dismissed him and retained Ernst & Whinney to per-

form the following years audit. Apparently, ZZZZ Bests investment broker

requested that Minkow obtain a Big Eight accounting firm to enhance the credi-

bility of the companys financial statements. About the same time, and for the

same reason, Minkow retained a high-profile Los Angeles law firm to represent

ZZZZ Best as its legal counsel.

CASE 1.4 Z~ BEST COMPANY, INC.

The congressional subcommittee asked Greenspan what information he pro-

vided to Ernst & Whinney regarding his former client. In particular, the subcom-

mittee was interested in whether Greenspan had discussed the insurance

restoration contracts with the new auditors.

CONGRESSMAN WYDEN: Mr. Greenspan, in September 1986, Ernst & Whinney

came on as the new independent accountant for ZZZZ Best. What did you

communicate to Ernst & Whinney with respect to the restoration contracts?

MR. GREENSPAN: Nothing. I didthere was nothing because they never got in

touch withme. Its protocol for the new accountant to get in touchwith the old

accountant. They never got in touch with me, and its still a mystery to me.

Representatives of Ernst & Whinney later testified that they did, in fact, com-

municate with Greenspan prior to accepting ZZZZ Best as an audit client.

However, Ernst & Whinneys testimony did not disclose the nature or content of

that communication, andGreenspan was not recalled to rebut Ernst & Whinneys

testimony on this issue.

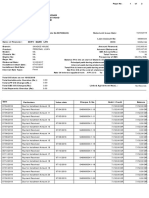

Exhibit 1 contains the engagement letter signedby Ernst & Whinney and Barry

Minkow inSeptember 1986. The engagement letter outlined four services that the

audit firm intended to provide ZZZZ Best: a review of the companys financial

statements for the three-month period ending July 31, 1986; assistance in the

preparation of a registration statement to be filed with the SEC; a comfort letter

to be submitted to ZZZZ Bests underwriters; and a full-scope audit for the fiscal

year ending April 30, 1987. Ernst & Whinney completed the review, provided the

comfort letter to ZZZZ Bests underwriters, and apparently assisted the company

in preparing the registration statement for the SEC; however, Ernst & Whinney

never completed the 1987 audit. The audit firm resigned on June 2, 1987, amid

growing concerns that ZZZZ Bests financial statements were grossly misstated.

The congressional subcommittee investigating the ZZZZ Best fraud ques-

tioned Ernst & Whinney representatives at length regarding the bogus insurance

restoration contractscontracts that accounted for 90 percent of ZZZZ Bests re-

ported profits. The congressional testimony disclosed that Ernst & Whinney re-

peatedly insisted on visiting several of the largest of these contract sites, and that

Minkow and his associates attempted to discourage such visits. Eventually,

Minkow realized that the auditors would not relent and agreed to allow them to

visit certain of the restoration sites, knowing full well that none of the sites actu-

ally existed.

To convince Ernst & Whinney that the insurance restoration contracts were au-

thentic, Minkow and his associates devised a series of sting operations. In the late

fall of 1986, Larry Gray, the engagement audit partner for ZZZZ Best, insisted on

visiting a restoration site in Sacramento on which ZZZZ Best had reported ob-

taining a multimillion-dollar contract. Minkow sent two of his cohorts to

Sacramento to find a large building under construction or renovation that would

provide a plausible site for a restoration contract. Gray had visited Sacramento

weeks earlier to search for the site that Minkow had refusedto divulge. As chance

would have it, the building chosen by the ZZZZ Best conspirators was the same

one Gray had identified as the most likely site of the insurance restoration job.

Minkows two confederates, while posing as leasing agents of a property man-

agement firm, convinced the supervisor of the construction site to provide the

keys to the building one weekend on the pretext that a large prospective tenant

46 SECTION ONE COMPREHENSIVE CASES

EXHIBIT 1 september 1 2,1 986

Ernst & Whinneys ZZZZ -

Best Engagement Letter

Mr. Barty Minkow

C hairman of the Board

ZZZZ Best C o. , I nc.

7040 Darby A venue

R eseda, C alifomia~ -. . . , .

Dear M r. M inkow: -

This letter is to confirm our understanding regarding our engagement as independent accoun-

tants of ~Z BE S T C O . I N C ( the C ompany) and the nature and limitations of the services we

will provide.

We wil l p erf orm the Iol l ovd ng servic es

1 . W e will review the balance sheet of the C ompany as of July 31 , 1 988, and the related state-

ments of income, retained earnings, and changes I n financial position for the three months then

ended, in accordance with standards established by the A merican I nstitute of C ertified Public

A ccountants. W e will riot perform an suds of such financial statements, the objective of which is

the expressing of an opinion regarding the financial statements taken as a whole, arid, accord-

ingly, we will not express an opinion on them. O ur report on the financial statements is presently

expected to read as follows:

- W e have made a review of the condensed consolidated balance sheet of BE S T

C O . , I N C . arid subsidiaries as of July 31 . 1 986, and ~herelated condensed consolidated

statements ~ income and changes in financial position for the three-month period ended July

31 . 1 986. u~accordance with standards establ~shed by the A merican I nstitute of C ertified

Public A oc6untants. A review of the condensed consolidated financial statements for the

comparative period of the prior year was not made~

;.~ 1A review of financial information eansists principally of obtaining an understanding of the

system for the preparation of interim financial information, app~ng analytical review proce-

dures to financial data, and making inquiries of persona responsible for financial and account-

ing matters.

it is substantially less than an examin~tlbn I n accordance ~vithgenerally accepted

auditing standards, which will be performed forth, fuN year with the objective of ex p ressing

an opinion regarding the financial statements taker~ as a whole. A ccordingly we do not ex-

press such an opinion.

Based on o~ur review, we are not aware of any material modifications that shouid be made

to the condensed consolidated I nterim financial statements referred to above for them to be in

conformity with generally accepted accounting principles! ~

O ur engagement cannot be relied upon to disclose errors, irregularities, or I legal acts, including

fraud or defalcatioris, that may e,dst. H owever, we will inform you of any such matters that come

to our attention.

2. W e will assist in the preparation of a R egistration S tatement ( Form S -I ) under the S ecurities

A ct of 1 833 including advice and counsel m conforming the financial statements and related in--

formation to R egulation S -X .

3. W e will assist I n resolving the accounting and financial reportI ng questions which will arise as

a part of the preparation of the R egietration S tatement referred to above.

4. W e will prepares latter for the underwriters, if required ( I . e. , a C omfort Letter), bearing I n

mind the limited nature of the work we have done with respect to the financial c4pta.

5 . W e will examine the consolidated financial statements of the C ompany as of A pril 30, 1 987,

and for the year then ended and issue our report in accordance with generally accepted auditing

standards approved by the A merican I nstitute of C ertified Public A ccountants. These standards

CASE 1.4 BEST COMPANY, INC.

contemplate, among other things, that ( 1 ) we will study and evaluate the C ompanys I nternal con-

trol system as a basis for reliance on the accounting records and for determining the extent of

our aud it tests; and (2) that we wil l be abl e to obtain suf f ic ient evid entiarmatter to af f ord a res-

sonabl e basis f orour op inion on the financial statements. H owever, I t should be understood that

our reports will necessarily be governed by the findings deveioped I n the course of our examine-

tion and that we c oul d be required , d ep end ing up on the c irc umstanc es, to modify our reporting

from the typical unqualified opinion. W e will advise you, as our examination progresses, if any

d eveiop ments Ind ic ate that we wil l be unabl e to ex p ress an unqual if ied ~op inion. Bec ause our ax -

amrnation wiN be p erf ormed general l y on a test basia, it wil t not nec .ssarl l y d isc l ose l wegul arl ties,

If any, that may e,d st. However, we wil l p romp tl y rep ort to you any Irregul arities whic h Our miami-

nation does disclose.

O ur fees will be derived from our customary rates for the various personnel involved plus out-of-

pocket expenses. C ertain factors can have an effect on the time incurred in the conduct of our

work Among these are the general c ond ition of the ac c ounting rec ord s, the amount of assis-

tanc e rec eived f rom your personnel I n the accumulation of data, the size and transaction volume

of business, any significant financial reporting issues that arise in connection with the S E C S re-

view of the S -i, ~swell as unforeseen circumstances. Based upon our current understanding of

the situation, the amount of our proposed billing for the various services which we will be provid-

ing are estimated to be:

Review of the Jul y 31 , 1 986 financial statements $ 5 ,000 $ 7,5 00

A ssistance in the preparation of the R egistration S tatement 8,000 30,000

C omfort Letter 4,000- 6,000

A udit of financial statements as of A pril 30, 1 987 24,000 29,000

We wil l uivoic e you eac h month f or the time c harges and ex p enses inc urred in the p revious

month and such I nvoices are due and payable upon presentation.

Larry D. G rass Partner, is the C lient S ervice E xacutive assigned to the engagement Peter G riffith,

A udit M anager, and M ichael Mc Cormic k, Tax Manager, have al so been assigned .

W e greatly appreciate your engagement of our firm; I f you have any questions, we shall be

pleased to discuss them with you. Please indicate your acceptance of the above arrangements

by signing and returning the enclosed copy. This ietter constitutes the full understanding of the

terms of our engagement.

Ve. ytruly yours, -

E rnst & W hinney

By Larry D. G ray, Partspr

A C C E PTE D:

ZZZZ BE S T C O . , I N C .

Barry J. M inkow, C hairman of the Board

( signed)

9-1 6-06

EXHIBIT 1c ontinued

Ernst & Whinneys ZZZZ

Best Engagement Letter

wished to tour the facility. Prior to the arrival of Larry Gray and an attorney rep-

resenting ZZZZ Bests law firm, Minkows subordinates visited the site and

placed placards on the walls at conspicuous locations indicating that ZZZZ Best

was the contractor for the building renovation. No details were overlooked by

Minkows lieutenants; they even paid the buildings security officer to greet the

visitors and demonstratethat he was aware inadvance of their tour of the site and

its purpose. Although the building had not been damaged and instead was

I

48 S E C TI O N O N E C O M PR E H E N S I VE C A S E S

simply inthe process of being completed, the sting operation went off as planned.

Exhibit 2 presents the memorandum Gray wrote describing his tour of the

buildinga memorandum that was included in Ernst & Whinneys ZZZZ Best

workpapers.

Congressional investigators quizzed Gray regarding the measures he took to

confirm that ZZZZ Best actually had a restoration contract on the Sacramento

building. They were particularlyconcerned that he never discovered the building

had not suffered several million dollars in damages a few months earlier, as

claimed by ZZZZ Best personnel.

CONGRESSMAN LE~r: . . . did you check the building permit or construction

permit?

Mit. Gi~x: No, sir. That wouldnt be necessary to accomplish what I was setting

out to accomplish.

CONGRESSMAN LErrn And you did not check with the buildings owners to see if

an insurance claim had been filed?

MR. G i~y: Same answer. It wasnt necessary. I had seen the paperwork inter-

nally of our client, the support for a great amount of detail. So, I had no need

to askto pursue that.

EXHIBIT 2

Ernst & Whinney Internal

Memo Regard ing Visit to

ZZZZ Best Restoration

Projec t

TO : ZZZZ Best C o. , I nc. File

FR O M : LarryD. G ray .

R E : Visit to S acramento Job

A t our request, the C ompany arranged tor atour of the job site I n S acramento on N ovember 23rd

[1 986]. The site ( not previously I dentified for us because of the confidentiality agreement with

their customer) had been informally visited by me on O ctober 27. 1 knew approximately where

the job was, and was able to identify it through theconstruction activity goI ng on.

O n N ovember 23, M ark M orse accompanied Mark Moskowitz of H ughes H ubbard & R eed and

to S acramento. W e visited first the offices of the Building M anager, M ark R oddy of

Assured Property M anagement, I nc. R oddy was hired by the I nsurance company ( at Tom

Padgetts suggestion according to M orse) to oversee the renovation activities and the leasing of

the sp ac e. Rod d y ac c omp anied us to the btMng site.

We were inf ormed that the d amage oc c urred f rom the water storage on the roof of the building.

The storage was f or the sp rinkl er systems, but the water was somehow rel eased in total, causing

construction damage to floors 1 7 and 1 8, primarily in bathrooms which were d irec tl y und er the

water hol d ing tower, then the water sp read out and f l ood ed f l oors 16 d own through about 5 c r6,

where it started to spread out even further~ndbe held in poois.

We toured f l oor 17 brief l y (It is c urrentl y oc c up ied by a raw f irm) then visited f l oor 12 (whic h had

a c onsid erabl e amount of unoc c up ied sp a~iand f l oor 7 . Morse p ointed out to us the c arp et,

painting and clean up work which had been~ Bests responsibility. W e noted some work not

done I n some other areas ( and in unoccupied tenant space). But per M ark, this was not ZZZZ

Bests responsibility rather was work being undertaken by tenants for their own purposes.

Per M orse ( and R oddy) ZZZZ Bests work I s substantially complete and has passed final I nspec-

tion. Final sign-off I s expected shortly, with final payment due to ZZZZBest iW earty December.

Morse was wel l versed I n the building history and in the work scope for BesLThe tour was

beneficial in gaining insight as to the scope of the damage that had occurred~d the typ e of

work that the Comp any c an d o.

CASE 1.4 BEST COMPANY, INC.

CONGRESSMAN LENT You understand that what you saw was not anything that

was real in anysense of the word?.. . You are saying you were duped, are you

not?

&IR. GRAY: Absolutely.

Congressional testimony disclosed that one of the visitations by Ernst &

Whinney forced ZZZZ Best to lease a partially completed building and to hire

subcontractors to do a considerable amount of work on the site. In total, ZZZZ

Best spent several million dollars for the sole purpose of deceiving its auditors.

The success of the bogus site visitations was due in large part to Minkows in-

;istence that Ernst & Whinney and ZZZZ Bests law firm sign confidentiality

tgreements before the visits were made. Acopy of one such agreement is shown

n Exhibit 3. Members of the congressional subcommittee were troubled by the

ollowing stipulation of the confidentiality agreement: We will not make any

0110w-up telephone calls to any contractors, insurance companies, the building

)wner, or other individuals involved in the restoration contract. This restriction

~ffectivelvprecluded the auditors and attorneys from corroborating the insurance

-estoration contracts with independent third parties.

RESIGNATION OF ERNST & WHINNEY

Ernst & Whinney resigned as ZZZZ Bests auditor on June 2, 1987, following a se-

ries of disturbing events that caused the firm to question the integrity of Minkow

and his associates. First, Ernst & Whinney was alarmed by a Los Angeles Times

article in mid-May 1987 that revealed Minkow had been involved in a string of

EXHIBIT 3

Ernst & Whinneys

Conf id ential Ity

Agreement with

ZZZZ Best Regard ing

Visits to Restoration

Projec ts

Mr. Barry Ml nl ~, Presid ent

7 040 D arby Avenue

R eseda, C alifornia . 4

Dear Berry: ,

I n connection with the proposed public offering ( the O ffering) of tJnfts consisting orcon man ~-.

stoc k and warrants of ZZZZ kst Co., Inc . (the Comp any), we have requested a tour of the site of

the C ompanys I nsurance restoration project I n S acramento, C alifornia, C ontract N o. 8886.

S ubject to the representations~and~*arrant~esb*~e C ompany has agreed to arrange such a

tour, which will be conducted by a*r~itafl~

1 I ~ssured Property M anagement I nc. ( the

R epresentative), which company is unaffillated ~ I nterstate A ppraisal S ervices. The under-

signed, personally and on behalf of E rnst & W hinney, hereby represents and warrants that

1 . W e will not disclose the location of such building, or any other information with respect to the

project or the building, to any third parties or to any other members or employees of our firm;

2. W e will not make any f ol l ow-up tel ep hone c al l s to~y c ontrac tors, Insuranc e c omp anies, the

building owner, or other I ndividuals I rivelved in the restoration project

3. W e will obey all on-site safety and other rules and regulations established by the Comp any,

I nterstate A ppraisal S ervices and the R epresentative,

4. The undersigned will be the only representative of this Firm present on the tour.

This C onfidentiality Letter I s aiso being furnished for the benefit of I nterstate A ppraisal Servic es, -

to the same satent as W it were furnished directly to such company.

50 SECTION ONE COMPREHENSIVE CASES

credit card forgeries as a teenager. Second, on May 28. 1987, ZZZZBest issued a

press release, without consulting or notifying Ernst & Whinney, that reported

record profits and revenues. The purpose of this press release was to restgre in-

vestors confidence in the companyconfidence that had been shaken by the

damaging Los Angeles Times story. Third, and most important, on May 29, Ernst &

Whinney auditors discovered evidence supporting allegations made several

weeks earlier by a third party informant that ZZZZ Bests insurance restoration

business was fictitious. The informant had contacted Ernst & Whinney in April

I

1987 and asked for $25,000 in exchange for information proving that one of the

firms clients was engaging in a massive fraud. Ernst & Whinney refused to pay

the sum, and the individual recanted shortly thereafter, but not until the firmde-

termined that the allegation involved ZZZZ Best. (Congressional testimony dis-

closed that the individual recanted because of a bribe paid to him by Minkow.)

Despite the retraction, Ernst & Whinney questioned Minkow and ZZZZ Bests

board of directors regarding the matter, at which point Minkow denied ever

knowing the individual who had madethe allegation. On May 29, 1987, however,

Ernst & Whinney auditors discovered several cancelled checks that Minkow had

personally written to the informant several months earlier.

Because ZZZZ Best was a public company, the resignation of its independent

auditor was required to be reported to the SEC in an 8-K filing. One purpose of

this requirement is to alert investors and creditors of the circumstances that may

have led to the change in auditors. At the time, SEC registrants were allowed fif-

teen days to file the 8-K auditor change announcement. After waiting the maxi-

mum permissible time, ZZZZ Best reported the change in auditors but, despite

Ernst & Whinneys insistence, made no mention in the 8-K of the fraud allegation

that had been subsequently recanted. The SECs rules that were in effect at the

time also required a former audit firm to file an exhibit letter to a former clients

8-K commenting on the 8-Ks accuracy and completeness. Former audit firms

were given thirty days to file the exhibit letter, which was the length of time Ernst

& Whinney waited before submitting its exhibit letter to the SEC. In that letter,

Ernst & Whinney reported its concern regarding the earlier allegation that ZZZZ

Bests insurance contracts were fraudulent.

The congressional subcommittee was alarmed that forty-five days passed be-

fore the charges of fraudulent misrepresentations in ZZZZ Bests financial state-

ments were disclosed to the public. By the time Ernst & Whinneys exhibit letter

was released to the public, ZZZZ Best had filed for protection from its creditors

under Chapter 11 of the federal bankruptcy code. During the period that elapsed

between Ernst & Whinneys resignation and its filing of the 8-K exhibit letter,

ZZZZBest obtained significant financing from several parties, including $1 mil-

lion from a close friend of Minkows. These parties never recovered the funds in-

vested in, or loaned to, ZZZZ Best. As a direct result of the ZZZZ Best debacle,

the SEC shortened the length of time that registrants and their former aiqditors

may wait before filing the required auditor change documents with the SEC.

The congressional subcommittee also quizzed Ernst & Whinney representa-

tives regarding the information theydisclosed to Price Waterhouse, the audit firm

hired by Minkow to replace Ernst & Whinney.

3 Congressman Wyden was

3. Price Waterhouse never issued an audit report on ZZZZBests financial statementsbecause

the company was Uquidated less than two months after that audit firmwasretained.

CASE 1.4 U~ BEST COMPANY, INC.

51

concerned that Price Waterhouse had not received all relevant information that

Ernst & Whinney had in its possession regarding its former client.

CONGRESSMAN WYDEN: I am going to insert into the record at this point a memo

entitled Discussion with successor auditor, written by Mr. Gray and dated

June 9, 1987. Regarding a June 4 meeting, Mr. Gray, with Dan Lyle of Price

Waterhouse concerning the integrity of ZZZZ Bests management, you stated

that you had no reportable disagreements and no reservations about manage-

ment integrity pending the results of a board of directors investigation. Then

you went on to say that you resigned because, and I quote here: We came

to a conclusion that we didnt want to become associated with the financial

statements.

Is that correct?

Mi~. GRAY: That is correct.

MR. WYDEN: . . . Mr. Gray, you told the committee staff on May 29. 1987, that

when you uncovered evidence to support allegations of fraud that you decided

to pack up your workpapers and leave the ZZZZ Best audit site. How did your

leaving without telling anybody except the ZZZZ Best management and board

of directors the reasons for leaving help the public and investors?

Ernst & Whinneys reluctance to disclose its reservations regarding Minkows in-

tegrity quite possibly stemmedfrom concern that such disclosures might result in

Minkow suing the audit firm.

4

A final twist to the ZZZZ Best scandal was an anonymous letter received by

Ernst & Whinney exactly one week after the firm resigned as ZZZZ Bests audi-

tors. On that date, no one other than Ernst & Whinney and ZZZZ Bests officers

was aware of the firms resignation. The letter, shown in Exhibit 4, detailed a

number of allegations suggesting that the ZZZZ Best financial statements were

fraudulent. According to the congressional testimony, Ernst & Whinney for-

warded this letter to the SEC on June 17, 1987.

COLLAPSE OF ZZZZ BEST

When the extremety negative and revealing article regarding Minkow appeared

in the Los Angeles Times in mid-May 1987, the collapse of ZZZZ Best was proba-

bly inevitable. Several years earlier, a homemaker had fallen victim to Minkows

credit card forgeries. Minkow had added a fraudulent charge to the credit card

slip the woman had used to make a payment on her account. Despite her persis-

tence, Minkow avoided repaying the small amount. The woman never forgot the

insult and industriously tracked down, and kept a record of, the individuals who

had been similarly harmed by Minkow. At the urging of this individual, a re-

porter for the Los Angeles Times investigated her allegations. The womans diary

eventually became the basis for the Los Angeles Times article that, for the first

time, cast doubt on the integrity of the boy wonder who was the talk of Wall

Street.

4. For a discussion of this issue and related issues, see M.C. Knapp and F.M. E~~,~Auditor

Changes and Information Suppression, Research in Accounting Regulation 4(1990). 320.

52

SECTION ONE COMPREI4!NS1VE CASES

EXHIBIT 4

Anonymous Letter

Rec eived by Ernst &

Whinney Regard ing

Z~ Best

June 9, 1 987 - ~d ~

~.t v~i-

Mr.GuyWl l son . .

,E mst & W W mney ~ .. . . -

5 1 5 S outh Flower A

Los Angel es, Cal hf of f l ia 90021

D ear Mr. Wil son:

V. . , I

form tio&~~~~

42n the financial condI tion of

I am an I ndividual having certaI n confidentI al in. ~. . . . . g

ZZZZ Best Co., Inc . have read the p rosp ec tus and your Review Rep ort d ated Oc tober 3, 1986

and rec ogniz e you have not d one an ex amination In ac c ord anc e with general l y ac c ep ted aud iting

stand ard s, but that suc h aud it wil l be f orthc oming by you.

I wish to make you aware of the following material facts which require you to confirm or d isa ffirm :

1 . The electric deneretors which appear on the balance sheet under N ote G as being purchased

for $1 ,970,000 were purchased for scrap for lees than $1 00,000 thru intermediaries of Z~ Best

and resold to ZZZZ Best at the I nflated value. The sole purpose was to boost the assets on the

bal anc e sheet. These generators have never ~een,used and have no util Ity to the c omp any

2. Note 5 of the bal anc e sh~et d isc usses Joint ventures and two restoration c ontrac ts. These

c ontrac ts are f ic titious as are the bookkeep ing entries to sup p ort their Ikity Interstate

A ppraisal S ervice [aid did not let such contracts although they confirm their existence. The same

is true for the alleged $7,000,000 S acramento contract and the $40 1 00 million contracts with

I nterstate.

3. Fuflher~ cheds made and passed between ~Z Best, its lofrut venturers and some of I ts

vendors are no more thanb~nsactions among conspirators to uu~ppor~ th~ validity of these

4. EarnIngs rep orted by ZZZZ Best are being reported as Billings in excess of costs and esti-

mated earnings on restoration contracts. These contracts do not exist nor do the earnlngs~ This

c an be c onf irmed d irec f l y bybontac ting the af l eg~d insuranc e c arriers as wel l as p hysic al insp ec -

tions as to the existence and extent of the contracts.

5. Billings and E arnings for ~985and 1 988 were1 ~bricated by the company before being pre-

sented to other ac c ountants f or c ertif ic ation. ~ ~,

cfuugence.

C onfirmation of these allegations can be accomplished by a S uch due dill-

genc e on your behal f is Imp erative f or your p rotec tion. . . + ~

Very trul y yours.

B. C autious

( S igned)

The newspaper article triggered a chain of events that quickly spelled the end

of ZZZZ Best. First, a small brokerage firm specializing in newly registered com-

panies with suspicious earnings histories began short-selling ZZZZ Best stock,

forcing the stocks price into a tailspin. Second, Ernst & Whinney, ZZZZ Bests

law firm, and ZZZZ Bests brokers began giving more credence to the allegations

and rumors of financial wrongdoing by Minkow and his associates. Third, and

most important, the article panicked Minkow and compelledhim to make anum-

ber of daring moves that cost him even more credibility. The most critical mistake

CASE 14 BEST COMPANY, INC.

was his issuance of the May 28, 1987, press release that boldly reported record

profits and revenues for his firm.

EPILOGUE

Among the parties most criticized for their roles in the ZZZZ Best scandal was

Ernst & Whinney. Included in the congressional testimony into the ZZZZ Best

fraud was a list of ten red flags that the audit firm had allegedly overlooked

while examining ZZZZ Bests financial statements (seeExhibit 5). In testifyingbe-

fore the subcommittee, Leroy Gardner, the West Coast director of accounting and

auditing for Ernst & Whinney, maintained that when all the facts were revealed,

his firm would be totally vindicated.

The ZZZZBest situation proves at least one thing: a well-orchestrated fraud will often

succeed even against careful, honest, hard-working people. . The facts that have

begun to emerge establish that Minkow along with confederates both inside and out-

side ZZZZ Best went to extraordinary lengths to deceive Ernst & Whinney. For exam-

ple, Thomas Padgett, an alleged conspirator, revealed in a recent televised interview

that Minkow spent $4 million to deceive Ernst & Whinney during avisit to oneof ZZZZ

Bests job sites. Ernst & Whinney never misled investors about the reliability of

ZZZZBests financial statements. Ernst & Whinnev never even issued an audit opinion

for ZZZZ Best. We are not part of the problem in this case. We were part of the

solution.

In one of the largest civil suits stemming from the ZZZZ Best insolvency, Ernst

& Whinney was found not liable to a large California bank that had extended

ZZZZ Best a multimillion-dollar loan in 1986. The bank alleged that in granting

the loan, it had relied upon the review report issued by Ernst & Whinney on

ZZZZ Bests financial statements for the three-month period endingJuly 31,1986.

However, an appellate judge ruled that the bank was not justified in relying on

EXHIBIT 5

Ten Red Fl ags that ZZZZ

Bests Aud itors Al l eged l y

Overl ooked

1. The amounts c al l ed f or by the insuranc e restoration c ontrac ts were unreaf l stic al l y l arge.

2- The number of mul timil l ion-d ol l ar Insuranc e restoration c ontrac ts rep orted l y obtained by

ZZZZ Best ex c eed ed the total number avail abl e nationwid e d uring the rel evant time p eriod .

a The purported contracts failed to identify the insureds, the insurance companies, or the

lodatlons of the jobs.

4. The c ontrac ts c onsisted of a sIngl e p age, whIc h f ail ed to contain details and specifications

of the work to be d one, suc h as the square yard age of c arp et to be rep l ac ed , whic h were

usual and customary in the restoration business.

5 . VI rtually all of the insurance restoration contracts were with the same party.

6. A large proportion of the ZZZZ Best insurance restoration contracts occurred immedI ately.

and op p ortunistic al l y, p rior to a p l anned of f ering of stoc k.

7. The purported contracts provided for payments to ZZZZ Best or M I nkow alone rather than

to the insured or Jointl y with ZZZZBest and the Insured ~ c ontrary to the p rac tic e of the In-

d ustry.

S. The p urp orted c ontrac ts p rovid ed f or p ayments by the Insuranc e ad justor c ontrary to normal

p rac tIc e I n the industry under which payments are c ustomaril y mad e by the insuranc e c om-

p any d irec tl y to Its insured or Jointl y to its Insured and the restorer.

9. ZZZZBests p urp orted gross p rof it margins f or Its restoration business were greatl y inex -

cees of the normal profit margins for the restoration industr~

1 0. The I nternal controls at ZZZZ Best were grossly inadequate.54 SECTION ONE COMPREHENSIVE CASES

the review report since Ernst & Whinney had expressly stated in the report that it

was not issuing an opinion on the ZZZZ Best financial statements: Ernst, be-

cause it issued only areview report, specifically declined toexpress an opinionon

ZZZZ Bests financial statements. The report expressly disclaimed any ~ght to

rely on its content.

5

In the late 1980s, the former stockholders of ZZZZ Best filed a large class

action lawsuit against Ernst & Whinney, ZZZZ Bests former lawfirm, andZZZZ

Bests former brokers. An Internet publication reported in March 1996 that this

lawsuit had been settled privately. The defendants reportedly paid the former

ZZZZ Best stockholders $35 million. However, the contributionof each defendant

to the settlement pool was not disclosed.6

In December 1994, Barry Minkow was released from prison. Minkow earned

the reduction in his twenty-five-year prison sentence for good behavior and ef-

forts to improve himself.7 These efforts included earning by correspondence

bachelors and masters degrees in religion from Liberty University, the univer-

sity founded by Jerry Falwell. Shortly after his release from prisQn, Minkow

began serving as the associate pastor of a large evangelical church in a commu-

nity near his hometownof Reseda. In February 1997, Minkow was appointed the

senior pastor of a large nondenominational church in San Diego.

Besides his pastoral duties, Minkow presents lectures and seminars across the

United States on how to prevent and detect financial fraud. Minkow has spoken

to groups of CPAs, educational institutions, and, most notably, the FBI Academy

at Quantico, Virginia. Many of the anecdotes included in Minkows presentations

are drawn from his autobiography, Clean Sweep, which was published in 1995 by

Thomas Nelson Publishers. Finally, in 1996, Minkow began hosting a syndicated

radio talk show in which he discusses his personal views on financial and spin-

tual matters. By late 1997, approximately forty radio stations scattered across the

nation broadcast Minkows talk show.

QUESTIONS

1. Ernst & Whinney never issued an audit opinion on the financial statements of

ZZZZ Best; however, Ernst & Whinney did issue a review report on the com-

panys quarterly statements for the three months ending July 31, 1986. How does

a review differ from an audit, particularly in terms of the level of assurance im-

plied by the auditors report?

2. SAS No. 31, Evidential Matter, identifies five key management assertions

that underlie a set of financial statements. In the case of ZZZZ Best, the existence

assertion was particularly critical with respect to the insurance restoration con-

tracts. ZZZZ Bests auditors obtained third party confirmations to support the

contracts, reviewed availabledocumentation, performed analytical procedures to

evaluate the reasonablenessof the revenues recorded on the contracts, and visited

5. Ernst & Young Not Liable in ZZZZ Best Case, Journal of Accountancy 172 (July 1991), 22.

6. C. Byron, $26 Million in theHole, Worth Online, March 1996.

7. M. Matzer, Barry Minkow, Forbes, 15 August 1994,134.

CASE 1.4 BEST COMPANY, INC.

selected restoration.sites. Comment on the limitations of the evidence that these

procedures provide with regard to the management assertion of existence.

3. Besides existence, what other management assertion orassertnsshould

ZZZZ Bests auditors have considered corroborating for the insurance restoration

contracts? What audit procedures would have been appropriate to substantiate

these assertions?

4. In testimony before Congress, George Greenspan reported that one means he

used to substantiate the insurance restoration contracts was to verify that his

client actually received payment on those jobs. How can such apparently reliable

evidence lead an auditor to an improper conclusion?

5. What is the purposeof predecessor-successor auditor communications? Which

party, the predecessor or successor auditor, has the responsibility for initiating

these communications? Briefly summarize the information that a successor audi-

tor should obtain from the predecessor auditor.

6. Did the confidentiality agreement that Minkow required Ernst & Whinney to

sign improperly limit the scope of the ZZZZ Best audit? Why or why not? Discuss

general circumstances under whichconfidentiality concerns on the part of a client

may properly affect audit planning decisions. At what point would these limita-

tions be so significant as to affect the type of audit opinion issued?

7. What procedures, if any, do professional standards require auditors to perform

when reviewing a clients pre-audit but post-year-end earnings press release?

You might also like

- The Madoff DebacleDocument23 pagesThe Madoff DebacleEdiSukarmantoNo ratings yet

- IfrsDocument273 pagesIfrsmargery_bumagat100% (9)

- Bayou Hedge Fund Group ScandalDocument9 pagesBayou Hedge Fund Group Scandalanirudh_rangarajanNo ratings yet

- Structuring Venture Capital and Private Equity (2016) - Detailed Table of ContentsDocument11 pagesStructuring Venture Capital and Private Equity (2016) - Detailed Table of ContentspyrosriderNo ratings yet

- MadoffDocument159 pagesMadoffErkut FenziNo ratings yet

- 2019.10.25 Press DemocratDocument44 pages2019.10.25 Press DemocratTed AppelNo ratings yet

- Business Associations OutlineDocument68 pagesBusiness Associations OutlineEric EricsNo ratings yet

- Enron Case History and Major Issues SummaryDocument6 pagesEnron Case History and Major Issues Summaryshanker23scribd100% (1)

- Crazy Eddie Auditing CaseDocument3 pagesCrazy Eddie Auditing CaseBrad Farber100% (2)

- Sources of finance for business assetsDocument41 pagesSources of finance for business assetsgaurav shettyNo ratings yet

- The Jere Beasley Report May 2004Document44 pagesThe Jere Beasley Report May 2004Beasley AllenNo ratings yet

- 2019.11.03 Kincade FireDocument9 pages2019.11.03 Kincade FireTed AppelNo ratings yet

- Case 5-2 ZZZZ Best 3eDocument11 pagesCase 5-2 ZZZZ Best 3easmaNo ratings yet

- WorldCom Scandal 2002 Case StudyDocument15 pagesWorldCom Scandal 2002 Case StudyIsfh 67No ratings yet

- MW FrauducationWhitePaperDocument20 pagesMW FrauducationWhitePapermattdoughNo ratings yet

- Health South Corporation CaseDocument3 pagesHealth South Corporation CasekamattoxNo ratings yet

- Midterm Acco 400Document7 pagesMidterm Acco 400Hugh Myron100% (1)

- Audit evidence limitations for ZZZZ Best insurance contractsDocument4 pagesAudit evidence limitations for ZZZZ Best insurance contractsNovah Mae Begaso SamarNo ratings yet

- Technical Analysis of The Size PremiumDocument4 pagesTechnical Analysis of The Size PremiumRamiro Gamen0% (1)

- Question 1Document2 pagesQuestion 1Doris WuNo ratings yet

- Vertical and Horizontal Analysis of ZZZZ Best Co FinancialsDocument12 pagesVertical and Horizontal Analysis of ZZZZ Best Co Financialsasma100% (2)

- ZZZZ Best Company Inc SummaryDocument1 pageZZZZ Best Company Inc SummaryNovah Mae Begaso Samar100% (1)

- Leslie Fay Companies Audit RisksDocument7 pagesLeslie Fay Companies Audit Riskslumiradut70100% (2)

- Case Peter GunnDocument1 pageCase Peter Gunnstrez_xrz100% (1)

- Crazy EddieDocument5 pagesCrazy EddieAmos N. SandoNo ratings yet

- Waste Management Fraud Scandal ExposedDocument4 pagesWaste Management Fraud Scandal ExposedLuke MazarelloNo ratings yet

- Assigment 4Document19 pagesAssigment 4Gabriela LueiroNo ratings yet

- Net Proceeds of Bond Sale Market Price NP I (Pvifa: KD, N N KD, NDocument3 pagesNet Proceeds of Bond Sale Market Price NP I (Pvifa: KD, N N KD, NMich Elle CabNo ratings yet

- Case StudyDocument5 pagesCase Studynovac18No ratings yet

- Forensic AccountingDocument12 pagesForensic Accountingrazali mohammed0% (1)

- Madoff ScandalDocument7 pagesMadoff ScandalRohit GoyalNo ratings yet

- Auditing Sols To Homework Tute Qs - S2 2016 (WK 4 CH 8)Document6 pagesAuditing Sols To Homework Tute Qs - S2 2016 (WK 4 CH 8)sonima aroraNo ratings yet

- Compilation of Accounting ScandalsDocument7 pagesCompilation of Accounting ScandalsYelyah HipolitoNo ratings yet

- Xerox Fraud Case SEC InvestigationDocument8 pagesXerox Fraud Case SEC InvestigationnurhoneyzNo ratings yet

- Mfa700 ExamDocument5 pagesMfa700 ExamThomas T.R HokoNo ratings yet

- FINA 2330 Assignment 5Document4 pagesFINA 2330 Assignment 5rebaNo ratings yet

- Collaborative Review Task M1 Enron Case StudyDocument2 pagesCollaborative Review Task M1 Enron Case StudyAbdullah AlGhamdiNo ratings yet

- Research Paper (Comparative Analysis of Global Financial Laws)Document17 pagesResearch Paper (Comparative Analysis of Global Financial Laws)Soumya SaranjiNo ratings yet

- R.J. CIPRIANI Vs GLENN BUNTINGDocument12 pagesR.J. CIPRIANI Vs GLENN BUNTINGDeadspinNo ratings yet

- Detecting Earnings Manipulation ModelDocument14 pagesDetecting Earnings Manipulation ModelM Abdul GaniNo ratings yet

- Final Exam Case NotesDocument17 pagesFinal Exam Case NotesMike Ambrosino100% (1)

- Worldcom FraudDocument20 pagesWorldcom FraudAfdal SyarifNo ratings yet

- Order On Motion of William B. Abrams Authorizing Discovery Regarding Administration of The Fire Victim TrustDocument12 pagesOrder On Motion of William B. Abrams Authorizing Discovery Regarding Administration of The Fire Victim TrustRyan Matthey100% (1)

- Case 2.3 HanauerDocument10 pagesCase 2.3 HanauerAlexa RodriguezNo ratings yet

- Gregg Jaclin SEC Testimony July 21 2014 - PR CompleteDocument8 pagesGregg Jaclin SEC Testimony July 21 2014 - PR CompleteTeri BuhlNo ratings yet

- Letter From Madoff Victim Lawrence R. VelvelDocument3 pagesLetter From Madoff Victim Lawrence R. VelvelDealBook100% (24)

- Leslie Fay Companies Accounting Fraud CaseDocument10 pagesLeslie Fay Companies Accounting Fraud CaseSalman J. Syed50% (2)

- NICA Class-Action LawsuitDocument18 pagesNICA Class-Action LawsuitCasey FrankNo ratings yet

- Chicago Interest Rate Swap Legal AnalysisDocument29 pagesChicago Interest Rate Swap Legal AnalysisThe Daily LineNo ratings yet

- Madoff Auditor Legal LiabilityDocument13 pagesMadoff Auditor Legal LiabilityRonelHorakOlver100% (2)

- Auditing - Hook Chapter 8 SolutionsDocument35 pagesAuditing - Hook Chapter 8 SolutionsZenni T XinNo ratings yet

- Assurance Service - Case 2 - WS 2016/2017Document12 pagesAssurance Service - Case 2 - WS 2016/2017RayCharlesCloud100% (1)

- O T Public - PleaDocument2 pagesO T Public - PleaoldeproNo ratings yet

- Sinclair Upton STRP Report-Nov 2015Document23 pagesSinclair Upton STRP Report-Nov 2015ZerohedgeNo ratings yet

- Regulator's Report On UFCW Pension Plan (Part 1)Document86 pagesRegulator's Report On UFCW Pension Plan (Part 1)Wanda Pasz100% (1)

- Accounting Scandal in TescoDocument1 pageAccounting Scandal in TescoMUHAMMED RABIHNo ratings yet

- Corporation TaxationDocument16 pagesCorporation TaxationMeg Lee0% (1)

- Business Interruption: Coverage, Claims, and Recovery, 2nd EditionFrom EverandBusiness Interruption: Coverage, Claims, and Recovery, 2nd EditionNo ratings yet

- ZZZZ Best AnsDocument9 pagesZZZZ Best AnsMatthew ChangNo ratings yet

- Barry MinkowDocument2 pagesBarry MinkowAbhishek KarekarNo ratings yet

- Gekko Echo - A Closer Look at The "Decade of Greed"Document12 pagesGekko Echo - A Closer Look at The "Decade of Greed"Jeffery ScottNo ratings yet

- Fungsi Sekunder Hukum Pidana Dalam Penanggulangan Tindak Pidana PerpajakanDocument12 pagesFungsi Sekunder Hukum Pidana Dalam Penanggulangan Tindak Pidana Perpajakandavidwijaya1986No ratings yet

- 18.PMK.03-2008 EngDocument2 pages18.PMK.03-2008 Engdavidwijaya1986No ratings yet

- Sifat Putusan Impeachment Mahkah Konstitusi Terhadap Status Hukum PresidenDocument14 pagesSifat Putusan Impeachment Mahkah Konstitusi Terhadap Status Hukum Presidendavidwijaya1986No ratings yet

- PP 80 2007Document22 pagesPP 80 2007davidwijaya1986No ratings yet

- Kewenangan Mahkamah Konstitusi Dalam Pemakzulan Presiden Dan/Atau Wakil Presiden Di IndonesiaDocument19 pagesKewenangan Mahkamah Konstitusi Dalam Pemakzulan Presiden Dan/Atau Wakil Presiden Di IndonesiaAbdullah HafidNo ratings yet

- Analisis Asas Ultimum Remedium Studi Keadilan Dan Konsekuensi Paksa Dalam Pengaturan PerpajakanDocument10 pagesAnalisis Asas Ultimum Remedium Studi Keadilan Dan Konsekuensi Paksa Dalam Pengaturan Perpajakandavidwijaya1986No ratings yet

- Kewenangan Mahkamah Konstitusi Dalam Pemakzulan Presiden Dan/Atau Wakil Presiden Di IndonesiaDocument19 pagesKewenangan Mahkamah Konstitusi Dalam Pemakzulan Presiden Dan/Atau Wakil Presiden Di IndonesiaAbdullah HafidNo ratings yet

- Emerald Magma Audha Alumnus Fakultas Hukum Universitas Jenderal Soedirman Naskah Diterima: 21/5/2020, Direvisi: 24/3/2021, Disetujui: 20/4/2021Document16 pagesEmerald Magma Audha Alumnus Fakultas Hukum Universitas Jenderal Soedirman Naskah Diterima: 21/5/2020, Direvisi: 24/3/2021, Disetujui: 20/4/2021davidwijaya1986No ratings yet

- Sifat Putusan Impeachment Mahkah Konstitusi Terhadap Status Hukum PresidenDocument14 pagesSifat Putusan Impeachment Mahkah Konstitusi Terhadap Status Hukum Presidendavidwijaya1986No ratings yet

- Practical Guide To Ifrs: Consolidated Financial Statements: Redefining ControlDocument80 pagesPractical Guide To Ifrs: Consolidated Financial Statements: Redefining Controldavidwijaya1986No ratings yet

- ID Perspektif Hukum Sebagai Landasan Pembangunan Ekonomi Di IndonesiaDocument29 pagesID Perspektif Hukum Sebagai Landasan Pembangunan Ekonomi Di IndonesiaregaNo ratings yet

- Bloomberg Businessweek USA 20210510Document68 pagesBloomberg Businessweek USA 20210510davidwijaya1986No ratings yet

- Newsweek USA 20210514Document52 pagesNewsweek USA 20210514davidwijaya1986No ratings yet

- PMK-169-2015 - Debt To Equity Ration - English VersionDocument13 pagesPMK-169-2015 - Debt To Equity Ration - English Versiondavidwijaya1986No ratings yet

- IFRS and US GAAP Similarities and Differences 2011 Edition v1Document238 pagesIFRS and US GAAP Similarities and Differences 2011 Edition v1davidwijaya1986No ratings yet

- US GAAP V IFRS Dec 2011Document56 pagesUS GAAP V IFRS Dec 2011safrinsadikNo ratings yet

- EY-Indonesia Tax Insight 20012013Document6 pagesEY-Indonesia Tax Insight 20012013davidwijaya1986No ratings yet

- BEPS Country by Country 140916Document48 pagesBEPS Country by Country 140916davidwijaya1986100% (1)

- Asean Tax Guide v2Document92 pagesAsean Tax Guide v2davidwijaya1986No ratings yet

- TP Documentation & Country by Country ReportingDocument74 pagesTP Documentation & Country by Country Reportingdavidwijaya1986No ratings yet

- Per 32 PJ 2011Document14 pagesPer 32 PJ 2011HenryNo ratings yet

- KPMG - Indonesian TaxDocument13 pagesKPMG - Indonesian Taxbang bebetNo ratings yet

- PWC Pocket Tax Book 2016Document112 pagesPWC Pocket Tax Book 2016davidwijaya1986No ratings yet

- EY Doing Business Slipsheet Booklet 7 Sept 2015Document32 pagesEY Doing Business Slipsheet Booklet 7 Sept 2015davidwijaya1986No ratings yet

- BLTADocument3 pagesBLTAdavidwijaya1986No ratings yet

- KPMG - Indonesian TaxDocument13 pagesKPMG - Indonesian Taxbang bebetNo ratings yet

- Bank QNB Kesawan TBK.: Company Report: July 2014 As of 25 July 2014Document3 pagesBank QNB Kesawan TBK.: Company Report: July 2014 As of 25 July 2014davidwijaya1986No ratings yet

- Bukit Darmo Property Tbk. (S) : Company Report: July 2014 As of 25 July 2014Document3 pagesBukit Darmo Property Tbk. (S) : Company Report: July 2014 As of 25 July 2014davidwijaya1986No ratings yet

- Sentul City Tbk. (S) : Company Report: July 2014 As of 25 July 2014Document3 pagesSentul City Tbk. (S) : Company Report: July 2014 As of 25 July 2014davidwijaya1986No ratings yet

- Teck Guan Annual Report 2019Document120 pagesTeck Guan Annual Report 2019sam wanNo ratings yet

- Chanakya National Law University: Project Work On The Topic TitledDocument25 pagesChanakya National Law University: Project Work On The Topic TitledRajeev VermaNo ratings yet

- Oxford PaperfinalDocument14 pagesOxford PaperfinalAngelie De LeonNo ratings yet

- Fastag Compliance Document PDFDocument7 pagesFastag Compliance Document PDFDev Printing SolutionNo ratings yet

- Corp. Law Outline 3 (2020)Document3 pagesCorp. Law Outline 3 (2020)Effy SantosNo ratings yet

- Financial Rehabilitation and Insolvency ActDocument2 pagesFinancial Rehabilitation and Insolvency ActReynelle Cata-alNo ratings yet

- Be A Sales SuperstarDocument2 pagesBe A Sales SuperstarworksatyajeetNo ratings yet

- FIJI LAW SOCIETY - Companies Bill Submission 070415Document9 pagesFIJI LAW SOCIETY - Companies Bill Submission 070415Seni NabouNo ratings yet

- Company Receives Excess Share Applications May Refund or Retain FundsDocument12 pagesCompany Receives Excess Share Applications May Refund or Retain FundsMoira Emma N. EdmondNo ratings yet

- 12 y 72Document5 pages12 y 72Alexis AlipudoNo ratings yet

- Top 10 PSE Stock With Highest Cash Dividend YieldDocument5 pagesTop 10 PSE Stock With Highest Cash Dividend YieldDexter GasconNo ratings yet

- FMCHAPTER ONE - PPT Power PT Slides - PPT 2Document55 pagesFMCHAPTER ONE - PPT Power PT Slides - PPT 2Alayou TeferaNo ratings yet

- Gold Derivatives Advance Payment Contract OptionsDocument42 pagesGold Derivatives Advance Payment Contract OptionsDipesh KumarNo ratings yet

- CFRS for SMEs TrainingDocument4 pagesCFRS for SMEs TrainingJessica HongNo ratings yet

- Law485 Jan 2012Document4 pagesLaw485 Jan 2012Khairul Ridzuan Bin Malik0% (1)

- A Primer On The Insolvency and Bankruptcy Code PDFDocument42 pagesA Primer On The Insolvency and Bankruptcy Code PDFAnurag SharmaNo ratings yet

- Assignment On Corporation (Najeeb)Document5 pagesAssignment On Corporation (Najeeb)Najeeb KhanNo ratings yet

- 1987 WCG Restates ConstitutionDocument3 pages1987 WCG Restates ConstitutionTimothy Kitchen Jr.No ratings yet

- Supreme Court Justice's Financial Records Face ScrutinyDocument3 pagesSupreme Court Justice's Financial Records Face ScrutinyJake VillaNo ratings yet

- Financial DerivativesDocument101 pagesFinancial DerivativesRevathialekhya Saradhi0% (1)

- Acctg7-MIDTERM REVIERDocument9 pagesAcctg7-MIDTERM REVIERDave ManaloNo ratings yet

- Question Answer Chapter 2 FInancial ReportingDocument4 pagesQuestion Answer Chapter 2 FInancial ReportingnasirNo ratings yet

- Companies Act, 2013 For Ca FoundationDocument54 pagesCompanies Act, 2013 For Ca FoundationAparnaNo ratings yet

- Republic of the Philippines Financial Rehabilitation and Insolvency ActDocument64 pagesRepublic of the Philippines Financial Rehabilitation and Insolvency Actnatnat02No ratings yet

- Subject:-Change of Address (Reg. Folio No. NAT016199) : Contact No. - 011-23457121 E-Mail: E-MailDocument5 pagesSubject:-Change of Address (Reg. Folio No. NAT016199) : Contact No. - 011-23457121 E-Mail: E-MailPoonam AggarwalNo ratings yet

- Indonesia Re General Reinsurance - Contact List 2019Document7 pagesIndonesia Re General Reinsurance - Contact List 2019Dany AryantoNo ratings yet

- SEBI Takeover Regulation 2011Document9 pagesSEBI Takeover Regulation 2011Himanshu AggarwalNo ratings yet

- Presentation On DerevativeDocument19 pagesPresentation On DerevativeAnkitaParabNo ratings yet