Professional Documents

Culture Documents

Ratio Analysis

Uploaded by

Shaheena SarfrazCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratio Analysis

Uploaded by

Shaheena SarfrazCopyright:

Available Formats

Assignment#2

Submitted to:

Sir Amir Rafique

Submitted by:

Shaheena Sarfraz

(1235172)

MBA-Eve

Submitted on:

03-07-2014

s

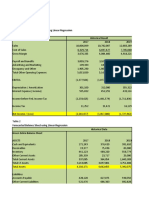

Ratio Analysis

1. Attock Cement LTD

(All amounts are in thousand Rupees)

2011 2012 2013

1.70 2.15 2.77

2011 2012 2013

0.73 1.45 2.19

1,378,379

2,347,481

1,334,512

3,358,000

1674350

4,630,800

s Liabilitie Current

Inventory - Assets Current

Ratio Quick 2.

Liabilites Current

Assets Current

ratio Current 1.

1,378,379

1,342,341 - 2,347,481

1,334,512

1,419,793 - 3,358,000

1674350

956,276 - 4,630,800

Assets Total

Sales Net

Turnover Asset Total 3.

2011 2012 2013

1.10 1.18 1.07

2011 2012 2013

0.0007 0 0.001

2011 2012 2013

0.0005 0 0.0007

7,743,149

8,533,921

8,901,483

10,503,898

10,705,596

11,507,706

Assets Total

Debt Total

Ratio Debt Total 4.

7,743,149

3,980

8,901,483

0

10,705,596

8,379

Equity Total

Debt Total

Ratio Equity to Debt 5.

Expense Interest

EBIT

Earned Interest Times 6.

5,798,412

3,980

6,628,893

0

7946651

379 , 8

(Already given in annual report)

2011 2012 2013

43.59 176.4 180.68

2011 2012 2013

0.21 0.26 0.30

2011 2012 2013

0.08 0.13 0.18

Sales Net

Sold Goods of Cost Sales Net

Margin Profit Gross 7.

8,553,921

6,823,346 - 8,553,921

10,503,898

7,691,421 - 10,503,898

1,378,379

11,507,70 - 11,507,706

Sales Net

Income Net

Margin Profit Net 8.

8,533,921

684,429

10,503,898

1,436,649

11,507,706

2,136,085

Assets Total

Income Net

Assets on Return 9.

2011 2012 2013

0.09 0.16 0.20

(Already given in annual report)

2011 2012 2013

0.11 0.21 0.26

(Already given in annual report)

2011 2012 2013

Rs 7.901 Rs 16.59 Rs 21.45

77,743,149

684,429

8,901,483

1,436,649

10,705,596

2,136,085

Equity Total

Income Net

Equity on Return 10.

g Outstandin Shares

Income Net

Share Per Earnings 11.

2. Bestway Cement LTD

(All amounts are in rupees)

2011 2012 2013

0.53 1.18 0.63

2011 2012 2013

0.53 0.68 0.66

120 9,629,477,

761 5,103,635,

6,775,390

7,963,337

8,083,854

5,167,017

s Liabilitie Current

Inventory - Assets Current

Ratio Quick 2.

120 9,629,477,

2,337,548 - 761 5,103,635,

8,083,854

2,493,464 - 7,963,337

6,775,390

3,510,782 - 7,963,337

Assets Total

Sales Net

Turnover Asset Total 3.

Liabilites Current

Assets Current

ratio Current 1.

2011 2012 2013

0.46 0.60 0.52

2011 2012 2013

0.62 0.26 0.21

2011 2012 2013

0.23 0.12 0.14

,185 29,409,252

6,906 813,332,36

39,885,981

24,074,046

33,693,878

17,788,956

Assets Total

Debt Total

Ratio Debt Total 4.

,185 29,409,252

445 6,906,944,

39,855,981

4,760,828

33,693,878

4,996,528

Equity Total

Debt Total

Ratio Equity to Debt 5.

Expense Interest

EBIT

Earned Interest Times 6.

18,417,218

4,760,828

23,955,020

4,966,528

,923 10,972,168

445 , 944 , 906 , 6

2011 2012 2013

3.41 1.94 1.89

2011 2012 2013

0.22 0.32 0.41

2011 2012 2013

0.13 4.98 3.82

5 124,232,13

6 424,137,60

1,363,170

2,657,503

1,436,217

2,725,418

Sales Net

Sold Goods of Cost Sales Net

Margin Profit Gross 7.

,906 13,332,306

,089 10,418,537 - ,906 13,332,306

17,788,956

12,093,170 - 17,788,956

24,074,046

14,103,717 - 24,074,046

Sales Net

Income Net

Margin Profit Net 8.

,906 13,332,306

5 179,230,22

3,570,935

6 117,788,95

6,288,271

24,074,045

Assets Total

Income Net

Assets on Return 9.

2011 2012 2013

0.006 052 0.60

(Already given in annual report)

2011 2012 2013

0.12 0.33 0.30

(Already given in annual report)

2011 2012 2013

Rs 0.57 Rs 6.18 Rs 10.86

,185 29,409,252

5 179,230,22

33,693,878

17,778,596

39,855,981

24,074,046

Equity Total

Income Net

Equity on Return 10.

g Outstandin Shares

Income Net

Share Per Earnings 11.

3. Cherat Cement Ltd

2011 2012 2013

0.95 1.23 1.96

2011 2012 2013

1.67 0.32 2.40

1,799,917

1,717,555

1,040,162

1,289,206

782,308

1,535,642

s Liabilitie Current

Inventory - Assets Current

Ratio Quick 2.

1,799,917

1,179,905 - 1,717,555

1,289,206

869,760 - 1,289,206

1,533,642

967,917 - 1,533,642

Assets Total

Sales Net

Turnover Asset Total 3.

Liabilites Current

Assets Current

ratio Current 1.

2011 2012 2013

0.79 1.16 1.24

(Already Given in annual report)

2011 2012 2013

34.60 24.73 5.57

(Already Given in annual report)

2011 2012 2013

2011 2012 2013

0.41 0.28 0.08

5,635315

4,244,009

4,711,564

5,457,207

5,064,501

6,294,376

Assets Total

Debt Total

Ratio Debt Total 4.

5,365,315

2,250,913

4,711,564

1,325,014

5,064,501

440,800

Equity Total

Debt Total

Ratio Equity to Debt 5.

Expense Interest

EBIT

Earned Interest Times 6.

15.51 2.84 1.19

2011 2012 2013

0.13 -3.88 -1.43

2011 2012 2013

0.016 0.49 0.72

2011 2012 2013

0.012 0.09 0.24

Sales Net

Sold Goods of Cost Sales Net

Margin Profit Gross 7.

4,244,009

3,677,159 - 4,244,009

882,318

4,304,750 - 882,318

1,690,688

4,107,727 - 1,690,688

Sales Net

Income Net

Margin Profit Net 8.

4,244,009

68,051

882,318

436,826

1,690,688

1,224,214

Assets Total

Income Net

Assets on Return 9.

5,365,315

5 179,230,22

4,711,564

436,826,

39,855,981

1,224,214

(Already given in annual report)

2011 2012 2013

0.03 0.17 0.37

(Already given in annual report)

2011 2012 2013

Rs 0.72 Rs 4.57 Rs 12.81

Equity Total

Income Net

Equity on Return 10.

g Outstandin Shares

Income Net

Share Per Earnings 11.

You might also like

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Balance Sheet of Engro FoodsDocument20 pagesBalance Sheet of Engro FoodsMuhib NoharioNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Guna Fibres Annual Income Statements 2012 ForecastDocument12 pagesGuna Fibres Annual Income Statements 2012 ForecastShrey BhalaNo ratings yet

- Bajaj Auto FinancialsDocument21 pagesBajaj Auto FinancialsJanendra YadavNo ratings yet

- Vertical AnalysisDocument3 pagesVertical AnalysisJayvee CaguimbalNo ratings yet

- BHEL Valuation of CompanyDocument23 pagesBHEL Valuation of CompanyVishalNo ratings yet

- Financial Report - ShyamDocument14 pagesFinancial Report - ShyamYaswanth MaripiNo ratings yet

- Prospective Analysis 2Document7 pagesProspective Analysis 2MAYANK JAINNo ratings yet

- Amtek Ratios 1Document18 pagesAmtek Ratios 1Dr Sakshi SharmaNo ratings yet

- Ratio Analysis Memo and Presentation: ACCA 500Document8 pagesRatio Analysis Memo and Presentation: ACCA 500Awrangzeb AwrangNo ratings yet

- 1 - Case 12 Guna FibresDocument11 pages1 - Case 12 Guna FibresBalaji Palatine100% (1)

- Ratio Analysis of Fuel Company-3Document21 pagesRatio Analysis of Fuel Company-3Zakaria ShuvoNo ratings yet

- LDG - Financial TemplateDocument20 pagesLDG - Financial TemplateQuan LeNo ratings yet

- Accounting Presentation (Beximco Pharma)Document18 pagesAccounting Presentation (Beximco Pharma)asifonikNo ratings yet

- Balance Sheet: Particulars 2014 2015 AssetsDocument11 pagesBalance Sheet: Particulars 2014 2015 AssetsTaiba SarmadNo ratings yet

- Financial Statement Analysis Ratios ExplainedDocument20 pagesFinancial Statement Analysis Ratios ExplainedRoxieNo ratings yet

- Under ArmourDocument6 pagesUnder Armourzcdbnrdkm4No ratings yet

- Income Statement & Financial Ratios 2009-2011Document5 pagesIncome Statement & Financial Ratios 2009-2011Michael FrancoNo ratings yet

- Praktikum FinancialDocument22 pagesPraktikum Financiallisa amaliaNo ratings yet

- Financial Statements Analysis: Arsalan FarooqueDocument31 pagesFinancial Statements Analysis: Arsalan FarooqueMuhib NoharioNo ratings yet

- WACC, Growth Rates, and DCF Valuation for Bluntly MediaDocument18 pagesWACC, Growth Rates, and DCF Valuation for Bluntly Mediahimanshu sagarNo ratings yet

- Hello GunaDocument10 pagesHello GunaMajed Abou AlkhirNo ratings yet

- Aamir Ali Bba Viii ADocument9 pagesAamir Ali Bba Viii Aaamir aliNo ratings yet

- Description Variable 2008: Financial Leverege (Nfo/cse)Document9 pagesDescription Variable 2008: Financial Leverege (Nfo/cse)Nizam Uddin MasudNo ratings yet

- Name of The company-JSW STEEL LTD Financial Analysis Financial Statements 1) Income StatementDocument6 pagesName of The company-JSW STEEL LTD Financial Analysis Financial Statements 1) Income StatementzaniNo ratings yet

- Financial Performance and Projections of Chanman Lal Sethia ExportsDocument8 pagesFinancial Performance and Projections of Chanman Lal Sethia ExportsKhush GosraniNo ratings yet

- Merged Income Statement and Balance Sheet of Pacific Grove Spice CompanyDocument9 pagesMerged Income Statement and Balance Sheet of Pacific Grove Spice CompanyArnab SarkarNo ratings yet

- Interloop Limited Income Statement: Rupees in ThousandDocument13 pagesInterloop Limited Income Statement: Rupees in ThousandAsad AliNo ratings yet

- Ratio AnalysisDocument6 pagesRatio Analysisamitca9No ratings yet

- new-heritage-doll-company-capital-budgetDocument10 pagesnew-heritage-doll-company-capital-budgetIris Belen Medina OrozcoNo ratings yet

- 2013 IKBI IKBI Annual Report 2013Document120 pages2013 IKBI IKBI Annual Report 2013PrabowoBektiSantoso100% (1)

- Prospective Analysis - FinalDocument7 pagesProspective Analysis - FinalMAYANK JAINNo ratings yet

- Confidence Cement sales growth and profit over timeDocument20 pagesConfidence Cement sales growth and profit over timeIftekar Hasan SajibNo ratings yet

- BDlampDocument59 pagesBDlampSohel RanaNo ratings yet

- Tarea Heritage Doll CompanyDocument6 pagesTarea Heritage Doll CompanyFelipe HidalgoNo ratings yet

- New Heritage Doll Company Capital Budgeting SolutionDocument10 pagesNew Heritage Doll Company Capital Budgeting SolutionBiswadeep royNo ratings yet

- Pran Company Ratio AnalysisDocument6 pagesPran Company Ratio AnalysisAhmed Afridi Bin FerdousNo ratings yet

- Forecasted Income Statement and Balance Sheet for Green Zebra with Store ExpansionDocument14 pagesForecasted Income Statement and Balance Sheet for Green Zebra with Store ExpansionJessie FranzNo ratings yet

- Letchoose Farm Corporation Financial Highlights (Insert FS)Document31 pagesLetchoose Farm Corporation Financial Highlights (Insert FS)Cking CunananNo ratings yet

- Binani Zinc Company ProfileDocument22 pagesBinani Zinc Company ProfileHaseena ShameemNo ratings yet

- Fadm Project 3Document11 pagesFadm Project 3Vimal AgrawalNo ratings yet

- Additional Information Adidas Ar20Document9 pagesAdditional Information Adidas Ar20LT COL VIKRAM SINGH EPGDIB 2021-22No ratings yet

- BF1 Package Ratios ForecastingDocument16 pagesBF1 Package Ratios ForecastingBilal Javed JafraniNo ratings yet

- Ajanta Pharma LTD.: LiquidityDocument4 pagesAjanta Pharma LTD.: LiquidityDeepak DashNo ratings yet

- Adidas Chartgenerator ArDocument2 pagesAdidas Chartgenerator ArTrần Thuỳ NgânNo ratings yet

- New Heritage Doll Company Capital Budgeting NPV AnalysisDocument5 pagesNew Heritage Doll Company Capital Budgeting NPV AnalysisPGP37 392 Abhishek SinghNo ratings yet

- DataDocument11 pagesDataA30Yash YellewarNo ratings yet

- PIOC Data For Corporate ValuationDocument6 pagesPIOC Data For Corporate ValuationMuhammad Ali SamarNo ratings yet

- Term Paper OF Accounting For Managers ON Ashoak Leyland: Lovely Professional UniversityDocument9 pagesTerm Paper OF Accounting For Managers ON Ashoak Leyland: Lovely Professional Universitymanpreet1415No ratings yet

- New Heritage DollDocument8 pagesNew Heritage DollJITESH GUPTANo ratings yet

- Total Shareholders Funds 12,797 13,195 10,206 10,505 10,485Document6 pagesTotal Shareholders Funds 12,797 13,195 10,206 10,505 10,485sayan duttaNo ratings yet

- 5 6120493211875018431Document62 pages5 6120493211875018431Hafsah Amod DisomangcopNo ratings yet

- Six Years at A Glance: Chairman's Review Financial Analysis Financial Statements Annual General Meeting GovernanceDocument5 pagesSix Years at A Glance: Chairman's Review Financial Analysis Financial Statements Annual General Meeting GovernanceraviaxgNo ratings yet

- Balance Sheet: AssetsDocument19 pagesBalance Sheet: Assetssumeer shafiqNo ratings yet

- Profit and Loss Forecast for Manufacturing CompanyDocument20 pagesProfit and Loss Forecast for Manufacturing CompanyJulio Arroyo GilNo ratings yet

- Shell Pakistan: Total Non Current Assets Current AssetsDocument17 pagesShell Pakistan: Total Non Current Assets Current AssetsshamzanNo ratings yet

- Alro SA (ALR RO) Enterprise Value and Multiples AnalysisDocument147 pagesAlro SA (ALR RO) Enterprise Value and Multiples AnalysisAlexLupescuNo ratings yet

- Assets: Balance SheetDocument4 pagesAssets: Balance SheetAsadvirkNo ratings yet

- Vertical Analysis PDFDocument12 pagesVertical Analysis PDFAbdul Rehman SafdarNo ratings yet

- RAP Submission Form, OBIDocument3 pagesRAP Submission Form, OBIAhmed MustafaNo ratings yet

- Self-Assessment On Accountability: I. QuestionsDocument2 pagesSelf-Assessment On Accountability: I. QuestionsAjit Kumar SahuNo ratings yet

- Information Pack For Indonesian Candidate 23.06.2023Document6 pagesInformation Pack For Indonesian Candidate 23.06.2023Serevinna DewitaNo ratings yet

- Conplast SP430 0407Document4 pagesConplast SP430 0407Harz IndNo ratings yet

- Chapter 6: Structured Query Language (SQL) : Customer Custid Custname OccupationDocument16 pagesChapter 6: Structured Query Language (SQL) : Customer Custid Custname OccupationSarmila MahendranNo ratings yet

- Com 0991Document362 pagesCom 0991Facer DancerNo ratings yet

- ABS Rules for Steel Vessels Under 90mDocument91 pagesABS Rules for Steel Vessels Under 90mGean Antonny Gamarra DamianNo ratings yet

- Death Without A SuccessorDocument2 pagesDeath Without A Successorilmanman16No ratings yet

- 1 Estafa - Arriola Vs PeopleDocument11 pages1 Estafa - Arriola Vs PeopleAtty Richard TenorioNo ratings yet

- Biggest Lessons of 20 Years InvestingDocument227 pagesBiggest Lessons of 20 Years InvestingRohi Shetty100% (5)

- CompactLogix 5480 Controller Sales GuideDocument2 pagesCompactLogix 5480 Controller Sales GuideMora ArthaNo ratings yet

- Cercado VsDocument1 pageCercado VsAnn MarieNo ratings yet

- Milwaukee 4203 838a PB CatalogaciónDocument2 pagesMilwaukee 4203 838a PB CatalogaciónJuan carlosNo ratings yet

- Chapter 2a Non Structured DataRozianiwatiDocument43 pagesChapter 2a Non Structured DataRozianiwatiNur AnisaNo ratings yet

- ARMOR Winter-Spring 2018 EditionDocument84 pagesARMOR Winter-Spring 2018 Editionmai100No ratings yet

- Resume Ajeet KumarDocument2 pagesResume Ajeet KumarEr Suraj KumarNo ratings yet

- Victor's Letter Identity V Wiki FandomDocument1 pageVictor's Letter Identity V Wiki FandomvickyNo ratings yet

- Understanding CTS Log MessagesDocument63 pagesUnderstanding CTS Log MessagesStudentNo ratings yet

- ABBBADocument151 pagesABBBAJeremy MaraveNo ratings yet

- Conversion of Units of Temperature - Wikipedia, The Free Encyclopedia PDFDocument7 pagesConversion of Units of Temperature - Wikipedia, The Free Encyclopedia PDFrizal123No ratings yet

- Bill of ConveyanceDocument3 pagesBill of Conveyance:Lawiy-Zodok:Shamu:-El80% (5)

- Qatar Airways E-ticket Receipt for Travel from Baghdad to AthensDocument1 pageQatar Airways E-ticket Receipt for Travel from Baghdad to Athensمحمد الشريفي mohammed alshareefiNo ratings yet

- Pyrometallurgical Refining of Copper in An Anode Furnace: January 2005Document13 pagesPyrometallurgical Refining of Copper in An Anode Furnace: January 2005maxi roaNo ratings yet

- Denial and AR Basic Manual v2Document31 pagesDenial and AR Basic Manual v2Calvin PatrickNo ratings yet

- CCS PDFDocument2 pagesCCS PDFАндрей НадточийNo ratings yet

- Variable Displacement Closed Circuit: Model 70160 Model 70360Document56 pagesVariable Displacement Closed Circuit: Model 70160 Model 70360michael bossa alisteNo ratings yet

- Module 5Document10 pagesModule 5kero keropiNo ratings yet

- Super Flexible, Super Fast, Super Value: Gigabit PTMP Client and PTP With Modular AntennasDocument5 pagesSuper Flexible, Super Fast, Super Value: Gigabit PTMP Client and PTP With Modular AntennasAbdallaNo ratings yet

- Notes On Lesson: Faculty Name Code Subject Name CodeDocument108 pagesNotes On Lesson: Faculty Name Code Subject Name CodeJeba ChristoNo ratings yet

- WELDING EQUIPMENT CALIBRATION STATUSDocument4 pagesWELDING EQUIPMENT CALIBRATION STATUSAMIT SHAHNo ratings yet