Professional Documents

Culture Documents

Declaration of Originality 5 Final

Uploaded by

Ridwan KingdomCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Declaration of Originality 5 Final

Uploaded by

Ridwan KingdomCopyright:

Available Formats

Page | 1

Declaration of Originality

I do hereby solemnly declare that the work presented that it has been carried out by me and has

not been previously submitted to any other university for an academic qualification.

The work does not abuse any existing copyright regulation. Information derived from the

published and unpublished work of others has been acknowledged in the text and references.

I further undertake to insure that the department as well as university against any loss or damage

arising from breach of the foregoing obligations.

Signature

Dewan Ridwan Ferdous

ID No. 103-12-0119

Section: HRM 11A

Major in HRM

Faculty of business

ASA University Bangladesh

Page | 2

Supervisors Certificate

Dear Madam,

I am pleased to submit hereby the project of Compensation system of the Dhaka bank

Bangladesh for your kind evaluation. To prepare the project, I have given my best effort that

would enhance the project.

Thee project attempts to describe my observations, learning during the study thercourse.

I made sincere efforts to study related materials, documents, annual report and examine relevant

records for preparation of the project as comprehensive and informative as possible within the

time allowed for me. Due to various there may be some mistakes for which I beg your apology.

I would be glad if you accept the project paper and also requesting to consider limitations with a

soft view that had made due to my limitations and oblige thereby.

With the best regards,

Signature

.

Mrs.Monsura Zaman

Assistant Professor,

Faculty of Business

ASA University Bangladesh

Page | 3

LETTER OF TRANSMITTAL

submission

Monsura Zaman

Assistant Professor,

Faculty of Business

ASA University Bangladesh.

Dear

Sir/ madam,

It is great pleasure to submit a project on Compensation System of the Dhaka bank

Bangladesh" as the fulfillment of the partial requirement of BBA program.

The project is done to find how compensation system of the Dhaka bank in Bangladesh. We are

working on bank we find how employee get compensation. The project has helped me to find

those employees are happy with their compensation.

We sincerely hope that you will enjoy reading the report as much as we enjoyed it writing. If

you need any further clarification interpreting our analysis please feel free to ask.

Sincerely

yours,

Dewan Ridwan Ferdous

ID No. 103-12-0119

Section: HRM 11A

Major in HRM

Faculty of business

ASA University Bangladesh

Page | 4

Table of contents

Page | 5

Acknowledgment

At this point i would specially like to thank those who had made it possible for me to prepare

my project. Without their cooperation the completion of this project would have been difficult.

We are most grateful to the many people in the banking sector in Bangladesh, bank employees,

managers, and experts, who willingly cooperated in the difficult task of data gathering.

I would also like to express my thanks to the respondents - the Directors and the Managing

Committee of Dhaka Bank Ltd. Bangladesh Mirpur Branch, who has helped me by contributing

their time and providing us with information related to the topic. I appreciate their consideration,

and their consent to give the interviews.

I want to express my thanks to my Supervisor Mrs.Monsura Zama who had given me this

project and helped me in all possible ways and directed, guided me properly in completing of

my project. Her continuous support and re -enforcement has encouraged me to complete this

project, through which I gained experience on real life research situation.

Finally, All in all it was a wonderful experience to work in doing this research and preparing

this project on such an important issue.

Page | 6

Executive summary

Dhaka Bank Limited is the leading Banks in the bank business and efficiently broadening their

horizon, we thought it would be interesting to know about their practices and their strategies

which they apply in their day to day activities in controlling the compensation system and

human resource and also planning policies to reach the goals in time.

Dhaka Bank Limited follow stable compensation system, for therreason Dhaka Bank

Limited goes for long term planning, also the strategies Dhaka Bank Limited followed in

their Human Resource Planning is flexibility. We know in compensation system Human

Resource planning organization go for reactive HRP. As we know Dhaka Bank Limited is in

now Growth stages.

To estimate future demand and supply of employees Dhaka Bank Limited uses Managerial

Judgment. To forecasting the internal supply of employees they used their own software which

is HRIS. For external supply how employees they take fresh University Graduates.

Banks maintains 100% privacy to their employees personal information. Dhaka Bank Limited

is now growth stage Company. So, their business has expended dramatically. For that reasons

they never face the situation like employees surplus. Dhaka Bank Limited sometimes faces

labor shortage problem. In that situation the company go for hire temporary employees and

employees are given overtimes.

In the case of compensation system they follow all the process like at first they make a plan then

develop a strategy after that they go for searching and screening at last the evaluate the whole

compensation system process. For the analysis we, focused on the compensation system

practiced by two private banks of Bangladesh.

Page | 7

Chapter-One

Introduction

Page | 8

Introduction

During the late nineties the banking sector of Bangladesh saw a sudden shift of expansion as the

government approved operation of a good number of new Private and Foreign Commercial

Banks. Therexpansion irresistibly brought in greater benefits to the consumers because of the

highly competitive market condition. The period has seen emergence of some dynamic and high-

tech banking services of which our consumers were deprived of. Thernew era of banking

services include:

One Stop Utility Service

Automated Teller Machine

Phone Banking

Credit Card

On-line Banking

Syndicated loan

But these advancements in banking technology didnt solely benefit the customers. It brought

greater challenge in parts of the employees or bankers who were designated with high profile

jobs with tougher goals to meet, a dynamic career with attractive remuneration, greater benefits

and stunning status. The report will take an attempt to study the career private commercial banks

of our country through the evaluation of the employee maintenance functions as practiced in the

sector.

Rationale of the study

Compensation is the important part for human resource. Human resource employee must know

about pay structure or compensation system. If a human resource employee doesnt know about

pay structure or compensation then he/she can face difficulties on his/her future job. Thats why

therstudy has more interesting information about compensation systems of private commercial

banks in Bangladesh.

Objectives of the study

General objective

Develop reward structures that are equitable with consistent and fair pay relationships between

differently valued jobs.

Specific objectives

1. To understand in details how to establish pay rates to different level of employee.

2. To evaluate perfomance, quality and customers satisfaction.

3. To understand how many employees are satisfied or dissatisfied about their job.

4. To Attract new and retain talent employees.

Page | 9

Limitations of the study

Every study of the type has some limitation. The topic of my study also has faced some

limitations, I have faced a few impediments & restriction while conducting the study, whish may

be termed as limitations. These as follows:

There is time limitation due to short time period of internship program.

Every company has some policy of not disclosing some data to all, so the report does not

acquire all aspects of each topic.

Insufficient data: Its very difficult to collect recent data, which is very important for

interpretation of report.

Page | 10

Chapter-Two

Literature Review

Page | 11

Pay of the skilled and experienced employees and the top management has a connection with

the performance of the company. In a more structured way we can say that a company is a

system in which the input is the skills of the employees which is organized and controlled by the

top management, and the output is the overall performance of the company. Managerial

activities and the compensation are linked to each other. If the relationship between the

compensation and managerial activities is weaken than it will affect the relationship of the input

and the output of the company as this (compensation and managerial activities) link is the

connecting chain between the input and the output of the company. (Harris, Helfat 1997)

This paper discusses the compensation structure of skilled workers in a hierarchical firm.

Promotion depending upon the compensating the employee is a systematic process. The

appraisal process takes a long period of time and do not serve its purpose as the workers use

their shrewdness techniques showing that they are among the skilled workers. On the other

hand, the manager can also show unacceptable behavior, sometimes by not providing the

incentives that the employee really deserves. Usually the managers appraise the the

educated workers despite of the fact that two workers are working on the some level and even

though the uneducated worker is more skillful the promotion is given to the educated and less

skillful person. The paper discusses the action plan of providing promotion plan that are efficient

and effective at the same time.(Bernhardt 1995)

Studies extended and implicated of facts that develop a theoretical framework recognize and

comprehending the executive compensation under the roof of ethics and moral values.

Importance is given to the ethical standards set in the light of liberty and equality. Study

conducted emphasizes on the need on clearly defining the rules and procedures that formulates

the compensation for the top management of the business.(Rodgers, Gago 2003)

Page | 12

History of Banking

Bangladesh inherited its banking structure from the British regime and had 49 banks and other

financial institutions before the Partition of India in 1947. The Dhaka Bank established in 1806

was the first commercial bank in the Bangladesh region of British India. Bengal Bank, the first

British-Patronized modern bank established in India in 1784, had opened its two branches in

1873 in Sirajganj and Chittagong of Bangladesh region. Later in 1862, the Bengal Bank

Purchased the Dhaka Bank and opened its first branch in Dhaka in the same year by

reconstituting and merging the Dhaka Bank. Thereafter, another branch of Bengal Bank was

opened in Chandpur in 1900. A number of other branches of Bengal Bank were opened in the

region and some branches had been closed in Course of time. There were six other branches of

Bengal Bank in operation in the territory of Bangladesh until the Partition of British-India in

1947 and these branches were at Chittagong (1906), Mymensing (1922), Rangpur (1923),

Chandpur (1924), and Narayanganj (1926).

Following the emergence of Pakistan in 1947, Stat Bank of Pakistan, the Central Bank of the

country, came into being in July 1948. Later, the National bank of Pakistan, a strong commercial

bank was set up in 1949. In all, 36 scheduled commercial banks were in operation in the whole

Pakistan until 1971. Pakistanis owned most of these banks and only three of them namely,

National Bank of Pakistan, Habib Bank Ltd. and the Australasia Bank Ltd, had one branch of

each in East Pakistan in 1949. During 1950-58, there other Pakistani-owned banks, Premier

Bank Ltd., Bank of Bhowalpur Ltd. and Muslim Commercial Bank, had Opened their branch in

East Pakistan. Four Pakistan-owned banks, the United Bank Ltd., Union Bank Ltd., Standard

Bank Ltd. and the commerce Bank Ltd. Conducted banking business in the Province during

1959-1965.But all of them Had their headquarters in west Pakistan. East Pakistan had only two

banks Owned by local business groups white headquarters in Dhaka. These were the Eastern

Mercantile Bank Ltd. (Presently Pubali Bank Ltd.) and Eastern Banking Corporation Ltd.

(Presently Uttara Bank Ltd.) established in 1959 and 1965 respectively.

In the beginning of 1971, there were 1130 branches of 12 banks in operation in East Pakistan.

The foundation of independent banking system in Bangladesh was laid through the

establishment of the Bangladesh Bank in 1972 by the Presidential Order No. 127of 1972 (which

took effect on 16

th

December,1971). Through the Order, the eastern branch of the former State

Bank of Pakistan at Dhaka was renamed as the Bangladesh Bank as a full-fledged office of the

central bank of Bangladesh and the entire undertaking of the State Bank of Pakistan in, and in

relation to Bangladesh has been delivered to the Bank.

Page | 13

Bangladesh Bank has been entrusted whit all of the traditional central banking functions

including the sole responsibilities of issuing currency, Keeping the reserves, formulating and

managing the monetary and credit policy, regulating the banking system, stabilizing domestic

and external monetary value, preserving the par value of Bangladesh Taka, fostering economic

growth and development and the development of the countrys market.

The Bangladesh Banks (Nationalization) Order enacted in 1972 nationalized all banks except

foreign ones. Six nationalized banks were formed through merging the existing banks of the

period.

The rate of growth and development of banking sector in the country was extremely slow until

1983 when the government allowed to establish private banks and started denationalization

process: initially, the Uttara Bank in the same year and thereafter, the Pubali Bank, and the

Rupali Bank in 1986. Growth pattern of banks during the period 1973-1983.

Economic history shows that development has started everywhere with the banking system and

its contribution towards financial development of a country is the highest in the initial stage.

Schumpeter (1933) regarded the banking system as one of the two main agents (other being

entrepreneurship) in the whole process of development. Keynes also emphasized the role of

banking services in the process of economic development of a country, while SHE was

addressing the House of Lords regarding International and Monetary System (quoted in Sharma

1985). Moreover Alexander Gerashchenko (1962) in herpopularly known Gerschenkrons

Hypothesis explained the banking system as the key role player at certain stage of the

industrialization process.

Modern banking system plays a vital role for a nations economic development. Over the last

few years the banking world has been undergoing a lot of changes due to deregulation,

technological innovations, globalization etc. These changes in the banking system also brought

revolutionary changes in a countrys economy. Present world is changing rapidly to face the

challenge of competitive free market economy. It is well recognized that there is an urgent need

for better, qualified management and better-trained staff in the dynamic global financial market.

Bangladesh is no exceptions of thertrend. Banking Sector in Bangladesh is facing challenges

from different angles though its prospect is bright in the future.

History of Private Banks in Bangladesh

Page | 14

There were no domestic private commercial banks in Bangladesh until 1982; When the Arab-

Bangladesh Bank Ltd. commenced private commercial banking in the country. Five more

commercial banks came up in 1983 and initiated a moderate growth in banking financial

institutions. Despite slow growth in number of individual lbanks, there had been a relatively

higher growth of branches of nationalized commercial banks (NCBs) during 1973-83. There

number had increased from 1512 in 1973-74 to4603 in 1982-83.

Financial sector reforms to strengthen the regulatory and supervisory framework for banks made

headway in 2006 although at a slower than expected pace. Overall health of the banking system

showed improvement since 2002 as the gross Non-performing Loans (NPL) declined from 28

percent to 14 percent while net NPL (less Provision) reduced to 8 percent from 21 percent.

Therled significant improvement in the profitability ratios. Although the Private Commercial

Banks (PCB) NPL ratio registered a record low of 6 percent, the four Nationalized Commercial

Banks (NCB) position are still weak and showed very high NPL at 25 percent. The NCBs have

large capital shortfalls with a risk-weighted capital asset ratio of just 0.5 percent (June 2006) as

against the required 9 percent. For the PCBs risk-weighted capital asset ratio stood at 10 percent.

Bangladesh Bank issued a good number of prudential guidelines during the year 2006 and the

first quarter of 2007 which among others relate to:

rationalization of prudential norms for loan classification and provisioning,

policy for rescheduling of loans,

designing and enforcing an "integrated credit risk grading manual",

credit rating of the banks, and

Revisions to the make-up of Tier-2 capital.

Besides, recent decision of the Government to corporative the remaining three NCBs along with

the initiative to sale the Rupali Bank are bound to usher in changes in the banking sector

competitiveness aspect. Bangladesh Bank has also taken up the task of implementing the Basel

II capital accord. Further, the recent enactment of the Micro-credit Regulatory Authority Act

(MRAA) for the regulation of the Micro Finance Institutions (MFI) has been a major

development in the year 2006. Since 1998 CAMEL rating of banks gradually improved and in

2006 Bangladesh Bank updated therrating model by incorporating the market risk and the new

Page | 15

Modern banks play an important part in promoting economic development of a country. Banks

provide necessary funds for executing various programs underway in the process of economic

development. They collect savings of large masses of people scattered through out the country,

which in the absence of banks would have remained idle and unproductive. These scattered

amounts are collected, pooled together and made available to commerce and industry for

meeting the requirements. Economy of Bangladesh is in the group of worlds most

underdeveloped economics. One of the reasons may be its underdeveloped banking system.

Government as well as different international organizations have also identified that

underdeveloped banking system causes some obstacles to the process of economic development.

So they have highly recommended for reforming financial sector. Since, 1990, Bangladesh

government has taken a lot of financial sector reform measurements for making financial sector

as well as banking sector more transparent formulation and implementation of these reform

activities has also been participated by different international organization like world Bank, IMF

etc.

Page | 16

AN OVERVIEW OF BANKING SECTOR IN BANGLADESH

The Banking Industry in Bangladesh is a complex and competitive one. The sector can be

diagramed as follows:

The sector can be diagramed as follows:

Bangladesh Bank

Specialized Banks Commercial Banks Non-Banking

Financial Institutions

Nationalized Banks Private Commercial Foreign Banks

Banks

A brief description of each of the groups is noted here:

Bangladesh Bank

Bangladesh Bank is the Central Bank of Bangladesh and the chief regulatory authority in the

sector. The banking system consists of four nationalized commercial Banks, around forty private

commercial banks, nine foreign multinational banks and some specialized banks. The ministry

of Finance in association with Bangladesh bank regulates the banking sector through monetary

and fiscal policies whereas banks are operating under guidelines set by Bangladesh Bank.

Specialized Banks

These banks basically are specialized micro-finance institution, which revolutionized the

concept of micro-credit and contributed greatly towards poverty reduction and the empowerment

of women in Bangladesh.The Nobel-prize winning Grameen Bank is a specialized micro-

finance institution, which revolutionized the concept of micro-credit and contributed greatly

towards poverty reduction and the empowerment of women in Bangladesh. Out of the

specialized banks, two (Bangladesh Krishi Bank and Rajshahi Krishi Unnayan Bank) were

created to meet the credit needs of the agricultural sector while the other two ( Bangladesh

Page | 17

Shilpa Bank (BSB) & Bangladesh Shilpa Rin Sangtha (BSRS) are for extending term loans to

the industrial sector. The Specialized banks are:

Grameen Bank

Bangladesh Krishi Bank

Bangladesh Shilpa Bank

Rajshahi Krishi Unnayan Bank

Bangladesh Shilpa Rin Sangstha

Basic Bank Ltd (Bank of Small Industries and Commerce)

Bangladesh Somobay Bank Limited(Cooperative Bank)

The Dhaka Mercantile Co-operative Bank Limited (DMCBL)

Nationalized Banks

The banking system of Bangladesh is dominated by the 4 Nationalized Commercial Banks,

which together controlled more than 50%-55% of deposits. The nationalized commercial banks

are:

Sonali Bank

Janata Bank

Agrani Bank

Rupali Bank

Private Commercial Banks

Private Banks are the highest growth sector due to the dismal performances of government

banks (above). They tend to offer better service and products.

AB Bank Limited

BRAC Bank Limited

Dutch Bangla Bank Limited

Page | 18

Dhaka Bank Limited

Islami Bank Bangladesh Ltd

IFIC Bank Limited

United Commercial Bank Limited

NCC Bank Limited

Prime Bank Limited

Exim Bank Limited

Bank Asia Limited

Trust Bank Limited and many more

Foreign Commercial Banks

Citigroup

HSBC

Dhaka Bank

Commercial Bank of Ceylon

State Bank of India

National Bank of Pakistan and many more

Page | 19

Total Compensation and Benefits Package

THE SEGMENTS OF PAY COMPONENTS

To evaluate the various components of the total compensation package, the

values of non-cash perquisites and benefits have been monetized at current

market rates.

While computing Annual Guaranteed Cash, items like Performance Bonus,

which is variable, and Terminal Payments have not been taken into account

though these have been considered for the purpose of Annual Cost to the

Company.

The compensation package has been divided into five segments:

Monthly Guaranteed Cash

Annual Guaranteed Cash.

Annual Variable Cash

Terminal Payments

Monthly Cost of Benefits

MONTHLY GUARANTEED CASH

Basic Salary

Actual average basic salary of the benchmarks has been taken.

No employer agrees to provide actual individual salary for the

benchmark jobs as theris confidential between the employer and the

employee. Where a job is held by one person, the individuals

actual salary has been shown. Where 2/3 benchmark jobs fall under

one grade, actual average of that grade has been taken. Where actual

average has not been available, the meaningful point of the salary

range, applicable to the job grades of the benchmark has been taken.

House Rent Allowance

Specific amounts or percentage of basic salary paid in cash for each

matched job have been taken.

Domestic Aids Wage

Specific amounts paid in cash for each matched job have been

taken.

Utilities / Maintenance

Page | 20

Specific amounts paid as cash allowance have been taken.

Transport Allowance

Specific amounts paid in cash for each matched job have been taken.

Medical Allowance

A specific amount paid in cash has been used.

Personal / Special / Other Allowance

Specific amounts paid in cash as allowances have been utilized.

Quite a few costs are lumped into therand paid in cash. With reduction of

personal tax slabs, employers are opting for a more transparent pay system

conforming to the tax regulations.

Meal Allowance

Specific amounts paid in cash as allowance have been used.

Children Education Allowance

Specific amount paid in cash has been used.

ANNUAL GUARANTEED CASH

Annual Bonus

Theris a deferred wage not linked to profitability. Actual amount

paid under therhead has been used.

Festival Bonus

Actual amount paid under therhead has been used.

Leave Fare Assistance

Actual amounts paid to the employees have been taken.

ANNUAL VARIABLE CASH

Performance Bonus

Actual amounts paid have been taken. Theris paid by

the employers in different forms based on:

Employees performance only

Combined performance of the group, business unit and the

employee

Company performance

Profit Bonus

Actual amounts paid, based on company profitability, have been

taken.

Page | 21

Incentive Bonus

SMC pays an incentive bonus to its all its employees. The incentive

amount is a fixed sum for each grade.

TERMINAL BENEFITS

Provident Fund

Actual payments made by the employers to the Fund have been

used.

Gratuity

Actual amounts provided by the employers in the Books of

Accounts have been used.

Pension Fund

Actual payments made by the employers to the Fund have been

used.

MONTHLY COST OF BENEFITS

Company Leased Accommodation

Actual cost has been taken.

Household Effects (Depreciation)

Therreflects the cost of depreciation on account of hard and soft

furnishing and electrical appliances provided by the comparators.

Utilities / Maintenance

Costs under therhead have been taken at actual.

Telephone

Actual cost has been taken.

Company Car (Depreciation)

Where company cars are provided for both functional and personal

purposes, the figures mentioned represent the cost of depreciation.

Running and Maintenance Cost

Actual amounts spent for fuel and car maintenance have been used.

Drivers Wages

Where drivers are Company employees, their actual cost has been

taken. Where Private Drivers wages are paid for, actual amounts

paid to the employees have been taken.

Page | 22

Registration / Insurance / Tax

Costs of registration, insurance, tax, etc. have been taken, at actual.

Pickup-Drop / Transportation Cost

Actual cost to the company for pickup-drop facility has been taken.

Entertainment Allowance

Specific costs reimbursed have been utilized.

Canteen Subsidy

Specific costs on account of company provided subsidized meals

have been taken.

Company Products

Specific costs on account of company products have been taken.

Club Membership

The actual amounts paid for by the employers have been utilized.

Group Life Insurance

Actual premium paid by the employers has been used.

Medical Expense

The average cost to the employer on account of medical

reimbursement has been used, at actual.

Hospitalization Scheme

Premium paid by the comparators under the Hospitalization

Insurance Policies has been taken at actual.

Loan

Amount of interests absorbed by the comparator for utilization of

various loan policies has been taken.

Fringe Benefits

Employee benefits, sometimes called fringe benefits, are those rewards

that employees receive for being members of the organization and for

their position in the organization unlike wage, salaries and incentives,

benefits are usually not related to employee performance.

The term fringe benefits was coined over 40 years ago by the war labor

Board, Reasoning that employer provided benefits such as paid vacation,

holidays and pensions were on the fringe of wages , are agency exempted

them from pay controls. It has been argued that theraction, more that any

single event, led to the dramatic expansion of employee benefits that has

Page | 23

since occurred. However, because of the significance of benefits to total

compensation, many employers have dropped the word fringe for fear that

it has a minimizing effect.

Following is the list showing the types of benefits that employees can

receive from the company:

RETIREMENT

INSURANCE

PAYMENT

FOR TIME

OTHERS

RELATED

RELATED

NOT WORKED

Pension fund Medical insurance Vacation Company discounts

Annuity plan Accident insurance Holidays Meals furnished by company

Early retirement Life insurance Sick leave Moving expenses

Disability

Disability insurance

Military leave

Severance pay

retirement

Retirement gratuity Dental insurance Paid rest periods Tuition refunds

Survivor benefits Lunch periods Credit union

Travel time Company car

Legal service

Financial counseling

Recreation facilities

Page | 24

Dhaka Bank Limited

Background of Dhaka Bank Limited (DBL)

Bangladesh economy has been experiencing a rapid growth since the '90s.

Industrial and agricultural development, international trade, inflow of

expatriate Bangladeshi workers' remittance, local and foreign investments

in construction, communication, power, food processing and service

enterprises ushered in an era of economic activities. Urbanization and

lifestyle changes concurrent with the economic development created a

demand for banking products and services to support the new initiatives as

well as to channelize consumer investments in a profitable manner. A

group of highly acclaimed businessmen of the country grouped together to

responded to therneed and established Dhaka Bank Limited in the year

1995.

The Bank was incorporated as a public limited company under the

Companies Act. 1994. The Bank started its commercial operation on July

05, 1995 with an authorized capital of Tk. 1,000 million and paid up capital

of Tk. 100 million. The paid up capital of the Bank stood at Tk

2,659,597,763 as on March 31, 2010. The total equity (capital and reserves)

of the Bank as on March 31, 2010 stood at Tk 6,036,368,754.

The Bank has 62 Branches, 3 SME Service Centers, 6 CMS Units, 2

Offshore Banking Unit across the country and a wide network of

correspondents all over the world. The Bank has plans to open more

Branches in the current fiscal year to expand the network.

The Bank offers the full range of banking and investment services for

personal and corporate customers, backed by the stateofthe-art

technology and a team of highly motivated Professionals.

As an integral part of our commitment to Excellence in Banking, Dhaka

Bank now offers the full range of real-time online banking services through

its all Branches, ATMs and Internet Banking Channels.

Dhaka Bank Ltd. is the preferred choice in banking for friendly and

personalized services, cutting edge technology, tailored solutions for

Page | 25

business needs, global reach in trade and commerce and high yield on

investments.

Our Mission

To be the premier financial institution in the country providing high quality

products and services backed by latest technology and a team of highly

motivated personnel to deliver Excellence in Banking.

Our Vision

At Dhaka Bank, we draw our inspiration from the distant stars. Our team is

committed to assure a standard that makes every banking transaction a

pleasurable experience. Our endeavour is to offer you razor sharp sparkle

through accuracy, reliability, timely delivery, cutting edge technology, and

tailored solution for business needs, global reach in trade and commerce

and high yield on your investments.

Long-term Goal:

To be the Market Leader both in terms of Deposits and good

advances among Private Commercial Banks in Bangladesh by the

year 2015.

Short-term Goal:

To increase Current Market Shares at least 0.50% by 2015.

Financial Goal:

To reduce the existing Cost of Fund by 1%, thercurrently stands at

11.06%

Values

Customer Focus

Integrity

Team Work

Respect for Individual

Quality

Responsible Citizenship

Page | 26

Motto

The Bank will be a confluence of the following three interests:

Of the Bank : Profit Maximization and Sustained Growth.

Of the Customer : Maximum Benefit and Satisfaction.

Of the Society : Maximization of Welfare

MANAGEMENT SYSTEM

Dhaka Bank Ltd is governed by a board of Director. The Board includes:

Chairman

Vice Chairman

19 Directors

20 Sponsor Shareholders

Managing Director

Current chairman of the Board of Director is Mr. Reshadur Rahman and the

Managing Director is Mr. Khondker Fazle Rashid

Board of Directors

Mr. Abdul Hai Sarker

Chairman

Mrs. Rokshana Zaman

Vice Chairperson

Mr. Mirza Abbas Uddin Ahmed

Director

Mr. Reshadur Rahman

Director

Mr. Altaf Hossain Sarker

Director

Mr. Mohammed Hanif

Director

Mr. Md. Amirullah

Director

Mr. Abdullah Al Ahsan

Director

Mr. Khondoker Monir Uddin

Page | 27

Director

Mr. Tahidul Hossain Chowdhury

Director

Mr. Jashim Uddin

Director

Mr. Khondoker Jamil Uddin

Director

Mr. Mirza Yasser Abbas

Director

Mr. Amanullah Sarker

Director

Mr. Syed Abu Naser Bukhtear Ahmed

Independent Director

Mr. Suez Islam

Independent Director

Mr. Khondker Fazle Rashid

Managing Director (Ex-Officio Director)

Executive Committee

Mr. Abdul Hai Sarker

Chairman

Mrs. Rokshana Zaman

Vice Chairperson

Mr. Mirza Abbas Uddin Ahmed

Member

Mr. Reshadur Rahman

Member

Mr. Altaf Hossain Sarker

Member

Mr. Abdullah Al Ahsan

Member

Mr. Mirza Yasser Abbas

Member

Management Committee

Page | 28

Mr. Khondker Fazle Rashid

Managing Director

Mr. Niaz Habib

Additional Managing Director

Mr. Neaz Mohammad Khan

Deputy Managing Director (RM)

Mr. Emranul Huq

Deputy Managing Director

Mr. Arham Masudul Huq

Senior Executive Vice President

Company Secretary

Mrs Shamshad Begum

Senior Executive Vice President & Principal,

Dhaka Bank Training Institute

Mr. Sirajul Hoque

Executive Vice President &

Head of Islamic Banking Division

Mr. S.A.F.A. Musabbir

Executive Vice President &

Head of Legal & Recovery

Mr. Azad Shamsi

Executive Vice President &

Head of Retail Banking Division

Mr. Asadul Azim

Executive Vice President &

Head of Credit

Mr. Fakhrul Islam

Senior Vice President &

Head of Operations

Mr. Mujib A Siddiqui

Senior Vice President &

Head of Human Resources

Mr. Darashiko Khasru

Senior Vice President &

Head - Finance & Accounts

Mr. J Q M Habibullah

Vice President

Board Secretariat & Share Division

Mr. Syed Faisal Omar

Page | 29

Vice President

& Head of Global Trade Services

Mr. A K M Ahsan Kabir

First Vice President

In-charge Internal Control & Compliance

Mr. K.M.Faisal Faruqui

Senior Assistant Vice President &

Head of Treasury

PRODUCTS

Deposit Pension Scheme (DPS)

Deposit Double (Get double within 72 months)

Special Deposit Scheme

Smart Plan

Edu-Savings Plan

Home Loan

SME

Personal Loan

Car Loan

Dual Currency Credit Card

Mobile Banking

ATM Card

Remittance

Gift Cheque

Student Service Centre

Platinum, Gold & Silver Savings Accounts

SERVICE SEGMENTS OF DBL

1. Corporate Banking

2. Retail Banking:

ATM /Debit Card

Credit Card

3. SME

4. GTS

5. Islamic Banking

6. Capital Market Service

7. Locker

Page | 30

Corporate Banking

Some Corporate Services:

Securitization of Assets

Corporate Finance and Advisory Services

Syndication of Funds

Project Finance

Syndication & Structured Finance

Trade Finance

Working Capital Finance

Retail Banking

Some Retail Services:

Deposit Double

Deposit Pension Scheme [DPS]

Salary Account

Excel Account

Bundled Savings Product

ATM Card

Personal Loan

Car Loan

Home Loan

Vacation Loan

Any Purpose Loan

Credit Card

Page | 31

Total Compensation and Benefits Package of DBL

Objectives

Therchapter outlines the rules relating to compensation structure

and the benefit package of the Bank and gives detailed

procedures for exercising them in order to promote fair treatment

and consistency within the organisation.

Revision of Pay Elements

The compensation structure may be revised, if necessary, with

the approval of the Director, Admin/HR, Head of the Dept.,

Finance and the Chief Executive.

Employee Compensation Records

Employee Pay Records are maintained by the Personnel & Admin

Department for Workers and Supervisors and by the Human Resource

Department for the Executives. These departments maintain personal file of

all employees where all records in regards to the employee are kept in

addition to any soft copy (in computer database) maintained by the

departments. These records are confidential and should not be accessible to

any unauthorised persons (authorisation defined by HR or Personnel &

Admin dept. head).

Page | 32

Salary structure

HYPOTHETICAL SALARY STRUCTURE OF BRAC BANK LTD.

MANAGING DIRECTOR (3, 00,000tk )

SENIOR EXECUTIVE VICE PRESIDENT (SEVP) (2, 50,000tk)

EXECUTIVE VICE PRESIDENT (EVP) (1,50000tk)

SENIOR VICE PRESIDENT (SVP) (1,20000tk)

VICE PRESIDENT (VP) (80,000-1,20000tk)

FIRST VICE PRESIDENT (FVP) (80,000-1,00000tk)

ASSISTANCE VICE PRESIDENT (AVP) (80,000-1,00000tk)

FIRST ASSISTANCE VICE PRESIDENT (FAVP) (80,000tk)

SENIOR EXECUTIVE OFFICER (70,000tk)

EXECUTIVE OFFICER (55,000-65,000tk)

SENIOR OFFICER (45,000tk)

OFFICER(40,000tk)

JUNIOR OFFICER (35,000tk)

ASSISTANCE OFFICER (30,000tk)

BANKING OFFICER (25,000tk)

TELLER (20,000tk)

Page | 33

Basic Employee Benefits for Permanent Employees

Provident Fund

The Bank's Provident Fund is a funded scheme. All confirmed

and permanent employees are entitled to be members of the

Provident Fund. The employee contribution, equal to 10% of the

basic salary, is deducted each month through the payroll. The

Bank contributes an equal amount and both the employees' and

the organization's contributions are paid to the Fund each month.

In the Provident Fund Ledger, both the employee's and the

Bank's contributions are credited to the individual employee's

account.

The membership of the Trustees of the Provident Fund must

include at a minimum:

a) Representation from the HR Department

b) Representation from Finance & Accounts Department

c) Two representatives from the Workers

Group Term Life Insurance

The Bank provides coverage of life insurance to all Permanent

employees after their joining with the organization effective on

the date of joining. To participate in the Group Term Life

Insurance policy, all employees are required to fill up "Group

Term Life Insurance Registration Form", and submit to

HR/Personnel & Admin dept for processing. To change the

beneficiary at any time, the employee must complete the

Beneficiary Change Form, and submit to the Human Resource

Department or to the

Personnel & Admin dept for making the changes.

In the event of the death of an employee while in the banks

service, other than: 1) death by suicide, 2) death by criminal

prosecution, or 3) death by taking part in any activities

subversive of the state, the bank depending on the classification

Page | 34

of employees shall pay benefits on normal death and accidental

death from insurance bank as follows:

Employee classification Normal death benefit Accidental death

benefit

Executives 36 month last basic 72 month last basic

salary salary

Detail of compensation other than death (partial disability) will

be determined as per calculation within the purview of insurance

coverage policy. No recovery or adjustments of loans or salary

advances etc. shall be made from the insurance claim benefits.

In addition to thercoverage of insurance benefits compensation

will also be made as per "Workman's Compensation Act 1923"

in the case of death/disability of employees.

Bonuses

All confirmed Permanent employees of Dhaka Bank Limited

are entitled to one Annual Bonus each equivalent to Basic

Salary under the following conditions:

Attendance in the Calendar Bonus Entitlement

Year

213 days + 100% of the Bonus

107 days + 50% of the Bonus

Meal Facilities

The following facilities are provided in each of the organisation

under Dhaka Bank

Limited:

Branches

Executives:

Meals are provided at a subsidised rate.

Head Office:

Page | 35

Executives:

No meals are provided.

Accommodation

The Bank on the basis of requirements and availability provides

accommodation to

DBLs Top Executives at their own established facilities in

Dhaka city. Outside the Dhaka city, the Bank provides expenses

of the

Utilities Allowances

Executives between grades J to M4:

No utility allowance is paid.

Executives of grades M5 and above:

Water

Telephone

Electricity

Gas

(Local &

(Limit/Mont

NWD)

Designation

(Limit/Month)

(Limit/Month)

h)

(Limit/Month)

Taka

Taka

Taka

Taka

Manager /

Sr.

2,500

At Actual

At Actual

At Actual

Manager

EVP and

At Actual

At Actual

At Actual

At Actual

above

Page | 36

To get reimbursed for utilities bills, complete Expense Reimbursement

Form, and submit to the Accounts Department. The Accounts Department

will make reimbursement payment to the employee within 45 days from the

date of submission. Telephone bill has to be forwarded to the IT

department, so payments can be made by the company, if it is in the name

of the Bank.

Medical Benefits

Medical Benefits for the Executive Staff

The bank will reimburse the cost of authorised medical

treatments in Bangladesh including hospitalisation, surgical and

childbirth subject to the conditions mentioned hereunder. In case

of any overseas treatment prior approval from the Chief

Executive is required. The following are the basic guidelines in

regards to medical benefits provided to the Executives:

(i) Treatment to be carried out by a registered Medical

Practitioner. The Bank reserves the right to approve the

Medical Practitioner consulted.

(ii) Dental treatment included as preventative measures, the

Bank will reimburse for Upper and Lower dental

cleaning twice a year.

(iii) Reimbursement of the cost will be restricted to the

treatment of the executive, spouse and children.

(iv) Relevant details including names and dates of birth of

spouse and the eligible children should be sent to HRD

for record.

(v) Children attaining 21 years of age or getting married,

whichever is earlier, will not be entitled to

reimbursement of the cost of medical treatment.

(vi) Expenditure on medical treatment of Executives is

Page | 37

reimbursed by the company as per following

entitlements:

(vii) Expenses Cannot not be claimed: The Bank will not

reimburse the following expenses:

The supply of dentures and false caps.

Any cosmetic dental work.

The supply of spectacle frames.

Special diets except in hospitals under medical advice

Promotion/Up-gradation

Promotion cannot be claimed as a matter of right and all promotions shall

be made on merit and no employee shall have a claim to be promoted to a

higher grade by virtue of his seniority alone. All promotions shall be made

be on the basis of Performance and different criterion laid down by the

Management from time to time.

An employee may get Accelerated promotion once within ayear

based on his/her performance.

a) Promotion in Executive Grade

An employee promoted to Executive grade from Senior Principal Officer

(SPO) may need to sit for written examination or face Viva after duly

recommended by his/her supervisor and supported by the concern Head of

the Division/Department/Unit/Branch in the Performance Appraisal

b) Promotion in Officer Grade

i. An employee may be directed to officiate in a higher post for a temporary

period for which s/he shall not be entitled to the salary of the post in which

he officiates. An employee so officiating will be reverted to his substantive

post when such temporary vacancy ceases to exist. Such posting should be

Page | 38

seen as giving an opportunity to the employee as recognition of his

competency as well as proficiency.

ii. Promotional increases will be awarded on progress to a post in a higher

salary range.

iii. In the event of an employee being promoted to a higher job grade,

he/she receives an additional increment in his/her basic salary as

promotional benefit, in addition to his/her regular annual increment in the

previous grade. Both promotional benefit and the annual increment (if any)

should be taken into account while fixing his/her salary in the new grade.

iv. In case his/her new salary falls short of the starting salary of the new job

grade, the employee will be given the differential between his/her salary

and the starting salary of the new job grade.

Page | 39

Treatments not covered under paragraphs (i) and (ii)

Transportation Facilities and Car Purchase Scheme

Transportation Facilities for the Executives

Executives

DBL Branches:

There are no transportation facilities provided for the Executives

between grade J to M4

Head Office:

There are no transportation facilities provided for the Executives

between grades J to M4. For business purpose travel, Pool Car

can be provided based on availability.

Car Purchase Scheme:

Senior Executives:

Employees in thergrade, which is Managers, Senior Managers,

and Vice President, are eligible to apply for a Car Purchase

Scheme upon the expiry of one month after the date of joining in

the Bank. To initiate the request for participating in therCar

Purchase Scheme, the employee is required to write a note to the

HR Department. The Human Resource Department then gets

necessary approvals and then forwards the request to the Head

Office Admin department.

The objective of the scheme is to provide financial assistance to bank

executives for the purchase of cars and thus to provide executives with

transport necessary for carrying out their duties.

An employee who has acquired a car under therscheme will not be eligible

to apply again for a period of five (5) years. The following are the approved

Page | 40

specification of the transport and benefit given to the employee:

Description of the 1300/1500 cc new or reconditioned. Four door Sedan.

car :

Car Price : Tk 900,000/= (maximum Tk 1,000,000)

Purchase Employee 50%; Bank 50%

Contributions :

Fuel Allowance Allowance of 350 litters per month to be paid by the

Bank for worker based at Head Office and also

worker who are working at the branches.

Maintenance: Based on manufacturers year model, for up to 6 year

old car, the Bank will pay a maintenance allowance

of Tk 3,000/= per month.

For 8 years or older cars, the Bank will pay a

maintenance allowance of Tk 4,000/= per month.

For 10 years or older cars, the Bank will pay a

maintenance allowance of Tk 5,000/= per month.

The money will be accumulated in the employees

account in the accounts department and will be

utilised for repairs and maintenance when they arise.

The accounts department will be responsible to pay

the money immediately upon submission of paid in

receipt from the Workshops.

Driver : To be employed by the employee concerned. An

allowance of Tk 4,100 per month will be paid by the

Bank to cover the drivers salary.

Major Accidental Any vehicle under therscheme will maintain a 1

st

Repairs Party insurance. The Admin. Department will ensure

filing of all insurance claims considering the amount

of money required to repair and the amount of

deductible. The amount of deductible and/or the

amount of repairs will be split 50:50 between the

employer and the employee if the balance of the

maintenance fund is not adequate to cover the

expenses. The employer initially will make the full

payment to the insurance company and/or to the

repair shop, then the portion of the employee will be

deducted from the salary in equivalent 12

instalments, if not covered by the insurance. The

Admin. Department (and the employee if willing to)

will supervise all repair work and do the

administrative tasks, then forward a bill of the

employees portion, signed by the employee, to the

Accounts Department for repayment.

Page | 41

hasbeen with the company for a minimum period of two years. In case he does not

choose to exercise the purchase option, the Bank will reimburse the employee 75% of

the amount contributed by him/her towards the cost of the car, and the car will then

remain in or be transferred to the ownership of the Bank.

The employee will be expected to use the car for the Banks business as well as for

fulfilling herprivate transport needs, including the transport of children to school, etc.

Employees who have availed for therscheme are expected to meet all their

transportation needs with the vehicle provided under scheme. No other transport will

be provided to an employee who has availed of therscheme. However, if the employee

is asked to travel outside Dhaka on Banks business, he will be reimbursed at Tk. 6/-

per km, subject to prior permission from herdepartment head, plus an allowance of Tk.

100/- per day for the driver. Tolls and other expenses will be paid at actual.

Repairs and maintenance of the vehicle will be the responsibility of the employee. A

maintenance allowance will be paid as explained earlier in thersection.

All taxes, fees, duties, registration costs, and insurance will be paid by the Bank. The

employee must inform the Admin Department one month prior to the due date for

Fitness/Insurance and the Admin Department will take full responsibilities to complete

the said tasks.

The Banks approval to participate into therscheme will be based on the nature of the

employees job and on the availability of funds with the Bank, at the time when the

application to join the scheme is made.

The employee may choose to select a car that is presently in the name of the Bank and

if made available to the employee for purchase. The administrative department will be

responsible to identify the market value of the car, get approval from the HR

Department, and make an offer to the employee. For the purchase of the company car,

the employee shall be liable to pay 50% of the market value of the vehicle, in equal

monthly instalments to the Bank over a period of three (3) years. All other terms and

conditions shall remain the same.

The Management reserves the right to change, modify, amend, cancel or waive any or

all of the provisions of therscheme at its absolute discretion and without any prior

Page | 42

notice and also to withhold or reject any application to join the scheme, without

assigning any reason whatsoever.

Top Executives

Top Executives of grade M6 and above, i.e. Sr. Vice President and above are entitled

to 24 hours company paid transportation. The company also pays for the fuel at cost,

Drivers salary, and for all necessary maintenance/repair and administrative cost of the

vehicle.

Leave Entitlements

Basic Leave Types

All Permanent Executives of the Bank are entitled to various types of Leaves that are

calculated based on calendar year and prorated from the date of joining the Bank's

service for the first year. Leave entitlements of expatriate (Contract) employees shall

be governed by their respective terms of employment with the company specified in

the Appointment Letter.

For Employees the leave entitlements are calculated in accordance with "The Shops

and Establishment Act 1965", Factories Act 1965 and the Factory Rules 1979.

These entitlements are as follows:

Types of Leave Days Per Year

Casual Leave (with full wages) 10

Sick Leave (on average wages) 14

Earned Leave (1 for every 22 days 12

actual work with wages)

Public Holidays 10 (minimum)

Page | 43

The following are the Basic Leave entitlements for the Executives at Head Office:

Types of Leave Days Per Year

Weekends (with full wages) As per Section 5.5

Casual Leave (with full wages) 15

Sick Leave (with full wages) 10

Earned Leave 15

Public Holidays

As per list of holidays

declared by the Govt.

The following are the Basic Leave entitlements for the Executives at Branches:

Types of Leave Days Per Year

Weekends (with full wages) As per Section 5.5

Casual Leave (with full wages) 15

Sick Leave (with full wages) 10

Earned Leave 15

Public Holidays 10 (minimum)

Public Holidays for Head Office worker are governed by the policy of the Board of

Directors of the Bank and is based on the list of holidays declared by Govt. For

Branch employees, the Management determines the Public Holidays (minimum 10

days) and it is announced at the beginning of the year.

Page | 44

Definitions of Basic Leave Entitlements

The following are some definitions of Basic Leaves entitlements:

Casual Leave

Entitlement to casual leave for the Executive at Head-Office and Branch Site, it is 15 days based

on each calendar year. The employee is entitled to exercise Casual Leave from the very next day

of joining; though the Casual Leave is pro-rated for the balance period of the year counting from

the joining date. Casual leave cannot be availed for more than three days at a time. Also, it

cannot be carried forward to the following year or cashed. Casual Leave can be taken with

Weekends, Public Holidays, Earned Leaves, etc. but be limited to only 3 days.

Sick Leave

Entitlement to Sick Leave for the Executives at Head-Office and Branch Site it is 15

days on the basis of each calendar year. The employee is eligible to exercise the Sick

Leave benefit from the date of his/her joining. The above entitlements represent the

maximum number of days Sick Leave that an employee can avail in a year. Normally,

medical certificates are not required but if the sick leave exceeds three days at a time

or if it is being taken as an extension of Earned Leave, then a Medical Certificate is

required. Where theris not the case an application for Sick Leave is considered

enough. Sick leave cannot be carried forward to the succeeding year and cannot be

cashed. If an employee is sick on Weekend or on a Public Holiday, that day will not be

counted as a sick day and the number of Sick Leave taken out of his/her allocated days

will be excluding those days.

Earned Leave

Entitlement to Earned Leave for the Executives at Head-Office and Branch Site is 15

days on the basis of each completed year of service. A maximum of thirty (30) days

can be accumulated. Any accumulation beyond therwill automatically lapse on the

following 1

st

of January each year. The entitlement to Earned Leave is exclusive of

Page | 45

Weekends and Public Holidays i.e., Weekends and Public Holidays falling during the

annual leave taken will be considered additional to the entitlement.

Though Earned Leave is counted from the date of joining but it cannot be taken until

the employee passes the probationary period receiving confirmation.

Other Leave Options

The following sections explain some additional leave options that an employee may exercise

depending on the need.

Maternity Leave

Married woman employees are entitled to Maternity Leave benefit as per "The

Maternity Benefit Act, 1939". The period of Maternity Leave shall be 84 actual days

of absence which shall include the Public Holidays and Weekends (non-working days)

and including the day of delivery. The entitlement to maternity leave is to be availed

as follows:

Six weeks or 42 days immediately preceding and including the day of delivery.

Six weeks or 42 days immediately following the day of delivery.

A woman shall not be entitled to maternity leave unless she has been employed

by the Bank for a period of not less than nine months immediately preceding the

date of delivery.

Study Leave

An Executive may be granted Study Leave, with or without pay, entirely at the banks

discretion, once s/he has been in the bank for at least one year. Study leave is normally

granted if the course of study which the employee intends to pursue is likely to benefit

the Banks operations. Study Leave can be given for up to a maximum period of two

years.

Page | 46

Hajj Leave

A Permanent Executives who intends to perform Hajj at herown expenses, upon

completion of one year of service, may be allowed for a 45 days Hajj Leave with pay

at the sole discretion of the management. Therleave can only be availed once in the

entire period of service.

Similar leave may be granted for employees other than Muslims, if the occasion is a

once in a life time holy event significant to the believers.

Special Leave

Special leave may be granted to the Permanent or Contract employees with or without

pay and allowances at the sole discretion of the management. Application for special

leave should be forwarded to HR/Personnel department, through the relevant

departmental head, along with appropriate reasons and recommendations for

necessary action. Some examples of such leave request may be for marriage, death in

the family, etc.

Leave Encashment

Executives before leaving the Bank due to resignation, retirement or termination are

allowed to cash the Earned and Compensatory Leave due to them up to a maximum of

30 days, while for workers it is 20 days plus the prorated entitlement for the current

year. The amount paid on encashment includes only the employee's last drawn basic

salary for the period. Allowances are not included in theramount.

Maintenance of Leave Records

Approved leave applications received from departments are entered in a Leave

Register and the lower portion of the leave application showing the balance of leave is

sent to the employee. Leave records for all Executives and Head Office Staffs are

Page | 47

maintained by HR Department.

Financial Assistance Schemes

Objectives

To meet various emergency and incidental expenses, the Bank provides financial

assistance in the form of advance payment of salary and loan against provident fund to

its employees. The following sections give detailed procedures for salary advances and

loan sanctions under Financial Assistance Schemes.

Priorities for Loan against Provident Fund (PF) or Salary Advance

The following priorities will be maintained for PF loan or salary advance request

processing:

1. Medical emergencies for spouse or children

2. Death of Spouse or children

3. Medical emergencies for other dependent

4. Death of other dependent

5. Rental advance

6. Own marriage

7. Other emergencies

8. Marriage of siblings

9. Education

10. Other requirements

Loan against Provident Fund (PF) or Salary Advance Eligibility and Limits

Loan against Provident Fund

1. All Permanent employees who have contributed to atleast18 instalments in the

Page | 48

Contributory Provident Fund of Dhaka Bank Limited and have been in the Bank

for less than 3 years, are eligible to take loan against the provident fund equal and

up to 75% of the employees own contribution.

2. All Permanent employees who are members of the Contributory Provident Fund

and have been in the Bank for more than 3 years but less than 4 years, are eligible

to take loan against the provident fund equal and up to 100% of the employees

own contribution.

3.All Permanent employees who are members of the Contributory Provident Fund and

have been in the Bank for more than 4 years but less than 5 years, are eligible to take

loan against the provident fund equal and up to 70% of the total contribution

(employees own contribution + Banks contribution).

4. All Permanent employees who are members of the Contributory Provident Fund

and have been in the Bank for more than 5 years are eligible to take loan against

the provident fund equal and up to 75% of the total contribution (employees

own contribution + Banks contribution).

Salary Advance

Salary Advance is given only in those situations where the Permanent employee does

not have enough contribution to the Provident Fund but the urgency is very high.

Usually one months average gross salary is given as advance but based on the

emergency; a maximum of two months salary can be given as advance.

Repayment of Loan or Salary Advance

One months grace period is given to the employee before the repayment starts. The

employee, through automatic deductions by the Accounts Dept. from his/her Pay-

check, makes the payment. The following are some guidelines for repayments:

1. If financial situation permits, the employee is asked to pay the money back with 6

equal monthly payments.

2. If the financial situation does not permit, the employee is given the opportunity to

Page | 49

pay back with 12 equal monthly installments.

3. If the amount of loan is large and the repayment imposes hardship on the

employee, it may be considered to extend the repayment schedule to a maximum

of 24 equal installments. In such cases, the Department Head of the employee must

recommend the accounts department to do so.

If the loan or advance is related to medical payments and the employee is eligible for medical

benefit, the advance/loan will be applied towards the eligible benefit once the treatment is

received. Upon receipt of all medical vouchers, the employee is required to submit Medical

Bills Reimbursement Form, as per guidelines provided in Section 6.12.2 and apply the

advance/loan towards the refund. Any excess amount taken as advance/loan must be paid back

immediately after the treatment is over.

Procedures to Apply and Processing of a Loan or Salary Advance

Request

The employee completes a Loan Application Form, and upon receiving an approval

from the Department Head, submits to the Accounts Department. The Accounts Dept.

personnel review the application, discuss with the employee if necessary, and let the

employee know about the outcome. At the time of processing the loan/advance

request, the Accounts Dept. identifies the repayment agreement discussing with the

employee.

The following are guidelines for loan/advance approving:

Loan Amount (Tk) Approval Authority

< or = 5,000.00 Section Head responsible for

Loan/Advance

>5,000.00 < or = Second level authorisation by

20,000.00 Manager or above.

> 20,000.00 Department Head

Page | 50

Chapter-Three

Methodology

Page | 51

Methodology

Term paper is conclusive as well as descriptive in nature. The purpose of the paper is to gather a

practical knowledge. To collect the primary data, the following steps have been followed to obtain

the term paper objectives:

1. Sending questionnaire to 10 entry level employees.

2. Data are collected from documents and Internet.

3. Face to face interviews with personal managers, some employees and

consumers.

Primary source

face to face interview

survey using questionnaires

personal observation while visiting the company

Data collection

Employee were interviewed through structured questionnaire in different outlets

Designing questionnaire

Structured questionnaires have been used for therstudy in with multiple choice and open ended

question.

Secondary data

o annual report

o internet

o newspaper

Study Design

I have undertaken Descriptive Research Design to Study the compensation management system in

commercial banking industry at Dhaka bank. Employee were interviewed through structured

questionnaire in different outlets. Structured questionnaires have been used for therstudy in with

multiple choice and open ended question.

Page | 52

Chapter Four

Analysis

Page | 53

Analysis:

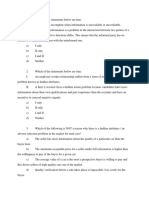

This graph shows that company provide compensation to their employees on the basis of base pay

& Travelling/meal/housing allowance.80% of employee prefer Travelling/meal/housing allowance

& only 20% of employee prefer base pay.

0%

20%

Base Pay

0%

Commissions

80%

Travelling/meal/housin

g

allowance

Page | 54

Analysis:

From the chart above we find that, 67% of employee prefers monetary benefits & only 33% of

employee are happy & satisfied with non monetary benefits like rewards. In this company neither

the employee are motivated nor are they satisfied with holiday package as compensation.

Page | 55

Analysis:

From the chart given above we can clearly see that 80% of employees are satisfied with the

compensation they receives & only 20% of employees are dissatisfied with the compensation they

receives.

Page | 56

70% 30%

Analysis:

Yes, there are different types of compensation for different type of services like direct and indirect

compensation provided to the employee of the organization for increasing their motivation and

retention of employees.

Page | 57

Analysis:

Attracting and Retaining Employees: From Bank point of view, the compensation management

aims at attracting and retaining right employees in the bank. We see 80% employees got attract to

join this bank and 20% employees dissatisfied about joining this bank or dissatisfied about their

compensation package.

Page | 58

Chapter-Five

Finding of the study

Page | 59

Finding of the study

o Most of the employees are satisfied with their job and organization fulfills

their psychological contact.

o Employee can develop their career and can gather knowledge and skills for

future.

o Organization can recognize their contribution so that they are satisfied.

o Organization hires qualified employees and for their contribution organization

provides a good compensation benefits and to develop them organization arrange

training program.

o But some contractual employees are not satisfied in specific area.

o Employees are satisfied with their job and compensation

packages.

o They like to grow their career with the organization and they are motivated to work

for the organization.

o They are satisfied with organizations personnel development process.

o They are satisfied with job so that they work with full of energy and they serve

quality service.

o They like to execute their job and they are interested to take

challenges.

o Their urge influences them to work for the organization.

o Organization provides best compensation to them.

o Organizations HR practices are effectively influence employees best output.

o Organization maintains good relationship with the employee.

Page | 60

Chapter-Six

Discussion

Page | 61

Discussion

Compensation is the remuneration received by an employee in return for his/her contribution to the

organization. It is an organized practice that involves balancing the work-employee relation by

providing monetary and non-monetary benefits to employees.

Compensation is an integral part of human resource management which helps in motivating the

employees and improving organizational effectiveness.

Compensation is a systematic approach to providing- Monetary rewards [Extrinsic rewards] Direct

( Salary , bonuses , Incentive ) , Indirect ( social security , pensions , insurance, training , sick days

, vacations , holiday , rest periods , Legal advice , Elder care ) & Nonmonetary rewards [Intrinsic

rewards] ( Job security , Status symbol , Social Rewards ) to employees in exchange for work

performed. Compensation may achieve several purposes assisting in recruitment, job performance,

and job satisfaction compensation management, also known as wage and salary administration,

remuneration management, or reward management, is concerned with designing and implementing

total compensation package.

Page | 62

Chapter-Seven

Conclusion &

Recommendation

Page | 63

Conclusion

Banking is becoming more vital for economic development of Bangladesh in mobilizing

capital and other resources. Dhaka Bank is also extending such contributions to the

advancement of the socioeconomic condition of the country. Dhaka Bank is committed to

provide quality services, maintain corporate governance & support international business as

a continuation of excellence in performance since its incorporation. They are fully

committed to conduct its business activities in economically, environmentally &

socially sustainable manner. The Bank has ensured hygienic & convenient work

environment for its employees. Dhaka Bank respects the worth & dignity of each employee.

HR programs and policies are integrated within a larger framework facilitating, in general, the

organizations mission and specifically its objectives. Dhaka bank has a good HR

policy. They believe that ensuring a right people in a right place at the right time can

produce the optimum output. So, they put and practice the great importance to ensure that

they have the right people with required skills and knowledge. They also revise the

recruitment policy thoroughly based on the demand. They have some uniqueness in their

selection process but they are very much careful and concerned for hiring employees from

outside. Also they strictly verify the references before hiring anybody because it is

given that an organizations performance is a direct to the individuals it employs, the

specific strategies used and decisions made in the staffing process will directly impact an

organizations success or lack thereof. Today Dhaka Bank is leading the Banking sector

and the employees are the leaders who are assigned through a good recruitment system

and other HR activities. Not only recruiting system therorganization encouraged employees

through compensation packages and career development and most of the employees are

satisfied with therorganization and its culture and therorganization follows discipline to

maintain employee relationship and to create better work environment for work and The

Bank's compensation policy is to provide a fair and consistent basis for motivating and

rewarding employees appropriately according to their job / rolesize, performance,

contribution, skill and competence.

Page | 64

Recommendations

The bank should practice proper Dhaka bank guideline. The purpose of Human

Resource Management is to improve the productive contribution of people.

To get effective and efficient employee, the bank should arrange proper training and

development programs.

The entire HR department should be will informed regarding the employment

personal.

Employees development is needed for the own interest of the bank.

The bank should provide well direct compensation as well as direct to its staffs. The

bank should have job evaluated salary structure, which is most competitive than other

banks in the country.

To evaluate employees performance the bank should follow promotion policy

properly.

In order to get competitive advantage and to deliver quality service, top management

should try to modify the services.

Dhaka Bank Limited (DBL) needs to advertise through various Media about

Credit Cards

ATM Cards

Tele Banking &

Other Product & Services

Letter of Credit opening procedure and Margin requirement may be relaxed to the

qualified employees to keep motivating.

Periodical performance appraisal and giving recognition and rewards to the qualified

employees to keep motivating them.

Proper training needed for ensuring efficient performance of the employees.

Page | 65

Chapter-Eight

Reference

Page | 66

References

Books:

1. Milkovich, G.T. , Newman, J.M. , Venkata Ratnam, C.S. (ed)2009. Compensation,

McGrawHill.

2. Henderson,R.L.2006 Compensation management in a knowledge-based world,

Pearson Education

3. Harod,R. 2008 Global Compensation and Benefits Developing Policiesfor Local

Nationals. SHRM

4. Thorpe, R.,Homan,G., 2000 Strategic Reward Systems, Financial Times

Websites:

1. Braskamp, L. A., Muffo, J. A., Langston, I. W., 1978. Determining Salary Equity: Policies,

Procedures, and Problems. The Journal of Higher Education, 49(3):pp. 231-246

2. Bloom, M., 2004. The Ethics of Compensation Systems. Journal of Business Ethics, 52(2):

pp. 149-152

3. Harris, D., Helfat, C., 1997. Specificity of CEO Human Capital and Compensation.

Strategic Management Journal, Vol. 18 (11): pp. 895-920

4. Boyd, B. K., Salamin, A., 2001. Strategic Reward Systems- A Contingency Model of Pay

System. Strategic Management Journal, 22 (8) :pp. 777-792

5. Meyer, M. A., Mookherjee, D. 1987. Incentives, Compensation, and Social Welfare.

Journal of The Review of Economic Studies, 54(2): pp. 209-226

6. Bernhardt, D., 1995. Strategic Promotion and Compensation. Journal of The Review of

Economic Studies, 62 (2): pp. 315-339

7. Ford, M. 2008. Integrating Compensation Systems With Corporate Strategies.