Professional Documents

Culture Documents

Solutions of Selected Problems in Chapter 4 - The Time Value of Money (Part 2)

Uploaded by

Sana Khan100%(1)100% found this document useful (1 vote)

198 views10 pagesCh04_sol

Original Title

Ch04_sol

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCh04_sol

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

198 views10 pagesSolutions of Selected Problems in Chapter 4 - The Time Value of Money (Part 2)

Uploaded by

Sana KhanCh04_sol

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 10

76

2013 Pearson Education, Inc. Publishing as Prentice Hall

Solutions of Selected Problems

in Chapter 4 - The Time Value of Money (Part 2)

Prepping for Exams

1. b.

2. b.

3. d.

4. a.

5. b.

6. a.

7. d.

8. c.

9. a.

10. b.

Problems

1. Different Cash Flow. Given the following cash inflow at the end of each year, what is

the future value of this cash flow at 6%, 9%, and 15% interest rates at the end of the

seventh year?

Year 1 $15,000

Year 2 $20,000

Year 3 $30,000

Years 4 through 6 $0

Year 7 $150,000

ANSWER

FV at 6% = $15,000 1.06

6

= $15,000 1.4185 = $21,277.79

+ $20,000 1.06

5

= $20,000 1.3382 = $26,764.51

+ $30,000 1.06

4

= $30,000 1.2625 = $37,874.31

+ $150,000 1.06

0

= $15,000 1.0000 = $150,000.00

FV = $21,277.79 + $26,764.51 + $37,874.31 + $150,000.00 = $235,916.61

FV at 9% = $15,000 1.09

6

= $15,000 1.6771 = $25,156.50

+ $20,000 1.09

5

= $20,000 1.5386 = $30,772.48

+ $30,000 1.09

4

= $30,000 1.4116 = $42,347.45

+ $150,000 1.09

0

= $15,000 1.0000 = $150,000.00

FV = $25,156.50 + $30,772.48 + $42,347.45 + $150,000.00 = $248,276.43

FV at 15% = $15,000 1.15

6

= $15,000 2.3131 = $34,695.91

+ $20,000 1.15

5

= $20,000 2.0114 = $40,227.14

+ $30,000 1.15

4

= $30,000 1.7490 = $52,470.19

Chapter 4 The Time Value of Money (Part 2) 77

2013 Pearson Education, Inc. Publishing as Prentice Hall

+ $150,000 1.15

0

= $15,000 1.0000 = $150,000.00

FV = $34,695.91 + $40,227.14 + $52,470.19 + $150,000.00 = $277,393.24

3. Future value. A speculator has purchased land along the southern Oregon coast. He has

taken out a ten-year loan with annual payments of $7,200. The loan rate is 6%. At the

end of ten years, he believes that he can sell the land for $100,000. If he is right on the

future price, did he make a wise investment?

ANSWER

To solve this problem, we must calculate the rate of return earned on an annual investment

of $7,200 over a 10-year period, with a future value of $100,000 and compare it with the

interest rate paid on the loan. If the rate earned is higher, then the investment would be

worth it.

FV = $100,000; PMT = -$7,200; n = 10; PV = 0; CPT I% = 7.11% > 6%; Good Investment

5. Future value: You are a new employee with the Metropolis Daily Planet. The Planet

offers three different retirement plans for you to choose from. Plan 1 starts the first day

of work and puts $1,000 away in your retirement account at the end of every year for

forty years. Plan 2 starts after ten years and puts away $2,000 every year for thirty

years. Plan 3 starts after twenty years and puts away $4,000 every year for the last

twenty years of employment. All three plans guarantee an annual growth rate of 8%.

a. Which plan should you choose if you plan to work at the Planet for forty years?

b. Which plan should you choose if you only plan to work at the Planet for the next

thirty years?

c. Which plan should you choose if you only plan to work at the Planet for the next

twenty years?

d. Which plan should you choose if you only plan to work at the Planet for the next

ten years?

e. What do the answers in parts (a) through (d) imply about savings?

ANSWER

Part a: Plan One FV = $1,000 (1.08

40

-1)/0.08 = $1,000 259.0565 = $259,056.51

Part a: Plan Two FV = $2,000 (1.08

30

-1)/0.08 = $2,000 113.2832 = $226,566.42

Part a: Plan Three FV = $4,000 (1.08

20

-1)/0.08 = $4,000 45.7620 = $183,047.86

Chose Plan One

Part b: Plan One FV = $1,000 (1.08

30

-1)/0.08 = $1,000 113.2832 = $113,283.21

Part b: Plan Two FV = $2,000 (1.08

20

-1)/0.08 = $2,000 45.7620 = $91,523.93

Part b: Plan Three FV = $4,000 (1.08

10

-1)/0.08 = $4,000 14.4866 = $57,946.25

78 Brooks Financial Management: Core Concepts, 2e

2013 Pearson Education, Inc. Publishing as Prentice Hall

Chose Plan One

Part c: Plan One FV = $1,000 (1.08

20

-1)/0.08 = $1,000 45.7620 = $45,761.96

Part c: Plan Two FV = $2,000 (1.08

10

-1)/0.08 = $2,000 14.4866 = $28,973.12

Part c: Plan Three FV = $4,000 (1.08

0

-1)/0.08 = $4,000 0.0000 = $0.00

Chose Plan One

Part d: Plan One FV = $1,000 (1.08

10

-1)/0.08 = $1,000 14.4866 = $14,486.56

Part d: Plan Two FV = $2,000 (1.08

0

-1)/0.08 = $2,000 0.0000 = $0.00

Part d: Plan Three FV = $4,000 (1.08

0

-1)/0.08 = $4,000 0.0000 = $0.00

Chose Plan One

Part e: The sooner you begin to save the better and that increasing the amount of savings in

later years may not be sufficient to catch up to an early savings program.

7. Present value of an ordinary annuity. Fill in the missing present values in the

following table for an ordinary annuity.

Number of

Payments or

Years

Annual

Interest Rate Future Value Annuity Present Value

10 6% 0 $250.00

20 12% 0 $3,387.88

25 4% 0 $600.00

360 1% 0 $2,571.53

ANSWER

Formula Answer (Rounded final answer to two decimal places)

PV = $250.00 [1 -1/(1 + 0.06)

10

] / 0.06 = $250.00 7.3601 = $1,840.02

PV = $3,387.88 [1 -1/(1 + 0.12)

20

] / 0.12 = $3,387.88 7.4694 = $25,305.58

PV = $600.00 [1 -1/(1 + 0.04)

25

] / 0.04 = $600.00 15.6221 = $9,373.25

PV = $2,571.53 [1 -1/(1 + 0.01)

360

] / 0.01 = $2,571.53 97.2183 = $249,999.85

9. Present value. County Ranch Insurance Company wants to offer a guaranteed annuity

in units of $500, payable at the end of each year for twenty-five years. The company

has a strong investment record and can consistently earn 7% on its investments after

taxes. If the company wants to make 1% on this contract, what price should it set on it?

Use 6% as the discount rate. Assume that it is an ordinary annuity and that the price is

the same as present value.

Chapter 4 The Time Value of Money (Part 2) 79

2013 Pearson Education, Inc. Publishing as Prentice Hall

ANSWER

Formula Answer (Rounded final answer to two decimal places)

PV = $500.00 ([1 -1/(1 + 0.06)

25

] / 0.06) = $500.00 12.7834 = $6,391.68

11. Payments. Cooley Landscaping Company needs to borrow $30,000 for a new front-end

dirt loader. The bank is willing to loan the funds at 8.5% interest with annual payments

at the end of the year for the next ten years. What is the annual payment on this loan for

Cooley Landscaping?

ANSWER

Payments = $30,000 / [(1 1/(1.085)

10

) / .085] = $30,000 / 6.5613 = $4,572.23

13. Annuity due. Reginald is about to lease an apartment for the year. The landlord wants

the lease payments paid at the start of the month. The twelve monthly payments are

$1,300 per month. The landlord says he will allow Reginald to prepay the rent for the

entire year with a discount. The one-time annual payment due at the beginning of the

lease is $14,778. What is the implied monthly discount rate for the rent? If Reginald is

earning 1.5% on his savings monthly, should he pay by month or take the one annual

payment?

ANSWER

Using TVM Keys from a Texas Instrument BAII Plus Calculator and rounded to two

decimal places for interest percent. The P/Y and C/Y variables are set to 12. Set the MODE

to BGN as this is an annuity due problem.

INPUT 12 -14,778 1,300 0

TVM KEYS N I/Y PV PMT FV

OUTPUT 12.00

This is an annual rate so with simple interest you get 12% / 12 = 1% per month.

If he can get 1.5% interest per month...then his annual rate is 18% and he can generate

$1,334.82 per month with the $14,778 it would take to pay off the rent. He is ahead $34.82

per month by not taking the one time payment.

INPUT 12 18.0 -14,778 0

TVM KEYS N I/Y PV PMT FV

OUTPUT 1,334.82

15. Perpetuities. The Canadian Government has once again decided to issue a consol (a

bond with a never-ending interest payment and no maturity date). The bond will pay

$50 in interest each year (at the end of the year) but never return the principal. The

current discount rate for Canadian government bonds is 6.5%. What should this bond

sell for in the market? What if the interest rate should fall to 4.5%? Rise to 8.5%? Why

80 Brooks Financial Management: Core Concepts, 2e

2013 Pearson Education, Inc. Publishing as Prentice Hall

does the price go up when interest rates fall? Why does the price go down when interest

rates rise?

ANSWER

at 6.5%, $50 / 0.065 = $769.23

at 4.5%, $50 / 0.045 = $1,111.11

at 8.5%, $50 / 0.085 = $588.24

The price rises when interest rates fall because the present value of each future interest

payment is worth more in present value due to the lower discount rate. The price falls when

interest rates rise because the present value of each future interest payment is worth less in

present value due to the higher discount rate.

17. Annuity due perpetuity. In Problem 16, The Stack agrees to the one-time payment at a

5% discount rate but wants the royalty payments figured from the beginning of the

year, not the end of the year. How much more will the band receive with annuity-due

payments on the royalty checks?

ANSWER

This is the same as before but with an additional payment at time 0 or PV = $200,000 +

$200,000 / 0.05 = $4,200,000

Use the following information for Problems 18 through 21. Chuck Ponzi has talked an

elderly woman into loaning him $25,000 for a new business venture. She has,

however, successfully passed a finance class and requires Chuck to sign a binding

contract on repayment of the $25,000 with an annual interest rate of 10% over the

next ten years. She has left the method of repayment up to him.

18. Discount loan (interest and principal at maturity). Determine the cash flow to the

woman under a discount loan, in which Ponzi will have a lump-sum payment at the end

of the contract.

ANSWER

FV = $25,000 1.10

10

= $25,000 2.593742 = $64,843.56

19. I nterest-only loan (regular interest payments each year and principal at end).

Determine the cash flow to the woman under an interest-only loan, in which Ponzi will

pay the annual interest expense each year and pay the principal back at the end of the

contract.

ANSWER

Ten Annual Interest Payments are $25,000 0.10 = $2,500

Plus the principal of $25,000 for total repayment of $2,500 10 + $25,000

Chapter 4 The Time Value of Money (Part 2) 81

2013 Pearson Education, Inc. Publishing as Prentice Hall

= $50,000.00

20. Fully amortized loan (annual payments for principal and interest with the same

amount each year). Determine the cash flow to the woman under a fully amortized

loan, in which Ponzi will make equal annual payments at the end of each year so that

the final payment will completely retire the original $25,000 loan.

ANSWER

PMT = $25,000 / [(1 1/1.10

10

) / 0.10] = $25,000 / 6.144567

Annual Payment = $4,068.6348 and total payment back is 10 $4,068.6348 = $40,686.35

21. Amortization schedule. Ponzi may choose to pay off the loan early if interest rates

change during the next ten years. Determine the ending balance of the loan each year

under the three different payment plans.

ANSWER

Plan One (discount loan)

Year

(a)

Beginning

Balance

(a) 1.10 = (c)

Annual Increase

(c)

Ending Balance

1 $25,000.00 $25,000.00 1.10 = $27,500.00 $27,500.00

2 $27,500.00 $27,500.00 1.10 = $30,250.00 $30,250.00

3 $30,250.00 $30,250.00 1.10 = $33,275.00 $33,275.00

4 $33,275.00 $33,275.00 1.10 = $36,602.50 $36,602.50

5 $36,602.50 $36,602.50 1.10 = $40,262.75 $40,262.75

6 $40,262.75 $40,262.75 1.10 =

$44,289.025

$44,289.03

7 $44,289.03 $44,289.03 1.10 = $48,717.93 $48,717.93

8 $48,717.93 $48,717.93 1.10 = $53,589.72 $53,589.72

9 $53,589.72 $53,589.72 1.10 = $58,948.69 $58,948.69

10 $58,948.69 $58,948.69 1.10 = $64,843.56 $64,843.56

Plan Two (interest only loan)

Each year the interest is paid so the ending balance is $25,000.00 which reflects the

original principal.

Plan Three (amortized loan)

Amortization Schedule of Payments

82 Brooks Financial Management: Core Concepts, 2e

2013 Pearson Education, Inc. Publishing as Prentice Hall

Annual Interest is Beginning Balance 0.10

And Principal Paid is Payment Interest

Year

(a)

Beginning.

Balance

(b)

Payment

(a) 0.10 = (c)

Interest for Year

(b) (c) = (d)

Principal Paid

(a) (d)

Ending

Balance

1 $25,000.00 $4.068.63 $2,500.00 $1,568.63 $23,431.37

2 $23,431.37 $4.068.63 $2,343.14 $1,725.50 $21,705.87

3 $21,705.87 $4.068.63 $2,170.59 $1,898.05 $19,807.82

4 $19,807.82 $4.068.63 $1,980.82 $2,087.85 $17,719.97

5 $17,719.97 $4.068.63 $1,772.00 $2,296.64 $15,423.33

6 $15,423.33 $4.068.63 $1,542.33 $2,526.30 $12,897.03

7 $12,897.03 $4.068.63 $1,289.70 $2,778.93 $10,118.09

8 $10,118.09 $4.068.63 $1,011.81 $3,056.83 $7,061.27

9 $7,061.27 $4.068.63 $706.13 $3,362.51 $3,698.76

10 $3,698.76 $4.068.63 $369.88 $3,698.76 $0.00

Note that all payments, interest for year, principal paid, and ending balance are rounded to

nearest cent.

23. Waiting period with an ordinary annuity. Fill in the missing waiting periods (years) or

number of payments in the following table for an ordinary annuity stream.

Number of

Payments or

Years

Annual Interest

Rate Future Value Annuity Present Value

6% 0 $250.00 $2,867.48

8% $5,794.62 $400.00 0

10% 0 $636.48 $6,000.00

4% $100,000.00 $80.80 0

ANSWER

Formula Answer (Rounded final answer to whole periods)

n = ln [$250 / ($250-$2,867.48 0.06)] / ln [1+0.06] = 1.1654 / 0.0583 = 20

n = ln [$5,794.62 0.08/$400 +1] / ln [1+0.08] = 0.7696 / 0.0770 = 10

Chapter 4 The Time Value of Money (Part 2) 83

2013 Pearson Education, Inc. Publishing as Prentice Hall

n = ln [$636.48 / ($636.48-$6,000 0.10)] / ln [1+0.10] = 2.8592 / 0.0953 = 30

n = ln [$100,000 0.04/$80.80 +1] / ln [1+0.04] = 3.9221 / 0.0392 = 100

25. Number of payments. Your grandfather will sell you a beach front property for

$72,500. He says the price is firm whenever you can pay him cash. You know that your

finances will only allow you to save $5,000 a year and that you can make 8% on your

investment. If you invest faithfully every year at the end of the year, how long will it

take for you to accumulate the necessary $72,500 future cash for the beach front

property?

ANSWER

Number of Payments = ln [($72,500 0.08 / $5,000) + 1] / ln (1.08)

= ln [($5,800/$5,000) + 1] / ln (1.08)

= 0.7701 / 0.0770 = 100065

10 payments or 10 years

Or on the calculator

INPUT ? 8.0 $0 -$5,000 $72,500

Variables N I/Y PV PMT FV

OUTPUT 10.0065

27. Estimating the annual interest rate with an annuity due. Fill in the missing annual

interest rates in the following table for an annuity-due stream.

Number of

Payments or

Years

Annual

Interest Rate Future Value Annuity Present Value

10 0 $500.00 $3,680.04

20 $25,000.00 $346.97 0

30 0 $1,946.73 $20,000.00

100 $1,044,010.06 $400.00 0

ANSWER

Using TVM Keys from a Texas Instrument BAII Plus Calculator and rounded to two

decimal places for interest percent. The P/Y and C/Y variables are set to 1. The Mode is Srt

to BGN for each of these solutions.

INPUT 10 -3,680.04 500.00 0

TVM KEYS N I/Y PV PMT FV

OUTPUT 7.57

INPUT 20 0 -346.97 25,000

84 Brooks Financial Management: Core Concepts, 2e

2013 Pearson Education, Inc. Publishing as Prentice Hall

TVM KEYS N I/Y PV PMT FV

OUTPUT 11.09

INPUT 30 -20,000 1,946.73 0

TVM KEYS N I/Y PV PMT FV

OUTPUT 10.13

INPUT 100 0 400.00 -1,044,010.06

TVM KEYS N I/Y PV PMT FV

OUTPUT 4.94

29. I nterest rate with annuity. A local government is about to run a lottery but does not

want to be involved in the payoff if a winner picks an annuity payoff. The government

contracts with a trust to pay the lump-sum payout to the trust and have the trust

(probably a local bank) pay the annual payments. The first winner of the lottery chooses

the annuity and will receive $150,000 a year for the next twenty-five years. The local

government will give the trust $2,000,000 to pay for this annuity. What investment rate

must the trust earn to break even on this arrangement?

ANSWER

Using a calculator TVM keys with P/y=1 and C/y = 1 in end mode:

INPUT 25 ? $2,000,000-$150,000 $0

Variables N I/Y PV PMT FV

OUTPUT 5.5619%

31. Lottery. Your dreams of becoming rich have just come true. You have won the State of

Tranquilitys Lottery. The State offers you two payment plans for the $5,000,000

advertised jackpot. You can take annual payments of $250,000 for the next twenty

years or $2,867,480 today.

a. If your investment rate over the next twenty years is 8%, which payoff will you

choose?

b. If your investment rate over the next twenty years is 5%, which payoff will you

choose?

c. At what investment rate will the annuity stream of $250,000 be the same as the

lump sum payment of $2,867,480?

ANSWER

Part a. Find the present value of the annuity stream at an 8% discount rate.

PV = $250,000 (1 1/1.08

20

) / 0.08 = $250,000 9.8181 = $2,454,536.85

Take the lump sum of $2,867,480.

Part b. Find the present value of the annuity stream at a 5% discount rate.

Chapter 4 The Time Value of Money (Part 2) 85

2013 Pearson Education, Inc. Publishing as Prentice Hall

PV = $250,000 (1 1/1.05

20

) / 0.05 = $250,000 12.4622 = $3,115,552.59

Take the annuity stream of $250,000.

Part c. Find the interest rate that sets the PV of $2,867,480 equal to a twenty year annuity

stream of $250,000.

$2,867.480 = $250,000 (1 1/(1+R)

20

) / R and

this implies that the PVIFA is

PVIFA = (1 - 1/(1+R)

20

) / R = $2,867,480 / $250,000 = 11.4699

Looking up this value on Table A-3 for N = 20 we find the value in column 6%.

Or on the calculator

INPUT 20 ? $2,867,480 $250,000 $0

Variables N I/Y PV PMT FV

OUTPUT 6.0

So at 6% investment rate over the next twenty years you would be indifferent between the

two payoff choices.

You might also like

- Dividend Growth Rate CalculationDocument6 pagesDividend Growth Rate CalculationCrew's GamingNo ratings yet

- CH 3Document13 pagesCH 3Madyoka Raimbek100% (1)

- Compound Interest Factors ExplainedDocument61 pagesCompound Interest Factors ExplainedJom Ancheta BautistaNo ratings yet

- Solved ProblemsDocument24 pagesSolved ProblemsSammir MalhotraNo ratings yet

- GNB14 e CH 12 ExamDocument6 pagesGNB14 e CH 12 Exama_elsaied0% (1)

- JOB, BATCH AND SERVICE COSTING-lesson 11Document22 pagesJOB, BATCH AND SERVICE COSTING-lesson 11Kj NayeeNo ratings yet

- AFDM Quiz 1Document8 pagesAFDM Quiz 1Mohsin JalilNo ratings yet

- PS3 ADocument10 pagesPS3 AShrey BudhirajaNo ratings yet

- Asset Recognition and Operating Assets: Fourth EditionDocument55 pagesAsset Recognition and Operating Assets: Fourth EditionAyush JainNo ratings yet

- Black Knights Factory Location Analysis: Building C NPV LowestDocument6 pagesBlack Knights Factory Location Analysis: Building C NPV LowestVịt HoàngNo ratings yet

- Analyze Investment Projects with NPVDocument16 pagesAnalyze Investment Projects with NPVAbdul Fattaah Bakhsh 1837065No ratings yet

- Assigment 3Document4 pagesAssigment 3anita teshome100% (1)

- Capm ProblemsDocument1 pageCapm ProblemsPadyala SriramNo ratings yet

- Unit-3 Assignement Model Notes & Practice QuestionsDocument19 pagesUnit-3 Assignement Model Notes & Practice QuestionsIsha NatuNo ratings yet

- Individual Assignment Acct 232 Management Accounting 2Document3 pagesIndividual Assignment Acct 232 Management Accounting 2pfungwaNo ratings yet

- MGT 3332 Sample Test 1Document3 pagesMGT 3332 Sample Test 1Ahmed0% (1)

- Perfect Competition 2Document3 pagesPerfect Competition 2Aakash MehtaNo ratings yet

- Af201 Final Exam Revision Package - S2, 2020 Face-to-Face & Blended Modes Suggested Partial SolutionsDocument9 pagesAf201 Final Exam Revision Package - S2, 2020 Face-to-Face & Blended Modes Suggested Partial SolutionsChand DivneshNo ratings yet

- Chapter 8Document30 pagesChapter 8carlo knowsNo ratings yet

- Performance Prism 200302 - 14Document4 pagesPerformance Prism 200302 - 14rajad2010No ratings yet

- Ch5 Capacity PlanningDocument8 pagesCh5 Capacity PlanningJess JerinnNo ratings yet

- Example 4Document3 pagesExample 4dimash209100% (1)

- International Trade and Factor Mobility Theory ExplainedDocument25 pagesInternational Trade and Factor Mobility Theory Explained9667802447No ratings yet

- 03 Understanding Income Statements 2Document36 pages03 Understanding Income Statements 2Roy GSNo ratings yet

- Merrion ProductsDocument11 pagesMerrion ProductsVivek NarayananNo ratings yet

- 2014 Bep Analysis ExercisesDocument5 pages2014 Bep Analysis ExercisesaimeeNo ratings yet

- Exam 2012 Introductory Econometrics AnswersDocument6 pagesExam 2012 Introductory Econometrics AnswersOut Log100% (1)

- Ilide - Info Review Qs PRDocument93 pagesIlide - Info Review Qs PRMobashir KabirNo ratings yet

- Waiting Line ModelsDocument30 pagesWaiting Line ModelsPinky GuptaNo ratings yet

- Using Solver to maximize profitDocument3 pagesUsing Solver to maximize profitMinh ThanhNo ratings yet

- Linear Programming ExamplesDocument7 pagesLinear Programming ExamplesgoforjessicaNo ratings yet

- NetworkDocument12 pagesNetworkDira Silvia IrvannyNo ratings yet

- Ryerson University Department of Economics ECN 204 Midterm Winter 2013Document22 pagesRyerson University Department of Economics ECN 204 Midterm Winter 2013creepyslimeNo ratings yet

- Production & Operations Management - UploadDocument42 pagesProduction & Operations Management - UploadAlison Browne-Ellis100% (2)

- OD5 PL Dynamic Programming ADocument4 pagesOD5 PL Dynamic Programming AcarolinarvsocnNo ratings yet

- E SRKRPORTALuploadsSyllabus ModelPapersModel R17 B.tech MECH 69Document33 pagesE SRKRPORTALuploadsSyllabus ModelPapersModel R17 B.tech MECH 69prasadNo ratings yet

- Quiz 2Document2 pagesQuiz 2hrshtkatwala100% (1)

- Implicit Taxes Arbitrage Restrictions and FrictionsDocument33 pagesImplicit Taxes Arbitrage Restrictions and FrictionsDownloadNo ratings yet

- Economics Subject Test ReviewDocument14 pagesEconomics Subject Test ReviewJenny ShenNo ratings yet

- TutorialActivity 3Document7 pagesTutorialActivity 3Adarsh AchoyburNo ratings yet

- Chapter 03 TP EndDocument43 pagesChapter 03 TP EndMesfin MekuriaNo ratings yet

- MGT613Document19 pagesMGT613Taimoor Sultan100% (3)

- Standard CostingDocument18 pagesStandard Costingpakistan 123No ratings yet

- MG314 Operations Management Assignment SolutionsDocument2 pagesMG314 Operations Management Assignment Solutionsdip_g_007No ratings yet

- 1 Af 101 Ffa Icmap 2013 PaperDocument4 pages1 Af 101 Ffa Icmap 2013 PaperZulfiqar AliNo ratings yet

- Assignment PDFDocument4 pagesAssignment PDFDark LightNo ratings yet

- Discrete ch12 PDFDocument0 pagesDiscrete ch12 PDFnidhinpillaiNo ratings yet

- Chap 1Document22 pagesChap 1Zara Sikander33% (3)

- SM Manpower AustraliaDocument37 pagesSM Manpower Australiadhwani malde100% (1)

- HorngrenIMA14eSM ch10Document64 pagesHorngrenIMA14eSM ch10Piyal Hossain100% (2)

- Business Planning Process: Rajendran Ananda KrishnanDocument53 pagesBusiness Planning Process: Rajendran Ananda KrishnanMahesh KumarNo ratings yet

- Topic 7 - Financial Leverage - ExtraDocument57 pagesTopic 7 - Financial Leverage - ExtraBaby KhorNo ratings yet

- Preparing Financial StatementsDocument14 pagesPreparing Financial StatementsArik HassanNo ratings yet

- TPO Homework Spring 2013Document8 pagesTPO Homework Spring 2013Haja SheriefNo ratings yet

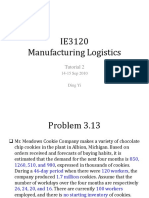

- IE3120 Manufacturing Logistics: Tutorial 2Document27 pagesIE3120 Manufacturing Logistics: Tutorial 2Joli SmithNo ratings yet

- HW Solution Chapter 4 5Document15 pagesHW Solution Chapter 4 5Trần Thị Ngọc BíchNo ratings yet

- MalaDocument5 pagesMalaAruna MadasamyNo ratings yet

- TVM Exercises: - in The First Year: - in The Second YearDocument2 pagesTVM Exercises: - in The First Year: - in The Second YearCu Thi Hong NhungNo ratings yet

- SBE211-Regular ExamDocument4 pagesSBE211-Regular ExamThanh Hoa TrầnNo ratings yet

- File 8Document8 pagesFile 8Sana KhanNo ratings yet

- 109 12 Quick IRR Calculation SlidesDocument14 pages109 12 Quick IRR Calculation SlidesfmexiaNo ratings yet

- 12Document34 pages12Sana KhanNo ratings yet

- Solution of 518024 - FINDocument1 pageSolution of 518024 - FINSana KhanNo ratings yet

- 94 4 Fin Ref 15 17Document17 pages94 4 Fin Ref 15 17Sana KhanNo ratings yet

- Cash Flow-Tricky Widget-Cross Over-Asumption No.2 - SensDocument20 pagesCash Flow-Tricky Widget-Cross Over-Asumption No.2 - SensSana KhanNo ratings yet

- Valuation Practice QuizDocument6 pagesValuation Practice QuizSana KhanNo ratings yet

- CH 06 TutoriaDocument31 pagesCH 06 TutoriaSana Khan100% (1)

- S-C Chap006Document5 pagesS-C Chap006Sana KhanNo ratings yet

- HW 1 AnsDocument12 pagesHW 1 AnsSana Khan100% (3)

- Chapter 9 SolutionsDocument4 pagesChapter 9 SolutionsSana KhanNo ratings yet

- 2009-12-23 224056 Slayer2Document3 pages2009-12-23 224056 Slayer2Sana KhanNo ratings yet

- PK07 NotesDocument27 pagesPK07 NotesSana KhanNo ratings yet

- Fina HW4 StepsDocument6 pagesFina HW4 StepsSana KhanNo ratings yet

- 03 LasherIM Ch03Document47 pages03 LasherIM Ch03Sana Khan100% (1)

- Products Liability Act 1989: Scope of The ActDocument6 pagesProducts Liability Act 1989: Scope of The ActSana KhanNo ratings yet

- Ch03 - Breakeven SolutionDocument42 pagesCh03 - Breakeven SolutionSana Khan0% (1)

- 115 B M A V CDocument2 pages115 B M A V CSana KhanNo ratings yet

- Fabricator RefDocument2 pagesFabricator RefSana KhanNo ratings yet

- Running Head: INSURANCES 1Document5 pagesRunning Head: INSURANCES 1Sana KhanNo ratings yet

- PK07 NotesDocument27 pagesPK07 NotesSana KhanNo ratings yet

- Deepdyve Com LP Springer Journals Exploring Top ManaDocument3 pagesDeepdyve Com LP Springer Journals Exploring Top ManaSana KhanNo ratings yet

- FormulasDocument2 pagesFormulasSana KhanNo ratings yet

- Damages Under ContractDocument5 pagesDamages Under ContractMasar Abdul RakmanNo ratings yet

- South Dakota Microbrewery Pricing StrategyDocument6 pagesSouth Dakota Microbrewery Pricing StrategySana Khan100% (1)

- Heart-Health Insurance Password and User Policy UpdateDocument3 pagesHeart-Health Insurance Password and User Policy UpdateSana KhanNo ratings yet

- Agreements IDocument41 pagesAgreements ISana KhanNo ratings yet

- SLA RLHT - Task3Document5 pagesSLA RLHT - Task3lburt43100% (1)

- RLHT Task2 2011-05-16Document4 pagesRLHT Task2 2011-05-16Sana KhanNo ratings yet

- Course Code: DMGT402: COURSE TITLE: Management Practices & Organizational BehaviorDocument1 pageCourse Code: DMGT402: COURSE TITLE: Management Practices & Organizational Behaviortanvirpal singh DhanjuNo ratings yet

- Reflection Paper AristotleDocument3 pagesReflection Paper AristotleMelissa Sullivan67% (9)

- RR 7-95 Consolidated VATDocument64 pagesRR 7-95 Consolidated VATjankriezlNo ratings yet

- Big Bazaar Case Study 11.07.10Document18 pagesBig Bazaar Case Study 11.07.10Bhawna Gosain0% (1)

- All About Form 15CA Form 15CBDocument6 pagesAll About Form 15CA Form 15CBKirti SanghaviNo ratings yet

- Political Science Assignment Sem v-1Document4 pagesPolitical Science Assignment Sem v-1Aayush SinhaNo ratings yet

- TestbankDocument11 pagesTestbankA. MagnoNo ratings yet

- From Bela Bartok's Folk Music Research in TurkeyDocument3 pagesFrom Bela Bartok's Folk Music Research in TurkeyssiiuullLLNo ratings yet

- (Critical Criminological Perspectives) Deborah H. Drake (Auth.) - Prisons, Punishment and The Pursuit of Security-Palgrave Macmillan UK (2012)Document231 pages(Critical Criminological Perspectives) Deborah H. Drake (Auth.) - Prisons, Punishment and The Pursuit of Security-Palgrave Macmillan UK (2012)Yaeru EuphemiaNo ratings yet

- On The Coins of The Kings of Ghazní / by Edward ThomasDocument123 pagesOn The Coins of The Kings of Ghazní / by Edward ThomasDigital Library Numis (DLN)No ratings yet

- Interview Questions of FinanceDocument126 pagesInterview Questions of FinanceAnand KumarNo ratings yet

- Teaching Portfolio Showcases Skills and AchievementsDocument37 pagesTeaching Portfolio Showcases Skills and AchievementsIj CamataNo ratings yet

- Research TitleDocument5 pagesResearch TitleAthena HasinNo ratings yet

- Security AgreementDocument5 pagesSecurity AgreementGanesh TarimelaNo ratings yet

- Joyce Flickinger Self Assessment GuidanceDocument5 pagesJoyce Flickinger Self Assessment Guidanceapi-548033745No ratings yet

- Philippines-Expanded Social Assistance ProjectDocument2 pagesPhilippines-Expanded Social Assistance ProjectCarlos O. TulaliNo ratings yet

- RA 8293 Key Provisions on Compulsory Licensing and Patent RightsDocument30 pagesRA 8293 Key Provisions on Compulsory Licensing and Patent RightsPrincessNo ratings yet

- 2017 Cannes Product Design ShortlistDocument6 pages2017 Cannes Product Design Shortlistadobo magazineNo ratings yet

- Locked Ideas at QuirkyDocument22 pagesLocked Ideas at Quirkymasid1No ratings yet

- 1-C 2-D3-E4-A5-B6-E7-D8-A9-D10-BDocument36 pages1-C 2-D3-E4-A5-B6-E7-D8-A9-D10-BJewel Emerald100% (4)

- Omoluabi Perspectives To Value and Chara PDFDocument11 pagesOmoluabi Perspectives To Value and Chara PDFJuan Daniel Botero JaramilloNo ratings yet

- Case Study 2, Domino?s Sizzles With Pizza TrackerDocument3 pagesCase Study 2, Domino?s Sizzles With Pizza TrackerAman GoelNo ratings yet

- HDFC BankDocument6 pagesHDFC BankGhanshyam SahNo ratings yet

- Passwordless The Future of AuthenticationDocument16 pagesPasswordless The Future of AuthenticationTour GuruNo ratings yet

- Föreställningar Om Klass Och Kön I Arbetsförmedlingens Yrkesbeskrivningar?Document28 pagesFöreställningar Om Klass Och Kön I Arbetsförmedlingens Yrkesbeskrivningar?Filozófus ÖnjelöltNo ratings yet

- UKG Monthly SyllabusDocument4 pagesUKG Monthly Syllabusenglish1234No ratings yet

- Procter &gamble: Our PurposeDocument39 pagesProcter &gamble: Our Purposemubasharabdali5373No ratings yet

- Bob Marley - SunumDocument5 pagesBob Marley - SunumNaz SakinciNo ratings yet

- Ch9A Resource Allocation 2006Document31 pagesCh9A Resource Allocation 2006daNo ratings yet

- Project ReportDocument55 pagesProject Reportshrestha mobile repringNo ratings yet