Professional Documents

Culture Documents

Ch10 13ed CapitalBudget MinicMaster

Uploaded by

Kathryn SmithCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ch10 13ed CapitalBudget MinicMaster

Uploaded by

Kathryn SmithCopyright:

Available Formats

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

A B C D E F G H I J K

1/1/2012

Capital Budgeting Decisions

Situation

Franchise S

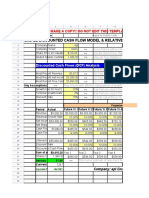

Year (t) Franchise S Franchise L 0 1 2 3

0 ($100) ($100) (100) 70 50 20

1 70 10

2 50 60 Franchise L

3 20 80

0 1 2 3

(100) 10 60 80

Net Present Value (NPV)

WACC = 10%

Franchise S

Time period: 0 1 2 3

Cash flow: (100) 70 50 20

Disc. cash flow: (100) 64 41 15

NPV(S) = $19.98 = Sum disc. CF's. or $19.98 = Uses NPV function.

b. What is the difference between independent and mutually exclusive projects? Answer: See Chapter 10 Mini Case Show

Chapter 10. Mini Case

Expected

Net Cash Flows

You have narrowed your selection down to two choices: (1) Franchise L, Lisa's Soups, Salads, & Stuff, and (2) Franchise S,

Sam's Fabulous Fried Chicken. The net cash flows shown below include the price you would receive for selling the franchise in

Year 3 and the forecast of how each franchise will do over the 3-year period. Franchise L's cash flows will start off slowly but

will increase rather quickly as people become more health conscious, while Franchise S's cash flows will start off high but will

trail off as other chicken competitors enter the marketplace and as people become more health conscious and avoid fried foods.

Franchise L serves breakfast and lunch, while Franchise S serves only dinner, so it is possible for you to invest in both

franchises. You see these franchises as perfect complements to one another: You could attract both the lunch and dinner

crowds and the health conscious and not so health conscious crowds without the franchises directly competing against one

another.

Here are the net cash flows (in thousands of dollars):

You have just graduated from the MBA program of a large university, and one of your favorite courses was "Today's

Entrepreneurs." In fact, you enjoyed it so much you have decided you want to "be your own boss." While you were in the

master's program, your grandfather died and left you $1 million to do with as you please. You are not an inventor, and you do

not have a trade skill that you can market; however, you have decided that you would like to purchase at least one established

franchise in the fast-foods area, maybe two (if profitable). The problem is that you have never been one to stay with any project

for too long, so you figure that your time frame is three years. After three years you will go on to something else.

Depreciation, salvage values, net working capital requirements, and tax effects are all included in these cash flows.

You also have made subjective risk assessments of each franchise and concluded that both franchises have risk characteristics

that require a return of 10%. You must now determine whether one or both of the franchises should be accepted.

c. (1.) Define the term net present value (NPV). What is each franchise's NPV?

To calculate the NPV, we find the present value of the individual cash flows and find the sum of those discounted cash flows.

This value represents the value the project add to shareholder wealth.

a. What is capital budgeting? Answer: See Chapter 10 Mini Case Show

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

121

A B C D E F G H I J K

Franchise L

Time period: 0 1 2 3

Cash flow: (100) 10 60 80

Disc. cash flow: (100) 9 50 60

NPV(L) = $18.78 $18.78 = Uses NPV function.

Internal Rate of Return (IRR)

Year (t) Franchise S Franchise L

0 ($100) ($100)

1 70 10 IRR

S

= 23.56%

2 50 60 IRR

L

= 18.13%

3 20 80

Constant Cash Flows

Year (t) Cash Flow

0 ($100) 0 1 2 3

1 40 (100) 40 40 40

2 40

3 40

IRR = 9.70% Note: You can use the Rate function if

payments are constant.

Similarity to a bond:

0 1 2 3 4 5 6 7 8 9 10

(1,134) 90 90 90 90 90 90 90 90 90 1,090

IRR = 7.08%

The NPV method of capital budgeting dictates that all independent projects that have positive NPV should accepted. The

rationale behind that assertion arises from the idea that all such projects add wealth, and that should be the overall goal of the

manager in all respects. If strictly using the NPV method to evaluate two mutually exclusive projects, you would want to accept

the project that adds the most value (i.e. the project with the higher NPV). Hence, if considering the above two projects, you

would accept both projects if they are independent, and you would only accept Project S if they are mutually exclusive.

(3.) Would the NPVs change if the cost of capital changed? Answer: See Chapter 10 Mini Case Show

The internal rate of return is defined as the discount rate that equates the present value of a project's cash inflows to its

outflows. It is the discount rate that forces the PV of the inflows to equal the initial cost. In other words, the internal rate of

return is the interest rate that forces NPV to zero. The calculation for IRR can be tedious, but Excel provides an IRR function

that merely requires you to access the function and enter the array of cash flows. The IRR's for Franchises S and L are shown

below, along with the data entry for Franchise S.

d. (1.) Define the term internal rate of return (IRR). What is each franchise's IRR?

(2.) How is the IRR on a project related to the YTM on a bond?

net cash flows

(2.) What is the rationale behind the NPV method? According to NPV, which franchise or franchises should be accepted if

they

The IRR function

assumes payments occur

at end of periods, so that

function does not have to

be adjusted.

Expected

Notice that for IRR you must

specify all cash flows,

including the time zero cash

flow. This is in contrast to

the NPV function, in which

you specify only the future

cash flows.

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

140

141

142

143

144

145

146

147

148

149

150

151

152

153

154

155

156

157

158

159

160

161

162

163

164

165

166

167

168

169

170

171

172

173

174

175

176

177

178

179

180

181

182

183

184

185

186

187

A B C D E F G H I J K

NPV Profiles

e. Draw NPV profiles for Franchises L and S. At what discount rate do the profiles cross?

Franchise S Franchise L

WACC $19.98 WACC $18.78

0% 40.00 0% 50.00

2% 35.53 2% 42.86

4% 31.32 4% 36.21

6% 27.33 6% 30.00

8% 23.56 8% 24.21

10% 19.98 10% 18.78

12% 16.60 12% 13.70

14% 13.38 14% 8.94

16% 10.32 16% 4.46

18% 7.40 18% 0.26

20% 4.63 20% (3.70)

22% 1.98 22% (7.43)

24% (0.54) 24% (10.95)

f. (1.) What is the underlying cause of ranking conflicts between NPV and IRR?

(2.) What is the "reinvestment rate assumption," and how does it affect the NPV versus IRR conflict? Answer: See

Chapter

The IRR method of capital budgeting maintains that projects should be accepted if their IRR is greater than the cost of capital.

Strict adherence to the IRR method would further dictate that mutually exclusive projects should be chosen on the basis of the

greatest IRR. In this scenario, both franchises have IRRs that exceed the cost of capital (10%) and both should be accepted, if

they are independent. If, however, the franchises are mutually exclusive, we would choose Franchise S. Recall, that this was

our determination using the NPV method as well. The question that naturally arises is whether or not the NPV and IRR

methods will always arrive at the same conclusion.

Previously, we had discussed that in some instances the NPV and IRR methods can give conflicting results. First, we should

attempt to define what we see in this graph. Notice, that the two franchises' profiles (S and L) intersect the X-axis at costs of

capital of 18.13% and 23.56%, respectively. Not coincidently, those are the IRRs of the franchises. If we think about the

definition of IRR, we remember that the internal rate of return is the cost of capital at which a project will have an NPV of

zero. Looking at our graph, it is a logical conclusion that the project IRR is defined as the point at which its profile intersects

the

(4.) Would the franchises' IRRs change if the cost of capital changed?

(2.) Look at your NPV profile graph without referring to the actual NPVs and IRRs. Which franchise or franchises should

be

accepted if they are independent? Mutually exclusive? Explain. Are your answers correct at any cost of capital less

When dealing with independent projects, the NPV and IRR methods will always yield the same accept/reject result. However,

in the case of mutually exclusive projects, NPV and IRR can give conflicting results. One shortcoming of the internal rate of

return is that it assumes that cash flows received are reinvested at the project's internal rate of return, which is not usually

true. The nature of the congruence of the NPV and IRR methods is further detailed in a latter section of this model.

(3.) What is the logic behind the IRR method? According to IRR, which franchises should be accepted if they are

independent?

(20)

(10)

0

10

20

30

40

50

60

0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 22% 24%

NPV ($)

Cost of Capital

NPV Profile of Franchises S and L

Project L

Project S

Franchise L- IRR

Franchise

S- IRR

Crossover Rate =

8.7%

188

189

190

191

192

193

194

195

196

197

198

199

200

201

202

203

204

205

206

207

208

209

210

211

212

213

214

215

216

217

218

219

220

221

222

223

224

225

226

227

228

229

230

231

232

233

234

235

236

237

238

239

240

241

242

243

244

245

246

247

248

249

250

251

252

A B C D E F G H I J K

Cash Flow

Year (t) Franchise S Franchise L Differential

0 ($100) ($100) 0

1 70 10 60

2 50 60 (10)

3 20 80 (60)

IRR = Crossover rate = 8.68%

Modified Internal Rate of Return (MIRR)

WACC = 10% MIRR

S =

16.89%

Franchise S MIRR

L = 16.50%

10%

0 1 2 3

(100) 70 50 20

Franchise L

0 1 2 3

(100) 10 60 80

66

12.1

P V : (100) TV = 158.1

(3.) Which method is the best? Why? Answer: See Chapter 10 Mini Case Show

The advantage of using the MIRR, relative to the IRR, is that the MIRR assumes that cash flows received are reinvested at the

cost of capital, not the IRR. Since reinvestment at the cost of capital is more likely, the MIRR is a better indicator of a project's

profitability. Moreover, it solves the multiple IRR problem, as a set of cash flows can have but one MIRR .

Also note that Excel's MIRR function allows for discounting and reinvestment to occur at different rates. Generally, MIRR is

defined as reinvestment at the WACC, though Excel allows the calculation of a special MIRR where reinvestment occurs at a

different rate than WACC.

The modified internal rate of return is the discount rate that causes a project's cost (or cash outflows) to equal the present

value of the project's terminal value. The terminal value is defined as the sum of the future values of the project's cash inflows,

compounded at the project's cost of capital. To find MIRR, calculate the PV of the outflows and the FV of the inflows and then

find the discount rate that equates the two. Or, you can solve using Excel's MIRR function.

g. (1.) Define the term modified IRR (MIRR). Find the MIRRs for Franchises L and S.

Expected

Net Cash Flows

Note that if negative cash flows occur in years beyond Year 1, those cash flows would be discounted at the cost of capital and

added to the Year 0 cost to find the total PV of costs. If both positive and negative flows occurred in some year, the negative

flow should be discounted, and the positive one compounded, rather than just dealing with the net cash flow. This makes a

difference.

The intuition behind the relationship between the NPV profile and the crossover rate is as follows: (1) Distant cash flows are

heavily penalized by high discount rates--the denominator is (1 + r)

t

, and it increases geometrically; hence, it gets very large at

high values of t. (2) Long-term projects like L have most of their cash flows coming in the later years, when the discount

penalty is largest; hence, they are most severely impacted by high capital costs. (3) Therefore, Franchise L's NPV profile is

steeper than that of S. (4) Since the two profiles have different slopes, they cross one another.

Finally, it is stated in the text, when the IRR versus the NPV is discussed, that the NPV is superior because (1) the NPV

assumes that cash flows are reinvested at the cost of capital whereas the IRR assumes reinvestment at the IRR, and (2) it is

more likely, in a competitive world, that the actual reinvestment rate is more likely to be the cost of capital than the IRR,

especially if the IRR is quite high. The MIRR setup can be used to prove that NPV indeed does assume reinvestment at the

WACC, and IRR at the IRR.

Looking further at the NPV profiles, we see that the two franchises profiles intersect at a point we shall call the crossover rate.

We observe that at costs of capital greater than the crossover rate, the franchise with the greater IRR (Franchise S, in this case)

also has the greater NPV. But at costs of capital less than the crossover rate, the franchise with the lesser IRR has the greater

NPV. This relationship is the source of discrepancy between the NPV and IRR methods. By looking at the graph, we see that

the crossover rate appears to occur at approximately 8.7%. Luckily, there is a more precise way of determining the crossover

rate. To find the crossover rate, we will find the difference between the two franchises' cash flows in each year, and then find

the IRR of this series of differential cash flows. This IRR is the crossover rate.

(2.) What are the MIRR's advantages and disadvantages vis-a-vis the regular IRR? What are the MIRR's advantages and

disadvantages vis-a-vis the NPV?

253

254

255

256

257

258

259

260

261

262

263

264

265

266

267

268

269

270

271

272

273

274

275

276

277

278

279

280

281

282

283

284

285

286

287

288

289

290

291

292

293

294

295

296

297

298

299

300

301

302

303

304

305

306

307

308

309

310

311

312

313

314

315

316

317

A B C D E F G H I J K

PROFITABILITY INDEX

h. What does the profitability index (PI) measure? What are the PI's for Franchises S and L?

For Franchise S:

PI(S) = PV of future cash flows Initial cost

PI(S) = $119.98 $100

PI(S) = 1.1998

For Franchise L:

PI(L) = PV of future cash flows Initial cost

PI(L) = $118.78 $100

PI(L) = 1.1878

i. (1.) What is the payback period? Find the paybacks for Franchises L and S.

Payback Period

Franchise S

Time period: 0 1 2 3

Cash flow: (100) 70 50 20

Cumulative cash flow: (100) (30) 20 40

Payback: 1.600

Franchise L

Time period: 0 1 2 3

Cash flow: (100) 10 60 80

Cumulative cash flow: (100) (90) (30) 50

Payback: 2.375

Discounted Payback Period

WACC = 10%

Franchise S

Time period: 0 1 2 3

Cash flow: (100) 70 50 20

Disc. cash flow: (100) 64 41 15 Cash Flows Discounted back at 10%.

Disc. cum. cash flow: (100) (36) 5 20

Discounted Payback: 1.9

(2.) What is the rationale for the payback method? According to the payback criterion, which franchise or franchises

should

be accepted if the firm's maximum acceptable payback is 2 years, and if Franchise L and S are independent? If they

The profitability index is the present value of all future cash flows divided by the intial cost. It measures the PV per dollar of

investment.

Discounted payback period uses the project's cost of capital to discount the expected cash flows. The calculation of discounted

payback period is identical to the calculation of regular payback period, except you must base the calculation on a new row of

discounted cash flows. Note that both projects have a cost of capital of 10%.

(3.) What is the difference between the regular and discounted payback periods?

The payback period is defined as the expected number of years required to recover the investment, and it was the first formal

method used to evaluate capital budgeting projects. First, we identify the year in which the cumulative cash inflows exceed the

initial cash outflows. That is the payback year. Then we take the previous year and add to it the fraction calculated as the

unrecovered balance at the end of that year divided by the following year's cash flow. Generally speaking, the shorter the

payback period, the better the investment.

318

319

320

321

322

323

324

325

326

327

328

329

330

331

332

333

334

335

336

337

338

339

340

341

342

343

344

345

346

347

348

349

350

351

352

353

354

355

356

357

358

359

360

361

362

363

364

365

366

367

368

369

370

371

372

373

A B C D E F G H I J K

Franchise L

Time period: 0 1 2 3 4

Cash flow: (100) 10 60 80 0

Disc. cash flow: (100) 9 50 60 0

Disc. cum. cash flow: (100) (91) (41) 19 19

Discounted Payback: 2.7

Multiple IRRs

Project M: 0 1 2

(800) 5,000 (5,000)

The project is estimated to be of average risk, so its cost of capital is 10%.

(2.) What is Project P's NPV? What is its IRR? Its MIRR?

NPV

M

= ($386.78)

IRR

M

1

= 25.0% MIRR = 5.6%

IRR

M

2

= 400%

0 1 2

(800.0) 5,000 (5,000)

j. As a separate project (Project P), you are considering sponsoring a pavilion at the upcoming World's Fair. The pavilion

would

cost $800,000, and it is expected to result in $5 million of incremental cash inflows during its 1 year of operation. However,

it

We will solve this IRR twice, the first time using the default guess of 10%, and the second time we will enter a guess of 200%.

Notice, that the first IRR calculation is exactly as it was above.

The two solutions to this problem tell us that this project will have a positive NPV for all costs of capital between 25% and

400%. We illustrate this point by creating a data table and a graph of the project NPVs.

(4.) What is the main disadvantage of discounted payback? Is the payback method of any real usefulness in capital budgeting

decisions?

The inherent problem with both paybacks is that they ignore cash flows that occur after the payback period mark and neither

provides a specific acceptance rule. While the discounted method accounts for timing issues (to some extent), it still falls short

of fully analyzing projects. However, all else equal, these two methods do provide some information about projects' liquidity

and risk.

(1.) What are normal and nonnormal cash flows? Answer: See Chapter 10 Mini Case Show

374

375

376

377

378

379

380

381

382

383

384

385

386

387

388

389

390

391

392

393

394

395

396

397

398

399

400

401

402

403

404

405

406

407

408

409

410

411

412

413

414

415

416

417

418

419

420

421

422

423

424

425

426

427

428

429

430

431

432

433

434

A B C D E F G H I J K

r = 25.0%

NPV = 0.00

NPV

r $0.0

0% (800.00)

25% 0.00

50% 311.11

75% 424.49

100% 450.00 Max.

125% 434.57

150% 400.00

175% 357.02

200% 311.11

225% 265.09

250% 220.41

275% 177.78

300% 137.50

325% 99.65

350% 64.20

375% 31.02

400% 0.00

425% (29.02)

450% (56.20)

475% (81.66)

500% (105.56)

525% (128.00)

550% (149.11)

PROJECTS WITH UNEQUAL LIVES

k. In an unrelated analysis, you have the opportunity to choose between the following two mutually exclusive projects:

Year Project S Project L

0 ($100,000) ($100,000)

1 60,000 33,500

2 60,000 33,500

3 33,500

4 33,500

Project L WACC: 10.0%

0 1 2 3 4

($100) $33.5 $33.5 $33.5 $33.5

NPV $6.19

Project S

0 1 2 3 4

($100) $60 $60

NPV $4.13

End of Period:

End of Period:

The projects provide a necessary service, so whichever one is selected is expected to be repeated into the foreseeable future.

Both projects have a 10% cost of capital.

(3.) Draw Project P's NPV profile. Does Project P have normal or nonnormal cash flows? Should this project be accepted?

(1.) What is each projects initial NPV without replication?

-1,000

-800

-600

-400

-200

0

200

400

600

-100% 0% 100% 200% 300% 400% 500%

NPV ($)

Cost of Capital

Multiple Rates of Return

435

436

437

438

439

440

441

442

443

444

445

446

447

448

449

450

451

452

453

454

455

456

457

458

459

460

461

462

463

464

465

466

467

468

469

470

471

472

473

474

475

476

477

478

479

480

481

482

483

484

485

486

487

488

489

490

491

492

493

494

495

496

497

A B C D E F G H I J K

Equivalent Annual Annuity (EAA) Approach

Here are the steps in the EAA approach.

1. Find the NPV of each project over its initial life (we already did this in our previous analysis).

NPV

L

= $6.19

NPV

S

= $4.13

2. Convert the NPV into an annuity payment with a life equal to the life of the project.

EAA

L

= $1.95 Note: we used Excel's PMT function by using the function wizard.

EAA

S

= $2.38

Project S

0 1 2 3

($100) $60 $60

($100) $60 $60

($100) $60 ($40) $60 $60

NPV $7.55

Project S

0 1 2 3

($100) $60 $60

($105) $60 $60

($100) $60 ($45) $60 $60

NPV $3.42

ECONOMIC LIFE VS. PHYSICAL LIFE

Year

Operating

Cash Flow

Salvage

Value

0 ($5,000) $5,000

1 $2,100 $3,100

2 $2,000 $2,000

3 $1,750 $0

3-Year NPV = Initial Cost +

PV of

Operating

Cash Flow

+

PV of

Salvage

Value

= ($5,000.00) + $4,876.78 + $0.00

3-Year NPV = ($123.22)

2-Year NPV = Initial Cost +

PV of

Operating

Cash Flow

+

PV of

Salvage

Value

= ($5,000.00) + $3,561.98 + $1,652.89

2-Year NPV = $214.88

l. You are also considering another project which has a physical life of 3 years; that is, the machinery will be totally worn out

after 3 years. However, if the project were terminated prior to the end of 3 years, the machinery would have a positive

salvage

The asset has a negative NPV if it is kept for three years. But even though the asset will last three years, it might be better to

operate the asset for either one or two years, and then salvage it.

(1.) Using the 10% cost of capital, what is the project's NPV If it is operated for the full 3 years?

End of Period:

End of Period:

(2.) What is each projects equivalent annual annuity?

(4.) Now assume that the cost to replicate Project S in 2 years will increase to $105,000 because of inflationary pressures.

How should the analysis be handled now, and which project should be chosen?

(3.) Now apply the replacement chain approach to determine the projects extended NPVs. Which project should be chosen?

(2.) Would the NPV change if the company planned to terminate the project at the end of Year 2?

498

499

500

501

502

503

504

505

506

507

508

509

A B C D E F G H I J K

1-Year NPV = Initial Cost +

PV of

Operating

+

PV of

Salvage

= ($5,000.00) + $1,909.09 + $2,818.18

1-Year NPV = ($272.73)

The project's NPV will only be positive when it is operated for 2 years. Therefore, the project's economic life is 2 years.

m. After examining all the potential projects, you discover that there are many more projects this year with positive NPVs

than in

a normal year. What two problems might this extra large capital budget cause? Answer: S ee Chapter 10 Mini Case Show

(4.) What is the projects optimal (economic) life?

(3.) At the end of Year 1?

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

L M N O P Q R S T U

Notice that the NPV function isn't really a Net present value.

Instead, it is the present value of future cash flows. Thus, you

specify only the future cash flows in the NPV function. To find the

true NPV, you must add the time zero cash flow to the result of the

NPV function.

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

121

L M N O P Q R S T U

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

140

141

142

143

144

145

146

147

148

149

150

151

152

153

154

155

156

157

158

159

160

161

162

163

164

165

166

167

168

169

170

171

172

173

174

175

176

177

178

179

180

181

182

183

184

185

186

187

L M N O P Q R S T U

188

189

190

191

192

193

194

195

196

197

198

199

200

201

202

203

204

205

206

207

208

209

210

211

212

213

214

215

216

217

218

219

220

221

222

223

224

225

226

227

228

229

230

231

232

233

234

235

236

237

238

239

240

241

242

243

244

245

246

247

248

249

250

251

252

L M N O P Q R S T U

253

254

255

256

257

258

259

260

261

262

263

264

265

266

267

268

269

270

271

272

273

274

275

276

277

278

279

280

281

282

283

284

285

286

287

288

289

290

291

292

293

294

295

296

297

298

299

300

301

302

303

304

305

306

307

308

309

310

311

312

313

314

315

316

317

L M N O P Q R S T U

Cash Flows Discounted back at 10%.

You might also like

- Basics of Capital Budgeting and Franchise SelectionDocument2 pagesBasics of Capital Budgeting and Franchise SelectionKhurram ShahzadNo ratings yet

- MBA Graduate Considers Fast Food Franchise InvestmentsDocument4 pagesMBA Graduate Considers Fast Food Franchise InvestmentsTran PhuongNo ratings yet

- Ch05 Mini CaseDocument8 pagesCh05 Mini CaseTia1977No ratings yet

- Investment, Time & Capital MarketsDocument62 pagesInvestment, Time & Capital MarketsAkshay ModakNo ratings yet

- FIN 440: Individual Assignment Total: 50Document12 pagesFIN 440: Individual Assignment Total: 50ImrAn KhAnNo ratings yet

- NPV and IRR investment rulesDocument37 pagesNPV and IRR investment rulesBouchraya MilitoNo ratings yet

- 9370637Document10 pages9370637Note EightNo ratings yet

- MBA Managerial Finance Group Online MidtermDocument9 pagesMBA Managerial Finance Group Online MidtermAhmed Mohamed AwadNo ratings yet

- Net Present Value and The Internal Rate of Return - CFA Level 1 - InvestopediaDocument9 pagesNet Present Value and The Internal Rate of Return - CFA Level 1 - InvestopediaPrannoyChakrabortyNo ratings yet

- Fundamentals of Corporate Finance 3rd Edition Parrino Solutions Manual DownloadDocument47 pagesFundamentals of Corporate Finance 3rd Edition Parrino Solutions Manual DownloadSamuel Hobart100% (23)

- Introduction to Financial Modeling BasicsDocument5 pagesIntroduction to Financial Modeling Basicsleul habtamuNo ratings yet

- Cap 5Document21 pagesCap 5IvanaNo ratings yet

- A Financial Model Is Simply A Tool ThatDocument5 pagesA Financial Model Is Simply A Tool ThatHarshalKolhatkarNo ratings yet

- Finance Interview QuestionsDocument14 pagesFinance Interview QuestionsVivek SequeiraNo ratings yet

- Investment Decision CriteriaDocument71 pagesInvestment Decision CriteriaBitu GuptaNo ratings yet

- Finance Mini CaseDocument59 pagesFinance Mini Caseaudy100% (1)

- Final Exam/2: Multiple ChoiceDocument4 pagesFinal Exam/2: Multiple ChoiceJing SongNo ratings yet

- Capital Budgeting Decisions: Analyzing Marge Simpson's Falafel and Pretzel Business Opportunities Using NPV and IRRDocument66 pagesCapital Budgeting Decisions: Analyzing Marge Simpson's Falafel and Pretzel Business Opportunities Using NPV and IRRKhizer Ahmed KhanNo ratings yet

- Chapter 5 SummaryDocument24 pagesChapter 5 SummaryDY CMM GRCNo ratings yet

- 5.2 Discounted Cash Flows, Internal Rate of Return, ROI. Feb 8-12. 2Document13 pages5.2 Discounted Cash Flows, Internal Rate of Return, ROI. Feb 8-12. 2John GarciaNo ratings yet

- Chap 11Document45 pagesChap 11SEATQMNo ratings yet

- Capital Budgeting Decision Rules: What Real Investments Should Firms Make?Document31 pagesCapital Budgeting Decision Rules: What Real Investments Should Firms Make?mkkaran90No ratings yet

- Review Notes FinalDocument12 pagesReview Notes FinalJoseph AbalosNo ratings yet

- Chapter One Introduction To Financial Modeling and ValuationDocument6 pagesChapter One Introduction To Financial Modeling and ValuationBobasa S AhmedNo ratings yet

- Shrieves Casting Company Chapter 12 (11ed-11) Cash Flow Estimation and Risk AnalysisDocument12 pagesShrieves Casting Company Chapter 12 (11ed-11) Cash Flow Estimation and Risk AnalysisHayat Omer Malik100% (1)

- Corp Fin OverviewDocument32 pagesCorp Fin OverviewKonstantinos DelaportasNo ratings yet

- Capital Budgeting Decision Rules: What Real Investments Should Firms Make?Document31 pagesCapital Budgeting Decision Rules: What Real Investments Should Firms Make?Adolfo SnyderNo ratings yet

- The Basics of Capital Budgeting: Should We Build This Plant?Document41 pagesThe Basics of Capital Budgeting: Should We Build This Plant?MoheuddinMayrajNo ratings yet

- Rate of Return Analysis: Week 11Document25 pagesRate of Return Analysis: Week 11Sonia FausaNo ratings yet

- Economics Final Exam SolutionsDocument4 pagesEconomics Final Exam SolutionsPower GirlsNo ratings yet

- An20211101 1376Document9 pagesAn20211101 1376Carl BwanyaNo ratings yet

- Simple Discounted Cash Flow Model & Relative ValuationDocument14 pagesSimple Discounted Cash Flow Model & Relative ValuationlearnNo ratings yet

- The Basics of Capital Budgeting: Should We Build This Plant?Document70 pagesThe Basics of Capital Budgeting: Should We Build This Plant?Jithin NairNo ratings yet

- Capital Budgeting TechniquesDocument6 pagesCapital Budgeting TechniquesMichael ReyesNo ratings yet

- Principles of Finance Work BookDocument53 pagesPrinciples of Finance Work BookNicole MartinezNo ratings yet

- Making Investment Decisions with the NPV RuleDocument24 pagesMaking Investment Decisions with the NPV RuleSebine MemmedliNo ratings yet

- Problem Sets: Example, Requires Compounded Semiannualiy. Equivalent CompoundedDocument5 pagesProblem Sets: Example, Requires Compounded Semiannualiy. Equivalent CompoundedvineethNo ratings yet

- Investment DecDocument29 pagesInvestment DecSajal BasuNo ratings yet

- Homework Notes Unit 3 MBA 615Document9 pagesHomework Notes Unit 3 MBA 615Kevin NyasogoNo ratings yet

- What is Internal Rate of Return (IRR) and how does it compare to Net Present Value (NPVDocument4 pagesWhat is Internal Rate of Return (IRR) and how does it compare to Net Present Value (NPVMihir AsherNo ratings yet

- Midterm 2 Spring 2013Document9 pagesMidterm 2 Spring 2013Simreyna KangNo ratings yet

- Cost of Capital Components Debt Preferred Common Equity WaccDocument54 pagesCost of Capital Components Debt Preferred Common Equity WaccAbdullahRafiqNo ratings yet

- Capital Budgeting: Decision CriteriaDocument66 pagesCapital Budgeting: Decision CriteriaBich VietNo ratings yet

- Case Study ReportDocument7 pagesCase Study ReportHytham RiadNo ratings yet

- Fin701 Module3Document22 pagesFin701 Module3Krista CataldoNo ratings yet

- IRR Vs MIRR Vs NPV (Finatics)Document4 pagesIRR Vs MIRR Vs NPV (Finatics)miranirfanNo ratings yet

- AnswerDocument13 pagesAnswerEhab M. Abdel HadyNo ratings yet

- Capital BudgetingDocument12 pagesCapital BudgetingRizwan Ali100% (1)

- Topic 9 - Advanced Valuation and Capital Budgeting - Practice SolutionsDocument7 pagesTopic 9 - Advanced Valuation and Capital Budgeting - Practice SolutionsSelina LiNo ratings yet

- Capital Budgeting Decisions Made EasyDocument9 pagesCapital Budgeting Decisions Made EasyiteddyzNo ratings yet

- Chapter 13 Capital BudgetingDocument60 pagesChapter 13 Capital BudgetinggelskNo ratings yet

- What is Engineering EconomicsDocument28 pagesWhat is Engineering EconomicsEdwordNo ratings yet

- MGT 2281 Fall 2019 Assignment Solution Outline: Page 1 of 13Document13 pagesMGT 2281 Fall 2019 Assignment Solution Outline: Page 1 of 13BessieDuNo ratings yet

- ACCT 2200 - Chapter 11 P2 - With SolutionsDocument26 pagesACCT 2200 - Chapter 11 P2 - With Solutionsafsdasdf3qf4341f4asDNo ratings yet

- Personal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyFrom EverandPersonal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Decoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisFrom EverandDecoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisNo ratings yet

- UI for CRUD, Listing & Search with Spell Check, Phrases & SynonymsDocument1 pageUI for CRUD, Listing & Search with Spell Check, Phrases & SynonymsKathryn SmithNo ratings yet

- GarbageDocument2 pagesGarbageKathryn SmithNo ratings yet

- Risk MeasuresDocument1 pageRisk MeasuresKathryn SmithNo ratings yet

- Financial Mathematics GuideDocument10 pagesFinancial Mathematics GuideKathryn SmithNo ratings yet

- FinalDocument2 pagesFinalKathryn SmithNo ratings yet

- Risk Measures - SolutionsDocument2 pagesRisk Measures - SolutionsKathryn SmithNo ratings yet

- Final CVDocument2 pagesFinal CVKathryn SmithNo ratings yet

- Financial Mathematics GuideDocument10 pagesFinancial Mathematics GuideKathryn SmithNo ratings yet

- CompaniesDocument1 pageCompaniesKathryn SmithNo ratings yet

- WAC - Digital Chocolate - MBA-M City - Mohammed AsgherDocument9 pagesWAC - Digital Chocolate - MBA-M City - Mohammed AsgherKathryn SmithNo ratings yet

- Call4PapersDocument6 pagesCall4PapersKathryn SmithNo ratings yet

- Actuarial ScienceDocument3 pagesActuarial ScienceKathryn SmithNo ratings yet

- LDP PaperjrmvDocument17 pagesLDP PaperjrmvKathryn SmithNo ratings yet

- ETR Module 10 Example Question - Handwritten SolutionDocument2 pagesETR Module 10 Example Question - Handwritten SolutionKathryn SmithNo ratings yet

- 2008Document14 pages2008Kathryn SmithNo ratings yet

- 5 L 4 S 5 Xs 9 D 4 VDDocument70 pages5 L 4 S 5 Xs 9 D 4 VDKathryn SmithNo ratings yet

- Chapter 1 ProbDocument8 pagesChapter 1 ProbKathryn SmithNo ratings yet

- Ammonium Nitrophosphate Production ProcessDocument133 pagesAmmonium Nitrophosphate Production ProcessHit Busa100% (1)

- A Cranial Approach To Sinus Congestion: By, Nathan Widboom D.ODocument31 pagesA Cranial Approach To Sinus Congestion: By, Nathan Widboom D.ONancyNo ratings yet

- MGN 363Document14 pagesMGN 363Nitin PatidarNo ratings yet

- Syllabus: Android Training Course: 1. JAVA ConceptsDocument6 pagesSyllabus: Android Training Course: 1. JAVA ConceptsVenkata Rao GudeNo ratings yet

- How COVID-19 Affects Corporate Financial Performance and Corporate Valuation in Bangladesh: An Empirical StudyDocument8 pagesHow COVID-19 Affects Corporate Financial Performance and Corporate Valuation in Bangladesh: An Empirical StudyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Geography Lesson PlanDocument4 pagesGeography Lesson Planapi-204977805100% (3)

- CompReg 13SEPTEMBER2023Document2,725 pagesCompReg 13SEPTEMBER2023syed pashaNo ratings yet

- Product Placement in Movies- Impact on SalesDocument3 pagesProduct Placement in Movies- Impact on SalesBhavya DiddeeNo ratings yet

- C15 DiagranmaDocument2 pagesC15 Diagranmajose manuel100% (1)

- Chapter 4-Market EquilibriumDocument24 pagesChapter 4-Market EquilibriumAiman Daniel100% (2)

- Return On Marketing InvestmentDocument16 pagesReturn On Marketing Investmentraj_thanviNo ratings yet

- Joou No Gohoubi - Tate No Yuusha No Nariagari 288869 Doujin - EdoujinDocument25 pagesJoou No Gohoubi - Tate No Yuusha No Nariagari 288869 Doujin - Edoujinaura.nazhifa10020% (1)

- BL ListDocument8 pagesBL ListStraña Abigail Alonsabe Villacis100% (1)

- Quotation For Villa Maintainance at Al RiqqaDocument2 pagesQuotation For Villa Maintainance at Al RiqqaAkosh AchuNo ratings yet

- 5 Nighttime Image Enhancement Using A NewDocument7 pages5 Nighttime Image Enhancement Using A NewNithish CenaNo ratings yet

- Small-Scale Fisheries Co-op ConstitutionDocument37 pagesSmall-Scale Fisheries Co-op ConstitutionCalyn MusondaNo ratings yet

- SSC CGL 13th Dec 2022 Shift-4 by CrackuDocument29 pagesSSC CGL 13th Dec 2022 Shift-4 by CrackuyuviNo ratings yet

- Derivatives and Foreign Currency: Concepts and Common TransactionsDocument28 pagesDerivatives and Foreign Currency: Concepts and Common TransactionsElle PaizNo ratings yet

- Underpinning Methods, Procedure and ApplicationsDocument10 pagesUnderpinning Methods, Procedure and ApplicationsShivaun Seecharan0% (1)

- Bleed Fan SelectionDocument4 pagesBleed Fan Selectionomar abdullahNo ratings yet

- Hepatobiliary Surgery BlumgartDocument301 pagesHepatobiliary Surgery Blumgartaejazahsan100% (7)

- Knife Gate ValveDocument67 pagesKnife Gate Valvekrishna100% (1)

- Conflict Analysis Tools PDFDocument12 pagesConflict Analysis Tools PDFApeuDerrop0% (1)

- English Assignment AnswersDocument4 pagesEnglish Assignment AnswersAfidaNo ratings yet

- Mercado - 10 Fabrikam Investments SolutionDocument3 pagesMercado - 10 Fabrikam Investments SolutionMila MercadoNo ratings yet

- The NF and BNF Charts from the Trading RoomDocument23 pagesThe NF and BNF Charts from the Trading RoomSinghRaviNo ratings yet

- Newman News January 2017 EditionDocument12 pagesNewman News January 2017 EditionSonya MathesonNo ratings yet

- STTH2002C: High Efficiency Ultrafast DiodeDocument16 pagesSTTH2002C: High Efficiency Ultrafast DiodeAseng saputraNo ratings yet

- Lecture Notes On Revaluation and Impairment PDFDocument6 pagesLecture Notes On Revaluation and Impairment PDFjudel ArielNo ratings yet

- Organic FertilizerDocument2 pagesOrganic FertilizerBien Morfe67% (3)