Professional Documents

Culture Documents

Debt Management in India

Uploaded by

Sarbartho MukherjeeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Debt Management in India

Uploaded by

Sarbartho MukherjeeCopyright:

Available Formats

COMMENTARY

Economic & Political Weekly EPW June 28, 2014 vol xlix nos 26 & 27

23

Debt Management in India

Need for Separation and Independence

K Kanagasabapathy, Charan Singh

A discussion of the long-standing

proposal to establish a Public

Debt Management Agency that

would be independent of the

central bank. There is need

for a separation but there must

be greater clarity than at

present on the independence the

agency will enjoy from the

central government.

E

ver since the onset of nancial

sector reforms in India in the ear-

ly 1990s, the proposal for separa-

tion of debt management from monetary

management and the setting up of an

independent Debt Management Ofce

(DMO) has been prominently discussed.

As both debt and monetary management

became market-oriented, the potential

conict between the two has surfaced.

The Reserve Bank of India (RBI), being the

major investor in government securities,

its market interventions through open

market operations in government securi-

ties and liquidity management operations

through the Cash Reserve Ratio (CRR) or

the Liquidity Adjustment Facility (LAF) is

highly susceptible to be clouded by debt

management objectives. The strength of

scal-monetary nexus in that sense

cannot be underestimated. As the role of

the RBI is restricted to management of

market loans, debt management should

be viewed in a holistic manner while

structuring the new DMO. The interests

of all stakeholders, namely, the central

government, state governments and the

RBI also need to be kept in view.

The public debt of the country has

been estimated at 66.0% of GDP at end-

March 2013 and the trend in the rise of

public debt reveals domestic debt has

been steadily increasing (Table 1).

The major components of domestic

debt are internal debt, small savings,

provident funds, and reserve funds and

deposits (Table 2). The Constitution of

India provides for the option of placing a

limit on internal debt, both at the centre

and the states, but no such limit has been

imposed so far. Internal debt, the most

prominent component of domestic debt,

consists of markets loans, Treasury bills

and other bonds issued by the central

and state governments.

The overall amount of total market

borrowings is decided in consultation

with the Planning Commission, state

governments, the central government

and the RBI. The RBI also advises the

central and the state governments on

the quantum, timing and terms of issue

of new loans for each of the tranches.

While the volumes of market borrowings

have increased substantially, the owner-

ship pattern of market loans has under-

gone signicant change too the share

of commercial banks has declined and

that of insurance and provident funds

has increased over the years.

The government also offers a variety

of small savings schemes to meet the

varying needs of different groups of

small investors. In respect of each

scheme, statutory rules are framed by

the central government indicating vari-

ous details including the rate of interest

and the maturity period. Small saving

instruments can be classied under the

following three heads: postal deposits,

savings certicates and public provident

fund (PPF), with PPF being a small

K Kanagasabapathy is a former director,

EPW Research Foundation and Charan Singh

teaches Economics at IIM Bangalore.

Table 1: Public Debt of the Government

Year In Rs Billion As Per Cent of GDP

External Debt Domestic Debt Public Debt External Debt* Domestic Debt Public Debt

1980-81 134.8 582.5 717.3 9.0 38.9 47.9

1990-91 663.1 3373.0 4036.1 11.3 57.5 68.9

2000-01 1899.9 14141.1 16041.0 8.7 64.9 73.7

2010-11 2788.8 48291.9 51080.7 3.6 61.9 65.5

2011-12 3229.0 55575.5 58804.5 3.6 61.9 65.5

2012-13 3320.0 62849.0 66169.0 3.3 62.7 66.0

* Historical values.

Source: RBI.

Table 2: Components of Domestic Debt of

the Government (in %)

Year Internal Small Reserve Domestic

Debt Savings Funds and Debt

Deposits and Deposits

Provident and Other

Funds Accounts

1980-81 60.6 22.6 16.8 100.0

1990-91 51.3 23.3 25.4 100.0

2000-01 67.4 13.0 19.6 100.0

2010-11 70.7 16.6 12.7 100.0

2011-12 73.5 15.2 11.2 100.0

2012-13 75.9 14.1 10.0 100.0

Source: RBI.

COMMENTARY

June 28, 2014 vol xlix nos 26 & 27 EPW Economic & Political Weekly

24

component.

1

The ownership pattern of

small savings is not available, though a few

ad hoc surveys have been undertaken.

Over the past three decades the share

of internal debt and market loans has in-

creased while small savings and reserve

funds declined from about 39% in end-

March 1981 to 24% in end-March 2013.

In fact, there is lack of comprehensive

analysis of the liabilities of the c entral

and state government and their distribu-

tional aspects, which impedes informed

decision-making regarding domestic bor-

rowing and thus calls for separation of

debt management.

Separation of Debt Management

In India, the issue of separation of debt

from monetary management has been

discussed in detail for more than a

d ecade. Such separation of debt would

p rovide the RBI with necessary independ-

ence in monetary management and an

environment to pursue an ination target,

if assigned by the government. The sep-

aration of debt management would also

provide focus to the task of asset-liability

management of government liabilities,

undertake risk analysis and help to

prioritise government ex pen diture through

higher awareness of interest costs. The

need for setting up a specialised frame-

work on public debt management which

will take a comprehensive view of the

liabilities of government, and establish

the strategy for low-cost nancing in

the long run has been advocated by

various expert committees since the

late 1990s (Table 3).

Financial Sector Legislative

Reforms Commission

Last year, the Financial Sector Legislative

Reforms Commission (FSLRC) also exam-

ined the issue and presented its report in

two parts: Volume I the text of the nd-

ings and recommendations and Volume II

the basic framework of a draft law in

March 2013. The FSLRC proposed crea-

tion of a specialised statutory Public Debt

Management Agency (PDMA) that will be

equipped to manage the liabilities of the

government in a holistic manner. The

analytical part of the report (Volume I)

clearly states that the PDMA would have

an independent goal and objective but

would operate as an agent of the central

government. The principles of govern-

ance, including transparency and ac -

countability will apply to all functions

of the agency, its committee and the

council. The governance and operations

of the PDMA would be handled through

a two-tiered arrange ment, guided by an

advisory council and run by a manage-

ment committee. The composition of

the advisory council and management

committee will be broadly similar, with

representation from the RBI and the

central g overnment. The management

committee should be headed by the chief

executive of the agency, and the adviso-

ry council should be headed by an inde-

pendent chairperson.

The objective of setting up the PDMA is

to provide a specialised framework on

public debt management in the country

that takes a comprehensive view of the

liabilities of the government, and estab-

lishes the strategy for low-cost nancing

in the long run. In brief, the PDMA would

undertake the following functions:

(a) Debt Management: Preparation of

an annual calendar for the central gov-

ernment borrowings and repayment in

consultation with the RBI and other

stakeholders. The PDMA will be empow-

ered to make recommendations, even if

on a daily basis, and will also be respon-

sible for ensuring integrated approach to

debt management, including external

debt for the central government.

(b) Cash Management: Coordinate

with the departments, ministries and

agencies of the central government and

the RBI to estimate, monitor and manage

daily cash balances. Also advise the gov-

ernment on measures to promote ef-

cient cash management practices and to

deal with surpluses and decits.

(c) Contingent Liabilities: Management

and execution of implicit and explicit

Table 3: Summary of Reports on Debt Management

Year Source Recommendations

1997 Report of the Committee on Capital Account Convertibility Setting up of an Office of the Public Debt (OPD)

1997 A working group on Separation of Debt Management from Separate Debt management office as a company under the Indian Companies

Monetary Management Act

2000 The Advisory Group on Transparency in Monetary and Financial Policies Independent Debt Management Office, in a phased manner.

2001 The RBI Annual Report 2000-01 Separate DMO.

2001 The Internal Expert Group on the Need for a Middle Office for Public Establishing an autonomous Public Debt Office.

Debt Management

2004 The Report on the Ministry of Finance for 21st Century National Treasury Management Agency.

2004 The Fiscal Responsibility and Budget Management (FRBM) Act Prohibits the Reserve Bank from participating in the primary market for central

government securities with effect from April 2006.

2006 Fuller Capital Account Convertibility Set up of Office of Public Debt outside RBI

2007 The Union Budget 2007-08 Establishment of a DMO in the government.

2008 The High Level Committee on Financial Sector Reforms Structural change of public debt management, such that it minimises financial

repression and generates a vibrant bond market. Set up independent DMO.

2008 Internal Working Group on Debt Management Establishing a DMO.

2012 Report of the Working Group on Debt Management Office Independent DMO.

2012 The Financial Sector Legislative Reforms Commission Approach Paper Separation of debt management with specialised investment banking

capability for public debt management.

2013 The Financial Sector Legislative Reforms Commission Specialised framework to analyse comprehensive structure of liabilities of the

government, and strategising minimal cost techniques for raising and servicing

public debt over the long term within an acceptable level of risk.

Source: Various Reports, GoI and RBI.

COMMENTARY

Economic & Political Weekly EPW June 28, 2014 vol xlix nos 26 & 27

25

contingent liabilities. As well as evalua-

tion of the potential risk of contingent

liabilities. The central government will

seek PDMAs advice before issuing any

fresh guarantees as it affects the overall

stability of the public debt portfolio. The

PDMA will also advise the central govern-

ment about the fees to be charged.

(d) Research and Information: Must

have a complete view of the entire liabil-

ity structure of the central government

for maintaining and managing informa-

tion systems. Disseminate information

and data; and conduct and facilitate

research relating to its functions.

(e) Foster a Liquid and Efcient Market

for Government Securities: This includes

advising the regulators and the central

government on the policy and design of

the market to ensure low-cost nancing.

Thus the PDMA must ensure growth and

diversity in investors and intermediaries,

fair play, competition in intermediation,

cost-minimising mechanisms for issuance

and trading. Measurement of liquidity

and market efciency, and presentation

of an annual report on the progress of

the Government of India sovereign bond

market, is also essential.

According to FSLRC Volume I, the plac-

ing of all contingent liabilities in the single

debt ofce will facilitate the scrutiny of

issuances, record keeping, risk assess-

ment, pricing, audit and approval by

Parliament. This will help in better coor-

dination of the debt management func-

tion, operational efciency, risk assess-

ment, accountability and responsibility.

There are limitations on the functions of

the PDMA and these mainly pertain to

expanding its role to the state govern-

ments as the management of state debt

is a state subject. However, the PDMA

would be obliged to undertake those

functions related to the state government

which has implications for the central

governments debt portfolio. This would

involve maintaining a database on state

government debt and coordinating the

central governments borrowing calen-

dar with that of the state government.

The state governments may choose the

PDMA to manage their debt and the PDMA

should be empowered to offer technical

assistance to state governments to set up

their own PDMAs if required.

Conict

There, seemingly, is a conict in the two

volumes of the FSLRC. While in Volume I,

it is clear that independence of debt

management is of paramount importance,

the situation is different in Volume II,

which stipulates that the PDMA will

always act on instructions from the

central government. But if the instruc-

tion does not enable its objectives to be

met, then the PDMA must have the

opportunity to place its objections on

record. The central government should

be obliged to consider the views of the

PDMA and if there is a disagreement b

etween the two, then the PDMA would be

statutorily bound to meet the instructions,

by very clearly articulating on record its

inability to meet the objectives. The ac-

countability mechanism routed through

the central government and eventually

through Parliament would pay cogni-

sance to the effort made by the PDMA

in achieving its objectives and the

objections raised.

Moreover in Section 389 of the draft

law (FSLRC Volume II), it is stated that

the central government may issue to the

PDMA, by an order in writing, directions

on policy from time to time. The debt

agency is bound by any directions issued

under this section in the exercise of its

powers or the performance of its func-

tions under this part.

A disconnect between the recommen-

dations in Volume I and the draft code in

Volume II of the report is notable. The

draft code clearly indicates that the inde-

pendence of the PDMA would not be en-

sured. The objective or a preamble clear-

ly delineated in Volume II states that the

Debt Agency has the objective of minimis-

ing the cost of raising and servicing public

debt over the long-term within an accept-

able level of risk at all times, under the

general superintendence of the Central

Government.

In view of the conict in the two

volumes of the report by the FSLRC,

the policy stance on independence of

the PDMA is not transparently clear. In

this situation, the present arrangement

under the RBI seems to be more

independent than the status envisaged

for the PDMA. Therefore, this aspect of

the independence of the PDMA has to be

revisited in the FSLRC.

Note

1 Total deposits constitutes of post ofce saving

bank deposits, MGNREGA, National Saving

Scheme, 1987, National Saving Scheme, 1992,

Monthly Income Scheme, Senior Citizen

Scheme, Post Ofce Time Deposits: one year

time deposits, two year time deposits, three

year time deposits, ve year time deposits; Post

Ofce Recurring Deposits, Post Ofce Cumula-

tive Time Deposits, other deposits. Saving cer-

ticates constitutes of National Savings Certi-

cate VIII issue, Indira Vikas Patras, Kisan Vikas

Patras, National Saving Certicate VI issue,

National Saving Certicate VII issue, other cer-

ticates and Public Provident Fund.

References

Government of India (2008): Report of the Inter-

nal Working Group on Debt Management

Technical Report, Department of Economic

Affairs, Ministry of Finance.

(2013): Report of the Financial Sector Legisla-

tive Reforms Commission, Volume I, Analysis

and Recommendations, Ministry of Finance.

(2013): Report of the Financial Sector Legisla-

tive Reforms Commission, Volume II, Draft

Law, Ministry of Finance.

(2013): Middle Ofce (Debt Management),

Department of Economic Affairs, Ministry of

Finance.

Kanagasabapathy, K and C Singh (2013): A Sepa-

rate Debt Management Ofce: Rationale, Scope

and Structure, WP No 431, Indian Institute of

Management Bangalore.

Reserve Bank of India (2013): Handbook of Statis-

tics on the Indian Economy.

EPW Index

An author-title index for EPW has been prepared for the years from 1968 to 2012. The PDFs of the

Index have been uploaded, year-wise, on the EPW website. Visitors can download the Index for

all the years from the site. (The Index for a few years is yet to be prepared and will be uploaded

when ready.)

EPW would like to acknowledge the help of the staff of the library of the Indira Gandhi Institute

of Development Research, Mumbai, in preparing the index under a project supported by the

RD Tata Trust.

You might also like

- Principles of Management at MicrosoftDocument39 pagesPrinciples of Management at MicrosoftRushabh KathaneNo ratings yet

- Company Profile MicrosoftDocument7 pagesCompany Profile MicrosoftAnaghaPuranikNo ratings yet

- Human Resource Management at Microsoft: Recruitment and Selection - in The BeginningDocument5 pagesHuman Resource Management at Microsoft: Recruitment and Selection - in The BeginningJayanta 1No ratings yet

- LG TV ReportDocument31 pagesLG TV ReportAkmal GhazaliNo ratings yet

- Corporate Accountability in IndiaDocument30 pagesCorporate Accountability in India2nabls0% (1)

- Research Methodology Into Ratio Analysis of HSBC BankDocument11 pagesResearch Methodology Into Ratio Analysis of HSBC Banklopbokilo0% (1)

- Hero Honda MotorsDocument4 pagesHero Honda Motorsmeann colinaNo ratings yet

- A Comprehensive Study On BSNL Revival CADocument16 pagesA Comprehensive Study On BSNL Revival CARAVI KUMARNo ratings yet

- Recruitment & Selection 1Document63 pagesRecruitment & Selection 1Anuj ShahNo ratings yet

- Group Facebook Case Study 2 AnswerDocument10 pagesGroup Facebook Case Study 2 AnswerNCTNo ratings yet

- McKinsey 7S Framework Assessment of Royal Mail ChangesDocument5 pagesMcKinsey 7S Framework Assessment of Royal Mail ChangesBishal KarkiNo ratings yet

- Group Assignment Logistic and Supply Chain Management ALS2023Document29 pagesGroup Assignment Logistic and Supply Chain Management ALS2023邢益润No ratings yet

- Mrc2213 Strategic ManagementDocument59 pagesMrc2213 Strategic ManagementDarylGamaraNo ratings yet

- Global Dimensions of Management and International BusinessDocument7 pagesGlobal Dimensions of Management and International Businesskakali kayal100% (1)

- Strategic Audit Google IncDocument12 pagesStrategic Audit Google IncAlfonsus Roni Hartono0% (1)

- Internet Search and The Rise of Google Case StudyDocument18 pagesInternet Search and The Rise of Google Case StudySandeep ManeNo ratings yet

- Equity and Entrepreneurship FundDocument3 pagesEquity and Entrepreneurship Fundbuetce041662912No ratings yet

- MARKETING PROCESSES & PLANNING FOR COCONUT BLISSDocument19 pagesMARKETING PROCESSES & PLANNING FOR COCONUT BLISSMishahim SaeedNo ratings yet

- Business Analytics Modeling and PredictionsDocument4 pagesBusiness Analytics Modeling and PredictionsVidehi BajajNo ratings yet

- IfrsDocument24 pagesIfrsJeevan JainNo ratings yet

- Service Sector in India - A SWOT AnalysisDocument12 pagesService Sector in India - A SWOT AnalysisMohammad Miyan0% (1)

- Economic Environment Assignment#1Document9 pagesEconomic Environment Assignment#1Bhavana MehtaNo ratings yet

- Microsoft's $7.2B acquisition of Nokia's devices businessDocument6 pagesMicrosoft's $7.2B acquisition of Nokia's devices businessManav RizwaniNo ratings yet

- Performance Management MobilinkDocument9 pagesPerformance Management MobilinkMuhammad Hassan100% (1)

- Operations Management Practices at Bashundhara CementDocument11 pagesOperations Management Practices at Bashundhara CementMd. Shadman AminNo ratings yet

- SWOT Analysis For Samsung Mary Bridget Phiri University of Zambia Graduate School of BusinessDocument6 pagesSWOT Analysis For Samsung Mary Bridget Phiri University of Zambia Graduate School of BusinessMary Bridget PhiriNo ratings yet

- Case Study On Microsoft: Introduction and History Clients Products and Services Profit Future Goals and ConclusionDocument11 pagesCase Study On Microsoft: Introduction and History Clients Products and Services Profit Future Goals and ConclusionSarvani ShettigarNo ratings yet

- Understanding CSR in China: Government, Corporations and StakeholdersDocument5 pagesUnderstanding CSR in China: Government, Corporations and StakeholdersLester Eslava OrpillaNo ratings yet

- Warehouse Expansion Project ManagementDocument30 pagesWarehouse Expansion Project Managementjey456No ratings yet

- GROUP 3 - Pablo Gil - Case Study 1Document12 pagesGROUP 3 - Pablo Gil - Case Study 1Pablo GilNo ratings yet

- Management AccountingDocument14 pagesManagement AccountingAmit RajNo ratings yet

- Integrated Marketing Communication Unit 1Document63 pagesIntegrated Marketing Communication Unit 1pecmbaNo ratings yet

- Financial and Cost Accounting ProjectDocument10 pagesFinancial and Cost Accounting ProjectChandani PatelNo ratings yet

- FICT System Development & Analysis AssignmentDocument3 pagesFICT System Development & Analysis AssignmentCR7 الظاهرةNo ratings yet

- BRM Assignment # 02Document7 pagesBRM Assignment # 02Muneer HussainNo ratings yet

- Banking Sector Growth StoryDocument9 pagesBanking Sector Growth Storybiswarup4463No ratings yet

- Sealed Air Diversey Merger Acquisition Presentation Slides Deck PPT June 2011Document40 pagesSealed Air Diversey Merger Acquisition Presentation Slides Deck PPT June 2011Ala BasterNo ratings yet

- RBL Bank's Strategies for Centralization, Niche Lending and AcquisitionsDocument4 pagesRBL Bank's Strategies for Centralization, Niche Lending and AcquisitionsPankaj ShuklaNo ratings yet

- Impact of Online Shopping On Shopping MallsDocument55 pagesImpact of Online Shopping On Shopping MallsSimbarashe Sheldon ChizhandeNo ratings yet

- Effectiveness of Advertisement Strategies at TVS Mba Project ReportsDocument71 pagesEffectiveness of Advertisement Strategies at TVS Mba Project ReportsBabasab Patil (Karrisatte)100% (1)

- L&T's major sources of financeDocument6 pagesL&T's major sources of financeabhishek anandNo ratings yet

- SM C6 ReportDocument7 pagesSM C6 ReportKshitij vijayNo ratings yet

- Assignment 3 Ethics and GovernanceDocument21 pagesAssignment 3 Ethics and GovernanceHy CaoNo ratings yet

- Maldives AssignmentDocument8 pagesMaldives AssignmentSrividya NatarajanNo ratings yet

- POST OFFICE ACCOUNT APPLICATIONDocument2 pagesPOST OFFICE ACCOUNT APPLICATIONplr.post50% (2)

- Porter's Diamond Model (Analysis of Competitiveness) ...Document2 pagesPorter's Diamond Model (Analysis of Competitiveness) ...BobbyNicholsNo ratings yet

- Annual Report AnalysisDocument14 pagesAnnual Report AnalysisUma ShankarNo ratings yet

- Analysis of Financial Performance Ratios for HP, IBM and DELL from 2008-2010Document35 pagesAnalysis of Financial Performance Ratios for HP, IBM and DELL from 2008-2010Husban Ahmed Chowdhury100% (2)

- Tata Motors AnalysisDocument6 pagesTata Motors AnalysisYatin GuptaNo ratings yet

- SWOT Analysis FinalDocument2 pagesSWOT Analysis FinalNajar Aryal50% (2)

- Minimum Wage Impact On RMG Sector of Bangladesh: Prospects, Opportunities and Challenges of New Payout StructureDocument14 pagesMinimum Wage Impact On RMG Sector of Bangladesh: Prospects, Opportunities and Challenges of New Payout StructureNaim H. FaisalNo ratings yet

- Barriers to Effective CommunicationDocument8 pagesBarriers to Effective CommunicationShashi SainiNo ratings yet

- Industry ProfileDocument20 pagesIndustry ProfileShanu shriNo ratings yet

- Acn301 Assignment FinalDocument13 pagesAcn301 Assignment FinalMd Mohimenul IslamNo ratings yet

- Final Examination (21355)Document13 pagesFinal Examination (21355)Omifare Foluke Ayo100% (1)

- Conclusion: A. The ConceptDocument3 pagesConclusion: A. The Conceptkochanparambil abdulNo ratings yet

- Walton Company Group 10Document9 pagesWalton Company Group 10MD. JULFIKER HASANNo ratings yet

- Npa PNBDocument70 pagesNpa PNBSahil SethiNo ratings yet

- Precision Turned Products World Summary: Market Values & Financials by CountryFrom EverandPrecision Turned Products World Summary: Market Values & Financials by CountryNo ratings yet

- Middle East Fruits and Vegetables December 2014Document22 pagesMiddle East Fruits and Vegetables December 2014Sarbartho MukherjeeNo ratings yet

- The Demographic Dividend CP ChandrasekharDocument10 pagesThe Demographic Dividend CP ChandrasekharSarbartho MukherjeeNo ratings yet

- FeedbackDocument8 pagesFeedbackSarbartho MukherjeeNo ratings yet

- Brochure Final DraftDocument19 pagesBrochure Final DraftSarbartho MukherjeeNo ratings yet

- UntitledDocument1 pageUntitledSarbartho MukherjeeNo ratings yet

- Good QuotesDocument1 pageGood QuotesSarbartho MukherjeeNo ratings yet

- Detailed Syllabus ST Xaviers Kolkata Eco HonsDocument20 pagesDetailed Syllabus ST Xaviers Kolkata Eco HonsSarbartho MukherjeeNo ratings yet

- EpwDocument7 pagesEpwSarbartho MukherjeeNo ratings yet

- Keynesian VsDocument8 pagesKeynesian VsSarbartho MukherjeeNo ratings yet

- Amfi Mock TestDocument6 pagesAmfi Mock TestDhiraj100% (3)

- Fibria Investor DayDocument55 pagesFibria Investor DayFibriaRINo ratings yet

- Mint Money 1 For WEBDocument17 pagesMint Money 1 For WEBRoshan KumarNo ratings yet

- Abstract:: Financial Institutions and Their Role in The Development and Financing of Small Individual ProjectsDocument14 pagesAbstract:: Financial Institutions and Their Role in The Development and Financing of Small Individual ProjectsRamona Georgiana IonițăNo ratings yet

- Chapter 3: Depository Institutions: Activities and CharacteristicsDocument24 pagesChapter 3: Depository Institutions: Activities and Characteristicstjarnob13No ratings yet

- Project Report of Axis Mutual Fund by Kamal SharmaDocument81 pagesProject Report of Axis Mutual Fund by Kamal SharmaKamal Sharma100% (4)

- A Handbook For The Viva Preparation For The Post of Assistant Director of Bangladesh BankDocument25 pagesA Handbook For The Viva Preparation For The Post of Assistant Director of Bangladesh BankRakibul Islam Rakib100% (2)

- Weekly FinDocument6 pagesWeekly FinInternational Business TimesNo ratings yet

- Ratio AnalysisDocument14 pagesRatio AnalysisVijay KumarNo ratings yet

- S&P 500 Inclusion Effects Driven by Investor AwarenessDocument19 pagesS&P 500 Inclusion Effects Driven by Investor AwarenessFatharani SholihatNo ratings yet

- Banking IndustryDocument33 pagesBanking IndustryJOHN PAUL DOROINNo ratings yet

- Northern RockDocument15 pagesNorthern RockÁi PhươngNo ratings yet

- Maximising wealth through non-SLR investmentsDocument78 pagesMaximising wealth through non-SLR investmentsSanchita NaikNo ratings yet

- Financial Analysis of a Selected CompanyDocument20 pagesFinancial Analysis of a Selected CompanyDavid SamuelNo ratings yet

- A Brief Study of Equity Products by Ravi Raj Yadav at Karvy Stock BrokingDocument31 pagesA Brief Study of Equity Products by Ravi Raj Yadav at Karvy Stock BrokingraviNo ratings yet

- QUIZ 1 Risk Answers PDFDocument6 pagesQUIZ 1 Risk Answers PDFLandeelyn Godinez100% (1)

- Working Capital ManagementDocument10 pagesWorking Capital ManagementHarshit GoyalNo ratings yet

- % of Par Value of Rs. 50/-Funds Dividend (RS.)Document10 pages% of Par Value of Rs. 50/-Funds Dividend (RS.)Salman ArshadNo ratings yet

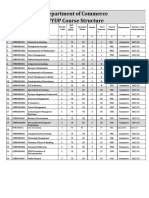

- Department of Commerce FYUP Course Structure: CMBCMJ4001 Cost Accounting C 70 30 4 IV MJC Commerce 2022-23Document67 pagesDepartment of Commerce FYUP Course Structure: CMBCMJ4001 Cost Accounting C 70 30 4 IV MJC Commerce 2022-23amittrivedionmusicNo ratings yet

- This Content Downloaded From 140.213.59.20 On Sun, 13 Sep 2020 09:17:59 UTCDocument20 pagesThis Content Downloaded From 140.213.59.20 On Sun, 13 Sep 2020 09:17:59 UTCprasnaNo ratings yet

- 1 s2.0 S0313592622001369 MainDocument14 pages1 s2.0 S0313592622001369 MainNGOC VO LE THANHNo ratings yet

- Introducing Drip - The Deflationary Daily ROI NetworkDocument10 pagesIntroducing Drip - The Deflationary Daily ROI NetworkRaheel AslamNo ratings yet

- ECONOMICS - BLOCK REVISION MOCK 3 KEY POINTSDocument38 pagesECONOMICS - BLOCK REVISION MOCK 3 KEY POINTSSamielMuhamedOmarNo ratings yet

- Operational Risk Management in BanksDocument47 pagesOperational Risk Management in BanksJuhi Ansari100% (3)

- Ratio Analysis of Top 5 Banks in PakistanDocument324 pagesRatio Analysis of Top 5 Banks in PakistanDavid VillarrealNo ratings yet

- Unit 1 - Introduction To BankingDocument17 pagesUnit 1 - Introduction To Bankingc08No ratings yet

- Working Capital ManagementDocument45 pagesWorking Capital ManagementssanjitkumarNo ratings yet

- Foundations in Financial Management (Sec A PT1) - With AnswerDocument7 pagesFoundations in Financial Management (Sec A PT1) - With AnswerDawn CaldeiraNo ratings yet

- Chapter 1 Overview of Financial Management GoalsDocument14 pagesChapter 1 Overview of Financial Management GoalsJoyluxxiNo ratings yet

- Management Accounting (Volume I) - Solutions Manual Chapter 5 Financial Statements Analysis - IIDocument29 pagesManagement Accounting (Volume I) - Solutions Manual Chapter 5 Financial Statements Analysis - IIMar-ramos Ramos50% (6)