Professional Documents

Culture Documents

Ahsanullah University of Science and Technology Main Report

Uploaded by

Stephen Rogers0 ratings0% found this document useful (0 votes)

1K views38 pagesMohammad Ashikur Rahman has completed his internship at janata bank ltd. For preparation of this report I collected as much information as possible from the Foreign Exchange Department of the bank. He has tried to learn the practical banking activities to realize it with his theoretical knowledge, which he has greathearted and going to acquire from various courses of his BBA program.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMohammad Ashikur Rahman has completed his internship at janata bank ltd. For preparation of this report I collected as much information as possible from the Foreign Exchange Department of the bank. He has tried to learn the practical banking activities to realize it with his theoretical knowledge, which he has greathearted and going to acquire from various courses of his BBA program.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1K views38 pagesAhsanullah University of Science and Technology Main Report

Uploaded by

Stephen RogersMohammad Ashikur Rahman has completed his internship at janata bank ltd. For preparation of this report I collected as much information as possible from the Foreign Exchange Department of the bank. He has tried to learn the practical banking activities to realize it with his theoretical knowledge, which he has greathearted and going to acquire from various courses of his BBA program.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 38

1

Ahsanullah University of Science and Technology (AUST)

INTERNSHIP AFFILIATION REPORT

ON

Performance & Activities of Foreign

Exchange of Janata Bank Limited

An Internship Affiliation Report Presented to the School of Business

Administration in Partial Fulfillment of the Requirements for the Degree

of Bachelor of Business Administration

Supervised by:

Ms. Salma Akter

Lecturer

School of business

Ahsanullah University Of Science and Technology

Submitted By:

Mohammad Ashikur Rahman

BBA program, 2014 (25

th

Batch)

ID: 10.01.02.108

Major: Accounting

School of business

Ahsanullah University of Science & Technology

Date of Submission: August 14, 2014

2

INTERNSHIP AFFILIATION REPORT

ON

Performance & Activities of Foreign

Exchange of Janata Bank Limited

3

Letter of Transmittal

August 14, 2014

Ms. Salma Akter

Lecturer

Internship Supervisor

School of business

Ahsanullah University of Science & Technology

Sub: Submission of Internship Affiliation Report

Dear Madam,

I am submitting my internship affiliation report on the topic Performance & Activities of Foreign

Exchange of Janata Bank Limited to you within the given time allowed to me by you. I just tried my level

best to participate, observe and identify the Banking activities, specifically on the Foreign Exchange

Department of Janata Bank Ltd. It has written it down in this report from my own experience. For

preparation of this report I collected as much information as possible from the Foreign Exchange

Department of the bank.

During the course of my practical orientation I have tried to learn the practical banking activities to

realize it with my theoretical knowledge, which I have greathearted and going to acquire from various

courses of my BBA program.

Yours Sincerely,

Mohammad Ashikur Rahman

BBA Program, 2014 (25

th

Batch)

ID: 10.01.02.108

Major in Accounting

School of Business

Ahsanullah University if Science & Technology

4

Acknowledgement

Completion of anything need support & help. I am very much fortunate to get the sincere guidance and

supervision from a number of persons. My sincere gratitude goes to

As an internee of JBL, I have truly enjoyed my internship from the learning and experience viewpoint. I

am confident that this three months internship program at JBL will definitely help me to realize my

further carrier in the job market. Without his supportive hand and recommendations, it would be

difficult for me to complete this Report.

5

Letter of Endorsement

The Internship Affiliation Report entitled Performance & Activities of Foreign Exchange of

Janata Bank Limited has been submitted to the Office, in partial fulfillment of the

requirements for the degree of Bachelor of Business Administration, Major in Accounting, and

School of Business on 14

th

August by Mohammad Ashikur Rahman ID: 10.01.02.108 The

report has been accepted and may be presented to the Internship Defense Committee for

evaluation.

Supervisory Committee

___________________

MS. Salma Akter

Lecturer

Internship Supervisor

School of Business

Ahsanullah University of Science & Technology (AUST)

6

TABLE OF CONTENTS

Contents Page No.

Internship Affiliation Report

01-02

Letter Of Transmittal

03

Acknowledgement 04

Letter Of Endorsement

05

Title Report

07

Introduction

08-13

Activities Undertaken

14-25

Challenges & Proposed Course of Action

& Improvement

26-29

Lessons Learned From Internship

30-31

Concluding Statement

32-34

Suggestions

35-36

Appendix 37-38

7

Chapter -1

TITLE OF THE REPORT:

Performance & Activities of Foreign Exchange of Janata

Bank Limited

8

CHAPTER -2

Introduction

9

2.1)Rational of the Report

A bank is financial intermediary a dealer in loans and debts. After completing my

Bachelor of Business Administration (BBA) as a student of Ahsanullah University of Science &

Technology I got the opportunity to perform my internship in the JBL as an intern. The

internship report on the topic Performance & Activities of Foreign Exchange of Janata Bank

Limited is prepared. I have selected Foreign Exchange department of Janata Bank Limited

because here all international transaction occur through Import and Export. And anyone can

easily trade with other foreign countries through L/C. So I have tried to represent their

performance and prospects on the ground of foreign trade. I choose this topic to know overall

foreign trading system and currency exchange policy

2.2Historical Background of the Organization

Janata Bank Limited is the 2

nd

largest state owned commercial bank in

Bangladesh. Immediately after the emergence of Bangladesh in 1971, the erstwhile United Bank

Limited and Union Bank Limited were named as Janata Bank. It was established under the

Bangladesh Bank order 1972. During the privatization process it was incorporated as a public

Limited Company on 21 May, 07 vide certificate of incorporation No-C66933(4425)07. The

Bank has taken the over the business of Janata Bank at a purchase consideration of Tk. 2593.90

million as a going concern through a vendor agreement signed between the Ministry of Finance

of the Peoples Republic of Bangladesh and the Board of Directors on behalf of Janata Bank

Limited on 15

th

November 2007. Janata Bank Limited operates through 851 branches including 4

overseas branches at United Arab Emirates and a subsidiary company named Janata Exchange

Company Srl in Italy. It is linked 1202 foreign correspondents all over the world.

10

2.3) Branches

There are 851 branches of Janata Bank Limited in home and abroad. Among them 443

branches are situated in urban areas including four foreign branches and 408 branches are in

rural areas. And all foreign branches are situated in United Arab Emirates.

Division Town Rural zone Total

Dhaka 162 82 244

Chittagong 100 88 188

Rajshahi 80 131 211

Sylhet 22 36 58

Khulna 75 71 146

Overseas 4 0 4

Total 443 408 851

Overseas Branches

SL.No: City No of Branch Status

01. Abu Dhabi 01 Foreign

02. Al-Ain 01 Foreign

03. Sharjah 01 Foreign

04. Dubai 01 Foreign

Total 04

11

2.4)Management

Like every other business organization, the top management makes all the major decisions of

Janata Bank. The board of directors being at the highest level of organizational structure plays an

important role in policy formulation, but it is not directly concerned with the day-day operations

of the bank. They have delegated this duty to the management committee. The board mainly

establishes the objectives and policies of the bank. One chairman, eleven directors, one CEO &

MD and one company secretary are consist of Board of Directors of Janata Bank Limited.

Mid and lower level employees get the direction and instruction from the Board of Directors

about the duties and tasks they have to perform. The chief executive provides the guideline to the

managers and employees, but delegates responsibility for determining how tasks and goals are to

be accomplished.

As per decision of the govt. 46 (Forty Six) branches of our bank (40 branches in Dhaka city,

1(one) branch in Narayongonj city and 5(five) branches in Chittagong city) are involved to

receive the all utility bills in a same station from January04.

2.5) Mission & Vission

2.5.1) Mission

To be recognized as the leading commercial bank in the Bangladesh market providing retail and

corporate banking services and as a trusted and respected partner in the social and economic

development program of our nation.

2.5.1)Vision

The vision of Janata Bank Ltd. is to become effective largest commercial bank in Bangladesh, to

support socio-economic development of the country and to be a leading bank in South-Asia.

12

2.6)Scope of the Report

This study would focus on the following areas of Janata Bank Limited.

Actual Foreign Trade management of Janata Bank Limited.

Overview the current procedure of export & import management.

Opening LC and maintenance of other formalities of foreign trade.

Organizational structures and responsibilities of management.

Each of the above areas would be critically analyzed to determine the proper efficiency of

Janata Banks Foreign Trade Management system

2.7)Limitation of the Study

2.7.1)Time limitation:

It was one of the main constraints that affected covering all aspects of the study

2.7.2)Lack of Secondary Information:

The import export data of Bangladesh is not much available over the net. Secondary source of

information was not sufficient for the completion of the report.

Much confidential information was not disclosed by respective personnel of the department

2.8) Objectives:

2.8.1) Broad objectives:

To analyze the real Foreign Exchange performance of Bangladesh.

To know the Foreign Exchange Import and Export guideline, police, rules and regulation

of Bangladesh.

13

2.8.2) Specific objectives

To know about LC.

To learn about LC opening procedures.

To know about the use of Invoice in LC.

To know the current procedure of export & import and remittance.

To learn maintaining of other formalities of foreign exchange.

To know how to exchange currency.

Overall knowledge of export import system.

To find out how Foreign Trade and Foreign Exchange is operating in Bangladesh.

To relate the theoretical learning with the real life situation.

To find out the strengths, weaknesses, opportunities and threats of Foreign Trade and

Foreign Exchange of Bangladesh.

To know how to control the foreign trading system

14

Chapter -3

ACTIVITIES UNDERTAKEN

15

3.1) Work- Related:

I started my internship program in Janata Bank Limited, on 5th May, 2014. As my topic of

internship report is Performance & Activities of foreign exchange of Janata Bank Limited,

Tajgaon industrial area (TIA) Branch. I am going to describe about Foreign Exchange. I had

plenty of opportunity to work and understand the sectors of Foreign exchange. I had done many

things as an intern, such as opening different types of accounts ( current account, fixed deposit

account), then I used to check the LC form or others accounts form whether it was correct or not

because I had noticed in their internal audit report and found that there was several mistakes for

not fulfilling the form properly.

3.1.1) Foreign Exchange:

Foreign exchange department of Janata Bank Limited is one of the most important departments

among all departments. This department handles various types of activities.

.3.2) Organization Wide:

Foreign Exchange Department

Foreign Exchange means exchange of foreign currency between two countries. If we consider

Foreign Exchange as a subject, then it means all kinds of transaction related to foreign

currency. In other words, foreign exchange deals with foreign financial transactions.

The Foreign Trade and foreign exchange are categorized as follows:

Foreign Remittance

Import

Export

3.2.1) Foreign Remittance

Remittance means transfer of fund from one place to another and when money is transferred

from one country to another then it is called Foreign Remittance. Janata Bank is an authorized

dealer to deal in foreign exchange business. As an authorized dealer, a bank must provide some

16

services to the client regarding foreign exchange and this branch provides these services through

foreign remittance department. The basic function of this department is outward and inward

remittance of foreign exchange from one country to another country. In the process of providing

this remittance service, it sells and buys foreign currency.

Comparison foreign remittance Janata Bank Ltd Tajgaon Industrial Area (TIA) Branch from

2009-2013

Foreign Remittance of Janata Bank Ltd

Year (Taka In Lac)

2009 489.04

2010 689.34

2011 994.05

2012 552.21

2013 573.13

3.2.2) Remittance Procedures Of Foreign Currency:

There are two types of remittance:

3.2.2.1)Inward Foreign Remittance:

Normally, Inward Foreign Remittance comprises all incoming foreign currencies. Remittances

issued by the correspondent banks situated in the foreign countries and thereby drawn on Janata

Bank, Tajgaon Industrial Area (TIA) road Branch are considered to be its Inward Foreign

Remittances. Followings are the Inward Foreign Remittances, Janata Bank Tajgaon Industrial

Area (TIA) road Branch

17

The term inward remittances includes not only remittances by TT., MT., Drafts etc. but also

purchases of bills, purchases of drafts under travelers letter of credit and purchases of travelers

cheques. Foreign currency notes against which payment is made to the beneficiary also a part of

inward remittances. Thus the following are the Mode of inward remittances:

Telegraphic Transfer.

Mail Transfer.

Foreign Drafts.

Travelers Cheque.

Foreign currency notes. .

3.2.2.2) Outward foreign Remittances:

The remittance in foreign currency which is being made from our country to abroad, is known

as foreign outward remittance. Remittances issued by Janata Bank Tajgaon Industrial Area

(TIA) Branch to their foreign correspondents to fulfill their customers needs are considered to

be the Outward Foreign Remittances. It comprises the followings:

FDD Issued

FTT Issued

TC Issued

Endorsement of foreign currencies in the passport.

Sale of foreign currencies

18

3.2.3) Import Of Janata Bank Ltd.:

An import is any good or service brought into a country from another country in a fair and

acceptable fashion, typically for use in trade. Imported goods or services introduce domestic

consumers to newer things by foreign producers. Companies usually import goods and services

to supply to the domestic market at a cheaper price and provide goods that are superior compared

to goods manufactured in the domestic market.

Comparison import of Janata Bank Ltd Tajgaon Industrial Area (TIA) Branch from 2009-2013

Import of Janata Bank Ltd

Year (Taka In Lac)

2009 81.04

2010 198.49

2011 3387

2012 2178.87

2013 1713.48

3.2.3.1) Import Operations under L/C:

Procurement of IRC from the concerned authority.

importer favoring the exporter/ seller/ beneficiary.

importer and request other bank (advising Bank) located in sellers/ exporter to advise the L/C to

the beneficiary. The issuing bank may also request the advising Bank to confirm the credit, if

necessary.

19

and conditions; he is in a position to make shipment of the goods.

e

document to the negotiating bank for negotiation.

and sends the documents to the L/C issuing Bank.

nes the documents and if

found ok makes payment to the negotiating bank.

then releases the importer goods from the port authority.

3.2.4) Export Of Janata Bank Ltd:

Export is the process of selling goods and services to the other countries. A good or service that

is produced in one country and then sold to and consumed in another country. Because many

companies are heavily dependent on exports for sales, any factors such as government policies or

exchange rates that affect exports can have significant impact on corporate profits. A good

produced in one country and sold to a customer in another country. Exports bring money into the

producing country; for that reason, many economists believe that a nation's proper balance of

trade means more exports are sold than imports bought. Bangladesh exports a large quantity of

goods and services to foreign households. Readymade textile garments, Jute, Jute-made

products, frozen shrimps, tea are the main goods that Bangladeshi exporters export to foreign

countries. Garments sector is the largest sector that exports the lion share of the countrys export.

20

Export Growth of Janata Bank Limited (2009-2013)

Export Growth of Janata Bank Ltd

Year (Taka In Millions)

2009 70897

2010 71855

2011 85418

2012 88653

2013 118515

Documents Used In Export:

EXP form,

ERC (valid),

L/C copy,

Customer Duty Certificate,

Shipping Instruction,

Transport Documents,

Insurance Documents,

Invoice,

Bills of Exchange (if required)

Certificate of Origin,

Inspection Certificate,

Quality Control Certificate,

G.S.P. Certificate,

21

3.2.4.1) Export Procedure:

Export policies formulated by the Ministry of Commerce, GOB provide the overall guideline

and incentives for promotion of exports in Bangladesh. Export policies also set out commodity-

wise annual target. It has been decided to formulate these policies to cover a five-year period to

make them contemporaneous with the five-year plans and to provide the policy regime.

The import and export trade in our country are regulated by the Import and

Export (Control) Act, 1950.Under the export policy of Bangladesh the exporter has to

get valid Export registration Certificate (ERC) from Chief Controller of Import &

Export (CCI&E). The ERC is required to renew every year. The ERC number is to

incorporate on EXP forms and other papers connected with exports

The terms of the L/C are in conformity with those of the contract

The L/C is an irrevocable one, preferably confirmed by the advising bank

The L/C allows sufficient time for shipment and negotiation

After making the deal and on having the L/C opened in his favor, the next step for the

exporter is to set about the task of procuring or manufacturing the contracted

merchandise.

Then the exporter should take the preparation for export arrangement for delivery of

goods as per L/C and incomers, prepare and submit shipping documents for Payment/

Acceptance/ Negotiation in due time.

Final step: Submission of the documents to the Bank for negotiation

3.2.4.2) Export Finance:

Financing exports constitutes an important part of a banks activities. Exporters require financial

services at four different stages of their export operation. During each of these phases exporters

need different types of financial assistance depending on the nature of the export contract.

Pre-shipment credit

Post-shipment credit

22

Pre-shipment credit:

Pre-shipment credit, as the name suggests, is given to finance the activities of an exporter prior

to the actual shipment of the goods for export. The purpose of such credit is to meet working

capital needs starting from the point of purchasing of raw materials to final shipment of goods

for export to foreign country. Before allowing such credit to the exporters the bank takes into

consideration about the credit worthiness, export performance of the exporters, together with all

other necessary information required for sanctioning the credit in accordance with the existing

rules and regulations. Pre-shipment credit is given for the following purposes

Post Shipment Credit:

This type of credit refers to the credit facilities extended to the exporters by the banks after

shipment of the goods against export documents. Banks in our country extend post shipment

credit to the exporters through:

Negotiation of documents under L/C;

Foreign Documentary Bill Purchase (FDBP):

Advances against Export Bills surrendered for collection

3.3) Other relevant activities:

3.3.1) Foreign Demand Draft (FDD) Issued:

People used to send money abroad for various purposes. JBL issues most of the FDD for the

purpose of payment of the application fees to the foreign universities. For the issuance of

FDD; T/M Form has to be filled up duly. This form is filled up under the Foreign Exchange

Regulation Act, 1947. This form contains

The purpose of travel,

Name of the country where the applicant will go,

23

Name of the air or shipping company,

Passport number,

Signature, name & address of the applicant

3.3.2) How to issue letter of credit

3.3.2.1) LC throughout swift

SWIFT is the industry-owned co-operative supplying secure, standardized messaging

Services and interface software to nearly 8,100 financial institutions in 207 countries and

territories, SWIFT members include banks, broker-dealers and investment managers. The

broader SWIFT community also encompasses corporate as well as market infrastructures in

payment, securities, treasury and trade. Over the past ten years, SWIFT message prices have

been reduced over 80% and reliability 99.999% of uptime.

.

Janata Bank Limited is the member of SWIFT (Society for Worldwide Inter-bank Financial

Telecommunication). SWIFT is a member owned co-operative, which provides a fast and

accurate communication network for financial transactions such as Letters of Credit, Fund

transfer etc. By becoming a member of SWIFT, the bank has opened up possibilities for

uninterrupted connectivity with over 5,700 user institutions in 150 countries around the world.

SWIFT is a highly secured messaging network enables Banks to send and receive Fund

Transfer, L/C related and other free format messages to and from any banks active in the

network.

3.3.2.2)Necessary steps To Open A Cash L/C:

To open cash LC MTB wants some documents from importer. These are given below

24

-forma invoice

3.3.3) Payment of foreign currency notes:

there is

no transaction with head office

3.3.4) Payment system Of T.T.

- C".

25

3.3.5)Budget and Performance (Under EXPORT Policy 2012-2013)

No. 2012 2013

Budget Actual Budget Actual

1 Interest Income 18,300 19,027 15,550 14,868

2 Interest Expenditure 11,900 11,960.30 10,500 10,376.98

3 Interest Margin(1-2) 6,400 7,067.20 5,050 4,491.02

4 Investment Income

Including Other

Income

11,070 11,566.40 8,800 9,206.10

5 Total operating

Income

17,470 18,653.60 13,850 13,697.12

6 Salaries and

Allowances

5,000 5,155.30 4,064 3,996.58

7 Fixed Cost 552.50 632.20 647.90 553.72

8 Variable Cost 917.50 829.70 637.60 568.70

9 Total Operating Cost

(6+7+8)

6,470 6,617.20 5,350 5,119

10 Operating Profit

(5-9)

11,000 12,036.40 8,500 8,578.12

26

Chapter-4

Challenges And Proposed Course Of Action For

Improvement.

27

4.1) SWOT Analysis of Janata Bank Ltd:

Business Strength:

Second Largest bank of the country

874 Branches across the countries

Good reputation in the banking industries

Sponsoring by the government

Maintain good relationships with foreign banks

Sound and large capital base

Sustainable growth

Weakness:

Lack of using single softer to integrate all the branches of the bank.

Lack of using new technology

Not implementing the Online Banking in all activities

Opportunity:

Maintaining required Capital Adequacy

Business expansion in capital market

Real online banking software will be in function soon

Consideration of prime customers.

Threat:

Mismanagement of administration

Strong interference of CBA (Collective Bargaining Agent)

28

4.2) Problems Identified in the Organization:

There were some constraints or limitation inside the organization and they could be categorized

as:

4.2.1) Limitations Faced by Me:

While working in the JBL, sometimes this place seemed to me as very challenging place to work

for me. I experienced the reality of current challenge of the present job market which moves on

more intensely due to the increasing competition. These parts of the report will emphasis on the

factors of challenges faced in the organization.

The foreign exchange activities of JBL are so much big. So sometimes it is very difficult

to cover all the activities.

Sometimes the bank officers are very busy in their own work, so it is difficult to discuss

with them about different types of important things.

Some employees attitude is very negative.

There is no canteen in office so sometimes I face problem of hungriness.

Sitting problem is another limitation which I faced.

4.2.2) Limitations Observed in the Organization:

I think the banking system run very traditional and modernization is hardly pragmatic.

In spite of the good banking service, sometimes customer service is not up to the level to

some extents.

As part of modern banking, their ATM booth service is not introduced yet.

29

Employees satisfaction is one of the most crucial factors in an organization. However, it

has been observed that the salary was not to satisfactory level after interviewing some

staffs.

The most important part I have observed in JBL that some security system is very poor

other than any private bank or multi-national companies.

4.3) Proposed Course of Action:

The main objective of an internship program is to make the bridge between the theoretical

knowledge and implication of it in the practical professional life. There are number of courses

have been undertaken during my BBA program in AUST and I have chosen accounting as major

because of great importance of this field in the current professional life. Nevertheless, all the

courses I have undertaken might not match precisely in the practical field and I have come across

a numbers of relevance and mismatches during pursuing my internship program.

4.4) Mismatches with my academic preparation:

In some cases, I have experienced mismatch with my academic courses while I am doing

internship program. Its hard to believe that there are only a few courses those focus on banking

activities. In my BBA course I have achieved knowledge in various aspects in accounting,

budgeting and less knowledge in branding, marketing, promoting,

Distributing where very few of them deeply focuses on banking activities. Also, the university

always highlighting on the theoretical knowledge where I have not much scopes for gaining

much practical knowledge on banking activities.

30

Chapter-5

Lessons Learned From The Internship

31

5.1) Implications to organization:

It is necessary that an intern will do work with various sectors and departments of an

organization. The different kind of task I have performed in the Branch. And now, I am

feeling that I have achieved some more facts. These multi-facts pieces

of work could be helpful for my career.

Organizational socialization is very important because This is enhanced my knowledge,

skill and the power of implementing of my academic knowledge in a workplace.

As an intern, I have achieved significant amount of knowledge about customer service

and I have realized that great communication skill is the fundamental requirement of

serving the customers.

5.2) Implications to Universitys Internship Program:

I learned how to follow supervisor instructions strictly.

How to present work experience in the report.

Concern for integrating experiences and external experiences

Way of communication

I maintain strict discipline in my university that helps me to maintain banks discipline

32

CHAPTER-6

Concluding Statements

33

6.1) Recommendations for future strategic actions:

There are several recommendations have been realized from the whole internship program. Some

of them mentioned below.

1) The communication between the intern and the supervisor should be clear and on the

regular basis so that the intern has the total understanding and control over the entire

internship program.

2) The university sometimes could take initiative for the students who often fail to get offer

form the companies for internship. The university could make some reference lists with

big companies and make them offer its students for internship.

6.2) Recommendations: (Over-all Internship Program: Affiliation

and University)

To provide a student with more practical knowledge,

Establish most powerful networking system.

Frequently and quickly communicating with foreign bank.

To provide knowledge which course should be taken by student as a result they can gain more

knowledge

34

6.3) Summary:

Internship is a link between theoretical knowledge and practical knowledge. I have completed

my Internship, I believe the experience I have gathered it will be very helpful for me. This

internship program assisted me a lot to realize my further career for the coming future. Rather

than drawing a conclusion, I would like to say that this study was utterly indicative for me for

my future career.

As there are lots of local and foreign banks in Bangladesh the JBL is promising commercial

Bank among them. JBL is more capable of contributing towards economic development as

compared with other bank. JBL Invested more funds in export and import business. It is obvious

that the right thinking of this bank including establishing a successful network over the country.

From the experience of the whole internship program, the JBL is a nice place to work with its

nice and co-operative people within it. Additionally, understanding various sectors of the bank, it

can be said that JBL plays some vital roles for the countrys economy.

35

CHAPTER-7

Suggestions for Improvement or Course of

Action

36

7.1) Suggestions

For improving customer satisfaction the information related to customer should be available

to the branch.

For improving customer satisfaction so many facilities should be emphasized by the bank on

priority basis.

For the customers satisfaction service delivery should be given within 10-15 minutes.

While delivering of services friendly behaviors should be ensured by the employees because

it becomes a necessity of customers.

For better customer satisfaction the interest rate of the bank should be as fewer as possible.

The product and services of the bank should be new and competitive.

For improving customer satisfaction, bank should launch customer complain box in every

branch.

For better satisfaction bank could initiate to establish customer service center for its

customers.

The better interior and nice location of the branch could be an incentive for customer

satisfaction.

Available sitting arrangements for customers in the bank could be a good sign for satisfaction

of customers.

Definitely to be competitive and ensuring of faster services for customers satisfaction online

banking system should be start all over the branches as fast as possible.

Customers are delighted with services of the bank but not in greater extent.

Online banking services should be introduced by all over the branches as soon as possible.

Banking services may be given 24 hours on the main branches if possible.

ATM booth should be available especially in the major areas. Like city and commercial

areas.

37

APPENDICES:

Curriculum Vitae of

Mohammad Ashikur Rahman

69/1 Sikkatuly lane, Nazir Bazar

Dhaka-1100

Email: ashikurr24@gmail.com

Cell: +8801680040051

OBJECTIVE:

A business administration graduate with expertise in accounting seeking to develop a career in

corporate business with emphasis to customer service whilst enabling further personal and

professional development.

EDUCATIONAL QUALIFICATIONS:

BBA (Bachelor of Business Administration) Major in Accounting

Institution : Ahsanullah University of Science & Technology

Result : CGPA: 2.94 out of 4.00

Passing year : 2014

A Levels/ HSC

Institution : Udayan Uccha Maddhamik Biddalaya

Department : Business studies

Result : GPA: 4.30 out of 5.00

Passing year : 2009

O Levels/ SSC

Institution : Hammadia High School

Department : Business studies

Result : GPA: 4.19 out of 5.00

Passing year : 2007

SKILLS:

Capable of working with MS Office, MS Excel, MS PowerPoint and the Internet.

Excellent written and oral communication skills.

Able to multi-task in a fast paced environment with great attention to detail.

Other than English, fluent in Bengali, Urdu and Hindi.

38

PERSONAL DETAILS:

Fathers Name : MD. Abdul Matin

Mothers Name : Najmun Nahar

Date of Birth : 24

th

April 1991

Marital Status : Unmarried

Religion : Islam

Sex : Male

Nationality : Bangladeshi (by birth)

Permanent Address : 69/1 Sikkatuly lane, Nazir Bazar Dhaka-1100

REFERENCES:

I hereby, declare that the statement made by me in the Curriculum Vitae is

True Complete and correct to the best in my knowledge and behalf.

Signature

_______________

MOHAMMAD ASHIKUR RAHMAN Date: 20-08-2014

You might also like

- Original PDF Global Problems and The Culture of Capitalism Books A La Carte 7th EditionDocument61 pagesOriginal PDF Global Problems and The Culture of Capitalism Books A La Carte 7th Editioncarla.campbell348100% (41)

- Financial Performance Analysis of Banking Sector in Bangladesh - A Case Study On Selected Commercial BanksDocument70 pagesFinancial Performance Analysis of Banking Sector in Bangladesh - A Case Study On Selected Commercial BanksAshaduzzamanNo ratings yet

- Credit AppraisalDocument94 pagesCredit AppraisalpratikshaNo ratings yet

- A Study On Bank of Maharashtra: Commercial Banking SystemDocument13 pagesA Study On Bank of Maharashtra: Commercial Banking SystemGovind N VNo ratings yet

- Chapter - 9 Multifactor ModelsDocument15 pagesChapter - 9 Multifactor ModelsAntora Hoque100% (1)

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Report BCBLDocument98 pagesReport BCBLTanvir Ahamed100% (1)

- Recent Trend of NPL in Banking SectorDocument14 pagesRecent Trend of NPL in Banking SectorAbid HasanNo ratings yet

- Thesis Report of 5 BankDocument180 pagesThesis Report of 5 BankMd KamruzzamanNo ratings yet

- Companies List 2014 PDFDocument36 pagesCompanies List 2014 PDFArnold JohnnyNo ratings yet

- This Report Is To Analysis Credit Risk Management of Eastern Bank LimitedDocument30 pagesThis Report Is To Analysis Credit Risk Management of Eastern Bank Limitedশফিকুল ইসলাম লিপুNo ratings yet

- Banking Financial InstitutionsDocument126 pagesBanking Financial InstitutionsMahalakshmi GowdaNo ratings yet

- Determinants of Non-Performing Loans in Bangladesh's NBFI SectorDocument14 pagesDeterminants of Non-Performing Loans in Bangladesh's NBFI SectorSpade AceNo ratings yet

- Project Report ON: Foreign Exchange Operation: A Study On Social Islami Bank Limited Submitted ToDocument55 pagesProject Report ON: Foreign Exchange Operation: A Study On Social Islami Bank Limited Submitted ToJannatul FerdousNo ratings yet

- 1.1 Background: " A Study On SME Banking Practices in Janata Bank Limited"Document56 pages1.1 Background: " A Study On SME Banking Practices in Janata Bank Limited"Tareq AlamNo ratings yet

- Exim BankDocument48 pagesExim BankAnonymous w7zJFTwqiQNo ratings yet

- Financial Inclusion Study on Rocket Mobile BankingDocument56 pagesFinancial Inclusion Study on Rocket Mobile BankingTanjin UrmiNo ratings yet

- Comparative Analysis Between Islami Bank Bangladesh Limited and Jamuna Bank Limite1Document42 pagesComparative Analysis Between Islami Bank Bangladesh Limited and Jamuna Bank Limite1Tahsin Monabil0% (1)

- Bangladesh Banking HistoryDocument7 pagesBangladesh Banking Historymirmoinul100% (1)

- Electronic Banking in BangladeshDocument77 pagesElectronic Banking in BangladeshshuvofinduNo ratings yet

- Overview of E Banking and Mobile Banking in BangladeshDocument74 pagesOverview of E Banking and Mobile Banking in BangladeshNasim AhmedNo ratings yet

- Credit Management of Mercantile Bank LimitedDocument61 pagesCredit Management of Mercantile Bank LimitedMoyan Hossain100% (1)

- Executive Summary: Mobile BankingDocument48 pagesExecutive Summary: Mobile Bankingzillurr_11No ratings yet

- Foreign Exchange On First Security Islami Bank LTDDocument60 pagesForeign Exchange On First Security Islami Bank LTDAhadul Islam100% (2)

- BD Bond Market: Current State & ProspectsDocument13 pagesBD Bond Market: Current State & ProspectsAnikaNo ratings yet

- Understanding General Banking Functions of Agrani BankDocument41 pagesUnderstanding General Banking Functions of Agrani BankArefeen HridoyNo ratings yet

- Literature Review On Credit CardsDocument3 pagesLiterature Review On Credit CardsAkshay singhNo ratings yet

- Internship Report On Loan & Deposit Policy of HBLDocument52 pagesInternship Report On Loan & Deposit Policy of HBLLochan Khanal100% (3)

- Recent Trends in BankingDocument8 pagesRecent Trends in BankingNeha bansalNo ratings yet

- Internship ReportDocument54 pagesInternship ReportZubayer HossainNo ratings yet

- Corruption in Banking Sector of BangladeshDocument3 pagesCorruption in Banking Sector of BangladeshMezbaul Haider Shawon50% (4)

- Internship Report On Non-Performing Loans of Commercial Banks in BangladeshDocument26 pagesInternship Report On Non-Performing Loans of Commercial Banks in BangladeshVivek Roy100% (1)

- Research Methodology Mon Evening 714 42630 PDFDocument3 pagesResearch Methodology Mon Evening 714 42630 PDFHamid WafaNo ratings yet

- Internship Report On Credit Adminitraation of Mutual Trust BankDocument140 pagesInternship Report On Credit Adminitraation of Mutual Trust BankNazmul Amin AqibNo ratings yet

- Internship Report On Foreign Exchange Operation of Jamuna Bank LimitedDocument154 pagesInternship Report On Foreign Exchange Operation of Jamuna Bank LimitedAtikul Arif0% (1)

- Electronic Banking in BangladeshDocument19 pagesElectronic Banking in BangladeshjonneymanNo ratings yet

- EBL Internship ReportDocument59 pagesEBL Internship ReportRiyad AhsanNo ratings yet

- Modes of Investment of IBBLDocument53 pagesModes of Investment of IBBLMussa Ratul100% (2)

- Banking Report: NCC Bank InternshipDocument62 pagesBanking Report: NCC Bank InternshipJahangir AlamNo ratings yet

- Internship Report On General Banking Operation of EXIM Bank LimitedDocument39 pagesInternship Report On General Banking Operation of EXIM Bank LimitedJohnathan Rice50% (2)

- Credit Management of Sonali Bank Limited27 6Document49 pagesCredit Management of Sonali Bank Limited27 6Md Alamgir KabirNo ratings yet

- Traditional Online BankingDocument36 pagesTraditional Online BankingJay KoliNo ratings yet

- E BankingDocument49 pagesE BankingParas PundirNo ratings yet

- Credit AppraisalDocument12 pagesCredit AppraisalAishwarya KrishnanNo ratings yet

- Internet Banking in SBI - Preeti Pawar 357358Document90 pagesInternet Banking in SBI - Preeti Pawar 357358pawarprateek100% (3)

- Retail Banking Literature ReviewDocument1 pageRetail Banking Literature ReviewAsh Jerk100% (1)

- DMS in Banking SectorDocument86 pagesDMS in Banking SectorSoodesh BeegunNo ratings yet

- Impact of E-Commerce On Organization Performance Evidence From Banking Sector of PakistanDocument18 pagesImpact of E-Commerce On Organization Performance Evidence From Banking Sector of PakistanMEHTABAZEEMNo ratings yet

- Financial Performance Analysis On Dhaka Bank LTDDocument15 pagesFinancial Performance Analysis On Dhaka Bank LTDনূরুল আলম শুভNo ratings yet

- Credit Risk Management of National Bank Ltd.Document51 pagesCredit Risk Management of National Bank Ltd.Mou Tushi100% (1)

- Repoprt On Loans & Advances PDFDocument66 pagesRepoprt On Loans & Advances PDFTitas Manower50% (4)

- An Analysis of Financial Performance of BRAC Bank LTD - Al SukranDocument56 pagesAn Analysis of Financial Performance of BRAC Bank LTD - Al SukranAl Sukran86% (7)

- Internship Report On General Banking of Janata Bank LimitedDocument35 pagesInternship Report On General Banking of Janata Bank LimitedMd. Tareq AzizNo ratings yet

- Union Bank of IndiaDocument58 pagesUnion Bank of IndiaRakesh Prabhakar ShrivastavaNo ratings yet

- Alfiya Adem PDFDocument54 pagesAlfiya Adem PDFÄbu KègåNo ratings yet

- Jamuna BankDocument88 pagesJamuna BankMasood PervezNo ratings yet

- Internship - HRM Practice in Dhaka BANK Limited"Document58 pagesInternship - HRM Practice in Dhaka BANK Limited"Rasel SarderNo ratings yet

- Bank of Khyber Internship Report For The Year Ended 2010Document108 pagesBank of Khyber Internship Report For The Year Ended 2010Mohammad Arif67% (3)

- Effect of Credit Risk On The Financial Performance of Nepalese Commercial Bank.Document40 pagesEffect of Credit Risk On The Financial Performance of Nepalese Commercial Bank.RJ RajvanshiNo ratings yet

- Internship Report On Customer Satisfaction On Servises of Standard Bank Ltd. Dhanmondi BranchDocument29 pagesInternship Report On Customer Satisfaction On Servises of Standard Bank Ltd. Dhanmondi BranchAsif Mahmud Khan67% (3)

- Capital Market InstrumentsDocument6 pagesCapital Market Instrumentsgeet_rawat36No ratings yet

- Forecasting PDFDocument87 pagesForecasting PDFSimple SoulNo ratings yet

- Seminar Assignments Multiple Choice Questions City Size Growth PDFDocument4 pagesSeminar Assignments Multiple Choice Questions City Size Growth PDFminlwintheinNo ratings yet

- SEC Application of Perkins Coie TWB Investment Partnerships SEC 2008Document6 pagesSEC Application of Perkins Coie TWB Investment Partnerships SEC 2008Beverly TranNo ratings yet

- Data Analysis of a Fabric Production JobDocument3 pagesData Analysis of a Fabric Production Job孙诚0% (2)

- World Bank Review Global AsiaDocument5 pagesWorld Bank Review Global AsiaRadhakrishnanNo ratings yet

- Part 1: Foundations of Entrepreneurship: Chapter 1: The Entrepreneurial MindsetDocument50 pagesPart 1: Foundations of Entrepreneurship: Chapter 1: The Entrepreneurial MindsetMary Rose De TorresNo ratings yet

- Renewal Premium Receipt - NON ULIP: Life Assured: Mr. Vinodkumar Sheth Assignee: N.A. Policy DetailsDocument1 pageRenewal Premium Receipt - NON ULIP: Life Assured: Mr. Vinodkumar Sheth Assignee: N.A. Policy DetailsVinodkumar ShethNo ratings yet

- Differences & Similarities Between Anti Dumping & SafeguardsDocument2 pagesDifferences & Similarities Between Anti Dumping & SafeguardsShalu Singh100% (3)

- SEMINAR KERJA PRAKTIK EVALUATES CDU FURNACESDocument41 pagesSEMINAR KERJA PRAKTIK EVALUATES CDU FURNACESMuhammad AswanNo ratings yet

- Chapter 2 Consumer's BehaviourDocument14 pagesChapter 2 Consumer's BehaviourAdnan KanwalNo ratings yet

- Urbanized - Gary HustwitDocument3 pagesUrbanized - Gary HustwitJithin josNo ratings yet

- Trade For Corporates OverviewDocument47 pagesTrade For Corporates OverviewZayd Iskandar Dzolkarnain Al-HadramiNo ratings yet

- HUL EthicsDocument29 pagesHUL EthicsRimci KalyanNo ratings yet

- ACT EAST POLICY & ASEAN by Soumyabrata DharDocument6 pagesACT EAST POLICY & ASEAN by Soumyabrata DharSoumyabrata DharNo ratings yet

- RD Sharma Cbse Class 11 Business Studies Sample Paper 2014 1Document3 pagesRD Sharma Cbse Class 11 Business Studies Sample Paper 2014 1praveensharma61No ratings yet

- QR 0298 Economy 17A 22:10: Boarding PassDocument2 pagesQR 0298 Economy 17A 22:10: Boarding PassannaNo ratings yet

- Basel III: Bank Regulation and StandardsDocument13 pagesBasel III: Bank Regulation and Standardskirtan patelNo ratings yet

- Marico's Leading Brands and Targeting StrategiesDocument11 pagesMarico's Leading Brands and Targeting StrategiesSatyendr KulkarniNo ratings yet

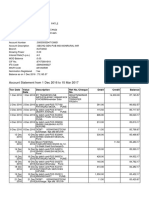

- Account statement showing transactions from Dec 2016 to Feb 2017Document4 pagesAccount statement showing transactions from Dec 2016 to Feb 2017AnuAnuNo ratings yet

- ReidtaylorDocument326 pagesReidtayloralankriti12345No ratings yet

- Certificate of AcceptanceDocument30 pagesCertificate of AcceptanceJamielor BalmedianoNo ratings yet

- KjujDocument17 pagesKjujMohamed KamalNo ratings yet

- The Welcome Magazine FLORENCEDocument52 pagesThe Welcome Magazine FLORENCEJohn D.No ratings yet

- University Grants Commission Bahadurshah Zafar Marg NEW DELHI-110 002Document10 pagesUniversity Grants Commission Bahadurshah Zafar Marg NEW DELHI-110 002Arun PrakashNo ratings yet

- Questionnaires On Entrepreneurship DevelopmentDocument24 pagesQuestionnaires On Entrepreneurship DevelopmentKawalpreet Singh Makkar100% (1)

- Research Article StudyDocument2 pagesResearch Article StudyRica Mae DacoyloNo ratings yet