Professional Documents

Culture Documents

Narasimhulu CR COLLEGE Funds Flow 021

Uploaded by

Sakhamuri Ram'sCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Narasimhulu CR COLLEGE Funds Flow 021

Uploaded by

Sakhamuri Ram'sCopyright:

Available Formats

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.

,

INTRODUCTION

Financial management is the managerial activity, which is concerned with

the planning and controlling of the firms financial resources. As a separate activity

or discipline, it or recent origin. It was a branch of economics till 189. !ill today,

it has no uni"ue body of its #nowledge of its own, and draws heavily on economics

for its theoretical concepts. Financial management, has an academic discipline has

undergone fundamental changes in its scope and coverage. In the early years of its

evolution it was treated synonymously with the raising of funds.

!he sub$ect of financial management is of immense to academicians and

practicing managers. It is of great interest to academicians because the sub$ect is

still developing, and there are still certain areas where controversies e%it for which

no unanimous solution have been reached yet practicing managers are interested in

this sub$ect because among the most crucial decisions of the firm are those which

related to finance and an understanding of the theory of financial management

provides them with conceptual and analytical insights to ma#e those decisions

s#illfully

1 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

EVOLUTION OF FINANCIAL MANAGEMENT&

Financial management emerged as a distinct field of study at turn of the '

th

century. Its evolution may be divided into boar phase( the traditional phase, the

transaction phase and the modern phase. !he traditional phase lasted for about four

decades.

THE FEATURES ARE:

!he focus was mainly on certain episodic events li#e formation, issuance of

capital merger, reorgani)ation and li"uidation of the firm.

!he approach was mainly descriptive and intuitional.

It was viewed mainly from the point of view the ban#ers lenders and outside

interests.

TRADITIONAL APPROACH:

!he traditional period began around *s and continued till +s. It was similar to

that of traditional phase greater importance was placed on the day to day problem

faced by the finance manager in the areas of funds analysis, planning and control.

MODREN APPROACH:

!he modern period began in the mid 19+s and has witnessed an accelerated

pace of development with the infusion of ideas from economic theory and

application of "uantitative methods of analysis. !he central concerned of financial

management is considered to be a rational matching of funds to their uses. ,o as to

ma%imi)e the wealth of current shareholders. !he approach of financial

management has become more analytical and "uantitative.

' S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

FUNDS FLOW STATEMENTS:

-A statement prospective or retrospective, setting out the sources and

applications of the fund of an enterprise. !he purpose of statement is indicate

clearly the re"uirement of funds and how they are proposed to be raised and the

efficient utili)ation and application of the scheme.

(I.C.W.A in its glossar o! "anag#"#nt A$$o%nting&

-A statement summari)ing the significant financial changes which have

occurred between the beginning and the end of companys accounting period..

-Analysis of changes in structure is the domain of funds flow statement. /y

e%amining the changes in /alance sheet items between sheet dates, one may

determine the sources of the funds and the ways in which these funds were used

during this limited time period.

(Gor'on an' s(illing La)&

-A statement is prepared in summary from to indicate changes 0and trends if

prepared regularly1 occurring in terms of financial condition between two different

balance sheet..

(*orston+ S"t( an' ,ro)n(

-!he funds flow statement describes the sources from which additional funds

derived and the uses to which these funds were put..

Ro,#rt N. Ant(on

2 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

CONCEPT OF FUNDS:

-Funds are the economic values that changes hands in business transactions

or that e%ist in the business..

!he e%planation of the precise concept of 3Fund is essential for giving a

proper construction of reference and focus of understanding for the entire e%ercise

involved in Funds flow analysis. !he term 3funds has a variety of meanings. At

one e%treme, to many the word 3funds is synonymous with cash. !o those funds

statement is nothing but an enumeration of the net effects of various #inds of

business events of cash. !his e%plains the trend towards the preparation and

presentation of cash flow statements in published annual reports of accounts. A

record of cash receipts and disbursements while valuable in its own way

undoubtedly a form of funds statement is probably very narrow in its import.

4n the other e%treme Funds refer to economic values e%pressed in money

measurements that are sub$ect to firms $urisdiction( the reservoir of these values is

described in the list of assets to which funds stands committed and the source of

these values is detailed in the list of liabilities from where the funds are derived.

!his is #nown as 3all financial resources of funds. whereas both these concept of

funds constitute the e%tremes, the most acceptable view is the one relating to net

wor#ing capital. !he term wor#ing capital is particularly appropriate e%pression for

showing the wealth of an enterprise, which is continuously revolving through the

stages more desired by the customer 0inventories1 and by the firm 0cost1. !he

interviewing stage 0receivables1 identifies the current relationship between the firm

and its customers. !he magnitude of the investment in wor#ing capital is an

important decision of managerial strategy.

* S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

!he concept funds as wor#ing capital had gained such wide acceptance as to

ma#e some people believe that the title 3change in wor#ing capital is preferable to

one which employs the term 3funds such as 3sources and application of funds. It

is of course true that during the cycle of business operations the current assets are

constantly circulating through the cash accounts but many transactions have a

delayed effect upon cash. !he purchase of merchandise shows as part of cost of

goods sold may represent an increase in accounts payable rather than an immediate

cash outlay. In the same way, e%press may be reflected in current liability, such as

accrued e%penses, rather than immediately in cash. 5owever, increases in current

debt have the same effect on net current assets on wor#ing capital as decrease in

cash. 6onse"uently save for cash e%ceptions as depreciation, the current income

and e%penses are best through of as changing wor#ing capital rather than cash. !his

reasoning leads to visuali)ing of balance sheet changes, including the income, as

wor#ing capital changes rather than movement of funds.

Apart from the fact that the use of word 3wor#ing capital helps in deciding

the content of funds statement, it acts as the basis for determining inclusion or

e%clusion of a financial event because any e%ternal transaction, which increase 3net

wor#ing capital is, by definition, a 3source of funds an any such transaction

resulting in the decrease of the 3net wor#ing capital is, for the same reason, an

3application of funds. !o illustrate, accounting to this of bonus shares would not

find its place in the funds statement because it does not involve any net wor#ing

capital account is either its debit or credit aspect, while dividend paid in cash, it

involves a reduction of 3net wor#ing capital therefore, a part of funds flow

statement, indirectly, this means that internal transaction( transfers and

amorti)ation( do not form part of funds statement.

+ S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

CONCEPT OF FLOW:

!he 3flow of funds refers to transfer of economic values one asset to

another, from one e"uity to another, from an asset to e"uity or vice versa or

combination of any of these. According to wor#ing capital concepts of funds, the

3flow of funds refers to any movement of funds described in terms of the flow in

and out of the wor#ing capital area. !his occurs when changes occurring in

noncurrent assets 0e.g., fi%ed assets, functions assets, long term liabilities, internal

reserves, etc1 are set off by corresponding changes in current accounts 0current

assets and current liabilities1 and vice versa, e.g. when a cash purchase of

machinery is effected, debentures are redeemed by payment in cash, creditors are

paid by raising long term loan, cash dividend is distributed among shareholders or

permutations and combinations of any of these.

Funds Flow ,tatement is an attempt to report the flow of funds between the

various assets and e"uity items during an accounting period. !hus it provides a

missing lin# in the compliment of final account statement. It demonstrates the

manner in which periods activities call upon and generates the financial resources

of the business unit and the resultant ebb and flow of these resources through the

temporary the reservoir of firms assets. In this process, it highlights the changes in

the financial structure of an underta#ing. !he statement shows the movement of

funds or wor#ing capital in the given period of time, normally between two

financial years. !he movement of li"uid assets between two dates is #nown by this

statement. Inflow and outflow of finds different forms are #nown from this

analysis. Increase or decrease in funds as ad$usted by depreciation, ta%es, profit or

losses, dividends will also be #nown.

7 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

FLOW OF FUNDS:

At the end of the accounting period normally every business concern

prepares two statements i. e. the income statement and balance sheet. !hese

statements do not provide necessary information to the interested parties li#e

investors, debenture holders, creditors, government and wor#ers. !he profit and

loss account contains a summary of e%penses incurred and the revenue reali)ed in

the accounting period. It does not highlight the changes in the financial position of

a business. !he balance sheet gives a static view of the resources have been put at

certain period of time. It does not disclose the different points of time. It does not

lend itself to detailed analysis relating to increase or decrease of wor#ing capital.

5ence, another statement has to be prepared to show the changes in the assets and

liabilities from the end of one accounting period to another. !his statement is called

-Funds Flow ,tatement..

Funds flow statement mainly discloses information concerning financing

and investing activities of a business concern and the conse"uent changes in its

financial position for a period. !his statement helps the owners and creditors to

$udge the financial management with respect to its ability in generating the funds

from various sources and effectively utili)ing them for various productive uses

without effecting device to analysis the changes in the financial condition of a

business enterprise between two accounting dates.

It is mandatory on the part of business concerns to prepare a funds flow

statement in addition to income statement and balance sheet.8

9 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

!he funds flow statement helps in the analysis of the financial operations of

the business, to #now causes for changes in the assets and liabilities. It serves as an

instrument for proper allocation of resources.

!his is an important tool in the hands of the management for decision ma#ing

as well as for future planning and policy. !he word 3Fund has been defined in

number of ways.

1. In the narrow sense 3Fund means cash only. ,o that a funds flow statement

is nothing than a cash account. ,uch cash account or statement enumerates

not effect of the receipts and payments of cash.

'. In the broader sense 3funds refers to money values in whatever form it may

e%ist. It means all financial resources, used in business whether in the form

of men, material, money, machinery and other elements.

2. In the popular sense 3funds means wor#ing capital i.e. the e%cess of current

assets over current liabilities. !here are two concepts of wor#ing capital vi).

gross wor#ing capital and net wor#ing capital. !he concept of gross wor#ing

capital refers to the firms investment in the current assets while net wor#ing

capital means e%cess of current assets over current liabilities. In actual sense,

the wor#ing capital means the funds available for conducting the day(to(day

operations of an enterprise.

!he term flow means movement and it includes both 3inflow and 3outflow.

Flow of funds means transfer of economic values from one asset of e"uity to

another. Flow of funds ta#es place when any transaction brings a change in the

amount of funds available. :hen the fund is used in the sense of wor#ing capital,

8 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

funds flow will mean inflow and outflow of wor#ing capital. :hen the transaction

results in the increase of wor#ing capital it is said to be inflow of funds and when it

results in the decrease of wor#ing capital. It is said to be an outflow or application

of funds. Funds flow statement is otherwise #nown as

1. ,tatement of source or application of funds.

'. ,tatement of source and use of funds.

2. ,tatement of financial changes in position.

*. :here(got and where( gone statement.

!he flow of funds occurs when a transaction changes on the one hand a non(

current account and on the other a current account and vice versa.

PREPARATION OF FUNDS FLOW STATEMENT:

Funds flow statement is a method by which we can study the changes in the

financial position of a business concern between two balance sheet dates. 5ence,

this statement is prepared by comparing two balance sheets and with some other

additional information. /roadly spea#ing, the preparation of funds flow statement

consists of two parts.

1. ,chedule of changes in wor#ing capital.

'. ,tatement of sources application of funds.

SCHEDULE OF CHANGES IN WOR-ING CAPITAL:

9 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

!he schedule of changes in wor#ing capital is prepared to show the changes

in the wor#ing capital between two balance sheet dates. It is prepared with the help

of current assets and current liabilities ta#en from two successive balance sheets.

!he change in the amount of any current asset or liability in the current

balance sheet as compared to the of the asset or liability in the current balance

sheet as compared to that of the previous balance sheet either results in increase or

decrease in wor#ing capital. !he difference is recorded in the individual current

asset and current liability column.

In case a current asset in the current period is more than in the previous

period, the effect is an increase in wor#ing capital and it is recorded in the decrease

column or vice versa. !he total increase and the total decrease are compared and

the difference shows the net increase or net decrease in the wor#ing capital which

helps for the preparation of funds flow statement.

The following crude rules may be followed:

1. An increase in current asset increases the wor#ing capital.

'. A decrease in current liability increases the wor#ing capital.

2. An increase in the current liability decreases the wor#ing capital.

*. ;ecrease in the current asset will decrease the wor#ing capital.

A P#r!or"a s$(#'%l# o! $(ang#s in )or.ing $a/ital:

PARTICULARS PREVIOUS

*EAR

CURRENT

*EAR

WOR-ING CAPITAL

INCREASE DECREASE

CURRENT ASSETS:

6ash in hand

6ash at ban#

/<=

;ebtors

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

1 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

,toc#

!emporary Invst.

>repaid e%penses

4utstanding incomes

Total $%rr#nt ass#ts0A1

CURRENT LIA2ILITIES&

/ills payable

,undry creditors

4utstanding e%penses

/an# overdraft

,hort term advances

>roposed for !a%ation

>roposed dividend

>rovision for ta%ation

Total $%rr#nt lia,iliti#s021&

Wor.ing $a/ital 0A&21

Increase<decrease of wor#ing

capital

XXX

XXX

XXX

XXX

3333

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

3333

3333

????

XXX

XXX

XXX

XXX

3333

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

3333

3333

???? ???? ????

FUNDS FROM OPERATIONS:

It is the only internal source of funds. ,ome ad$ustments are to be made in

calculating funds from operations to the net profit.

11 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

Cal$%lation o! !%n's !ro" o/#rations:

A''itions:

;epreciation on fi%ed assets

>reliminary e%penses or good will etc. written off&

6ontribution to debenture redemption fund, transfer to general reserves they are&

;educting from the net profit.

>rovision for ta%ation and proposed dividend.

!hese payments already deducted.

Loss on sal# o! !i4#' ass#ts:

D#'%$t:

>rofit on sale of fi%ed assets

>rofit on revaluation of fi%ed assets

@on(operating income such as dividend received or accrued rent. !hese items

increase fund but they are non(operating income. !hey will be shown under

separate heads as 3source of funds.

Int#r/r#ting t(# FFS:

/ased on this decrease in assets treated as a source, when an asset account

increases, it uses of funds. !he funds flow statement helps, is it properly using

funds are not.

FFS on a $as( ,asis:

1. 6lassifying net b<s changes that are seen between two points in time in to

changes that increase<decrease cash.

'. 6lassifying from the income statement the factors that increase and decrease

cash.

1' S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

2. 6onsolidating this information into a source and uses of funds format.

So%r$#s o! !%n's t(at in$r#as# $as( ar#:

1. A net decrease in any asset other than cash or fi%ed assets.

'. A gross decrease in fi%ed assets.

2. A net increase in any liability.

*. ,ale of e"uity.

+. Funds from operations.

Us#s o! !%n's in$l%'#&

1. Increase in any asset.

'. @et decrease in any liability

2. >urchase of stoc#

*. 6ash dividends.

FUNDS FLOW STATEMENT PREPARATION:

After preparing the schedule of changes in wor#ing capital, the statement of

sources and applications is prepared. !his statement is prepared with the help of

the remaining items of the balance sheets, i.e. all non(current assets, liabilities and

with the help of additional 3information. !his statement indicates the various

sources and uses of funds. !he difference between the total of sources and that of

uses of e%plains the net change in the net wor#ing capital as shown by the schedule

of changes in wor#ing capital.

S/#$i"#n o! A$$o%nt !or" !%n's !lo) stat#"#nt:

So%r$# A//li$ation

12 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

1.Funds from operations

'.Issue of share capital

2.Issue of debentures

*. =aising of loans

+. sale of fi%ed assets

7.sale of investments

9. @on(trading dividends

8. ;ecrease in wor#ing

capital

1.Funds lost in operations

'.=edemption of preference

shares

2.=edemption of debentures

*. =epayment of long term

loans

+. purchase of fi%ed assets

7. purchase of long term

investment

9.;rawings

8. >ayment of ta%es

9. payment of dividends

1 @et increases in :or#ing

capital.

O25ECTIVES OF FINANCIAL MANAGEMENT:

!he ob$ectives or goals or financial management are(

0a1 >rofit ma%imi)ation,

0b1 :ealth ma%imi)ation.

061 Pro!it "a4i"i7ation:

Aa%imi)ation of profits is generally regarded as the main ob$ective of a

business enterprise. Bach company collects its finance by way of issue of shares to

the public. Investors in shares purchase these shares in the hope of getting medium

profits from the company as dividend It is possible only when the company8s goal

is to earn ma%imum profits out of its available resources.

1* S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

081 Goal o! W#alt( Ma4i"i7ation:

Fre"uently, Aa%imi)ation of profits is regarded the proper ob$ective of the

firm but it is not as inclusive a goal as that of ma%imi)ing it value to its

shareholders. Calue is represented by the mar#et price of the ordinary share of the

company over the long run which is certainly a reflection of company8s investment

and financing decisions.

!o organi)e 6o(operatives of mil# producers at village and district levels.

!o provide essential inputs to enhance mil# production, feed and fodder

production, cross breeding programs, and veterinary aid.

!o initiate development programs to provide effective leadership and

management s#ills to mil# producers to help them manage their own 6o(

operatives.

!o develop infrastructure for processing of mil# and manufacturing dairy

products.

1+ S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

!o enable mar#eting of "uality mil# and mil# products.

!o fulfill the needs of mil# and mil# products of consumers within the ,tate.

!o develop new products and pac#aging lines in tune with the changing

scenario of consumer needs.

!o integrate dairy development with rural development efforts and provide

greater employment to the poor in rural areas.

IMPORTANCE OF FINANCIAL MANAGEMENT&

!he importance of financial management cannot be defined in every

organi)ation, where finance or money is involved sound financial management is

indispensable.

Finance is the life blood of an organi)ation. Bvery business unit needs

money to ma#e more money. /ut money will get more money only if it

managed properly.

In the words of 6ollins broo#s, -/ad production management and bad

sales management have slain in hundreds but faulty finance has in

thousands..

17 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

Financial management helps a firm in monitoring the effective

employment of funds in fi%ed assets.

Financial management helps a firm in optimi)ing the output from a given

input if funds 0i.e. a given amount of money1.

Financial management helps in profit panning, capital, budgeting,

controlling inventories and account receivables.

Financial management is important even for non(production organi)ation.

It helps the non(profit ma#ing organi)ation to control the costs and use the

funds at their disposal in the most useful manner.

As we #now that, a basic limitation of traditional financial statements

comprising the balance sheet and profit and loss account is that they are not give

all the information regarding the financial operations of the firm. @evertheless,

they provide some e%tremely useful information to the e%tent the balance sheet

mirrors the financial position on a particular date in terms of the structure of assets,

liabilities and owners e"uity, and so on and the profit and loss account shows the

results of the operations during a certain period of time in the terms of revenues

obtained and the cost incurred during the year.

!hus, the financial statements provide a summari)ed view of financial

position and operations of the firm thereforeD much can be learnt about a firm from

a careful e%amination of its financial statements as invaluable document reports.

!he analysis of financial management is, thus an important aid financial analysis.

61 Us#!%l in '#$ision "a.ing to t(# "anag#"#nt:

19 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

!his statement helps to the manager in deciding the ma#e(up of

capitali)ation. Ese of funds for new fi%ed assets, wor#ing capital, dividend and

repayment of debt are made for each of several future years. !he funds flow

statement reveals clearly the causes for the financial difficulties of the company.

81 Us#!%l as a $ontrol '#9i$#&

It serve as a control device in that the statement compared with the

budgeted figures will show to what e%tent the funds were put to use according

to plan. !his enables the finance manager to find out deviation from the planned

course of action and ta#e remedial steps.

:1 Us#!%l to t(# #4t#rnal /arti#s:

!he funds statement provides an insight into the financial operations of a

business enterprise to the e%ternal parties so that they can ta#e right decision for

their wealth.

;1 D#t#$tion o! i",alan$# an' a//ro/riat# a$tion:

!hese Analyses spanning several years might reveal growth in inventories

which is out of proportion with the growth of other assets and sales.

<1 Di9isional /#r!or"an$# a//raisal:

:hen a company has a number of divisions, individual funds

statements will enable top management to appraise the performance of each

division.

=1 E9al%ation o! t(# !ir">s !inan$ing&

An analysis of the ma$or sources of funds in the past reveals what

proportion of the firms growth was financed internally and what portion

18 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

e%ternally. A funds flow analysis will also tell us whether short(term liabilities

have been used to finance fi%ed assets and permanent portion of wor#ing

capital, in which case, at least in the future, the mi% of short(term and long(

term finance has to be strictly watched over.

?1 Planning o! !%t%r# !inan$ing:

An analysis of a FF, for the future will reveal the firms total

prospective need for funds when these needs will arise and how these are to be

financial depending on whether the need is for fi%ed assets, fluctuating

component of wor#ing capital etc. thus, FFA is very important analytical tool

in the hands of the finance manager in developing information to be used in

financial decision(ma#ing.

LIMITATIONS OF FUNDS FLOW STATEMENT:

!he funds flow statement has a number of usesD however, it has certain limitations

also which are listed as under.

11 !his statement is not a substitute to income statement and balance sheet.

It gives an additional information regarding changes in wor#ing capital.

'1 It can not reveal continuous changes

21 It is not an original statement, but rearranged statement.

*1 It is historic in nature and a pro$ected funds flow statement cannot be

prepared with much accuracy.

19 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

+1 !ransactions between current assets and transactions between non(current

assets are completely ignored while preparing the statement.

71 ;ue to shortage of time overall analysis of the company becomes

difficult.

91 !he company due to some statuary re"uirements so it becomes difficult

to get the overall information of the company.

81 ,ince we are new to the company refused to provide its financial

information.

!he study is limited to a period of five years for analy)ing the data.

NEED OF THE STUD*

!he main need of study is to analysis the financial information of the company.

!o find out the li"uidity or short term solvency of the company.

!o allow relationship among various aspects is such a way that it allows

conclusion about the performance, strength and wea#ness of the company.

!o #now the short term surveying ability of the company.

!o #now how finance wor#s in the typical organi)ation structure.

!o #now wor#ing capital covers all the current account of a firm.

' S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

METHODOLOG* OF THE STUD*

Aethodology is a systematic process of collecting information in order to analy)e

and verifies a phenomenon. !he collection of data is two principle sources. !hey

are discussed as

I. >rimary data

II. ,econdary data

PRIMAR* DATA:

>rimary data are those which are collected afresh and for the first time, and thus

happen to be original in character.

'1 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

!he primary data is collected by discussions with the !%n$tional "anag#rs, o!!i$#rs,

sta!! and ot(#r "#",#rs of the organi)ation.

SECONDAR* DATA:

,econdary data are those which have been already collected by some else and which

have been already passed through the statistical process.

!he secondary data is obtained from ann%al r#/ort and !%n's !lo) stat#"#nt that is

,alan$# s(##t and /ro!it an' loss a$$o%nt, and from the t#4t ,oo.s of financial

management.

5ere the pro$ect is done on secondary data.

SCOPE OF THE STUD*

An e%tensive study is done on the financial transactions financial

information of the company.

!he study covers the historical financial information of the company and

finds growth of the company.

!he study covers all the transaction of the company and the funds flow

statement.

!he company covers the measurement of profitability of the firm and the

operating efficiency and relationship among different financial aspects.

'' S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

INDUSTR* PROFILE

T#4til# In'%str:

!he te%tile industry occupies a uni"ue place in our 6ountry .4ne

of the earliest to come into e%istence in India, it accounts or 1*F of the total

Industrial production, contributes to nearly 2F of the total e%ports and is the

second largest employment generator after agriculture.

India contributes to about '+F share in the world trade of cotton

yarn. India, the worlds third(largest producer of cotton and the second( Gargest

producer of cotton yarns and te%tiles, is poised to play an increasingly important

role in global cotton and te%tile mar#ets as a result of domestic and multilateral

policy reform.

Indian te%tile industry contributes about '' F to the world

'2 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

spindle age and about 7F to the world rotor capacity installed .India has second

highest spindle age in the world after 6hina with an installed capacity of 28.7

million spindles. Indian te%tile industry has the highest loom age 0including

handlooms1 in the world and contributes about 71F of the world loom age. It

contributes about 1'F to the world production of te%tile fibers and yarns. India is

one of the largest consumers of cotton in the world, ran#ing second ne%t to 6hina

in production of cotton yarn and fabrics and first in installed spinning and weaving

capacity.

!e%tile industry is providing one of the most basic needs of people and the

holds importanceD maintaining sustained growth for improving "uality of life. It

has a uni"ue position as a self(reliant industry, from the production of raw

materials to the delivery of finished products, with substantial value(addition at

each stage of processingD it is a ma$or 6ontribution to the country8s economy.

Its vast potential for creation of employment opportunities in the

agricultural, industrial, organi)ed and decentrali)ed sectors H rural and urban

areas, particularly for women and the disadvantaged is @oteworthy.

Although the development of te%tile sector was earlier ta#ing place in

terms of general policies, in recognition of the importance of this sector, for the

first time a separate >olicy ,tatement was made in 198+ in regard to development

of te%tile sector. !he te%tile policy of ' aims at achieving the target of te%tile

and apparel e%ports of E, I + billion by '1 of which the share of garments will

be E, I '+ billion. !he main mar#ets for Indian te%tiles and apparels are E,A,

EAB, EJ, Kermany, France, Italy, =ussia, 6anada, /angladesh, and Lapan.

!he main ob$ective of the te%tile policy ' is to provide cloth of

'* S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

acceptable "uality at reasonable prices for the vast Aa$ority of the >opulation of

the country, to increasingly contribute to the provision of sustainable employment

and the economic growth of the nationD and to compete with confidence for an

increasing share of the global mar#et vast pool of s#illed manpowerD

entrepreneurshipD fle%ibility in production processD and long e%perience with

E,<BE 0Buropean Enion1.

At the same time, there are constraints relating to fragmented industry,

constraints of processing, "uality of cotton, concerns over power cost, labour

reforms and other infrastructural constraints and bottlenec#s. B.g., cost of power

was =s.8 per garment in India whereas in 6hina it was only =s.' per garment.

Further, for the benefit of e%porters, there should be a state(owned cargo

shipping mechanism. ,everal initiatives have already been ta#en by the

government to overcome some of these concerns including rationali)ation of fiscal

dutiesD technology up gradation through the !echnology Ep gradation Fund

,cheme 0!EF,1D setting up of Apparel >ar#sD and liberali)ation of restrictive

regulatory practices.

C%rr#nt s$#nario:

;eveloping countries with both te%tile and clothing capacity may be able to

prosper in the new competitive environment after the te%tile "uota regime of

"uantitative import restrictions under the multi(fiber arrangement 0AFA1 came to

an end on 1st Lanuary, '+ under the :orld !rade 4rgani)ation 0:!41

Agreement on !e%tiles and 6lothing.

!he mood in the Indian te%tile industry given the phase out of the "uota

regime of the multi(fiber arrangement 0AFA1 is upbeat with new statement lowing

'+ S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

in and increased orders for the industry as a result of which capacities are fully

boo#ed up to April '+. As a result of various initiatives ta#en by the government,

there has been new investment of =s.+, crores in the te%tile industry in the

last five years. @ine te%tile ma$ors invested =s.', 7 crores and plan to invest

another =s.7, * crores. Further, India8s cotton production increased by +9F over

the last five yearsD and 2 million additional spindles and 2, shuttles(less looms

were installed. !he industry e%pects investment of =s.1, *, crores in this

sector in the post(AFA phase. A Cision '1 for te%tiles formulated by the

government after intensive interaction with the industry and B%port >romotion

6ouncils to capitali)e on the upbeat mood aims to increase India8s share in

world8s te%tile trade from the current *F to 8F by '1 and to achieve e%port

value of E, I + billion by '1 Cision '1 for te%tiles envisages growth in

Indian te%tile economy from the current E, I 29 billion to I 8+ billion by '1D

reaction of 1' million new $obs in the te%tile sectorD and moderni)ation and

consolidation for creating a globally competitive te%tile industry.

!here will be opportunities as well as challenges for the Indian te%tile

industry in the post(AFA era. /ut India has natural advantages which can be

capitali)ed on strong raw material base ( cotton, man(made fibers, $ute, sil#D large

production capacity 0spinning ( '1F of world capacity and weaving ( 22F of

world capacity but of low technology1D

In9#st"#nt in In'ian T#4til# In'%str:

!he scenario of investment in the Indian te%tile industry started to change

after the inception of the special -!e%tile >ac#age. during the '2('* budgets.

!he recommendations made in the budget included the reforms that are re"uired to

'7 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

be made in the fiscal policy of the Indian te%tile Industry for attracting investment

in this industry. !he policy matters associated with restructuring of debt for

financial viability of this industrial sector are also being addressed in this budget. A

fund was set up in accordance with the recommendations of the aforesaid budget

with an initial principal amount of =s.2 crores. !his fund was meant for

restructuring of the te%tile sector.

Fa$tors r#s/onsi,l# !or )ooing t(# in9#stors in In'ian t#4til# in'%str:

1. !he si)e of the te%tile along with apparel mar#et in India is "uite big.

'. >erformance of this industry has been consistent right from the start of the

new millennium.

2. Availability of the s#illed labor in India is comparatively cheap in relation to

the same in other parts of the world.

*. !he policies related to the Foreign ;irect Investment in India are

comparatively lenient and are transparent in nature among all the developing

countries.

+. !here is no limit on foreign direct investment in the te%tile industry and

hence 1F direct investment can be done by the foreign capitalists in the

'9 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

Indian te%tile industry.

7. Foreign Investments done in the Indian !e%tile Industry through the

automatic route offers a hassle(free way of investing. !hese investments are

not re"uired to be approved by the government or the ape% ban# of India,

=/I. !he foreign investors are only re"uired to ma#e a notification to the

regional office of the ape% ban# only after receiving the receipt of the

remittance. !his notification is re"uired to be done within thirty days from

the date of receiving remittance.

9. !he ministry concerned with the development of te%tile Industry in India has

formed a special cell for attracting F;I in this sector.

O,@#$ti9#s o! t(is s/#$ial $#ll !or )ooing FDI ar#:

1. !his cell helps the willing foreign companies to find out viable partners

meant for floating a $oint venture company in order to produce te%tile

products.

'. F;I special cell acts as the mediator between the foreign investor and the

different organi)ations for setting up the te%tile industry. !he speciali)ed

helps that are given by this cell involve advisory support along with

assistance.

2. At the time of operation of the te%tile industry set by the foreign investor

certain problems may crop up. !hese problems are sorted out by the F;I

cell.

'8 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

*. F;I cell monitors as well as maintains the data related with the total

production of the te%tile sector. !hey also collect the stratified data of

production by both domestic industry as well as the industry set up by the

foreign investor. It has been found out that the percentage share of the te%tile

industry in the total foreign investment done was 1.'F.A ma$or

development has occurred in the te%tile industry when /lac#stone, an

investment management company of E,A has bought +.1F sta#e of the

domestic apparel manufacturing company called Ko#aldas B%ports. !he deal

was sealed at the price of =s '9+ per share. After the completion of the sta#e

transfer the promoters of the Ko#aldas B%ports, the 5indu$as, were left with

a share amounting to 'F.

+. As a part of domestic te%tile sector e%pansion, the companies of Indian

origin are also not far behind in ma#ing investments. Arvind Aills Gimited

is e%panding its production as well as capacity base through the construction

of two new industrial set ups in /angalore and Ahmadabad. Another te%tile

company of India name super >inning mills is also ac"uiring two sic# units

of Aadurai for enhancing their production capacity for meeting the needs

generated by the E,A mar#et. :orld largest terry towel producing company

called :els pun India Gtd. Is setting up a te%tiles plant in the state of Ku$arat

at the initial capital of E, '' millionM

. GROWTH OF INDIAN TE3TILE INDUSTR*:

Krowth along with the investment of an industry depends heavily on the

economic health of the country. Indian economy grew rapidly during the fiscal year

'9 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

'9('8 posting a growth rate of 9.*F p.a. @ot only this, India has been

performing significantly in the last three years where its average yearly rate of

growth has been estimated to be 8F. !he fruits of economic growth have tric#led

down to people of the state which can be evidenced from the rising per capital

income of India. ,tatistics reveal that during ''('8 0up to Aarch '81 the per

capital income of India has increased by 7' F and has reached the level of =s

'+,998 or E,I +81.29 per annum.

4ne of the most beneficial classes of this economic growth saga has been

the middle income section of the society. !he total strength of this class in absolute

terms has been found out to be '17 million which is e%pected to rise to 2+1 million

by '1. !he ma$or demand that is being generated is by a new class of people

from the booming I!(/>4 sector who are still at their prime age and are outwardly

fashion savvy. !his has generated huge demand for fashionable dresses which has

conse"uently led to the emergence of some world class Indian designers with their

latest fashion apparels.

>ropensity of consumption 0after e%cluding all spending on essential

items li#e housing, health, education, etc.1 by the average Indian people has

increased at the rate of +F to a total amount of E,I '19 billion in the year '+.

At this time, the organi)ed retail sector has been able to tap a mar#et of around

E,I 8.' billion which is pro$ected to increase to E,I '+ billion by '1.

!e%tile industry is one of the ma$or contributors to the total output of the act

growing Indian industrial sector which is at present revolving around *F. !e%tile

sector8s contribution to K;> of India is also significant which currently amounts to

*F. It has been found out that Indian te%tile industry s one of the ma$or sources of

2 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

foreign e%change earnings for India and contributes around 17(19F.From the

above discussion it is "uite clear to us that the mar#et si)e of India is growing at a

very high pace. !hat is why the foreign investors are floc#ing to India for

investment purposes in order to get hold of a chun# of this e%panding pie. :ith

increasing demand for the products of Indian !e%tile Industry, new players are

$umping in the league to get a slice of the profitable pie and the already e%isting

te%tile mills are raising their capacity for increasing their supply. 5ence, the

e%pansion process of the domestic industry is also not far behind. !hus, it can be

said that the whole Indian economy is on a growing trend which has its obvious

impact on every possible sector including the Indian Industry. Indian !e%tile

Industry is going through a ma$or change in its outloo# after the e%piry of Aulti(

Fiber Agreement.

Aulti Fiber Agreement was introduced in the year 199* as a short term

measure directed towards providing a limited time period to the developed

countries for ad$usting their te%tile industries in accordance with that of the

developing countries. !he te%tile industries are characteri)ed by their labor

intensive nature of commodity production. Availability of surplus labor is abundant

in the developing countries. !hese countries have comparative advantage in the

production of te%tile related products and hence are able to supply goods at a very

low price. !he basic idea behind this policy was to eradicate all sorts of "uota

system from the apparel and te%tile industry all over the world so that a level

playing field could be established.

@ow, this era after AFA is being loo#ed upon by the e%perts as a means

through which the Indian te%tile and apparel industry is going to grow a much

faster pace and would conse"uently be able to leave a mar# on the whole world.

21 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

Integration of this Indian industry with that of the whole world started from the last

period of 198s. Ep to '9('8 where the final financial year represents the

pro$ected figure. !he figure above shows total produce of Indian !e%tile Industry in

fabric sector along with the produce in all the sub sectors under it. !his highlights

the fact that the total production of fabricated products by the Indian !e%tile

Industry between the period '*('+ and '7('9 increased at a moderate

rate from *1992 million s"uare meters to *+298 million s"uare meters. /ut after

the AFA period 0i.e. after 1.1.'91, the same has increased from *+298 million

s". mts to +*'7 million s". mts between the period '7('9 and '8('9.

5ence it is evident that the percentage increase in the fabric te%tile product during

the period '7('9and '8('9 has seen a rise of around 17.29F whereas it

was only 9.+F during '*('+ and '7('9.

National T#4til# Poli$:

1. !he @ational !e%tile >olicy was formulated #eeping in mind the following

ob$ectives&

'. ;evelopment of the te%tile sector in India in order to nurture and maintain its

position in the global arena as the leading and e%porter of clothing.

2. Aaintenance of a leading position in the domestic mar#et by doing away

with import penetration.

*. In$ecting competitive spirit by the liberali)ation of stringent controls.

+. Bncouraging Foreign ;irect Investment as well as research and development

2' S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

in this sector.

7. ,tressing on the diversification of production and its up gradation ta#ing into

consideration the environmental concerns.

9. ;evelopment of a firm multi(fiber base along with the s#ill of the weavers

and the craftsmen.

S%$( goals ar# s#t to "##t t(# !ollo)ing targ#ts:

1. !he si)e of te%tile and apparel e%ports must reach a level of E, + billion by

the year '1.

'. !he !echnology up gradation Fund ,cheme should be implemented in a

strict manner.

2. !he garments industry should be removed from the list of the small scale

industry sector.

*. !he handloom industry should be boosted and encouraged to enter into

foreign ventures so as to compete globally. !he @ational !e%tile >olicy has

also formulated rules pertaining to certain specific sectors. ,ome of the most

important items in the agenda happen to be the availability and productivity

22 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

along with the "uality of the raw materials. ,pecial care is also ta#en to curb

the fluctuating price of raw materials. ,teps have also been ta#en to raise

sil# to the international standard preamble.

+. !o comprehend the purpose of te%tile industry that is to provide one the most

basic needs of the people and promote its sustained growth to improve the

"uality of life.

7. !o ac#nowledge te%tile industry as a self(reliant industry, from producing

raw materials to delivery of finished productsD and its ma$or contribution to

the economy of the country.

9. !o understand its immense potentiality for creating employment

opportunities in significant sectors li#e agriculture, industry, organi)ed

sector, decentrali)ed sector, urban areas and rural areas, specifically for

women and deprived. =ecogni)e the !e%tile >olicy of 198+, which boosted

the annual growth rate of cloth production by 9.12F, e%port of te%tile by

12.2'F and per capita availability of fabrics by 2.7F.

8. !o analy)e the issues and problems of te%tile industry and the guidelines

provided by the e%pert committee set up for this specific purpose.

9. !o give a different specification to the ob$ectives and thrust areas of te%tile

industry.

1.!o produce good "uality cloth for fulfilling the demands of the people with

reasonable prices.

11. !o maintain a competitive global mar#et.

2* S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

T(r%st ar#as:

Go9#rn"#nt o! In'ia is tring to /ro"ot# t#4til# in'%str , gi9ing #"/(asis

on s#9#ral ar#as o! t#4til#+ )(i$( ar# as ,#lo)&

1. Innovative mar#eting strategies

'. ;iversification of product

2. Bnhancement of te%tile oriented technology

*. Nuality awareness

+. Intensifying raw materials

7. Krowth of productivity

9. Increase in e%ports

8. Financing arrangements

9. 6reating employment opportunities

1.5uman =esource ;evelopment

2+ S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

Kovernment of India has set some targets to intensify and promote te%tile industry.

!o materiali)e these targets, efforts are being made, which are as follows&

1. !e%tile and apparel e%ports will reach the E, I + billion mar# by '1

'. All manufacturing segments of te%tile industry will come under !EF,

0!echnology Ep gradation Fund ,cheme1

2. Increase the "uality and productivity of cotton. !he target is to increase +F

productivity and maintain the "uality to international standards.

*. Bstablish the !echnology Aission on $ute with an ob$ective to increase

cotton productivity of the country.

+. Bncourage private organi)ation to provide financial support for the te%tile

industry

7. >romote private sectors for establishing a world class te%tile industry

9. Bncourage handloom industry for producing value added items

8. Bncourage private sectors to set up a world class te%tile industry comprising

27 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

various te%tile processing units in different parts of India

9. =egenerate functions of the !=A 0!e%tile =esearch Associations1 to stress on

research wor#s government policy on cotton and manmade fiber.

1.4ne of the principal targets of the government policy is to enhance the

"uality and production of cotton and man(made fiber. Ainistry of

Agriculture, Ainistry of !e%tiles, cotton growing states is primarily

responsible for implementing this target.

Ot(#r t(r%st ar#as:

In!or"ation t#$(nolog:

>lays a significant role behind the development of te%tile industry in

India. I! 0Information !echnology1 can promote to establish a sound commercial

networ# for the te%tile industry to prosper.

H%"an R#so%r$# D#9#lo/"#nt:

Bffective utili)ation of human resource can strengthen this te%tile

industry to a large e%tent. Kovernment of India has adopted some effective policies

to properly utili)e the manpower of the country in favor of the te%tile industry.

Finan$ing arrang#"#nt:

Kovernment of India is also trying to encourage talented Indian

designers and technologists to wor# for Indian te%tile industry and accordingly

29 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

government is setting up venture capital fund in collaboration with financial

establishments.

A$ts:

,ome of the ma$or acts relating to te%tile industry include

a1 6entral ,il# /oard Act, 19*8

b1 !he !e%tiles 6ommittee Act, 1972

c1 !he 5andlooms Act, 198+

d1 6otton 6ontrol 4rder, 1987

!he !e%tile Enderta#ings Act, 199+ Kovernment of India is earnestly trying

to provide all the relevant facilities for the te%tile industry to utili)e its full

potential and achieve the target. !he te%tile industry is presently e%periencing

an average annual growth rate of 9(1F and is e%pected to grow at a rate of

17F in value, which will eventually reach the target of E, I 11+ billion by

'1'. !he clothing and apparel sector are e%pected to grow at a rate of '1 Ft in

value terms.

28 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

Cotton:

6otton is a soft, staple fiber that grows around the seeds of the cotton plant.

It is a natural fiber harvested from the cotton plant. !he fiber most often is spun

into yarn or thread and used to ma#e a soft, breathable te%tile, which is the most

widely, used natural(fiber cloth in clothing today.

Pro$#ssing o! Cotton in In'ia:

In India the raw cotton, also called as Japa is processed in a multi(stage

process described as below. !he >roducts of processing are

I. Oarn.

II. 6ottonseed 4il.

III. 6ottonseed Aeal.

I. Pro'%$tion o! *arn:

6. -a/a to lint& Japa 0also #nown as raw cotton or seed cotton1 is unpinned

cotton or the white fibrous substance covering the seed that is obtained from

the cotton plant. !he first step in the process is, the cotton is vacuumed into

tubes that carry it to a dryer to reduce moisture and improve the fiber "uality.

!hen it runs through cleaning e"uipment to remove leaf trash, stic#s and

29 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

other foreign matter. In ginning a roller gin is used to grab the fiber. !he raw

fiber, now called lint.

8. Lint to ,al#& !he lint ma#es its way through another series of pipes to a

press where it is compressed into bales 0lint pac#aged for mar#et1. After

baling, the cotton lint is hauled to either storage yards, te%tile mills, or

shipped to foreign countries.

:. @ote& !he cotton seed is delivered to a seed storage area from where it is

loaded into truc#s and transported to a cottonseed oil mill.

;. 2al# to la/& 5ere the bales are bro#en down and a wor#er feeds the cotton

into a machine called a Pbrea#erP which gets rid of some of the dirt. From

here the cotton goes to a PscutcherP. 04perated by a wor#er also called a

scutcher1. !his machine cleans the cotton of any remaining dirt and

separates the fibers. !he cotton emerges in the form of thin Pblan#etP called

the PlapP.

<. La/ to Car'ing: 6arding is the process of pulling the fibers into parallel

alignment to form a thin web. 5igh speed electronic e"uipment with wire

toothed rollers performs this tas#. !he web of fibers is eventually condensed

into a continuous, untwisted, rope(li#e strand called a sliver.

=. Sil9#r to Ro9ing& !he silver is then sent to combing machine. 5ere, the

fibers shorter than half(inch and impurities are removed from the cotton. !he

sliver is drawn out to a thinner strand and given a slight twist to improve

strength, and then wound on bobbins. !his >rocess is called =oving.

* S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

?. Ro9ing to *arn: 0,>I@@I@K1& ,pinning is the last process in yarn

manufacturing. ,pinning draws out the short fibers from the mass of cotton

and twists them together into a long. ,pinning machines have a metal spi#e

called a spindle which the thread winds around.

II. Pro'%$tion o! Cotton S##' Oil:

>rocessing of cottonseed in modern mills involves a number of steps. !hey are as

follows&

6. !he first step is its entry into the sha#er room where, through a number of

screens and air e"uipment, twigs, leaves and other trash are removed.

8. !he cleaned seed is then sent to gin stands where the linters are removed

from the seed 0delimited1. !he linters of the highest grade, referred to as

first(cut linters are used in manufacturing non(chemical products, such as

medical supplies, twine, and candle wic#s. !he second(cut linters removed

*1 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

in further delimiting steps, are incorporated in chemical products, found in

various foods, toiletries, film, and paper.

:. !he delimited seeds now go to the huller. !he huller removes the tough seed

coat with a series of #nives and sha#ers. !he #nives cut the hulls 0tough

outer shell of the seed1 to loosen them from the #ernels 0the inside meat of

the seed, rich in oil1 and sha#ers separate the hulls and #ernels.

;. !he #ernels are now ready for oil e%traction. !hey pass through fla#ing

rollers made of heavy cast iron, spinning at high speeds. !his presses the

meats into thin fla#es. !hese fla#es then travel to a coo#er where they are

coo#ed at 19 degrees F to reduce their moisture levels. !he prepared meats

are conveyed to the e%tractor and washed with he%ane 0organic solvent that

dissolves out the oil1 removing up to 98F of the oil.

<. 6rude cottonseed oil re"uires further processing before it may be used for

food. !he first step in this process is refining. :ith the scientific use of

heat, sodium hydro%ide and a centrifuge 0e"uipment used to separate

substances through spinning action1, the dar# colored crude oil is

transformed into a transparent, yellow oil. !his clear oil may then be

bleached with special bleaching clay to produce transparent, amber colored

oil.

III. Pro'%$tion o! Cottons##' M#alACa.#A-a/as.(alli

Japas#halli 0cottonseed e%traction<meal1 is a byproduct of the cottonseed

industry.

6ottonseed is a by(product of the cotton plant, which is primarily grown for

its fiber. Although cotton has been grown for its fiber for several thousand

*' S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

years, the use of cottonseed on a commercial scale is of relatively recent

origin.

Rol# o! Cotton In'%str in In'ian E$ono":

4ver the years, country has achieved significant "uantitative increase in cotton

production. !ill 199s, country used to import massive "uantities of cotton in the

range of 8. to 9. la#shs bales per annum. 5owever, after Kovernment

launched special schemes li#e intensive cotton production programmers through

successive five(year plans that cotton production received the necessary impetus

through increase in area and sowing of 5ybrid varieties around mid 9s. ,ince then

country has become self(sufficient in cotton production barring few years in the

late 9s and early 's when large "uantities of cotton had to be imported due to

lower crop production and increasing cotton re"uirements of the domestic te%tile

industry.

Cotton /ro'%$tion Ar#as in In'ia:

India is an important grower of cotton on a global scale. It ran#s third

in global cotton production after the Enited ,tates and 6hinaD with 9.+ million

hectares grown each year, India accounts for appro%imately '1F of the world8s

total cotton area and 12F of global cotton production. !he 6otton producing areas

in India are spread throughout the country. /ut the ma$or cotton producing states

which account for more than 9+F of the area under and output are&

1. >un$ab.

'. 5aryana.

2. =a$asthan.

*. Aaharashtra.

+. Ku$arat.

*2 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

7. Aadhya >radesh.

9. Andhra >radesh.

8. !amil @adu.

9. Jarnata#a.

4f the nine cotton producing ,tates in India, average yields are highest in

>un$ab where most of the cotton area is irrigated /ut the yields of cotton in India

are low, with an average yield of +2 #g<ha compared to the world average of 92*

#g<ha. !he problem is also compounded by higher production costs and poor

"uality in terms of varietals purity and trash content.

5owever the 6otton plays an important role in the @ational economy providing

large employment in the farm, mar#eting and processing sectors. 6otton te%tiles

along with other te%tiles also contribute about 1<2rd of the Indian e%ports.

St#/s ta.#n , t(# Cotton Pro'%$#rs in In'ia:

@ow(a(days the Indian 6otton producers are continuously wor#ing to

up(grade the "uality and increase the cotton production to cope up with the

increased global demand for cotton te%tiles and to meet the needs of the 29 million

spindles capacity of the domestic te%tile industry which presently consumes about

1'(1* million bales annually.

In India, cotton yields increased significantly in the 198s and

through the first half of 198s but since 1997 there is no increase in yield. In the

past, the increase in cost of production of cotton was partially offset by increase in

yield but now with stagnant yield the cost of production is raising. /esides low

yield, Indian cotton also suffers from inconsistent "uality in terms of length,

microware and strength.

** S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

Poli$ o! Go9#rn"#nt o! In'ia to)ar's Cotton In'%str

!he 6otton production policies in India historically have been

oriented toward promoting and supporting the te%tile industry.

!he Kovernment of India announces a minimum support price for

each variety of seed cotton 0#apas1 based on recommendations from the

6ommission for Agricultural 6osts and >rices. !he Kovernment of India is also

providing subsidies to the production inputs of the cotton in the areas of fertili)er,

power, etcQ

Mar.#ts !or In'ian Cotton:

!he three ma$or groups in the cotton mar#et are

>rivate traders,

,tate(level cooperatives,

!he 6otton 6orporation of India Gimited.

4f these three groups, private traders handle more than 9 percent of

cottonseed and lint, followed by cooperatives and the 66I.

!he 6otton 6orporation of India Gtd. for the year '8(9 had

purchased 7.2 la#hs "uintals of #apas e"uivalent to 11.99 la#hs bales valuing

=s.1'18.9 crores in Andhra >radesh, Aaharashtra, Aadhya >radesh, 4rissa and

Jarnata#a. /eside these the 6orporation had also carried out commercial

operations and purchased '.91 la#hs bales valuing =s.'8+.8' crores in the year

*+ S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

'8(9 as compared to around 1. la#hs bales valuing =s.18.81 crores during

the previous year 0i.e. for the year '7(91.

E4/orts o! Cotton:

!he main mar#et for Indian cotton e%port is 6hina. !he other mar#ets

also include !aiwan, !hailand and !ur#ey. In Luly '1, the union government

removed all curbs on cotton e%ports. As a result of these, now the e%porters are not

re"uired to obtain any certificate from the !e%tile 6ommissioner on the

registration, allocation, "uality and "uantity of e%port. India e%ported around '+

per cent cotton during '8(9 and it is estimated nearly 7' per cent e%ported to

6hina.

;uring the year '8(9 the prices of Indian cotton in early part of the

season being lower than the international prices, had been attractive to foreign

buyers and there was good demand for Indian cotton, especially ,(7, 5(* and

/unny, which had resulted in sustained cotton e%ports, which are estimated at

++. la#hs bales !he 6otton Advisory /oard estimated an 18(' percent increase

in cotton e%ports to 7+ la#hs bales for 4ct '9( ,ep '1, as against its Aug '9

estimate of +8 la#hs bales.

I"/orts o! Cotton:

;espite good domestic crops, India is importing cotton because of

"uality problems or low world prices particularly for processing into e%portable

products li#e yarns and fabrics.

*7 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

India imported $ust 9'1, bales of cotton in '*(+. !he imports

rose to 1,'19, la#hs bales in '+(7, *,9, la#hs bales in '7(9 and the

anticipated imports for the year '9(8 are ++, la#hs bales.

For the year '9(8 the cotton imports into the country had once

again remained limited mainly to B%tra Gong staple cottons, li#e as previous year,

which were in short supply at around 7 la#hs bales inclusive of import of around '

la#hs bales of long staple varieties contracted by mills during April(Aay '9.

F%t%r# C(all#ng#s !or t(# In'ian Cotton In'%str

!he challenges that are going to face by the cotton producers in India

for the season '9(1 are&

R%/## a//r#$iation:

!he increase in the value of the rupee gives only smaller import

orders to the cotton producers.

C(#a/#r I"/orts:

!he appreciated rupee value ma#es the cotton imports cheaper

when compared to past. ,o this aspect is also re"uired to consider by the cotton

producers.

Lo) B%alit

*9 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

!he Nuality of cotton is also far from satisfactory considering the

presence of a large number of contaminants. ,o the cotton producers are also

re"uired to ta#e care in this aspect.

COMPAN* PROFILE

INTRODUCTION

Oarram ,ridhar =eddy spinning mills is a !echnocrat pro$ect set up by people

who were in employment earlier unli#e capitalists, who can mobili)e vast

resources. !he technocrats have been involved fully in the standards of living the

wor#ing force in the nearby villages. O.,.= spinning mills has been situated at

Kanapavarm village, @adendla Aandal, in Kuntur ;istrict, Andhra >radesh having

8.+ acres of area including the wor#man residing colony and premises. !his unit

has been started with the assistance of ,./.I., nationali)ed ban#s and other

financial institutions. !his area as declared as industrial area and government of

*8 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

Andhra >radesh has a reliable subsidy to those who have installed industries in this

district.

!he company in setting up spinning mills with an E@ stalled capacity of 9

spindles. !he pro$ect has been financed by the ,./.I with participation in "uality

share capital and is also financed by the 6entral Financial Institution ,./.I., !he

cost of the pro$ect was around 2.+ crores and the turn over or the company is

around 9 crores. !his factory will go a long way to improve the living conditions of

the poor and wea#er sections of the Kanapavarm and surrounding villages. !he

industry is a labour oriented and has been set up purely within advice of providing

employment to more than 9+ wor# men directly and indirectly. As a matter of

fact, both women and men from nearby villages have been engages at the $ob and

are getting trained. !here are more than wor#ers employed per day. !his unit also

went as other organi)ations to achieve its modern developments in new

technological development and automatic system and seedling la#e son the same.

O.,.= ,pinning Aills Gtd is a well established spinning mill in the

southern Indian state of Andhra >radesh. !he mill was founded in 1982 by Ar.

,ridhar =eddy, a technocrat with a wide range of e%perience in cotton gaining mill

from a modest ', spindles, the spindle capacity today has increased to '+,.

!he ,adasivpet unit accounts for *, spindles while the Kanapavarm plant

accounts for the remaining ', spindles. In the course of time the company has

gained not only an I,4 91 certification but also the status of an e%port house. In

the year '*('+ the company had registered a turnover of =,.1+ crores.

*9 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

!he company is well established in the mar#eting of cotton and synthetic blended

yarns and has also made a foray in the direction of fabric and garment e%ports.

6ompanys immediate future plans are focused on growth in the area yarn

manufacturing with a pro$ected capacity e%pansion in spindled by '', spindles

ta#ing the total spindle to 8', spindles. /lueprints are also being drawn up for a

garment manufacturing unit. !he company has gained not only I,4 91

certification but also the status of an e%port house.

:e have achieved a great height of success due to the hard wor# of the

chairman and A=. O.,=I@ICA,EGE =B;;O, the managing director have a

highly s#illed team of employees, who carries loads of e%perience have a strong

infrastructural base, which is well e"uipped with the advise. :e always endeavor

to provide the best of are fabrics to our customer chec# the "uality content of the

fabric.

:e are engaged in the manufacturing of wide range of fine cotton

fabrics have a remar#able characteristic of providing smoothness and we are

rec#oned as one of the leading cotton fabric is used by big companies for

production of various types of also become one of the foremost organic cotton yarn

supplier in India. !he grown without the use of any harmful pesticides and

chemicals and the increase in its "uality.

@ame of the 6B4 Ar. O. ,ridhar =eddy

>rimary /usiness !ype Aanufacturer

Bstablishment Oear 1999

@4. 4f Bmployees 2

Aar#et 6over 6hina

Annual ,ale 2. crores

+ S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

>roducts we offer 6otton Oarn H Fabric

CHAIRMAN>S DES-

Ar. Oerram ,ridhar =eddy ,tarted his business as cotton commission native place

idupulapadu, in#ollu manadalam, >ra#asam district, Andhra >radesh planned

forward integration of Kinner in 1982. 5e started a firm company in 1989.

,upplied cotton blasR to various spinning mills in !a >radesh.

It was in the year 1999 he established a spinning mill at Kanapavarm

capacity of *+ spindles. 5is hard wor#, innovative thoughts and strategy made

O.,.= ,pinning and weaving mills >vt. Gtd., turn in to one of the 1 F cotton

yarns to may domestic and e%ported oriented weaving mills country.

VISION

The company has vision to excel in all feld of textile industry

produce basis.

We will be intensely customer focused and will ofer products

provide the best values for our customers.

MISSION

!o manufacture a high "uality yarn thereby with standing competitiveness.

;eveloping a long team relationship with our customers and suppliers.

!o use latest technological strategies during production there by for

approach.

!o provide a safe, fulfilling and rewarding wor# environment.

,ervicing and supporting the comities in the us operate.

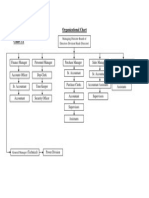

F%n$tions o! H#a' o! D#/art"#nts in *.S.R S/inning Mills Lt':

+1 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

!he following are functions of the 5eads of ;epartments that are mostly relevant

to the >ro$ect.

F%n$tions o! Finan$# Manag#r:

1. 1. 5e loo#s after day(to(day accounting and financial operations in the

Accounts ;epartments.

'. 5e is closely associated in completion of statutory audit of !he 6ompany

under 6ompanies Act 19+7 and also in connection with the annual !a% Audit

under Income(ta% Act.

2. 5e is independently responsible for submitting wor#ing capital renewal

application to /an#s and also furnishers re"uired information under

Nuarterly Information ,ystem.

*. Further, he provides information to /oard Aeeting relating to >rofit and

Goss Account, /alance ,heet, !urnover particulars and En(audited results

etc., for each "uarter.

+. Apart from the above he loo#s after sales ta% matters of the company and

attends before ,ales !a% ;epartments for completion of Assessments.

F%n$tions o! Mar.#ting Manag#r:

1 5e coordinates with production department, "uality control H dispatch

section for planning of the production, supply of right product and at the

right time to the customers.

' 5e continuously e%plores new mar#ets or customers.

2 In order to promote the producers of the organi)ation regular customer

contacts are maintained.

+' S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

* In view of the limited growth of the industry, maintaining the mar#et

situation in order to retain the customers.

+ 5e #eeps an eye on the competitors strategies by analy)ing the mar#et

situation in order to retain the customers.

7 Aonitoring the overall performance of sales organi)ation is also one of the

functions.

F%n$tions o! Pro'%$tion Manag#r:

1 5e is in charge of the >roduction ;epartment.

' 5e prepares re"uirements of raw materials as per the indents given by the

Aar#eting ;epartment.

2 5e ta#es total responsibility from the stage of processing raw material to the

stage of pac#ing of finished products.

* 5is efforts include minimi)ing the labor cost, inventory, wastage in order to

achieve high productivity.

+ 5is responsibility includes advising the Aanagement with respect to

capacity utili)ation and further re"uirements.

A$$o%nting Poli$i#s o! *.S.R S/inning Mills Lt':

G#n#ral

!o >repare financial statements in accordance with applicable with

applicable accounting standards in India.

!he financial statements have also been prepared in accordance with

relevant presentational re"uirements of the companies act, 19+7.

+2 S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

R#9#n%#s

It is the corporate policy to state turnover, which represents invoiced value

of goods sold net of ta%es, insurance and freights.

!he company is following mercantile system of accounting i.e.,

revenues<e%penses are recogni)ed as and when they are earned< incurred.

In9#ntori#s

In our opinion and to the best of our information and according to

e%planations given to us, they said accounts read with the significant accounting

policies, the Inventories are valued as follows&

=aw materials, ,tores H ,pares and materials in transit have been valued at

the lower of cost or net reali)able value.

,aleable ,toc# of scrap is valued at estimated net reali)able value.

6ost of inventories is generally assigned by using the first in first out method.

Fi4#' Ass#ts

Fi%ed Assets are stated at cost < original value according to the accounting

standard(1.

B%penditure incurred for construction of new plant was capitali)ed.

6ost of fi%ed assets comprises of its purchase price and other costs directly

attributable to bringing the asset to its wor#ing condition for its intended use li#e

site preparation, initial delivery and handling charges, installation cost such as for

+* S.C.R.ENGINEERING COLLEGE.

MBA PROGRAMME Y.S.R. SPINNING MILLS (PVT. ) LTD.,

special foundation and professional fees paid to architects and engineers..

D#/r#$iation

;epreciation on fi%ed assets is provided on ,GA method at rates and in the

manner prescribed by the schedule ?CI of the companies act, 19+7 0as amended1

and according to the accounting standard S7 issued by I6A I

Prior /#rio' it#"s