Professional Documents

Culture Documents

2.BMMF5103 FINAL EXAM Formated-Moderated 1-2013

Uploaded by

theatresonicOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2.BMMF5103 FINAL EXAM Formated-Moderated 1-2013

Uploaded by

theatresonicCopyright:

Available Formats

BMMF5103/JAN13/F-WB

1

PART A

INSTRUCTIONS: 1. THERE ARE TWO (2) QUESTIONS IN THIS PART.

2. ANSWER BOTH QUESTIONS.

Question 1

a. The expected returns of Purnama Bhds stock are highly dependent on the state

of the economy as follows:

State of Economy Probability Returns

Depression .05 -50%

Recession .10 -15%

Mild Slowdown .20 5%

Normal .30 15%

Broad Expansion .20 25%

Strong Expansion .15 40%

Based on the information above, calculate the:

(i) expected return. (2 marks)

(ii) standard deviation (6 marks)

(iii) coefficient of variation (2 marks)

b. An investor has invested RM5,000 in a stock which has an estimated beta of 1.2,

and another RM15,000 in the stock of her own company. The risk-free rate is 6

percent and the market risk premium is also 6 percent. If the investor requires 15

percent rate of return for her total (RM20,000) portfolio, what is the beta of her

company?

(5 marks)

BMMF5103/JAN13/F-WB

2

c. What is the difference between unsystematic risk and systematic risk? Describe

the sources of unsystematic risk. What will the required rate of return for an asset

if the level of its systematic risk is high?

(5 marks)

[Total: 20 Marks]

Question 2

a. Your boss has asked you to monitor the financial performance of a company.

You have gathered the following information pertaining to the company.

Net income: RM240

Sales: RM10,000

Total assets: RM6,000

Debt ratio: 75%

TIE ratio: 2.0

Current ratio: 1.2

BEP ratio: 13.33%

You have just discovered that the company could streamline its operations, cut

the operating costs and raise the net income to RM300, without affecting sales or

the balance sheet (the additional profits will be paid out as dividends). How much

would the companys ROE increase due to your latest finding?

(6 marks)

BMMF5103/JAN13/F-WB

3

a. Perkasa Bhd has forecast the following numbers for this upcoming year:

Sales RM1,000,000

Total Costs 600,000

Interest Expense 100,000

Net Income 180,000

The company is in the 40 percent tax bracket. Its total costs always represent 60

percent of its sales. The companys CEO is unhappy with the forecast and wants

the firm to achieve a net income equal to RM240,000. Assume that the

companys interest expense remains constant. In order to achieve this level of

net income, what level of sales(RM) should the company achieve?

(6 marks)

b. What is a liquid asset and why is it necessary for a firm to maintain a reasonable

level of liquid assets?

(4 marks)

c. Explain why the income statement is not a good representation of cash flow.

(4 marks)

[Total: 20 Marks]

BMMF5103/JAN13/F-WB

4

PART B

INSTRUCTIONS: 1. THERE ARE FIVE (5) QUESTIONS IN THIS PART.

2. ANSWER THREE (3) QUESTIONS ONLY.

Question 1

a. What are agency costs and how do these costs come about?

(4 marks)

b. What are the three principal forms of business organisation? What are the

advantages and disadvantages of each?

(6 marks)

c. Discuss the three levels of market efficiency which are distinguished by the

degree of information reflected in security prices.

(6 marks)

d. Discuss the limitations of using the financial ratios to evaluate the financial

position and performance of a company.

(4 marks)

[Total: 20 Marks]

Question 2

a. One year ago, the Brilliant Minds Bhd has deposited RM3,600 in an investment

account for the purpose of buying a new equipment four years from today.

Today, it is adding another RM5,000 to this account. It plans to put in a final

deposit of RM7,500 to the account next year. How much will be available in its

investment account when it is ready to buy the equipment, assuming it earns a

7% rate of return?

(6 marks)

b. You borrow RM149,000 to buy a house. The mortgage rate is 7.5% and the loan

period is 30 years. Payments are made monthly. At the end of 30 years, how

much total interest you have paid?

BMMF5103/JAN13/F-WB

5

(6 marks)

c. (i) Using an example of a savings account, explain the difference between the

effective annual rate and the annual percentage rate.

(4 marks)

(ii) Discuss why a ringgit tomorrow cannot be worth less than a ringgit the day

after tomorrow.

(4 marks)

[Total: 20 Marks]

Question 3

a. The risk-free rate of return is 8 percent; the expected rate of return on the market

is 12 percent. Stock X has a beta coefficient of 1.3, an earnings and

dividend-growth rate of 7 percent, and a current dividend of RM2.40. If the stock

is selling for RM35, should you purchase the stock? Why?

(6 marks)

b. Two stocks each pay a RM1.00 dividend that is growing annually at 8 percent.

Stock I has a beta of 1.3 and Stock II's beta is 0.8.

(i) Which stock is more volatile? Why? (2 marks)

(ii) If treasury bills yield 6 percent and you expect the market return to rise to 12

percent, what is your risk-adjusted required rate of return for each stock?

(3 marks)

(iii) Using the dividend-growth model, what is the maximum amount you would be

willing to pay for each stock?

(3 marks)

BMMF5103/JAN13/F-WB

6

c. A number of publicly traded firms pay no dividends, yet investors are willing to

buy shares in these firms. How is this possible? Does this violate our basic

principle of stock valuation? Explain your answer.

(6 marks)

[Total: 20 Marks]

Question 4

a. A bond is called a premium bond when the selling price is higher than its par

value. Theoretically, why do premium bonds exist?

(4 marks)

b. What is a callable bond? What is the importance of a sinking fund? Should the

issuing company exercise the option to call the bond when the interest rate

rises? Why or why not?

(6 marks)

c. A zero coupon bond has a yield to maturity of 6.33 percent and 12 years until it

fully matures. What is the current price of this bond if the face value is RM1,000?

(4 marks)

d. An annual, ten-year bond is currently selling for RM1,037.86 and has a yield to

maturity of 6.23 percent. What is the coupon rate of this bond if the face value is

RM1,000?

(6 marks)

[Total: 20 Marks]

BMMF5103/JAN13/F-WB

7

Question 5

a. A corporation is considering a capital project for the coming year. The project has

an internal rate of return of 14 percent. If the firm has the following target capital

structure and costs, should it accept the project? Why?

Source of Capital Proportion After-Tax

Cost

Long-term debt 0.40 10%

Preferred stock 0.10 15%

Common stock

equity

0.50 20%

(4 marks)

b. Your company is considering a machine which will cost RM50,000 at Time 0 and

can be sold for RM10,000 after 3 years time. RM12,000 must be invested at

Time 0 in inventories and receivables and this output will be recovered when the

operation is closed at the end of Year 3. The machine will severate sales

revenues of RM50,000/year for 3 years; variable operating costs (excluding

depreciation) will be 40 percent of sales. No fixed costs will be incurred.

Operating cash inflows will begin 1 year from today (at t = 1). The machine will

have depreciation expenses of RM40,000, RM5,000, and RM5,000 in Years 1, 2,

and 3 respectively. The company has a 40 percent tax rate, enough taxable

income from other assets to enable it to get a tax refund on this project if the

project's income is negative, and a 15 percent cost of capital. Inflation is zero.

What is the project's NPV? Should the machine be purchased? Why/Why not?

(8 marks)

c. (i) Should financing costs be included as an incremental cash flows in capital

budgeting analysis? Explain your answer.

BMMF5103/JAN13/F-WB

8

(4 marks)

(ii) Explain the difference between a sunk cost and an opportunity cost by using

appropriate examples.

(4 marks)

[Total: 20 Marks]

QUESTION PAPER ENDS HERE

BMMF5103/JAN13/F-WB

9

APPENDIX

List of formula:

k = RFR + (R

m

RFR) k = (D

1

/P

0

) + g

E(R) = p

i

x R

i

2

= p

i

x (R

i

E(R))

2

=

2(1/2)

CV = / E(R)

E(R)

port

= w

i

x E(R)

I

port

= w

i

x

i

WACC = (w

d

)(k

d

)(1 tax rate) + (w

ps

)(k

ps

) + (w

cs

)(k

cs

)

Current Ratio = Current Assets/Current Liabilities

Quick Ratio = (Current Assets -Inventories)/Current Liabilities

Days Sales Outstanding = Account Receivables/(Sales/365)

Inventory Turnover = Sales/Inventory

Debt ratio = Total Debt/Total Assets

Times Interest Earned = EBIT/interest expense

Gross profit margin = Gross Profit/Sales

Net profit margin = Net Income/Sales

Basic Earning Power = EBIT/Total Assets

Return On Assets = Net Income/Total Assets

Return On Equity = Net Income/Owners Equity

You might also like

- 2.BMMF5103 - EQ Formattedl May 2012Document7 pages2.BMMF5103 - EQ Formattedl May 2012thaingtNo ratings yet

- Bmac 5203Document10 pagesBmac 5203ShaanySirajNo ratings yet

- BMLW5103Document256 pagesBMLW5103Thethanh Phamnguyen67% (3)

- Bbpm2103 Sample FeDocument5 pagesBbpm2103 Sample FeYogeswari SubramaniamNo ratings yet

- Bbaw2103 Financial AccountingDocument9 pagesBbaw2103 Financial AccountingRazi100% (1)

- BMME5103 Full Version Study Guide PDFDocument13 pagesBMME5103 Full Version Study Guide PDFWill NguyenNo ratings yet

- Bbma3103 - Management Accounting 1Document8 pagesBbma3103 - Management Accounting 1Ikmal HisyamNo ratings yet

- Proton Full Report From Proton Case StudyDocument7 pagesProton Full Report From Proton Case Studyilyaninasir91No ratings yet

- Ma 2 - Past Year Questions - PMDocument10 pagesMa 2 - Past Year Questions - PMAna FarhanaNo ratings yet

- FIN420 Individual Assignment 20214Document3 pagesFIN420 Individual Assignment 20214Admin & Accounts AssistantNo ratings yet

- Sales Forecasting: Types of Sales Forecast: The Term Forecast' Is Generally Used To Describe A PredictionDocument18 pagesSales Forecasting: Types of Sales Forecast: The Term Forecast' Is Generally Used To Describe A PredictionVinay GoenkaNo ratings yet

- Ebqm 3103 - Total Quality ManagementDocument12 pagesEbqm 3103 - Total Quality ManagementSITI NOOR AZLYNEI BT RAMLI STUDENTNo ratings yet

- Financial Security of Common Stocks: Case StudyDocument10 pagesFinancial Security of Common Stocks: Case Studyrizzqi shahNo ratings yet

- Bbpm2203 - Marketing Management IIDocument10 pagesBbpm2203 - Marketing Management IISimon RajNo ratings yet

- MPU3223 - 03 Decision Making Skills TMA 1 January 2017Document2 pagesMPU3223 - 03 Decision Making Skills TMA 1 January 2017jowins limNo ratings yet

- BMMF5103: Managerial FinanceDocument182 pagesBMMF5103: Managerial FinanceIam Abdiwali100% (1)

- BBEK4203 Government Budget SurplusDocument4 pagesBBEK4203 Government Budget SurplusMarlissa Nur OthmanNo ratings yet

- 4.dividend DecisionsDocument5 pages4.dividend DecisionskingrajpkvNo ratings yet

- Proposal of SuperstoreDocument5 pagesProposal of SuperstoreTamzid Rabby Tanmoy100% (1)

- BBMA3203 MANAGEMENT ACCOUNTING II (Exam)Document9 pagesBBMA3203 MANAGEMENT ACCOUNTING II (Exam)AnnieNo ratings yet

- Test 1 Maf653 Oct2017 QnADocument7 pagesTest 1 Maf653 Oct2017 QnAFakhrul Haziq Md FarisNo ratings yet

- BBFA2303 Sample Exam QuestionDocument11 pagesBBFA2303 Sample Exam QuestionAnnieNo ratings yet

- Financial Accounting KartiniDocument10 pagesFinancial Accounting KartinikarrthiniNo ratings yet

- BBFA2303 Take Home Exam - Eng & BM - Jan20Document10 pagesBBFA2303 Take Home Exam - Eng & BM - Jan20AnnieNo ratings yet

- PBL Case 2 - Ais 630Document36 pagesPBL Case 2 - Ais 630Normala HamzahNo ratings yet

- Ologopoly NoteDocument11 pagesOlogopoly NoteSneha VarmaNo ratings yet

- Financial Structure Analysis of Two Malaysian Public Listed CompaniesDocument8 pagesFinancial Structure Analysis of Two Malaysian Public Listed CompanieskaybeezuhdiNo ratings yet

- Multiple Choice Practice QuestionsDocument41 pagesMultiple Choice Practice QuestionsFurqan Ahmed KhanNo ratings yet

- Bbaw2103 - Financial AccountingDocument13 pagesBbaw2103 - Financial AccountingSimon RajNo ratings yet

- Business Information System Assignment-I What Is An Information System?Document7 pagesBusiness Information System Assignment-I What Is An Information System?Amit SanglikarNo ratings yet

- Reconfigurable OrganisationDocument10 pagesReconfigurable OrganisationelvatoNo ratings yet

- Fin430 - Dec2019Document6 pagesFin430 - Dec2019nurinsabyhahNo ratings yet

- Homework Economic - Topic 2.3Document13 pagesHomework Economic - Topic 2.3Do Van Tu100% (1)

- Recognition of Financial AssetDocument2 pagesRecognition of Financial Assethaliza amirahNo ratings yet

- BMME5103 - Assignment - Oct 2011 211111Document6 pagesBMME5103 - Assignment - Oct 2011 211111maiphuong200708No ratings yet

- SCCG3123 Ia1 238529Document5 pagesSCCG3123 Ia1 238529نور شهبره فانوتNo ratings yet

- Assessing financial performance of AEON and PARKSONDocument27 pagesAssessing financial performance of AEON and PARKSONPK LNo ratings yet

- ABPG1103/SAMPLE: Explaining Maslow's Hierarchy and Describing Sleep DisordersDocument1 pageABPG1103/SAMPLE: Explaining Maslow's Hierarchy and Describing Sleep DisordersBabraNo ratings yet

- Tutorial 9 Year End Adjustments (Q)Document4 pagesTutorial 9 Year End Adjustments (Q)lious liiNo ratings yet

- Mystery of Disappearing OilDocument19 pagesMystery of Disappearing OilAini SalehaNo ratings yet

- BMAC5203Document177 pagesBMAC5203PrabhuNo ratings yet

- AssignmentDocument6 pagesAssignmentHisham WahabNo ratings yet

- BBGO4103 Organisational Behaviour AssignmentDocument10 pagesBBGO4103 Organisational Behaviour AssignmentIja Mirza0% (1)

- PBL 2 Mac 2020Document4 pagesPBL 2 Mac 2020Ummu UmairahNo ratings yet

- ACC 106 Chapter 1Document13 pagesACC 106 Chapter 1Firdaus Yahaya100% (4)

- BBMP1103 Mathemaics For Management AssignmentDocument12 pagesBBMP1103 Mathemaics For Management AssignmentANGEL DEBORAH JOHN studentNo ratings yet

- Individual Assignment March 2021Document1 pageIndividual Assignment March 2021Muhammad RusydiNo ratings yet

- Assignment/ Tugasan - Accounting TheoryDocument10 pagesAssignment/ Tugasan - Accounting TheoryWONGNo ratings yet

- Introduction ... . 3: PagesDocument29 pagesIntroduction ... . 3: PagesVithia AngamuthuNo ratings yet

- A162 Answer Tutorial 1 and Answer Siti NorlizaDocument13 pagesA162 Answer Tutorial 1 and Answer Siti NorlizaXiao Yun Yap0% (2)

- Transaction Processing SystemDocument7 pagesTransaction Processing SystemHimanshu AggarwalNo ratings yet

- Business Process Reengineering Critical PDFDocument19 pagesBusiness Process Reengineering Critical PDFadambg88100% (1)

- MGT657 Jan2013 PDFDocument5 pagesMGT657 Jan2013 PDFAthirah Hassan0% (1)

- Maths Derivatives Integration Profit FunctionsDocument7 pagesMaths Derivatives Integration Profit Functionseffendy100% (1)

- BBPR 2103 Planning Recruitment and Selection of HRDocument7 pagesBBPR 2103 Planning Recruitment and Selection of HRalistairNo ratings yet

- BBS 3rd Year Foundation of Financial Systems Model QuestionDocument8 pagesBBS 3rd Year Foundation of Financial Systems Model QuestionNirajan SilwalNo ratings yet

- Pravinn Mahajan CA FINAL SFM-NOV2011 Ques PaperDocument9 pagesPravinn Mahajan CA FINAL SFM-NOV2011 Ques PaperPravinn_MahajanNo ratings yet

- Group Assignment Fm2 A112Document15 pagesGroup Assignment Fm2 A112Ho-Ly Victor67% (3)

- Financial Management Tutorial QuestionsDocument8 pagesFinancial Management Tutorial QuestionsStephen Olieka100% (2)

- TWO (2) Questions From SECTION B in The Answer Booklet Provided. All Question CarryDocument4 pagesTWO (2) Questions From SECTION B in The Answer Booklet Provided. All Question CarrynatlyhNo ratings yet

- YumeSdnBhd SampleBusinessPlanDocument96 pagesYumeSdnBhd SampleBusinessPlanvesagan100% (1)

- DownloadDocument2 pagesDownloadtheatresonicNo ratings yet

- Chronology - Event Batu PutehDocument167 pagesChronology - Event Batu PutehtheatresonicNo ratings yet

- Application Procedures For Copyright Voluntary Notification - 2022Document3 pagesApplication Procedures For Copyright Voluntary Notification - 2022theatresonicNo ratings yet

- Cfp-9353-Gryphon Graphite Chemical Industries LTDDocument2 pagesCfp-9353-Gryphon Graphite Chemical Industries LTDtheatresonicNo ratings yet

- The Mythos of The ArkDocument48 pagesThe Mythos of The ArktheatresonicNo ratings yet

- The Secret of The LodgeDocument248 pagesThe Secret of The LodgeClaudio Novaes100% (1)

- The Royal Arch Exaltation CeremonyDocument22 pagesThe Royal Arch Exaltation Ceremonytheatresonic100% (2)

- Magner 22 User ManualDocument10 pagesMagner 22 User ManualtheatresonicNo ratings yet

- Entered Apprentice Fellow Craft Master Mason: 1st Degree 2nd Degree 3rd DegreeDocument22 pagesEntered Apprentice Fellow Craft Master Mason: 1st Degree 2nd Degree 3rd DegreetheatresonicNo ratings yet

- TRUEHNDocument3 pagesTRUEHNtheatresonicNo ratings yet

- Letter To World LeadersDocument6 pagesLetter To World LeaderstheatresonicNo ratings yet

- Frequently Ask Questions (Faq) Perlindungan Tenang Voucher (PTV)Document6 pagesFrequently Ask Questions (Faq) Perlindungan Tenang Voucher (PTV)theatresonicNo ratings yet

- Senerath Gunawardena Marketing PlanDocument21 pagesSenerath Gunawardena Marketing PlantheatresonicNo ratings yet

- Seminar Tawau - Kawalselia Kelengkapan ElektrikDocument43 pagesSeminar Tawau - Kawalselia Kelengkapan ElektriktheatresonicNo ratings yet

- Defining The Benefits of It Investments in Business PracticeDocument8 pagesDefining The Benefits of It Investments in Business PracticetheatresonicNo ratings yet

- Employee Adjustment and Well-Being in The Era of COVID-19: Implications For Human Resource ManagementDocument20 pagesEmployee Adjustment and Well-Being in The Era of COVID-19: Implications For Human Resource ManagementSarita MoreNo ratings yet

- Malaysian Economics Development PDFDocument171 pagesMalaysian Economics Development PDFtheatresonicNo ratings yet

- WORLD BANK PDFDocument93 pagesWORLD BANK PDFtheatresonicNo ratings yet

- Insurance Plan OverviewDocument90 pagesInsurance Plan OverviewAlmira SalsabilaNo ratings yet

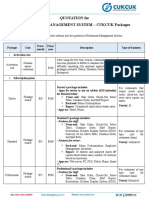

- Restaurant Management System Quotation Provides Packages Starting from $30/MonthDocument2 pagesRestaurant Management System Quotation Provides Packages Starting from $30/MonththeatresonicNo ratings yet

- Malaysian Economics Development PDFDocument171 pagesMalaysian Economics Development PDFtheatresonicNo ratings yet

- A Proposal For An Economic Attendance Management System: Bokrae Jang, Jaegeol Yim and Seung-Hyun OhDocument10 pagesA Proposal For An Economic Attendance Management System: Bokrae Jang, Jaegeol Yim and Seung-Hyun OhMd. Hasin Ishrak ZuhaniNo ratings yet

- Alliance Lite2: Your Connection To The Financial WorldDocument2 pagesAlliance Lite2: Your Connection To The Financial WorldtheatresonicNo ratings yet

- Nice WFM 7.0Document15 pagesNice WFM 7.0theatresonicNo ratings yet

- Silo - Tips - 1 Andalusia Is An Excellent Location For Business in Spain EuropeDocument14 pagesSilo - Tips - 1 Andalusia Is An Excellent Location For Business in Spain EuropetheatresonicNo ratings yet

- Rank Picture Thought Leader InfoDocument7 pagesRank Picture Thought Leader InfotheatresonicNo ratings yet

- Realmalay PDFDocument326 pagesRealmalay PDFtheatresonicNo ratings yet

- Descarga-En-2 AndaluciaDocument110 pagesDescarga-En-2 AndaluciatheatresonicNo ratings yet

- Malay Chiri Sanskrit PDFDocument36 pagesMalay Chiri Sanskrit PDFtheatresonicNo ratings yet

- Internship Report: N. M. Baki Billah Lecturer, BRAC Business School Brac UniversityDocument35 pagesInternship Report: N. M. Baki Billah Lecturer, BRAC Business School Brac Universityanisul islamNo ratings yet

- The Advantages and Disadvantages of FIFO MehtodDocument5 pagesThe Advantages and Disadvantages of FIFO Mehtodmuhammadifan2210100% (8)

- Procurement Strategies and StructuresDocument52 pagesProcurement Strategies and StructuresKalkidan100% (1)

- BANALATA SWEETS Homemade Food Business PlanDocument10 pagesBANALATA SWEETS Homemade Food Business PlanAhsan TanmirNo ratings yet

- Comparative Analysis of Mutual FundsDocument76 pagesComparative Analysis of Mutual FundsAditi Atre0% (1)

- Market Microstructure OverviewDocument7 pagesMarket Microstructure OverviewflavioNo ratings yet

- Technical Analysis ElearnDocument44 pagesTechnical Analysis ElearnRavi Tomar100% (3)

- (Answer Keys) : Multiple Choice Exercise QuestionsDocument3 pages(Answer Keys) : Multiple Choice Exercise QuestionsCharlyn Jewel Olaes100% (1)

- The Cost of Capital: Prof. Dr. MD Mohan UddinDocument57 pagesThe Cost of Capital: Prof. Dr. MD Mohan UddinMd. Mehedi HasanNo ratings yet

- International BusinessDocument9 pagesInternational BusinessNiraj MishraNo ratings yet

- Media Budget - LaysDocument3 pagesMedia Budget - Laysapi-479482734No ratings yet

- Social Media: PortfolioDocument26 pagesSocial Media: PortfolioF IklanquNo ratings yet

- Elliott Wave Theory Is A Collection of Complex TechniquesDocument6 pagesElliott Wave Theory Is A Collection of Complex TechniquessriNo ratings yet

- PFRS 2 Share-Based Payments GuideDocument18 pagesPFRS 2 Share-Based Payments GuideRaezel Carla Santos FontanillaNo ratings yet

- MKT 101 Chap 10Document21 pagesMKT 101 Chap 10বহুব্রীহি আর একটা দাঁড়কাকNo ratings yet

- R58 Basics of Derivative Pricing and Valuation - Q BankDocument17 pagesR58 Basics of Derivative Pricing and Valuation - Q BankAdnan AshrafNo ratings yet

- 807512Document24 pages807512Shweta SrivastavaNo ratings yet

- BM - Module 3 - IMT NagDocument20 pagesBM - Module 3 - IMT NagChitvan DaulaniNo ratings yet

- Arbitrage Pricing TheoryDocument4 pagesArbitrage Pricing TheoryVijaya KadiyalaNo ratings yet

- Case Analysis Direction: Analyze The Case and Answer The Given QuestionsDocument2 pagesCase Analysis Direction: Analyze The Case and Answer The Given QuestionsZednem JhenggNo ratings yet

- Pastillas DelightDocument6 pagesPastillas DelightBryan DutchaNo ratings yet

- Bajaj Auto Salesforce StrategyDocument18 pagesBajaj Auto Salesforce Strategym omprakashNo ratings yet

- Idea To Launch (Stage Gate) Model: An Overview: by Scott J. EdgettDocument5 pagesIdea To Launch (Stage Gate) Model: An Overview: by Scott J. EdgettanassaleemNo ratings yet

- International Strategic ManagementDocument82 pagesInternational Strategic Managementhimanshu sisodia50% (2)

- Marketing ManagementDocument90 pagesMarketing Managementmech430No ratings yet

- Pivot Point Trading Strategy GuideDocument12 pagesPivot Point Trading Strategy Guideforstermakhado492No ratings yet

- The Harvard and Chicago Schools and The Dominant FirmDocument28 pagesThe Harvard and Chicago Schools and The Dominant FirmGhada TariqNo ratings yet

- St. Vincent de Ferrer College Financial Management 2 Exam ReviewDocument4 pagesSt. Vincent de Ferrer College Financial Management 2 Exam ReviewNANNo ratings yet

- Tesco's International Expansion into the US Market with Fresh & Easy Convenience StoresDocument11 pagesTesco's International Expansion into the US Market with Fresh & Easy Convenience StoresAmmar KhanNo ratings yet

- Pas 21 The Effects of Changes in Foreign Exchange RatesDocument2 pagesPas 21 The Effects of Changes in Foreign Exchange RatesRaven BermalNo ratings yet