Professional Documents

Culture Documents

Internship Report Format

Uploaded by

Gopi Nath0 ratings0% found this document useful (0 votes)

47 views57 pagesinternship report

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentinternship report

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

47 views57 pagesInternship Report Format

Uploaded by

Gopi Nathinternship report

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 57

DESIGNING A FINANCIAL MODEL FOR MAHARASHTRA CSC PROJECT

AT M/S. BHARTIYA SAMRUDDHI FINANCE LIMITED

A Summer internship report submitted in partial fulfillment of the Degree of Master of

Business Administration of Thiagarajar School of Management, Madurai

By

SRIRAM B.S.K.

Reg No 1011081

Under the guidance of

Internal Guide : Prof. Subramanian, Finance Area

External Guide : Mr. Vikas Raut, Senior Manager, BSFL

Thiagarajar School of Management

Autonomous

(Affiliated to Madurai Kamaraj University)

Madurai 625 005

April June 2012

2

CERTIFICATE FROM COLLEGE Comment [a1]: Will be issued by TSM in TSM

letter head.

3

DECLARATION BY THE CANDIDATE

SRIRAM B.S.K.

Reg No 1011081

II MBA

THIAGARAJAR SCHOOL OF MANAGEMENT

MADURAI 5

I hereby state that the report entitled, DESIGNING A FINANCIAL MODEL FOR

MAHARASHTRA CSC PROJECT AT M/S. BHARTIYA SAMRUDDHI FINANCE

LIMITED was undertaken at M/s. Bhartiya Samruddhi Finance Ltd. in Hyderabad,

submitted to Thiagarajar School of Management, Madurai in partial fulfillment of Master of

Business Administration Degree is a record of original work done by me and no part of this

internship report has been submitted for the award of any other Degree, Diploma, Fellowship

or other similar studies.

Place: Madurai

Date:

Signature of the Candidate

(SRIRAM B.S.K.)

4

LETTER OF AUTHORIZATION Comment [A2]: Refers to Certificate issued by

Organization on completion of your Internship.

5

Adhavan.A.S. +91-9500346007

adhavemail@gmail.com

_____________________________________________________________

_

Career objective:

To work in a challenging environment where I can apply my

knowledge and develop my skills for the betterment and growth of my

organization with sincerity and commitment.

Academic Qualification:

Year of

passing

Qualification Institution % or CGPA

2013 MBA

Thiagarajar School of

Management,

Madurai

CGPA: 7.15

(till II

trimester)

2010 B.B.A

JAMAL MOHAMED ARTS

& SCIENCE COLLEGE,

Trichy

78%

2007 HSC

SRIRANGAM BOYS

HIGHER SECONDARY

Trichy

84%

2005 Tenth

MAHATHMA GHANDHI

HIGHER-SECONDARY

VIDYALAYA , TENNUR,

TRICHY-17

66%

Awards and Accolades:

Best v.c. award from P&G.

Four certificates for topper in U.G.

Highlights

Areas of interest

Financial accounting

Financial analysis

Quick learner

Fluent in English and

Tamil

References:

Prof. M. Subramanian,

Assistant Professor

(Finance Area),

Thiagarajar School

of Management,

Pamban Swamy Nagar,

Thiruparankundram,

Madurai - 625 005

Official email:

subramanianm@tsm.

ac.in

Cell: (0)99521-18297

Prof.M. Arunachalam,

Assistant Professor,

Thiagarajar School

of Management,

Pamban Swamy Nagar,

Thiruparankundram,

Madurai - 625 005

Official email:

arunachalamm@tsm.

ac.in

Cell: (0)94436-64470

6

Other qualifications and skills:

Hardware and networking from systec academy, Trichy

Typewriting lower.

Software known Microsoft office, Tally, spss.

Hindi Language certificate of prathmic

Industrial Exposure:

Industrial visit - LOYAL TEXTILES in Kovilpatti

Two years experience as Team leader in B.P.O.

One year experience as marketing executive in P&G distributor.

Extra Curricular Activities:

Interest in karathi, kabadi, foot ball etc.

Special interests:

Internet surfing, blogging.

Personal Information:

Name : Adhavan.A.S

Date of Birth : 31-03-1989

Fathers Name : A.sivasubramanian

Address : 6/25 palanichamy konar store,

Bharathi nagar, Tennur,

Trichy-17

Declaration:

I hereby declare that the information stated above is true to the best of my knowledge.

Madurai,

28-02-2012 (Adhavan.A.S.)

7

ACKNOWLEDGEMENT

I put forth my heart and soul to thank the management of ICRA MANAGEMENT

CONSULTING SERVICES LTD., CHENNAI for giving me the golden opportunity to

pursue my summer internship with them.

I also extend my deep sense of gratitude to Mr.R.Raghuttama Rao, Managing Director, ICRA

Management Consulting Services Ltd, for giving me the opportunity to undertake my

internship program. I am thankful to Mr. M. Sairam, Assistant General Manager, ICRA

Management Consulting Services Ltd.,) for the valuable suggestions, constant encouragement

and constructive criticism at every step of my internship.

I sincerely thank Dr. M. Naga Raju, Principal, Thiagarajar School of Management, for his

encouragement and Ms.S.Anjana, Assistant Professor, TSM for providing guidance and

valuable ideas which helped me to complete this project successfully.

Finally, I extend my heartfelt thanks to my friends and family members who have been a

source of inspiration and support during my internship.

8

EXECUTIVE SUMMARY

The purpose of the study is to understand the Market Preferences in the

Broadband Segment in South India. It also concentrates in finding the level of Broadband

penetration in each State. A market survey has been conducted in South India (Tamilnadu,

Kerala, Karnataka and Andhra Pradesh) for this purpose. It helps to identify the top players in

terms of their market share and also the most preferred brand. It helps to reveal the buying

behavior of the consumers while selecting a broadband connection from an Internet Service

Provider (ISP).

9

TABLE OF CONTENTS

CHAPTER TOPIC PAGE NO.

List of Table 10

List of Graphs 11

List of Figures 12

Chapter 1 Introduction 13

1.1 Nature and Scope of the Project 14

1.2 Implifications of the Study 15

1.3 Chapterisation 15

Chapter 2 Organizational profile and Review of literature 16

2.1 Profile of the Industry 17

2.2 BASIX Group 17

2.3 Bhartiya Samruddhi Finance Ltd. 18

2.4 Background of CSC 19

2.5 CSC Services 20

2.6 Review of Literature 23

2.7 Value Chain of BSFL + CSC 24

Chapter 3 Business Plan & Financial Model Development 25

3.1 Business Plan 26

3.1.1 Executive Summary 26

3.1.2 The Market 28

3.1.3 Strategies 28

3.1.4 The Management Structure 29

3.2 The Financial Plan 30

3.2.1 Financial Needs Summary 30

3.2.2 Revenue Model 31

3.2.3 Assumptions and Comments 31

3.3 Development of Model 32

3.3.1 Revenue Sharing 33

10

3.3.2 Market sales assumptions 34

3.3.3 Setup and Fixed cost assumptions 34

3.3.4 Rollout Plan 37

3.3.5 Individual CSC Financial model 37

3.3.6 Income Statement 38

3.3.7 Cash Flow Statement 39

Chapter 4 Analysis and Interpretation 40

4.1 Financial Analysis 41

4.1.1 Breakeven Analysis 41

4.1.2 Ratio Analysis 42

4.2 Business Process Mapping 43

4.2.1 Flowchart for CSC Commissioning 44

4.2.2 Flowchart for CSC Operation 45

4.3 Financial Interpretation 45

Chapter 5 Recommendation, Limitation and Conclusion 47

5.1 Recommendations 48

5.2 Limitations 48

5.3 Conclusion 48

Chapter 6 Bibliography 49

Chapter 7 Appendix 51

7.1 Work Diary 52

7.2 Financial Model 54

7.3 Breakeven Analysis 55

11

LIST OF TABLES

SL. NO. TITLE PAGE NO.

2.1 Parties involved in CSC 20

2.2 Value chain of CSC 24

3.1 Market Analysis 28

3.2 1

st

Yr Setup and Operating Costs 30

3.3 Revenue Share 34

3.4 Market Sales Assumptions 34

3.5 CSC Setup Cost 35

3.6 Cluster Office Setup Cost 35

3.7 State Office Setup Cost 35

3.8 IT Infrastructure Cost 35

3.9 HR Fixed Cost 36

3.10 Office Opex 36

3.11 CSC Portal Fixed Cost 36

3.12 Variable Cost 36

3.13 Rollout Plan 37

3.14 Income Statement for Year 1 38

3.15 Cash flow Statement for March 2012 39

4.1 Breakeven Table for the business 41

4.2 Ratio Analysis 42

7.1 Work Diary 52

12

LIST OF GRAPHS

SL. NO. TITLE PAGE NO.

4.1 Breakeven chart for the business 42

7.1 Revenue Mix 54

7.2 Expense Mix 54

7.3 Rollout Completion 55

7.4 Breakeven Chart 55

13

LIST OF FIGURES

SL. NO. TITLE PAGE NO.

2.1 BASIX Corporate Structure 18

2.2 CSC 3-Tier Structure 19

4.1 CSC Commissioning Flowchart 44

4.2 CSC Operation Flowchart 45

14

CHAPTER 1

INTRODUCTION

15

1. Introduction

1.1 Nature and Scope of the Project

This internship project attempts to develop a financial model for the CSC business in

Maharashtra Nashik region. The product portfolio, forecasted financials, breakeven study is

also conducted on the prepared business model. Two technical analyses are done to decide

upon the ways to improve financial performance. In addition a commissioning flowchart and

a operation flowchart are designed to speed up the roll-out process.

Name of the Business: CSC Project in Nashik region (Nashik region includes Nashik,

Jalgaon, Ahmednagar, Dhule and Nandubar districts)

Services to be provided: Both G2C (Government to Consumer) and B2C (Business to

Consumer) service

Nos of CSCs: 1,362 in Nashik region

Some of the B2C services: Micro credit, Micro insurance, Education loans, Micro

enterprise loans, etc.

Some of the G2C services: Issuance of certificates, land records, bill payments, ticket

booking, ePayments, etc.

Deliverables of the Project:

1. Financial model should contain initial CSC rollout model, services roll out model,

business revenues, expenses, projected financials and breakeven analysis by

considering all of the legal (in accordance to MSA), operational (actual field data)

constraints and field and past assumptions.

2. Model will be consisting of all G2C and B2C businesses, revenue sharing options,

multiband CSC productivity.

3. In addition I am also preparing a commissioning process flowchart for CSC which

will be helpful for a hassle free commissioning and completion during rollout.

16

1.2 Implications of the Study

This project gives the field managers a tool to understand how to improve the financial

performance, what corrective actions can be done to strengthen the cash flows. Also the

managers can view what amount of expenses will be incurred in addition for the extra sales

effort taken by the VLE. In addition, breakeven point is to be found for the companys

business. Also the commissioning (rollout) flow chart will be helpful to speed up the rollout

processes

1.3 Chapter Scheme

Chapter 1:

This chapter deals with introduction about the project which includes the Nature & scope and

implication of the project

Chapter 2:

This chapter deals with organization profile and review of literature

Chapter 3:

This chapter deals with the business plan and financial model and its development

Chapter 4:

This chapter deals with the Analysis and Interpretation of the financial model. Breakeven

Analysis is conducted on the financial model. It also covers the commissioning flowchart and

operation flowchart.

Chapter 5:

This chapter deals with the conclusions, recommendations and limitations of the project

Chapter 6:

This chapter contains Bibliography

Chapter 7:

This chapter contains Work diary, references, financial model & flowcharts

17

18

CHAPTER 2

ORGANIZATION PROFILE AND

REVIEW OF LITERATURE

19

2. Organization profile and review of literature

2.1 Profile of the Industry

Micro Finance Institutions is collection of small scale financial service providers serving at

the BOP (bottom of pyramid) population. They concentrate on population which has been

financial excluded in the traditional financial system and concentrate to up lift their

livelihood and empowerment. MFIs (abbreviation for Micro-Finance Institutions) operate on

both small scale credit and savings collection from the largely financial excluded population

who are in dire need of capital for their agriculture and non agriculture based livelihood.

Learnt from the highly successful Grameen Bank based in Bangladesh, many MFIs have been

started in India with their vision aligned to reduce poverty, improve savings of the deprived

population and to develop the BOP economics activities. As of March 2009, MFIs in India

has reached more than 22 million borrowers and had a portfolio outstanding (loan and credit

lended to the borrowers) in excess of $2.3 billion. The industries ROE (Return on Equity)

typically ranges from 20% to 30%.

From 2006 to 2010, the industrys CAGR for loan portfolio outstanding is 86% and for

number of borrowers is 96%. These figures are remarkable considering the higher interest

rate needed to be charged by MFI to achieve the last mile connectivity to the BOP. These

days, MFIs have started to provide non credit facilities to cater the growing need of other

services to their borrowers. The new services have made them attractive to grow in both their

current and newer businesses.

2.2 BASIX Group

History:

BASIX (or Bhartiya Samruddhi Investments and Consulting Service) is a livelihood

promoting organization founded in 1996 by Shri Vijay Mahajan, Shri Deep Joshi and Shri

Bharathi Gupta Ramola. It works with more than 1.5 million households and has presence in

19 states through its 244 unit locations. BASIX is a collection of different entities that work

in synergy to create a sustainable model for Microfinance in India.

The holding company is BASICS Ltd. It set up two fund based companies Bhartiya

Samruddhi Finance Ltd, a micro-finance NBFC in 1997 and Krishna Bhima Samruddhi Local

Area Bank Ltd in 2001.

20

Mission:

BASIX mission is to promote a large number of sustainable livelihoods, including for the

rural poor and women, through the provision of financial services and technical assistance in

an integrated manner. BASIX will strive to yield a competitive rate of return to its investors

so as to be able to access mainstream capital and human resources on a continuous basis.

Corporate Structure:

Figure 2.1: BASIX Corporate Structure

2.3 Bhartiya Samruddhi Finance Ltd.

Bhartiya Samruddhi Finance Ltd. is registered with the Reserve Bank of India (RBI) as a Non

Banking Finance Company (NBFC) and incorporated as a Company under the Companies

Act, 1956, through which credit and technical assistance is delivered. This is the flagship

company of the BASIX group.

BASICS Ltd earlier owned nearly 100 percent of Samruddhi with an equity base of Rs 4.5

crore at its birth in the year 1997. Samruddhi expanded its equity base to Rs 20.6 crore in

21

2001. The additional equity came from the IFC, Washington, Shore Bank, Chicago; Hivos-

Triodos Fund, Netherlands; the ICICI Bank and HDFC Limited from India. The investment

by BASICS Ltd was also enhanced to Rs 9.7 crore, bringing its share of Samruddhi holdings

to 49.5 percent.

2.4 Background of CSC

The CSC is a strategic cornerstone of the National e-Governance Plan (NeGP), as part of its

commitment in the National Common Minimum Programme to introduce e-governance on a

massive scale.

The CSCs would provide high quality and cost-effective video, voice and data content and

services, in the areas of e-governance, education, health, telemedicine, entertainment as well

as other private services. A highlight of the CSCs is that it will offer web-enabled e-

governance services in rural areas, including application forms, certificates, and utility

payments such as electricity, telephone and water bills.

The Scheme creates a conducive environment for the private sector and NGOs (in our case it

is BSFL which is a part of BASIX Group dealing with livelihood program for rural public) to

play an active role in implementation of the CSC Scheme, thereby becoming a partner of the

government in the development of rural India. The PPP model of the CSC scheme envisages

a 3-tier structure consisting of the CSC operator (called Village Level Entrepreneur or VLE)

the Service Centre Agency (SCA), that will be responsible for a division of 500-1000 CSCs

and a State Designated Agency (SDA) identified by the State Government responsible for

managing the implementation over the entire State.

Figure 2.2: CSC 3-Tier Structure

State Designated

Agency (for

Maharashtra SETU)

Service Center

Agency (for Nashik

BSFL)

Village Level

Entrepreneurs (at

1362 locations)

22

The CSC Scheme has been approved by Government in September 2006 with an outlay of

Rs.5742 Crore over a period of 4 years.

BSFL has successfully implemented CSC projects in Orissa, Tripura, Sikkim and Meghalaya.

BSFL has started to commission CSC centers in Punjab from March 2011 and from currently

BSFL has undertaken to start their CSC centers in Maharashtra. In Maharashtra, BSFL has

won license to setup CSC in Nashik Region which includes Nashik, Ahmednagar, Dhule,

Nandurbar and Jalgaon.

Parties involved in CSC Maharashtra

Sl Company Designation Responsibility

1 SETU SDA It is the bridge between DoT, GoM (Maharashtra

Govt.) and SCA regarding all CSC activities.

2 BSFL SCA Party responsible to setup and operate 1362 locations

of CSC in Nashik region for four years

3 BKSL Livelihood service

provider

Provides AgLEDS services

4 B-ABLE Vocation Training

provider

Provides Vocational training courses

5 Magnum Opus IT Partner Responsible to provide all IT support, to initial recruit

1362 VLEs, train them and develop CSC portal for its

operation

6 AVIVA / Royal

Sundaram

Insurance provider Provider of General and Life Insurance

7 DoT NeGP Provider Monitors the progress of NeGP implementation and

provides viability funding to the SCA

Table 2.1 Parties involved in CSC

2.5 CSC services

CSC will be providing both G2C and B2C Services for the benefit of rural areas. BSFL will

be extending its micro credit and other livelihood services via B2C channel to these CSC and

capture the rural market. Some of the key G2C services are

1. Land records

2. Vehicle Registration

3. Issue of certificates / Government schemes

23

4. Employment exchange

5. Ration cards

6. Electoral services

7. Pension schemes

8. Road transport

9. Public grievance

10. Utility / Telephone Bills (Government undertakings)

Some key B2C services of BSFL through CSC are

1. Micro credit

2. Micro insurance

3. Livelihood programs

4. AgBDES (Agriculture & Business Development Services)

In addition to these B2C services, BSFL is building tie up with other partners to market their

product through CSCs. Some of them are

1. Gautham Polymers

2. Hariyali Kisan Bazaar, Etc.,

Also, the CSCs can provide services like

1. Commercial Services

a. Digital Photos

b. Web surfing

c. Photocopy

d. DTP, Email / Chats

e. CD Burning, Etc.

24

2. e-Commerce / online services

a. Railway Tickets

b. Astrology

c. Matrimonial

d. Shopping

e. Resumes

3. Education Services

a. IT Education

b. English Skills Training

4. Entertainment

a. DTH - Community TV

b. Telemedicine

5. Business-to-Business services (B2B)

a. Advertising & Promotion Services

b. Data Collection Services

c. Research Data collection

d. Distribution Services

6. Banking Services

a. Loan application

b. Collection of deposits

c. Drawing money

25

2.6 Review of Literature

Financial Planning by Richard A Brealey & et. all. (Principle of Corporate Finance, 8

th

Edition McGraw Hill)

Financial statements not only help you to understand the past but they also provide the

starting point for developing a financial plan for the future. Here is where finance and

strategy need to come together. A coherent financial plan demands an understanding of how

the firm can generate superior long-term returns by its choice of industry and by the way that

it position itself within that industry. When companies prepare a financial plan, they dont

just look at the most likely outcomes. They also plan for the unexpected. One way to do this

is to work through the consequences of the plan under the most likely set of circumferences

and then use sensitivity analysis to vary assumptions one at a time. Another approach is to

look at the Implifications of different plausible scenarios.

Financial Modeling by Simon Benninga (Financial Modeling, 2

nd

Edition Cambridge MIT

Press)

Financial modeling is the task of building an abstract representation (a model) of a

financial decision making situation. This is a mathematical model designed to represent (a

simplified version of) the performance of a financial asset or a portfolio, of a business,

a project, or any other investment. Financial modeling is a general term that means different

things to different users; the reference usually relates either to accounting and corporate

finance applications, or to quantitative finance applications. While there has been some

debate in the industry as to the nature of financial modeling - whether it is a tradecraft, such

as welding, or a science - the task of financial modeling has been gaining acceptance and

rigor over the years.

26

2.7 Value chain of BSFL + CSC

P

r

i

m

a

r

y

A

c

t

i

v

i

t

i

e

s

Finance: Low investment cost, BASIX is trying to reach more number of rural customers with established

supply chain like CSC

Corporate Management: BASIX has the blend of both professional and NGO style of management. The

primary goal of business is to make money for sustainable growth and to cater the livelihood of rural population

through their timely intervention

Technology: BASIX is to partner with network and IT solution provider M/s. Magnum Opus for its IT

services, VLE identification, recruitment and training. MO will also develop CSC web-portal

Human Resource: Clear organization structure and dedicated team to overlook the commissioning part of

CSC. VLE will own and run the CSC, MO FX (Field Executive) will act as the bridge between VLEs and

BSFL & MO.

S

e

c

o

n

d

a

r

y

A

c

t

i

v

i

t

i

e

s

Sourcing:

1. For B2C services, BSFL and

Magnum will partner with many

businesses to establish their sales

activity

2. For G2C services, Maha e-Seva site

will be used to cater to the need

3. For BASIX services, BDX will

directly reach to the VLEs and collect

referrals and loan processing forms

4. BSFL will provide banking facility

to CSC

Operations:

1. VLE

operates from

the CSC

Center

2. VLE does

all his online

transactions

via special

B2C portal

and G2C

portals

3. BSFL BDX

collects the

offline filled in

application to

process BSFL

micro credit,

insurance etc.

Distribution:

1. Livelihood

Service

Providers) will

come to village

to provide

AgBDES

services

2. People can

directly come

to CSC to apply

for certificates

3. B-ABLE will

provide based

upon the batch

strength

Marketing:

1. VLE can

market their

services via

posters,

signboard

2. CSC also

gets approval

from Gram

Panchayat

3. CSC cannot

advertise in

newspaper for

advertisement

and at the same

time all its

services offered

must be

overseen by

SCA (BSFL)

Service:

1. Faster

delivery of

Government

services

2. No chance

of corruption

for speeding

up the process

3. Last mile

connectivity

for many rural

based

businesses

Table 2.2 Value chain of CSC

27

CHAPTER 3

BUSINESS PLAN & FINANCIAL

MODEL DEVELOPMENT

28

3. Business Plan & Financial Model Development

3.1 Business Plan

Business Planning is not just about producing a report. The work of writing, of thinking

things through is as important as the final document. The Business Plan is dynamic.

Each business and its personality are different and the Business Plan should reflect this.

Objectives of a business plan are

Is the idea viable?

It helps to think long term, not just about starting a business but staying in business.

Is the business going to be profitable?

Will the company require outside financing to start or operate this business?

What are the major bottlenecks?

It will help to anticipate problems.

Gathering information for the plan will increase the decision makers knowledge of

the industry thereby assisting you in making more informed decisions.

The plan raises questions that will help inspire solutions before a crisis occurs.

By identifying strengths and weaknesses, it reveals where the business will need

assistance.

Use the Business Plan as a guide to keep you focused and making progress during the

business start up phase.

Use the Business Plan to sell your business opportunity to potential investors,

employees and suppliers.

3.1.1 Executive Summary

BSFL wanted to expand its rural reach in Maharashtra region. After overcoming recession

period and slow growth of Microfinance sector in India, BASIX wants to diversify into safer

business and also into newer segments of market. One such initiative taken by BSFL was

29

bidding for a four year contract to run CSC centers in Nashik region of Maharashtra. BSFL

won the bid and Master Service Agreement (MSA) was signed on 07 Jan 2011. BSFL (SCA)

should implement CSC commissioning by 12 months period and by Jan 2012 all 1362 CSC

should be in operational condition.

CSC will cater to the needs of the rural and urban public. The major services which will be

provided to them are G2C services (like land, nationality, income certificates, etc), Insurance,

Livelihood services, Vocational training and Utility (B2C services). Due to the slower growth

in microfinance, credit services will not be provided by through CSC.

CSC will be owned by individual VLEs. They will own computers, furniture and all

necessary setup equipments for the CSC. Identification, recruitment and training of VLEs

will be done by M/s. Magnum Opus. They are the IT partners of this project with BSFL and

provide backend IT supports, datacenters, B2C service interactions, CSC portal and web

support.

The potential of the CSC is very promising. Number of G2C transaction for 1

st

year will be

36,77,400; for 2

nd

year will be 45,96,750; for 3

rd

year will be 55,16,100 and for 4

th

year will

be 67,41,900. Number of Insurance (General) policies sold for 1

st

year will be 61,290; for 2

nd

year will be 85,806; for 3

rd

year will be 1,22,580 and for 4

th

year will be 1,47,096

The projected PAT for 1

st

year will be Rs. 2.63crores; for 2

nd

year will be Rs. 5.01crores; for

3

rd

year will be Rs. 5.48crores; and for 4

th

year will be Rs. 6.47crores. The initial setup cost

for the project is Rs. 7.20lakhs (for the month April, May and June 2011).

VLE will get an average monthly commission of Rs. 3,761 for 1

st

year, Rs. 5,954 for 2

nd

year,

Rs. 7,395 for 3

rd

year and Rs. 9,267 for 4

th

year. Magnum Opus will get an average monthly

commission per CSC of Rs. 1,920 for 1

st

year, Rs. 2,588 for 2

nd

year, Rs. 3,069 for 3

rd

year

and Rs. 3,697 for 4

th

year.

Viability funding of Rs. 2,291 per CSC for 1112 CSC has been taken. Also the Non

refundable deposit collected from VLEs (Rs. 25,000) has been collected from VLEs.

30

3.1.2 The Market

Market Analysis:

During the business plan development phase, credit business was not taken in CSC model.

More focus was proposed to be given in G2C, Insurance and BASIX services. Below is the

table that describes the target audience for the business plan

Target Market for

1362 CSCs

Y1 Y2 Y3 Y4

Avg. Earning

Rs.

Activity

Ratio

Credit 0 0 0 0 0 0.75

G2C Revenues 300 375 450 550 20 1.00

General Insurance 7 10 12 15 600 0.75

Life Insurance 2 5 7 10 5000 0.25

AgLEDS 20 30 40 50 600 0.30

Skill Training by B-ABLE 1 8 10 12 2250 0.33

Utility Payments 300 350 400 420 5 0.60

Table 3.1 Market Analysis

Market Segmentation:

CSCs are going to be segmented into four categories based upon their population and location

A. Urban Areas = 138 CSCs

Except AgLEDS (Livelihood) all services will be provided

B. Semi Urban; Population above 5000 = 958 CSCs

All services will be provided

C. Rural; Population below 5000 and above 1500 = 151 CSCs

All services will be provided

D. Tribal; Population below 1500 = 115 CSCs

Only G2C and Insurance services will be provided

3.1.3 Strategies

Strategies include a step of decisions taken in order to achieve the goals of the business. CSC

strategies can be classified into Marketing strategy, Sales strategy and Strategic Alliances.

Marketing Strategy:

31

Product: G2C, B2C, Insurance, Livelihood services.

Pricing: Pricing according to the service providers. In order to attract sales during

seasonal period, service providers will provide attractive discounts.

Promotion: Both VLE and MO will get very good commission for their contribution of

work.

Place: Located in almost one in six villages in Nashik region

Sales Strategy:

Sales strategy is oriented toward the idea of arming the sales force with information so they

completely understand both the product and the market and can hit the ground running.

Magnum Opus will be using sales forecast software and will drive the VLEs to achieve the

sales target.

Sales team (initially a Magnum Opus sales representatives and a BSFL cluster manager) will

be divided by geographic territory and will be on a base salary plus commission structure.

Company will provide sales forecast for each and individual districts based upon the market

segmentation.

Strategic Alliance:

BSFL has strategically aligned itself with Magnum Opus and has agreed to share 25% of its

revenue with Magnum Opus.

3.1.4 The Management Structure

BSFL Structure:

BSFL will be having a three tier management structure. In first tier, there is a Zonal head

based in Thane. He is the top decision maker for the functioning and process parameters of

the CSC. He controls the product development, and will provide inputs for the business plan

team to develop the financial model. Revenue sharing agreement with be decided by the

Zonal head. He is the liaison officer with the IT partner M/s. Magnum Opus.

32

In second tier, State head is based in Nashik. He coordinates with Zonal head and all the five

individual cluster managers. He also interacts with DoT, GoM, SETU and MO. All proposals

signed for CSC are collectively administered by both State and Zonal head.

In third tier, there are 5 nos. of Cluster managers who are based in all five districts covering

Nashik region. They function as the bridge and direct functioning officer between BSFL and

MO. MOs field executive report to Cluster manager regarding the functions of CSC.

Magnum Opus Structure:

Magnum Opus will have four tier structures. In first tier, will be the top management who

will be the decision makers and will sign revenue sharing agreement and proposal with BSFL

In second tier, there will be five district managers based in five district offices, setup for

monitoring CSC in those districts. They will work in conjoin with BSFL cluster manager and

coordinate with the actual field executives.

In third tier, there will be IT and web support personnel. Also software and web portal

development team will be present. The work will be done centralized and only the support

team will be based in all the five districts.

In fourth tier, there will be 20 to 30 nos. of field executives. They start from VLE

identification, recruitment, training and commissioning of CSC. After commissioning, they

look after their allocated CSC and attend to the grievance of those CSC. They also actively

participate in sales promotion and are in charge to submit the CSC performance to the district

manager.

3.2 The Financial Plan

3.2.1 Financial Needs Summary

Investment funding is needed for capital expenses and operating expenses for the first year of

operation.

Particular In Rs. Type

Commissions given to VLE 2,47,95,083 Operating cost

Commissions given to MO 92,82,291 Operating cost

Recruitment and training 61,29,000 Setup cost

33

State Office CAPEX 4,00,000 Setup Cost

CSC Opex 32,12,000 Operating cost

Office Opex 14,04,000 Operating cost

Salaries 36,81,210 Operating cost

Depreciation 16,721 Non cash expenditure

Total 4,89,20,306

Table 3.2 1

st

Yr Setup and Operating Costs

3.2.2 Revenue Model

BSFL revenue through CSC will be brought in through G2C service sales, Insurance policy

sale, insurance policy renewals, Vocational training enrollment and B2C & Utility service

sales. Further avenues of revenue include extension of product offering in B2C services,

partnering with new service providers who deal with agriculture and rural products, gradual

rolling of microfinance products through CSCs, undertaking NABARD projects, providing

Sub-K services. For the first four years, CSC project is entitled to receive viability funding

from Govt. of Maharashtra.

3.2.3 Assumptions and Comments

1. There will not be any cluster office for this business. Cluster managers will be based

in MO District offices. No BDX (Business Development Executive) will be there to

monitor CSC. MO will provide their FX for monitoring CSC.

2. No credit business in CSC model. Only G2C, Insurance, Training, B2C and other

partner services to be provided through CSC. Revenue sharing between DoT, DC,

BSFL, VLE and MO for G2C has been fixed. Revenue sharing between BSFL, VLE

& MO for other services is yet to be approved by Zonal Head.

3. Urban CSC require 3 PCs, Rural CSC require 1PC. All PCs, furniture and other setup

equipments to be procured by VLEs. A flat rate of Non Refundable Deposit of Rs.

25,000 per CSC is to be collected from VLEs. No expense incurred by BSFL for CSC

infrastructure preparation.

4. Magnum will be the IT partner and VLE recruiter. Magnum will be paid Rs. 4,500 per

VLE selected. Magnum will be paid 25% of BSFL earning for both G2C and B2C

services. Magnum will be paid Rs. 500 per CSC per month for CSC portal charges.

34

5. No lease cost incurred for data servers and data warehouse. Zero IT investment from

BSFL. No software and consultants cost incurred by BSFL, because Magnum will

provide IT support.

6. Minimizing HR cost by having HR count at 11. 1 State Head, 5 Cluster Manager, 1

HR Admin, 1 Office boy and 2 Accountants. Recurring cost for State office was taken

from May-2011. Salary for State head was taken from May-2011.

7. Commission rates for BSFL earning for different services has been fixed and needs

approval from Zonal head. For ease of business plan development, sales forecast is

done year wise and price of the product has been averaged. G2C, Insurance and

AgLEDS will be rolled out from the 2

nd

month of CSC commissioning, while rest will

be rolled out from the 3

rd

month of CSC commissioning.

8. VLE commission for all services has been fixed at 60% of BSFL earning, and for MO

commission for all services has been fixed at 25% of BSFL earning. The commission

rates are subject to change with approval from Zonal head.

9. Since the market for CSC products is highly segmented, activity ratio is taken into

consideration to forecast figures on the conservative side. Sales forecast has been

taken based on sales data available in Punjab, Orissa CSC business and few changes

have been made to consider local assumptions.

10. Viability funding has been added to the revenue stream. Access fees (Non refundable

deposits) revenue has been collected from the VLEs. A flat deprecation of 20% is

provided for accounting purpose. Tax rate is 33%.

3.3 Development of Model

For any new capital investment or for entering into new business, the top management needs

to make very important decisions based upon forecasted data. For a complex business, it is

necessary to develop a business model and see whether the business can make profit, how

much would the cash inflow, when can the business breakeven, what are the services that

provide good cash flow, etc,.

The objectives of financial model are

1. Decision making purpose

35

2. For business simulation

3. Capital budgeting

4. Project crashing etc.

In order to prepare the financial model, the nature of the business is to be understood first.

The business flow & its process should be well defined. Since this is a new business, it is

required to make some fundamental assumptions based on experimental study or by past

experience. Also, since this is a PPP project, there is little restriction in operations and the

assumptions which we are taking should come within the acceptable limits.

Procedure:

1. Define the project parameters

2. Prepare the Rollout schedule

3. Prepare the framework for cost and revenue for an individual CSC

4. Prepare the Revenue projection for all individual services

5. Prepare the Expense projection for both fixed and setup expenses

6. Prepare the Income statement based upon the revenue and expense projections

7. Prepare the Cash flow statement

8. Prepare the Breakeven table for the business

9. Prepare the Breakeven chart for the business

10. Prepare Summary sheet for quick glance of PAT, revenue mix and expense mix for

the four years.

3.3.1 Revenue Sharing

Since this project involves a strategic partnership, franchise model (VLE), regulators and

various service providers, revenue sharing is a very important activity in financial model.

Revenue share for this model was based framed as follows

1. VLEs will be entitled to receive 60% of BSFL earning in all services

36

2. Magnum Opus will be entitled to receive 15% of BSFL earning in all services except

G2C (in G2C it will receive 25% of BSFL Earning)

Service Provider BSFL Earning

% of service

cost

VLE Earning

% of BSFL

Earning

MO Earning

% of BSFL

Earning

Credit BSFL 100.00% 60% 15%

G2C Revenues Govt. 80.00% 60% 25%

INSURANCE (General) -

Productivity

Royal

Sundaram

15.00% 60% 15%

INSURANCE (Life) - Productivity AVIVA 20.00% 60% 15%

AgLEDS BKSL 10.00% 60% 15%

Skill Training by B-ABLE B-ABLE 20.00% 60% 15%

Utility Payments B2C 100.00% 60% 15%

Table 3.3 Revenue Share

3.3.2 Market sales assumptions

Sales figures for the project were based upon experimental and field data obtained from

active CSC operations. Also Transactional database was provided by strategic partner who

had collected actual sales data from operational CSC in other regions of Maharashtra.

By consolidating those figures we made an assumption for all four categories of CSC. For

conservative purpose, activity ratio (percentage of CSC which will achieve the sales

assumption) was given for each of these services.

Table 3.4 Market Sales Assumption

3.3.3 Setup and Fixed cost assumptions

Setup cost of this project is incurred at four levels. The first level is the IT infrastructure to

support the data servers, warehouses, portals. The second level is the CAPEX needed to setup

State Office (1 no.), third level is the CAPEX needed to setup Cluster office (5 nos.) and the

fourth level is the CAPEX needed to setup all 1,362 CSCs. These assumptions were made

during the initial planning to prepare the Business Plan considering the model implemented

Market Sales

Assumptions

Y1 Y2 Y3 Y4 Avg.

Earning

(Rs.)

Activity

Ratio

Start of

Service after

rollout

Credit Services 0 0 0 0 0 0.00 N.A.

G2C Revenues 300 375 450 550 20 1.00 1.00

General Insurance 7 10 12 15 600 0.75 1.00

Life Insurance 2 5 7 10 5000 0.25 2.00

AgLEDS 20 30 40 50 600 0.30 1.00

Skill Training by B-ABLE 1 8 10 12 2250 0.33 2.00

Utility payments 300 350 400 420 5 0.60 0.00

37

in Orissa, Meghalaya. But unlike those states, the penetration of PC in villages is moderately

high in Maharashtra. Therefore the CSC Setup cost is not borne by BSFL and it is borne by

individual VLEs. This reduces CAPEX achieves breakeven early. Also in addition, having

M/s. Magnum Opus as our strategic partner into the business model, no cluster office will be

setup by BSFL. Therefore there is no setup and fixed cost involved in Cluster office for this

business. Recruitment cost of Rs. 4,500 is to be paid to Magnum Opus per CSC.

Particular Cost (Rs.) Comments

Computer & IT

Peripherals

93,717 Borne by VLE

Furniture 4,450 Borne by VLE

CSC Infra Preparation 2,450 Borne by VLE

Recruitment 4,500 Borne by BSFL, paid to

Magnum Opus

Total per CSC 1,05,117

Table 3.5 CSC Setup Cost

Particular Cost (Rs.) Comments

Hardware 60,000 No cluster office

Furniture 15,000 No cluster office

Infrastructure

preparation

25,000 No cluster office

Rent Advance 1,50,000 No cluster office

Others 40,500 No cluster office

Total per Cluster Office 2,90,500

Table 3.6 Cluster Office Setup cost

Particular Cost (Rs.) Comments

Hardware & Furniture 3,00,000 CAPEX to be allocated

Rent Advance 1,00,000 Paid

TPC Hardware 1,50,000 CAPEX not allocated

Software development 5,20,000 Borne by Magnum

Total 10,20,000

Table 3.7 State Office Setup Cost

Particular Cost (Rs.) Comments

Helpdesk Server 4,00,000 Borne by Magnum

Application Server 10,00,000 Borne by Magnum

DR Application Server 4,00,000 Borne by Magnum

Data Centre 12,00,000 Borne by Magnum

Disaster recovery 20,00,000 Borne by Magnum

Internet for DR 6,00,000 Borne by Magnum

38

Total 56,00,000

Table 3.8 IT Infrastructure Setup Cost

Fixed cost is incurred at three levels. The first level is the HR cost, the second level is the

Office Opex expenses incurred monthly and the final level is the CSC portal monthly charges

paid to Magnum Opus Rs. 500 per CSC.

Particular Cost (Rs.) Comments

State Head 96,800 1 no.

Cluster Manager 54,843 5 nos.

TPC Accountant 9,847 3 nos.

HR & Admin 14,695 1 no.

Office Boy 5,000 1 no.

Total 10,20,000

Table 3.9 HR Fixed Cost

Particular Cost (Rs.) Comments

State Office Rent 25,000 Borne by BSFL

Electricity 2,000 Borne by BSFL

Internet & Telephone 5,000 Borne by BSFL

Travel allowance 80,000 10,000 per CM

20,000 per SH

10,000 per HR

Others 5,000 Borne by BSFL

Total 1,17,000

Table 3.10 Office Opex Fixed Cost

Particular Cost (Rs.) Comments

CSC Portal Charges 500 Paid by BSFL to Magnum

Opus per CSC per month

Total 81,72,000 Yearly CSC Portal charges

Table 3.11 CSC Portal Fixed Cost

The variable cost is incurred at two levels. First level is the Commission paid to VLE and the

second level is the commission paid to Magnum Opus.

Particular % of BSFL

Earning

Comments

VLE Commission 60% Paid to individual VLEs

Magnum Opus

Commission

25% G2C

15% Rest

Paid to Magnum Opus

Table 3.12 Variable Cost

39

3.3.4 Rollout Plan

The SCA will be required to establish and operationalize CSCs in phases as per the time

schedule prescribed by the Government of Maharashtra / SETU Maharashtra. The SCA shall

set up and operationalize the CSCs at its own cost and expense within 12 months in phases

from the Effective Date, as per the Deliverables outlined in the RFP (Request for Proposal)

document. The SCA shall operate and manage the CSCs for four years from the date of

operationalization (Rollout plan was started from July 2011) of all CSCs in the SCAs

division or 5 years from the date of signing the MSA (Master Service Agreement was signed

on Jan 7

th

, 2011), whichever is earlier.

Month July August September October November December January February

Nashik 15 30 40 55 55 55 62 86

Dhule 15 20 25 30 30 11 5 0

Jalgaon 20 30 35 45 35 48 48 51

Ahmednagar 0 10 30 45 50 56 55 80

Nandurbar 0 10 20 25 30 30 30 44

Cumulative

Total Comp.

50 150 300 500 700 900 1100 1361

In % 4% 11% 22% 37% 51% 66% 81% 100%

Table 3.13 CSC Rollout Plan

3.3.5 Individual CSC Financial model

In order to develop the financial model, two methods can be used. The financial model which

is currently used in this project is 8

th

modified and has been considered for Business plan

proposal. In both the methods we require Microsoft Excel 2007.

In first method, we need to list all revenues in separate sheets, all expenses in separate sheets

and link them to the master financial statements. In second method, we will list all the

revenue and expense for an individual CSC in a single sheet and link the same to the master

financial statements sheet. It has been found that this method is far more easy to track

formula bugs and for understanding. While development, we followed Method 1 up to 4

th

model. Method 2 was followed for the successive models.

Individual CSC financial model consists of Revenue earned from the services sold by an

individual CSC, the expenses which it is incurring. The revenue consists of all services like

G2C, B2C, Insurance, B-ABLE Training, AgLEDS etc. The expenses incurred by an

individual CSC consists of the CSC Portal charges paid to Magnum Opus, Commission given

40

to VLEs, Commission given to Magnum Opus, Tax. Also monthly averaged revenue from

each of these services are found out and mentioned. In addition the VLE commission from

each of these individual services is also found out and mentioned in the model. Following

details are mentioned in this model

Revenue and expense per CSC

Commission to VLE & MO per CSC

Cash flows per CSC

3.3.6 Income Statement

Income statement is a company's financial statement that indicates how the revenue (money

received from the sale of products and services before expenses are taken out, also known as

the "top line") is transformed into the net income (the result after all revenues and expenses

have been accounted for, also known as the "bottom line"). It displays the revenues

recognized for a specific period, and the cost and expenses charged against these revenues,

including write-offs (e.g., depreciation and amortization of various assets) and taxes. The

purpose of the income statement is to show managers and investors whether the company

made or lost money during the period being reported. Here data are taken from the Individual

CSC sheet and linked with rollout plan and the actual revenue stream is found out. In the

same way, we should also calculate the expense actually incurred by BSFL for this business.

Income Statement As on 31

st

Mar 2012

Revenues (Rs.) - As per rollout

G2C Revenues 3,08,35,200

Insurance 54,59,062

AgLEDS 31,79,880

B-ABLE 7,94,970

Access Fee 3,40,50,000

B2C - MO 57,81,600

Viability Funding 83,02,584

Total revenue 8,84,03,296

Expenses (Rs.) - As per Rollout

Commissions given to VLE 2,47,95,083

Commissions given to MO 92,82,291

Recruitment and training 61,29,000

State Office Setup 4,00,000

CSC Opex (CSC Portal) 32,12,000

Office Opex 14,04,000

Salaries 36,81,210

Depreciation 1,92,432

Total Expenses 4,90,96,016

41

PBT 3,93,07,279

Tax @ 33% 1,29,71,402

PAT 2,63,35,877

Table 3.14 Income Statement for Year 1

3.3.7 Cash Flow Statement

Cash flow statement is a financial statement that shows how changes in balance sheet

accounts and income affect cash and cash equivalents, and breaks the analysis down to

operating, investing, and financing activities. Essentially, the cash flow statement is

concerned with the flow of cash in and cash out of the business. The statement captures both

the current operating results and the accompanying changes in the balance sheet. As an

analytical tool, the statement of cash flows is useful in determining the short-term viability of

a company, particularly its ability to pay bills.

Cash Flow Statement 01 Mar 2012 to

31 Mar 2012

Opening Cash 1,00,000

Cash Inflows

Revenues 1,23,11,146

Cash Outflows

Operating Expenses 84,88,646

To Reserves 38,22,500

Closing Cash 1,00,000

Table 3.15 Cash Flow Statement for March 2012

42

CHAPTER 4

ANALYSIS AND

INTERPRETATIONS

43

4. Analysis and Interpretation

4.1 Financial Analysis

Financial analysis is done to assess the viability, stability and profitability of a business, sub-

business or project. It is performed by professionals who prepare reports using ratios that

make use of information taken from financial statements and other reports. These reports are

usually presented to top management as one of their bases in making business decisions.

Continue or discontinue its main operation or part of its business

Make or purchase certain materials in the manufacture of its product

Acquire or rent/lease certain machineries and equipment in the production of its goods

Issue stocks or negotiate for a bank loan to increase its working capital

Make decisions regarding investing or lending capital

In this project, both breakeven and ratio analysis is conducted.

4.1.1 Breakeven Analysis

In economics & business, specifically cost accounting, the break-even point (BEP) is the

point at which cost or expenses and revenue are equal: there is no net loss or gain, and one

has "broken even". A profit or a loss has not been made, although opportunity costs have

been paid, and capital has received the risk-adjusted, expected return. Refer breakeven chart

for breakeven analysis.

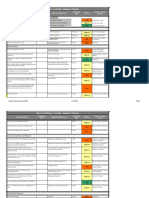

Month Apr 11 May 11 Jun 11 Jul 11 Aug 11 Sep 11

Revenue

- - - 16,08,427 51,83,708 1,10,84,271

Expense

1,25,430 4,70,715 7,20,931 15,64,377 34,09,571 63,31,428

PBT

(1,25,430) (4,70,715) (7,20,931) 44,050 17,74,137 47,52,843

TAX 33%

- - - 14,537 5,85,465 15,68,438

PAT

(1,25,430) (4,70,715) (7,20,931) 29,514 11,88,672 31,84,405

Table 4.1 Breakeven Table for the business

44

Graph 4.1 Breakeven Chart for the business

4.1.2 Ratio Analysis

Ratio Analysis is a tool used to conduct a quantitative analysis of information in a company's

financial statements. Ratios are calculated from two consecutive years for this financial

model.

Ratio Analysis

31 March

2012

31 March

2013

31 March

2014

31 March

2015

Incr.

%

for

2012

2013

Incr.

%

for

2013

2014

Incr.

%

for

2014

2014

Revenues

G2C Revenues 3,08,35,200 9,80,64,000 11,76,76,800 14,38,27,200

218 20 22

Insurance 54,59,062 3,14,62,200 4,18,40,640 5,74,08,300

476 33 37

AgLEDS 31,79,880 1,32,38,640 1,76,51,520 2,20,64,400

316 33 25

B-ABLE 7,94,970 1,94,16,672 2,42,70,840 2,91,25,008

2342 25 20

Access Fee 3,40,50,000 - - -

-100 0 0

B2C MO 57,81,600 1,71,61,200 1,96,12,800 2,05,93,440

196 14 5

Viability Funding 67,85,942 3,05,71,104 3,05,71,104 3,05,71,104 350 0 0

Total revenue 8,68,86,654 20,99,13,816 25,16,23,704 30,35,89,452

141 19 20

Expenses

Commissions given to VLE 1,95,15,154 8,59,92,322 11,30,12,222 14,12,57,923

340 31 25

Commissions given to MO 73,08,549 3,06,50,720 3,93,66,976 4,88,25,521

320 28 24

Recruitment and training 61,29,000 - - -

0 0 0

State Office Setup 4,00,000 - - -

0 0 0

CSC Opex (CSC Portal) 25,31,000 81,72,000 81,72,000 81,72,000

222 0 0

Office Opex 12,87,000 14,04,000 14,04,000 14,04,000

9 0 0

Salaries 32,60,957 46,22,783 46,22,783 46,22,783

41 0 0

Depreciation 1,75,711 1,97,775 1,94,533 1,91,344

12 -1.6 -1.6

Apr May Jun Jul Aug Sep

Revenue - - - 1,608,427 5,183,708 11,084,271

Expense 125,430 470,715 720,931 1,564,377 3,409,571 6,331,428

-

2,000,000

4,000,000

6,000,000

8,000,000

10,000,000

12,000,000

R

e

v

e

n

u

e

a

n

d

E

x

p

e

n

s

e

Breakeven Chart

45

Total Expenses 4,06,07,371 13,10,39,600 16,67,72,514 20,31,86,571

222 27 21

PBT 3,65,15,729 7,88,74,216 8,48,51,190 10,04,02,881

116 7 18

Tax @ 33% 1,20,50,191 2,60,28,491 2,80,00,893 3,31,32,951

116 7 18

PAT 2,44,65,539 5,28,45,725 5,68,50,297 6,72,69,930

116 7 18

Table 4.2 Ratio Analysis

4.2 Business Process Mapping

Business process mapping refers to activities involved in defining exactly what a business

entity does, who is responsible, to what standard a process should be completed and how the

success of a business process can be determined. Once this is done, there can be no

uncertainty as to the requirements of every internal business process. A business process

illustration (flowchart) is produced. The first step in gaining control over an organization is to

know and understand the basic processes.

A business process is a collection of related, structured activities or tasks that produce a

specific service or product for a particular customer or customers. There are three main types

of business processes:

1. Management processes like Corporate Governance, Strategic Management

2. Operational processes like Purchasing, Manufacturing, Marketing, and Sales

3. Supporting processes like Accounting, Recruitment and Technical support

In CSC business process two flowcharts were prepared. Currently in rollout stage,

recruitment, setup and commissioning of CSC is the most important process that needs to be

modeled. After rollout, the operation processes are needed to be modeled. Both have been

modeled in form of activity diagram (flowcharts)

46

4.2.1 Flowchart for CSC Commissioning

Figure 4.1 CSC Commissioning Flowchart

47

4.2.2 Flowchart for CSC Operation

Figure 4.2 CSC Operation Flowchart

4.3 Financial Interpretations

Seeing the financial projections of this business model, it can be well understood that this

business starts making profit right from the first month of its rollout. Since almost no high

CAPEX IT infrastructure is incurred by the company, it has very less investments in place.

And with its strategic partner Magnum Opus delivering all the IT support and web based

applications, BSFL is ready to share its earnings with it and pay a monthly fixed charge for

the CSC Portal.

The rollout starts from July and the revenue that will be generated from the months

operation will be Rs. 16.08lakhs. The expense that will be incurred in that month is estimated

to be Rs. 15.64lakhs. The company would have received Rs. 12.5lakhs as Access Fees (non

refundable deposits) from the VLEs and would have paid Rs. 2.25lakhs to Magnum Opus as

Recruitment fees. The PAT stands at modest Rs. 29,514 figure. At the end of first year, the

revenue for first year 2011 2012 would be Rs. 8.84crores, expense would be Rs. 4.90crores

48

and the PAT would be Rs. 2.63crores. Rollout would be completed by the month of Feb

2012. And the company would have received Rs. 3.40crores from the VLEs. The Viability

fund which is received from the Govt. would be would be Rs. 83.02lakhs. The recruitment

cost paid to Magnum Opus would be Rs. 61.29lakhs. The commission paid to VLEs for the

year is Rs. 2.47crores and to Magnum Opus is Rs. 92.82lakhs. A VLE will receive Rs. 3,761

as his monthly earning from this business.

The revenue for the second year 2012 2013 would have been to Rs. 20.99crores a jump of

141%. The operating expenses also would have been increased to Rs. 13.10crores a jump of

222%. The increase in expenses is more than increase in revenue because the non refundable

deposit collected from the VLEs is single time revenue and it does not feature in the second

year. Therefore there is a drop in the growth figure comparing the expense. A VLE will

receive Rs. 5,594 as his monthly earning from this business which is a jump of 58%.

The revenue for the third year 2013 2014 would have been to Rs. 25.16crores a jump of

19%. The operating expenses also would have been increased to Rs. 16.98crores a jump of

27%. A VLE will receive Rs. 7,395 as his monthly earning from this business which is a

jump of 24%.

The revenue for the fourth year 2014 2015 would have been to Rs. 30.36crores a jump of

20%. The operating expenses also would have been increased to Rs. 20.70crores a jump of

21%. A VLE will receive Rs. 9,267 as his monthly earning from this business which is a

jump of 25%.

Even though this business model is different from those followed from Punjab, Orissa, etc.

the company has managed to earn profit right from its first month of rollout. This can be

achieved only by reducing the CAPEX expenditure, sharing the revenue with strategic

partners (who invest in CAPEX) and by developing simple and effective business model.

49

CHAPTER 5

RECOMMENDATION,

LIMITATION AND CONCLUSION

50

5. Recommendation, Limitation and Conclusion

5.1 Recommendations

Even without Credit in this business model, BSFL has managed to show profit in this CSC

business. But with micro credit and livelihood as its core competencies BSFL should start

lending micro credit through this CSC network. With all network communication and faster

information and cash transactions, CSC network might be the next revolution in micro

finance industry. BSFL should be the front runner in this endeavor and by starting to lend

money through CSCs, BSFL can try to reduce the operating expenses of Credit business and

introduce loan products a highly competitive rates than that of the competitors

5.2 Limitations

This study is limited to the business model developed for Nashik region. The cost, revenue

assumptions, rollout plan was specially designed for Nashik region and if it is needed to be

extended to other location, assumptions would be needed to change. Also the sales

assumptions for the business model are limited to this business model.

Also the financial model itself has few limitations. The calculation of depreciation and fixed

asset are both linked in a circular reference. Enable iterative calculations in Formulas Excel

Option to calculate those figures.

5.3 Conclusion

The outcome of this project has been achieved. The business income statement has been

prepared, the cash flow statements, also the commission sheet has also been prepared. Since

all the excel sheet are linked with formulas, we can change the sales assumptions and see the

corresponding change in income structure. This helps in setting sales targets which can be

communicated to individual VLEs. This financial plan serves a financial calculator to see the

change in outcome in change in assumption.

51

CHAPTER 6

BIBLIOGRAPHY

52

6. Bibliography

1. Principles of Corporate Finance, by Richard A Brealey et.al.

2. www.csc-india.org

3. www.investopedia.com

4. www.bplans.com

5. www.mit.gov.in/content/common-services-centers

6. MSA Master Service Agreement signed between BSFL and SETU, Maharashtra

7. RFP Request For Proposal (bid document by BSFL)

8. Revenue Support system by GoI and GoM

9. Magnum Opus Proposal

53

CHAPTER 7

APPENDIX

54

7. Appendix

7.1 Work Diary:

Date Description of Work Remarks

Guide Signature

(Fortnightly)

01-06-2011

Reported to Ms. Madhurima Nag (HR) and to our Project Guide

Mr. Sharad Venugopal

Comp.

02-06-2011

Project allocated. On Common Service Centers. Location is

Nasik, Maharashtra. Read MSA (Master Service Agreement) of

Maharashtra CSC Project for Nashik Division

Comp.

03-06-2011

Gone through the Business and financial model of Maharashtra

CSC Project

Comp.

04-06-2011

Read the RFP (Request for Proposal) of Maharashtra CSC Project

for Nashik Division. Prepared the KRAs and Deliverable for the

proposed project

Comp.

05-06-2011 Holiday Holiday

06-06-2011 Going to Nashik Travel

07-06-2011

Reporting to Nashik State Office. Met with Mr. Vikas Raut, Mr.

Shadanan (B-ABLE) and 4 BDExs. Had discussions with them

regarding the progress of the CSC

Comp.

08-06-2011

Worked on the Excel framework. Met with Mr. Vikas Raut and

discussed upon the possible product portfolio for the CSCs

Comp.

09-06-2011

Listing out the product portfolio, assumptions for the financial

model

Comp.

10-06-2011

Showing the Excel financial model and get the suggestions and

recommendations from Mr. Vikas Raut

Comp.

11-06-2011 Holiday Holiday

12-06-2011 Holiday Holiday

13-06-2011

Met with Mr. Anand Naik, GM (West) at Thane office and got his

inputs and ideas for the internship

Comp.

14-06-2011

Resumed duty at Nashik office. Working on the initial version of

the financial model

Comp.

15-06-2011

Working on the draft version of the financial model. Assumptions

taken from Actual CSC financials for the yr 2010 2011. Data

obtained from Ms Sangeeta

Comp.

Date Description of Work Remarks

Guide Signature

(Fortnightly)

55

16-06-2011 Working on the four category model Comp.

17-06-2011 Work continued Comp.

18-06-2011 Completion on the draft model and mailed to Mr. Sharad Comp.

19-06-2011 Holiday Holiday

20-06-2011

Completion of the first modified model (it incorporates all the

changes in assumptions)

Comp.

21-06-2011

Completion of the Second modified model (it incorporates the

four categories of VLEs)

Comp.

22-06-2011 Working on third model Comp.

23-06-2011 Work Contd. Comp.

24-06-2011 Working on fourth model Comp.

25-06-2011 Work Contd. Comp.

26-06-2011 Holiday Holiday

27-06-2011 Work Contd. Comp.

28-06-2011 Work Contd. Comp.

29-06-2011 Working on the Flowchart Comp.

30-06-2011 Working on the fifth model Comp.

01-07-2011 Work contd. Comp.

02-07-2011 Work contd. Comp.

03-07-2011 Holiday Holiday

04-07-2011 Work condt. on fifth model Comp.

05-07-2011 Work contd. On Sixth model Comp.

06-07-2011 Work contd. On seventh model Comp.

07-07-2011

Completion of CSC Commissioning and Operations flowcharts

and mailed the Business plan to Mr. Anand Naik for approval

Comp.

08-07-2011

Completion of Rollout plan (block wise and district wise) and

mailed to Mr. Anand Naik for approval

Comp.

09-07-2011

Completing the project report and sending the ecopy of the

project report to Mr. Vikas Raut, Mr. Sharad Venugopal and

Internal guide Prof Subramanian and HR

Comp.

10-07-2011 Holiday Holiday

11-07-2011

Final presentation to Mr. Vikas Raut and Ecopy sent to Mr.

Anand Naik, Mr. Sharad Venugopal and HR

Comp.

Table 7.1 Work Diary

56

7.2 Financial Model

7.2.1 Summary Refer Excel Printout

7.2.2 Assumptions Refer Excel Printout

7.2.3 Revenue Sharing Refer Excel Printout

7.2.4 Rollout and Manpower Plan Refer Excel Printout

7.2.5 CSC Maharashtra Business Plan Refer Excel Printout

7.2.9 Revenue Mix

Graph 7.1 Revenue Mix

7.2.10 Expense Mix

Graph 7.2 Expense Mix

0,0%

10,0%

20,0%

30,0%

40,0%

50,0%

Revenue Mix

Y1

Y2

Y3

Y4

0,0%

50,0%

100,0%

Expense Mix

Y1

Y2

Y3

Y4

57

7.2.11 Rollout Completion

Graph 7.3 Rollout trend

7.3 Breakeven Analysis

7.3.1 Breakeven Chart

Graph 7.4 Breakeven Chart

0%

20%

40%

60%

80%

100%

J

u

n

/

1

1

J

u

l

/

1

1

A

u

g

/

1

1

S

e

p

/

1

1

O

c

t

/

1

1

N

o

v

/

1

1

D

e

c

/

1

1

J

a

n

/

1

2

F

e

b

/

1

2

Rollout Completion

Percentage of Rollout

Apr May Jun Jul Aug Sep

Revenue - - - 1,608,427 5,183,708 11,084,271

Expense 125,430 470,715 720,931 1,564,377 3,409,571 6,331,428

-

2,000,000

4,000,000

6,000,000

8,000,000

10,000,000

12,000,000

R

e

v

e

n

u

e

a

n

d

E

x

p

e

n

s

e

Breakeven Chart

You might also like

- Questions and topics covered in various company PIsDocument7 pagesQuestions and topics covered in various company PIsGopi NathNo ratings yet

- 12mo61 Iso Course Plan - 20.07.2014Document3 pages12mo61 Iso Course Plan - 20.07.2014Gopi NathNo ratings yet

- Mutual Fund - PPT TSMDocument30 pagesMutual Fund - PPT TSMGopi NathNo ratings yet

- GravureDocument17 pagesGravureGopi NathNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- DOF HandoverChecklistDocument4 pagesDOF HandoverChecklistRamy AmirNo ratings yet

- Fundamentals of Accountancy, Business and Management 2Document58 pagesFundamentals of Accountancy, Business and Management 2Carmina Dongcayan100% (1)

- Tugas PA Bab 16Document7 pagesTugas PA Bab 16Adrian BatubaraNo ratings yet

- Annual Report 201720171002153148931Document174 pagesAnnual Report 201720171002153148931aliNo ratings yet

- Learnopolis Eib 5Document22 pagesLearnopolis Eib 5api-597573338No ratings yet

- Accrual AccountingDocument44 pagesAccrual AccountingSophia LynchNo ratings yet

- Botswana Accounting SyllabusDocument26 pagesBotswana Accounting Syllabusgapeezee50% (4)

- Cost BBIT Lec-1Document11 pagesCost BBIT Lec-1Amna Seok-JinNo ratings yet

- Measurement Concepts and Valuation of Marketable SecuritiesDocument13 pagesMeasurement Concepts and Valuation of Marketable SecuritiesMohamed YusufNo ratings yet

- Brigade Enterprises LimitedDocument36 pagesBrigade Enterprises LimitedAnkur MittalNo ratings yet

- ACTBFAR Exercise Set #1Document7 pagesACTBFAR Exercise Set #1Nikko Bowie PascualNo ratings yet

- BSB52415 Diploma of Marketing and Communication Assessment 3: Financial AnalysisDocument14 pagesBSB52415 Diploma of Marketing and Communication Assessment 3: Financial AnalysisASTRI CAHYANINGSIHNo ratings yet

- Paper - 1: Accounting: © The Institute of Chartered Accountants of IndiaDocument110 pagesPaper - 1: Accounting: © The Institute of Chartered Accountants of IndiaP.Vishnu VardhiniNo ratings yet

- FINA2207 Solutions To Practice QuestionsDocument22 pagesFINA2207 Solutions To Practice Questionszdoug1No ratings yet

- Traditional Job Cost Accounting: or Sam P. and Mary Little Go Into ConstructionDocument36 pagesTraditional Job Cost Accounting: or Sam P. and Mary Little Go Into Constructionangelosyster1No ratings yet

- Cash flow statement problemsDocument12 pagesCash flow statement problemsAnjali Mehta100% (1)

- Chapter Five: Corporation Organization and OperationDocument8 pagesChapter Five: Corporation Organization and OperationSamuel DebebeNo ratings yet

- ACC2002 Practice 2Document8 pagesACC2002 Practice 2Đan LêNo ratings yet

- Master Budget Exercises for Patrick IncDocument10 pagesMaster Budget Exercises for Patrick IncLuigi Enderez BalucanNo ratings yet

- Matrikulasi Financial ManagementDocument61 pagesMatrikulasi Financial ManagementMuhammad Faizal AkbarNo ratings yet

- Fabm1 Quarter4 Module 10 Week 2Document16 pagesFabm1 Quarter4 Module 10 Week 2Princess Nicole EsioNo ratings yet

- Johannes Period 1 To 3 SolutionDocument5 pagesJohannes Period 1 To 3 SolutionHue PhamNo ratings yet

- Chapter 5 CVPDocument56 pagesChapter 5 CVPLegogie Moses AnoghenaNo ratings yet

- Statement of Comprehensive IncomeDocument1 pageStatement of Comprehensive IncomeKent Raysil PamaongNo ratings yet

- COURSEBOOK 2022-2023 - Nick Croft F&M Accounting v4Document2 pagesCOURSEBOOK 2022-2023 - Nick Croft F&M Accounting v4Ahmad Ridwan FauziNo ratings yet

- Chapter 15 SolutionsDocument6 pagesChapter 15 SolutionshappysparkyNo ratings yet

- p1 Quiz With TheoryDocument16 pagesp1 Quiz With TheoryRica RegorisNo ratings yet

- Financial Accounting 1Document21 pagesFinancial Accounting 1Louella GudesNo ratings yet

- Businesses resist sharing forecast data due to competitive risksDocument3 pagesBusinesses resist sharing forecast data due to competitive risksKai GreenNo ratings yet

- Financial Ratios and Analysis of XYZ CompanyDocument4 pagesFinancial Ratios and Analysis of XYZ CompanyMa Theresa MaguadNo ratings yet