Professional Documents

Culture Documents

Assignment: ON Computer Applications in Business

Uploaded by

ALANJAMES1234Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment: ON Computer Applications in Business

Uploaded by

ALANJAMES1234Copyright:

Available Formats

ASSIGNMENT

ON

COMPUTER APPLICATIONS IN BUSINESS

SUBMITTED TO,

Dr.SHIJIN S

ASSISTANT PROFFESOR

DEPARTMENT O COMMERCE

PONDICHERRY UNIVERSITY

SUBMITTED BY,

Jyotish. T

REG. NO:

1

ST

SEM. M.COM (B.F)

SECTION: A

TOPIC;

ANALYSIS OF INVESTMENT PROPOSAL by "Tata-JLR in Dubai"

INTRODUCTION;

In this assignment we are going to analyze the financial viability of investment proposal made

by Tata-JLR on Dubai. Tata acquired JLR (Jaguar Land Rover) since 2008.And in the process of

expanding the JLR market in the Middle Eastern counties Tata came up with a new proposal of

building a new manufacturing plant in Dubai.

The proposal was in such manner that Tata is going to invest full investment is done by Tata as

in the form of equity capital. In here the amount Tata has going to invest is Dubai is 100 million

pound that is 1011.3 core Indian currency .

In here I am going to analyze that the proposal made by Tata motor in its new plant will be

profitable or not for future. By analyzing we will be able to know whether to invest in the

proposal or not to invest in the proposal.

In this analysis we are making some assumptions

Tata-JLR

Tata motor is acquired

Temasek Holdings is an investment company owned by the Government of

Singapore. It manages a portfolio of s$198 billion at the end of March 2013.This investment

Company was incorporated in 1974 by an Act of parliament in Singapore. The present chairman

Of Temasek Holdings is S.Dhanabalannand its headquarters is situated at Singapore. It holds

Investments in many large foreign companies, including ICICI Bank, Bank of China, Standard

Chartered etc.

The investment proposal made by Temasek on 11

th

March 2011 was based on

The returns earned by the investors of Health Care Global Enterprises (HCGE).HCGE is a

Bangalore based cancer care provider.I got their information regarding investment from the

website.

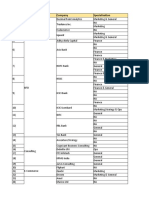

ANALYSIS AND INTERPRETATION

This investment proposal is evaluated by using two important evaluation techniques ie.NPV

method and IRR method. Under Net Present Value method npv is calculated which is the

difference between present value of cash inflow and cash outflow. if the npv is positive the

investment proposal will be accepted. Here the npv is 50.39 which is positive. So this

investment proposal is a profitable one as per npv method.

Internal rate of return is the rate at which present value of cash inflow is equal to the present

value of cash outflow that is it is the rate at which npv is zero..If irr is greater than the discount

rate that is the expected rate of return of the investment, we will accept the proposal. In this

project proposal the irr is 31% and discount rate is 18%, which means irr is greater than

discount rate so it is a profit yielding investment proposal.

Opportunity cost is the cost of next best alternative. It is the cost of the best alternative

forgone by a decision. If the TEMASEK invest their 140 corers in bonds of 12.5% yield their

future value after 5 years will be 252.28 crore.the same in equity with a rate of 18% is 320

crore.Equities are more risky than bonds so the expected future value may or may not be

raised. So the opportunity cost is 252.28 crore with low risk.

CONCLUSION

Through this assignment iget idea about how an investment proposal can be evaluated using

excels.The investment proposal made by TEMASEK HOLDINGS in HEALTH CARE GLOBAL

ENTERPRISES is a profitable one. It is a viable investment proposal according to IRR and NPV

evaluation criteria.

You might also like

- Summary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingFrom EverandSummary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingNo ratings yet

- Capital Rationing Is The Process of Selecting The Most Valuable Projects To Invest Available FundsDocument7 pagesCapital Rationing Is The Process of Selecting The Most Valuable Projects To Invest Available FundsKazi HasanNo ratings yet

- Effective Project Financing Essential Principles And Tactics: An Introduction To Finance, Cash Flows, And Project EvaluationFrom EverandEffective Project Financing Essential Principles And Tactics: An Introduction To Finance, Cash Flows, And Project EvaluationNo ratings yet

- Internal Rate of ReturnDocument6 pagesInternal Rate of ReturnGaluh DewandaruNo ratings yet

- The Investor's Guide to Investing in Direct Participation Oil and Gas ProgramsFrom EverandThe Investor's Guide to Investing in Direct Participation Oil and Gas ProgramsRating: 5 out of 5 stars5/5 (1)

- Investment - LeasingDocument5 pagesInvestment - LeasingNadya RizkitaNo ratings yet

- Leveraging on India: Best Practices Related to Manufacturing, Engineering, and ItFrom EverandLeveraging on India: Best Practices Related to Manufacturing, Engineering, and ItNo ratings yet

- PEVC - Group 5 - Shriram Transport FinanceDocument5 pagesPEVC - Group 5 - Shriram Transport FinanceRakesh KumarNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Ranking Investment Proposals: Learning ObjectiveDocument5 pagesRanking Investment Proposals: Learning ObjectivePratibha NagvekarNo ratings yet

- How to Write a Business Case: For AnythingFrom EverandHow to Write a Business Case: For AnythingRating: 5 out of 5 stars5/5 (3)

- Capital Budgeting of ITC Company LimitedDocument12 pagesCapital Budgeting of ITC Company LimitedRama Sardesai50% (2)

- Modified Internal Rate of ReturnDocument5 pagesModified Internal Rate of ReturnGaluh DewandaruNo ratings yet

- Corporate AccountingDocument12 pagesCorporate AccountingStutiNo ratings yet

- Capital Budgeting Prof. M S NarasimhanDocument1 pageCapital Budgeting Prof. M S NarasimhanRAHUL BARSAIYANNo ratings yet

- Corporate FinanceDocument14 pagesCorporate FinanceRohit SoniNo ratings yet

- IPO in IndiaDocument15 pagesIPO in IndiaSingh GurpreetNo ratings yet

- Assignment - Capital BudgetingDocument9 pagesAssignment - Capital BudgetingSahid KarimbanakkalNo ratings yet

- Pioneer Invest Corp - Harshit TaunkDocument40 pagesPioneer Invest Corp - Harshit Taunkrjain_112No ratings yet

- The Nature of Project Selection ModelsDocument13 pagesThe Nature of Project Selection ModelsGopalsamy SelvaduraiNo ratings yet

- 10 Things You Must Do Before Buying An IPO, But Nobody Tells You About ThemDocument11 pages10 Things You Must Do Before Buying An IPO, But Nobody Tells You About ThemRanjit SahooNo ratings yet

- A Project On Equity AnalysisDocument93 pagesA Project On Equity AnalysisAjith CherloNo ratings yet

- Final Synospsis F P A11Document19 pagesFinal Synospsis F P A11Neeraj GuptaNo ratings yet

- Marco Polo Marine: Corporate News FlashDocument3 pagesMarco Polo Marine: Corporate News FlashphuawlNo ratings yet

- CF Group 1 - BioconDocument18 pagesCF Group 1 - BioconVivek ChhariNo ratings yet

- Project On Capital Budgeting PPT DataDocument3 pagesProject On Capital Budgeting PPT DataMadhuri GuptaNo ratings yet

- Swot Analysis of Tata Motor'sDocument17 pagesSwot Analysis of Tata Motor'sSourav Ssingh0% (1)

- Corporate FinanceDocument11 pagesCorporate FinancecpaatuldwivediNo ratings yet

- Thesis Fund ManagementDocument5 pagesThesis Fund Managementangieleeportland100% (2)

- Profitability of An InvestmentDocument3 pagesProfitability of An InvestmentnikunjNo ratings yet

- Analisis Kelayakan Investasi Pengembangan Perumahan Subsidi Di Kabupaten TangerangDocument11 pagesAnalisis Kelayakan Investasi Pengembangan Perumahan Subsidi Di Kabupaten TangerangWida Ayu NahdiniNo ratings yet

- AggrivateDocument14 pagesAggrivatemvtharish138No ratings yet

- Study of Depository and Their Financial Analysis by Sapna OswalDocument75 pagesStudy of Depository and Their Financial Analysis by Sapna OswalManisha KhubchandaniNo ratings yet

- Alset International LimitedDocument13 pagesAlset International LimitedSieng MenghongNo ratings yet

- Investment Appraisal Report (Individual Report)Document10 pagesInvestment Appraisal Report (Individual Report)Eric AwinoNo ratings yet

- Devansh Agarwaal ED CT-2 AnswerDocument3 pagesDevansh Agarwaal ED CT-2 Answer2K19/BMBA/13 RITIKANo ratings yet

- What Is Capital Budgeting?Document6 pagesWhat Is Capital Budgeting?Yadhu ManuNo ratings yet

- Financial Justification of ProjectsDocument5 pagesFinancial Justification of ProjectsDilippndtNo ratings yet

- Chapter 8 EcoDocument10 pagesChapter 8 EcoAngel Jasmin TupazNo ratings yet

- Capital Budgeting at IOCLDocument12 pagesCapital Budgeting at IOCLFadhal AbdullaNo ratings yet

- Fundamanetal Analysis of Automobile Industry (Tata Motors)Document63 pagesFundamanetal Analysis of Automobile Industry (Tata Motors)Amit Sharma100% (1)

- Executive SummaryDocument6 pagesExecutive SummaryAnonymous g7uPednINo ratings yet

- Big Boy BillionairesDocument8 pagesBig Boy BillionairesAkash PamnaniNo ratings yet

- Case Study - The Investment DetectiveDocument6 pagesCase Study - The Investment DetectiveKelly BrookNo ratings yet

- Equity AnalysisDocument90 pagesEquity AnalysisAbhishek SaxenaNo ratings yet

- Final Report - PrintDocument105 pagesFinal Report - PrintabhikhosNo ratings yet

- Ipo Dissertation TopicsDocument8 pagesIpo Dissertation TopicsHelpWritingACollegePaperSingapore100% (1)

- Cap Bud - HeroDocument13 pagesCap Bud - HeroMohmmedKhayyumNo ratings yet

- BUS635. Final Assignment - AlveeDocument12 pagesBUS635. Final Assignment - AlveeAlvee Musharrat Hridita 1825132No ratings yet

- Analysis Investment Decision - IndiabullsDocument72 pagesAnalysis Investment Decision - Indiabullssaiyuvatech100% (1)

- ShcilDocument58 pagesShcilDevika RaniNo ratings yet

- Capital Budgeting: Questions & Answers Q18.1Document38 pagesCapital Budgeting: Questions & Answers Q18.1Japhary Shaibu67% (3)

- Case 5: The Investmen Detective: BackgroundDocument5 pagesCase 5: The Investmen Detective: BackgroundMuhamad GilangNo ratings yet

- Irr CalculationDocument3 pagesIrr CalculationniharjNo ratings yet

- Presented By: Pawan Kumar Mba (Pup) 102562005Document16 pagesPresented By: Pawan Kumar Mba (Pup) 102562005Gourav GargNo ratings yet

- Risk-Return Analysis of Five Selected Companies in Telecom Service Sector - A Study Conducted at Hedge Equities LTD, KochiDocument154 pagesRisk-Return Analysis of Five Selected Companies in Telecom Service Sector - A Study Conducted at Hedge Equities LTD, Kochiamalmohan72% (18)

- Project 2Document12 pagesProject 2Birunda RajanNo ratings yet

- Market Impact: HDFC Bank Investment Advisory GroupDocument2 pagesMarket Impact: HDFC Bank Investment Advisory GroupMLastTryNo ratings yet

- Id IciciDocument11 pagesId IciciKhaisarKhaisarNo ratings yet

- File No.7Document6 pagesFile No.7Rajesh InsbNo ratings yet

- Business Finance Week 7 Basic Long-Term Financial ConceptsDocument16 pagesBusiness Finance Week 7 Basic Long-Term Financial ConceptsJessa Gallardo0% (1)

- ELSSDocument15 pagesELSSSecure Plus100% (1)

- Challan UpdatedDocument1 pageChallan UpdatedSonali KumariNo ratings yet

- Final Project NPA MANAGEMENT IN BANKSDocument88 pagesFinal Project NPA MANAGEMENT IN BANKSmanish223283% (18)

- Project Management Chapter 8 Investment Criteria Question AnswersDocument6 pagesProject Management Chapter 8 Investment Criteria Question AnswersAkm EngidaNo ratings yet

- Exam On Foreign Currency Transaction 40Document6 pagesExam On Foreign Currency Transaction 40nigusNo ratings yet

- Market Profile 102Document44 pagesMarket Profile 102sinatra11235100% (4)

- INDIVIDUAL QUIZ BFM 4273 Islamic Trade Finance PDFDocument3 pagesINDIVIDUAL QUIZ BFM 4273 Islamic Trade Finance PDFNORSARINA SIRI BIBFNo ratings yet

- Cruz, Leyra R. Bsba Block 1-9 Readings in Philippine HistoryDocument11 pagesCruz, Leyra R. Bsba Block 1-9 Readings in Philippine HistoryBLOG BLOGNo ratings yet

- Quality InvestingDocument4 pagesQuality InvestingKhaled FatnassiNo ratings yet

- "Credit Risk Management": Tribhuvan University Faculty of Management A Project Proposal OnDocument14 pages"Credit Risk Management": Tribhuvan University Faculty of Management A Project Proposal Onrk shahNo ratings yet

- Exercises For Before The Exam: November 11th November 18thDocument32 pagesExercises For Before The Exam: November 11th November 18thMušija AjlaNo ratings yet

- Canara Bank ProfileDocument13 pagesCanara Bank ProfileRaveendra BatageriNo ratings yet

- National Income New PDFDocument25 pagesNational Income New PDFLaksh SahniNo ratings yet

- Summer Internship ProjectDocument90 pagesSummer Internship ProjectAchyut Saxena40% (5)

- Magic Formula Investing HKDocument46 pagesMagic Formula Investing HKMeester KewpieNo ratings yet

- 149 - PNB vs. Bitulok SawmillDocument1 page149 - PNB vs. Bitulok Sawmillmimiyuki_No ratings yet

- SynopsisDocument12 pagesSynopsisVINIT RATANNo ratings yet

- Final Examination in Management Strategic Business Analysis Name: Date: Score: Course/Year/Section: Student #Document2 pagesFinal Examination in Management Strategic Business Analysis Name: Date: Score: Course/Year/Section: Student #Jessa Mae LavadoNo ratings yet

- Name: Instructor: Accounting Principles Primer On Using Excel in AccountingDocument14 pagesName: Instructor: Accounting Principles Primer On Using Excel in Accountingranim m7mdNo ratings yet

- Swot AnalysisDocument6 pagesSwot Analysissouvikrock12No ratings yet

- IIM Udaipur Placements DecodedDocument4 pagesIIM Udaipur Placements DecodedUjjwalPratapSinghNo ratings yet

- GST Challan FloraciaDocument2 pagesGST Challan Floraciasalini jhaNo ratings yet

- Question: Microtech Corporation Is Expanding Rapidly and Currently Needs To Retain All of Its Earning Henc..Document3 pagesQuestion: Microtech Corporation Is Expanding Rapidly and Currently Needs To Retain All of Its Earning Henc..Malik AsadNo ratings yet

- 2023 Tax Rates and Other DataDocument9 pages2023 Tax Rates and Other DataNonietandelNo ratings yet

- Ratio Analysis ReportDocument121 pagesRatio Analysis ReportChandrakant ChopdeNo ratings yet

- Playconomics 4 - MacroeconomicsDocument302 pagesPlayconomics 4 - MacroeconomicsMinhNo ratings yet

- X Ay TFF XMST 3 N Avx YDocument8 pagesX Ay TFF XMST 3 N Avx YRV SATYANARAYANANo ratings yet

- Policy Documents - EncryptedDocument15 pagesPolicy Documents - EncryptedsuitaiaNo ratings yet

- Foreign Currency TransactionsDocument14 pagesForeign Currency TransactionsXavier AresNo ratings yet

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (8)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetFrom EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetRating: 5 out of 5 stars5/5 (2)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamFrom EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNo ratings yet

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (34)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsFrom EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsRating: 5 out of 5 stars5/5 (1)

- Creating Shareholder Value: A Guide For Managers And InvestorsFrom EverandCreating Shareholder Value: A Guide For Managers And InvestorsRating: 4.5 out of 5 stars4.5/5 (8)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistFrom EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistRating: 4 out of 5 stars4/5 (32)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthFrom EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthRating: 4 out of 5 stars4/5 (20)