Professional Documents

Culture Documents

Many Foreign Banks Remain Unclear On How The Wholly Owned Ubsidaries

Uploaded by

Mausam PanchalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Many Foreign Banks Remain Unclear On How The Wholly Owned Ubsidaries

Uploaded by

Mausam PanchalCopyright:

Available Formats

Many foreign banks remain unclear on how the wholly owned subsidiaries (WOS) route offered by the reserve

bank of India to them will play out as priority sector lending as well as setting up and operating rural branches

pose challenges, says a survey by PWC India.

According to the recently released WOS guidelines, foreign banks that choose to adopt the WOS model may

enter into mergers and acquisition with domestic private banks. However, this will be subject to regulatory

approvals necessary for the transaction, as well as assessment of the foreign lenders participation and success

in the banking space.

CHALLENGES FOR BANKS

Acquisition targets in India that are primarily promoter driven and command high valuation, may also pose

challenges for foreign banks. The lack of alignment of voting rights with shareholding was concern expressed by

many participants , the survey of 32 foreign banks said.

Further, given the current voting rights cap of 10 percent, immediate interest in inorganic growth (M&A) was

not as high as expected.

The new guidelines also allow foreign banks to open new branches, scale up their business in India and list on

ex-changes, subject to overall investment limit of74 percent. Further, the RBI has also mandated foreign banks

with more than 20 branches to meet the 40 percent priority sector norm, which is challenge for them.

According to PWC, compliance with capital requirements would also pose problem for foreign banks.

Shinjini Kumar, Leader, Banking and Capital Markets, PWC India said, As foreign banks seek greater clarity on

these option and admits the re-balancing of capital, trade ties and political ties within Asia, there is a possibility

of change in the landscape of foreign banks in India.

Foreign bank account for less than 1 percent (334 branches of 43 banks) on Indias total branch network, about

7 percent of the total banking sector assets and a sizeable 11 percent of profits. This data is as on March 2013.

Big foreign banks Standard Chartered, Citibank, HSBC and Barclays have India exposure of between 1 percent

and 5 percent their parents assets books and more than 20 branches of in India. For the remaining foreign

banks, their exposure is below 1 percent.

CHINA OVER INDIA

The survey highlighted that majority of foreign banks prefer China to India as the most attractive destination.

They cite Indias uncertain regulatory environment as a hindrances despite it being a large market for their

banks.

There was a sense of weariness about the tax regime. Refreshingly, most banks still seemed to have growth on

their minds as their hiring preference were in business lines and not in regulatory compliance, the trend across

the developed markets, Kumar said.

You might also like

- Pharma Policy of Govt of IndiaDocument18 pagesPharma Policy of Govt of IndiaMausam PanchalNo ratings yet

- Study Material On Processes-Query DeskDocument107 pagesStudy Material On Processes-Query DeskMausam PanchalNo ratings yet

- 23022011Document70 pages23022011Mausam PanchalNo ratings yet

- Blackbook Project On Credit AppraisalDocument95 pagesBlackbook Project On Credit AppraisalMausam PanchalNo ratings yet

- Microsoft Word - Co-Op Accounting ModuleDocument4 pagesMicrosoft Word - Co-Op Accounting ModuleMausam PanchalNo ratings yet

- Banking Codes and Standards Board of IndiaDocument2 pagesBanking Codes and Standards Board of IndiaMausam PanchalNo ratings yet

- VAT Form PDFDocument3 pagesVAT Form PDFMausam PanchalNo ratings yet

- Irctcs E Ticketing Service Electronic Cancellation Slip (Personal User)Document1 pageIrctcs E Ticketing Service Electronic Cancellation Slip (Personal User)Karan PanchalNo ratings yet

- VAT TaxDocument8 pagesVAT Taxsankar_rao333No ratings yet

- Customer Satisfaction in The Indian Banking SectorDocument70 pagesCustomer Satisfaction in The Indian Banking SectorMausam PanchalNo ratings yet

- Fraud GuideDocument61 pagesFraud Guidearas54No ratings yet

- LockerDocument6 pagesLockerMausam PanchalNo ratings yet

- 1Document4 pages1Mausam PanchalNo ratings yet

- Blackbook Project On Credit AppraisalDocument95 pagesBlackbook Project On Credit AppraisalMausam PanchalNo ratings yet

- Billgatts 090524021338 Phpapp02Document11 pagesBillgatts 090524021338 Phpapp02Mausam PanchalNo ratings yet

- History of MicrosoftDocument16 pagesHistory of MicrosoftMausam PanchalNo ratings yet

- FinalDocument19 pagesFinalMausam PanchalNo ratings yet

- 19849ipcc Blec Law Vol2 Chapter6bDocument0 pages19849ipcc Blec Law Vol2 Chapter6bMausam PanchalNo ratings yet

- Bill GatesDocument14 pagesBill GatesMausam PanchalNo ratings yet

- What Is EntrepreneurDocument24 pagesWhat Is EntrepreneurMausam PanchalNo ratings yet

- Date Title Architecture: 20 November 1985Document5 pagesDate Title Architecture: 20 November 1985Mausam PanchalNo ratings yet

- At A Lower Price Get Physical: PresentingDocument16 pagesAt A Lower Price Get Physical: PresentingMausam PanchalNo ratings yet

- Deepak ParekhDocument1 pageDeepak ParekhMausam PanchalNo ratings yet

- Motilal Oswal MOSt Shares Gold ETF (MOSt Gold Shares) Scheme DetailsDocument0 pagesMotilal Oswal MOSt Shares Gold ETF (MOSt Gold Shares) Scheme DetailsMausam PanchalNo ratings yet

- India Presence: Foreign Banks On Wait and Watch' ModeDocument1 pageIndia Presence: Foreign Banks On Wait and Watch' ModeMausam PanchalNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- HR Pepsi CoDocument3 pagesHR Pepsi CookingNo ratings yet

- High Performance OrganizationsDocument25 pagesHigh Performance OrganizationsRamakrishnanNo ratings yet

- SSS-TQM-UII 2 Juron and ShewartDocument5 pagesSSS-TQM-UII 2 Juron and Shewartதோனி முருகன்No ratings yet

- Student Assignment Answer ALIDocument9 pagesStudent Assignment Answer ALIasadullahqureshi2No ratings yet

- Internship ReportDocument63 pagesInternship Reportrahul palNo ratings yet

- 10 - Chapter 2 - Background of Insurance IndustryDocument29 pages10 - Chapter 2 - Background of Insurance IndustryBounna PhoumalavongNo ratings yet

- Eap Counselling: Outcomes, Impact & Return On Investment.: Paul J Flanagan & Jeffrey OtsDocument11 pagesEap Counselling: Outcomes, Impact & Return On Investment.: Paul J Flanagan & Jeffrey OtsPavan KumarNo ratings yet

- Indian FMCG Industry, September 2012Document3 pagesIndian FMCG Industry, September 2012Vinoth PalaniappanNo ratings yet

- BMST5103Document38 pagesBMST5103yusufNo ratings yet

- Morgan Stanley 2022 ESG ReportDocument115 pagesMorgan Stanley 2022 ESG ReportVidya BarnwalNo ratings yet

- Multinational Cost of Capital and Capital StructureDocument11 pagesMultinational Cost of Capital and Capital StructureMon LuffyNo ratings yet

- Mergers and Acquisitions of Masan and Singha as a Tool for GrowthDocument6 pagesMergers and Acquisitions of Masan and Singha as a Tool for GrowthNguyễn Trần HoàngNo ratings yet

- Chapter 1 ReviewerDocument7 pagesChapter 1 ReviewerClariña VirataNo ratings yet

- Hubspot and Motion Ai: Chatbot-Enabled CRM: Akanksha Jaiswal Sahil JangamDocument21 pagesHubspot and Motion Ai: Chatbot-Enabled CRM: Akanksha Jaiswal Sahil JangamNikitha CorreyaNo ratings yet

- 2.1 Chapter 2 - The Fundamental Concepts of AuditDocument21 pages2.1 Chapter 2 - The Fundamental Concepts of AuditĐức Qúach TrọngNo ratings yet

- Starbucks Success Built on Ethics and QualityDocument19 pagesStarbucks Success Built on Ethics and QualityReuben EscarlanNo ratings yet

- Mind Map For Sales & Operations Planning 2.0: Supply Chain MindmappingDocument1 pageMind Map For Sales & Operations Planning 2.0: Supply Chain MindmappingLintasnusa Informasi VenturaNo ratings yet

- Physical Evidence and Servicescape: EssaysDocument7 pagesPhysical Evidence and Servicescape: EssaysCristinaNo ratings yet

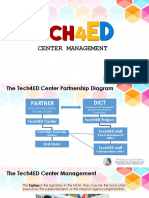

- BCMT Module 3 - Tech4ED Center ManagementDocument46 pagesBCMT Module 3 - Tech4ED Center ManagementCabaluay NHSNo ratings yet

- OutsourcingDocument24 pagesOutsourcingihabkarinaNo ratings yet

- 000463Document238 pages000463Del Farai BalenguNo ratings yet

- Database Design: Conceptual, Logical and Physical DesignDocument3 pagesDatabase Design: Conceptual, Logical and Physical DesignYahya RamadhanNo ratings yet

- Spencer Trading BooksDocument2 pagesSpencer Trading BookscherrynestNo ratings yet

- Enterprise Structure OverviewDocument5 pagesEnterprise Structure OverviewAnonymous 7CVuZbInUNo ratings yet

- Lazy River Scalping StrategyDocument10 pagesLazy River Scalping StrategyPanayiotis Peppas0% (1)

- Coca Cola InternshipDocument3 pagesCoca Cola InternshipManik AroraNo ratings yet

- IA3 Statement of Financial PositionDocument36 pagesIA3 Statement of Financial PositionHello HiNo ratings yet

- Fundamentals of Financial StatementsDocument13 pagesFundamentals of Financial StatementsJuvilyn Cariaga FelipeNo ratings yet

- Top 10 Opportunities Opportunity Title Client Status Opp Lead Est Fee (GBP K)Document5 pagesTop 10 Opportunities Opportunity Title Client Status Opp Lead Est Fee (GBP K)Anonymous Xb3zHioNo ratings yet

- CA Final - Paper 3 - Advanced Auditing and Professional EthicsDocument12 pagesCA Final - Paper 3 - Advanced Auditing and Professional EthicsAyushi GuptaNo ratings yet