Professional Documents

Culture Documents

Adjudication Order Against Dilip Yewale in The Matter of Mahindra & Mahindra Limited

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adjudication Order Against Dilip Yewale in The Matter of Mahindra & Mahindra Limited

Uploaded by

Shyam SunderCopyright:

Available Formats

Page1of7

BEFORE THE ADJUDICATING OFFICER

SECURITIES AND EXCHANGE BOARD OF INDIA

[ ADJUDICATION ORDER NO. EAD-2/DSR/ VVK/176/2014 ]

______________________________________________________________________

UNDER SECTION 15-I OF SECURITIES AND EXCHANGE BOARD OF INDIA ACT,

1992 READ WITH RULE 5 OF SEBI (PROCEDURE FOR HOLDING INQUIRY AND

IMPOSING PENALTIES BY ADJUDICATING OFFICER) RULES, 1995

In respect of

DILIP YEWALE

( PAN AAMPY5403F )

Background :

Mahindra & Mahindra Limited ( hereinafter referred to as " M&M / Company" ), whose

shares are listed at the National Stock Exchange of India Limited ( hereinafter referred

to as " NSE" ) and The Bombay Stock Exchange Limited ( hereinafter referred to as

" BSE" ). M&M vide its letter dated 27th December, 2013 reported to the Securities and

Exchange Board of India ( hereinafter referred to as " SEBI" ) that the designated

employee of the Company, inter alia, Mr. Dilip Yewale ( hereinafter referred to as

" Noticee" ) has dealt in the shares of the Company on 24th October, 2014 i.e. during

the closure of trading window from October 01, 2013 to November 14, 2013

(hereinafter referred to as " Period of Examination / PoE " ) on account of the

announcement of Unaudited Financial Results of the Company for the second quarter

and half year ended September 30, 2013. The results were announced on November

13, 2013.

2. Thereafter, SEBI examined the possibility of trading on the basis of unpublished

price sensitive information in violation of SEBI ( Prohibition of Insider Trading )

Brought to you by http://StockViz.biz

Page2of7

Regulations,1992 ( hereinafter referred to as the " PIT Regulations,1992" ), if any, in

the matter.

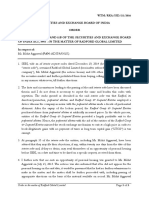

3. It was observed that that the Noticee had traded in the shares of the company on

24th October,2014 (i.e. during closure of trading window from October 1, 2013 to

November 14,2013) by selling 644 shares of the Company on the NSE platform for a

total amount of Rs.5,70,380/-. As a result of this sale transaction, the noticee was

required to make disclosures under Regulation 13(4) read with Regulation 13(5) of the

PIT Regulations,1992 to the company and the stock exchange viz. NSE within the

specified two days which the noticee allegedly failed to comply with. The noticee's

sale transaction is given as below:

Date

Exchg Gr

Buy

Vol

Gr Sell

Vol

Net

Trd

Vol

Gr

Trd

Vol

Gr

Buy

Value

Gr Sell

Value

Vol% -

Gr

Trd

Vol/M

kt

Vol% -

Net Trd

Vol/ Mkt

Net

DILIP YEWALE (AAMPY 5403F)

24/10/2013

NSE 0 644 -644 644 0 570380 0.02 0.09

Appointment of Adjudicating Officer :

4. I have been appointed as the Adjudicating Officer under Section 15-I of the Act read

with Rule 3 of the SEBI (Procedure for Holding Inquiry and Imposing Penalties by

Adjudicating Officer) Rules, 1995 (hereinafter referred to as Rules) vide order dated

6th May, 2014 to inquire into and adjudge under Section 15A(b) of the Securities and

Exchange Board of India Act,1992 ( hereinafter referred to as the " SEBI Act, 1992 "), the

alleged violation of Regulation 13(4) read with Regulation 13(5) of the PIT Regulations, 1992

committed by the Noticee.

Brought to you by http://StockViz.biz

Page3of7

Notice, Reply & Personal Hearing:

5. Accordingly, the Show Cause Notice dated 28th May, 2014 (hereinafter referred to

as the SCN) was issued to the Noticee in terms of Rule 4 of the Rules requiring it to

show cause as to why an inquiry should not be held for the alleged violations. The

Noticee vide his reply dated the 6th J une,2014 made submissions, which are, inter alia,

reproduced as below : --

" * At the beginning itself, I accept and sincerely apologize for the error committed

by me.

* I had to make some initial payments hence sold M&M shares.

* Details of M&M shares sold : 644 nos., on 24.10.2013 and the transaction note

details are NSEN 2013203 / 02021669.

* I work in M7M Vehicle Manufacturing Plant in Nasik as a General Manager, Plant

Quality. And have no access or aware of the financial details of the company

due to my job role. I am aware that that in specific period every quarter sale or

purchase is not to be done and have always been adhering that in the past.

* I was not aware that I had sold in the `No transaction period' until informed by my

company. I have explained and apologized to them for my error and they are not

at fault in any way. It has happened due to a mix up by me on the closure period

and there is no other intention for sale except to pay for the house. I carry the

learnings from here and will ensure it never repeats. I am the only source of

income for my family.

* I sincerely request you to be considerate and waiver the penal action, inquiry as

it was an error happened unknowingly and with no hidden intention.

5. In the interest of natural justice and in order to conduct an inquiry as per Rule 4(3) of

the Adjudication Rules, an opportunity of personal hearing was granted to the Noticee

on 6th August, 2014. The noticee attended the hearing and reiterated the contents of

his reply dated 6th J une,2014 .

Brought to you by http://StockViz.biz

Page4of7

Consideration of Issues, Evidence and Findings

6. I have carefully perused the charges against the Noticee , reply of the Noticee, and

the other material available on record.

The issues that arise for consideration in the present case are :-

(a) Whether the Noticee has violated the provisions of Regulation 13(4) read with

Regulation 13(5) of the PIT Regulations,1992?

(b) Does the violation, if any, on the part of the Noticee attract any penalty under

Sections 15A(b) of the SEBI Act,1992?

(c) If yes, what should be the quantum of penalty?

7. Before moving forward, it will be appropriate to refer to the relevant provisions of PIT

Regulations,1992 which read as under :-

Disclosure of interest or holding in listed companies by certain persons -

Continual Disclosure

13.Continual disclosure.

(3) .........

(4) Any person who is a director or officer of a listed company, shall disclose to the

company and the stock exchange where the securities are listed in Form D, the total

number of shares or voting rights held and change in shareholding or voting rights, if

there has been a change in such holdings of such person and his dependents (as

defined by the company) from the last disclosure made under sub-regulation (2) or

Brought to you by http://StockViz.biz

Page5of7

under this sub-regulation, and the change exceeds Rs. 5 lakh in value or 25,000 shares

or 1% of total shareholding or voting rights, whichever is lower.

(4A) ......

(5) The disclosure mentioned in sub-regulations (3), (4) and (4A) shall be made within

two working days of :

(a) the receipts of intimation of allotment of shares, or

(b) the acquisition or sale of shares or voting rights, as the case may be."

8. I observe that the Noticee had sold 644 shares of M&M on 24th October,2013 for a

total amount of 5,70,380/-. As a result of the sale of shares by the noticee , there was a

change in shareholding of the noticee exceeding Rs.5 lakh which required disclosures

to be made to the Company and the stock exchange within the specified two days under

regulation 13(4) read with regulation 13(5) of the PIT Regulations, 1992. However, it is

observed that the noticee admittedly failed to make the necessary disclosures in this

regard. I do not find merit in the submissions made by the noticee. In view of this, I

conclude that the Noticee has violated the provisions of Regulation 13(4) read with

Regulation 13(5) of the PIT Regulations, 1992, thus, warranting monetary penalty

under Section 15A(b) of the SEBI Act,1992.

11. Section 15A(b) of the SEBI Act,1992 reads as under :-

" 15A. Penalty for failure to furnish information, return, etc. If any person who is

required under this Act or any rules or regulations made there under:-

(a)........

(b) to file any return or furnish any information, books or other documents within the

time specified therefore in the regulations, fails to file return or furnish the same within

the time specified therefore in the regulations, he shall be liable to a penalty of one lakh

Brought to you by http://StockViz.biz

Page6of7

rupees for each day during which such failure continues or one crore rupees, whichever

is less. "

12. The Hon'ble Supreme Court of India in the matter of SEBI vs. Shriram Mutual

Funds [2006] 68 SCL (216) SC held that " once a violation of statutory regulation is

established, imposition of penalty becomes sine qua non of violation and the intention of

the parties committing such violation becomes totally irrelevant. Once the contravention

is established then penalty is to follow".

The Hon'ble Securities Appellate Tribunal in the matter of Milan Mahindra Securities

Private Limited vs SEBI ( in Appeal No. 66 of 2003) observed that " the purpose of

these disclosures is to bring about transparency in the transactions and assist the

Regulator to effectively monitor the transactions in the market."

13. While determining the quantum of penalty under Section 15A(b) of the SEBI

Act,1992, it is important to consider the factors stipulated in Section 15-J of the SEBI

Act,1992 which reads as under :-

15J Factors to be taken into account by the adjudicating officer :

While adjudging quantum of penalty under section 15-I, the adjudicating officer shall

have due regard to the following factors, namely:

(a) the amount of disproportionate gain or unfair advantage, wherever quantifiable,

made as a result of the default;

(b) the amount of loss caused to an investor or group of investors as a result of the

default;

(c) the repetitive nature of the default.

14. It is difficult, as per the material available on record, to quantify any gain or unfair

advantage accrued to the Noticee & the extent of loss suffered by the investors as a

result of the default of the Noticee. The disclosures made under Regulation 13(4) read

Brought to you by http://StockViz.biz

Page7of7

with regulation 13(5) of the PIT Regulations,1992 are made public only through the

Stock Exchange. It is with this end in view that the regulations require the making of

disclosures so that investing public is not deprived of any vital information. The

disclosures made to the stock exchange are the means to attain such end and,

therefore, dissemination of true and complete information is required.

ORDER

16. In view of the above, after considering all the facts and circumstances of the case

and exercising the powers conferred upon me under Section 15-I(2) of the SEBI Act,

1992 read with Rule 5 of the said Rules, I hereby impose a penalty of ` 2,00,000/-

(Rupees two lakh only ) on Mr.Dilip Yewale under Section 15A(b) of the SEBI Act,1992.

In my view, the penalty is commensurate with the default committed by the Noticee.

17. The penalty amount shall be paid by the Noticee through a Demand Draft drawn in

favour of SEBI Penalties Remittable to Government of India and payable at Mumbai,

within 45 (forty five) days of receipt of this order. The said Demand Draft should be

forwarded to the Division Chief, Integrated Surveillance Department (ISD), Securities

and Exchange Board of India, SEBI Bhavan, Plot No. C4 -A, G Block, Bandra-Kurla

Complex, Bandra (E), Mumbai 400 051.

18. In terms of Rule 6 of the said Rules, copies of this order are sent to the Noticee and

also to Securities and Exchange Board of India.

Date : August 12, 2014 D.SURA REDDY

Place: Mumbai ADJUDICATING OFFICER

Brought to you by http://StockViz.biz

You might also like

- Adjudication Order Against Ms - Manju Gupta in The Matter of Asian Oilfield Services LTDDocument7 pagesAdjudication Order Against Ms - Manju Gupta in The Matter of Asian Oilfield Services LTDShyam SunderNo ratings yet

- Adjudication Order Against Rajamani in The Matter of Gee Gee Granites Ltd.Document6 pagesAdjudication Order Against Rajamani in The Matter of Gee Gee Granites Ltd.Shyam SunderNo ratings yet

- Adjudication Order Against MR - Sagar Pravin Shah in The Matter of Amar Remedies LimitedDocument9 pagesAdjudication Order Against MR - Sagar Pravin Shah in The Matter of Amar Remedies LimitedShyam SunderNo ratings yet

- Adjudication Order Against Kothari Global Limited in The Matter of SCORESDocument6 pagesAdjudication Order Against Kothari Global Limited in The Matter of SCORESShyam SunderNo ratings yet

- Adjudication Order in The Matter of M/s Coromandel International Limited (Erstwhile Liberty Phosphate Limited) Page 1 of 9Document9 pagesAdjudication Order in The Matter of M/s Coromandel International Limited (Erstwhile Liberty Phosphate Limited) Page 1 of 9Shyam SunderNo ratings yet

- Adjudication Order in Respect of Mr. Rajat Mathur in The Matter of M/s Wipro Ltd.Document11 pagesAdjudication Order in Respect of Mr. Rajat Mathur in The Matter of M/s Wipro Ltd.Shyam SunderNo ratings yet

- Adjudication Order Against Hooghly Mills Project Ltd. and Hooghly Stocks & Bonds Pvt. Ltd. in The Matter of Waverly Investments Ltd.Document7 pagesAdjudication Order Against Hooghly Mills Project Ltd. and Hooghly Stocks & Bonds Pvt. Ltd. in The Matter of Waverly Investments Ltd.Shyam SunderNo ratings yet

- Adjudication Order in Respect of Waverley Investments Ltd.Document8 pagesAdjudication Order in Respect of Waverley Investments Ltd.Shyam SunderNo ratings yet

- Adjudication Order Against CRB Capital Markets LimitedDocument5 pagesAdjudication Order Against CRB Capital Markets LimitedShyam SunderNo ratings yet

- Chairman, SEBI vs. Shriram Mutual FundsDocument11 pagesChairman, SEBI vs. Shriram Mutual FundsRohit Singh DhurveNo ratings yet

- Adjudication Order in Respect of Rudra Securities & Capital Limited in The Matter of Turbotech Engineering LTDDocument5 pagesAdjudication Order in Respect of Rudra Securities & Capital Limited in The Matter of Turbotech Engineering LTDShyam SunderNo ratings yet

- Adjudicatory Mechanism Under Sebi Act: Securities Law ProjectDocument15 pagesAdjudicatory Mechanism Under Sebi Act: Securities Law ProjectsharikaNo ratings yet

- The Chairman, Sebi Vs Shriram Mutual Fund & AnrDocument13 pagesThe Chairman, Sebi Vs Shriram Mutual Fund & AnrShrom SethiNo ratings yet

- Adjudication Order Against Complex Trading Company Limited in The Matter of SCORESDocument6 pagesAdjudication Order Against Complex Trading Company Limited in The Matter of SCORESShyam SunderNo ratings yet

- Adjudication Order in Respect of M/s Genus Prime Infra Limited (Erstwhile Known As 'M/s Gulshan Chemfill Limited')Document7 pagesAdjudication Order in Respect of M/s Genus Prime Infra Limited (Erstwhile Known As 'M/s Gulshan Chemfill Limited')Shyam SunderNo ratings yet

- Adjudication Order Against Midland Rubber and Produce Company LTD., MR Ajit Thomas, Ms. Shanthi Thomas and Neelamalai Agro Industries LTD - in The Matter of AVT Natural Products Ltd.Document7 pagesAdjudication Order Against Midland Rubber and Produce Company LTD., MR Ajit Thomas, Ms. Shanthi Thomas and Neelamalai Agro Industries LTD - in The Matter of AVT Natural Products Ltd.Shyam SunderNo ratings yet

- Adjudication Order in Respect of M/s Ambe Hotel & Resorts LimitedDocument8 pagesAdjudication Order in Respect of M/s Ambe Hotel & Resorts LimitedShyam SunderNo ratings yet

- Adjudication Order in Respect of Sanjay Thakkar in The Matter of M/s. Gujarat Arth Ltd.Document14 pagesAdjudication Order in Respect of Sanjay Thakkar in The Matter of M/s. Gujarat Arth Ltd.Shyam SunderNo ratings yet

- Adjudication Order Against MFL India LTD in Matter of Non-Redressal of Investor Grievances(s)Document5 pagesAdjudication Order Against MFL India LTD in Matter of Non-Redressal of Investor Grievances(s)Shyam SunderNo ratings yet

- Adjudication Order Against Computech International Limited in The Matter of SCORESDocument6 pagesAdjudication Order Against Computech International Limited in The Matter of SCORESShyam SunderNo ratings yet

- Adjudication Order Against Hatigor Tea Estates Limited in The Matter of SCORESDocument6 pagesAdjudication Order Against Hatigor Tea Estates Limited in The Matter of SCORESShyam SunderNo ratings yet

- Adjudication Order Against Mercury Fund Management Company LTD in The Matter of Gennex Laboratories Ltd.Document10 pagesAdjudication Order Against Mercury Fund Management Company LTD in The Matter of Gennex Laboratories Ltd.Shyam SunderNo ratings yet

- Adjudication Order in Respect of in Respect of Mipco Seamless Rings (Gujarat) Ltd.Document7 pagesAdjudication Order in Respect of in Respect of Mipco Seamless Rings (Gujarat) Ltd.Shyam SunderNo ratings yet

- Order in The Matter of Kukar Sons (Indo French) Exports Ltd.Document11 pagesOrder in The Matter of Kukar Sons (Indo French) Exports Ltd.Shyam SunderNo ratings yet

- SEBI Order Addresses Circular Trading in Mindvision Capital LtdDocument26 pagesSEBI Order Addresses Circular Trading in Mindvision Capital Ltdsakshi baadkarNo ratings yet

- Adjudication Order Against Upvan Securities Pvt. Ltd. (Currently Known As Altius Finserve Pvt. LTD.) in The Matter of Capman Financials Ltd.Document7 pagesAdjudication Order Against Upvan Securities Pvt. Ltd. (Currently Known As Altius Finserve Pvt. LTD.) in The Matter of Capman Financials Ltd.Shyam SunderNo ratings yet

- Adjudication Order in Respect of Shri Mahendra P Rathod in The Matter of SEL Manufacturing Co Ltd.Document7 pagesAdjudication Order in Respect of Shri Mahendra P Rathod in The Matter of SEL Manufacturing Co Ltd.Shyam SunderNo ratings yet

- Adjudication Order Dated May 05, 2015 With Respect To The Promoters of Austral Coke and Projects LimitedDocument17 pagesAdjudication Order Dated May 05, 2015 With Respect To The Promoters of Austral Coke and Projects LimitedShyam SunderNo ratings yet

- Interim Order Cum Show Cause Notice in The Matter of Bhabiswajyoti Infrastructure India LimitedDocument16 pagesInterim Order Cum Show Cause Notice in The Matter of Bhabiswajyoti Infrastructure India LimitedShyam SunderNo ratings yet

- Adjudication Order in Respect of M/s Mark Omega Organic Industries Limited in The Matter of M/s Mark Omega Organic Industries LimitedDocument10 pagesAdjudication Order in Respect of M/s Mark Omega Organic Industries Limited in The Matter of M/s Mark Omega Organic Industries LimitedShyam SunderNo ratings yet

- Adjudication Order in Respect of Haresh Infrastructure Private Ltd. in The Scrip of Turbotech Engineering Ltd.Document5 pagesAdjudication Order in Respect of Haresh Infrastructure Private Ltd. in The Scrip of Turbotech Engineering Ltd.Shyam SunderNo ratings yet

- Adjudication Order in Respect of M/s Arihant Thermoware Limited in The Matter of M/s Arihant Thermoware LimitedDocument11 pagesAdjudication Order in Respect of M/s Arihant Thermoware Limited in The Matter of M/s Arihant Thermoware LimitedShyam SunderNo ratings yet

- Adjudication Order in Respect of Shreeji Broking Pvt. Ltd. in The Matter of Turbotech Engineering LTDDocument5 pagesAdjudication Order in Respect of Shreeji Broking Pvt. Ltd. in The Matter of Turbotech Engineering LTDShyam SunderNo ratings yet

- Adjudication Order Against Shri Laxmilal Achha in The Matter of Vamshi Rubber LTDDocument4 pagesAdjudication Order Against Shri Laxmilal Achha in The Matter of Vamshi Rubber LTDShyam SunderNo ratings yet

- Adjudication Order in Respect of Shri Dipin Surana in The Matter of P.M. Telelinks Ltd.Document7 pagesAdjudication Order in Respect of Shri Dipin Surana in The Matter of P.M. Telelinks Ltd.Shyam SunderNo ratings yet

- Adjudication Order in Respect of M/s Western Foods LimitedDocument8 pagesAdjudication Order in Respect of M/s Western Foods LimitedShyam SunderNo ratings yet

- In The Matter of Akriti Global Traders Ltd.Document8 pagesIn The Matter of Akriti Global Traders Ltd.Shyam SunderNo ratings yet

- Settlement Order in The Matter of M/s. Welspun India LimitedDocument3 pagesSettlement Order in The Matter of M/s. Welspun India LimitedShyam SunderNo ratings yet

- Adjudication Order in Respect of Right Finstock Pvt. Ltd. in The Matter of M/s Gujarat Arth Ltd.Document16 pagesAdjudication Order in Respect of Right Finstock Pvt. Ltd. in The Matter of M/s Gujarat Arth Ltd.Shyam SunderNo ratings yet

- Adjudication Order Against Samara Capital Partners Fund I LTD in The Matter of Asian Oilfield Services LimitedDocument8 pagesAdjudication Order Against Samara Capital Partners Fund I LTD in The Matter of Asian Oilfield Services LimitedShyam SunderNo ratings yet

- Adjudication Order Against Parikarma Tecfhnofab LTD in Matter of Non-Redressal of Investor GrievancesDocument5 pagesAdjudication Order Against Parikarma Tecfhnofab LTD in Matter of Non-Redressal of Investor GrievancesShyam SunderNo ratings yet

- Confirmatory Order Against Mohit Aggarwal in The Matter of Radford Global Ltd.Document3 pagesConfirmatory Order Against Mohit Aggarwal in The Matter of Radford Global Ltd.Shyam SunderNo ratings yet

- Order in The Matter of M/s. Alchemist Infra Realty LimitedDocument12 pagesOrder in The Matter of M/s. Alchemist Infra Realty LimitedShyam SunderNo ratings yet

- Adjudication Order Against Shriram Bearings LTD in Matter of Non-Redressal of Investor Grievances(s)Document6 pagesAdjudication Order Against Shriram Bearings LTD in Matter of Non-Redressal of Investor Grievances(s)Shyam SunderNo ratings yet

- Adjudication Order in Respect of Neha Jainarain Agarwal in The Matter of Jaipan Industries LimitedDocument7 pagesAdjudication Order in Respect of Neha Jainarain Agarwal in The Matter of Jaipan Industries LimitedShyam SunderNo ratings yet

- Adjudication Order in The Matter of Hotline Teletubes & Components LTDDocument5 pagesAdjudication Order in The Matter of Hotline Teletubes & Components LTDShyam SunderNo ratings yet

- Adjudication Order Against Chain Impex Limited in The Matter of SCORESDocument6 pagesAdjudication Order Against Chain Impex Limited in The Matter of SCORESShyam SunderNo ratings yet

- Adjudication Order in Respect of Vinod Shares Ltd. in The Matter of Maharashtra Polybutenes Ltd.Document17 pagesAdjudication Order in Respect of Vinod Shares Ltd. in The Matter of Maharashtra Polybutenes Ltd.Shyam SunderNo ratings yet

- Order in The Matter of M/s Alchemist Infra Realty LTDDocument32 pagesOrder in The Matter of M/s Alchemist Infra Realty LTDShyam SunderNo ratings yet

- Adjudication Order Against Compact Disc India Limited in Matter of Non-Redressal of Investor Grievance(s)Document5 pagesAdjudication Order Against Compact Disc India Limited in Matter of Non-Redressal of Investor Grievance(s)Shyam SunderNo ratings yet

- Adjudication Order Against Organic Chemoils Limited in Matter of Non-Redressal of Investor Grievances(s)Document5 pagesAdjudication Order Against Organic Chemoils Limited in Matter of Non-Redressal of Investor Grievances(s)Shyam SunderNo ratings yet

- Adjudication Order against Shri. Bhanwarlal H Ranka, Shri. Pradeep B Ranka, Ms. Kusum B Ranka, Ms. Sangeetha P Ranka, Ms. Anjana B Ranka, Shri. Arun B Ranka , Ms. Rachana A Ranka and Shri. Kantilal G Bafna in the matter of Residency Projects and Infratech Ltd.Document8 pagesAdjudication Order against Shri. Bhanwarlal H Ranka, Shri. Pradeep B Ranka, Ms. Kusum B Ranka, Ms. Sangeetha P Ranka, Ms. Anjana B Ranka, Shri. Arun B Ranka , Ms. Rachana A Ranka and Shri. Kantilal G Bafna in the matter of Residency Projects and Infratech Ltd.Shyam SunderNo ratings yet

- Adjudication Order Against Usha Rectifier Corporation Ltd. in Matter of Non-Redressal of Investor GrievancesDocument6 pagesAdjudication Order Against Usha Rectifier Corporation Ltd. in Matter of Non-Redressal of Investor GrievancesShyam SunderNo ratings yet

- Adjudication Order Against Sooraj Automobiles Ltd. in The Matter of Non-Redressal of Investor GrievanceDocument6 pagesAdjudication Order Against Sooraj Automobiles Ltd. in The Matter of Non-Redressal of Investor GrievanceShyam SunderNo ratings yet

- Adjudication Order Against Kanika Infotech Limited in The Matter of SCORESDocument5 pagesAdjudication Order Against Kanika Infotech Limited in The Matter of SCORESShyam SunderNo ratings yet

- Adjudication Order in Respect of M/s Tasc Finance Limited in The Matter of M/s Tasc Finance LimitedDocument11 pagesAdjudication Order in Respect of M/s Tasc Finance Limited in The Matter of M/s Tasc Finance LimitedShyam SunderNo ratings yet

- Interim Order in The Matter of Mass Infra Realty LimitedDocument17 pagesInterim Order in The Matter of Mass Infra Realty LimitedShyam Sunder0% (1)

- Kamat Hotels CaseDocument11 pagesKamat Hotels CaseJIA SHARMANo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Zaid Hamid: Alhamdolillah ... Declarations From The FB Battle Station From January To November 2013 !!Document1,140 pagesZaid Hamid: Alhamdolillah ... Declarations From The FB Battle Station From January To November 2013 !!Sabeqoon Wal AwaloonNo ratings yet

- Nationalism and The Ukrainian MilitaryDocument114 pagesNationalism and The Ukrainian MilitaryAndrew K. Fesiak100% (1)

- 1 - Normative and Theoretical Foundations of Human Rights - Anthony Langlois PDFDocument15 pages1 - Normative and Theoretical Foundations of Human Rights - Anthony Langlois PDFnoreen singhNo ratings yet

- Obiasca V BasalloteDocument2 pagesObiasca V BasalloteKenneth Peter MolaveNo ratings yet

- Introduction To International Trade Law Note 3 of 13 Notes: Dispute SettlementDocument40 pagesIntroduction To International Trade Law Note 3 of 13 Notes: Dispute SettlementMusbri MohamedNo ratings yet

- Strengthening Judicial Independence in A Modern ScotlandDocument10 pagesStrengthening Judicial Independence in A Modern ScotlandThe Royal Society of EdinburghNo ratings yet

- Is Mercantilism still alive? Economic nationalism and global cooperationDocument3 pagesIs Mercantilism still alive? Economic nationalism and global cooperationRicha ILSNo ratings yet

- Latifah Bte Mat Zin V Rosmawati Bte SharibunDocument20 pagesLatifah Bte Mat Zin V Rosmawati Bte SharibunNur Ain Yusof100% (1)

- Date Sheet PG (November 2017)Document10 pagesDate Sheet PG (November 2017)Lekh RajNo ratings yet

- The Rise and Political Influence of the Aquino DynastyDocument13 pagesThe Rise and Political Influence of the Aquino DynastyCarl Jibri C. SIANo ratings yet

- Tanim Bala and Tanim Droga - GRP 3 HR - Consolidated PDFDocument82 pagesTanim Bala and Tanim Droga - GRP 3 HR - Consolidated PDFRaamah DadhwalNo ratings yet

- Appellate Brief by StateDocument25 pagesAppellate Brief by StateMark A. Adams JD/MBA100% (2)

- BAR MATTER 1153 Estelito MendozaDocument3 pagesBAR MATTER 1153 Estelito MendozaRonald Jay Gopez100% (1)

- Affidavit of Citizenship Status 20160120Document1 pageAffidavit of Citizenship Status 20160120Don SalaNo ratings yet

- Supreme Court Convicts Man of Treason for Aiding Japanese During WWII Zoning OperationDocument2 pagesSupreme Court Convicts Man of Treason for Aiding Japanese During WWII Zoning OperationMyrna B RoqueNo ratings yet

- Medina SpectorDocument18 pagesMedina SpectorLeonardo De QueirozNo ratings yet

- Philippine politics and legal functions explored through key conceptsDocument12 pagesPhilippine politics and legal functions explored through key conceptsJOACHIM LAMBERTO PASTORALNo ratings yet

- Approaches to Studying Political ScienceDocument12 pagesApproaches to Studying Political ScienceOnindya MitraNo ratings yet

- (9781849804516 - Comparative Contract Law) Chapter 1 - Theories of Contract LawDocument12 pages(9781849804516 - Comparative Contract Law) Chapter 1 - Theories of Contract LawSuryanshi GuptaNo ratings yet

- GC Conference Detailed Script Schedule ExampleDocument14 pagesGC Conference Detailed Script Schedule Exampleapi-333845297No ratings yet

- Women in Development ApproachesDocument11 pagesWomen in Development ApproachesCyra BukshNo ratings yet

- Plumptre Vs RiveraDocument2 pagesPlumptre Vs RiveraTeZzieAwas100% (5)

- United States v. Mark Zborowski, 271 F.2d 661, 2d Cir. (1959)Document9 pagesUnited States v. Mark Zborowski, 271 F.2d 661, 2d Cir. (1959)Scribd Government DocsNo ratings yet

- Industrial Timber Corp V AbabonDocument2 pagesIndustrial Timber Corp V AbabonglainarvacanNo ratings yet

- Constitutional Law Essay Rules For Bar ExamDocument14 pagesConstitutional Law Essay Rules For Bar ExamT Sheth100% (6)

- List of Charitable Organisations in Abu DhabiDocument3 pagesList of Charitable Organisations in Abu DhabiAhmad SudirmanNo ratings yet

- The Rise of Nationalism in EuropeDocument23 pagesThe Rise of Nationalism in EuropeNikhil Kumar 193% (15)

- The GG Background HyperdocDocument6 pagesThe GG Background Hyperdocapi-520774179No ratings yet

- People Vs PrietoDocument2 pagesPeople Vs PrietoJuralexNo ratings yet

- Eliza TurnerDocument7 pagesEliza TurnerAnonymous puqCYDnQNo ratings yet