Professional Documents

Culture Documents

Jidhaa Coal

Uploaded by

KUNALJAY0 ratings0% found this document useful (0 votes)

28 views36 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views36 pagesJidhaa Coal

Uploaded by

KUNALJAYCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 36

Australian LV Coal Producers:

Proven performance, but where to next?

Ross Stainlay

General Manager Marketing

J ellinbah Resources

CoalTrans World Anthracite & PCI Conference, September 2004, Hanoi

J e l l i nb ah Res o ur c e s

Outline

Mines

Location

Production

Quality

Infrastructure

Port, Rail

End Use

PCI and other uses

Future Projections

Mines

1.6 Mt Export Sales

2003/2004

Gladstone Port

Blackwater Rail System

Yarrabee Coal

Company

Mine Operator

YARRABEE Mine Name

4.0 Mt Export Sales

2003/2004

Gladstone Port

Blackwater Rail System

J ellinbah

Resources

Mine Operator

JELLINBAH Mine Name

1.9 Mt Export Sales

2003/2004

Dalrymple Bay Port

Goonyella Rail System

FoxleighMining Mine Operator

FOXLEIGH Mine Name

5.2 Mt Export Sales

2003/2004

Dalrymple Bay Port

Goonyella Rail System

Australian Premium

Coals

Mine Operator

COPPABELLA /

MOORVALE

Mine Name

3.7 Mt Export Sales

2003/2004

Hay Point Port

Goonyella Rail System

BMA Mine Operator

SOUTH WALKER

CREEK

Mine Name

Queensland LV Coal Producers

Total Reserves

Measured 363 Mt

Queensland LV Coal Exports

0

2

4

6

8

10

12

14

16

18

1995/96 1996/97 1997/98 1998/99 1999/00 2000/01 2001/02 2002/03 2003/04

Austral i an Fi scal Year (endi ng 30 June)

Mt

Moorval e

Foxl ei gh

Coppabel l a

South Wal ker Creek

Yarrabee

Jel l i nbah

Source: Department of Natural Resources & Mines - Qld Coal Industry Reviews

0

5

10

15

20

25

Source: Department of Natural Resources & Mines, 2003 Australian Black Coal Statistics

Queensland Coal Mines Strip Ratio

Strip Ratio (bcm / product tonne)

LV Coal is shown in red

LV Coals from Queensland

0.40

0.45

0.50

0.55

0.60

0.65

0.70

9 10 11 12 13 14 15 16 17

VM % (ad)

TS % (ad)

Jel l i nbah

Coppabel l a

Sout h Wal ker Creek

Foxl ei gh

Yarrabee

Moorval e

Area is proportional to tonnes

Queensland Rangal Coals

PCI / Thermal Fraction CPP Flowsheet

DMC

(Secondary)

DMC

(Primary)

FINES

CIRCUIT

FINES

CIRCUIT

REJECT PCI /

THERMAL

COKING

COAL

Coarse

Intermediate

Fines

Slimes

FEED SIZE

PROCESS

* DMC =dense medium cyclone

F

S

S

F

Infrastructure

QR* Coal Railings (*formerl y Queensland Rail)

50

70

90

110

130

150

1

9

9

0

/

9

1

1

9

9

1

/

9

2

1

9

9

2

/

9

3

1

9

9

3

/

9

4

1

9

9

4

/

9

5

1

9

9

5

/

9

6

1

9

9

6

/

9

7

1

9

9

7

/

9

8

1

9

9

8

/

9

9

1

9

9

9

/

0

0

2

0

0

0

/

0

1

2

0

0

1

/

0

2

2

0

0

2

/

0

3

2

0

0

3

/

0

4

Mt

Source: QR

QR Rail Snapshot

250 locomotives

5 500 coal wagons

Average 470 services a week

Train Sizes up to 10 000 t

Average 7 000 t

Queensland Coal Exports by Port

(2003/04 Provisional Figures)

Gladstone

Brisbane

Abbot Point

Dalrymple Bay

Hay Point

LV Coal

Other

3 Mt

42 Mt

34 Mt

44 Mt

12 Mt

Source: Barlow J onker Aug 04

CQPA Port of Gladstone - Coal Exports

0

5

10

15

20

25

30

35

40

45

1999/00 2000/01 2001/02 2002/03 2003/04

Mt

Barney Poi nt

RGTCT Non-

bl ended

RGTCT

Bl ended

1993/94 exports

= 18 Mt approx

Source: Central Queensland Ports Authority

Hay Point Coal Terminal Throughput

0

5

10

15

20

25

30

35

40

1999/00 2000/01 2001/02 2002/03 2003/04

Mt

Provisi onal

Source: Barlow J onker Aug 04

Dalrymple Bay Coal Terminal

- Historic and Projected Capacity

0

10

20

30

40

50

60

70

80

90

100

1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010

Aust ralian Fiscal Year (ending 30 June)

Mtpa

Actual Throughput

Net Operati onal Capaci ty

Hi gh Case proj ecti ons

Low Case proj ecti ons

Source: Prime Infrastructure

Projected

Expansion

Stage 1

2

3

4

5

6

High

Low

Utilisation of Port Capacity - 2003

97 %

91 %

81 %

0

10

20

30

40

50

60

Dal rympl e Bay Gl adstone Hay Poi nt

Mt

Export s (Mt) Capaci ty (Mt)

Source: Barlow J onker Aug 04

Queensland Coal Industry

- Working Days Lost per 1000 Employees

0

1000

2000

3000

4000

5000

6000

7000

8000

1996 1997 1998 1999 2000 2001 2002 2003

Cal endar Year

No. of Days

Source: Australian Bureau of Statistics

End Use

Pulverized Coal Injection into Blast Furnaces

Coke

PCI

Coal

Coke Ovens Blast Furnace

Coal Grinding and

Injection System

Courtesy of BMH

Typical PCI Installation

Raw Coal

Blast Furnace L

10 000 t HM / d

Natural

Gas

Nitrogen

Booster Compressors

2000 t

Inj ection Station

2 x 19

834 t

2 x 42 t/h

2 x 42 t/h

Pulveri zers

Source: Claudius Peters Technologies GmbH

0

10

20

30

40

50

60

70

Europe Japan Brazi l * Chi na * Indi a

No of BFs

Operat i ng BF PCI Fi t ted

* China have another 130 furnaces between 200 and 1000 m

3.

Brazil excludes charcoal BFs

PCI Coverage by Region & Average Injection Rates

(furnaces larger than 1000 m

3

)

155

Average PCI Rate

kg/tHM

125

135

125

130

0

5

10

15

20

25

30

35

40

45

97 98 99 00 01 02 03 04

F

05

F

06

F

07

F

08

F

09

F

10

F

Mt

Other

Canada

Venezuel a

Indonesi a

RSA

Austral i a:

Other

Austral i a: Low

Vol

PCI Coal Exports by Origin

F =Forecast

Source: Barlow J onker Aug 04

Vietnam included

in Other

Coddington Intl

Hill & Associates

Queensland LV Coal - Exports by Region

0

2

4

6

8

10

12

14

16

18

1995/96 1996/97 1997/98 1998/99 1999/00 2000/01 2001/02 2002/03 2003/04

Austral i an Fi scal Years (endi ng 30 June)

Mt

Other

Ameri cas

EU15

Asi a

Source: Department of Natural Resources & Mines - Qld Coal Industry Reviews

0

5

10

15

20

25

30

35

40

1997 1998 1999 2000 2001 2002 2003 2004

F

2005

F

2006

F

2007

F

2008

F

2009

F

2010

F

Mt

Other

Ameri cas

EU15

Asi a

Demand for Imported PCI Coal

Source: Barlow J onker Aug 04

F =Forecast

75 80 85 90

Carbon (%daf)

0.2

0.4

0.6

0.8

1.0

R

e

p

l

a

c

e

m

e

n

t

R

a

t

i

o

European correlation (Brouwer & Toxopeus, 1991)*

Other European correlation (1999)*

J apanese correlation (Ishii, 2000)*

Modelling 1 (Hutny and others, 1990)**

Modelling 2 (Fukushima, 2000)**

* Actual blast furnace performance

** Theoretical computer model

Replacement Ratio

(RR = kg of coke repl aced for each kg of coal injected)

LV Coals

The LV Advantage (4 Mtpa HM)

High Vol PCI

Coking Coal 509 kg/tHM @ $US50/t

Yields 386 kg/tHM Coke

PCI 150 kg/tHM

RR 0.76 & $US40/t

Coal Cost = US$31.45 /tHM

= US$126 million pa

Savings US$ 6 million pa

Coking Coal 479 kg/tHM @ $US50/t

Yields 362 kg/tHM Coke

PCI 150 kg/tHM

RR 0.92 & $US40/t

Coal Cost = US$29.95 /tHM

= US$120 million pa

Savings US$ 12 million pa

LV PCI

All coal prices FOB basis coke blend of HCC & SSCC coals

Excludes value of by-products, coke oven gas and coke breeze

Coking Coal 662 kg/tHM @ $US50/t

Yields 500 kg/tHM Coke

Coal Cost = US$33.10 /tHM

= US$132 million pa

No PCI

Coal prices are for comparison purposes only.

RR = coke replacement ratio

Low Vol PCI Coal High Vol PCI Coal

Low VM Coal

High VM Coal

Hot Blast:

Equal or

Slightl y Higher

Hot Blast:

Equal or

Slightl y Lower

O

2

Rate:

Equal or

Lower

O

2

Rate:

Equal or

Higher

Permeability:

Equal or

Slightly Lower

Permeability:

Equal or

Slightly Higher

Gas Reduction:

Lower

Gas Reduction:

Higher

RAFT: Higher

RAFT: Lower

Combustion

Efficiency: Lower

Combustion

Efficiency: Higher

Fuel Rati o: Lower

Coke Rati o: Lower

Fuel Rati o: Higher

Coke Rati o: Higher

Top Gas Vol.: Lower

Calorific Value: Lower

Top Gas Vol.: Higher

Calorific Value: Higher

Dust : Equal or

Slightl y Higher

Dust : Equal or

Slightl y Lower

Impact of PCI Coal Type on BF Operation

Pig Iron Production by Calendar Year

* assumes same production in 2

nd

half of year 2004

0

25

50

75

100

125

150

1997 1998 1999 2000 2001 2002 2003 2004 P

Mt Asia (excluding China)

0

25

50

75

100

125

150

1997 1998 1999 2000 2001 2002 2003 2004 P

Mt EU15

0

20

40

60

80

1997 1998 1999 2000 2001 2002 2003 2004 P

Mt

NAFTA

0

20

40

60

80

1997 1998 1999 2000 2001 2002 2003 2004 P

Mt

South Ameri ca

*

*

*

*

Source: IISI

Japan Pig Iron by Cal endar Year

* assumes same production in 2

nd

half of year 2004

70

72

74

76

78

80

82

84

1997 1998 1999 2000 2001 2002 2003 2004

Cal endar Year

Mt

Projected

*

Source: IISI

15

16

17

18

19

20

21

22

Months - August 2003 to Jul y 2004

Mt

2003/2004 Correspondi ng peri od 12 months previ ous

Countries include: Japan, Belgium,

France, Germany, The Netherlands, UK,

Brazil, India, Korea & Chinese Taipei

Blast Furnace Iron Production

- Major Coal Importing Countries, August 2003 to July 2004

CRU Steel Price Index, Global

60

70

80

90

100

110

120

130

140

150

160

J

a

n

-

0

2

M

a

r

-

0

2

M

a

y

-

0

2

J

u

l

-

0

2

S

e

p

-

0

2

N

o

v

-

0

2

J

a

n

-

0

3

M

a

r

-

0

3

M

a

y

-

0

3

J

u

l

-

0

3

S

e

p

-

0

3

N

o

v

-

0

3

J

a

n

-

0

4

M

a

r

-

0

4

M

a

y

-

0

4

J

u

l

-

0

4

S

e

p

-

0

4

Index Val ue

Apri l 1994 = 100

Source: CRU Monitor

20 % LV 40 % LV 60 % LV

80 % LV

100

110

120

130

140

150

160

170

180

190

200

0 5 10 15 20 25

LV PCI Coal Requi rements (Mt )

PCI Rate (kg/tHM)

Source: IISI

* Approx 190 Mt hot metal

(Example onl y)

Impact of Changing PCI Usage Patterns

- Top 10 Steel Producers* Using Imported PCI Coal

Features of Queensland LV Operations

5 independent producers, operating in a

politically stable environment

Large reserve base

Favourable mining conditions (open cut)

World class infrastructure including 3 major

coal terminals

Proven performance and capacity to expand

The future &

concluding

comments

The Future

Demand for LV coal is a function of:

BF hot metal production (coastal plants)

PCI rate (kg/t)

% of low vol in PCI coal

Also depends on price competitiveness relative

to alternative fuels (thermal coal, oil and gas)

Immediate outlook is for continuing strong

demand with measured production increases

from existing mines along with new capacity

J e l l i nbah Res our c es

Thank you

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Steel Metallurgy For The Non-Metallurgist: January 2007Document11 pagesSteel Metallurgy For The Non-Metallurgist: January 2007Anurag RamdasNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- DicyanineDocument4 pagesDicyanineHennie Namløs ThorneNo ratings yet

- Digital ExciterDocument80 pagesDigital ExciterKUNALJAY100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- ABB Protection Application HandbookDocument356 pagesABB Protection Application HandbookSyed Muhammad Munavvar HussainNo ratings yet

- Motor TestingDocument26 pagesMotor TestingGas Gas DucatiNo ratings yet

- Cable Sizing Charts RevADocument8 pagesCable Sizing Charts RevAKUNALJAYNo ratings yet

- Strength of MaterialsDocument13 pagesStrength of MaterialsPJ Gealone50% (12)

- Reactor ProtectionDocument25 pagesReactor Protectiongkpalepu90% (10)

- Stoichiometry Notes KEYDocument17 pagesStoichiometry Notes KEYOnofre Algara Jr.No ratings yet

- 400-200 KV Substation DesignDocument62 pages400-200 KV Substation DesignMousum91% (22)

- Asian Sciences Olympiad 2015 CONTEST: Rules and RegulationsDocument8 pagesAsian Sciences Olympiad 2015 CONTEST: Rules and RegulationsNguyễn Thị HảiNo ratings yet

- Element of PowerDocument334 pagesElement of Powermwu08No ratings yet

- Abb Excitation 1Document45 pagesAbb Excitation 1Erbil KeskinNo ratings yet

- Torqueo Pikotek PDFDocument4 pagesTorqueo Pikotek PDFjast111100% (1)

- Physics of Radio Frequency Plasmas PDFDocument395 pagesPhysics of Radio Frequency Plasmas PDFdada12100% (1)

- Coal Dust Explosions in Cement IndustryDocument17 pagesCoal Dust Explosions in Cement Industrymareymorsy2822No ratings yet

- Advantages of Low Volatile Coals for PCIDocument24 pagesAdvantages of Low Volatile Coals for PCIKUNALJAYNo ratings yet

- The Kakas of New ZealandDocument3 pagesThe Kakas of New ZealandKUNALJAYNo ratings yet

- Presentation For Monthly PerformanceDocument9 pagesPresentation For Monthly PerformanceKUNALJAYNo ratings yet

- On Line Energy Conservation System: K.R. Nerkar GM (Electrical)Document47 pagesOn Line Energy Conservation System: K.R. Nerkar GM (Electrical)KUNALJAYNo ratings yet

- Scot M3K-MXP PDFDocument2 pagesScot M3K-MXP PDFKUNALJAYNo ratings yet

- Vacuum Interrupter Tester: VidarDocument3 pagesVacuum Interrupter Tester: VidarKUNALJAYNo ratings yet

- Vacuum Interrupter Tester: VidarDocument3 pagesVacuum Interrupter Tester: VidarKUNALJAYNo ratings yet

- HJGFHJFGDocument2 pagesHJGFHJFGNanang Jaka PerdanaNo ratings yet

- Control Accessories Product CatalogDocument56 pagesControl Accessories Product CatalogKUNALJAYNo ratings yet

- Overview Bearing Types PDFDocument9 pagesOverview Bearing Types PDFKUNALJAYNo ratings yet

- General Maths InstructionsDocument3 pagesGeneral Maths InstructionsKUNALJAYNo ratings yet

- WoodwardDocument4 pagesWoodwardKUNALJAYNo ratings yet

- 3882 1 SipolCatalogueDocument12 pages3882 1 SipolCatalogueAlfonso Núñez SchorrNo ratings yet

- Ger 3181Document10 pagesGer 3181bpchimeraNo ratings yet

- VMDocument9 pagesVMKUNALJAYNo ratings yet

- Electrical Safety - SampleDocument29 pagesElectrical Safety - SamplesyakirohNo ratings yet

- HJGFHJFGDocument2 pagesHJGFHJFGNanang Jaka PerdanaNo ratings yet

- Product Spec Energy Coal South AfricaDocument1 pageProduct Spec Energy Coal South Africarabbu14No ratings yet

- Low Volatile Doosan BabcockDocument22 pagesLow Volatile Doosan BabcockKUNALJAY100% (1)

- Sulphur Formula As Per USDocument9 pagesSulphur Formula As Per USKUNALJAYNo ratings yet

- Sulphur Formula As Per USDocument9 pagesSulphur Formula As Per USKUNALJAYNo ratings yet

- Combustion Characteristics of Low Grade Coal And: Principal Research ResultsDocument2 pagesCombustion Characteristics of Low Grade Coal And: Principal Research ResultsKUNALJAYNo ratings yet

- Failure Analysis of Metal Alloy Propeller Shafts: SciencedirectDocument4 pagesFailure Analysis of Metal Alloy Propeller Shafts: SciencedirectAfiq IkhwanNo ratings yet

- Lecturer Chemistry Model QuestionDocument11 pagesLecturer Chemistry Model QuestionPrathana Vidya100% (1)

- Nanotechnology v1.0Document43 pagesNanotechnology v1.0Faizan AhmedNo ratings yet

- PV Module IonDocument4 pagesPV Module IonrmalewarNo ratings yet

- 01-02. The Chemical Context of LifeDocument4 pages01-02. The Chemical Context of LifeDaniel Angelo MiradorNo ratings yet

- Am95 PDFDocument43 pagesAm95 PDFgarridolopezNo ratings yet

- Bitumen Colloidal and Structural Stability CharacterizationDocument16 pagesBitumen Colloidal and Structural Stability CharacterizationAnonymous x7VY8VF7100% (1)

- Shell Rimula R3 Turbo 15W-40Document2 pagesShell Rimula R3 Turbo 15W-40HUM CIREBON DFLTSNo ratings yet

- Chem 2 Q1 Module 1 Attractive ForcesDocument9 pagesChem 2 Q1 Module 1 Attractive ForcesPrincess Venita BerganteNo ratings yet

- Chemical Looping of CO2Document23 pagesChemical Looping of CO2shyamNo ratings yet

- SP LogDocument28 pagesSP LogVito YogyakartaNo ratings yet

- Microporous and Mesoporous Materials: Sean M.W. Wilson, Vida A. Gabriel, F.Handan TezelDocument11 pagesMicroporous and Mesoporous Materials: Sean M.W. Wilson, Vida A. Gabriel, F.Handan TezelEcNo ratings yet

- PWS&PQRDocument1 pagePWS&PQRkuppiliramaNo ratings yet

- Katalog Mikrofilter Facet AllDocument12 pagesKatalog Mikrofilter Facet Alltogentong100% (1)

- Study of Gas-Condensate Well Productivity in Santa Barbara Field, Venezuela, by Well Test AnalysisDocument9 pagesStudy of Gas-Condensate Well Productivity in Santa Barbara Field, Venezuela, by Well Test AnalysisWaleed Barakat MariaNo ratings yet

- Compressed Air SystemDocument29 pagesCompressed Air Systemsk sajidNo ratings yet

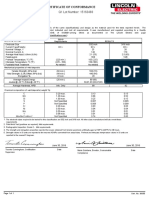

- Certificate of Conformance: Q1 Lot Number: 15163483Document1 pageCertificate of Conformance: Q1 Lot Number: 15163483interx00No ratings yet

- Tds-Duraplate UhsDocument4 pagesTds-Duraplate UhsAlberto Acosta GongoraNo ratings yet

- Investigations On Fouling Rate in Convective BundlesDocument11 pagesInvestigations On Fouling Rate in Convective BundlesAnitha Kumari SivathanuNo ratings yet

- PLAJEX SN Leaflet 2019Document2 pagesPLAJEX SN Leaflet 2019pushpanjali singhNo ratings yet

- Formula Sheet HTDocument8 pagesFormula Sheet HTChristopher FernandesNo ratings yet

- Ts 1 5 Specific Feed Safety LimitsDocument87 pagesTs 1 5 Specific Feed Safety Limitsraed abujoudehNo ratings yet