Professional Documents

Culture Documents

Chapter 6

Uploaded by

Hasan Tarek0 ratings0% found this document useful (0 votes)

43 views5 pagesGanville Day Distribution Cost of goods available for sale Date Explanation Units Rate Amount 1-mar Beginning inven. 1500 7 10500 5-mar Purchase 300 8 24000 13-mar Purchase 5500 9 49500 21-mar Purchase 4000 10 40000 16-mar Purchase 2000 11 22000 Total 16000 146000 Cost of goods sold=146000-37000=109000.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGanville Day Distribution Cost of goods available for sale Date Explanation Units Rate Amount 1-mar Beginning inven. 1500 7 10500 5-mar Purchase 300 8 24000 13-mar Purchase 5500 9 49500 21-mar Purchase 4000 10 40000 16-mar Purchase 2000 11 22000 Total 16000 146000 Cost of goods sold=146000-37000=109000.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

43 views5 pagesChapter 6

Uploaded by

Hasan TarekGanville Day Distribution Cost of goods available for sale Date Explanation Units Rate Amount 1-mar Beginning inven. 1500 7 10500 5-mar Purchase 300 8 24000 13-mar Purchase 5500 9 49500 21-mar Purchase 4000 10 40000 16-mar Purchase 2000 11 22000 Total 16000 146000 Cost of goods sold=146000-37000=109000.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 5

P(6)-2(A)

Ganville Day Distribution

Cost Of Godds Available For Sale

Date Explanation Units Rate Amount

1-Mar Beginning inven. 1500 7 10500

5-Mar Purchase 300 8 24000

13-Mar Purchase 5500 9 49500

21-Mar Purchase 4000 10 40000

16-Mar Purchase 2000 11 22000

Total 16000 146000

(B) Fifo Method

Ending Inventory

Date Explanation Units Rate Amount

21-Mar Purchase 1500 10 15000

26-Mar Purchase 2000 11 22000

Total 3500 37000

Cost of goods sold=146000-37000=109000

Proof

Date Explanation Units Rate Amount

1-Mar Beginning Inv. 1500 7 10500

5-Mar Purchase 3000 8 24000

13-Mar Purchase 5500 9 49500

21-Mar Purchase 2500 10 25000

Total 12500 109000

Lifo Method

Ending Inventory

Date Explanation Units Rate Amount

1-Mar Beginning Inv. 1500 7 10500

5-Mar Purchase 2000 8 16000

Total 3500 26500

Cost of goods sold=146000-26500=119500

Proof

Date Explanation Units Rate Amount

26-Mar Purchase 2000 11 22000

21-Mar Purchase 4000 10 40000

13-Mar Purchase 5500 9 49500

5-Mar Purchase 1000 8 8000

Total 12500 119500

Average Cost Mathod

Ending Inventory

Date Explanation Units Rate Amount

31-Mar 146000+16000 3500 9125 31937.5

Total 3500 31937.5

Cost of goods sold=146000-31937.5=114062.5

Proof

Date Explanation Units Rate Amount

31-Mar 146000/16000 12500 9.125 114062.5

Total 12500 114062.5

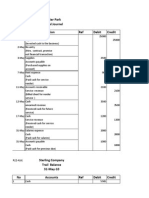

P(6)-3(a)

Edding Company

Cost of goods available for sale

Date Expalanation Unit Rate Amount

1-Jan Beginning Inv. 400 8 3200

20-Feb Purchase 600 9 5400

15-May Purchase 500 10 5000

12-Aug Purchase 300 11 3300

8-Dec Purchase 200 12 2400

Total 2000 19300

(B) FIFO Method

Ending Inventory

Date Explanation Unit Rate Amount

12-Aug Purchase 300 11 3300

8-Dec Purchase 200 12 2400

Total 500 5700

Cost of goods sold=19300-5700=13600

Proof

Date Explanation Unit Rate Amount

1-Jan Beginning Inv. 400 8 3200

20-Feb Purchase 600 9 400

5-May Purchase 500 10 5000

Total 1500 13600

Lifo Method

Ending Inventory

Date Explanation Unit Rate Amount

1-Jan Beginning Inv. 400 8 3200

20-Feb Purchase 100 9 900

Total 500 4100

Cost of goods sold=19300-4100=15200

Proof

Date Explanation Unit Rate Amount

8-Dec Purchase 200 12 2400

12-Aug Purchase 300 11 3300

12-May Purchase 500 10 5000

20-Feb Purchase 500 9 4500

Total 1500 15200

Average Cost Method

Ending Inventory

Date Explanation Unit Rate Amount

1-Dec 19300+2000 500 9.65 4825

Total 500 4825

Cost of goods sold=19300-4825=14475

Proof

Date Explanation Unit Rate Amount

31-Dec 19300/2000 1500 9.25 14475

Total 1500 14475

P(6)-4(A)

Morals Co

Condencet Income Statement

For the year ended December 31,2008

Particulars Fifo Lifo

Sales 865000 865000

Less

Beginning inventory 32000 32000

Cost of goods purshased 595000 595000

Ending Inventory 84000 68000

Gross Profit 322000 306000

Less

Operating expence 147000 147000

Income from operation 175000 159000

Less

Income tax 59500 54060

Net Income 115500 115500

Ending inventory(FIFO)=3000*2.80=84000

Ending inventory(LIFO)=32000+(15000*2.40)=68000

(B) Monar Inc.

Condensed Income Statement

For the year ended December 31,2010

Particulars Fifo Lifo

Sales 747000 747000

Less

Beginning Inventory 16000 16000

Ending inventory 48600 38000

Gross Profit 311600 301000

Less

Operating expence 130000 130000

Income from operation 181600 171000

Less

Income tax 72640 68400

Net income 108960 102600

Income statement

Particulars Amount Amount

Sales 600000

Less:Cost of

goods sold

Beginning Inv. 32000

Purchase 377000

Less: returns and

allowence 13300

Less: discount 8500

Add:Freight in 8800

Cost of goods

available for sale 396000

Less:Ending Inv. 36000

Cost of goods

sold 364000

Gross profit 240000

Income Statement

Particulars Amount Amount

Sales 700000

Less:Estaimated

gross profit 280000

420000

Estimated cost

of goods sold

Beginning Inv. 32000

Purchase 424000

Less: purchase

return 14900

Less: purchase

discount 9500

Add:Friegt in 9900

Cost of goods

available for sale 445500

Cost of goods

available for sale 445500

Less:Estimated

Cost of goods

sold 420000

Ending inventory

lost in fair 25500

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Pizza HutDocument5 pagesPizza HutHasan Tarek100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Chp-15 Conflict & Negotiation FinalDocument53 pagesChp-15 Conflict & Negotiation FinalHasan Tarek100% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- SWOTDocument2 pagesSWOTHasan TarekNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Sample ActivityDocument5 pagesSample ActivityHasan TarekNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Getco ProfileDocument38 pagesGetco ProfileHasan TarekNo ratings yet

- Sansomita Journal Entries: Date Explanation Ref Debit CreditDocument7 pagesSansomita Journal Entries: Date Explanation Ref Debit CreditHasan TarekNo ratings yet

- JournalsDocument27 pagesJournalsHasan TarekNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Chapter 08Document41 pagesChapter 08Hasan TarekNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Forntier Park General Journel Date Titles & Explanation Ref Debit CreditDocument15 pagesForntier Park General Journel Date Titles & Explanation Ref Debit CreditHasan TarekNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Ann RPT 2011Document68 pagesAnn RPT 2011Hasan TarekNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Chapter - 2 Hospital PharmacyDocument33 pagesChapter - 2 Hospital PharmacyPallavi PatilNo ratings yet

- Stores LedgerDocument2 pagesStores LedgerM211110 ANVATHA.M100% (1)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Level Four Code 2 Project One: Process PayrollDocument3 pagesLevel Four Code 2 Project One: Process PayrollbiniamNo ratings yet

- Diferent Models NutekDocument52 pagesDiferent Models NutekIvanRemiNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Inventory and Store Management HeritageDocument83 pagesInventory and Store Management HeritageSagar Paul'gNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- MCQ On Process CostingDocument5 pagesMCQ On Process CostingSocial SectorNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Quiz2 With AnswersDocument11 pagesQuiz2 With AnswersJogja AntiqNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- CFA Tai Lieu On TapDocument100 pagesCFA Tai Lieu On Tapkey4onNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Oracle WMS Implementation QuestionsDocument24 pagesOracle WMS Implementation QuestionsAde Goke67% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sha1 ACT 201 Final Exam-Fall 2021Document4 pagesSha1 ACT 201 Final Exam-Fall 2021Ifaz Mohammed IslamNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- On AS 2Document14 pagesOn AS 2khushi jaiswalNo ratings yet

- Asset Conversion CycleDocument12 pagesAsset Conversion Cyclessimi137No ratings yet

- 3 Persed BRG-Lat2Document2 pages3 Persed BRG-Lat2hasnaglowNo ratings yet

- Accounts FinnalDocument21 pagesAccounts FinnalAyusha MakenNo ratings yet

- Question Paper - FA (BCA)Document2 pagesQuestion Paper - FA (BCA)gurjeetkaur1991No ratings yet

- ACCT 201: Reporting and Analyzing InventoryDocument22 pagesACCT 201: Reporting and Analyzing InventoryDuygu YılmazNo ratings yet

- Chapter 13 Solutions - Excluding HomeworkDocument32 pagesChapter 13 Solutions - Excluding Homeworktest boyNo ratings yet

- Fossil Inc. FINALDocument111 pagesFossil Inc. FINALkrama5No ratings yet

- Rais12 SM CH18Document22 pagesRais12 SM CH18Chris Lau100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Oracle Inventory Consigned Inventory From Supplier Process GuideDocument60 pagesOracle Inventory Consigned Inventory From Supplier Process GuideJenny RochaNo ratings yet

- Section A. Total of 50 Points. Answer ALL The Questions at 5 PointsDocument3 pagesSection A. Total of 50 Points. Answer ALL The Questions at 5 PointsIka Puspa SatrianyNo ratings yet

- Reconciliation of Cost and Financial AccountingDocument5 pagesReconciliation of Cost and Financial AccountingMighty RajuNo ratings yet

- Practice Questions Quizz 1 - WITHOUT ANSWERSDocument40 pagesPractice Questions Quizz 1 - WITHOUT ANSWERSSun NyNo ratings yet

- 1.basics of Inventory Management PDFDocument38 pages1.basics of Inventory Management PDFEtoos EduNo ratings yet

- Cost AccountingDocument4 pagesCost Accountingdivanshi maheshwariNo ratings yet

- FAR.2902 Inventories PDFDocument8 pagesFAR.2902 Inventories PDFNah HamzaNo ratings yet

- Chap1 3 Improving Warehouse Activityy in Cdo Foodsphere IncDocument47 pagesChap1 3 Improving Warehouse Activityy in Cdo Foodsphere IncPol Vince Bernard Salisi100% (1)

- CFA Financial Statement Analysis Flashcards - Chegg - Com1Document16 pagesCFA Financial Statement Analysis Flashcards - Chegg - Com1anissa claritaNo ratings yet

- Unit I Cost Accounting NotesDocument27 pagesUnit I Cost Accounting NotesParmeet KaurNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chapter 2 Worldwide Accounting DiversityDocument43 pagesChapter 2 Worldwide Accounting DiversitynoofNo ratings yet