Professional Documents

Culture Documents

Chapter 17

Uploaded by

Hasan TarekOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 17

Uploaded by

Hasan TarekCopyright:

Available Formats

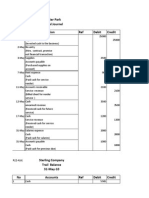

P(17)-7(A)

Waller Company

Statement Of Cash Flow

Account Amount Amount

Cash Flow From operating ACT

Net Income 32000

Adjustment net Income to

net cash

Operating Activities

Dep. Expence 14500

Acc. Receivable increase -19000

Increase in inventory -7000

Increase in Acc. Payable 14000

Decrease in income tax -1000

Payable 1500

Net cash provided by

operating activities 33500

Cash flows from Investigating

activities

Sales of equipment 8500

Net cash provided by

Investigating Activities 8500

Cash Fiow from financing

activities

Payment for cash devident -25000

Redemption on bond -6000

Issurance of common stock 4000

Net cash usued by Financing

activities -27000

Net increase in cash 15000

Cash at the beginning 20000

Cash at the end 35000

17(5) Grania Company

Statement of cash Fiow

Account Amount Amount

Cash flows from operating

activities

Net income 230000

Adjustment of net income

Depriciation expence 60000

Loss of sale of equipment 16000

Acc. Receivable increase -15000

Acc. Payable increase 13000

Income tax payable increase 4000 78000

Net cash usuad by operating

activities 308000

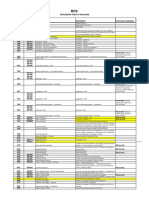

17(9) ARMA INC

Statement of Cash Flow

Accounts Amount Amount

Cash flow from operating

activities

Net cash 158900

Adjustment of net income to

net cash

Operating activities

Dep. Expence 46500

Acc. Receivable increase -59800

Inventory increase -9650

Prepaid expence increase -2400

Acc. Payable increase 44700

Accured expence decrise -500

Loss on sale of plant asset 7500 26350

Net cash provided by

operating expence 185250

Cash flow from Investigating

Sale of plant asset 1500

Purchase of plant -85000

Purchase of investment -24000

Net cash usuad by

investigating activities -107500

Cash flow from Financing

Payment of cash devidend -40350

Redemption of bond -40000

Issuance of common stock 45000

Net cash usuad by Financing 35350

Net increase in cash 42400

Cash at the beginning 48400

Cash at the end 90800

17(11) Ramerez Company

Cash flow Statement

Accounts Amount Amount

Cash flow from operating

activities

Net Income 37000

Adjustment of net income to

net cash

Dep. Expence 42000

Acc. Receivable decrise 18000

Increase in inventory -9450

Decrease in prepaid expence 5720

Increase in Acc. Payable 7730

Loss of sale equipment 4000 68000

Net cash by Operating

activities 105000

Cash flow from Investigating

sale of equipment 6000

Purchase of equipment -95000

Sale of land 25000

Net cash usuad by

investigating -64000

Cash flow from Financing

Payment of cash devidend -15000

Net cash usuad by financing -15000

Neat increase 26000

Cash at the beginning 45000

Cash at the end 71000

P(17)-B(5) Brisling Company

Statement of cash flow

Accounts Amount Amount

Cash flow from operating

activities

Net income 109000

Adjustment of net income to

net cash

Decrease in Acc. Receivable 20000

Decrease in Acc. Payable -21000

increase in income tax

payable 6000 5000

Net cash provided by

operating expence 114000

P(17)-3(A) Albart company

Cash flow

Accounts Amount Amount

Cash flow from operating

activities

Net income 1650000

Adjustment of net income to

neat cash

Dep. Expence 90000

Increase in Acc.receivable -250000

Decrease in inventory 500000

Increase in prepaid expence -150000

Decrease in accured payable -100000

Decrease in account payable -34000 -250000

Net cash usuad by operating

expence 1400000

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Exam Questions and AnswersDocument18 pagesExam Questions and AnswersAna Aliyah AnginNo ratings yet

- Business Development ManagerDocument4 pagesBusiness Development ManagerJuan CruzNo ratings yet

- 1 POM FrameworkDocument32 pages1 POM FrameworkRyan ParadinaNo ratings yet

- Q1 How Serious Is The Threat of DJC To American Connector CompanyDocument2 pagesQ1 How Serious Is The Threat of DJC To American Connector CompanyNithya Nair0% (1)

- Operation Management ReportDocument14 pagesOperation Management ReportClaudia SmithNo ratings yet

- Annual Report Highlights of Dhaka Electric Supply CompanyDocument68 pagesAnnual Report Highlights of Dhaka Electric Supply CompanyHasan TarekNo ratings yet

- Retail Store Design (Unit IV)Document126 pagesRetail Store Design (Unit IV)Shikhar SrivastavaNo ratings yet

- ch07 AIS TEST BANKDocument8 pagesch07 AIS TEST BANKmcdo friesNo ratings yet

- Water Purification Business PlanDocument48 pagesWater Purification Business PlanHasan Tarek100% (1)

- Working Capital Management in BhelDocument86 pagesWorking Capital Management in BhelDipesh Gandhi100% (1)

- CPPP Module 1Document35 pagesCPPP Module 1Murali100% (1)

- Warehouse Management Using Microsoft Dynamics AX 2012 R3 (PDFDrive)Document553 pagesWarehouse Management Using Microsoft Dynamics AX 2012 R3 (PDFDrive)Saadia Riaz100% (2)

- SO23 Supplier ColorcardDocument1 pageSO23 Supplier ColorcardHasan TarekNo ratings yet

- BEFTN Bank Branch Routing Numbers-Appendix IIDocument146 pagesBEFTN Bank Branch Routing Numbers-Appendix IIRownakul100% (8)

- Enron Scandal: A Corporate View: Analyzed and Prepared by Group 6Document17 pagesEnron Scandal: A Corporate View: Analyzed and Prepared by Group 6PankajYadavNo ratings yet

- SWOTDocument2 pagesSWOTHasan TarekNo ratings yet

- Green HRMDocument10 pagesGreen HRMHasan TarekNo ratings yet

- Vital Role of Sampling in Garment ManufacturingDocument5 pagesVital Role of Sampling in Garment ManufacturingHasan TarekNo ratings yet

- Pizza HutDocument5 pagesPizza HutHasan Tarek100% (1)

- 1Document21 pages1Hasan TarekNo ratings yet

- Green HRMDocument10 pagesGreen HRMHasan TarekNo ratings yet

- PizzaHut ReportDocument19 pagesPizzaHut ReportDaniel KarthikNo ratings yet

- Chp-15 Conflict & Negotiation FinalDocument53 pagesChp-15 Conflict & Negotiation FinalHasan Tarek100% (1)

- Chp-3 & 4-Values, Attitue and Job Satisfaction FinalDocument41 pagesChp-3 & 4-Values, Attitue and Job Satisfaction FinalHasan TarekNo ratings yet

- Paper 05 PDFDocument12 pagesPaper 05 PDFHasan TarekNo ratings yet

- Final Professional BDocument2 pagesFinal Professional BHasan TarekNo ratings yet

- ADJUSTING JOURNALSDocument27 pagesADJUSTING JOURNALSHasan TarekNo ratings yet

- Developing Agri Business Strategy in BangladeshDocument0 pagesDeveloping Agri Business Strategy in BangladeshOoAIDoONo ratings yet

- Chapter 6Document5 pagesChapter 6Hasan TarekNo ratings yet

- Getco ProfileDocument38 pagesGetco ProfileHasan TarekNo ratings yet

- Sansomita Journal Entries: Date Explanation Ref Debit CreditDocument7 pagesSansomita Journal Entries: Date Explanation Ref Debit CreditHasan TarekNo ratings yet

- Forntier Park General Journel Date Titles & Explanation Ref Debit CreditDocument15 pagesForntier Park General Journel Date Titles & Explanation Ref Debit CreditHasan TarekNo ratings yet

- Annual Report 2013Document77 pagesAnnual Report 2013Hasan TarekNo ratings yet

- Getco ProfileDocument38 pagesGetco ProfileHasan TarekNo ratings yet

- Chapter 08Document41 pagesChapter 08Hasan TarekNo ratings yet

- Chapter 07Document38 pagesChapter 07Hasan TarekNo ratings yet

- Chapter 07Document38 pagesChapter 07Hasan TarekNo ratings yet

- Ch1 Ten PrinciplesDocument29 pagesCh1 Ten PrinciplesHeta ShastriNo ratings yet

- Chapter 08Document41 pagesChapter 08Hasan TarekNo ratings yet

- Cro FarmDocument9 pagesCro FarmAkash DherangeNo ratings yet

- Final 2Document81 pagesFinal 2komalNo ratings yet

- Ratio Analysis of GodrejDocument3 pagesRatio Analysis of Godrejdeadshot7973No ratings yet

- Phinma-University of Pangasinan College of Engineering and ArchitectureDocument4 pagesPhinma-University of Pangasinan College of Engineering and ArchitectureEditha BaniquedNo ratings yet

- Balaji Traders: Service Operations ManagemnetDocument14 pagesBalaji Traders: Service Operations ManagemnetMihir PatelNo ratings yet

- Descriptive Chart of AccountsDocument3 pagesDescriptive Chart of AccountsNaveen Pragash100% (1)

- Standard Costing - Solutions To Home Work Problems: Question No: 19 Reconciliation With Finished Goods InventoryDocument7 pagesStandard Costing - Solutions To Home Work Problems: Question No: 19 Reconciliation With Finished Goods InventoryDevi ParameshNo ratings yet

- Chapter 4 Financial Statement AnalysisDocument54 pagesChapter 4 Financial Statement AnalysisDemelash Agegnhu BeleteNo ratings yet

- QBES 18 0 White PaperDocument69 pagesQBES 18 0 White PaperJohn CaringalNo ratings yet

- KASNEB MGT Acc Dec 2012Document5 pagesKASNEB MGT Acc Dec 2012NelsonMoseMNo ratings yet

- LAB University Student's Learning Diary Provides Insights Into Logistics FieldDocument17 pagesLAB University Student's Learning Diary Provides Insights Into Logistics FieldThu Hoai100% (1)

- Sitra Textile Industries LTDDocument17 pagesSitra Textile Industries LTDHassan ZadaNo ratings yet

- Questionnaire Expenditure CycleDocument1 pageQuestionnaire Expenditure Cycleleodenin tulangNo ratings yet

- ChikachinoDocument22 pagesChikachinoShahzeb HayatNo ratings yet

- Application and Analysis Exercises 28.1 and 28.2Document8 pagesApplication and Analysis Exercises 28.1 and 28.2Peper12345No ratings yet

- Review - Logistics DEDocument71 pagesReview - Logistics DEHuệ Hứa ThụcNo ratings yet

- Concept PaperDocument7 pagesConcept PaperPius VirtNo ratings yet

- Sas#1 Acc100Document14 pagesSas#1 Acc100Jhoylie BesinNo ratings yet

- Ostendo Evaluation QuestionaireDocument28 pagesOstendo Evaluation QuestionaireTony100% (1)