Professional Documents

Culture Documents

Guide To Certifications Robert Half

Uploaded by

Brook Rene Johnson0 ratings0% found this document useful (0 votes)

282 views26 pagesguide

Original Title

Guide to Certifications Robert Half

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentguide

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

282 views26 pagesGuide To Certifications Robert Half

Uploaded by

Brook Rene Johnsonguide

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 26

Guide to Certifications

For Accounting, Finance and Operations Management

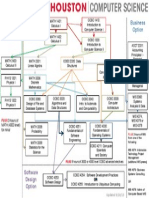

Table of Contents

About the Guide . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

The Value of Certifcations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Certifcation Descriptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Public Accounting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Corporate Accounting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Government . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Banking and Financial Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Personal Financial Management . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Audit, Fraud and Risk Management . . . . . . . . . . . . . . . . . . . . . . . . 7

Operations Management . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10

Information Technology . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Payroll . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .12

Certifcation Descriptions: Canada . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Directory of Accrediting Organizations . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Index of Certifcations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

The Leading Resource . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

About the Company . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

Guide to Certifcations Robert Half ii

Guide to Certifcations

About the Guide

The Guide to Certifcations provides an overview of a wide range of

professional designations in the felds of accounting, fnance and operations

management. Descriptions are based on publicly available information

provided by professional associations and other accreditation groups.

Contact information for these organizations is listed on Pages 15-20.

The Guide to Certifcations is published for informational purposes only and

is provided without any warranty or guarantee. Certifcation requirements

are changing continually. Certifcation seekers should always contact the

sponsoring organization to verify requirements and obtain the most current

information. Most certifcations require application and examination fees.

Continuing education is almost always necessary to maintain certifcations,

and fees may be charged to renew them.

Robert Half 1

Robert Half 2 Guide to Certifcations

The Value of Certifcations

Corporate governance reforms, an increasingly global business environ-

ment and rapidly changing technologies have heightened the demand for

accounting and fnance professionals who possess advanced skills and

have demonstrated their expertise and commitment to ongoing education

by earning professional designations.

Maintaining industry-recognized accreditations can provide numerous benefts,

including improved career prospects and enhanced earning power. In a Robert

Half survey of chief fnancial offcers (CFOs), a large majority said earning a

certifcation is valuable for an accounting or fnance professionals career

advancement. In addition, according to the Salary Guide from Robert Half,

those who have earned professional credentials may receive starting salaries

up to 10 percent above the market average.

Not only can certifcations help individuals differentiate themselves in the

marketplace, but they also serve as an indicator to employers that a potential

hire has the requisite skills to perform a specifc job or service. Many frms

support ongoing learning and accreditation for their employees to develop a

more skilled workforce.

Certain credentials have become particularly desirable. These include the

certifed public accountant (CPA), certifed general accountant (CGA), certifed

internal auditor (CIA), certifed fraud examiner (CFE), certifed information systems

auditor (CISA), certifed management accountant (CMA) and chartered accountant

(CA) designations. Professional associations continue to create additional

specialty certifcations to help their members address the increasing complexity of

new regulations and business trends.

In the years ahead, organizations are likely to place even more value on certif-

cations as a means of differentiating top candidates. The accounting and fnance

feld offers a wide range of opportunities for professionals to specialize as they

advance in their careers. Employers look to those who can demonstrate their

knowledge in niche areas through a combination of work experience and the

formal training and education gained during the certifcation process.

Robert Half 3 Guide to Certifcations

Certifcation Descriptions

Public Accounting

Accredited Business Accountant (ABA) This credential offered by the

Accreditation Council for Accountancy and Taxation (ACAT) is for practitioners

who specialize in the needs of small to midsize businesses and in fnancial

services to individuals and families. Candidates must have three years of related

work experience and receive 70 percent or better on both sections of the

eight-hour ABA exam, which covers fnancial accounting, reporting, statement

preparation, taxation, business consulting services, business law and ethics.

For more information, visit www.acatcredentials.org.

Accredited in Business Valuation (ABV) Administered by the American

Institute of Certifed Public Accountants (AICPA), this credential is granted

exclusively to certifed public accountants (CPAs) who exhibit substantial skills

and knowledge in business valuation services. Candidates must show evidence

of competency and experience by completing 10 business valuation engagements

and 75 hours of lifelong learning activities as well as passing an exam. The ABV

exam consists of two parts and covers engagement practices, professional and

regulatory standards, qualitative and quantitative analysis, valuation analysis,

and other valuation-related topics. Candidates who hold a certifed valuation

analyst (CVA), certifed bank auditor (CBA) or chartered fnancial analyst (CFA)

designation need to complete only one part of the exam. Individuals holding

the accredited senior appraiser (ASA) designation are exempt from the exam

requirement. For more information, visit www.aicpa.org/bvfs.

Certifed Public Accountant (CPA) A CPA is an individual who has passed

the Uniform CPA Examination and has received his or her CPA certifcate and/or

CPA license (if required) from the State Board of Accountancy of the state in

which that individual intends to practice. Each state has its own education and

experience requirements that must be met before a candidate is given permission

to take the exam and obtain a certifcate/license. The Uniform CPA Examination is

delivered in a computer-based format in authorized testing centers across the

United States. For more information, visit www.nasba.org or www.cpa-exam.org.

Certifed Valuation Analyst (CVA) The National Association of Certifed Valu-

ation Analysts (NACVA) certifes CVAs to perform business and intangible asset

valuations as a service to both the consulting community and the users of their

services. This designation requires the applicant to hold a valid CPA license,

be a practitioner member of NACVA in good standing, complete a fve-day training

program, submit three personal and three business references, and pass a compre-

hensive two-part examination. For more information, visit www.nacva.com.

Robert Half 4 Guide to Certifcations

Corporate Accounting

Certifed Accounts Payable Associate (CAPA) Accounts payable professionals

who are interested in obtaining the CAPA designation offered by International

Accounts Payable Professionals (IAPP) must take and pass the CAPA certifcation

exam. In order to be approved for the exam, candidates must provide employment

verifcation and agree to uphold the IAPP code of ethics. Candidates also must have

at least one year of experience with an associates degree or higher, or at least three

years of experience with no degree. Recertifcation is attained by either retaking

and passing the exam or accumulating a minimum number of qualifying credit hours

through continuing education. For more information, visit www.iappnet.org.

Certifed Accounts Payable Professional (CAPP) Accounts payable profession-

als interested in obtaining the CAPP designation, offered by IAPP, must take and pass

the CAPP certifcation exam. In order to be approved for the exam, candidates must

maintain IAPP membership, provide employment verifcation and agree to uphold the

IAPP code of ethics. Candidates must also have at least two years of experience with

a bachelors degree or higher, three years of experience with an associates degree or

fve years of experience with no degree. Federal government agencies may be exempt

from the IAPP membership requirement. Recertifcation is attained by either retaking

and passing the exam or accumulating a minimum number of qualifying credit hours

through continuing education. For more information, visit www.iappnet.org.

Certifed Bookkeeper (CB) Awarded by the American Institute of Professional

Bookkeepers (AIPB), this certifcation requires that candidates have at least two years

of bookkeeping experience, pass a national exam offered at any of more than 300 Pro-

metric test centers and adhere to a code of ethics. The exam covers adjusting entries,

error correction, payroll, depreciation, merchandise inventory and internal controls.

For more information, visit www.aipb.org.

Certifed Management Accountant (CMA) Offered by the Institute of Management

Accountants (IMA), the globally recognized CMA credential distinguishes those who

have earned it as advanced accounting professionals qualifed to work inside organiza-

tions where technical competence and a thorough understanding of the linkage

between strategy and fnancial performance are critical. IMAs CMA program embodies

an extensive curriculum covering accounting, fnance and important related felds.

The four-part exam is designed to develop and measure critical thinking and decision-

making skills. For more information, visit www.imanet.org.

Certifed Treasury Professional (CTP) The Association for Financial Professionals

(AFP) awards this credential (formerly the certifed cash manager designation) to

treasury and fnance professionals who demonstrate mastery of subjects including

mergers and acquisitions, cash management, risk management, capital structure

and corporate governance. To qualify for the computer-based CTP exam, applicants

must have at least two years of fnance-related work experience or the equivalent

as defned by the AFP. For more information, visit www.afponline.org.

Robert Half 5 Guide to Certifcations

Government

Certifed Defense Financial Manager (CDFM) The American Society of Military

Comptrollers (ASMC) issues the CDFM, a standard designed to assure Department of

Defense (DoD) fnancial professionals have a working knowledge of the full spectrum

of skills, competencies and the related fscal law required to perform successfully at the

journeyman level in fnancial management positions at all levels within the department.

Candidates must pass three comprehensive examinations and satisfy experience and

ethics requirements for initial certifcation. Following initial certifcation, those holding

the designation must complete 80 hours of continuing professional education every

24 months to remain certifed. For those candidates seeking to demonstrate and

document a specialized knowledge of the DoD acquisition process, a fourth, optional

module is available. For more information, visit www.asmccertifcation.com.

Certifed Government Auditing Professional (CGAP) A specialty certifcation

program issued by The Institute of Internal Auditors (The IIA), the CGAP is designed

for audit practitioners in the public sector. The certifcation exam tests a candidates

knowledge of public sector auditing, including certain features that are unique to the

public sector (e.g., fund accounting, grants, legislative oversight and confdentiality

rights). Candidates also must meet educational requirements, submit a character

reference and have at least two years of auditing experience in a government

environment. For more information, visit www.theiia.org.

Certifed Government Financial Manager (CGFM) The Association of Government

Accountants (AGA) issues the CGFM designation, a standard for measuring the

knowledge and skills of fnancial management professionals working in government

at the federal, state and local levels. Candidates must meet education, experience and

ethics requirements. They also must pass three comprehensive exams relating to the

government environment: governmental accounting, fnancial reporting and budgeting,

and governmental fnancial management and control. For more information, visit www.

agacgfm.org.

Certifed Public Finance Offcer (CPFO) The Certifed Public Finance Offcers

Program of the Government Finance Offcers Association of the United States

and Canada (GFOA) is a broad educational self-study program designed to verify

knowledge in the disciplines of government fnance. To earn the designation,

candidates must pass a series of fve examinations covering the major disciplines of

public fnance. A candidate has seven years in which to successfully complete the

program. Once earned, the designation is maintained by participating in 30 hours of

continuing professional education each year. While GFOA certifes that an individual

who passes one or more of GFOAs certifcation examinations demonstrates certain

competencies, GFOA withholds an opinion as to the capabilities of any individual to

successfully perform in a given position. For more information, visit www.gfoa.org.

Robert Half 6 Guide to Certifcations

Banking and Financial Services

Accredited Senior Appraiser (ASA) To qualify for this designation, offered by

the American Society of Appraisers (ASA), professionals must have a minimum of

fve years of full-time appraisal experience, a college degree or its equivalent, and

successfully completed course and examination requirements for four 27-hour

discipline-specifc principles of valuation courses. Candidates for the designation

also must submit two appraisal reports for peer review and approval. Individuals

must submit evidence of professional growth through continuing education and/or

participation in professional activities to remain an accredited and designated ASA.

For more information, visit www.appraisers.org.

Certifcate in Loan Review The BAI Center for Certifcation offers the Loan Review

Certifcate Program. Professionals awarded the Certifcate in Loan Review have

proven their expertise in the loan review practices and procedures that serve as the

standard for the fnancial services industry. The Loan Review Certifcate Program

is designed for commercial loan review and lending personnel as well as for national

and state banking regulators. For more information, visit www.bai.org.

Certifed Bank Auditor (CBA) Offered by the BAI Center for Certifcation, the

CBA designation ensures candidates have knowledge in four bank-specifc areas:

accounting, auditing principles and bank laws, regulations, and auditing practices

and general business. To qualify for the CBA exam, candidates must possess a

bachelors degree and have a minimum of two years of bank auditing experience.

Individuals must pass all four CBA exam areas within a three-year period. For

more information, visit www.bai.org.

Certifed Financial Services Auditor (CFSA) The IIA confers this specialty

credential on individuals who demonstrate their knowledge of current auditing

principles and practices relating to the fnancial services industry. The exam format

offers candidates a choice of three fnancial services disciplines: banking, insurance

or securities. Candidates also must meet educational requirements, submit a

character reference and have at least two years of auditing experience in a fnancial

services environment. For more information, visit www.theiia.org.

Chartered Financial Analyst (CFA) Awarded by the CFA Institute, the CFAs

self-study curriculum develops and reinforces a fundamental knowledge of investment

principles in the felds of portfolio management and investment analysis. Three

levels of examination verify a candidates ability to apply these principles across

all areas of the investment decision-making process. Candidates must pass each

level sequentially and fulfll other program requirements before earning the CFA

designation. For more information, visit www.cfainstitute.org.

Robert Half 7 Guide to Certifcations

Personal Financial Management

Certifed Financial Planner (CFP) Individuals earning this credential from the

Certifed Financial Planner Board of Standards, Inc. (CFP Board) have met rigorous

professional standards and agreed to adhere to principles of ethical and professional

responsibility in their interactions with clients. Applicants must meet requirements

for education, experience and ethics, in addition to passing a comprehensive exam.

Certifcation must be renewed every two years. For more information, visit www.cfp.net.

Elder Care Specialist (ECS) This credential from the Accreditation Council

for Accountancy and Taxation (ACAT) recognizes professionals who have a thorough

knowledge of preparing their clients for retirement, the essentials of estate and

trust planning, and fnancial planning for the elderly. Candidates also must have

demonstrated their customer sensitivity and communication skills. Applicants must

complete all three of the National Society of Accountants Serving Aging America

tracks and pass the ECS examination with a score of at least 70 percent. For more

information, visit www.acatcredentials.org.

Personal Financial Specialist (PFS) This credential, established by the AICPA,

is for fnancial planners who want to distinguish their expertise and experience.

Holders of the credential receive recognition for blending fnancial planning and

business acumen and for being competent, trustworthy and objective. To earn the

designation, CPAs must have business experience in at least one of six fnancial

planning disciplines, fulfll lifelong learning activities and pass one of the following

exams: CFP; ChFC; CFA; or NASD Series 65, 66 or 7. For more information, visit

www.aicpa.org/pfp.

Audit, Fraud and Risk Management

Accredited Valuation Analyst (AVA) NACVA certifes AVAs to perform business

and intangible asset valuations as a service to both the consulting community and

the users of their services. This designation requires the applicant to hold a business

degree and/or a masters in business administration from an accredited college

or university, be a practitioner member of NACVA in good standing, be able to

demonstrate substantial experience in business valuation, submit three personal and

three business references, and pass a comprehensive two-part examination. For more

information, visit www.nacva.com.

Robert Half 8 Guide to Certifcations

Anti-Money Laundering Professional (AMLP) The BAI Center for Certifcation

offers the AMLP designation for anti-money laundering and Bank Secrecy Act (BSA)

professionals employed within fnancial institutions or national and state regulatory

agencies. Candidates with 10 years of experience can qualify for the grandfathering

provision (offered until November 1, 2007). Those with less than 10 years of exper-

ience must complete a 150 multiple-choice question profciency exam based on the

following areas: AML and BSA laws and rules, Suspicious Activity Reporting (SAR),

OFAC procedures and USAPA laws. A passing grade of 70 percent on each exam

is required to earn the certifcation. A bachelors degree from an accredited college or

university is required, along with at least three years of work experience in the felds

of AML, BSA, SAR, OFAC and USAPA. For more information, visit www.bai.org.

Certifcation in Control Self-Assessment (CCSA) The IIA awards this specialty

certifcation to practitioners of control self-assessment who successfully complete

the CCSA exam. CCSA candidates must meet eligibility requirements for education,

character, work experience, and facilitation experience and training. For more

information, visit www.theiia.org.

Certifed Forensic Financial Analyst (CFFA) NACVA certifes CFFAs to provide

competent and professional forensic fnancial support services to the legal community.

Prerequisites for the designation include receiving a business valuation credential or

a masters degree, serving as a practitioner member of NACVA in good standing,

providing proof of substantial experience providing litigation consulting, completing

a fve-day training program, submitting one business and two legal references, and pass-

ing a comprehensive two-part examination. For more information, visit www.nacva.com.

Certifed Fraud Examiner (CFE) A globally recognized credential offered by the

Association of Certifed Fraud Examiners (ACFE), a CFE specializes in fraud

prevention, detection and deterrence. The CFE exam covers four areas: fnancial

transactions, legal elements of fraud, fraud investigation, and criminology and

ethics. For more information, visit www.acfe.com.

Certifed Internal Auditor (CIA) Offered in 17 languages in more than 95 countries,

The IIAs premier certifcation is the only internationally accepted designation for internal

auditors. The CIA exam is offered in four parts: the internal audit activitys role in

governance, risk and control; conducting the internal audit engagement; business

analysis and information technology; and business management skills. CIA candi-

dates must meet eligibility requirements for education, character and work experience.

For more information, visit www.theiia.org.

Robert Half 9 Guide to Certifcations

Certifed Risk Professional (CRP) Developed by the BAI Center for Certifcation,

the CRP certifcation recognizes individuals who have a strong knowledge of risk

identifcation, assessment and management in the fnancial services industry.

Financial services professionals seeking accreditation must meet a demanding set of

examination, experience, education and ethical requirements. The CRP designation

offers specialization in one or more of the following areas: audit; treasury and

AML; fnance and accounting; and regulatory compliance. For more information,

visit www.bai.org.

Operations Management

APICS Certifed in Integrated Resource Management (CIRM) APICS, The

Association for Operations Management, offers the APICS CIRM program to help

professionals enhance collaboration among the following business functions: product

development, marketing/sales, human resources, fnance and operations. The

certifcation exam consists of fve modules: enterprise concepts and fundamentals,

identifying and creating demand, designing products and processes, delivering

products and services, and integrated enterprise management. For more information,

visit www.apics.org.

APICS will discontinue the APICS CIRM program on June 1, 2008. Content of the APICS CIRM

program will continue to be recognized as a valuable part of the APICS body of knowledge.

APICS Certifed in Production and Inventory Management (CPIM) The APICS

CPIM designation is intended for professionals involved in production and inventory

management, operations, supply chain management, procurement, materials manage-

ment, and purchasing. The certifcation focuses primarily on manufacturing and

provides an in-depth view of materials management, master scheduling, production

planning, forecasting and quality improvement. Those who earn the APICS CPIM

designation also become eligible for the more advanced APICS Certifed Fellow in

Production and Inventory Management (CFPIM) designation, awarded to a select

group of professionals who share their knowledge by presenting, publishing, teaching

and participating in other professional development activities. For more information,

visit www.apics.org.

APICS Certifed Supply Chain Professional (CSCP) This designation from

APICS is geared for professionals currently working in or interested in the feld of

supply chain management, as well as for individuals working with enterprise resource

planning (ERP) systems. The APICS CSCP designation offers an all-encompassing

and integrated view of supply chain management from the supplier all the way to

the end customer. For more information, visit www.apics.org.

Robert Half 10 Guide to Certifcations

Tax

Accredited Tax Advisor (ATA) ACAT offers this credential for practitioners

who handle sophisticated tax planning issues, including ownership of closely held

businesses, qualifed retirement plans and complex estates. Applicants must score

70 percent or higher on the ATA exam and have fve years of work experience in tax

preparation, compliance, tax planning and consulting, of which 40 percent must be in

tax planning and consulting. For more information, visit www.acatcredentials.org.

Accredited Tax Preparer (ATP) Professionals earning this credential from ACAT

must have demonstrated a thorough knowledge of the existing tax code and the

preparation of individual, corporate and partnership tax returns. Individuals must

have three years of work experience in tax preparation. Beyond that, candidates can

qualify for the ATP credential by receiving a 70 percent or higher score on the ATP

examination or by demonstrating the successful completion of at least 60 hours of

qualifying education in tax preparation and/or planning. Enrolled agents, CPAs,

state licensed accountants, attorneys, current ATA credential holders and individuals

with a graduate degree in taxation also are prequalifed for this credential. For more

information, visit www.acatcredentials.org.

Enrolled Agent (EA) An EA is a federally authorized tax practitioner who has

technical expertise in the feld of taxation and is empowered by the U.S. Department

of the Treasury to represent taxpayers before all administrative levels of the Internal

Revenue Service (IRS) for audits, collections and appeals. The EA designation is

earned by passing a three-part exam administered by the IRS or by being employed

by the IRS for at least fve years in a position in which the provisions of the Internal

Revenue Code and its regulations are interpreted regularly. A minimum of 24 hours

of continuing education is required each year to maintain EA status with the IRS.

Members of the National Association of Enrolled Agents (NAEA), the professional

association of EAs, must complete at least 30 hours of continuing education. For more

information, visit www.naea.org.

Robert Half 11 Guide to Certifcations

Information Technology

Certifed Information Security Manager (CISM) The CISM certifcation, awarded

by Information Systems Audit and Control Association (ISACA), is for experienced

information security managers and professionals with information security management

responsibilities. The CISM designation, which has earned accreditation from the

American National Standards Institute (ANSI), provides executive management with

the assurance that those with the certifcation have the experience and knowledge

needed to provide effective security management and consulting services. For

additional information, visit www.isaca.org/cism.

Certifed Information Systems Auditor (CISA) Awarded by ISACA, this

internationally recognized credential signifes profciency in information systems

auditing, control and security. With the growing demand for professionals possessing

information systems audit, control and security skills, the ANSI-accredited CISA

designation has become a preferred certifcation for individuals and organizations

around the world. For more information, visit www.isaca.org/cisa.

Certifed Information Technology Professional (CITP) The AICPA issues this

credential to CPAs who demonstrate a broad range of technology skills and apply

them to achieve business solutions. It is held by professionals who hold a variety of

positions in business, technology and academia. To be awarded the CITP credential,

a CPA must possess at least 2,000 hours of business technology experience and at

least 200 hours of technology education, both earned within a fve-year period. For

more information, visit www.aicpa.org/infotech.

Credit

Certifed Credit Executive (CCE) The National Association of Credit Management

(NACM) offers this executive-level designation, which endorses its achievers as

capable of managing the credit function at an executive level. Candidates must meet

minimum requirements of a combination of experience, education and participation in

the credit feld through one of three different plans and must pass a rigorous four-hour

exam that tests skills in the areas of accounting, fnance, domestic and international

credit concepts, management, and law. CCEs are required to recertify every three

years. For more information, visit www.nacm.org.

Robert Half 12 Guide to Certifcations

Credit Business Associate (CBA) Offered by the NACM, the CBA is an

academic-based designation that signifes mastery of three credit-related disciplines:

basic fnancial accounting, business credit principles and introductory fnancial

statement analysis. No minimum work experience is required for this designation, and

the course work needed to qualify can be obtained through colleges, local NACM-

affliated association programs, self-study or nationally sponsored programs. Those

pursuing the designation can choose from one of two plans for completing the course

work. Applicants also must pass a comprehensive three-hour examination to earn the

certifcation. For more information, visit www.nacm.org.

Credit Business Fellow (CBF) Awarded by the NACM, the CBF is an academic and

participation-based designation indicating that credential holders are knowledgeable

about and have contributed to the feld of business credit by frst earning the CBA

designation and completing specifc educational requirements. This includes courses

in business law, credit law and fnancial statements (interpretation and credit risk

assessment). Applicants also must pass the three-hour CBF exam. For more

information, visit www.nacm.org.

Payroll

Certifed Payroll Professional (CPP) The CPP exam is open to professionals

meeting one of three criteria listed in the American Payroll Associations (APA)

Certifcation Examination Handbook. The CPP exam is the APAs mastery-level

payroll certifcation. It tests for profciency in all areas of payroll, including core

payroll concepts, compliance, principles of paycheck calculation, payroll processes

and systems, accounting, payroll management and payroll administration. The CPP

designation is valid for fve years. Recertifcation is attained by either retaking and

passing the exam or accumulating a minimum number of qualifying recertifcation

credit hours (RCHs) through continuing education. For more information, visit

www.americanpayroll.org/certi.html.

Fundamental Payroll Certifcation (FPC) The APAs FPC exam is open to all

individuals who wish to demonstrate a basic level of payroll competency. There are

no eligibility requirements to take the FPC exam. The FPC exam is designed for

entry-level payroll professionals, sales professionals serving the payroll industry, systems

analysts and payroll service bureau client representatives. The FPC designation is

valid for three years. Recertifcation is attained by either retaking and passing the exam

or accumulating a minimum number of qualifying RCHs through continuing education.

For more information, visit www.americanpayroll.org/certi.html.

Robert Half 13 Guide to Certifcations

Certifed General Accountant (CGA) CGA certifcation standards are established

by the Certifed General Accountants Association of Canada (CGA - Canada)

and meet all national and international accounting standards. The CGA Program

of Professional Studies incorporates requirements of education, examination and

experience that individuals must meet to become a CGA. A bachelors degree is a

requirement for certifcation. CGAs are governed by a code of ethical principles and

rules of conduct and are required to complete ongoing professional development.

For more information, visit www.cga.org/canada.

Certifed Management Accountant (CMA) The internationally recognized CMA

designation is offered by the Society of Management Accountants of Canada

(CMA Canada). CMAs apply management best practices in strategic planning,

fnance, operations, sales and marketing, information technology and human resources

to identify new market opportunities, ensure corporate accountability and help

organizations maintain a long-term competitive advantage. To obtain the designation,

a prospective member must have a degree from a university program in business or

commerce and pass the CMA entrance examination, a comprehensive test of accounting

and management knowledge. The candidate then enters CMA - Canadas two-

year Strategic Leadership Program while gaining practical full-time experience in a

strategic management accounting environment. CMA - Canada also offers alternative

channels to the CMA designation, including the CMA Executive Program. For more

information, visit www.cma-canada.org.

Certifed Payroll Manager (CPM) This management-level certifcation provides

professionals with the knowledge and skills to effciently and effectively manage

payroll as a mission-critical function. Its unique body of knowledge includes payroll

management, business continuity, risk management, project management, payroll

systems, benchmarking, change management and supervision. The Payroll Compliance

Practitioner (PCP) certifcation is a prerequisite for the CPM designation. CPM

certifcation holders are required to adhere to a professional code of conduct and

participate in continuing professional education to maintain their certifcation status.

For more information, visit www.payroll.ca.

Chartered Accountant (CA) The CA is an international designation that is similar

in scope and stature to the CPA credential. The CA is prominent in Canada,

Australia, England, Ireland, Scotland, South Africa, New Zealand and Wales. The

national governing body for CAs in Canada is the Canadian Institute of Chartered

Accountants (CICA), although certifcation programs are administered through

provincial institutes. Requirements to earn the credential may vary slightly among

licensing countries, but in general, CAs must meet certain work prerequisites, pass

a qualifying exam, and maintain professional standards of conduct and competence.

For more information, visit www.cica.ca.

Certifcation Descriptions: Canada

Robert Half 14 Guide to Certifcations

Fellow Credit Institute (FCI) The certifed credit professional FCI Program

curriculum provides intermediate and senior credit professionals with the management

skills and confdence to assume a leadership role in their organizations. Prior to

graduation, students must obtain fve years of practical experience in a credit position.

Designated FCIs are bound by a code of professional ethics and participate in ongoing

professional development. Two of the eight courses in the certifed credit professional

FCI Program are in-depth credit management courses. The remaining six core courses

are provided by CGA Canada, which allows students to transfer credits toward

earning a CGA designation. For more information, visit www.creditinstitute.org.

Payroll Compliance Practitioner (PCP) The PCP certifcation provides practitioners

with the skills and competencies to ensure their organization is legislatively compliant

through an annual payroll cycle. This certifcation covers the federal, provincial and

territorial legislation, regulations and administrative requirements necessary to work

effectively in payroll in Canada. Its content includes payroll federal and provincial

legislation, processing payroll from the employee and organization perspectives,

exceptional pay situations, termination of employment, accounting for payroll, statutory

remittances and the year-end process. PCP certifcation holders are required to

adhere to a professional code of conduct and participate in continuing professional

education to maintain their certifcation status. For more information, visit www.payroll.ca.

Robert Half 15 Guide to Certifcations

Accreditation Council for Accountancy and Taxation (ACAT)

1010 North Fairfax Street

Alexandria, VA 22314

888.289.7763

www.acatcredentials.org

Certifcations:

Accredited Business Accountant (ABA)

Accredited Tax Advisor (ATA)

Accredited Tax Preparer (ATP)

Elder Care Specialist (ECS)

American Institute of Certifed Public Accountants (AICPA)

1211 Avenue of the Americas

New York, NY 10036

212.596.6200

www.aicpa.org

Certifcations:

Accredited in Business Valuation (ABV)

Certifed Information Technology Professional (CITP)

Certifed Public Accountant (CPA)*

Personal Financial Specialist (PFS)

American Institute of Professional Bookkeepers (AIPB)

6001 Montrose Road, Suite 500

Rockville, MD 20852

800.622.0121

www.aipb.org

Certifcation:

Certifed Bookkeeper (CB)

American Payroll Association (APA)

660 North Main Avenue, Suite 100

San Antonio, TX 78205

210.226.4600

www.americanpayroll.org

Certifcations:

Certifed Payroll Professional (CPP)

Fundamental Payroll Certifcation (FPC)

* The CPA designation is administrated by the State Board of Accountancy

of the state in which an individual intends to practice.

Directory of Accrediting Organizations

Robert Half 16 Guide to Certifcations

American Society of Appraisers (ASA)

555 Herndon Parkway, Suite 125

Herndon, VA 20170

703.478.2228

www.appraisers.org

Certifcation:

Accredited Senior Appraiser (ASA)

American Society of Military Comptrollers

415 North Alfred Street, Suite 3

Alexandria, VA 22314

703.549.0306

www.asmconline.org

Certifcation:

Certifed Defense Financial Manager (CDFM)

APICS The Association for Operations Management

5301 Shawnee Road

Alexandria, VA 22312

800.444.2742

www.apics.org

Certifcations:

APICS Certifed Fellow in Production and Inventory Management (CFPIM)

APICS Certifed in Integrated Resource Management (CIRM)

APICS Certifed in Production and Inventory Management (CPIM)

APICS Certifed Supply Chain Professional (CSCP)

Association of Certifed Fraud Examiners (ACFE)

716 West Avenue

Austin, TX 78701

512.478.9000

www.acfe.com

Certifcation:

Certifed Fraud Examiner (CFE)

Association for Financial Professionals (AFP)

4520 East West Highway, Suite 750

Bethesda, MD 20814

301.907.2862

www.afponline.org

Certifcation:

Certifed Treasury Professional (CTP)

Robert Half 17 Guide to Certifcations

Association of Government Accountants (AGA)

2208 Mount Vernon Avenue

Alexandria, VA 22301

703.684.6931

www.agacgfm.org

Certifcation:

Certifed Government Financial Manager (CGFM)

BAI Center for Certifcation

One North Franklin, Suite 1000

Chicago, IL 60606

888.284.4078

www.bai.org

Certifcations:

Anti-Money Laundering Professional (AMLP)

Certifcate in Loan Review

Certifed Bank Auditor (CBA)

Certifed Risk Professional (CRP)

Canadian Institute of Chartered Accountants (CICA)

277 Wellington Street West

Toronto, ON M5V 3H2, Canada

416.977.3222

www.cica.ca

Certifcation:

Chartered Accountant (CA)

Canadian Payroll Association (CPA)

250 Bloor Street East, Suite 1600

Toronto, ON M4W 1E6, Canada

800.387.4693

www.payroll.ca

Certifcations:

Certifed Payroll Manager (CPM)

Payroll Compliance Practitioner (PCP)

Robert Half 18 Guide to Certifcations

Certifed Financial Planner Board of Standards (CFP Board)

1670 Broadway, Suite 600

Denver, CO 80202

303.830.7500

www.cfp.net

Certifcation:

Certifed Financial Planner (CFP)

Certifed General Accountants Association of Canada (CGA Canada)

800 - 1188 West Georgia Street

Vancouver, BC V6E 4A2, Canada

800.633.1529

www.cga-online.org/canada

Certifcation:

Certifed General Accountant (CGA)

Chartered Financial Analyst (CFA) Institute

560 Ray C. Hunt Drive

Charlottesville, VA 22903

800.247.8132

www.cfainstitute.org

Certifcation:

Chartered Financial Analyst (CFA)

Credit Institute of Canada

219 Dufferin Street, Suite 216C

Toronto, ON M6K 3J1, Canada

416.572.2615

www.creditedu.org

Certifcation:

Fellow Credit Institute (FCI)

Government Finance Offcers Association (GFOA)

203 North LaSalle Street, Suite 2700

Chicago, IL 60601

312.977.9700

www.gfoa.org

Certifcation:

Certifed Public Finance Offcer (CPFO)

Robert Half 19 Guide to Certifcations

Information Systems Audit and Control Association (ISACA)

3701 Algonquin Road, Suite 1010

Rolling Meadows, IL 60008

847.253.1545

www.isaca.org

Certifcations:

Certifed Information Security Manager (CISM)

Certifed Information Systems Auditor (CISA)

The Institute of Internal Auditors (The IIA)

247 Maitland Avenue

Altamonte Springs, FL 32701

407.937.1100

www.theiia.org

Certifcations:

Certifcation in Control Self-Assessment (CCSA)

Certifed Financial Services Auditor (CFSA)

Certifed Government Auditing Professional (CGAP)

Certifed Internal Auditor (CIA)

Institute of Management Accountants (IMA)

10 Paragon Drive

Montvale, NJ 07645

800.638.4427

www.imanet.org

Certifcation:

Certifed Management Accountant (CMA)

International Accounts Payable Professionals (IAPP)

8427 South Park Circle, Suite 160

Orlando, FL 32819

407.351.3322

www.iappnet.org

Certifcations:

Certifed Accounts Payable Associate (CAPA)

Certifed Accounts Payable Professional (CAPP)

Robert Half 20 Guide to Certifcations

National Association of Certifed Valuation Analysts (NACVA)

1111 Brickyard Road, Suite 200

Salt Lake City, UT 84106

801.486.0600

www.nacva.com

Certifcations:

Accredited Valuation Analyst (AVA)

Certifed Forensic Financial Analyst (CFFA)

Certifed Valuation Analyst (CVA)

National Association of Credit Management (NACM)

8840 Columbia 100 Parkway

Columbia, MD 21045

410.740.5560

www.nacm.org

Certifcations:

Certifed Credit Executive (CCE)

Credit Business Associate (CBA)

Credit Business Fellow (CBF)

National Association of Enrolled Agents (NAEA)

1120 Connecticut Avenue, NW, Suite 460

Washington, DC 20036

202.822.6232

www.naea.org

Certifcation:

Enrolled Agent (EA)

Society of Certifed Management Accountants (CMA Canada)

One Robert Speck Parkway, Suite 1400

Mississauga, ON L4Z 3M3, Canada

800.263.7622

www.cma-canada.org

Certifcation:

Certifed Management Accountant (CMA)

Robert Half 21 Guide to Certifcations

Accredited Business Accountant (ABA) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Accredited in Business Valuation (ABV) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Accredited Senior Appraiser (ASA) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Accredited Tax Advisor (ATA) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Accredited Tax Preparer (ATP). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Accredited Valuation Analyst (AVA) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Anti-Money Laundering Professional (AMLP) . . . . . . . . . . . . . . . . . . . . . . . . . . 8

APICS Certifed Fellow in Production and Inventory Management (CFPIM) . . 9

APICS Certifed in Integrated Resource Management (CIRM) . . . . . . . . . . . . 9

APICS Certifed in Production and Inventory Management (CPIM) . . . . . . . . . 9

APICS Certifed Supply Chain Professional (CSCP) . . . . . . . . . . . . . . . . . . . . 9

Certifcate in Loan Review . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Certifcation in Control Self-Assessment (CCSA) . . . . . . . . . . . . . . . . . . . . . . 8

Certifed Accounts Payable Associate (CAPA) . . . . . . . . . . . . . . . . . . . . . . . . 4

Certifed Accounts Payable Professional (CAPP) . . . . . . . . . . . . . . . . . . . . . . . 4

Certifed Bank Auditor (CBA) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Certifed Bookkeeper (CB) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Certifed Credit Executive (CCE) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Certifed Defense Financial Manager (CDFM) . . . . . . . . . . . . . . . . . . . . . . . . . 5

Certifed Financial Planner (CFP) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Certifed Financial Services Auditor (CFSA) . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Certifed Forensic Financial Analyst (CFFA) . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Certifed Fraud Examiner (CFE) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Certifed General Accountant (CGA) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Certifed Government Auditing Professional (CGAP) . . . . . . . . . . . . . . . . . . . . 5

Certifed Government Financial Manager (CGFM) . . . . . . . . . . . . . . . . . . . . . . 5

Certifed Information Security Manager (CISM) . . . . . . . . . . . . . . . . . . . . . . . 11

Certifed Information Systems Auditor (CISA) . . . . . . . . . . . . . . . . . . . . . . . . . 11

Certifed Information Technology Professional (CITP) . . . . . . . . . . . . . . . . . . .11

Certifed Internal Auditor (CIA) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Certifed Management Accountant (CMA) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Certifed Management Accountant (CMA Canada) . . . . . . . . . . . . . . . . . . .13

Index of Certifcations

Robert Half 22 Guide to Certifcations

Certifed Payroll Manager (CPM) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13

Certifed Payroll Professional (CPP) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Certifed Public Accountant (CPA) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Certifed Public Finance Offcer (CPFO) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Certifed Risk Professional (CRP) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Certifed Treasury Professional (CTP) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Certifed Valuation Analyst (CVA) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Chartered Accountant (CA) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13

Chartered Financial Analyst (CFA) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Credit Business Associate (CBA) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Credit Business Fellow (CBF) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Elder Care Specialist (ECS) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Enrolled Agent (EA) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Fellow Credit Institute (FCI) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .14

Fundamental Payroll Certifcation (FPC) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Payroll Compliance Practitioner (PCP) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Personal Financial Specialist (PFS) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Robert Half 23 Guide to Certifcations

Robert Half is the industrys leading resource on hiring and employment trends.

Our reputation as a resource is evidenced by the business relationships weve

developed with professional associations. These include the American Institute

of Certifed Public Accountants, American Payroll Association, American

Society of Women Accountants, Association of Latino Professionals in Finance

and Accounting, Canadian Institute of Charted Accountants, Canadian Payroll

Association, Canadian Securities Institute, Certifed General Accountants

Association of Canada, Credit Institute of Canada, Financial Executives

International, The Institute of Internal Auditors, National Association of Credit

Management and Society of Certifed Management Accountants Canada.

These relationships enhance our network as well as underscore our leadership

position and reputation for excellence.

Robert Half provides compensation and management-related information

through a variety of resources, including our annual Salary Guide and booklets

such as the Glossary of Job Descriptions for Accounting and Finance, How to

Hire Smart, How to Keep Your Best People, 30 Ways to Maximize Employee

Productivity, How to Get Ahead in Accounting and Finance and How to Check

References When References Are Hard to Check.

Chairman and CEO Max Messmer is a widely published author and columnist

whose books for managers include Motivating Employees For Dummies; Human

Resources Kit For Dummies, 2

nd

Edition; and The Fast Forward MBA in Hiring

(John Wiley & Sons, Inc.). Professionals in every feld beneft from his career

advice in Managing Your Career For Dummies and Job Hunting For Dummies,

2

nd

Edition (John Wiley & Sons, Inc.).

To remain current on staffng and employment trends, Robert Half regularly

conducts extensive research and surveys on workplace topics of interest. This

information is shared with clients, job seekers and the media.

For more information about our services and resources, please contact your

nearest Robert Half offce at 1.800.803.8367 or visit us online at www.rhi.com.

The Leading Resource

Robert Half 24 Guide to Certifcations

2007 Robert Half International Inc. All rights reserved. An Equal Opportunity Employer. ATFAMR-0507

Founded in 1948, Robert Half is the worlds leader in specialized consulting and

staffng services and a member of Standard & Poors widely tracked S&P 500

index. The companys fnancial staffng divisions include Accountemps

, Robert

Half

Finance & Accounting and Robert Half

Management Resources, for

temporary, full-time and senior-level project professionals, respectively.

Accountemps is the worlds frst and largest temporary staffng service for

accounting, fnance and bookkeeping professionals. Our specialized experience

and reputation in the industry enable us to offer the most highly skilled temporary

employees and deliver outstanding service. Our temporary professionals

supplement our clients full-time personnel to meet their variable fnancial staffng

needs. We also offer guidance to our clients on the most effcient allocation of

human resources for major initiatives.

Since 1948, frms of all sizes and in a variety of industries have recognized

Robert Half Finance & Accounting as the pioneer in specialized fnancial

recruitment. Our clients rely on our unrivaled experience in matching highly skilled

candidates to the unique requirements of each position. In addition, our recruiting

professionals can advise companies on local hiring and compensation trends and

provide the latest information on issues impacting the accounting and fnance felds.

Established in 1997, Robert Half Management Resources is the worlds

premier provider of senior-level accounting and fnance professionals on a project

basis. Our consultants have skills and experience in a variety of areas, including

audit and compliance, accounting and accounting operations, fnance, regulatory

reporting, fnancial systems, taxation, administration and operations management,

and project management. They are often brought in to fll key fnancial positions

on an interim basis, such as chief fnancial offcer, vice president of fnance, internal

audit manager, tax director, controller and systems conversion manager.

Robert Half also is the parent company of Protiviti Inc., a leading provider of

independent internal audit and risk consulting services. Protiviti helps companies

identify, assess and manage operational and technology-related risks in their

businesses.

Robert Half has a global network of more than 400 staffng and consulting

locations worldwide. For more information about our professional services, please

visit www.rhi.com.

About the Company

You might also like

- Exam 2 Study SheetDocument14 pagesExam 2 Study SheetMatthew YoungNo ratings yet

- Apple Pro Training SeriesDocument2 pagesApple Pro Training Seriesmasterkira101No ratings yet

- Business Tax BasicsDocument60 pagesBusiness Tax BasicstinaNo ratings yet

- Bookkeeping Assoc BookletDocument25 pagesBookkeeping Assoc BookletAlfretta BrashearsNo ratings yet

- 2012 Basic Income Tax Course Rollout GuideDocument39 pages2012 Basic Income Tax Course Rollout GuidemeNo ratings yet

- 078 Federal Income TaxDocument67 pages078 Federal Income Taxcitygirl518No ratings yet

- Business Plan Sample LLC PDFDocument37 pagesBusiness Plan Sample LLC PDFJaffar MemonNo ratings yet

- QuickBooks Desktop Certification Training ObjectivesDocument181 pagesQuickBooks Desktop Certification Training ObjectivesNoel ArenaNo ratings yet

- Forensic Accounting:: Forensic Accounting, Forensic Accountancy or Financial Forensics Is The Specialty Practice AreaDocument2 pagesForensic Accounting:: Forensic Accounting, Forensic Accountancy or Financial Forensics Is The Specialty Practice AreaAanchal SinghalNo ratings yet

- 6 components of the Code of Ethics and 7 Standards of Professional ConductDocument258 pages6 components of the Code of Ethics and 7 Standards of Professional ConductBrook Rene Johnson71% (7)

- QuickBooks For Agricultural Financial RecordsDocument89 pagesQuickBooks For Agricultural Financial RecordsAbdalla Nizar Al-busaidy100% (2)

- Accounting For Business Study GuideDocument154 pagesAccounting For Business Study GuideSheikh Fareed AliNo ratings yet

- CPA ExamsDocument2 pagesCPA ExamsSharm DeleonNo ratings yet

- Bookkeeping Kit Cheat SheetDocument4 pagesBookkeeping Kit Cheat SheetAllan AmitNo ratings yet

- Level II Bookeeping Text Book Online CollectionDocument68 pagesLevel II Bookeeping Text Book Online CollectionHtain Lin MaungNo ratings yet

- CPA Exam Study MaterialsDocument3 pagesCPA Exam Study MaterialsBukola OlaniranNo ratings yet

- The Amazing Story of Stock Market SeasonalityDocument5 pagesThe Amazing Story of Stock Market SeasonalityBrook Rene JohnsonNo ratings yet

- Employer's Guide Payroll Deductions and RemittancesDocument59 pagesEmployer's Guide Payroll Deductions and RemittancesWill100% (2)

- Bookkeeping Keywords ListDocument1,492 pagesBookkeeping Keywords Listmohan1218100% (1)

- EA LectureNotesDocument84 pagesEA LectureNotesKim Nguyen100% (1)

- Agreement.: Dissolution IsDocument4 pagesAgreement.: Dissolution IsClauie BarsNo ratings yet

- Client Bookkeeping Solution TutorialDocument304 pagesClient Bookkeeping Solution Tutorialburhan_qureshiNo ratings yet

- Canadian Tax Planning and Decision Making GuideDocument33 pagesCanadian Tax Planning and Decision Making Guidendaguiam100% (1)

- Bookkeeping Video Training: (Handout)Document22 pagesBookkeeping Video Training: (Handout)Yusuf RaharjaNo ratings yet

- 7 Reasons Why Bookkeepers Should Prepare Taxes PDFDocument25 pages7 Reasons Why Bookkeepers Should Prepare Taxes PDFMerrill Taylor100% (1)

- Volunteer Tax Preparer Test - Good Practice Questions PDFDocument190 pagesVolunteer Tax Preparer Test - Good Practice Questions PDFnishuNo ratings yet

- 2012 Practice Analysis Executive Otr PDFDocument32 pages2012 Practice Analysis Executive Otr PDFRuxandra PredaNo ratings yet

- Bec Flash CardsDocument4,310 pagesBec Flash Cardsmohit2uc100% (1)

- ISACA Fact SheetDocument2 pagesISACA Fact SheetSilviaHerreraNo ratings yet

- QuickBooks For BeginnersDocument3 pagesQuickBooks For BeginnersZain U Ddin0% (1)

- OSCP - Offensive Security Certified ProfessionalDocument9 pagesOSCP - Offensive Security Certified ProfessionalSteve Foster100% (1)

- E-Tech Accountancy LTD in UKDocument4 pagesE-Tech Accountancy LTD in UKawaiskhokhar02No ratings yet

- Accounting Interview Questions and AnswersDocument30 pagesAccounting Interview Questions and AnswershimukabirjnuNo ratings yet

- Canadian Small Business Tax BookletDocument47 pagesCanadian Small Business Tax BookletNeel Roberts100% (1)

- Basic Bookkeeping For EntrepreneursDocument36 pagesBasic Bookkeeping For EntrepreneursDanney EkaNo ratings yet

- GRE Quant Concepts FormulaeDocument31 pagesGRE Quant Concepts Formulaeshaliniark100% (3)

- Promotion & ReclassificationDocument32 pagesPromotion & ReclassificationMelchor Balolong100% (2)

- QBO Advanced Certificaton - Modules 1 - 9 - WebsiteDocument455 pagesQBO Advanced Certificaton - Modules 1 - 9 - WebsiteMichael GaoNo ratings yet

- 2019-2020 Training Guide FNLDocument16 pages2019-2020 Training Guide FNLGerald HartmanNo ratings yet

- Course 5049A Managing Messaging Security Using Microsoft Exchange Server 2007Document200 pagesCourse 5049A Managing Messaging Security Using Microsoft Exchange Server 2007AhmedWaelNo ratings yet

- CCXP Handbook Updated62217Document28 pagesCCXP Handbook Updated62217omar.chohan3524No ratings yet

- Certified Management AccountantDocument3 pagesCertified Management AccountantYusuf Hussein100% (2)

- Debit Credit EditedDocument30 pagesDebit Credit EditedAce Christian MendozaNo ratings yet

- Step-by-Step Strategies to Prepare and Pass the IRS Compency ExaminationFrom EverandStep-by-Step Strategies to Prepare and Pass the IRS Compency ExaminationRating: 1 out of 5 stars1/5 (1)

- Accounting Principles: Rapid ReviewDocument3 pagesAccounting Principles: Rapid ReviewAhmedNiazNo ratings yet

- Importance of Auditing and its Role in Risk ReductionDocument29 pagesImportance of Auditing and its Role in Risk ReductionRayz100% (1)

- UKGAAP in Your Pocket - A Guide To FRS 102Document112 pagesUKGAAP in Your Pocket - A Guide To FRS 102Raouf ChNo ratings yet

- Waves 100Document6 pagesWaves 100Brook Rene JohnsonNo ratings yet

- Hikvision Certification ProgramDocument3 pagesHikvision Certification ProgramMithunNo ratings yet

- Small Business Accounting Kit For Start-UpsDocument13 pagesSmall Business Accounting Kit For Start-UpsLedgersOnline Inc.No ratings yet

- HR Block Income Tax Return Checklist Individuals 0620 FADocument1 pageHR Block Income Tax Return Checklist Individuals 0620 FAdeNo ratings yet

- Adair-Hoy, Angela - Life Skills - Writing - How To Publish Ebooks PDFDocument41 pagesAdair-Hoy, Angela - Life Skills - Writing - How To Publish Ebooks PDFfbaizNo ratings yet

- 2013 Recruiting Tax Pros MaterialDocument13 pages2013 Recruiting Tax Pros MaterialmeNo ratings yet

- Bookkeeping Engagement Letter BDH PDFDocument2 pagesBookkeeping Engagement Letter BDH PDFBoni MabtsNo ratings yet

- Calvin Lee applies for Investment Banking Analyst roleDocument1 pageCalvin Lee applies for Investment Banking Analyst roleZX LeeNo ratings yet

- Basic Financial Statements NotesDocument6 pagesBasic Financial Statements NotesNNo ratings yet

- Banking and BookkeepingDocument37 pagesBanking and Bookkeepingangela_edelNo ratings yet

- CHAP 13 Partnerships and Limited Liability CorporationsDocument89 pagesCHAP 13 Partnerships and Limited Liability Corporationspriyankagrawal7100% (1)

- NTS CPA ExamDocument2 pagesNTS CPA ExamMrudula V.No ratings yet

- Analyzing TransactionsDocument85 pagesAnalyzing TransactionswarsimaNo ratings yet

- CPA REVIEW Questions - LAMBERSDocument51 pagesCPA REVIEW Questions - LAMBERSAlellie Khay JordanNo ratings yet

- Income Tax - 2021Document24 pagesIncome Tax - 2021jayaksmcoNo ratings yet

- Vat NotesDocument7 pagesVat NotesZulqarnainNo ratings yet

- Certified Bookkeeper FlyerDocument2 pagesCertified Bookkeeper Flyerapi-308562859No ratings yet

- Digital Communincation and Technological College Inc. Training PlanDocument6 pagesDigital Communincation and Technological College Inc. Training PlanPrances PelobelloNo ratings yet

- Bookkeeping Course OutlineDocument3 pagesBookkeeping Course OutlineJevie Villa AbrilleNo ratings yet

- Chapter 4 SolutionsDocument13 pagesChapter 4 SolutionsjessicaNo ratings yet

- Final Exam Tax Preparer 2017Document19 pagesFinal Exam Tax Preparer 2017nzabanita6417% (6)

- Changing Cycle Frequencies Produces Different Effects Armstrong EconomicsDocument3 pagesChanging Cycle Frequencies Produces Different Effects Armstrong EconomicsBrook Rene JohnsonNo ratings yet

- Deep WebDocument49 pagesDeep WebBrook Rene JohnsonNo ratings yet

- Directions Magazine - GIS Jobs 2013Document48 pagesDirections Magazine - GIS Jobs 2013odcardozoNo ratings yet

- Differenced Price Has Low R SquaredDocument1 pageDifferenced Price Has Low R SquaredBrook Rene JohnsonNo ratings yet

- Home Protector - Quick - Quote - Cheat SheetDocument8 pagesHome Protector - Quick - Quote - Cheat SheetBrook Rene JohnsonNo ratings yet

- One-Way ANOVA Guide for Hypothesis TestingDocument18 pagesOne-Way ANOVA Guide for Hypothesis TestingBrook Rene JohnsonNo ratings yet

- One-Way ANOVA Guide for Hypothesis TestingDocument18 pagesOne-Way ANOVA Guide for Hypothesis TestingBrook Rene JohnsonNo ratings yet

- Recession Proof Graduate1Document30 pagesRecession Proof Graduate1truongpham91No ratings yet

- The 21 Laws of Boldness PDFDocument59 pagesThe 21 Laws of Boldness PDFVishnu Agnihotri100% (1)

- COSC FlowchartDocument1 pageCOSC FlowchartBrook Rene JohnsonNo ratings yet

- A Program To Estimate The Dominant Lyapunov Exponent of Noisy Nonlinear Systems From Time Series DataDocument27 pagesA Program To Estimate The Dominant Lyapunov Exponent of Noisy Nonlinear Systems From Time Series DataBrook Rene JohnsonNo ratings yet

- Introduction to Fractals in FinanceDocument28 pagesIntroduction to Fractals in FinanceprsrivastavNo ratings yet

- Time Value of Money Problems On A Texas Instruments TI-83 - TVM Appendix B Using The TI-83-84Document10 pagesTime Value of Money Problems On A Texas Instruments TI-83 - TVM Appendix B Using The TI-83-84Brook Rene JohnsonNo ratings yet

- Containing Systemic Risk: The Road To Reform CRMPG-IIIDocument176 pagesContaining Systemic Risk: The Road To Reform CRMPG-IIICDObaby100% (2)

- Predictability-Chaos-Lorenz Attractor MEA719 Lec4 Jan28 2009Document35 pagesPredictability-Chaos-Lorenz Attractor MEA719 Lec4 Jan28 2009Brook Rene JohnsonNo ratings yet

- User GuideDocument42 pagesUser GuideBrook Rene JohnsonNo ratings yet

- Primeserv Academy Image BrochureDocument28 pagesPrimeserv Academy Image BrochureM SarfarazNo ratings yet

- IRIS Certification PDFDocument2 pagesIRIS Certification PDFChromoNo ratings yet

- School Counseling in South Korea: Historical Development, Current Status, and ProspectsDocument25 pagesSchool Counseling in South Korea: Historical Development, Current Status, and ProspectsAya SofiaNo ratings yet

- Letter Authorization ConfirmationDocument1 pageLetter Authorization Confirmationjoni_joanNo ratings yet

- GEIT-65027US Remote Visual InspectionDocument16 pagesGEIT-65027US Remote Visual InspectionvrapciudorianNo ratings yet

- خطاب اقرار وتفويض الهيئة السعودية للمهندسينDocument1 pageخطاب اقرار وتفويض الهيئة السعودية للمهندسينMohammed AlhsamNo ratings yet

- D2L-L14 Issue of Certificate of CompetencyDocument26 pagesD2L-L14 Issue of Certificate of CompetencykamaleshaiahNo ratings yet

- Guidance Stepwise Final 04 10 2012Document60 pagesGuidance Stepwise Final 04 10 2012daku dakunaNo ratings yet

- Drafting and Design TechnologyDocument5 pagesDrafting and Design TechnologyVinod BhaskarNo ratings yet

- Farooq CV PipingDocument2 pagesFarooq CV PipingSarang JoshiNo ratings yet

- Bachelor of Science in Information Technology With An Advanced Cyber Security CertificateDocument3 pagesBachelor of Science in Information Technology With An Advanced Cyber Security CertificateLauraPerezNo ratings yet

- 2018 Agreement MikroTik Academy en 4Document2 pages2018 Agreement MikroTik Academy en 4Satria Infonet100% (1)

- Introduction To Project ManagementDocument49 pagesIntroduction To Project ManagementmonamNo ratings yet

- Key Performance Indicators For The Teach PDFDocument12 pagesKey Performance Indicators For The Teach PDFNieves Hoseña FigueroaNo ratings yet

- UMI Prospectus 2018 19 PDFDocument80 pagesUMI Prospectus 2018 19 PDFVincent Oryang100% (1)

- Check Your Eligibility For Challenge Pathway/direct CFP Exam 5/finalDocument3 pagesCheck Your Eligibility For Challenge Pathway/direct CFP Exam 5/finalkeyur1975No ratings yet

- Full 2014 Annual ReportDocument15 pagesFull 2014 Annual ReportByte BackNo ratings yet

- TR Emergency Medical Services NC IIDocument114 pagesTR Emergency Medical Services NC IIClarence Joy Luzon AbreaNo ratings yet

- Training Course Outline: Autocad ElectricalDocument2 pagesTraining Course Outline: Autocad ElectricalGRINE LOTFINo ratings yet

- NACM ProgramDocument27 pagesNACM ProgramRashmi KudtarkarNo ratings yet

- TRIPATRA'S TANGGUH LNG PROJECT Indonesian EPC company Tripatra recruiting for Tangguh LNG Project rolesDocument28 pagesTRIPATRA'S TANGGUH LNG PROJECT Indonesian EPC company Tripatra recruiting for Tangguh LNG Project rolesKholil JavaNo ratings yet