Professional Documents

Culture Documents

Securitization For Dummies

Uploaded by

Harpott GhantaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Securitization For Dummies

Uploaded by

Harpott GhantaCopyright:

Available Formats

6

B

Corporate

Securitization:

Seven Lessons for a CFO

Prof. Dr. Andre Thibeault

Dr. Dennis Vink

Before the subprime meltdown the

asset-backed market had grown to

become one of the largest capital

markets in the world in terms of

size and volume. The market was

not only accessed by financial insti-

tutions, but also by corporates.

Corporates increasingly often used

securitization techniques to refinance

whole lines of businesses by issuing

asset-backed debt that was rated

multiple notches above the rating of

the parent company. One of these

instruments that were used is whole-

business securitization, also defined

as operating-asset or corporate secu-

ritization.

1

The overall issuance has

continued in Europe and the United

States despite the crisis, albeit at

lower levels.

2

An interesting example

of a recent transaction done in the

market is that of Churchs Chicken.

In February 2011, Churchs Chicken

issued secured bonds in the aggre-

gate principal amount of $245

million. The new credit facility is the

first whole-business securitization

completed in the restaurant sector

since 2007. The bonds are backed by

the franchise revenues of the nearly

1,450 franchised Churchs Chicken-

branded and Texas Chicken-branded

restaurants in operation both

domestically and internationally and

substantially all of the tangible and

intangible assets of the approxima-

tely 230 company-owned Churchs

Chicken-branded restaurants in

operation in the United States. The

new credit facility is the first whole-

business securitization completed in

the restaurant sector since 2007.

The performance of whole

business securitizations

backed by restaurant

franchise payments, such

as the Churchs Chicken

bond, has been stable,

note Moodys Investors

Service analysts. These

havent suered during

the economic downturn

because they experienced

milder customer tra c

declines than did the more

expensive ne dining and

casual dining industry

segments,

the analysts note.

3

1

2

3

R

F

3

R

F

3

R

LESSONS

1

In one years time, both the Dunkin Brands transaction (May 2006) and the Dominos Pizza deal (April 2007) pushed about $3.5 billion of asset-backed papers

onto the market.

2

See report Recent Developments in Securitization, published by the European Central Bank in February 2011.

3

http://www.dowjones.de/site/2011/02/churchs-chicken-puts-franchise-fees-on-abs-menu.html.

7 The Fi nanci al Execut i ve n53 Oct ober 2011

The decision to use whole-business

securitization involves an explicit

choice regarding the financial struc-

ture concerned as well as managerial

involvement and control. This article

aims to introduce the reader to the

structural features of whole-business

securitization by discussing 7 impor-

tant lessons.

First, the general concept of

asset-backed securitization will be

discussed. Next, the reader will

be introduced to the terminology

framework for whole-business secu-

ritization. Finally, an answer will

be presented to the question how

whole- business securitization distin-

guishes itself from more traditional

areas of corporate finance.

Lesson 1:

The definition of asset-backed

securitization refers to the issu-

ance of tradable debt papers,

which are guaranteed based on a

well-defined collection of assets.

Unfortunately, the term asset-

backed securitization is used diffe-

rently by many, and the usage is

not necessarily comparable. Asset-

backed securitization first appeared

in bank funding. Hess and Smith

(1988), for example, defined asset-

backed securitization as a financial

intermediation process, which

re-bundles individual principal and

interest payments of existing loans

to create new securities. More

recently, the term asset-backed

securitization has come to be used

to refer to so-called structured

finance, the general process by

which illiquid assets are pooled,

repackaged and sold to investors. So,

asset-backed securitization can best

be defined as the process in which

assets are refinanced in the capital

market by issuing securities sold to

investors by a bankruptcy-remote

special purpose vehicle. This defini-

tion comprises the fundamentals of

asset securitization.

Lesson 2:

The objective is that only the

investors in the SPV will have

a claim against the securitized

assets in the event of the sellers

bankruptcy: not the seller or the

sellers creditors.

Legal concepts in the area of secu-

ritization often differ, and thus have

specific accounting and tax rules,

including tax consequences for both

sellers and investors. Common-law

countries (such as Australia, the

United Kingdom and the United

States) for example, follow different

legal rules in comparison with civil

countries (most other countries).

Despite fundamental differences in

the legal environment, the primary

objective of the SPV is to facilitate

the securitization of the assets and to

ensure that the SPV is established for

bankruptcy purposes as a legal entity

separate from the seller. In other

words, the objective is that only the

investors in the SPV will have a claim

against the securitized assets in the

event of the sellers bankruptcy: not

the seller or the sellers creditors.

Because the pool of assets is insu-

lated from the operating risk of the

seller, the SPV in itself may achieve

better financing terms than the seller

would have received on the basis of

his own merits. This is the key driver

for reducing financing costs by secu-

ritization in comparison with alterna-

tive forms of financing.

Lesson 3:

Asset-backed securities are not

the same as covered bonds.

The objective of securitization is that

the investors in the SPV will have a

claim against the securitized assets in

the event of the sellers bankruptcy:

investors do not have recourse on

the seller. That makes securitiza-

tion different than covered bonds,

because covered bonds do not allow

for risk transfer in the same way as

securitized products. In the event

of default, asset-backed securities

have recourse only on the pre-de-

fined pool of assets in the SPV,

while covered bonds have recourse

on both the SPV and the seller of

the assets. So one distinct feature

from securitized products is the

liability of the seller in the event of

default. Note that covered bonds are

frequently used as an alternative for

residential mortgage-backed securi-

ties (RMBS).

Lesson 4:

The element of future exploitation

of the asset is a key distinction

between standard securitization

and whole-business securitization.

Whole-business securitization

uses securitization techniques for

refinancing a whole business or

operating assets. You may wonder

what exactly is meant by whole

business, and where precisely the

difference lies compared with the

Prof. Dr. Andre

Thibeault

Professor of Finance and Risk

Management

Academic Director at Vlerick

Center for Financial Services

D

.

D

.

R

.

R

.

8

more usual types of collateral used

in securitization transactions: credit

cards or mortgages, for example.

In order to make you understand

whole-business securitization, its

definition will be presented first.

Next, the difference will briefly be

explained between whole-business

securitization and the more common

forms of securitization, as we know

them today: for example the use

of mortgages and credit cards.

Whole-business securitization can be

defined as a form of asset-backed

financing in which operating assets

are financed in the bond market

via a bankruptcy-remote vehicle

(hereafter: SPV) and in which the

operating company keeps complete

control over the assets securitized.

In case of default, control is handed

over to the security trustee for the

benefit of the note holders for the

remaining term of financing. One of

the great challenges lies in defining

the difference between operating

asset securitization and the more

common forms of securitization

transactions. Consider for instance

a mortgage pool. If the mortgages

have been securitized, the seller

(sponsor) has no further obliga-

tions towards the consumer. The

mortgage has been closed and stipu-

lations concerning future payments

to be made by the consumer have

been laid down in a contract. Simply

stated, the financial institution then

collects payments from the consumer

for the balance of the life of the

loan. In effect, the traditional classes

of securitization assets are self-liqui-

dating. By contrast, in the example

in which claims on the basis of

operating assets are securitized, the

sponsor has an obligation to exploit

the underlying assets. To offer an

illustration: when a football club

securitizes its revenues from the sale

of tickets, the sponsor must continue

to render services that allow foot-

ball fans to buy their tickets at the

box office. Thus, the securitization

process requires permanent mana-

gerial involvement on the part

of the original owner in order to

generate revenues. The element of

future exploitation of the asset is a

key distinction between standard

securitization and operating-asset

securitization. Control over the cash

flows of the securitized business is

established either through a sale of

the assets, or through an adequate

legal structure that ensures continua-

tion of cash flows in the event of the

insolvency of the borrower.

4

Lesson 5:

The receiver has authorization to

seize control over the assets of the

securitized business at the loss of

any other creditor.

In a standard whole-business secu-

ritization transaction, a financial

institution grants the sponsor (or

originator) a loan secured by a pledge

on the assets. This secured loan is

then transferred to a bankruptcy-re-

mote special purpose vehicle, which

issues the notes. The security atta-

ched to the loan is also transferred to

LESSONS

Dr. Dennis Vink

Associate Professor of

Finance

Director at Nyenrode Center

for Finance

D

.

D

.

R

.

R

5

This feature makes it difficult in some countries to structure a business securitization deal. In fact, it has been proven to be hard to separate the assets legally while

the sponsor still retains operating control and services these assets. Under U.K. law, this difficulty has almost been eliminated by the 1986 Insolvency Act, which

permits the holder of a charge over substantially all of the assets of a corporate to control the insolvency proceeds of that corporate through an administrative

receiver.

9 The Fi nanci al Execut i ve n53 Oct ober 2011

the SPV. Thus, ownership and control

of the assets remain with the sponsor,

and bondholders are only granted

charge over those assets. Control is

required because the owner of the

assets should exploit the assets for

the full term of financing. Also, the

sponsor intends to repay the loan

out of the cash flows generated from

its business. In case of default of the

sponsor, the SPV receives complete

control over the securitized assets

by appointing a receiver for the full

term of financing. The receiver has

authorization to seize control over

the assets of the securitized business

at the loss of any other creditor. This

is called bankruptcy remoteness. The

SPV increases the likelihood of the

business being able to continue as

a going concern rather than being

forced to have a fire sale of the

individual assets. This preserves

the value of the assets securitized,

which is of great importance to the

investors. Whole-business securiti-

zation therefore efficiently uses the

privileges of bankruptcy law offering

bondholders extensive security in

case of default.

A clear case of effective recei-

vership in default is that presented

by Welcome Break, the U.K.-based

motorway service area operator and

the first whole-business securitiza-

tion operation in its segment. When

Welcome Break was no longer able

to meet its obligations following its

weaker-than-expected operating

performance in 2002, the owner was

in danger - if the economy conti-

nued to slide of landing in a situa-

tion in which the company would

not be able to meet its debt obliga-

tions. The owner then made an offer

to the bondholders: Class As were

to be repaid at par (309 million par

value), and Class Bs at 55% (67

million par value). The bondholders

rejected this proposal. Subsequently,

after Welcome Break failed to make

full payment on its loan, it was

put into receivership. Deloitte was

appointed administrative receiver. A

few days later, the owner and the

administrative receiver finally orga-

nized a solution; the owner agreed

to pay all classes of bondholders

back at par by selling nine service

stations.

Lesson 6:

A whole-business securitization

structure tends to carry a lower

average cost of debt compared

to ordinary debt, and it usually

issues debt with a longer matu-

rity, which reduces pressure on

the corporate issuer to place

refinancing.

The result of bankruptcy remote-

ness is that the SPV generally issues

securities that are rated higher (and

in many cases significantly higher) in

comparison with other alternatives,

such as the issuance of ordinary

secured debt by the company. This

is the result of the risk mitigation

generated by isolating the assets

from the bankruptcy and other risks

of the parent company through the

whole-business securitization struc-

ture. Hence, the holder of an asset-

backed bond is in a position similar

to that held by the holder of an ordi-

nary secured bond with regard to

the sponsor, because repayment of

the bonds takes place from a defined

pool of assets. The difference is that

the holder of an asset-backed bond

is not affected by the non-perfor-

mance of the sponsors other assets,

whereas the ordinary bondholder is.

Furthermore, structural features in

whole-business securitization are

designed to decrease the moral

hazard of the borrower, and to

decrease potential investment

conflicts between borrower and

bondholder. In other words, these

features mitigate the risk that the

strength of the business will be

impaired through mismanagement.

Also, the structure is secured by the

entire set of cash flows generated by

the assets, as well as the value of the

underlying assets. As a result, the

structure tends to carry an average

lower cost of debt in comparison

with ordinary secured debt, thanks

to restrictive covenants on both

the asset and liability side of the

company. It usually issues debt with

a longer maturity, which reduces

pressure on the corporate issuer to

place refinancing.

Lesson 7:

Post-meltdown whole business

securitizations are similar to the

whole business deals that were

closed prior to the meltdown,

but.

The credit crisis had revealed several

shortcomings in the securitization

10

structure that includes: lack of trans-

parency regarding collateral, failing

monoline insurance companies, and

the recognition that financial engi-

neering cannot offset the risk related

to the fundamentals of the opera-

tional business . Although we expect

post-meltdown whole business secu-

ritizations to be similar to the whole

business deals that were closed prior

to the meltdown, we expect inves-

tors to favor simple and transparent

structures so that investors can now

scrutinize the product more carefully.

Without a doubt less financial engi-

neering is possible since we know

now that credit enhancement by

monoline insurers is not very popular

among investors these days. That

would probably result in less triple-A

rated tranches in the structure.

Tranches would reflect their real risk

according to the cash flow waterfall

and subordination levels. Also, origi-

nators are expected to have more

skin in the game that requires them

to retain some of the junior tranches

in the structure.

Conclusions

Whole-business securitization

enables a business to set up a

structure in which business and

financial risks can be managed and

in which the level of credit risk

for the investor can be substan-

tially reduced. It could be a good

alternative as opposed to a more

traditional secured loan or collate-

ralized mortgage-backed securities

(CMBS), because of the limited

amount of debt capacity available to

companies.

Corporate securitizations have

primarily focused on the intellectual

property arena, including fast food,

licensing, music, film and drug royal-

ties. But certain kinds of businesses

are not likely to benefit from a busi-

ness securitization transaction. These

include businesses that are capital

intensive, are reliant on unique

management skills, or are evolving

rapidly. All of the business securiti-

zation transactions executed were

business activities of which the cash

flows could be accurately estimated

thanks to long-term contracts and

a well-documented history of stable

cash flows through which the busi-

ness and financial risks were consi-

dered low, or could be significantly

mitigated by structural features.

Applying such structures, however,

is not without risks: witness the

problems encountered in the

Welcome Break transaction. A

combination of too little return on

investment and too high leverage

damaged the sponsor to such an

extent that it was ultimately forced

to make repayments to the investors

by winding up the business.

LESSONS

You might also like

- Asset Securitization by HuDocument22 pagesAsset Securitization by HucherryflavaNo ratings yet

- Asset Securitisation..Document20 pagesAsset Securitisation..raj sharmaNo ratings yet

- SecuritizationDocument46 pagesSecuritizationHitesh MoreNo ratings yet

- SecuritizationDocument146 pagesSecuritizationSaurabh ParasharNo ratings yet

- Leixner (1999) Securitization of Financial Assets - An IntroductionDocument8 pagesLeixner (1999) Securitization of Financial Assets - An Introductionapi-3778585No ratings yet

- A primer on whole business securitization financing structureDocument13 pagesA primer on whole business securitization financing structureSam TickerNo ratings yet

- Basics of Securitisation of AssetsDocument2 pagesBasics of Securitisation of Assetslapogk100% (1)

- The Securitization Markets Handbook: Structures and Dynamics of Mortgage- and Asset-backed SecuritiesFrom EverandThe Securitization Markets Handbook: Structures and Dynamics of Mortgage- and Asset-backed SecuritiesNo ratings yet

- Securitization and Structured Finance Post Credit Crunch: A Best Practice Deal Lifecycle GuideFrom EverandSecuritization and Structured Finance Post Credit Crunch: A Best Practice Deal Lifecycle GuideNo ratings yet

- Asset-backed Securitization and the Financial Crisis: The Product and Market Functions of Asset-backed Securitization: Retrospect and ProspectFrom EverandAsset-backed Securitization and the Financial Crisis: The Product and Market Functions of Asset-backed Securitization: Retrospect and ProspectNo ratings yet

- Naked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsFrom EverandNaked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsNo ratings yet

- Lecture 2 Financial System and InstrumentsDocument44 pagesLecture 2 Financial System and InstrumentsLuisLoNo ratings yet

- Financial Services Securitization Course OutlineDocument11 pagesFinancial Services Securitization Course Outlineyash nathaniNo ratings yet

- Securitization of DebtDocument52 pagesSecuritization of Debtnjsnghl100% (1)

- Debenture and BondDocument7 pagesDebenture and BondPiesie AmponsahNo ratings yet

- Securitization of BanksDocument31 pagesSecuritization of BanksKumar Deepak100% (1)

- SecuritizationDocument34 pagesSecuritizationshubh duggalNo ratings yet

- Debt instruments explainedDocument5 pagesDebt instruments explainedDhaval JoshiNo ratings yet

- Securitization Explained: Pooling Assets to Raise CapitalDocument4 pagesSecuritization Explained: Pooling Assets to Raise CapitalDiego LopezNo ratings yet

- Mortgage Backed SecuritiesDocument40 pagesMortgage Backed Securitiesyohanmatale100% (2)

- FR Coll GuidelinesDocument23 pagesFR Coll GuidelinesJustaNo ratings yet

- Securitization: An Overview of Concepts, Process, Instruments and RegulationsDocument17 pagesSecuritization: An Overview of Concepts, Process, Instruments and Regulationskhus1985No ratings yet

- Chpater 5 - Banking SystemDocument10 pagesChpater 5 - Banking System21augustNo ratings yet

- Securitization SubprimeCrisisDocument5 pagesSecuritization SubprimeCrisisNiraj MohanNo ratings yet

- Off Balance Sheet Bank InstrumentsDocument10 pagesOff Balance Sheet Bank Instrumentsphard2345No ratings yet

- 4-Securitization of DebtDocument26 pages4-Securitization of DebtjyotiangelNo ratings yet

- Credit Derivatives and Structured Credit: A Guide for InvestorsFrom EverandCredit Derivatives and Structured Credit: A Guide for InvestorsNo ratings yet

- Introduction To Collateralized Debt Obligations: Tavakoli Structured Finance, IncDocument6 pagesIntroduction To Collateralized Debt Obligations: Tavakoli Structured Finance, IncShanza ChNo ratings yet

- Securities Lending Times Issue 239Document44 pagesSecurities Lending Times Issue 239Securities Lending TimesNo ratings yet

- Negotiable InstrumentsDocument5 pagesNegotiable InstrumentsArshad Munir100% (1)

- Check List of Foreign Exchange Transaction in BankDocument20 pagesCheck List of Foreign Exchange Transaction in BankMohammad RokunuzzamanNo ratings yet

- SecuritizationDocument5 pagesSecuritizationAnand MishraNo ratings yet

- Types of BondsDocument76 pagesTypes of BondsRahul ShelarNo ratings yet

- Everything You Need to Know About Bond Issuance ProcessDocument22 pagesEverything You Need to Know About Bond Issuance ProcessPranoti PuroNo ratings yet

- Balance Sheet OptimizationDocument32 pagesBalance Sheet OptimizationImranullah KhanNo ratings yet

- BankDocument153 pagesBankdumchi100% (1)

- Insider Investment GuideDocument273 pagesInsider Investment GuideFhélixAbel LoyaNo ratings yet

- Credit Card Securitization RisksDocument18 pagesCredit Card Securitization RisksRahmi Elsa DianaNo ratings yet

- Pipeline Hedging: The New Imperative For The Independent Mortgage Banker.Document8 pagesPipeline Hedging: The New Imperative For The Independent Mortgage Banker.Andrew ArmstrongNo ratings yet

- Treasury Operations In Turkey and Contemporary Sovereign Treasury ManagementFrom EverandTreasury Operations In Turkey and Contemporary Sovereign Treasury ManagementNo ratings yet

- Introduction To Forensic and Investigative AccountingDocument30 pagesIntroduction To Forensic and Investigative AccountingdissidentmeNo ratings yet

- Curacao FoundationsDocument32 pagesCuracao Foundationsreuvek6957No ratings yet

- A BondDocument3 pagesA Bondnusra_t100% (1)

- Introduction To Investment BankingDocument45 pagesIntroduction To Investment BankingNgọc Phan Thị BíchNo ratings yet

- The Executive Guide to Boosting Cash Flow and Shareholder Value: The Profit Pool ApproachFrom EverandThe Executive Guide to Boosting Cash Flow and Shareholder Value: The Profit Pool ApproachNo ratings yet

- Finance - Treasury BillDocument38 pagesFinance - Treasury BillJayesh BhagatNo ratings yet

- The Use and Abuse of Special-Purpose Entities in Public FinanceSteven L. SchwarczDocument38 pagesThe Use and Abuse of Special-Purpose Entities in Public FinanceSteven L. SchwarczLisa Stinocher OHanlonNo ratings yet

- Comments on the SEC's Proposed Rules for Regulation CrowdfundingFrom EverandComments on the SEC's Proposed Rules for Regulation CrowdfundingNo ratings yet

- SBA 7(a) Loan Agent Fee Disclosure FormDocument3 pagesSBA 7(a) Loan Agent Fee Disclosure FormBrianNo ratings yet

- ANHD 2016 Economic Opportunity PosterDocument1 pageANHD 2016 Economic Opportunity PosterNorman OderNo ratings yet

- Okp 080114Document4 pagesOkp 080114Harpott GhantaNo ratings yet

- Asset Based Lending in Singapore Jun 2011Document14 pagesAsset Based Lending in Singapore Jun 2011Harpott GhantaNo ratings yet

- Aspen Publishers - Drafting Contracts - How and Why Lawyers Do What They Do 2E - Tina LDocument9 pagesAspen Publishers - Drafting Contracts - How and Why Lawyers Do What They Do 2E - Tina LHarpott Ghanta20% (5)

- Voidable Transactions in The Context of InsolvencyDocument7 pagesVoidable Transactions in The Context of InsolvencyHarpott GhantaNo ratings yet

- Hds Standards and PracticesDocument29 pagesHds Standards and PracticesHarpott GhantaNo ratings yet

- Re Wan Soon Construction Judicial Managers Entitlement to Sale ProceedsDocument6 pagesRe Wan Soon Construction Judicial Managers Entitlement to Sale ProceedsHarpott GhantaNo ratings yet

- Happy Nails Fa 1Document14 pagesHappy Nails Fa 1Harpott GhantaNo ratings yet

- HSBC Institutional Trust (Trustee of Starhill Global REIT) V Toshin Deve...Document34 pagesHSBC Institutional Trust (Trustee of Starhill Global REIT) V Toshin Deve...Harpott GhantaNo ratings yet

- FileStore - Pdfstore - LectureSpeech - NUSS Professorship Lecture - FromThirdWorldToFirstDocument26 pagesFileStore - Pdfstore - LectureSpeech - NUSS Professorship Lecture - FromThirdWorldToFirstHarpott GhantaNo ratings yet

- Bankruptcy RulesDocument154 pagesBankruptcy RulesHarpott GhantaNo ratings yet

- Companies (Application of Bankruptcy Act) RegulationsDocument3 pagesCompanies (Application of Bankruptcy Act) RegulationsHarpott GhantaNo ratings yet

- G2 - List of Videos On AdvocacyDocument1 pageG2 - List of Videos On AdvocacyHarpott GhantaNo ratings yet

- SAcL IP Law SummaryDocument15 pagesSAcL IP Law SummaryHarpott GhantaNo ratings yet

- Rules of CourtDocument574 pagesRules of CourtHarpott GhantaNo ratings yet

- G2 - List of Videos On AdvocacyDocument1 pageG2 - List of Videos On AdvocacyHarpott GhantaNo ratings yet

- Ny All LocationsDocument1 pageNy All LocationsHarpott GhantaNo ratings yet

- StateBarRequest - Feb 2015 & July 2015Document1 pageStateBarRequest - Feb 2015 & July 2015Harpott GhantaNo ratings yet

- Requirements to Practice Law in California for Foreign Educated Students (39 charactersDocument4 pagesRequirements to Practice Law in California for Foreign Educated Students (39 charactersCarlo Vincent BalicasNo ratings yet

- The Ultimate Bar Exam Preparation Resource GuideDocument18 pagesThe Ultimate Bar Exam Preparation Resource GuidejohnkyleNo ratings yet

- (TTC) Geis - Business Statistics IIDocument23 pages(TTC) Geis - Business Statistics IIminh_neuNo ratings yet

- WTO Regulation of Subsidies To State-Owned Enterprises (SOEs) SSRN-id939435Document47 pagesWTO Regulation of Subsidies To State-Owned Enterprises (SOEs) SSRN-id939435Harpott GhantaNo ratings yet

- Ny All LocationsDocument1 pageNy All LocationsHarpott GhantaNo ratings yet

- NYS Bar Exam Online Application InstructionsDocument4 pagesNYS Bar Exam Online Application InstructionsHarpott GhantaNo ratings yet

- Andenas On European Company LawDocument74 pagesAndenas On European Company LawHarpott GhantaNo ratings yet

- Bar Exams ScheduleDocument3 pagesBar Exams ScheduleHarpott GhantaNo ratings yet

- Handwritingsample4 6 09Document1 pageHandwritingsample4 6 09Harpott GhantaNo ratings yet

- Act of Congress Establishing The Treasury DepartmentDocument1 pageAct of Congress Establishing The Treasury DepartmentHarpott GhantaNo ratings yet

- Central Bank CollateralDocument14 pagesCentral Bank CollateralHarpott GhantaNo ratings yet

- Republic Act No. 11360: Official GazetteDocument1 pageRepublic Act No. 11360: Official GazetteKirk BejasaNo ratings yet

- Documents To Be Checked Before Buying HomeDocument3 pagesDocuments To Be Checked Before Buying HomeTanu RathiNo ratings yet

- Manajemen Fungsional Pertemuan 1Document64 pagesManajemen Fungsional Pertemuan 1ingridNo ratings yet

- Ultimate Book of Accountancy: Brilliant ProblemsDocument9 pagesUltimate Book of Accountancy: Brilliant ProblemsPramod VasudevNo ratings yet

- Introduction to Accounting EquationDocument1 pageIntroduction to Accounting Equationcons theNo ratings yet

- Business Environment AnalysisDocument9 pagesBusiness Environment AnalysisHtoo Wai Lin AungNo ratings yet

- How Monetary Policy Impacts Inflation in KenyaDocument46 pagesHow Monetary Policy Impacts Inflation in KenyaNjoguNo ratings yet

- BOI - New LetterDocument5 pagesBOI - New Lettersandip_banerjeeNo ratings yet

- Estado Bancario ChaseDocument2 pagesEstado Bancario ChasePedro Ant. Núñez Ulloa100% (1)

- Investment and Portfolio AnalysisDocument6 pagesInvestment and Portfolio AnalysisMuhammad HaiderNo ratings yet

- Overview of Business Processes: © 2009 Pearson Education, Inc. Publishing As Prentice HallDocument20 pagesOverview of Business Processes: © 2009 Pearson Education, Inc. Publishing As Prentice HallCharles MK ChanNo ratings yet

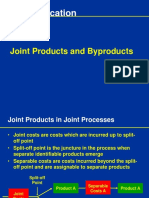

- Costing By-Product and Joint ProductsDocument36 pagesCosting By-Product and Joint ProductseltantiNo ratings yet

- Alliancing Best Practice PDFDocument48 pagesAlliancing Best Practice PDFgimasaviNo ratings yet

- Bài Tập Và Đáp Án Chương 1Document9 pagesBài Tập Và Đáp Án Chương 1nguyenductaiNo ratings yet

- Joint Cost Allocation Methods for Multiple ProductsDocument17 pagesJoint Cost Allocation Methods for Multiple ProductsATLASNo ratings yet

- Process Analysis: SL No Process Proces S Owner Input Output Methods Interfaces With Measure of Performance (MOP)Document12 pagesProcess Analysis: SL No Process Proces S Owner Input Output Methods Interfaces With Measure of Performance (MOP)DhinakaranNo ratings yet

- of OlayDocument14 pagesof OlaySneha KhapardeNo ratings yet

- Marketing AssignmentDocument16 pagesMarketing AssignmentkcperNo ratings yet

- A38 - Rani - Digital Labour Platforms and Their Contribution To Development OutcomesDocument4 pagesA38 - Rani - Digital Labour Platforms and Their Contribution To Development OutcomesPhilip AchokiNo ratings yet

- Rajiv Awas Yojana GuidelinesDocument24 pagesRajiv Awas Yojana GuidelinesSherine David SANo ratings yet

- 9 Public FacilitiesDocument2 pages9 Public FacilitiesSAI SRI VLOGSNo ratings yet

- Ayala Corporation Statement of Financial Position 2019 2018 in Millions Audited Audited AsssetsDocument11 pagesAyala Corporation Statement of Financial Position 2019 2018 in Millions Audited Audited AsssetsAlgen SabaytonNo ratings yet

- 5 Essential Business Strategy ToolsDocument30 pages5 Essential Business Strategy ToolsrlwersalNo ratings yet

- Industrial Finance Corporation of India (Ifci)Document2 pagesIndustrial Finance Corporation of India (Ifci)sumit athwaniNo ratings yet

- Kalamba Games - 51% Majority Stake Investment Opportunity - July23Document17 pagesKalamba Games - 51% Majority Stake Investment Opportunity - July23Calvin LimNo ratings yet

- Canons of TaxationDocument2 pagesCanons of Taxationmadeeha_2475% (4)

- New England Compounding Center (NECC) Case Study.Document7 pagesNew England Compounding Center (NECC) Case Study.onesmusnzomo20No ratings yet

- Business Models For Geographic Information: January 2018Document23 pagesBusiness Models For Geographic Information: January 2018Bala RaoNo ratings yet

- TSPIC v. Employees Union rules on salary increase creditingDocument8 pagesTSPIC v. Employees Union rules on salary increase creditingJohn Lloyd MacuñatNo ratings yet

- Institutional Framework For Small Business DevelopmentDocument59 pagesInstitutional Framework For Small Business DevelopmentNishantpiyooshNo ratings yet