Professional Documents

Culture Documents

Q3 - Acctba1 2012-13 2T

Uploaded by

Darwyn Mendoza0 ratings0% found this document useful (0 votes)

137 views10 pagesAccounting

Original Title

Q3 - ACCTBA1 2012-13 2T

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAccounting

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

137 views10 pagesQ3 - Acctba1 2012-13 2T

Uploaded by

Darwyn MendozaAccounting

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 10

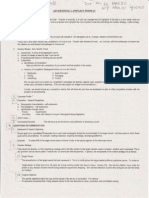

De La Salle University, Inc.

Ramon V. del Rosario - College of Business

ACCTBA1 - Fundametals of Accounting

2nd Term, AY 2012-2013 Dominguez,CPA

Answer Sheet SCORE

Name: Test I and II

ID No.: Test III

Section: TOTAL

Test I Multiple Choice Theories (10 points) - use scannable sheet

Test II True or False (10 points) - use scannable sheet

Test III Problem Solving and Journalizing (30 points) - use worksheet.

De La Salle University, Inc.

Ramon V. del Rosario - College of Business

ACCTBA1 - Fundametals of Accounting

Q3 - Adjustments Dominguez, CPA

INSTRUCTIONS TO THE EXAMINEE:

1 Only three (3) worksheets, calculator, ballpen and ruler are allowed at your desks. All others should be

placed at the side/platform of the room.

2 The examination is good for one and a half hours (1.5 hours).

3 Check the completeness and clarity of the questionnaire.

4 Read and follow instructions carefully. Ask questions only to the teacher.

5 You may write on any portion of the questionnaire.

6 CHEATING is a MAJOR offense, as provided for in Section 13.3.1.1 of the Student Handbook. In addition

to the major offense, anybody caught cheating will automatically receive a FINAL GRADE of 0.0.

I. Multiple Choice Theories: One (1) point each.

1 An accounting method in which revenue is recorded when it is earned and expenses are recorded when

they are incurred.

a. Unearned revenue c. Cash basis of accounting

b. Prepaid expenses d. Accrual basis of accounting

2 Adjusting entries normally involve

a. real accounts only

b. nominal accounts only

c. real and nominal accounts

d. neither real nor nominal accounts

3 The balance in an accrued revenue account represents an amount

Earned Collected

a. Yes Yes

b. Yes No

c. No Yes

d. No No

4 The purpose of adjusting entries is to

a. Prepare revenue and expense accounts for recording the transactions of the next period.

b. Apply the realization principle and the matching principle to transactions affecting two or

more accounting periods.

c. Adjust daily the balances in asset, liability, revenue and expense accounts for the effects

of business transactions.

d. Adjust the capital account for the revenue, expense and withdrawal transactions which

occurred during the year.

5 A prepaid expense can be best described as an amount

a. Paid and currently matched with earnings

b. Paid and not currently matched with earnings

c. Not paid and currently matched with earnings

d. Not paid and not currently matched with earnings

6 An unearned income can be best described as an amount

a. Collected and currently matched with expenses

b. Collected and not currently matched with expenses

c. Not collected and currently matched with expenses

d. Not collected and not currently matched with expenses

7 The accrual basis of accounting is based primarily on

a. Conservatism & revenue realization c. Consistency and matching

b. Conservatism and matching d. Revenue realization and matching

8 Which of the following is an asset account?

a. Accumulated depreciation c. Accrued taxes

b. Accrued interest income d. Allowance for doubful accounts

9 Which of the following is a liability account?

a. Allowance for doubful accounts c. Accrued wages

b. Prepaid rent expense d. Unused office supplies

10 In writing off worthless receivables, the account to be debited should be

a. Doubtful accounts expense c. Depreciation expense

b. Allowance for doubtful accounts d. Accumulated depreciation

II. True or False: One (1) point each. Shade A for true and B for false.

11 One company might depreciate a new computer over three (3) years while another company

might depreciate the samenew computer over five (5) years and both companies would not be

violating any generally accepted accounting principle.

12 A fully depreciated asset has an accumulated depreciation that always equals its depreciable cost.

13 Under the allowance method, writing off an uncollectible account affects both the Statement

of Financial Position and the Income Statement.

14 Recovery of an accounts receivable previously written off increases Bad Debts Expense

15 Failure to adjust a prepayment recorded under the asset method causes total assets and

total expenses to be overstated.

16 A one-year rent collected in advance on January 1, 2012 and recorded under the nominal

account method needs an adjusting entry at December 31, 2012.

17 Accrued interest income is a liability account

18 Accrued Rent Expense and Accrued Taxes Expense are liability accounts.

a. I and II are true c. Only II is true

b. Only I is true d. I and II are false

19 Accrued utilities expense is an income statement item

20 Accrued interest income is an income statement item

III. Problem Solving and preparation of adjusting journal entries. Two (2) points each.

21 Prior to adjustments, Supplies Expense account has a balance of P13,500. Adjustment data gathered

shows that supplies inventory on hand at year end amounted to 4,500. The amount of supplies to be shown

in the income statement should be P____________.

22 Provide the adjusting journal entry required for the transaction.

Eleanor Ong Co. pays all salaried employees on a biweekly basis. Ong Co accrues salaries expense

only at its December 31 year end. Data relating to salaries earned in December 2010 are as follows:

a. Last payroll was paid on 12/26/2010, for the 2-week period ended 12/26/2010.

b. Remaining work days in 2010 were December 29, 30 and 31, on which days there was

no overtime and holidays.

c. The recurring biweekly salaries total to P90,000

23 Assuming a five-day work week, Ong should record a liability at December 31, 2010 for accrued

salaries of P_________________.

24 Provide the adjusting journal entry to record the accrual of the Salaries Expense.

25 On July 1, 2011, Happee Sy Trading acquired an office equipment worth P620,000. The management

estimates the economic life and useful life is 5 years. Salvage value at the end of its useful life is P20,000.

The depreciation expense to be presented in Happee's 2012 Income Statement should be P_____________.

26 Provide the adjusting journal entry required for December 31, 2011.

27 The carrying value/book value of the office equipment on December 31, 2013 should be P__________.

As of December 31, 2011, Tricha Masigan Merchandising has several depreciable assets:

Date Purchased Cost Salvage Value

Equipment 2/28/2010 P 30,000 P 6,000

Furniture 12/1/2010 15,000 3,000

Machinery 11/1/2008 700,000 100,000

Building 1/31/2000 5,000,000 2,000,000

Land 1/1/2011 7,000,000 -

Bought a computer on April 30, 2009 for P30,000 with a salvage value of P6,000. Bought another

computer on July 31, 2010 for P20,000 with a salvage value of P2,000. Both computers have a useful life of 10 years.

As of December 31, 2011, compute for/prepare:

28 Depreciation Expense for Land

Prudent Company applies the conservatism principle in accounting for its accounts receivable. It estimates

that its bad debts is at 5% of outstanding accounts receivable. The valuation account has a debit balance

of P4,500 on June 30, 2011 before adjustment. During the natural business year, Prudent wrote off P10,300

of uncollectible receivables and recovered P6,750 from accounts previously written off. Accounts receivable

balance at June 30, 2011 is P987,600.

29 Provide the adjusting journal entry needed to recognize bad debts for the current year.

30 The net realizable value of Prudent's accounts receivable should be P________________.

The following data are taken from the records of Jappi Calumpag Enterprises:

Payments for rent during the year P 160,000

Accrued rent expense at the end of the year 15,000

Prepaid rent expense at the end of the year 25,000

31 The amount of rent expense that should be reported is P____________.

The following data are taken from the records of Carl Chiang Enterprises:

Collections from customers to apply on account P 144,855

Accrued income at the end of the year 45,600

Unearned income at the end of the year 35,800

32 The amount of revenue that should be reported is P____________.

The following data are taken from the records of Clarence Chua Enterprises:

Accounts Receivable, beginning balance P 82,650

Collections from customers to apply on account 345,950

Accounts Receivable, ending balance 78,550

33 The amount of revenue that should be reported is P____________.

WennaLyn Lopez Co. uses the aging analysis in determining its doubtful accounts. Accounts

receivable shows a balance of P 406,940 as of December 31, 2011, before adjustment. Analysis

of the accounts revealed the following:

Accounts Receivable Age of Accounts % of Collectibility

P 109,200 Not yet due 99%

151,800 1-30 days due 97%

31,500 31-60 days due 94%

63,640 61-90 days due 92%

33,800 91-120 days due 90%

17,000 Over 120 days due 75%

406,940

34 Assuming the Allowance for Doubtful Accounts has a debit balance of P2,240, before adjustment.

The Doubtful Accounts Expense to be reported by Lopez Co. should be P____________.

35 Assuming the Allowance for Doubtful Accounts has a credit balance of P9,560, before adjustment.

The Doubtful Accounts Expense to be reported by Lopez Co. should be P____________.

"If you are a good person and you work hard, good things will come to you..."

Dominguez, CPA

Only three (3) worksheets, calculator, ballpen and ruler are allowed at your desks. All others should be

CHEATING is a MAJOR offense, as provided for in Section 13.3.1.1 of the Student Handbook. In addition

An accounting method in which revenue is recorded when it is earned and expenses are recorded when

Prepare revenue and expense accounts for recording the transactions of the next period.

Apply the realization principle and the matching principle to transactions affecting two or

Adjust daily the balances in asset, liability, revenue and expense accounts for the effects

Adjust the capital account for the revenue, expense and withdrawal transactions which

Revenue realization and matching

Prior to adjustments, Supplies Expense account has a balance of P13,500. Adjustment data gathered

shows that supplies inventory on hand at year end amounted to 4,500. The amount of supplies to be shown

Eleanor Ong Co. pays all salaried employees on a biweekly basis. Ong Co accrues salaries expense

b. Remaining work days in 2010 were December 29, 30 and 31, on which days there was

On July 1, 2011, Happee Sy Trading acquired an office equipment worth P620,000. The management

estimates the economic life and useful life is 5 years. Salvage value at the end of its useful life is P20,000.

The depreciation expense to be presented in Happee's 2012 Income Statement should be P_____________.

The carrying value/book value of the office equipment on December 31, 2013 should be P__________.

Useful Life

(years)

6

12

12

30

-

computer on July 31, 2010 for P20,000 with a salvage value of P2,000. Both computers have a useful life of 10 years.

Prudent Company applies the conservatism principle in accounting for its accounts receivable. It estimates

that its bad debts is at 5% of outstanding accounts receivable. The valuation account has a debit balance

of P4,500 on June 30, 2011 before adjustment. During the natural business year, Prudent wrote off P10,300

of uncollectible receivables and recovered P6,750 from accounts previously written off. Accounts receivable

% of Collectibility

Joe Rogan

De La Salle University, Inc.

Ramon V. del Rosario - College of Business

ACCTBA1 - Fundametals of Accounting

Q3 - Adjustments Dominguez, CPA

Answer Key

I. Multiple Choice Theories: One (1) point each. II. True or False: One (1) point each.

1 D 11 A

2 C 12 A

3 B 13 B

4 B 14 B

5 B 15 B

6 B 16 B

7 D 17 B

8 B 18 A

9 C 19 B

10 B 20 B

III. Problem Solving and Journalizing: Two (2) points each.

21 2 points

22 Supplies 4,500 2 points

Supplies Expense 4,500

23 2 points

23 Salaries and Wages Expense 27,000 2 points

Accrued Salaries & Wages Expense/Salaries Payable 27,000

P90,000 x 3 days / 10 days

25 2 points

2012 Depreciation Expense:

P620,000 - 20,000/ 5 years 120,000

26 Depreciation Expense - Office Equipment 60,000 2 points

Accumulated Depreciation - Office Equipment 60,000

2011 Depreciation Expense:

P620,000 - 20,000/ 5 years x 6/12

27 P 320,000 2 points

Cost 620,000

Less: 2013 Accumulated Depreciation

(P600,000 x 2.5 years) 300,000

320,000

28 P 0 zero 2 points

Value of land does not depreciate

Allowance for Doubtful Accounts

29 Bad Debts Expense 57,430 2 points 4,500

Allowance for Bad Debts 57,430 10,300 6,750

57,430

30 2 points 49,380

=P 987,600 - 49,380

9,000

27,000

P 120,000

938,220.00

31

32

33

34 2

Ending bal., allowance for doubtful accounts 20,257

(P100,000 x 3%)

Accounts Receivable Age of Accounts % UncollectibleUncollectible

P 109,200 Not yet due 1% 1,092.00

151,800 1-30 days due 3% 4,554.00

31,500 31-60 days due 6% 1,890.00

63,640 61-90 days due 8% 5,091.20

33,800 91-120 days due 10% 3,380.00

17,000 Over 120 days due 25% 4,250.00

406,940 P 20,257.20

Allowance for Doubtful Accounts

Write-offs -

Beginning balance 2,240 - Recoveries

22,497.20 Doubful Accounts Expense

20,257.20 Ending balance

35 2

Allowance for Doubtful Accounts

Write-offs - 9,560 Beginning balance

- Recoveries

10,697.20 Doubful Accounts Expense

20,257.20 Ending balance

341,850

P 22,497.20

P 10,697.20

150,000

154,655

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Name - Course & Yr. - Schedule - Score - Test I. Multiple Choice. Encircle The Letter of The Best Answer in Each of The Given Question/sDocument11 pagesName - Course & Yr. - Schedule - Score - Test I. Multiple Choice. Encircle The Letter of The Best Answer in Each of The Given Question/sAtty CpaNo ratings yet

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthFrom EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthNo ratings yet

- Adjusting Entries ExerciseDocument2 pagesAdjusting Entries ExerciseMarc Eric RedondoNo ratings yet

- ProblemC ch05Document5 pagesProblemC ch05Adan FakihNo ratings yet

- Fundamentals of Accounting 1 and 2Document4 pagesFundamentals of Accounting 1 and 2Mia100% (1)

- 3tay1112 Jpia Finals E-Review - Actbas1Document3 pages3tay1112 Jpia Finals E-Review - Actbas1CGNo ratings yet

- AssignmentDocument8 pagesAssignmentNegil Patrick DolorNo ratings yet

- 1 The Basics of Adjusting EntriesDocument9 pages1 The Basics of Adjusting Entriescyrize mae fajardoNo ratings yet

- Adjusting EntriesDocument27 pagesAdjusting EntriesquintosjeryNo ratings yet

- ACCT - Quiz 5Document4 pagesACCT - Quiz 5Florencio FanoNo ratings yet

- Module 9 - The WorksheetDocument13 pagesModule 9 - The WorksheetNina AlexineNo ratings yet

- Afw 1000 Final Q s1 2014Document17 pagesAfw 1000 Final Q s1 2014Mohammad RashmanNo ratings yet

- Accounting Cycle StepsDocument18 pagesAccounting Cycle Stepsyna kyleneNo ratings yet

- Share 'Quiz Acco Chapters 1-5Document11 pagesShare 'Quiz Acco Chapters 1-5ella sakdalanNo ratings yet

- Part 2 Basic Accounting Journalizing LectureDocument11 pagesPart 2 Basic Accounting Journalizing LectureKong Aodian100% (2)

- Diagnostic Exam 1.23 AKDocument13 pagesDiagnostic Exam 1.23 AKmarygraceomacNo ratings yet

- Finals Quiz 2 HBA111 PDFDocument7 pagesFinals Quiz 2 HBA111 PDFMarife GloriaNo ratings yet

- BASIC ACCO Simulated MidtermDocument10 pagesBASIC ACCO Simulated MidtermistepNo ratings yet

- NUS Mock Mid-Term Test ReviewDocument9 pagesNUS Mock Mid-Term Test Reviewkik leeNo ratings yet

- FINANCIAL ACCOUNTING AND REPORTING QUIZBOWLDocument67 pagesFINANCIAL ACCOUNTING AND REPORTING QUIZBOWLKae Abegail Garcia0% (1)

- Basic AccountingDocument9 pagesBasic AccountingAllysa Almazan BoholstNo ratings yet

- Sir Dave's Classroom First Quiz Bee QuestionsDocument6 pagesSir Dave's Classroom First Quiz Bee QuestionsCharlene ViceralNo ratings yet

- Posting, Adjusting Entries, Process of Doing A 10-Columnar Worksheets, Closing Entries For Service Type of BusinessDocument18 pagesPosting, Adjusting Entries, Process of Doing A 10-Columnar Worksheets, Closing Entries For Service Type of BusinessRalphjoseph Tuazon100% (1)

- HW SMEsDocument3 pagesHW SMEsJennifer RasonabeNo ratings yet

- EOS Use of T AccountsDocument4 pagesEOS Use of T AccountsNoralyn DimnatangNo ratings yet

- Partnership Midterm Set BDocument10 pagesPartnership Midterm Set BLene100% (1)

- Tutorial 2 CompAccCycle221012 1Document5 pagesTutorial 2 CompAccCycle221012 1revaty18No ratings yet

- True or False Accounting Concepts ExplainedDocument7 pagesTrue or False Accounting Concepts ExplainedJan Allyson BiagNo ratings yet

- Lecture Notes Chapters 1-4Document28 pagesLecture Notes Chapters 1-4BlueFireOblivionNo ratings yet

- AJE QuizDocument4 pagesAJE QuizJohn cookNo ratings yet

- Lecture Notes Chapters 1-4Document32 pagesLecture Notes Chapters 1-4BlueFireOblivionNo ratings yet

- 6 Miscellaneous TransactionsDocument4 pages6 Miscellaneous TransactionsRichel ArmayanNo ratings yet

- Far TheoriesDocument6 pagesFar TheoriesallijahNo ratings yet

- Chapter 11 Adjusting EntriesDocument91 pagesChapter 11 Adjusting EntriesMelessa Pescador100% (1)

- Fabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionDocument16 pagesFabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionJosephine C QuibidoNo ratings yet

- Adjusting Entries Explained for Accruals and PrepaymentsDocument3 pagesAdjusting Entries Explained for Accruals and PrepaymentsJamie ToriagaNo ratings yet

- Basic Accounting - Midterm 2010Document6 pagesBasic Accounting - Midterm 2010Trixia Floie GalimbaNo ratings yet

- Accounting Assignment PDFDocument18 pagesAccounting Assignment PDFMohammed SafwatNo ratings yet

- 41Document20 pages41Rinku PatelNo ratings yet

- Accounting Principles I - Online: Chapters 3 & 4 - Exam - Part IIDocument7 pagesAccounting Principles I - Online: Chapters 3 & 4 - Exam - Part IILouie CraneNo ratings yet

- Test Content ReviewDocument40 pagesTest Content ReviewFat AjummaNo ratings yet

- Fa4e SM Ch03Document82 pagesFa4e SM Ch03michaelkwok1No ratings yet

- Ve4psutoy Activity Chapter 8 Adjusting EntriesDocument3 pagesVe4psutoy Activity Chapter 8 Adjusting EntriesLyra Mae De BotonNo ratings yet

- Ve4psutoy Activity Chapter 8 Adjusting EntriesDocument3 pagesVe4psutoy Activity Chapter 8 Adjusting EntriesLyra Mae De Boton100% (1)

- Accounting For ManagersDocument14 pagesAccounting For ManagersKabo Lucas67% (3)

- Exercises Short ProblemsDocument6 pagesExercises Short ProblemsKlaire SwswswsNo ratings yet

- ACT 501 - AssignmentDocument6 pagesACT 501 - AssignmentShariful Islam ShaheenNo ratings yet

- M8-Correcting-Closing-Reversing-Entries-and-Financial-StatementsDocument10 pagesM8-Correcting-Closing-Reversing-Entries-and-Financial-StatementsMicha AlcainNo ratings yet

- FAR-Questionnaire 1Document71 pagesFAR-Questionnaire 1Jilian Kate Alpapara Bustamante40% (5)

- Dagupan Accounting Review QuizDocument7 pagesDagupan Accounting Review QuizRezzan Joy Camara MejiaNo ratings yet

- Dmp3e Ch03 Solutions 02.17.10 FinalDocument83 pagesDmp3e Ch03 Solutions 02.17.10 Finalmichaelkwok1No ratings yet

- Accounts Receivable QuizzerDocument4 pagesAccounts Receivable Quizzerknorrpampapakang67% (3)

- Prelim Questions - Exam Set A Sy2020 21Document12 pagesPrelim Questions - Exam Set A Sy2020 21Sherrymae ValenzuelaNo ratings yet

- Fundamentals of Accountancy Adjusting EntriesDocument24 pagesFundamentals of Accountancy Adjusting Entriesrandy magbudhi100% (4)

- Financial Accounting-Mgt-322: Adeel Sohail, E-Mail: Adeel@Biit - Edu.Pk (Whatsapp No) 0331-5002033Document10 pagesFinancial Accounting-Mgt-322: Adeel Sohail, E-Mail: Adeel@Biit - Edu.Pk (Whatsapp No) 0331-5002033Tayyab NazirNo ratings yet

- 35-Principles of Accounting I WorksheetDocument6 pages35-Principles of Accounting I WorksheeteyoyoNo ratings yet

- Accounting Cycle of a Service BusinessDocument3 pagesAccounting Cycle of a Service BusinessANNANo ratings yet

- Business Junior CertDocument9 pagesBusiness Junior CertCathal O' GaraNo ratings yet

- Book Review - The Chinese Question.Document15 pagesBook Review - The Chinese Question.Darwyn MendozaNo ratings yet

- 1 - Science of Psychology Part 1Document25 pages1 - Science of Psychology Part 1Darwyn MendozaNo ratings yet

- ACCTBA3Document1 pageACCTBA3Darwyn MendozaNo ratings yet

- Create 1ADocument32 pagesCreate 1ADarwyn MendozaNo ratings yet

- 1 - Science of Psychology Part 2 and 3Document28 pages1 - Science of Psychology Part 2 and 3Darwyn MendozaNo ratings yet

- A Study of FactorsDocument142 pagesA Study of FactorsDarwyn MendozaNo ratings yet

- Guideline On TRED3 Photo Essay ContestDocument3 pagesGuideline On TRED3 Photo Essay ContestDarwyn MendozaNo ratings yet

- 2 - Development Across The Life Span Part 1 and 2Document34 pages2 - Development Across The Life Span Part 1 and 2Darwyn MendozaNo ratings yet

- 1 - Science of Psychology Part 1Document25 pages1 - Science of Psychology Part 1Darwyn MendozaNo ratings yet

- MARKPRU BK Observational Research (With Added Info)Document9 pagesMARKPRU BK Observational Research (With Added Info)Darwyn MendozaNo ratings yet

- International Trade Terms: Dr. Luz Suplico de La Salle University-Manila Atiftap Suplicol@dlsu - Edu.phDocument8 pagesInternational Trade Terms: Dr. Luz Suplico de La Salle University-Manila Atiftap Suplicol@dlsu - Edu.phDarwyn MendozaNo ratings yet

- Star City MARKSEVDocument53 pagesStar City MARKSEVDarwyn Mendoza100% (3)

- Bellwood AustronesianDocument8 pagesBellwood AustronesianDarwyn MendozaNo ratings yet

- Qualman k36 Midterms Team 4 Gregg's MinionsDocument9 pagesQualman k36 Midterms Team 4 Gregg's MinionsDarwyn MendozaNo ratings yet

- Principles of Marketing - Blue Ocean Strategy 07Document28 pagesPrinciples of Marketing - Blue Ocean Strategy 07Darwyn MendozaNo ratings yet

- MARKPRU K32 - Blue Ocean Strategy HandoutDocument12 pagesMARKPRU K32 - Blue Ocean Strategy HandoutDarwyn MendozaNo ratings yet

- Principles of Marketing - Blue Ocean Strategy 07Document28 pagesPrinciples of Marketing - Blue Ocean Strategy 07Darwyn MendozaNo ratings yet

- MARKPRU K32 - Blue Ocean Strategy HandoutDocument12 pagesMARKPRU K32 - Blue Ocean Strategy HandoutDarwyn MendozaNo ratings yet

- BK Compilation (Gerome + Lance + B.uy + Caitlin + Justine + Darwyn)Document2 pagesBK Compilation (Gerome + Lance + B.uy + Caitlin + Justine + Darwyn)Darwyn MendozaNo ratings yet

- Advertising CampaignDocument2 pagesAdvertising CampaignDarwyn MendozaNo ratings yet

- Chap 002Document15 pagesChap 002Darwyn MendozaNo ratings yet

- Nutritional Facts for BeveragesDocument16 pagesNutritional Facts for BeveragesDarwyn MendozaNo ratings yet

- HUMAART Oral Presentation - FoodDocument30 pagesHUMAART Oral Presentation - FoodDarwyn MendozaNo ratings yet

- Chap 001Document13 pagesChap 001Darwyn MendozaNo ratings yet

- Magazine layout choices highlighted with imagesDocument3 pagesMagazine layout choices highlighted with imagesDarwyn MendozaNo ratings yet

- Group Members History Christianity BeliefsDocument12 pagesGroup Members History Christianity BeliefsDarwyn MendozaNo ratings yet

- Chap 003Document15 pagesChap 003Darwyn MendozaNo ratings yet

- Q6 - Actpaco 2012-13 2TDocument12 pagesQ6 - Actpaco 2012-13 2TDarwyn MendozaNo ratings yet

- Q6 - Actpaco 2012-13 2TDocument12 pagesQ6 - Actpaco 2012-13 2TDarwyn MendozaNo ratings yet

- Mindtree Shareholders Report Q2 FY23Document6 pagesMindtree Shareholders Report Q2 FY23Punith DGNo ratings yet

- Theory Base of Accounting, As and IFRSDocument39 pagesTheory Base of Accounting, As and IFRSYash Goyal0% (1)

- Accounts: Debit CreditDocument15 pagesAccounts: Debit CreditKarylle LapigNo ratings yet

- Trial balance financial records year-end 1999Document9 pagesTrial balance financial records year-end 1999Bhuvaneshwari Palani0% (2)

- CASH FLOW STATEMENTS - Quiz 3Document2 pagesCASH FLOW STATEMENTS - Quiz 3JyNo ratings yet

- Notre Dame Mock Board Exam for Advanced Financial AccountingDocument17 pagesNotre Dame Mock Board Exam for Advanced Financial AccountingJerry Licayan0% (1)

- NBK Annual Report 2011Document43 pagesNBK Annual Report 2011Mohamad RizwanNo ratings yet

- Enterprise StructureDocument5 pagesEnterprise StructureSurajNo ratings yet

- Alphalist of Employees Q1-2021 FINALDocument84 pagesAlphalist of Employees Q1-2021 FINALvivian deocampoNo ratings yet

- Investor Presentation (Company Update)Document42 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- (April 1)Document1 page(April 1)Nakul NagpureNo ratings yet

- 7110 w11 Ms 21Document10 pages7110 w11 Ms 21mstudy123456No ratings yet

- Case Study For Fin AccountingDocument3 pagesCase Study For Fin AccountingyaarbaileeNo ratings yet

- Pasteurized Milk Butter CheeseDocument13 pagesPasteurized Milk Butter CheeseYem Ane100% (1)

- Fac3701 Exam PackDocument68 pagesFac3701 Exam Packmandisanomzamo72No ratings yet

- Chapter 3 The Accounting CycleDocument68 pagesChapter 3 The Accounting CycleChala EnkossaNo ratings yet

- Statement Profit Loss ConsolidatedDocument1 pageStatement Profit Loss Consolidatedshubham kumarNo ratings yet

- Final Acc-Numerical 1Document10 pagesFinal Acc-Numerical 1Rajshree BhardwajNo ratings yet

- HOCONV Event Sponsorship AgreementDocument4 pagesHOCONV Event Sponsorship Agreementurvish patelNo ratings yet

- Big Picture: Week 1-3: Unit Learning Outcomes (ULO) : at The End of The Unit, You AreDocument51 pagesBig Picture: Week 1-3: Unit Learning Outcomes (ULO) : at The End of The Unit, You Arekakao50% (2)

- On Tax AuditDocument148 pagesOn Tax AuditAnmol KumarNo ratings yet

- 3cash and AccrualDocument9 pages3cash and AccrualABDUL RAUF100% (2)

- Who Determines Gaap and What It ReallyDocument4 pagesWho Determines Gaap and What It ReallysajidsfaNo ratings yet

- A. THEORY. Letter Choices On The Date Column of Your WorksheetDocument7 pagesA. THEORY. Letter Choices On The Date Column of Your Worksheetjbsantos09No ratings yet

- Chapter 2 (Money Maangement Strategies)Document26 pagesChapter 2 (Money Maangement Strategies)Sarifah SaidsaripudinNo ratings yet

- Ch.8 Preparation of Accounts From Incomplete RecordsDocument22 pagesCh.8 Preparation of Accounts From Incomplete RecordsMalayaranjan PanigrahiNo ratings yet

- Chap 007 - Cash Flow AnalysisDocument36 pagesChap 007 - Cash Flow Analysishy_saingheng_760260989% (9)

- CORRUGATED BOX GUIDEDocument8 pagesCORRUGATED BOX GUIDEabhi050191No ratings yet

- IAS 23 - Borrowing CostDocument1 pageIAS 23 - Borrowing CostMarc Eric RedondoNo ratings yet

- Thanks For Downloading This Sample Business: Your Business Is Unique. Your Business Plan Should Be TooDocument43 pagesThanks For Downloading This Sample Business: Your Business Is Unique. Your Business Plan Should Be TooEva LopenaNo ratings yet