Professional Documents

Culture Documents

Chapter 27

Uploaded by

kazimkorogluOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 27

Uploaded by

kazimkorogluCopyright:

Available Formats

Solutions to Gripping IFRS : Graded

Questions

Government grants and assistance

Kolitz & Sowden-Service, 2009 Chapter 27: Page 1

Solution 27.1

a)

Debit Credit

1 January 20X6

Bank Given 150 000

Deferred grant income 150 000

Recognition of government grant

31 December 20X6

Staff costs Given 200 000

Bank 200 000

Wages paid during the year

31 December 20X6

Deferred grant income 200 000 x 20% 40 000

Grant income 40 000

Recognising grant income to the extent payments made

31 December 20X7

Staff costs Given 250 000

Bank 250 000

Wages paid during the year

31 December 20X7

Deferred grant income 250 000 x 20% 50 000

Grant income 50 000

Recognising grant income to the extent payments made

31 December 20X8

Staff costs Given 400 000

Bank 400 000

Wages paid during the year

31 December 20X8

Deferred grant income (400 000 x 20%) but limited to the balance in the

deferred income account: 150 000 40 000 50 000

60 000

Grant income 60 000

Recognising grant income to the extent payments made

P.S. Staff costs are an employee benefit. The account could therefore also be called employee benefit

expense: wages, if preferred.

Solutions to Gripping IFRS : Graded

Questions

Government grants and assistance

Kolitz & Sowden-Service, 2009 Chapter 27: Page 2

Solution 27.1 continued

b)

Debit Credit

1 January 20X6

Bank Given 150 000

Deferred grant income 150 000

Recognition of government grant

31 December 20X6

Staff costs Given 200 000

Bank 200 000

Wages paid during the year

31 December 20X6

Deferred grant income 200 000 x 20% 40 000

Staff costs 40 000

Recognising grant income to the extent payments made

31 December 20X7

Staff costs Given 250 000

Bank 250 000

Wages paid during the year

31 December 20X7

Deferred grant income 250 000 x 20% 50 000

Staff costs 50 000

Recognising grant income to the extent payments made

31 December 20X8

Staff costs Given 400 000

Bank 400 000

Wages paid during the year

31 December 20X8

Deferred grant income (400 000 x 20%) but limited to the balance in the

deferred income account: 150 000 40 000 50 000

60 000

Staff costs 60 000

Recognising grant income to the extent payments made

P.S. Staff costs are an employee benefit. The account could therefore also be called employee benefit

expense: wages, if preferred.

Solutions to Gripping IFRS : Graded

Questions

Government grants and assistance

Kolitz & Sowden-Service, 2009 Chapter 27: Page 3

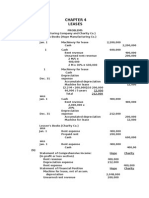

Solution 27.2

a)

Debit Credit

1 January 20X5

Bank Given 400 000

Deferred grant income 400 000

Recognition of government grant

Equipment: cost Given 1 500 000

Bank 1 500 000

Purchase of equipment

31 December 20X5

Depreciation (1 500 000 0) / 4 375 000

Equipment: accumulated depreciation 375 000

Depreciation charge for the year

Deferred grant income (400 000 / 4) 100 000

Grant income 100 000

Grant income recognised on the same basis as depreciation on the

equipment

31 December 20X6

Depreciation (1 500 000 0) / 4 375 000

Equipment: accumulated depreciation 375 000

Depreciation charge for the year

Deferred grant income (400 000 / 4) 100 000

Grant income 100 000

Grant income recognised on the same basis as depreciation on the

equipment

31 December 20X7

Depreciation (1 500 000 0) / 4 375 000

Equipment: accumulated depreciation 375 000

Depreciation charge for the year

Deferred grant income (400 000 / 4) 100 000

Grant income 100 000

Grant income recognised on the same basis as depreciation on the

equipment

31 December 20X8

Depreciation (1 500 000 0) / 4 375 000

Equipment: accumulated depreciation 375 000

Depreciation charge for the year

Deferred grant income (400 000 / 4) 100 000

Grant income 100 000

Grant income recognised on the same basis as depreciation on the

equipment

Solutions to Gripping IFRS : Graded

Questions

Government grants and assistance

Kolitz & Sowden-Service, 2009 Chapter 27: Page 4

Solution 27.2 continued

b)

Debit Credit

1 January 20X5

Bank Given 400 000

Deferred grant income 400 000

Recognition of government grant

Equipment: cost Given 1 500 000

Bank 1 500 000

Purchase of equipment

Deferred grant income 400 000

Equipment: cost 400 000

Recognizing grant as reduction of equipments cost

31 December 20X5

Depreciation (1 500 000 400 000 0 ) /4 275 000

Equipment: accumulated depreciation 275 000

Depreciation on equipment

31 December 20X6

Depreciation (1 500 000 400 000 0 ) /4 275 000

Equipment: accumulated depreciation 275 000

Depreciation on equipment

31 December 20X7

Depreciation (1 500 000 400 000 0 ) /4 275 000

Equipment: accumulated depreciation 275 000

Depreciation on equipment

31 December 20X8

Depreciation (1 500 000 400 000 0 ) /4 275 000

Equipment: accumulated depreciation 275 000

Depreciation on equipment

Solutions to Gripping IFRS : Graded

Questions

Government grants and assistance

Kolitz & Sowden-Service, 2009 Chapter 27: Page 5

Solution 27.3

a)

Debit Credit

1 January 20X5

Bank Given 500 000

Deferred grant income 500 000

Recognition of government grant

Deferred grant income Given 200 000

Grant income 200 000

Portion of the grant received for immediate financial support is

recognised as income immediately

Harvester: cost (asset) Given 900 000

Bank 900 000

Purchase of harvester

31 December 20X5

Depreciation (900 000 50 000) / 5 170 000

Harvester: accumulated depreciation 170 000

Depreciation for the year

Deferred grant income (500 000 - 200 000) / 5 60 000

Grant income 60 000

Grant income recognised on the same basis as depreciation

31 December 20X6

Depreciation (900 000 50 000) / 5 170 000

Harvester: accumulated depreciation 170 000

Depreciation for the year

Deferred grant income (500 000 - 200 000) / 5 60 000

Grant income 60 000

Grant income recognised on the same basis as depreciation

31 December 20X7

Depreciation (900 000 50 000) / 5 170 000

Harvester: accumulated depreciation 170 000

Depreciation for the year

Deferred grant income (500 000 - 200 000) / 5 60 000

Grant income 60 000

Grant income recognised on the same basis as depreciation

31 December 20X8

Depreciation (900 000 50 000) / 5 170 000

Harvester: accumulated depreciation 170 000

Depreciation for the year

Deferred grant income (500 000 - 200 000) / 5 60 000

Grant income 60 000

Grant income recognised on the same basis as depreciation

31 December 20X9

Depreciation (900 000 50 000) / 5 170 000

Harvester: accumulated depreciation 170 000

Depreciation for the year

Deferred grant income (500 000 - 200 000) / 5 60 000

Grant income 60 000

Grant income recognised on the same basis as depreciation

Solutions to Gripping IFRS : Graded

Questions

Government grants and assistance

Kolitz & Sowden-Service, 2009 Chapter 27: Page 6

Solution 27.3 continued

b)

Debit Credit

1 January 20X5

Bank Given 500 000

Deferred grant income 500 000

Recognition of government grant

Deferred grant income Given 200 000

Grant income 200 000

Portion of grant for immediate financial support is recognised as

income immediately

Harvester: cost (asset) Given 900 000

Bank 900 000

Purchase of harvester

Deferred grant income (500 000 200 000) 300 000

Harvester: cost (asset) 300 000

Grant set off against cost of harvester

31 December 20X5

Depreciation (900 000 300 000 50 000) / 5 110 000

Harvester: accumulated depreciation 110 000

Depreciation for the year

31 December 20X6

Depreciation (900 000 300 000 50 000) / 5 110 000

Harvester: accumulated depreciation 110 000

Depreciation for the year

31 December 20X7

Depreciation (900 000 300 000 50 000) / 5 110 000

Harvester: accumulated depreciation 110 000

Depreciation for the year

31 December 20X8

Depreciation (900 000 300 000 50 000) / 5 110 000

Harvester: accumulated depreciation 110 000

Depreciation for the year

31 December 20X9

Depreciation (900 000 300 000 50 000) / 5 110 000

Harvester: accumulated depreciation 110 000

Depreciation for the year

Solutions to Gripping IFRS : Graded

Questions

Government grants and assistance

Kolitz & Sowden-Service, 2009 Chapter 27: Page 7

Solution 27.4

a)

Debit Credit

1 January 20X6

Bank Given 250 000

Deferred grant income 250 000

Recognition of government grant

Machinery: cost (asset) Given 500 000

Bank 500 000

Purchase of machinery

31 December 20X6

Depreciation (500 000 0) /4 125 000

Machinery: accumulated depreciation 125 000

Depreciation for the year

Deferred grant income (250 000 / 4) 62 500

Grant income 62 500

Recognised on same basis as depreciation

31 December 20X7

Depreciation (500 000 0) /4 125 000

Machinery: accumulated depreciation 125 000

Depreciation for the year

Deferred grant income (250 000 / 4) 62 500

Grant income 62 500

Recognised on same basis as depreciation

1 December 20X8

Deferred grant income (250 000 62 500 62 500) 125 000

Grant forfeited expense Balancing 125 000

Bank Given 250 000

Grant forfeited, first reduce deferred grant income then expense rest

31 December 20X8

Depreciation (500 000 0) /4 125 000

Machinery: accumulated depreciation 125 000

Depreciation for the year

31 December 20X9

Depreciation (500 000 0) /4 125 000

Machinery: accumulated depreciation 125 000

Depreciation for the year

Solutions to Gripping IFRS : Graded

Questions

Government grants and assistance

Kolitz & Sowden-Service, 2009 Chapter 27: Page 8

Solution 27.4 continued

b)

Debit Credit

1 January 20X6

Bank Given 250 000

Deferred grant income 250 000

Recognition of government grant

Machinery: cost (asset) Given 500 000

Bank 500 000

Purchase of machinery

Deferred grant income Given 250 000

Machinery: cost (asset) 250 000

Recognising grant as a reduction of assets cost

31 December 20X6

Depreciation (500 000 250 000 0) /4 62 500

Machinery: accumulated depreciation 62 500

Depreciation for the year

31 December 20X7

Depreciation (500 000 250 000 0) /4 62 500

Machinery: accumulated depreciation 62 500

Depreciation for the year

1 December 20X8

Machinery: cost 250 000

Bank Given 250 000

Depreciation 125 000

Machinery: accumulated depreciation W1: (250 000 125 000) 125 000

Repayment of government grant and change in estimated depreciation

31 December 20X8

Depreciation (500 000 0) /4 125 000

Machinery: accumulated depreciation 125 000

Depreciation for the year

31 December 20X9

Depreciation (500 000 0) /4 125 000

Machinery: accumulated depreciation 125 000

Depreciation for the year

Solutions to Gripping IFRS : Graded

Questions

Government grants and assistance

Kolitz & Sowden-Service, 2009 Chapter 27: Page 9

Solution 27.4 continued

b) continued

Working 1: change in estimate

Date Calculations Was Is Difference

Cost 1/1/20X6 500 000 250

000

250 000 500 000 250 000

Depreciation 20X6 &

20X7

(250 000 0) / 4

x 2

(500 000 0) / 4

x 2

(125 000) (250 000) (125 000)

Carrying

amount

31/12/20X7 125 000 250 000 125 000

Depreciation 20X8 (250 000 0) / 4

x 1

(500 000 0) /4

x 1

(62 500) (125 000) (62 500)

Depreciation Future (250 000 0) / 4

x 1

(500 000 0) /4

x 1

(62 500) (125 000) (62 500)

Residual value 31/12/20X9 Given 0 0 0

It is interesting to note that the change in estimate is calculated on a cumulative catch-up basis, rather

than a reallocation basis suggested by IAS 8. This cumulative approach is required in IAS 20.32.

Solutions to Gripping IFRS : Graded

Questions

Government grants and assistance

Kolitz & Sowden-Service, 2009 Chapter 27: Page 10

Solution 27.5

a)

Debit Credit

30 June 20X8

Weapons licence: cost (FV) 900 000

Bank 50 000

Deferred grant income 850 000

Recognising the licence granted by the government at fair value

31 December 20X8

Amortisation - licence (900 000/ 5 x 6/ 12) 90 000

Licence: accumulated amortisation 90 000

Amortisation of weapons licence for 6 months

Deferred grant income (850 000/ 5 x 6/ 12) 85 000

Grant income 85 000

Recognised on the same basis as amortisation

b)

Debit Credit

30 June 20X8

Weapons licence: cost 50 000

Bank 50 000

Recognising the licence granted by the government at nominal amount

31 December 20X8

Amortisation - licence (50 000/ 5 x 6/ 12) 5 000

Licence: accumulated amortisation 5 000

Amortisation of weapons licence for 6 months

c)

ANTHONY LIMITED

NOTES TO THE FINANCIAL STATEMENTS (EXTRACTS)

FOR THE YEAR ENDED 31 DECEMBER 20X8

25. Government assistance

Anthony Limited received free advice from government experts. This advice included technical

manufacturing advice as well as marketing advice for the companys weapons manufacturing

operations. The company received this assistance because of its excellent BEE rating.

Solutions to Gripping IFRS : Graded

Questions

Government grants and assistance

Kolitz & Sowden-Service, 2009 Chapter 27: Page 11

Solution 27.6

The subsidy granted by the government would meet the definition of a government grant as

defined by IAS 20.3.

Government grants are assistance by government:

in the form of transfers of resources:

The amount of C800 000 is a resource and equates to a transfer of these resources even

if the grant has not yet been received in cash: the governments obligation and

Trailblazer Limiteds asset would be recognized on the basis that the flow of future

economic benefits were expected (if there was any risk that the company would not

complete the building, being a condition of the grant, then this grant would not be

recorded until either the cash were received or the condition was met);

to an entity in return for past or future compliance with certain conditions relating to the

operating activities of the entity:

A condition was attached to the grant requiring that a building be erected in

Themiddleofnowhere.

They exclude those forms of government assistance which:

cannot reasonably have a value placed upon them:

this grant clearly has a value since it will equal half of the costs of construction,

limited to a grant of C1 000 000. If Trailblazer Limited has no reliable estimate of the

costs of construction, then the definition of a grant would not be met: the grant would

need to be recognized as and when it was received or as soon as a reliable estimate

became possible

cannot be distinguished from the normal trading transactions of the entity:

the grant is clearly related to the normal trading transactions of the entity since the

grant relates to the building of a factory that is essential to the manufacture of its only

product: shoes.

The subsidy also meets the definition of a grant related to an asset as defined by IAS 20.3:

a grant whose primary condition is that an entity qualifying for them should purchase,

construct or otherwise acquire long-term assets.

The grant was conditional upon the construction of a factory in a specific area, thus a

condition to the grant exists.

The government grant therefore exists. Whether or not to recognize this grant, however,

depends on whether there is reasonable assurance that the entity will comply with the

conditions attaching to it, and that the grant will be received (IAS 20.8). Receipt of a grant

does not of itself provide conclusive evidence that the conditions attaching to the grant have

been or will be fulfilled.

Trailblazer Limited should therefore use professional judgement and be prudent in

recognizing this grant and only recognize the grant when the building is significantly

complete, feasibility studies have been done to ensure sufficiently cash is available to

complete the building etcetera. The terms of the agreement would need to be thoroughly

assessed before recognizing this grant and determining how much of the grant may be

recognized..

As the grant was provided for the construction of a factory that would be depreciated,

Trailblazer would have the choice of recognising the grant of C800 000 as either:

Deferred income and periodically amortising the grant on a rational and consistent basis,

e.g. the useful life of the factory, to profit or loss; or

A reduction against the cost of the factory. This would have the same effect on profit or

loss as the depreciation expense will be reduced.

Solutions to Gripping IFRS : Graded

Questions

Government grants and assistance

Kolitz & Sowden-Service, 2009 Chapter 27: Page 12

Solution 27.7

a)

Debit Credit

1 January 20X8

Bank 300 000

Deferred income: government grant 300 000

Government grant received

PPE: glass blower: cost 500 000

Bank 500 000

Purchase of glass blower

31 December 20X8

Depreciation glass blower (500 000 0) 5 100 000

PPE: glass blower: accumulated depreciation 100 000

Depreciation for 20X8

Deferred income: government grant 60 000

Grant income 300 000 5 60 000

Portion of grant income realised

31 December 20X9

Depreciation glass blower (500 000 0) 5 100 000

PPE: glass blower: cost accumulated depreciation 100 000

Depreciation for 20X9

Deferred income: government grant 60 000

Grant income 60 000

Grant income realised

Deferred income: government grant 60 000

Bank 300 000 x (2 000 10 000) 60 000

Portion of grant repaid

Grant income W1 or (60 000 + 60 000) x 20%

Deferred income: government grant 24 000

Grant income restated due to repayment (change in estimate) 24 000

W1: Change in estimate

Deferred

income

Was Should have been Difference

1/1/20X8 (1) 300 000 240 000 60 000

Movement (2)

(3)

(60 000) (48 000) (12 000) Less grant

income

31/12/20X8 240 000 192 000 48 000

Movement (60 000) (48 000) (12 000) Less grant

income

31/12/20X9 180 000 144 000 36 000

(1) Amount originally received: 300 000 Amount forfeited (repaid): 60 000 = 240 000

(2) 300 000 / 5 years = 60 000

(3) 240 000 / 5 years = 48 000

Solutions to Gripping IFRS : Graded

Questions

Government grants and assistance

Kolitz & Sowden-Service, 2009 Chapter 27: Page 13

Solution 27.7

b)

Debit Credit

1 January 20X8

Bank 300 000

Deferred income: government grant 300 000

Government grant received

PPE: glass blower: cost 500 000

Bank 500 000

Purchase of glass blower

Deferred income: government grant 300 000

PPE: glass blower: cost 300 000

Grant written off against asset

31 December 20X8

Depreciation (500 000 300 000 0) 5 40 000

PPE: glass blower: accumulated depreciation 40 000

Depreciation for 20X8

31 December 20X9

Depreciation (500 000 300 000 0) 5 40 000

PPE: glass blower: accumulated depreciation 40 000

Depreciation for 20X9

PPE: glass blower: cost 300 000 x (2 000 10 000) 60 000

Bank 60 000

Portion of grant repaid

Depreciation W1 or 60 000/ 5yrs x 2 yrs 24 000

PPE: glass blower: accumulated depreciation 24 000

Accumulated depreciation restated due to repayment of grant

W1: Change in estimate

Glass blower Was Should have been Difference

1/1/20X8 (1) (2) 200 000 260 000 60 000

Movement (3) (4) (40 000) (52 000) 12 000

31/12/20X8 160 000 208 000 (48 000)

Movement (40 000) (52 000) 12 000

31/12/20X9 120 000 156 000 (36 000)

(1) Cost: 500 000 Original grant: 300 000 = 200 000

(2) Cost: 500 000 Reduced grant: (300 000 60 000) = 260 000

(3) (200 000 0) / 5 years = 40 000

(4) (260 000 0) / 5 years = 52 000

You might also like

- Chapter 25 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document15 pagesChapter 25 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 10Document89 pagesChapter 10kazimkoroglu100% (1)

- Chapter 21 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document50 pagesChapter 21 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 5 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document33 pagesChapter 5 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 30 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document25 pagesChapter 30 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 23 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document29 pagesChapter 23 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Microsoft Word - Chapter 1Document4 pagesMicrosoft Word - Chapter 1SoblessedNo ratings yet

- Chapter 26 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document31 pagesChapter 26 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 1 None CompressDocument9 pagesChapter 1 None CompressiadcNo ratings yet

- Chapter 6 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document71 pagesChapter 6 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Vol 2 CH 1Document20 pagesVol 2 CH 1lee jong sukNo ratings yet

- Solutiondone 2-225Document1 pageSolutiondone 2-225trilocksp SinghNo ratings yet

- Mpu3123 Titas c2Document36 pagesMpu3123 Titas c2Beatrice Tan100% (2)

- Lease Accounting ProblemsDocument27 pagesLease Accounting ProblemsElijah Lou ViloriaNo ratings yet

- Midterm Exam - Ac-2Document7 pagesMidterm Exam - Ac-2Lyca ArcenaNo ratings yet

- Chapter 18 Govt GrantsDocument6 pagesChapter 18 Govt Grantsrobinady dollaga100% (2)

- Answers - V2Chapter 1 2012Document10 pagesAnswers - V2Chapter 1 2012Christopher Diaz0% (1)

- Chapter 8 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document47 pagesChapter 8 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- 06 Taxation - Deferred s20 Final-1Document44 pages06 Taxation - Deferred s20 Final-150902849No ratings yet

- Info SysDocument5 pagesInfo SysAtit SukheNo ratings yet

- Financial Accounting 2 Chapter 1 SolmanDocument17 pagesFinancial Accounting 2 Chapter 1 SolmanElijah Lou ViloriaNo ratings yet

- Sol. Man. Chapter 18 Govt Grants Ia Part 1BDocument6 pagesSol. Man. Chapter 18 Govt Grants Ia Part 1BChrismae Monteverde Santos100% (1)

- Problem 27 5Document20 pagesProblem 27 5Cjezerei Dangue VerdaderoNo ratings yet

- Chapter 8 - Investment Property, Other Non-current AssetsDocument7 pagesChapter 8 - Investment Property, Other Non-current AssetsPamela Cruz100% (1)

- F1 November 2010 AnswersDocument11 pagesF1 November 2010 AnswersmavkaziNo ratings yet

- CMA April - 14 Exam Question SolutionDocument55 pagesCMA April - 14 Exam Question Solutionkhandakeralihossain50% (2)

- Far 811S Test 2 2023Document7 pagesFar 811S Test 2 2023Grechen UdigengNo ratings yet

- Sba1501 Management Accounting Unit IiiDocument71 pagesSba1501 Management Accounting Unit Iiisandhya lakshmanNo ratings yet

- CASH FLOW FinalDocument24 pagesCASH FLOW FinalAll TrendsNo ratings yet

- Deductions SummaryDocument8 pagesDeductions SummaryDamdam AlunanNo ratings yet

- Financial Statement AnalysisDocument5 pagesFinancial Statement AnalysisChi ChiNo ratings yet

- Calculate tax liability for tutorial questionsDocument4 pagesCalculate tax liability for tutorial questionsMi ThaiNo ratings yet

- Model Answers Series 2 2010Document17 pagesModel Answers Series 2 2010Jack Tsang100% (1)

- CS Exec - Prog - Paper-2 Company AC Cost & Management AccountingDocument25 pagesCS Exec - Prog - Paper-2 Company AC Cost & Management AccountingGautam SinghNo ratings yet

- 2014 Volume 2 CH 1 Solution ManualDocument10 pages2014 Volume 2 CH 1 Solution ManualGabriel Dave AlamoNo ratings yet

- Notes ReceivableDocument47 pagesNotes ReceivableAlexandria Ann FloresNo ratings yet

- AMF 2202 Test 2 2022-2023 - 221111 - 085401Document3 pagesAMF 2202 Test 2 2022-2023 - 221111 - 085401mugenyi DixonNo ratings yet

- Sample Exam Fin Acc B - With SolutionDocument13 pagesSample Exam Fin Acc B - With SolutionAgata ANo ratings yet

- IAS 20 Summary NotesDocument5 pagesIAS 20 Summary NotesShiza ArifNo ratings yet

- Introduction To Management AccountingDocument5 pagesIntroduction To Management AccountingDechen WangmoNo ratings yet

- ACCT EXAM NceshDocument7 pagesACCT EXAM Nceshncedilembokazi23No ratings yet

- Financial Accounting11Document14 pagesFinancial Accounting11AleciafyNo ratings yet

- F7 CourseDocument118 pagesF7 CourseKodwoP100% (3)

- FfsDocument9 pagesFfsDivya PoornamNo ratings yet

- For Reg 1Document7 pagesFor Reg 1Shynne MabantaNo ratings yet

- Insurance Contracts ChapterDocument10 pagesInsurance Contracts ChapterGloowwjNo ratings yet

- Cash Flow Statement for ABC LtdDocument30 pagesCash Flow Statement for ABC LtdNaushad GulNo ratings yet

- AFA End Examination 2021-2022Document6 pagesAFA End Examination 2021-2022sebastian mlingwaNo ratings yet

- Thor Semiconductor Is An Exporter of Transistors To The United StatesDocument6 pagesThor Semiconductor Is An Exporter of Transistors To The United StatesSophia KeratinNo ratings yet

- Analyzing Adjusting Entries and Financial StatementsDocument12 pagesAnalyzing Adjusting Entries and Financial StatementsTuba AkbarNo ratings yet

- Financial Statements AssessmentDocument24 pagesFinancial Statements AssessmentLorgie Khim IslaNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- Wiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Finding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesFrom EverandFinding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesNo ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Corporate Law Made Easy - Volume 2Document95 pagesCorporate Law Made Easy - Volume 2Asif IqbalNo ratings yet

- Corporate Laws Made Easy Volume 1Document52 pagesCorporate Laws Made Easy Volume 1Falah Ud Din SheryarNo ratings yet

- InventoriesDocument48 pagesInventoriesFalah Ud Din SheryarNo ratings yet

- Chapter 17 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document32 pagesChapter 17 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 14 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document21 pagesChapter 14 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Introduction To Financial Statements and AuditDocument26 pagesIntroduction To Financial Statements and AuditFalah Ud Din SheryarNo ratings yet

- Ias 40 Investment Property by A Deel SaleemDocument12 pagesIas 40 Investment Property by A Deel SaleemFalah Ud Din Sheryar100% (1)

- Fixed Assets I As 16Document25 pagesFixed Assets I As 16Falah Ud Din SheryarNo ratings yet

- Ias 23 - Borrowing CostDocument11 pagesIas 23 - Borrowing CostATIFREHMANWARRIACHNo ratings yet

- Ias 16 Property, Plant & Equipment: Adeel SaleemDocument20 pagesIas 16 Property, Plant & Equipment: Adeel SaleemAtif RehmanNo ratings yet

- Chapter 15 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document19 pagesChapter 15 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 16 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document33 pagesChapter 16 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 7 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document49 pagesChapter 7 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (2)

- Chapter 11 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document20 pagesChapter 11 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 13 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document19 pagesChapter 13 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 12 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document16 pagesChapter 12 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 2 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document23 pagesChapter 2 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 8 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document47 pagesChapter 8 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 6 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document71 pagesChapter 6 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 9Document23 pagesChapter 9TouseefsabNo ratings yet

- Chapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document44 pagesChapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 4 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document40 pagesChapter 4 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 29 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document10 pagesChapter 29 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar0% (1)

- Chapter 3 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document24 pagesChapter 3 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 28 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document6 pagesChapter 28 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 26 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document31 pagesChapter 26 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet