Professional Documents

Culture Documents

PA

Uploaded by

sunny_3110Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PA

Uploaded by

sunny_3110Copyright:

Available Formats

BIRLA INSTITUTE OF TECHNOLOGY AND SCIENCE, Pilani

Pilani Campus

_

Please Do Not Print Unless Necessary

FIRST SEMESTER 2014-2015

Course Handout (Part II)

01.08.2014

In addition to Part-I (General Handout for all courses appended to the time table) this portion gives

further specific details regarding the course.

Course No. : ECON F411/ MBA C454/ MGTS C451

Course Title: Project Appraisal

Instructor-in-charge: OMVIR CHAUDHRY

1. Scope and Objective of the Course:

The Course will focus on the fundamental principles needed to appraise and evaluate projects

from commercial/financial and economic viewpoints and suitable techniques for achieving

those.

2. Text Book:

Chandra, P. Projects Planning, Analysis, Selection, Fin. Implementation and Review, Tata McGraw Hill,

7

th

Ed., 2009.

3. Reference Books:

R1 Gopalkrishnan, P & Rama Moorthy V E, Project Management, Macmillan India Ltd., 1993.

R2 UNIDO, Guidelines for Project Evaluation, United Nations, New York, 1972.

R3 UNIDO, Guide to Practical Project Appraisal, United Nations, New York, 1978.

R4 Marglin, S.A., Public Investment Criteria, Unwin University Press, 1967.

R5 Dinwiddy, C. and Francis Teal, Principles of Cost-Benefit Analysis for Developing

Countries, Cambridge University Press, 1996.

R6 Dasgupta, A.K. and D.W. Pearce, Cost-Benefit Analysis: Theory and Practice, Macmillan

Publishers Ltd, 1978.

R7 Tevfik F. Nas, Cost Benefit Analysis, Sage Publications, New Delhi, 1996.

R8 Irvin, G., Modern Cost-Benefit Methods, The Mac-Millan Press Ltd., 1978.

BIRLA INSTITUTE OF TECHNOLOGY AND SCIENCE, Pilani

Pilani Campus

_

Please Do Not Print Unless Necessary

3. Course Plan:

No.of

Lec

Topic to be covered Learning Objectives Ref. Text

Book

1 Overview Investment analysis & appraisal of scheme for

investing resources.

Ch. 1

2 Identification of Investment

Opportunities

Methodologies and realistic assessment of investment

opportunities

Ch. 3

2 Market and Demand Analysis Systematic method and key steps for analyzing

market and demand.

Ch. 4

1 Technical Analysis Technological factors in project implementation. Ch. 5

5 Financial analysis Understanding and analysis of a project from a

financial angle using financial parameters

Ch. 6

3 Project cash flows Principles and methodology of estimation of project

cash flows.

Ch. 9

3 Time value of money Effect of time value of money upon project Ch. 7

3 Cost of capital Determination of optimal capital structures for

maximization of value of firm.

Ch. 10

5 Appraisal criteria Judging projects on the basic of payback, NPV, IRR and

multiple criteria.

Ch. 8

4 Analysis of Risk Various methods of estimating risk for optimal capital

expenditure decision.

Ch. 11

9 Social cost benefit analysis SCBA UNIDO, LM approach Ch. 14

2 Project Management Establishing & operating organization suitable for

project management.

Class

notes

BIRLA INSTITUTE OF TECHNOLOGY AND SCIENCE, Pilani

Pilani Campus

_

Please Do Not Print Unless Necessary

4. Evaluation Schedule:

Component Duration Weightage Date & Time Venue Remarks

Mid-Sem Test 90 min. 35 13/10 4:00 - 5:30 PM CB

Surprise Quiz 30 min. 20 To be decided by IC CB

Compre. Exam. 3 hours 45 13/12 AN Partly OB

5. Chamber consultation hour: Wed 12:00 1:10 PM.

6. Notices: All notices regarding the course shall be put on the Economics and Finance Notice

Board.

7. Make-up Policy: Make-up may be given only on genuine grounds, if prior permission is

obtained specifically on production of documentary evidence of

(i) Sickness

(ii) Being out of station owing to unavoidable circumstances

(Verified by Warden in writing).

Instructor-in-charge

ECON F411/ MBA C454/ MGTS C451

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- MamaearthDocument9 pagesMamaearthAmar Singh100% (1)

- Indonesia Taxation Quarterly Report 2019 - I: ForewordDocument47 pagesIndonesia Taxation Quarterly Report 2019 - I: ForewordDaisy Anita SusiloNo ratings yet

- Financial Planning, Tools EtcDocument31 pagesFinancial Planning, Tools EtcEowyn DianaNo ratings yet

- John Rasplicka Resume 2016 09 07Document1 pageJohn Rasplicka Resume 2016 09 07api-356233900No ratings yet

- Proceedings SummitDocument3 pagesProceedings Summitamitsh20072458No ratings yet

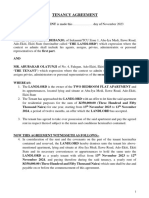

- Tenancy AgreementDocument3 pagesTenancy AgreementseunoyebanjiesqNo ratings yet

- Hawk Hardware Store - ProblemDocument17 pagesHawk Hardware Store - ProblemAngelo Labios50% (2)

- Makaon Final2Document46 pagesMakaon Final2Keyur MehtaNo ratings yet

- Analysis of Option Combination Strategies: February 2018Document11 pagesAnalysis of Option Combination Strategies: February 2018Shubham NamdevNo ratings yet

- Calculating partnership profits and capital balancesDocument1 pageCalculating partnership profits and capital balancesDe Nev Oel0% (1)

- AprilDocument4 pagesAprilTerry WinegarNo ratings yet

- Investor Prospectus QuinateDocument9 pagesInvestor Prospectus QuinateRichard WestermannNo ratings yet

- Claim Form1Document1 pageClaim Form1Long KUENo ratings yet

- Synthesis Essay Final DraftDocument5 pagesSynthesis Essay Final Draftapi-575352411No ratings yet

- DP World's Journey from Local to Global Port OperatorDocument20 pagesDP World's Journey from Local to Global Port OperatorlucasNo ratings yet

- Book Principles of Accounting PDFDocument268 pagesBook Principles of Accounting PDFYosuva JosuvaNo ratings yet

- BDA Advises Quasar Medical On Sale of Majority Stake To LongreachDocument3 pagesBDA Advises Quasar Medical On Sale of Majority Stake To LongreachPR.comNo ratings yet

- Captable Guide Formation To ExitDocument24 pagesCaptable Guide Formation To ExitV100% (1)

- LIC plans major shakeup of Escorts boardDocument6 pagesLIC plans major shakeup of Escorts boardqubrex1No ratings yet

- Micro-Finance Management & Critical Analysis in IndiaDocument47 pagesMicro-Finance Management & Critical Analysis in IndiaSABUJ GHOSH100% (1)

- Debt Management in Pakistan: Presented by Hira Wahla Saeed Ansari Atika Imtiaz Umair SiddiquiDocument38 pagesDebt Management in Pakistan: Presented by Hira Wahla Saeed Ansari Atika Imtiaz Umair Siddiquiumair_siddiqui89No ratings yet

- 4.unit-4 Capital BudgetingDocument51 pages4.unit-4 Capital BudgetingGaganGabriel100% (1)

- Chapter Consignment For B Com Ist YrDocument5 pagesChapter Consignment For B Com Ist YrhanumanthaiahgowdaNo ratings yet

- Audit of Cash and Cash Equivalent Problem 1 (Adapted)Document6 pagesAudit of Cash and Cash Equivalent Problem 1 (Adapted)Robelyn Asuna LegaraNo ratings yet

- Performance of Equity Schemes in Reliance Mutual FundsDocument3 pagesPerformance of Equity Schemes in Reliance Mutual FundsSunanda MathuriaNo ratings yet

- Hudson Law of Finance 2e 2013 Syndicated Loans ch.33Document16 pagesHudson Law of Finance 2e 2013 Syndicated Loans ch.33tracy.jiang0908No ratings yet

- Model Portfolio: DBS Group Research - EquityDocument12 pagesModel Portfolio: DBS Group Research - EquityFunk33qNo ratings yet

- C 1044Document28 pagesC 1044Maya Julieta Catacutan-EstabilloNo ratings yet

- Liquidity risk and core deposits in banksDocument1 pageLiquidity risk and core deposits in banksEvelyn RiesNo ratings yet

- Learn compound interest formulas and calculationsDocument30 pagesLearn compound interest formulas and calculationsShyla Patrice DantesNo ratings yet