Professional Documents

Culture Documents

Exam Tips F-7

Uploaded by

irfannabil20030 ratings0% found this document useful (0 votes)

8 views3 pagesacca exam tips f7

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentacca exam tips f7

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views3 pagesExam Tips F-7

Uploaded by

irfannabil2003acca exam tips f7

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

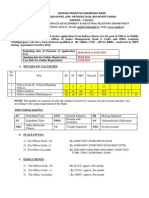

PAPER F-7

USEFULL Exam techniques AND TIPS

Expect not to finish any question. When you run out of time for that

question, stop and move on to the next.

Not finishing a question is not something to feel bad about; its just part of

your technique for passing the exam. (YOUR FIRST OBJECTIVE 50%)

Be prepared that your statement of financial position or cash flow may not

balance.

o If it doesnt, leave it and get on with the rest of the paper

o Dont worry about it now. (If it does balance, well done!)

BELOW ARE SOME USEFULL TIPS FOR ATTEMPTING AN EXAM

Q1) Groups consolidation

You will benefit from having the proforma/standard workings (5 STD

WORKINGS) of your final answer set up first.

o For example if the question requires a consolidated SFP then drawing

up the SFP with open brackets

o Beside those numbers that do not need a standard working can get all

the easy adding across 100% of the Parent and subsidiary figures.

o The other headings can have the standard working number written

beside them instead.

o A couple of lines would need to be left for each section of the SFP in

case other things come up in the additional information.

In addition to this setting up the standard workings can also be done.

o The subsidiaries share capital figures and the yearend retained

earnings can be put into these without reading any of the additional

information.

o In addition to this the parents retained earnings figure can also be put

into W5 (Retained earnings) without reading any additional narrative.

With all of the proforma and standard workings set up, it means that you are

able to tackle the issues in the order that they are presented in the question.

o It also allows you to deal with both sides of any adjustments as

everywhere is set up to make the adjustments.

o It hopefully prevents non-balancing accounts and means that each

issue only has to be addressed once;

o Thus helping with time management. Also if you run out of time,

o You will get full credit for all that you have already done provided

everything is referenced through.

A similar process can be applied to the income statement equivalent of

setting up final answer and workings to help tackle the issues that come up.

Q2) Single company financial statements

As with the groups question, it may be possible to get the proforma of the

final answer set up,

o Particularly if the data in the question is set up with the draft financial

statements rather than the trial balance.

o If possible it then means that open brackets can be used and the draft

figures placed in them, ready for adjustments as they arise.

o Generally speaking there are often more adjustments required for cost

of sales figure in the income statement and the PPE figure in the SFP.

o As such I would suggest these are likely to need separate workings

rather than just a bracket beside the final answer.

If there is a topic/adjustment that you are unsure of, come back to it.

o You are better to get the adjustments that you are comfortable with

done first.

o It is easy to get bogged down and waste time on a difficult adjustment

at the expense of doing an easier one that appears later in the question.

Q3) Performance appraisal

With a performance appraisal question you may be asked to calculate ratios

or prepare a statement of cash flow or both.

o When calculating ratios, if you are unsure of a particular calculation

always have a go,

o As even if the calculation is incorrect you will be awarded merit for

your discussion of the incorrect number in the written section of the

question.

o It also really helps the marker if you note your formula down so that

your working is clearly identified.

When preparing a statement of cash flow set up you proforma immediately

and begin to get the easy marks in the cash flow

o such as finding the movement in the cash and cash equivalent balance,

and finding the movements on basic shares and loans.

o You will also find the operating activities section familiar and useful

for scoring marks.

o If there are any cash items that you are unfamiliar with come back to

these at the end after you have dealt with the items that you can do.

o Finally, when appraising the performance of a company ensure that

you always refer to the scenario provided to ensure maximum credit is

awarded.

FAQs

Q. What are the core areas I need to learn?

As this is a compulsory paper the entire syllabus is examinable.

However, you will always find common traits at Q1 Q3 in that you will be

required to prepare a consolidation, single entity financial statements and

some form of performance appraisal including the calculation of

ratios/statement of cash flow.

Q. How much work is necessary to pass this paper?

You will need to ensure that you have practiced enough questions to feel

comfortable with both the examiner style and the content of the questions.

There are always familiar elements to every question.

Q. How should I present my answers?

As neatly as possible! The examiner often complains of difficult to read or

illegible answers.

Make sure you answer each question on a separate page.

Always present your answer first and include all supportive workings behind

this (i.e. set up your proforma consolidation and include the 5 standard

workings behind).

Q. How do you treat PUP adjustments between a parent and subsidiary?

For transactions between a parent and subsidiary, you always reduce the

inventory on the SFP.

The opposite entry will be to reduce the selling company's reserves, so if the

selling company is the parent, reduce W5, for the subsidiary reduces W2

(SFP and post-acquisition column).

Q. How do you treat PUP adjustments between a parent and associate?

For transactions between a parent and associate, you always reduce the

group reserves on W5.

The opposite entry will depend on which company is holding the inventory.

If the parent is holding the inventory, and therefore the inventory is included

on the group SFP, the inventory on the SFP should be reduced.

If the associate is holding the inventory, you should reduce the investment in

associate W6.

Q. Sometimes my non-current asset revaluation doesnt agree to the answer.

How do you treat a revalued asset in the financial statements?

When revaluations are examined (normally at question 2) a common mistake

is made by candidates.

This mistake is in the incorrect identification of the date the revaluation took

place.

If the revaluation takes place at the start of the year you must revalue the

asset immediately and depreciate the revalued amount over the remaining

useful economic life.

If the revaluation takes place at the end of the year then full years

depreciation should be charged based on the assets depreciation policy and

then the revaluation should be performed at the year end.

You might also like

- ACCA F9 F7 & F5 Exam Tips March 2017Document4 pagesACCA F9 F7 & F5 Exam Tips March 2017MeeroButtNo ratings yet

- Top 9 Formulas For The CFA Level 1 Exam - FinQuizFinQuizDocument6 pagesTop 9 Formulas For The CFA Level 1 Exam - FinQuizFinQuizAyushman GuptaNo ratings yet

- Abe How Do You Pass The Financial Accounting ExaminationDocument2 pagesAbe How Do You Pass The Financial Accounting ExaminationSami Islam100% (1)

- Individual Assignment Semester 22022Document3 pagesIndividual Assignment Semester 22022Navin GolyanNo ratings yet

- Module 13 - Integrated Financial ModellingDocument77 pagesModule 13 - Integrated Financial ModellingNirmal SudhakarNo ratings yet

- Exam Technique Financial Accounting PapersDocument2 pagesExam Technique Financial Accounting PapersLubna NaseemNo ratings yet

- How To Pass AFMDocument2 pagesHow To Pass AFMabdulmubdi.96No ratings yet

- Financial Ratios 2Document7 pagesFinancial Ratios 2Mohammed UsmanNo ratings yet

- 10 Most Difficult Areas of Level I of The CFA ProgramDocument2 pages10 Most Difficult Areas of Level I of The CFA Programaegis inmueblesNo ratings yet

- fn3092 Exc15Document23 pagesfn3092 Exc15Chloe ThamNo ratings yet

- 19 Common Financial Analyst Interview Questions and AnswersDocument12 pages19 Common Financial Analyst Interview Questions and AnswersCharish Jane Antonio CarreonNo ratings yet

- Key Technical Questions For Finance InterviewsDocument27 pagesKey Technical Questions For Finance InterviewsSeb SNo ratings yet

- F2 Exam Review: Performance, Budgeting ChangesDocument13 pagesF2 Exam Review: Performance, Budgeting ChangesAlmoutaz HassanNo ratings yet

- FP&A Interview Q TechnicalDocument17 pagesFP&A Interview Q Technicalsonu malikNo ratings yet

- Private Equity Case Studies in 3,017 WordsDocument7 pagesPrivate Equity Case Studies in 3,017 Wordsprateek2888No ratings yet

- Top 52 Financial Analyst Interview Questions and AnswersDocument24 pagesTop 52 Financial Analyst Interview Questions and AnswersJerry TurtleNo ratings yet

- Learning Unit 2 $3Document8 pagesLearning Unit 2 $3mmasalekNo ratings yet

- Hot Topics Dece 2015Document21 pagesHot Topics Dece 2015Ashraf ValappilNo ratings yet

- General Presentation GuidelinesDocument3 pagesGeneral Presentation GuidelinesMD Abu Hanif ShekNo ratings yet

- Nomura FA QuestionDocument18 pagesNomura FA Questionsandeep mauryaNo ratings yet

- Additional+Assignment+Guidance Spring2020-2Document6 pagesAdditional+Assignment+Guidance Spring2020-2nataliewong1615No ratings yet

- Guide To Creating A Salary Administration PlanDocument46 pagesGuide To Creating A Salary Administration PlanReymark RadjuliNo ratings yet

- 2015AFNCE205001Document6 pages2015AFNCE205001Nam VũNo ratings yet

- Class #8 "Detecting Earnings Management"Document9 pagesClass #8 "Detecting Earnings Management"adzkiya1700No ratings yet

- Works To Be Done in ROCKWELL AMCDocument2 pagesWorks To Be Done in ROCKWELL AMCgopisettyNo ratings yet

- Wall Street Playboys IB Interview GuideDocument5 pagesWall Street Playboys IB Interview GuideJack JacintoNo ratings yet

- Sa Oct12 f5 ApproachDocument5 pagesSa Oct12 f5 ApproachAiya TursynovaNo ratings yet

- It's Not A Plan Until The Numbers Add Up - Colwell, MichaelDocument48 pagesIt's Not A Plan Until The Numbers Add Up - Colwell, Michael678c328bNo ratings yet

- fn3092 Exc 13Document26 pagesfn3092 Exc 13guestuser1993No ratings yet

- Finance Interview Questions and AnswersDocument5 pagesFinance Interview Questions and AnswersKAZI NISHATNo ratings yet

- Helpful WSO PostsDocument23 pagesHelpful WSO PostsalbertNo ratings yet

- Aat Level 4 CourseworkDocument4 pagesAat Level 4 Courseworkmhzkehajd100% (2)

- How To Prepare Exam SubjectwiseDocument5 pagesHow To Prepare Exam SubjectwiseAjay GiriNo ratings yet

- The Restyle Accounting For Change: StudyDocument1 pageThe Restyle Accounting For Change: Studykarlr9No ratings yet

- Best Answer 3Document14 pagesBest Answer 3Chelsi Christine TenorioNo ratings yet

- Strategic Management A Competitive Advantage Approach Concepts 15th Edition David Solutions ManualDocument11 pagesStrategic Management A Competitive Advantage Approach Concepts 15th Edition David Solutions Manualequally.ungown.q5sgg100% (20)

- AP Statistics Chapter 10 Homework AnswersDocument5 pagesAP Statistics Chapter 10 Homework Answersafnaczdujozvqt100% (1)

- Global Body for Professional Accountants Review Past F6 P6 ExamsDocument26 pagesGlobal Body for Professional Accountants Review Past F6 P6 ExamslmuzivaNo ratings yet

- 1 Financial ReportingDocument27 pages1 Financial ReportingMeaghan FresnNo ratings yet

- Vital October Study BusinessstrategyDocument2 pagesVital October Study Businessstrategyalmond2009No ratings yet

- Answers in Tray Assessmentday PDFDocument17 pagesAnswers in Tray Assessmentday PDFbharathaninNo ratings yet

- PM MJ20 Detailed CommentaryDocument7 pagesPM MJ20 Detailed CommentaryNiki GeorgievNo ratings yet

- Tds ThesisDocument4 pagesTds Thesismelissamooreportland100% (1)

- Intermediate Financial Management 12th Edition Brigham Solutions ManualDocument31 pagesIntermediate Financial Management 12th Edition Brigham Solutions Manuallendablefloordpq7r100% (27)

- Important Tips For Interview For SAP SDDocument30 pagesImportant Tips For Interview For SAP SDPuneetTripathiNo ratings yet

- FP&A Interview Questions and AnswersDocument7 pagesFP&A Interview Questions and Answershrithikoswal1603No ratings yet

- Introduction To FinanceDocument20 pagesIntroduction To Financesanket411100% (3)

- Microsoft Word Abm Entrepreneurship 12 q1 w5 Mod5Document39 pagesMicrosoft Word Abm Entrepreneurship 12 q1 w5 Mod5mara ellyn lacsonNo ratings yet

- ACCA Interpreting Financial Statements Requires Analysis and Appraisal of The Performance and Position of An EntityDocument6 pagesACCA Interpreting Financial Statements Requires Analysis and Appraisal of The Performance and Position of An Entityyung kenNo ratings yet

- Dipfa Coursework HelpDocument4 pagesDipfa Coursework Helppkhdyfdjd100% (2)

- 7 Steps To Improve Business Performance in The Food IndustryDocument6 pages7 Steps To Improve Business Performance in The Food IndustryCarla RosaNo ratings yet

- Chat Session With Acca F9 TutorDocument4 pagesChat Session With Acca F9 TutorRana Salman AwaisNo ratings yet

- Full Download Corporate Finance Asia Global 1st Edition Ross Solutions ManualDocument35 pagesFull Download Corporate Finance Asia Global 1st Edition Ross Solutions Manualkisslingcicelypro100% (31)

- Financial Planning and Forecasting Financial Statements: Answers To Beginning-Of-Chapter QuestionsDocument24 pagesFinancial Planning and Forecasting Financial Statements: Answers To Beginning-Of-Chapter Questionscostel11100% (1)

- Case 3 Submission InstructionDocument4 pagesCase 3 Submission InstructionChip choi0% (1)

- Banking Interviews GuideDocument5 pagesBanking Interviews GuideSAKSHAM SINGHNo ratings yet

- General Finance Interview Tips: #1 Behavioral and Fit Questions Relate More ToDocument6 pagesGeneral Finance Interview Tips: #1 Behavioral and Fit Questions Relate More ToNneha BorkarNo ratings yet

- Formulas #1: Future Value of A Single Cash FlowDocument4 pagesFormulas #1: Future Value of A Single Cash FlowVikram Sathish AsokanNo ratings yet

- Introduction To Financial Modelling - Varsity by ZerodhaDocument8 pagesIntroduction To Financial Modelling - Varsity by ZerodhaBenudhar SahooNo ratings yet

- Initial Recognition 20-24 Subsequent Measurement 25-32Document27 pagesInitial Recognition 20-24 Subsequent Measurement 25-32irfannabil2003No ratings yet

- Ias 16 Questions OnlyDocument1 pageIas 16 Questions Onlyirfannabil2003No ratings yet

- Ias 16 Questions OnlyDocument1 pageIas 16 Questions Onlyirfannabil2003No ratings yet

- InternetDocument1 pageInternetirfannabil2003No ratings yet

- InternetDocument1 pageInternetirfannabil2003No ratings yet

- InternetDocument1 pageInternetirfannabil2003No ratings yet

- Four Major Risks Facing Woolworths AuditDocument9 pagesFour Major Risks Facing Woolworths AuditTanmoy NaskarNo ratings yet

- Midterm Bisek Chapter 2Document4 pagesMidterm Bisek Chapter 2FiqriNo ratings yet

- Albania Apartments in Saranda - Saranda Alba ResidenceDocument9 pagesAlbania Apartments in Saranda - Saranda Alba ResidenceAlbania PropertyNo ratings yet

- OffentliggorelseDocument59 pagesOffentliggorelsenot youNo ratings yet

- Portfolio Management Process and Life Cycle InvestingDocument9 pagesPortfolio Management Process and Life Cycle InvestingOsama MuzamilNo ratings yet

- Exercise InvestmentsDocument14 pagesExercise InvestmentsAlizah Lariosa Bucot43% (7)

- Balance Sheets: The Basics: Balance Sheet Reporting - Who, When and Where?Document10 pagesBalance Sheets: The Basics: Balance Sheet Reporting - Who, When and Where?Rama KrishnanNo ratings yet

- Power System Economics - Unilag Lecture NotesDocument43 pagesPower System Economics - Unilag Lecture Noteseresuyi100% (3)

- Normalization AdjustmentsDocument1 pageNormalization AdjustmentsAbraham ChinNo ratings yet

- Accounting For Management QuestAnsDocument47 pagesAccounting For Management QuestAnspappu_5889% (9)

- AC 501 (Pre-Mid)Document3 pagesAC 501 (Pre-Mid)RodNo ratings yet

- This Is A System Generated Payslip and Does Not Require SignatureDocument1 pageThis Is A System Generated Payslip and Does Not Require Signaturemamatha mamtaNo ratings yet

- Income Taxation Term Assessment 2 SEM SY 2019 - 2020: Coverage: Chapter 8 - 11Document4 pagesIncome Taxation Term Assessment 2 SEM SY 2019 - 2020: Coverage: Chapter 8 - 11Nhel AlvaroNo ratings yet

- Fine Print Pay Stub 1Document3 pagesFine Print Pay Stub 1api-585050784100% (1)

- Sale and Purchase Record SampleDocument6 pagesSale and Purchase Record SampleElda TeaNo ratings yet

- Unadjusted Trial Balance Adjusting Entries Adjusted Trial BalanceDocument3 pagesUnadjusted Trial Balance Adjusting Entries Adjusted Trial BalanceCj BarrettoNo ratings yet

- Auditing MaterialityDocument7 pagesAuditing MaterialityRey Joyce AbuelNo ratings yet

- Income Taxation - Co-Ownership Estates and TrustsDocument37 pagesIncome Taxation - Co-Ownership Estates and TrustsMaria Maganda MalditaNo ratings yet

- China Environmental Protection Equipment Market ReportDocument11 pagesChina Environmental Protection Equipment Market ReportAllChinaReports.comNo ratings yet

- Human Resoruces Development & Industrial Relations Department Phones: 08562 250137, Email: Apgbhrd@apgb - In, Web: WWW - Apgb.inDocument8 pagesHuman Resoruces Development & Industrial Relations Department Phones: 08562 250137, Email: Apgbhrd@apgb - In, Web: WWW - Apgb.inJeshiNo ratings yet

- CIR vs Philam Life Prescription RefundDocument1 pageCIR vs Philam Life Prescription RefundRaquel Doquenia100% (1)

- Chapter 13 Economy Market AnalysisDocument11 pagesChapter 13 Economy Market AnalysisAli HussainNo ratings yet

- Ch09 Solations Brigham 10th EDocument12 pagesCh09 Solations Brigham 10th ERafay HussainNo ratings yet

- Book value per share calculation and interpretationDocument6 pagesBook value per share calculation and interpretationEmely Grace YanongNo ratings yet

- Tally - Erp 9 FlyerDocument2 pagesTally - Erp 9 FlyerManish SharmaNo ratings yet

- Horniman HorticultureDocument5 pagesHorniman HorticultureLutfi HakimNo ratings yet

- Berger Paints India Limited: Public AnnouncementDocument16 pagesBerger Paints India Limited: Public Announcement563vasuNo ratings yet

- Case 1 Evafin FerrariDocument16 pagesCase 1 Evafin Ferrarisantiago angarita100% (1)

- BudgetingDocument11 pagesBudgetingWinnie Ann Daquil LomosadNo ratings yet

- Finite Math Final ProjectDocument14 pagesFinite Math Final Projectapi-396001914No ratings yet