Professional Documents

Culture Documents

Role of Banks

Uploaded by

Munish PathaniaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Role of Banks

Uploaded by

Munish PathaniaCopyright:

Available Formats

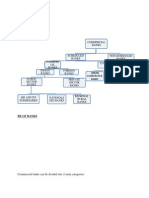

ROLE OF BANKS

1. ACCEPTING DEPOSITS: One of the vital role of banks is accepting deposits. The deposits are

accepted from the public at large, and not merely from its shareholders or members. Banks

accept deposits by mobilizing the savings of the public. To mobilize the savings and to hold

deposits, banks pay interest on these deposits. To attract the depositors, banks maintain

different types of accounts like:

Fixed deposit account

Saving bank deposit account

Current account

2. LENDING OR ADVANCING LOANS: Lending or advancing loan is another imporatnat role played

by the bank. Lending on the basis of funds raised through acceptance of deposits from the

public. The usual methods adopted by banks to make advances are as follows:

Term loans: this is a lumpsum loan advanced with a fixed maturity period of more than

one year. Term loans are usually secured and provide medium to long term funds to the

borrower. The entire loan sanctioned is paid or credited to the account of the customer.

The entire amount of loan is chargeable to interest.

ROLE

OF

BANKS

ACCEPTING

DEPOSITS

ADVANCING

LOANS

REMITTANCE

KEEPING OF

VALUALES

FINANCIAL

INTERMEDIARY

CATALYTIC

AGENT

CATER NEEDS OF

VARIOUS

SEGMENTS

Money at call: It is a money lent for very short period, generally varying from 1 to 14

days. Such advances are usually made to other banks and financial institutions only.

Money at call ensures liquidity.

Overdraft: An overdraft is an advance given by allowing the customer to overdraw his

current account upto an agreed amount. The overdraft facility is given to the

businessmen who have current account in the bank. The interest is charged to the

extent the account is overdrawn. In case of overdraft facility, there is no restriction on

the number of withdrawals in the current account.

Discounting of bills: in a bill of exchange, the debtor accepts the bill drawn upon him by

the creditor and thus agrees to pay the amount mentioned on maturity. In discounting,

the banks takes the bill and after making deductions, makes the payment to the holder.

3. REMITTANCE OF FUNDS: Banks remit the funds on behalf of their clients from one place to

another through cheques, drafts etc.

4. KEEPING OF VALUALES FOR SAFE CUSTODY: Banks accept the valuable articles and documents

for safe custody. They provide the locker facility. The customers keep their valuables in these

lockers.

5. ROLE AS A FINANCIAL INTERMEDIARY: Banks play the role of a middleman. They act as a linking

pin by making the borrowers and the lenders of money meet. People who have excess of funds

over income can deposit in the banks. Those who are in need of funds can approach to a bank

and can get the funds.

6. CATER TO NEEDS OF VARIOUS SEGMENTS OF THE SOCIETY: Banks not only cater to needs of

urban areas but also cater to the banking needs of the rural areas. RRBs set up in various parts

of the country. They provide banking and other credit facilities to the weaker sections of the

society.

7. CATALYTIC AGENT: Banks act as a catalytic agent by bringing about a change in the economy.

IDBI, SIDBI etc. provide funds for investment and development purposes. They help in the

development of the economy and bring about a change in the economy too.

You might also like

- Important Functions of Bank: What Is A Bank?Document3 pagesImportant Functions of Bank: What Is A Bank?Samiksha PawarNo ratings yet

- Commercial BankingDocument12 pagesCommercial BankingwubeNo ratings yet

- April 23 2021 12B, C, D, E, F, GChapter14BANKS NotesDocument16 pagesApril 23 2021 12B, C, D, E, F, GChapter14BANKS NotesStephine BochuNo ratings yet

- BRO - 4th BBADocument41 pagesBRO - 4th BBANithyananda PatelNo ratings yet

- Functions of BanksDocument8 pagesFunctions of BanksRanjeetha Vivek05No ratings yet

- Banking Functions and ServicesDocument7 pagesBanking Functions and ServicesMitali aroraNo ratings yet

- PanchatantraDocument10 pagesPanchatantraBinaya SahooNo ratings yet

- Banks Explained: Types, Functions and RolesDocument13 pagesBanks Explained: Types, Functions and RolesmohdportmanNo ratings yet

- Structure of Banking in IndiaDocument22 pagesStructure of Banking in IndiaTushar Kumar 1140No ratings yet

- TejshreeDocument51 pagesTejshreeSmily ShaikhNo ratings yet

- Ethiopian Banking Sector: 2.1. Organization and Structure of Ethiopian Banking Industry BanksDocument9 pagesEthiopian Banking Sector: 2.1. Organization and Structure of Ethiopian Banking Industry Banksመስቀል ኃይላችን ነውNo ratings yet

- Type of BanksDocument31 pagesType of BanksKasthuri SelvamNo ratings yet

- Unit 15: BanksDocument13 pagesUnit 15: BanksmohdportmanNo ratings yet

- Dhanalaxmi Bank Final Project Report by YkartheekgupthaDocument75 pagesDhanalaxmi Bank Final Project Report by YkartheekgupthaYkartheek GupthaNo ratings yet

- Commercial BankingDocument4 pagesCommercial Bankingsn nNo ratings yet

- Functions of Commercial Banks ReportDocument14 pagesFunctions of Commercial Banks ReportAryan Khan50% (2)

- Commercial Bankes in Sri LankaDocument15 pagesCommercial Bankes in Sri LankaRaashed RamzanNo ratings yet

- Chapter-2: Commercial BankDocument9 pagesChapter-2: Commercial Bankhasan alNo ratings yet

- Functions of BanksDocument3 pagesFunctions of BanksEbne FahadNo ratings yet

- Final Copy 1Document15 pagesFinal Copy 1gagana sNo ratings yet

- Chap 1. Banking System in IndiaDocument24 pagesChap 1. Banking System in IndiaShankha MaitiNo ratings yet

- Chapter Three Commercial Banking: 1 by SityDocument10 pagesChapter Three Commercial Banking: 1 by SitySeid KassawNo ratings yet

- Unit - Vii Commercial BanksDocument14 pagesUnit - Vii Commercial Bankssheetal rajputNo ratings yet

- Commercial Banking Functions and Role in Economic DevelopmentDocument28 pagesCommercial Banking Functions and Role in Economic DevelopmentDeepika. BabuNo ratings yet

- Banking Types and Functions in IndiaDocument64 pagesBanking Types and Functions in Indiaabhishekmohanty2No ratings yet

- Evolution of MoneyDocument9 pagesEvolution of MoneySenthil Kumar GanesanNo ratings yet

- Meaning of BankDocument56 pagesMeaning of BankDan John KarikottuNo ratings yet

- What Is BankDocument19 pagesWhat Is BankSunayana BasuNo ratings yet

- Chapter - : Money and Banking: Best Higher Secondary SchoolDocument11 pagesChapter - : Money and Banking: Best Higher Secondary Schoolapi-232747878No ratings yet

- 2-Notes On Banking Products & Services-Part 1Document16 pages2-Notes On Banking Products & Services-Part 1Kirti GiyamalaniNo ratings yet

- Measures to Reduce NPA in IndiaDocument29 pagesMeasures to Reduce NPA in IndiaYogesh ShankarNo ratings yet

- Chapter No.1: Banks and Scope of Banking: What Is Bank?Document58 pagesChapter No.1: Banks and Scope of Banking: What Is Bank?Manzoor HussainNo ratings yet

- Bank FundamentalsDocument7 pagesBank FundamentalsHAKUNA MATATANo ratings yet

- Banking Functions GuideDocument13 pagesBanking Functions Guideharesh KNo ratings yet

- Banking - ch-3333Document13 pagesBanking - ch-3333FantayNo ratings yet

- Private Sector BanksDocument3 pagesPrivate Sector BanksBalaji GajendranNo ratings yet

- GE - Money and Banking (443,449,508)Document16 pagesGE - Money and Banking (443,449,508)Kriti GandhiNo ratings yet

- Commercial BankDocument11 pagesCommercial BankVaibhavi BorhadeNo ratings yet

- UNIT 2 Process and DocumentationDocument27 pagesUNIT 2 Process and DocumentationAroop PalNo ratings yet

- Banking Pricnciples and Practices Lecture Notes ch3Document17 pagesBanking Pricnciples and Practices Lecture Notes ch3ejigu nigussieNo ratings yet

- Unit IiDocument29 pagesUnit IiMRIDUL JAINNo ratings yet

- Macro Economics LBA 402Document12 pagesMacro Economics LBA 402Harshita SarinNo ratings yet

- Letter of CreditDocument7 pagesLetter of CreditAnam AshfaqNo ratings yet

- Commercial Banking in IndiaDocument37 pagesCommercial Banking in Indiashaurya bandilNo ratings yet

- Eeim Unit 2 notes on central banks, commercial banks, monetary policy instrumentsDocument18 pagesEeim Unit 2 notes on central banks, commercial banks, monetary policy instrumentsRohidas JondhaleNo ratings yet

- KYC New ProjectDocument42 pagesKYC New ProjectNisha RathoreNo ratings yet

- Shaheem Final Project LAST WORKDocument69 pagesShaheem Final Project LAST WORKAshish WilsonNo ratings yet

- What is Banking? A Brief HistoryDocument26 pagesWhat is Banking? A Brief HistoryShikha KumariNo ratings yet

- Assignment 23550Document6 pagesAssignment 23550WondaferewChalaNo ratings yet

- What Is Credit Creation?Document6 pagesWhat Is Credit Creation?WondaferewChalaNo ratings yet

- What Is Credit Creation?Document6 pagesWhat Is Credit Creation?WondaferewChalaNo ratings yet

- What Are The Functions of Commercial Banks?Document8 pagesWhat Are The Functions of Commercial Banks?Anusha RaoNo ratings yet

- Unit-1 Banking and Insurance ManagementDocument25 pagesUnit-1 Banking and Insurance ManagementChandra sekhar VallepuNo ratings yet

- Session 3Document13 pagesSession 3Mohamed BadawyNo ratings yet

- F O C B ' B L: Unctions F Ommercial ANK S Anking AWDocument15 pagesF O C B ' B L: Unctions F Ommercial ANK S Anking AWRavi AnandNo ratings yet

- Idris AssignmentDocument8 pagesIdris AssignmentMuhammad IdrisNo ratings yet

- Bank Fundamentals: An Introduction to the World of Finance and BankingFrom EverandBank Fundamentals: An Introduction to the World of Finance and BankingRating: 4.5 out of 5 stars4.5/5 (4)

- Punjabi University Patiala 4th Sem Syllabus, 2010.Document43 pagesPunjabi University Patiala 4th Sem Syllabus, 2010.Hardeep SharmaNo ratings yet

- Pepsi BCG Matrix Analysis in Under 40Document2 pagesPepsi BCG Matrix Analysis in Under 40Munish PathaniaNo ratings yet

- SyllabusDocument74 pagesSyllabusMunish PathaniaNo ratings yet

- Management Control System PDFDocument14 pagesManagement Control System PDFAdnan MunirNo ratings yet

- Credit RiskDocument2 pagesCredit RiskMunish PathaniaNo ratings yet

- MCS of InfosysDocument7 pagesMCS of InfosysMunish PathaniaNo ratings yet

- Project Presentation ON: Paper Rock PicturesDocument18 pagesProject Presentation ON: Paper Rock PicturesMunish PathaniaNo ratings yet

- Feasibility AnalysisDocument13 pagesFeasibility AnalysisMunish PathaniaNo ratings yet

- Admin CodeDocument39 pagesAdmin CodeMunish PathaniaNo ratings yet

- Operational RiskDocument6 pagesOperational RiskMunish PathaniaNo ratings yet

- Import Public Class Public Static Void NullDocument1 pageImport Public Class Public Static Void NullMunish PathaniaNo ratings yet

- Concepts and Techniques: Data MiningDocument54 pagesConcepts and Techniques: Data MiningMunish PathaniaNo ratings yet

- Hardware and Software ConceptsDocument21 pagesHardware and Software ConceptsMunish PathaniaNo ratings yet

- HR Planning Ensures Right People at Right TimeDocument14 pagesHR Planning Ensures Right People at Right TimeMunish Pathania50% (2)

- Feasibility AnalysisDocument13 pagesFeasibility AnalysisMunish PathaniaNo ratings yet

- Perception of Customer Services Provided by Axis BankDocument45 pagesPerception of Customer Services Provided by Axis BankMunish Pathania100% (1)

- Structure of Commercial BanksDocument4 pagesStructure of Commercial BanksMunish PathaniaNo ratings yet

- Functions of RbiDocument4 pagesFunctions of RbiMunish PathaniaNo ratings yet

- Enterprise Resource Planning: Management Information Systems by Sahil RajDocument11 pagesEnterprise Resource Planning: Management Information Systems by Sahil RajMunish PathaniaNo ratings yet

- Credit Rating Project ReportDocument76 pagesCredit Rating Project ReportMunish Pathania0% (1)

- Presentation On Research Methodology: Coordinated By:-Anjali Amandeep Kaur Jyoti Amita Chandan SinghDocument11 pagesPresentation On Research Methodology: Coordinated By:-Anjali Amandeep Kaur Jyoti Amita Chandan SinghMunish Pathania100% (1)

- M 003Document23 pagesM 003Anthony De La CruzNo ratings yet

- Topic 5 - Cash and Cash Equivalent - Rev (Students)Document31 pagesTopic 5 - Cash and Cash Equivalent - Rev (Students)Novian Dwi Ramadana0% (1)

- Topic 1 Part 1 PDFDocument32 pagesTopic 1 Part 1 PDFsaherhcc4686100% (1)

- Financial Stability AssignmentDocument4 pagesFinancial Stability AssignmentSanjok Kc UnitedforeverNo ratings yet

- Description: Tags: RatesbylendersDocument187 pagesDescription: Tags: Ratesbylendersanon-968180No ratings yet

- MSRTC - Online Reservation System PDFDocument1 pageMSRTC - Online Reservation System PDFSiddhant GosaviNo ratings yet

- FINEX Board Resolutions SummaryDocument14 pagesFINEX Board Resolutions SummaryciryajamNo ratings yet

- Unc Dividend 2020 18 19Document51 pagesUnc Dividend 2020 18 19harsh bangurNo ratings yet

- BridgewaterDocument17 pagesBridgewaterMatthew Cain100% (2)

- Chapter 3 Exercise Adjusting EntriesDocument14 pagesChapter 3 Exercise Adjusting EntriesLy Chanraksmey100% (1)

- Financial ServicesDocument3 pagesFinancial ServicesAnZeerNo ratings yet

- Interest Rate Swaps Basics 1-08 USDocument6 pagesInterest Rate Swaps Basics 1-08 USbhagyashreeskNo ratings yet

- BillDesk Payment GatewayDocument1 pageBillDesk Payment GatewayDeba MalikNo ratings yet

- Mobile BankingDocument17 pagesMobile Bankingankitaneema87% (15)

- Union Bank: Personal BankingDocument3 pagesUnion Bank: Personal BankingBryan ParkerNo ratings yet

- Sanction Letter For ICICI Bank Car Loan Application of MITESHBHAI SARATANBHAI BHARVAD - NC002047354Document1 pageSanction Letter For ICICI Bank Car Loan Application of MITESHBHAI SARATANBHAI BHARVAD - NC002047354Sanjay SolankiNo ratings yet

- Modern Banking QuestionnaireDocument5 pagesModern Banking QuestionnaireCyano PremNo ratings yet

- Fintech in The Banking System of Russia Problems ADocument13 pagesFintech in The Banking System of Russia Problems Amy VinayNo ratings yet

- English Dot Work (2318251) Planning My Trip-Getting To Bogota-Andres RairanDocument2 pagesEnglish Dot Work (2318251) Planning My Trip-Getting To Bogota-Andres RairanAndres Santiago Rairan AcuñaNo ratings yet

- Landman Right of Way Agent in Oklahoma City OK Resume David ManningDocument2 pagesLandman Right of Way Agent in Oklahoma City OK Resume David ManningDavid ManningNo ratings yet

- Journal Entries & Correction of ErrorsDocument33 pagesJournal Entries & Correction of ErrorsSteven RaintungNo ratings yet

- FinMan-11 25Document92 pagesFinMan-11 25Jessa GalbadorNo ratings yet

- Monthly MIS FormatDocument19 pagesMonthly MIS FormatRajit SuriNo ratings yet

- Sap Fi ReportsDocument41 pagesSap Fi Reportssushilo_2100% (1)

- Ali Reza Iftekhar - A ProfileDocument2 pagesAli Reza Iftekhar - A ProfileAthena Hasin0% (1)

- Chapter 1Document20 pagesChapter 1Momentum PressNo ratings yet

- E Receipt For State Bank Collect PaymentDocument1 pageE Receipt For State Bank Collect PaymentAyush MukhopadhyayNo ratings yet

- Banking Regulation Act Objectives and Salient FeaturesDocument35 pagesBanking Regulation Act Objectives and Salient FeaturesM A MUBEEN 172919831047No ratings yet

- The Great Indian Bank RobberyDocument10 pagesThe Great Indian Bank RobberyJustin HallNo ratings yet

- Financial Management 1 Quiz CH2Document1 pageFinancial Management 1 Quiz CH2Trina Mae GarciaNo ratings yet