Professional Documents

Culture Documents

SISDO 2007 Final Annual Report Financial Statement

Uploaded by

nobleconsultants0 ratings0% found this document useful (0 votes)

51 views17 pagessisdo

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsisdo

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

51 views17 pagesSISDO 2007 Final Annual Report Financial Statement

Uploaded by

nobleconsultantssisdo

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 17

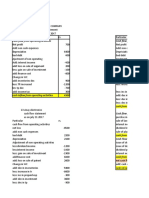

ANNUAL REPORT AND FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31ST DECEMBER 2007

CONTENTS PAGE

CORPORATE INFORMATION 2

REPORT OF THE DIRECTORS 3

STATEMENT OF DIRECTORS' RESPONSIBILITIES 4

REPORT OF THE INDEPENDENT AUDITOR 5

FINANCIAL STATEMENTS:

INCOME STATEMENT 6

BALANCE SHEET 7

STATEMENT OF CHANGES IN CAPITAL FUNDS 8

CASHFLOW STATEMENT 9

NOTES TO THE FINANCIAL STATEMENTS 10 -17

ANNUAL REPORT AND FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31ST DECEMBER 2007

CORPORATE INFORMATION

DIRECTORS: Ms. Miriam Cherogony: Chairperson

Mr. Austin T. Menya: Vice- Chairperson

Mr. Stephen M. Mirero : Treasurer

Mrs. Gladys N. Tarayia

Mr. John S. Kimathi

Mrs. Mwanjuma A. Abok

Dr. Roselyne Gakure

Mr. Henry Ikatukhu

Ms. Lillian A Owiti

REGISTERED OFFICE: Ngong Lane, off Ngong Road,

P.O. Box 76622-00508, NAIROBI

Phone: +254-20-3870280, 3864901

Fax: + 254-20-3871531

Cell: +254-722-200083, 736-175004

Email: sisdo@sisdo.org

Website: http\\:www.sisdo.org

AUDITORS: Wachira Irungu & Associates

Dominion House, Westlands

P.O. Box 46671 - 00100

Nairobi, Kenya

BANKERS: Co-operative Bank of Kenya Co-operative Bank of Kenya

Nairobi Business Centre, P.O. Box 1250-90100,

P.O. Box 19555-00202. MACHAKOS.

NAIROBI.

Co-operative Bank of Kenya Kenya Commercial Bank

P.O. Box 12253-10100, P.O. Box 7014,

NYERI. CHUKA.

Co-operative Bank of Kenya National Bank of Kenya

P.O. Box 101-60400, P.O. Box 240

CHUKA. LIMURU.

Kenya Commercial Bank

P.O. Box 65659-00400,

MILIMANI, NAIROBI.

2

ANNUAL REPORT AND FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31ST DECEMBER 2007

REPORT OF THE DIRECTORS

1 FINANCIAL STATEMENTS

The directors have the pleasure in presenting their report together with the audited Financial Statements for the year

ended 31st December 2007.

2 PRINCIPAL ACTIVITY

The principal activity of the organisation is lending to small-income earners two major types of loans, namely business and

agriculture loans both of which are based on the group lending methodology. Existing borrowers are entitled to add-on

loans to cover school fees, emergencies and asset financing.

3 RESULTS

The results for the year are set out on page 6.

4 DIRECTORS

The directors who held office during the year are shown on page 2.

6 AUDITORS

M/s Wachira Irungu & Associates were appointed during the year and have expressed their willingness to continue in

office in accordance with section 159(2) of the Kenyan Companies Act (Cap 486).

BY THE ORDER OF THE BOARD

SECRETARY----------------------------------------

DATE---------------------------------------

3

ANNUAL REPORT AND FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31ST DECEMBER 2007

STATEMENT OF THE DIRECTORS' RESPONSIBILITIES

The Non-Governmental Organisation (NGO) Coordination Act requires the directors to prepare financial

statements for each financial year, which give a true and fair view of the state of the financial affairs of the

company as at the end of the financial year and of its operating results for that year.It also requires the directors

to ensure that the company keeps proper accounting records which disclose with reasonable accuracy at any

time, the financial position of the company.They are also responsible for safeguarding the assets of the

organisation.

The directors are responsible for the preparation of these financial statements in accordance with International

Financial Reporting Standards. This responsibility includes: designing, implementing and maintaining internal

controls relevant to the preparation and fair presentation of financial statements that are free from material

misstatement, whether due to fraud or error, selecting and applying appropriate accounting policies, and

making accounting estimates that are reasonable in the circumstances.

The directors accept responsibility for the annual financial statements, which have been prepared using

appropriate accounting policies supported by reasonable and prudent judgements and estimates, in conformity

with International Financial Reporting Standards and the requirements of the NGO Coordination Act. The

directors are of the opinion that the financial statements give a true and fair view of the state of the financial

affairs of theorganisation and of its operating results. The directors further accept responsibility for the

maintenance of accounting records which may be relied upon in the preparation of financial statements, as

well as adequate systems of internal financial control.

Nothing has come to the attention of the directors to indicate that the organisation will not remain a going

concern for at least twelve months from the date of this statement.

DIRECTOR. DATE.

DIRECTOR. DATE.

4

ANNUAL REPORT AND FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31ST DECEMBER 2007

REPORT OF THE INDEPENDENT AUDITORS TO MEMBERS OF SISDO

REPORT ON FINANCIAL STATEMENTS

DIRECTORS' RESPONSIBILITY FOR THE FINANCIAL STATEMENTS

AUDITOR'S RESPONSIBILITY

as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have

obtained is sufficient and appropriate to provide a basis for our audit opinion.

OPINION

CERTIFIED PUBLIC ACCOUNTANTS

DOMINION HOUSE, MUTHITHI ROAD

P.O. BOX 46671 - 00100

NAIROBI

DATE:....

We have audited the accompanying financial statements of Smallholder Irrigation Scheme Development Organisation (SISDO) set

out on pages 6 to 17 which comprise the balance sheet as at 31st December 2007, and the income statement, the statement of

changes in capital funds and cash flow statement for the year then ended, and a summary of significant accounting policies and

other explanatory notes and have obtained all the information and explanations which to the best of our knowledge and belief were

necessary for the purposes of our audit.

The directors are responsible for the preparation and fair presentation of these financial statements in accordance with International

Financial Reporting Standards and the requirements of the NGO Coordination Act. This responsibility includes designing,

implementing and maintaining internal control relevant to the preparation and fair presentation of financial statements that are free

from material misstatement, whether due to fraud or error, selecting and applying appropriate accounting policies and making

accounting estimates that are reasonable in the circumstances. The NGO Coordination Act also requires the directors to ensure that

the organisation maintains proper books of accounts which are in agreement with the balance sheet and profit and loss account.

Our responsibility is to express an independent opinion on these financial statements based on our audit. We conducted our audit in

accordance with International Standards on Auditing. Those standards require that we comply with ethical requirements and plan

and perform the audit to obtain reasonable assurance whether the financial statements are free from material misstatement. An

audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The

procedures selected depend on our judgement, including the assessment of the risks of material misstatements of the financial

statements, whether due to fraud or error. In making those risk assessments, we considered the internal control relevant to the

organisation's preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in

the circumstances, but not for the purpose of expressing an opinion on the effectiveness of organisation's internal control. An audit

also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by

the directors,

In our opinion, the financial statements give a true and fair view of the state of financial affairs of the organisation at 31st December

2007 and of its financial performance and cash flows for the year then ended in accordance with International Financial Reporting

Standards and the NGO Coordination Act.

Wachira Irungu & Associates

5

FINANCIAL STATEMENTS FOR THE YEAR

ENDED 31ST DECEMBER 2007

INCOME STATEMENT

2007 2006

Restated

Note Kshs Kshs

Income 2 61,915,713 33,592,944

Operating Expenses 3 69,227,486 42,883,456

Operating Loss (7,311,773) (9,290,512)

Grants Received 7 3,098,736 6,107,785

Finance Costs 4 7,226,906 3,633,143

Net Loss for the Year (11,439,943) (6,815,870)

6

FINANCIAL STATEMENTS FOR THE YEAR ENDED

31ST DECEMBER 2007

BALANCE SHEET

2007 2006

Restated

Note Kshs Kshs

ASSETS

Non Current Assets

Property, Equipment & Software 1 (d) & 5 23,319,488 20,951,068

Intangible Assets 1 (e) & 6 2,645,265 109,396

25,964,752 21,060,464

Current Assets

Net Outstanding Loans 8 215,985,108 135,451,491

Other Receivables and Prepayments 9 2,684,609 1,534,084

Cash & Cash Equivalents 10 32,164,633 44,427,378

250,834,350 181,412,953

TOTAL ASSETS 276,799,102 202,473,417

FUNDS AND LIABILITIES

Capital Funds

Revolving Loan Fund 11 53,723,173 53,723,173

General Fund 12 (6,656,767) 4,783,176

47,066,406 58,506,349

Non-Current Liabilities

Long-term loans 13 61,000,000 31,000,000

61,000,000 31,000,000

Current Liabilities

Short-term loans 14 6,200,000 9,033,335

Collateral Deposits 15 155,476,880 102,894,832

Trade and Other Payables 16 7,055,816 1,038,901

168,732,696 112,967,068

TOTAL EQUITY AND LIABILITIES 276,799,102 202,473,417

The Financial Statements on pages 6 to 17 were approved for issue by the directors

on__________________ and signed on their behalf by:

DIRECTOR: ________________________

DIRECTOR: ________________________

7

FINANCIAL STATEMENTS FOR THE YEAR

ENDED 31ST DECEMBER 2007

STATEMENT OF CHANGES IN CAPITAL FUNDS

Revolving

Loan Fund

Property &

Equipment

Fund

Vehicle

Fund

Accumulated

Fund Total

Kshs

Kshs Kshs Kshs

Kshs

At 01/01/2006 53,723,173 1,299,181 2,621,426 7,506,747 65,150,527

Deficit for the Year- Restated - - - (6,815,870) (6,815,870)

Transfer to Property Fund - 7,000,000 - (7,000,000) -

Prior Year Items - - - 171,692 171,692

Transfer to/(from) Accumulated

Fund - 819,361 17,174 (836,535) -

At 31/12/2006 53,723,173 9,118,542 2,638,600 (6,973,966) 58,506,349

At 01/01/2007 53,723,173 9,118,542 2,638,600 (6,973,966) 58,506,349

Deficit for the Year - - - (11,439,943) (11,439,943)

Transfer to/ (from)

Accumulated Fund - 2,858,306 13,406 (2,871,712) -

At 31/12/2007 53,723,173 11,976,848 2,652,006 (21,285,622) 47,066,406

8

FINANCIAL STATEMENTS FOR THE YEAR

ENDED 31ST DECEMBER 2007

CASHFLOW STATEMENT

2007 2006

Restated

Note Kshs Kshs

Net Cash Used in Operations 17 (27,935,717) (13,390,341)

Investing Activities

Investment Income 397,324 -

Interest received - 1,260,142

Purchase of Property & Equipment 5 (3,904,346) (20,479,495)

Acquisition of computer software 6 (3,858,501) (164,094)

Net cash used in investing activities (7,365,523) (19,383,447)

Financing Activities

Bank loans received 30,000,000 37,200,000

Bank loan repayment (2,833,336) (4,761,904)

Interest on borrowings paid (4,376,778) (1,929,407)

Interest on collateral deposits (2,297,687) (1,703,736)

Loan processing fees (552,440) -

Grants received 3,098,736 6,107,785

Net cash generated from financing Activities 23,038,495 34,912,738

Net (Decrease)/ Increase in

Cash and Cash Equivalents (12,262,745) 2,138,950

Cash and cash equivalents at the beginning of the year 44,427,378 42,288,428

Cash and Cash Equivalents at the End of the Year 9 32,164,633 44,427,378

9

FINANCIAL STATEMENTS FOR THE YEAR

ENDED 31ST DECEMBER 2007

NOTES TO THE FINANCIAL STATEMENTS

1 Summary of significant accounting policies

The principal accounting policies adopted in the preparation of these financial statements are set out below.

a) Basis of Preparation

The financial statements are prepared in accordance with International Financial Reporting Standards(IFRS). The financial

statements are presented in Kenya Shillings (Kshs) and are prepared under the historical cost basis of accounting.

The preparation of financial statements in conformity with IFRS requires the use of assumptions that affect the reported

amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses

during the reported period. It also requires the directors to exercise judgement in the process of applying the company's

accounting policies. These policies have been consistently applied during the year unless otherwise stated.

b) Revenue Recognition

Interest on loans is recognised when the amount is received with effect from 1st January 2007. Prior to this date, interest was

being recognised on accrual basis.

c) Change of an accounting policy

During the year under review, the management considered it more prudent to recognise as income interest on loans only when

this is actually received by the organisation. This is a major departure from prior reported periods whereby interest on loan

earned but not yet received was recognised as income receiveable for the period. The decision was informed by the experience

that much of this interest receiveable is not subsequently collected. The effect of this change was to write off the deferred

interest income amounting to Kshs 25,655,000 against the loans receivable as on 31/12/2007.

d) Property & Equipment

Property & Equipment are stated at historical cost less accumulated depreciation. Depreciation is calculated on a reducing

balance method to write down their cost or revalued amounts to their residual values over their estimated useful lives using

the following annual rates:

Rate

Land Nil

Buildings 2.5%

Office equipment, furniture & fittings 12.5%

Computers 33%

Gains and losses on disposal of property & equipment are determined by reference to their carrying amounts and are taken

into account in determining operating profit.

e) Intangible Assets

Intangible Assets comprise the cost of purchased computer software programs. Costs incurred on computer software are

initially accounted for at cost as intangible assets and subsequently at cost less any accumulated amortisation and accumulated

impairment losses. Intangible assets are amortised on a reducing balance basis over their expected useful life of 3 years.

f) Employee Benefits

The organisation and all its employees contribute to the National Social Securiy Fund (NSSF), which is a defined contribution

scheme registered under the National Social Security Act. The company's obligations under the scheme are limited to

specific contributions legislated from time to time and are currently limited to a maximum of Kshs 200 per employee per

month. The company's obligations are recognised in the income statement as they fall due.

10

FINANCIAL STATEMENTS FOR THE YEAR

ENDED 31ST DECEMBER 2007

NOTES TO THE FINANCIAL STATEMENTS (CONT'D)

g) Financial Instruments

Financial assets and financial liabilities are recognised on the entity's balance sheet when the institution has become a party to the contractual

provisions of the instrument.

Loans and receivables originated by the organisation

Loans and receivables are carried at anticipated realisable value. An estimate is made for doubtful receivables based on the review of all outstanding

amounts at the year end. In addition, general provisions are maintained based on managements evaluation of the portfolio of loans to SISDO's customers

and other exposures in respect of losses which, although not specifically identified, are known from experience to be present in any such portfolio.

When a loan is deemed uncollectable it is written off against the related bad debt provision and/ collateral deposits from the customer held by the organisation.

Subsequent recoveries of loans that have been written off are credited to the income statement.

Trade and Other Payables

Trade and other payables are stated at their nominal value.

Borrowings

Interest-bearing loans and bank overdrafts are recorded at the proceeds received, net of direct issue costs. Finance charges, including premiums payable

on settlement or redemption, are accounted for on an accrual basis and are added to the carrying amount of the instrument to the extent that they are not

settled in the period in which they arise. Borrowing costs are charged to the income statement when incurred.

h) Impairment

At each balance sheet date, the company reviews the carrying amounts of its financial assets, tangible and intangible assets to determine whether there is

any indication that those assets have suffered an impairement loss. If any such indications exists, the recoverable amounts of the assets are estimated and

an impairment loss is recognised in the income statement whenever the carrying amount of the asset exceeds its recoverable amount.

i) Critical Judgements and Estimates

In the process of applying the company's accounting policies, management has made estimates and assumptions that affect the reported amounts of

assets and liabilities within the next financial period. Estimates and judgements are continually evaluated and are based on historical experience and other

factors including expectations of future events that are believed to be reasonable under the circumstances. These are dealt with below:

Equipment

Critical estimates are made by the directors in determining the useful lives and depreciation rates for equipment.

Impairement

If an indication exists that the company's assets have suffered an impairement loss at the balance sheet date, the directors estimate the asset's

recoverable amount.

j) Cash & Cash Equivalents

For the purpose of the cashflow statement, cash and cash equivalents comprise cash in hand and bank balances.

k) Comparatives

Where necessary, comparative figures have been adjusted to conform with changes in presentation in the current year. In particular, comparative figures

have been adjusted to comply with the presentation as per the International Financial Reporting Standards.

11

FINANCIAL STATEMENTS FOR THE YEAR

ENDED 31ST DECEMBER 2007

NOTES TO THE FINANCIAL STATEMENTS (CONT'D)

2007 2006

Restated

Kshs Kshs

2 Income

a) Interest on loans 54,698,085 28,295,089

b) Other income

Loan application fees 4,496,791 2,201,873

Bank interest - 954,052

Registration fees 964,410 760,320

Passbook fees 790,166 643,501

Bad debts recovered 336,564 383,530

Investment income 397,325 306,090

Penalties and exit fees 232,372 48,489

7,217,628 5,297,855

61,915,713 33,592,944

3 Operating Expenses

Personnel 29,717,101 22,410,983

Bad debts written off 3,232,515 1,576,936

Transport and travel 4,844,755 2,762,205

Rent & rates 1,101,785 1,749,524

Board travel 1,514,628 1,646,184

Stationery and printing 1,643,035 1,309,331

Communication 1,873,036 1,219,490

Training 1,185,386 1,122,108

Office expenses 700,840 534,229

Bank charges 1,069,311 501,400

Advertisement & publicity 498,405 442,705

Licenses and permits 486,590 291,500

Client mobilization & market research 125,100 228,350

Electricity and water 242,511 190,603

Provision for audit fees 200,000 196,040

Security 144,000 195,024

Legal fees 37,450 183,850

Repairs & Maintenance 314,281 175,471

Subscription 84,800 147,300

Consultancy 121,429 607,470

Insurance 54,126 52,513

Transformation costs 210,809 -

Performance incentives and awards 378,107 208,788

Foreign exchange loss 577,970 -

Evaluation costs 876,288 -

Provision for bad and doubtful debts 15,134,668 4,249,146

Provision for depreciation 1,535,927 827,608

Amortisation of intangible assets 1,322,632 54,698

69,227,486 42,883,456

12

FINANCIAL STATEMENTS FOR THE YEAR

ENDED 31ST DECEMBER 2007

NOTES TO THE FINANCIAL STATEMENTS (CONT'D)

2007 2006

Kshs Kshs

4 Finance Costs

Interest on borrowings 4,376,778 1,929,407

Loan processing fees 552,440 -

Interest on collateral deposits 2,297,688 1,703,736

7,226,906 3,633,143

5 Property & Equipment

COST/VALUATION Land Building

Office

Equipment,

Furniture &

Fittings Computers Totals

Kshs. Kshs. Kshs. Kshs Kshs.

At 01/01/2006 - - 1,007,755 1,062,741 2,070,496

Additions 14,720,010 4,000,000 669,755 1,253,824 20,643,589

At 31/12/2006 14,720,010 4,000,000 1,677,510 2,316,565 22,714,085

At 01/01/2007 14,720,010 4,000,000 1,677,510 2,316,565 22,714,085

Transfers to Intangible assets ( Note 6) - - - (164,094) (164,094)

Additions - 962,002 422,254 2,520,090 3,904,346

At 31/12/2007 14,720,010 4,962,002 2,099,764 4,672,561 26,454,337

DEPRECIATION

At 01/01/2006 - - 276,163 495,152 771,315

Charge for the year - 100,000 175,168 607,138 882,306

On transfers - - - (54,698) (54,698)

At 31/12/2006 - 100,000 451,331 1,047,592 1,598,923

At 01/01/2007 - 100,000 451,331 1,047,592 1,598,923

Charge for the year - 121,550 206,054 1,208,323 1,535,927

At 31/12/2007 - 221,550 657,385 2,255,915 3,134,850

NET BOOK VALUE

At 31/12/2007 14,720,010 4,740,452 1,442,379 2,416,646 23,319,487

At 31/12/2006 14,720,010 3,900,000 1,226,179 1,104,879 20,951,068

During the year, computer software was re-categorised as an intangible asset (Note 6) so as to comply

with IAS 38.

13

FINANCIAL STATEMENTS FOR THE YEAR

ENDED 31ST DECEMBER 2007

NOTES TO THE FINANCIAL STATEMENTS (CONT'D)

2007 2006

Restated

Kshs Kshs

6 Intangible Assets

Cost

At 1st January 164,094 -

Additions 3,858,501 164,094

At 31st December 4,022,595 164,094

Amortisation

At 1st January 54,698 -

Charge for the year 1,322,632 54,698

At 31st December 1,377,330 54,698

Net Book Value

At 31st December 2,645,265 109,396

7 Grants Received

Oxfam Novib 2,767,236 6,107,785

Oxfam International 331,500 -

3,098,736 6,107,785

8 Net Outstanding Loans

Micro-entreprise 198,637,019 121,417,101

Agriculture 29,426,142 38,758,583

Agri-business 6,713,556 5,868,921

Other products 4,588,556 3,307,383

Gross loans receivable 239,365,273 169,351,988

Deferred interest income derecognised (Note 1(c ). - (25,655,000)

Loan loss provision (23,380,165) (8,245,497)

215,985,108 135,451,491

9 Other Receivables and Prepayments

Staff car-loans 1,070,676 428,722

Rent deposits 384,156 347,656

Prepayments 1,081,214 714,873

Sundry debtors 64,944 32,204

Field staff travel imprest 83,619 10,629

2,684,609 1,534,084

10 Cash and Cash Equivalents

For purposes of the cashflow statement, cash and cash equivalents comprise

of the following:

Bank balances 32,149,853 6,171,288

Fixed deposits - 27,950,000

Money market fund - 10,306,090

Petty cash in hand 14,780 -

32,164,633 44,427,378

11 Revolving Fund

Balance at 31st December 53,723,173 53,723,173

This represents funds received from donors for on-lending.

14

FINANCIAL STATEMENTS FOR THE YEAR

ENDED 31ST DECEMBER 2007

NOTES TO THE FINANCIAL STATEMENTS (CONT'D)

2007 2006

Restated

Kshs Kshs

12 General Fund

Balance brought forward 4,783,176 11,427,354

Prior year adjustment - 171,692

Net loss for the year (11,439,943) (6,815,870)

Balance at 31st December (6,656,767) 4,783,176

13 Long-term Loans

Oxfam Novib- Long term loan 31,000,000 31,000,000

MESPT loan 30,000,000 -

61,000,000 31,000,000

Oxfam Novib loan is secured by SISDO's portfolio for a total amount of 150% of the outstanding loan plus interest

due in favour of the lender. The loan is repayable in six equal capital instalments, commencing 31/12/2007.

Interest is charged at a rate of 6% plus the yearly rate of inflation in Kenya; but the maximum rate is fixed at 11%

per annum.

MESPT loan is secured by a floating debenture over all of SISDO's assets, book debts and property. The loan is

repayable in 3 years from the date of disbursement. Interest is charged at a flat rate of 5% per annum subject to

change depending on the prevailing market conditions.

2007 2006

Kshs Kshs

14 Short-term Loans

Oxfam Novib- Short term loan 6,200,000 6,200,000

Jitegemee trust loan - 2,833,335

6,200,000 9,033,335

15 Collateral Deposits

Balance at 31st December 153,179,192 101,191,096

Provision for interest payable on the deposits 2,297,688 1,703,736

155,476,880 102,894,832

16 Trade and Other Payables

Trade payables 401,045 -

Accrued expenses 2,819,837 781,051

Other payables 3,577,084 -

Contingent liability (Note 20) 257,850 257,850

7,055,816 1,038,901

15

FINANCIAL STATEMENTS FOR THE YEAR

ENDED 31ST DECEMBER 2007

NOTES TO THE FINANCIAL STATEMENTS (CONT'D)

2007 2006

Restated

Kshs Kshs

17 Cash Generated From Operations

Operating loss (7,311,773) (9,290,512)

Adjustments for:

Depreciation 1,535,927 827,608

Amortisation 1,322,632 54,698

Investment Income (397,324) (306,090)

Interest income - (954,042)

Prior year adjustment - 171,692

Operating Loss Before Working Capital Changes (4,850,538) (9,496,646)

Increase in loans to customers (80,533,617) (46,693,882)

(Increase)/decrease in other receivables & prepayments (1,150,525) 694,744

Increase in trade and other payables 6,016,915 385,552

Increase in deferred interest income - 6,202,793

Increase in collateral deposits 52,582,048 35,517,098

Net Cash Used in Operations (27,935,717) (13,390,341)

18 Financial Risk Management Objectives and Policies

The organisation's activities expose it to a variety of financial risks, including credit risk and the effects of

changes in foreign currency exchange rates and interest rates. The organisations overall risk management

programme focuses on the unpredictability of financial markets and seeks to minimise potential adverse

effects on its financial performance, but the organisation does not hedge any risks.

Risk management is carried out by the management of the organisation in accordance with policies approved

by the Board of Directors.

Foreign exchange risk

The organisation's operations are predominantly in Kenya, where the currency has remained relatively stable

against major convertible currencies.A significant portion of the organisations borrowings and grants are

denominated in foreign currencies, and is therefore exposed to foreign exchange risk arising from various

currency exposures, primarily with respect to the US dollar and Euro. Foreign exchange risk arises from future

commercial transactions, and recognised assets and liabilities.

Credit risk

The organisation takes on exposure to credit risk, which is the risk that a counter party will be unable to pay

amounts in full, when due. The organisation structures the levels of credit risk it undertakes by placing limits

on amounts of risk accepted in relation to one borrower or group of borrowers. Such risks are monitored on a

revolving basis and subject to annual or more frequent review.

The organisation's credit risk is concentrated on low-income earners of the economy engaged in smallholder

crop and dairy farming, agribusiness and other micro-enterprises. Exposure to credit risk is managed

through regular analysis of the ability of borrowers and potential borrowers to meet interest and capital

repayment obligations and by changing lending limits where appropriate. Exposure to credit risk is also

managed in part by obtaining collateral and group guarantees.

16

FINANCIAL STATEMENTS FOR THE YEAR

ENDED 31ST DECEMBER 2007

NOTES TO THE FINANCIAL STATEMENTS (CONT'D)

18 Financial Risk Management Objectives and Policies (cont'd)

Liquidity risk

Prudent liquidity risk management includes maintaining sufficient cash balances to cover anticipated deposit

refunds to exiting customers and loan repayment instalments that fall due. Excess liquid funds are invested

in assets that can be easily liquidated.

Operational Risk

The company is exposed to operational risk which is associated with human error, system failures and

inadequate procedures and controls. The company ensures that there is an effective, integrated

operational risk management framework that incorporates a clearly defined organizational structure, with

defined roles and responsibilities for all aspects of operational risk.

19 Restatement of prior year comparatives

This relates to corrections made to opening balances of various items so as to fairly state them in the

current year.

20 Contingent Liabilities

A former employee sued the organisation fpr alleged wrong computation of his terminal benefits. The matter

is pending in court and the expected contingent liability of Kshs. 257,850, has been provided for.

(2006: Kshs. 257,850)

21 Foreign Currency

Transactions during the year in foreign currencies are translated at the rates ruling at the dates of the

transactions. Assets and liabilities denominated in foreign currencies at the end of the year are translated

at the rates of exchange ruling at the balance sheet date. Gains and losses on exchange are dealt with in

the income statement in the year in which they arise.

22 Incorporation

The organisation is domiciled and registered in Kenya as a Non Governmental Organisation (NGO) under

the Non- Governmental Organisations Coordination Act, 1990.

23 Currency

The financial statements are expressed in Kenya Shillings(Kshs).

17

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Athleta DCF and VC Model V1 DraftDocument19 pagesAthleta DCF and VC Model V1 Draftuygh g100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Installation Certificate for Vehicle Tracking DeviceDocument1 pageInstallation Certificate for Vehicle Tracking DevicenobleconsultantsNo ratings yet

- Cash Flow StatementDocument4 pagesCash Flow StatementRavina Singh100% (1)

- (MR Paul A Taylor) Consolidated Financial Reportin PDFDocument385 pages(MR Paul A Taylor) Consolidated Financial Reportin PDFMarcel Coșcodan100% (1)

- The Constitution For Rabi High SchoolDocument6 pagesThe Constitution For Rabi High SchoolnobleconsultantsNo ratings yet

- Bob - Zhang ImportingDocument1 pageBob - Zhang ImportingnobleconsultantsNo ratings yet

- Ombi La Kutaka Paspoti Ya Kenya Application For A Kenya PassportDocument4 pagesOmbi La Kutaka Paspoti Ya Kenya Application For A Kenya PassportnobleconsultantsNo ratings yet

- Ombi La Kutaka Paspoti Ya Kenya Application For A Kenya PassportDocument4 pagesOmbi La Kutaka Paspoti Ya Kenya Application For A Kenya PassportnobleconsultantsNo ratings yet

- Assure Solutions Cert PDFDocument1 pageAssure Solutions Cert PDFnobleconsultantsNo ratings yet

- 156quote TBL 21062018Document2 pages156quote TBL 21062018nobleconsultantsNo ratings yet

- Ombi La Kutaka Paspoti Ya Kenya Application For A Kenya PassportDocument4 pagesOmbi La Kutaka Paspoti Ya Kenya Application For A Kenya PassportnobleconsultantsNo ratings yet

- Assure Solutions CertDocument1 pageAssure Solutions CertnobleconsultantsNo ratings yet

- Legal Responses To Rape in MarriageDocument74 pagesLegal Responses To Rape in MarriagenobleconsultantsNo ratings yet

- Ombi La Kutaka Paspoti Ya Kenya Application For A Kenya PassportDocument4 pagesOmbi La Kutaka Paspoti Ya Kenya Application For A Kenya PassportnobleconsultantsNo ratings yet

- Legal Responses To Rape in MarriageDocument74 pagesLegal Responses To Rape in MarriagenobleconsultantsNo ratings yet

- Inv 1079715Document1 pageInv 1079715nobleconsultantsNo ratings yet

- Application FormDocument15 pagesApplication FormnobleconsultantsNo ratings yet

- Assure Solutions CertDocument1 pageAssure Solutions CertnobleconsultantsNo ratings yet

- LC at Sight-ContractDocument4 pagesLC at Sight-Contractnobleconsultants100% (1)

- Besos Wines and Spirit-FinancialsDocument3 pagesBesos Wines and Spirit-FinancialsnobleconsultantsNo ratings yet

- Noble ConsultantsDocument6 pagesNoble ConsultantsnobleconsultantsNo ratings yet

- Last 3 PagesDocument3 pagesLast 3 PagesnobleconsultantsNo ratings yet

- SEO-Optimized Title for Ramadhan Hardware Business PlanDocument11 pagesSEO-Optimized Title for Ramadhan Hardware Business PlannobleconsultantsNo ratings yet

- Mayfox Company Profile1Document20 pagesMayfox Company Profile1nobleconsultantsNo ratings yet

- Kosso Square LogsDocument2 pagesKosso Square LogsnobleconsultantsNo ratings yet

- SEO-Optimized Title for Ramadhan Hardware Business PlanDocument11 pagesSEO-Optimized Title for Ramadhan Hardware Business PlannobleconsultantsNo ratings yet

- Commercial in VoiceDocument1 pageCommercial in VoicenobleconsultantsNo ratings yet

- Bank Research TopicsDocument13 pagesBank Research TopicsnobleconsultantsNo ratings yet

- Biochac Co LTDDocument15 pagesBiochac Co LTDnobleconsultantsNo ratings yet

- Tax and Compliance PitchDocument1 pageTax and Compliance PitchnobleconsultantsNo ratings yet

- The Relationship Between Effectiveness of Internal Audit Function and Financial Performance, Evidence From The Nairobi Securities ExchangeDocument2 pagesThe Relationship Between Effectiveness of Internal Audit Function and Financial Performance, Evidence From The Nairobi Securities ExchangenobleconsultantsNo ratings yet

- Insatep Company Profile PDFDocument10 pagesInsatep Company Profile PDFnobleconsultantsNo ratings yet

- Mineralogy and Possible Genesis of Metallic Mineralization in The Kenyan CoastDocument1 pageMineralogy and Possible Genesis of Metallic Mineralization in The Kenyan CoastnobleconsultantsNo ratings yet

- Angler Gaming Reports Record Q1 RevenuesDocument9 pagesAngler Gaming Reports Record Q1 RevenuesAnton HenrikssonNo ratings yet

- ch01 ProblemsDocument7 pagesch01 Problemsapi-274120622No ratings yet

- MK - Kuliah MM 2-20Document33 pagesMK - Kuliah MM 2-20Dewi Murni Susanti100% (1)

- Midterm F13 Partial Final f13 For Posting Fall 14 7Document13 pagesMidterm F13 Partial Final f13 For Posting Fall 14 7Miruna CiteaNo ratings yet

- E-Rickshaw Business Loan ApplicationDocument29 pagesE-Rickshaw Business Loan ApplicationPawan KumarNo ratings yet

- Lebanese Association of Certified Public Accountants - IFRS KEY July Exam 2019Document5 pagesLebanese Association of Certified Public Accountants - IFRS KEY July Exam 2019jad NasserNo ratings yet

- EFM Simple DCF Model 4Document3 pagesEFM Simple DCF Model 4Anonymous xv5fUs4AvNo ratings yet

- Cash Flow StatementDocument12 pagesCash Flow StatementChikwason Sarcozy MwanzaNo ratings yet

- Jawapan Chapter 3Document7 pagesJawapan Chapter 3wawan0% (2)

- FinMan Financial Statement and Ratio AnalysisDocument8 pagesFinMan Financial Statement and Ratio AnalysisJames BarzoNo ratings yet

- Financial Ratios Analysis of Sample StatementsDocument20 pagesFinancial Ratios Analysis of Sample StatementsAlyssa Nikki VersozaNo ratings yet

- Summaries of International Accounting StandardsDocument69 pagesSummaries of International Accounting Standardsmaryam rajputtNo ratings yet

- Latihan Soal AkuntansiDocument5 pagesLatihan Soal Akuntansiabe cedeNo ratings yet

- Chapter 2 Far 2Document7 pagesChapter 2 Far 2Crestina100% (1)

- Midterm Examination in Auditing and Assurance Concepts and Applications Part 1Document10 pagesMidterm Examination in Auditing and Assurance Concepts and Applications Part 1Maricar PinedaNo ratings yet

- NGO Audited Documents Balance Sheet and Profit and Loss A CDocument27 pagesNGO Audited Documents Balance Sheet and Profit and Loss A Cvikash1905No ratings yet

- Consolidation IIIDocument36 pagesConsolidation IIIMuhammad Asad100% (1)

- Sap Fico NotesDocument42 pagesSap Fico NotesRama KrishnaNo ratings yet

- June 2019Document182 pagesJune 2019shankar k.c.No ratings yet

- Activity ThreeDocument2 pagesActivity ThreePrincess CondesNo ratings yet

- Appendix BDocument5 pagesAppendix Bowenish9903No ratings yet

- Quiz 3 Accounting Equation Without AnswerDocument5 pagesQuiz 3 Accounting Equation Without AnswerHello Kitty100% (1)

- Fin Acc Exam CompilationDocument27 pagesFin Acc Exam CompilationRiza100% (1)

- 6.1. Financial Requirements: Chapter - Six Financing Small BusinessDocument9 pages6.1. Financial Requirements: Chapter - Six Financing Small BusinessMelody LisaNo ratings yet

- Ind As & Ifrs Unit 3Document10 pagesInd As & Ifrs Unit 3Dhatri LNo ratings yet

- Annual Report 2015 PDFDocument232 pagesAnnual Report 2015 PDFHasnain QaiyumiNo ratings yet

- Test 2 SolutionDocument8 pagesTest 2 SolutionFelicia ChinNo ratings yet