Professional Documents

Culture Documents

Amount of Cash Flow From Operating Activity

Uploaded by

AfreenAfrin0 ratings0% found this document useful (0 votes)

40 views2 pagesACC GODREJ

Original Title

ACC

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentACC GODREJ

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

40 views2 pagesAmount of Cash Flow From Operating Activity

Uploaded by

AfreenAfrinACC GODREJ

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

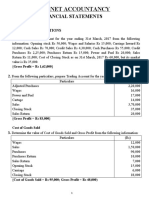

5.

Statement of cash flows

Amount of cash flow from Operating Activity:

Profit Before Tax 124.88

Adjustments for :

Depreciation 24.61

Unrealised Foreign Exchange revaluation 0.15

Profit on Sale of Investments 80.30

Loss on Sale of Fixed Assets 0.14

Profit on Assignment of Trademark 25.00

Dividend Income 86.01

Interest Income 26.31

Interest Expense 94.84

Employee Stock Option Compensation 3.47

(Write-back) / Provision for Diminution in

Value of Investments/Loans and

Advances 4.50

Write back for Doubtful Debts and

Sundry Balances (net) 6.37

Operating Profit Before Working Capital Changes 19.60

Adjustments for :

Inventories 97.29

Trade and Other Receivables 3.98

Trade Payables and Other Liabilities

and Provisions 179.13

Cash Generated from Operations 97.46

Direct Taxes Paid 5.30

Net Cash Generated from Operating Activities 92.16

Cash Flow from Investing Activities :

Purchase of Fixed Assets 228.51

Proceeds from Sale of Fixed Assets 9.10

Purchase of Investments 1,694.64

Refund of Fixed Deposits /

(Fixed Deposits placed) 412.39

Proceeds from Sale of Investments 1,044.92

Proceeds on Assignment of Trademark 25.00

Intercorporate Deposits / Loans (net) 13.54

Interest Received 17.31

Dividend Received 86.01

Net Cash used in Investing Activities 314.88

Cash Flow from Financing Activities :

Proceeds from issue of Equity shares 1.35

Proceeds from Borrowings 1,345.13

Repayments of Borrowings 921.02

Bank Overdrafts (net) 23.26

Interest Paid 88.64

Dividend Paid 58.68

Tax on Distributed Profits 1.69

Net Cash Generated from Financing Activities 253.19

D.What was the amount of change in cash:

Cash and Cash Equivalents (Opening Balance) 33.86

Add: Cash and Cash Equivalents on consolidation

of GIL ESOP Trust 0.20

Cash and Cash Equivalents (Closing Balance) 64.53

[

Cash on Hand and Balances with Banks 64.86

Closing balances of Fixed deposit

(more than 3 months but less than 12

months) ---

Other Bank Balances 0.33

Cash and Cash Equivalents 64.53

]

Net Increase/(Decrease)in Cash and Cash Equivalents 30.47

You might also like

- Cash Flow StatementDocument3 pagesCash Flow StatementCreativity life with SmritiNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Cash Flow Statement For The Year Ended March 31 2008Document12 pagesCash Flow Statement For The Year Ended March 31 2008rockhillsNo ratings yet

- Cash Flow Statement ExamplesDocument15 pagesCash Flow Statement ExamplesReactorAkkharNo ratings yet

- Standalone Cash Flow Statement: For The Year Ended March 31, 2019Document2 pagesStandalone Cash Flow Statement: For The Year Ended March 31, 2019deepzNo ratings yet

- Asian Paints Annual Report 2016-17Document2 pagesAsian Paints Annual Report 2016-17Amit Pandey0% (1)

- Dabur Consolidated Statement of Cash FlowDocument2 pagesDabur Consolidated Statement of Cash FlowAbhi SinghNo ratings yet

- Cash Flow Statement Examples2Document8 pagesCash Flow Statement Examples2ReactorAkkharNo ratings yet

- Cash Flow StatementDocument2 pagesCash Flow StatementVora JeetNo ratings yet

- Consolidated Cash Flow Statement: For The Year Ended March 31, 2016Document2 pagesConsolidated Cash Flow Statement: For The Year Ended March 31, 2016Tunvir SyncNo ratings yet

- Dabur India Limited Standalone Cash Flow Statement for FY 2019-20Document1 pageDabur India Limited Standalone Cash Flow Statement for FY 2019-20Yagika JagnaniNo ratings yet

- 58th Annual Cash Flow ReportDocument3 pages58th Annual Cash Flow ReportdeepakdsonawaneNo ratings yet

- Cash Flow Statement Examples3Document3 pagesCash Flow Statement Examples3ReactorAkkharNo ratings yet

- Standalone Cash Flow Statement: For The Year Ended 31 March 2020Document2 pagesStandalone Cash Flow Statement: For The Year Ended 31 March 2020Ashish GuptaNo ratings yet

- Consolidated Statement of Cash Flows: For The Year Ended 31st March, 2021Document3 pagesConsolidated Statement of Cash Flows: For The Year Ended 31st March, 2021Only For StudyNo ratings yet

- Cash Flow Statement AnalysisDocument1 pageCash Flow Statement AnalysisAmit PandeyNo ratings yet

- Consolidated Cash Flow Statement: For The Year Ended 31 March 2020Document3 pagesConsolidated Cash Flow Statement: For The Year Ended 31 March 2020Ashish GuptaNo ratings yet

- Data of Icici Bank LTDDocument17 pagesData of Icici Bank LTDAnujyadav MonuyadavNo ratings yet

- Standalone Cash Flow 2Document2 pagesStandalone Cash Flow 2rahulNo ratings yet

- Cash Flow StatementsDocument1 pageCash Flow StatementsSagar DholeNo ratings yet

- Ratio Analysis of (TCS & Infosys) (Shree Cement & Utratech Cement) AdvancedDocument67 pagesRatio Analysis of (TCS & Infosys) (Shree Cement & Utratech Cement) AdvancedmaneNo ratings yet

- Consolidated Statement of Cash Flows: For The Year Ended 31st March, 2021Document3 pagesConsolidated Statement of Cash Flows: For The Year Ended 31st March, 2021Only For StudyNo ratings yet

- Statement of Cash Flow: A. Cash Flows From Operating ActivitiesDocument2 pagesStatement of Cash Flow: A. Cash Flows From Operating ActivitiesRtr. Jai NandhikaNo ratings yet

- Cash Flow Statement: Profit/ (Loss) For The Year (7,289.63) 2,020.60Document2 pagesCash Flow Statement: Profit/ (Loss) For The Year (7,289.63) 2,020.60Prabha VishnuNo ratings yet

- Cash Flow StatementsitcDocument1 pageCash Flow StatementsitcVijayNo ratings yet

- Cash Flow StatementsDocument1 pageCash Flow StatementssayeedkhanNo ratings yet

- Annual Financial ResultDocument21 pagesAnnual Financial ResultBTS ARMY FOR LIFENo ratings yet

- Bandhan Bank LTD.: Balance Sheet (As On 31 March 2020)Document5 pagesBandhan Bank LTD.: Balance Sheet (As On 31 March 2020)Ragini VermaNo ratings yet

- DPL Annual Report 2022 23 PagesDocument1 pageDPL Annual Report 2022 23 Pagesworkf17hoursformeNo ratings yet

- TML Ir Ar 2018 19Document1 pageTML Ir Ar 2018 19SRINIDHI PEESAPATINo ratings yet

- STANDALONE STATEMENT OF CASH FLOWSDocument6 pagesSTANDALONE STATEMENT OF CASH FLOWSC17ShagunNo ratings yet

- Cash Flow Statement ConsolidatedDocument2 pagesCash Flow Statement Consolidatedsamarth rajvaidNo ratings yet

- Cash Flow Statement Analysis for 2021 Fiscal YearDocument6 pagesCash Flow Statement Analysis for 2021 Fiscal YearYash YellewarNo ratings yet

- Astralabs FY2021 FinancialsDocument3 pagesAstralabs FY2021 Financialsrichie0293No ratings yet

- Standalone Cash Flow Statement InsightsDocument2 pagesStandalone Cash Flow Statement InsightsRupasinghNo ratings yet

- TML Annual Report Fy 2020 21 Pages 182 183Document2 pagesTML Annual Report Fy 2020 21 Pages 182 183Atul PandeyNo ratings yet

- Cashflow ConsolidatedDocument2 pagesCashflow Consolidatedshubhramavat1322No ratings yet

- Asian Paints-Money Control - FFSDocument10 pagesAsian Paints-Money Control - FFSKeshav Singh RathoreNo ratings yet

- 3 UIQhlx Ufke 0 J RDDNE7 L9 OAn 37 FR RG 8 V SD DJ JQD NDocument1 page3 UIQhlx Ufke 0 J RDDNE7 L9 OAn 37 FR RG 8 V SD DJ JQD Njanel norbeNo ratings yet

- Gacl Ar-21 CFDocument7 pagesGacl Ar-21 CFNikhil KuraNo ratings yet

- Accountancy ProjectDocument25 pagesAccountancy ProjectkannabiranNo ratings yet

- (Rupees in Lakhs) : Parshawa Motors PVT TDDocument10 pages(Rupees in Lakhs) : Parshawa Motors PVT TDSURANA1973No ratings yet

- Financial AnalysisDocument14 pagesFinancial AnalysisNavneet MayankNo ratings yet

- Directors ReportDocument20 pagesDirectors ReportParasjkohli6659No ratings yet

- ITC Limited FinancialsDocument13 pagesITC Limited FinancialsKUNAL ANANDNo ratings yet

- City Union BankDocument7 pagesCity Union Bankrahila idrisiNo ratings yet

- Notes: AssetsDocument13 pagesNotes: AssetsChaitanya BhujadeNo ratings yet

- ITC standalone balance sheet and profit and loss highlights 2021-22Document7 pagesITC standalone balance sheet and profit and loss highlights 2021-22jhanvi tandonNo ratings yet

- Sub: Financial Accounting Sub: Financial AccountingDocument14 pagesSub: Financial Accounting Sub: Financial AccountingMilan PateliyaNo ratings yet

- Shareholders and financial highlights of HDFC BankDocument10 pagesShareholders and financial highlights of HDFC BankVinod KananiNo ratings yet

- Cash Flow Statement: (' in Crores)Document1 pageCash Flow Statement: (' in Crores)vinay saiNo ratings yet

- 1 - 433 - 1 - Cash Flow Statement 2016 2017Document1 page1 - 433 - 1 - Cash Flow Statement 2016 2017Avnit kumarNo ratings yet

- Statement of Profit and Loss: For The Year Ended 31st March, 2021Document2 pagesStatement of Profit and Loss: For The Year Ended 31st March, 2021Only For StudyNo ratings yet

- StmtCashFlow Standalone PDFDocument2 pagesStmtCashFlow Standalone PDFSumantNo ratings yet

- Fund FlowDocument15 pagesFund FlowArunRamachandranNo ratings yet

- BALANCE SHEET HIGHLIGHTSDocument9 pagesBALANCE SHEET HIGHLIGHTSMadhur Gulati0% (1)

- Analysis of Financial Statements: By: Dr. Divya, Asst. Professor, USMSDocument48 pagesAnalysis of Financial Statements: By: Dr. Divya, Asst. Professor, USMSSanya LambaNo ratings yet

- HPG Finance Statement 1Document25 pagesHPG Finance Statement 1Hoàng Ngọc OanhNo ratings yet

- ModelDocument31 pagesModelShubh GoelNo ratings yet

- Introduction To Managerial Accounting ACC 200Document22 pagesIntroduction To Managerial Accounting ACC 200Rahmati RahmatullahNo ratings yet

- Instant Download Ebook PDF Financial Accounting 7th Edition by Robert Libby PDF ScribdDocument41 pagesInstant Download Ebook PDF Financial Accounting 7th Edition by Robert Libby PDF Scribdrobert.gourley486100% (44)

- DCF Calculator - V2.2Document5 pagesDCF Calculator - V2.2MuhammadYahsyallahNo ratings yet

- Analysis of Beta Corporation's 1991 Cash Flow StatementDocument14 pagesAnalysis of Beta Corporation's 1991 Cash Flow Statementshahin selkarNo ratings yet

- HW1 NPVDocument4 pagesHW1 NPVLalit GuptaNo ratings yet

- Week 5 Tutorial Solutions PDFDocument19 pagesWeek 5 Tutorial Solutions PDFwainikitiraculeNo ratings yet

- Financial Accounting 10th Edition Harrison Test Bank 1Document73 pagesFinancial Accounting 10th Edition Harrison Test Bank 1harry100% (35)

- Chapter 10 Test Bank Subsidiary Preferred Stock, Cosolidated Earnings Per Share, and Consolidated Income TaxationDocument27 pagesChapter 10 Test Bank Subsidiary Preferred Stock, Cosolidated Earnings Per Share, and Consolidated Income TaxationAlfi Wahyu TifaniNo ratings yet

- Ch12 Harrison 8e GE SMDocument87 pagesCh12 Harrison 8e GE SMMuh BilalNo ratings yet

- Audit Testing Expenditure CycleDocument20 pagesAudit Testing Expenditure CycleMark Dwayne MalonzoNo ratings yet

- Understanding ReceivablesDocument8 pagesUnderstanding ReceivablesKian BarredoNo ratings yet

- FINANCIAL STATEMENT For PrintDocument4 pagesFINANCIAL STATEMENT For PrintGkgolam KibriaNo ratings yet

- ABC Chapter 5 Accounting For Business Combinations by Millan 2020Document25 pagesABC Chapter 5 Accounting For Business Combinations by Millan 2020Nayoung LeeNo ratings yet

- Cfap 1 Aafr PK PDFDocument312 pagesCfap 1 Aafr PK PDFMuhammad ShehzadNo ratings yet

- True/False: Chapter 11 The Cost of Capital 181Document44 pagesTrue/False: Chapter 11 The Cost of Capital 181Rudford GectoNo ratings yet

- MasDocument36 pagesMasClareng Anne57% (7)

- 3 Accounting MechanicsDocument50 pages3 Accounting MechanicsVasu Narang100% (1)

- Financial Accounting 2Document31 pagesFinancial Accounting 2Umurbey GençNo ratings yet

- Capital Contribution: Stockholder TINDocument17 pagesCapital Contribution: Stockholder TINEddie ParazoNo ratings yet

- ZNZVMXNDocument14 pagesZNZVMXNJohn Carlo PeruNo ratings yet

- Annual Report ECII 2016Document158 pagesAnnual Report ECII 2016No RainaNo ratings yet

- Practical Questions (Sandeep Garg 2018-19)Document10 pagesPractical Questions (Sandeep Garg 2018-19)Kanishk SinglaNo ratings yet

- Group 3 CFEV 5th Assignment-Hansson-Private-LabelDocument10 pagesGroup 3 CFEV 5th Assignment-Hansson-Private-LabelShashwat JhaNo ratings yet

- Problem 9-1, 2 & 3Document3 pagesProblem 9-1, 2 & 3Micah April SabularseNo ratings yet

- Introduction To Management AccountingDocument71 pagesIntroduction To Management AccountingAnonymous kwi5IqtWJNo ratings yet

- Serba Dinamik Holdings Outperform : Upstream DiversificationDocument5 pagesSerba Dinamik Holdings Outperform : Upstream DiversificationAng SHNo ratings yet

- LQ45 List IDX August 2018 - January 2019Document189 pagesLQ45 List IDX August 2018 - January 2019Nicodemus Sigit SutantoNo ratings yet

- What Is Ratio AnalysisDocument19 pagesWhat Is Ratio AnalysisMarie Frances Sayson100% (1)

- Dysas - Fin Acc - 3rdDocument5 pagesDysas - Fin Acc - 3rdJao FloresNo ratings yet

- Manufacturing Trading Account FormatDocument4 pagesManufacturing Trading Account FormatMoses AwuniNo ratings yet

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelFrom EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelRating: 5 out of 5 stars5/5 (51)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (85)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- Don't Start a Side Hustle!: Work Less, Earn More, and Live FreeFrom EverandDon't Start a Side Hustle!: Work Less, Earn More, and Live FreeRating: 4.5 out of 5 stars4.5/5 (30)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (38)

- Your Next Five Moves: Master the Art of Business StrategyFrom EverandYour Next Five Moves: Master the Art of Business StrategyRating: 5 out of 5 stars5/5 (795)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryFrom EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryRating: 4 out of 5 stars4/5 (26)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureFrom EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureRating: 4.5 out of 5 stars4.5/5 (100)

- Without a Doubt: How to Go from Underrated to UnbeatableFrom EverandWithout a Doubt: How to Go from Underrated to UnbeatableRating: 4 out of 5 stars4/5 (23)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsFrom EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsRating: 5 out of 5 stars5/5 (2)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:From EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Rating: 5 out of 5 stars5/5 (2)

- Anything You Want: 40 lessons for a new kind of entrepreneurFrom EverandAnything You Want: 40 lessons for a new kind of entrepreneurRating: 5 out of 5 stars5/5 (46)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldFrom Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldRating: 5 out of 5 stars5/5 (19)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- The Corporate Startup: How established companies can develop successful innovation ecosystemsFrom EverandThe Corporate Startup: How established companies can develop successful innovation ecosystemsRating: 4 out of 5 stars4/5 (6)

- How to Prospect, Sell and Build Your Network Marketing Business with StoriesFrom EverandHow to Prospect, Sell and Build Your Network Marketing Business with StoriesRating: 5 out of 5 stars5/5 (21)

- Expert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceFrom EverandExpert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceRating: 5 out of 5 stars5/5 (363)

- Invention: A Life of Learning Through FailureFrom EverandInvention: A Life of Learning Through FailureRating: 4.5 out of 5 stars4.5/5 (28)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andFrom EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andRating: 4.5 out of 5 stars4.5/5 (708)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeFrom EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeRating: 5 out of 5 stars5/5 (22)

- Get Scalable: The Operating System Your Business Needs To Run and Scale Without YouFrom EverandGet Scalable: The Operating System Your Business Needs To Run and Scale Without YouRating: 5 out of 5 stars5/5 (1)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursFrom EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursRating: 4.5 out of 5 stars4.5/5 (23)

- Summary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesFrom EverandSummary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesRating: 4.5 out of 5 stars4.5/5 (99)

- Summary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisFrom EverandSummary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisRating: 4.5 out of 5 stars4.5/5 (3)