Professional Documents

Culture Documents

Sa June11 Dipabv2fa

Uploaded by

Asis Koirala0 ratings0% found this document useful (0 votes)

17 views4 pagesasdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentasdf

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views4 pagesSa June11 Dipabv2fa

Uploaded by

Asis Koiralaasdf

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

DIPLOMA IN

ACCOUNTING AND BUSINESS

With effect from December 2011,

the ACCA Diploma in Accounting and

Business will be launched as part of

the new Foundations in Accountancy

suite of qualifications.

This new Diploma will provide a

flexible open-entry route into the Skills

module of the ACCA Qualification

for candidates who do not start

their ACCA Qualification studies with

the usual entry requirements. The

Diploma in Accounting and Business

is awarded on the completion of the

exams: Accountant in Business (FAB),

Management Accounting (FMA) and

Financial Accounting (FFA), and the

Foundations in Professionalism module.

The Diploma will also be available

to ACCA registered students who

register directly for and pass the

Fundamentals Knowledge module

papers: Paper F1, Accountant in

Business; Paper F2, Management

Accounting; and Paper F3, Financial

Accounting; and who successfully

complete the Foundations in

Professionalism module (see page 42).

WHO IS THE DIPLOMA AIMED AT?

The Diploma is suitable for those

aspiring to work, or already working, in

the following types of roles:

basic bookkeeping

trainee accountant in a commercial

organisation or accounting practice

accounts clerk in the public sector.

The Diploma in Accounting and

Business is broadly equivalent to HND

level/the first year of a degree.

HOW IS THE DIPLOMA STRUCTURED?

The Diploma in Accounting and

Business consists of three exams:

Paper FAB, Accountant in Business

Paper FMA, Management Accounting

Paper FFA, Financial Accounting

These three exams will also be the same

exams as:

Paper F1, Accountant in Business

Paper F2, Management Accounting

Paper F3, Financial Accounting

This is illustrated in Figure 1.

WHO IS ELIGIBLE TO TAKE THE

NEW DIPLOMA?

1 Certified Accounting Technician (CAT)

students (based on status prior to

August 2011) who take at least one

of Papers FAB, FMA and FFA from

December 2011.

2 MSER students (based on status prior

to August 2011) who take at least one

of Papers F1/FAB, F2/FMA or F3/FFA

from December 2011.

3 FIA registered students who take at

least one of Papers FAB, FMA and FFA

from December 2011.

4 ACCA registered students who take at

least one of Papers F1, F2, F3 from

December 2011.

To be awarded the Diploma, all three

of Papers FAB (F1), FMA (F2), and FFA

(F3) must be passed or exempted, with

at least one of the three papers having

been taken and passed from December

2011 onwards. In addition, the

Foundations in Professionalism module

must also be successfully completed

before the Diploma can be awarded.

The first Diploma certificates will be

awarded from February 2012.

SYLLABUS AND EXAM STRUCTURE

CHANGES FOR EXISTING STUDENTS

The new syllabuses for the FIA Diploma

in Accounting and Business are

being introduced to reflect updates

to national occupational standards

in technician-level curricula and to

take into account employer needs as

obtained from consultation surveys with

key stakeholders. The new syllabuses are

also being re-aligned to more effectively

underpin studies at higher levels within

the ACCA Qualification.

In addition to syllabus changes, there

are also exam structure changes that

students need to be aware of.

Which students will be affected?

1 CAT students (based on status prior to

August 2011) who have taken Paper 5,

Managing Systems and People; Paper

6, Drafting Accounting Statements;

and Paper 7, Planning Control and

Performance Management; and those

THE ACCA DIPLOMA IN ACCOUNTING AND BUSINESS WILL PROVIDE A FLEXIBLE

OPEN-ENTRY ROUTE INTO THE SKILLS MODULE OF THE MAIN ACCA QUALIFICATION.

FIGURE 1: ALTERNATIVE ROUTES TO THE ACCA DIPLOMA IN ACCOUNTING AND BUSINESS

01 FOUNDATIONS IN ACCOUNTANCY

DIPLOMA IN

ACCOUNTING AND BUSINESS

who will be taking FAB, FFA and FMA,

respectively, as the equivalent exams

from December 2011.

2 Existing and newly registered ACCA

students who are taking the existing

Paper F1, F2 and F3 exams during the

transitional period (between February

and November 2011) and who will be

taking the new Paper F1, F2 and F3

exams from December 2011 onwards.

3 MSER students (based on status prior

to August 2011) who take Papers F1/

TT5, F2/TT7 and F3/TT6 after August

2011, but who will be taking the new

Paper F1/FAB, F2/FMA and F3/FFA

exams from December 2011 onwards.

4 All FIA students who can take the

existing Papers TT5 (FAB), TT7

(FMA) and TT6 (FFA) exams during

the transitional period, which follow

the syllabuses for the existing Paper

F1, F2 and F3 exams respectively

(between February and November

2011), and who will be taking new

FAB, FMA and FFA, respectively, as

the equivalent exams from December

2011 onwards.

What changes do the above students need

to be aware of?

The specific syllabus and exam structure

changes explained in this article cover

four areas:

Syllabus areas no longer examined

from the existing CAT equivalent

exams Papers 5, 6 and 7.

New syllabus areas and changes in

the exam structures in the new FAB,

FMA and FFA exams as compared

with the CAT equivalent exams in

(1) above.

Syllabus areas no longer examined

from the existing Fundamentals

Knowledge exams Papers F1, F2

(MMA) and F3 (MFA)

New syllabus areas and changes in the

exam structures in the new Paper F1,

F2 and F3 exams as compared with

the ACCA and MSER equivalent exams

in (3) above.

Note: All these tables are to assist

students who may have to retake an

exam, or for tutors preparing to teach

towards the new exam. However, in all

cases, it is important to refer to the

Study Guide for full details.

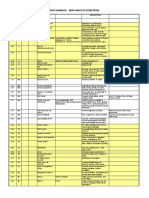

TABLE 1: SYLLABUS AREAS NO LONGER EXAMINED IN FAB, FMA AND FFA, WHICH

ARE CURRENTLY EXAMINED IN CAT EQUIVALENT EXAM SYLLABUSES PAPERS 5, 6

AND 7

PAPER 5 SYLLABUS PAPER 6 SYLLABUS PAPER 7 SYLLABUS

AREAS REMOVED* AREAS REMOVED* AREAS REMOVED*

None 1a) Discuss the 6d) Alternative

shortcomings of historical approaches to budgeting

cost accounting and how

they might be overcome

2a) Preparation of 9a) Session 27 pricing

partnership nancial and demand ALL

statements, admission and

dissolution of a partnership

9b) Session 28a(i) and

(ii) ie the calculations

elements have

been removed

9c) Session 28d(i)

Discuss the link between

target costing and pricing

9d) Session 28 d(iii)

Discuss the role of value

engineering in

target costing

* The references given are to the Syllabus and study sessions within these syllabuses

TABLE 2: EXAM STRUCTURE CHANGES BETWEEN CAT ADVANCED LEVEL AND THE

NEW DIPLOMA PAPERS

PAPER 5, MANAGING PAPER 6, DRAFTING PAPER 7, PLANNING,

SYSTEMS AND PEOPLE FINANCIAL STATEMENTS CONTROL AND

PERFORMANCE

MANAGEMENT

Old exam structure: Old exam structure: Old exam structure:

Section A: 12 x two-mark Section A: 10 x two-mark Section A: 10 x two-mark

MCQ questions MCQ questions MCQ questions

Section B: Four x 14-mark Section B: One x 40-mark Section B: Four x 20-mark

and one x 20-mark questions and two x 20-mark questions questions

FAB, Accountant in Business FFA, Financial Accounting FMA, Management

Accounting

New exam structure: New exam structure: New exam structure:

50 x two-mark objective 50 x two-mark objective 50 x two-mark objective

test questions test questions test questions

STUDENT ACCOUNTANT ISSUE 06/11

02

TABLE 4: EXAM STRUCTURE CHANGES BETWEEN EXISTING PAPERS F1, F2 AND F3

AND THE NEW PAPER F1, F2 AND F3 EXAMS

PAPER F1, ACCOUNTANT PAPER F2, MANAGEMENT PAPER F3, FINANCIAL

IN BUSINESS ACCOUNTING ACCOUNTING

Old exam structure: Old exam structure: Old exam structure:

40 x two and 10 x 40 x two and 10 x 40 x two and 10 x

one-mark MCQ questions one-mark MCQ questions one-mark MCQ questions

F1/FAB, Accountant F2/FMA, Management F3/FFA, Financial

in Business Accounting Accounting

New exam structure: New exam structure: New exam structure:

50 x two-mark objective 50 x two-mark objective 50 x two-mark objective

test questions test questions test questions

TABLE 3: SYLLABUS AREAS NO LONGER EXAMINED IN THE NEW PAPER F1, F2

AND F3 EXAMS, WHICH ARE EXAMINED IN THE EXISTING FUNDAMENTALS

KNOWLEDGE MODULE EXAM SYLLABUSES PAPERS F1, F2 AND F3

PAPER F1, ACCOUNTANT PAPER F2, MANAGEMENT PAPER F3, FINANCIAL

IN BUSINESS SYLLABUS ACCOUNTING SYLLABUS ACCOUNTING SYLLABUS

AREAS REMOVED** AREAS REMOVED** AREAS REMOVED**

A5d) Identify different C1 Dealing with B2 Alternative bases

sources of internal and uncertainty ALL used in the preparation

external information of nancial information

A5e) Describe the F1 Cost volume prot C3 Accounting systems

main features of analysis ALL and the impact of

information systems information technology

on nancial reporting

A7b) Identify inuences F2b) Calculate relevant F4 Accounting for

that determine whether costs for materials, partnerships. The old

behaviour and decisions labour and overheads and syllabus did not cover

are ethical or unethical c) Calculate the relevant detailed accounting for

costs associated with admissions and dissolution,

non-current assets only simple allocation

of prots

C1a) and b) History and F3 Limiting factors

role of accounting ALL except: 3a) Identify

in business single limiting factor

F2a) Explain the purposes

of personal development

plans

F3a) Dene

communications

**The syllabus refers to the existing Study Guides

IT IS MOST IMPORTANT FOR ALL STUDENTS TO BE FULLY AWARE THAT IF THEY TAKE

ANY CBE EXAMS TT5, TT6 AND/OR TT7 BETWEEN AUGUST AND NOVEMBER, THEY

WILL BE EXAMINED ON THE EXISTING SYLLABUSES OF PAPERS F1 TO F3, SO THE

CHANGES REFERRED TO IN THIS ARTICLE WILL NOT APPLY TO ANY EXAMS SAT BEFORE

DECEMBER 2011.

TRANSITIONAL ARRANGEMENTS

The changes referred to in this article

apply with effect from December 2011.

Computer-based exams (CBE) and

paper exams following new syllabuses

and structures will be available from

December 2011.

Up until December 2011, CAT

students (based on status prior to

August 2011) can take the CBE versions

of the F1 (TT5), F2 (TT7) and F3 (TT6)

exams from February until November.

Existing ACCA or MSER students

(based on status prior to August 2011)

may also take the CBE versions of the

existing syllabuses until November.

It is most important for all students to

be fully aware that if they take any CBE

exams TT5, TT6 and/or TT7 between

August and November, they will be

examined on the existing syllabuses of

Papers F1 to F3, so the changes referred

to in this article will not apply to any

exams sat before December 2011.

03 FOUNDATIONS IN ACCOUNTANCY

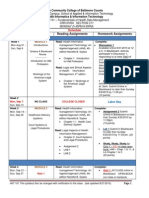

TABLE 5: NEW SYLLABUS AREAS EXAMINABLE IN THE FAB, FMA AND FFA SYLLABUSES AS COMPARED TO PAPERS 5, 6 AND 7

FAB NEW SYLLABUS AREAS ADDED AS FFA NEW SYLLABUS AREAS ADDED AS FMA NEW SYLLABUS AREAS ADDED AS

COMPARED TO THE PAPER 5 SYLLABUS COMPARED TO THE PAPER 6 SYLLABUS COMPARED TO THE PAPER 7 SYLLABUS

A4 Macroeconomics in more detail A5 Duties and responsibilities of those A3 Cost classication all except:

charged with governance h) high low analysis and;

i) explain the structure of linear functions

and equations

A5 Microeconomics ALL E1 Prepare a trial balance from B1 Accounting for material, labour and

ledger accounts overheads ALL

A8 Environmental factors ALL B3 Cost accounting methods ALL

A9 c) Porters ve forces model C5 Capital budgeting and discounted

cash ow ALL

B4 Committees in the business

organisation ALL

C4a) Explain the various purposes for

which the following nancial information

is required:

(i) IS (ii) SOCF (iii) SOFP

b) Describe the main purposes of the

following types of management

accounting reports:

i) Cost schedules

ii) Budgets

iii) Variance reports

E3 Competency frameworks ALL

F1 Fundamental principles of ethical

behaviour ALL

F3 Corporate codes of ethics ALL

F4 Ethical conicts and dilemmas ALL

TABLE 6: NEW SYLLABUS AREAS EXAMINABLE IN THE NEW PAPERS F1, F2, AND F3 SYLLABUSES AS COMPARED TO THE

EXISTING PAPERS F1, F2 AND F3

F1 NEW SYLLABUS AREAS ADDED AS F3 NEW SYLLABUS AREAS ADDED AS F2 NEW SYLLABUS AREAS ADDED AS

COMPARED TO THE OLD F1 SYLLABUS COMPARED TO THE OLD F3 SYLLABUS COMPARED TO THE OLD F2 SYLLABUS

A1 Purpose and types of business A5 Duties and responsibilities of A2 Sources of data ALL

organisation ALL those charged with governance

A5 Microeconomics ALL F3 Disclosure notes (explain purpose, draft A4 Presenting information ALL

non-current asset, provision, events after

the reporting period and inventory note)

A8 Environmental factors ALL G1 Accounting for subsidiaries B4 Alternative costing principles ALL

A9c) Porters ve forces model G2 Awareness of what associates are and C1 i) Time series analysis which are

equity accounting included in j) k), l), m) and n)

C4a) Explain the various purposes for H1 Importance and purpose of analysis C2b) Prepare cash budget and e) Prepare

which the following nancial information of nancial statements master budgets

is required: (i) IS (ii) SOCF (iii) SOFP

b) Describe the main purposes of the

following types of management

accounting reports:

i) Cost schedules

ii) Budgets

iii) Variance reports

E3 Competency frameworks ALL H2 Ratios C5 Capital budgeting and discounted

cash ow ALL

F1 Fundamental principles of ethical H3 Analysis of nancial statements C6e) Explain concept of controllable and

behaviour ALL uncontrollable costs

f) Prepare control reports suitable for

presentation to management

F3 Corporate codes of ethics ALL C7 Behavioural aspects of budgeting ALL

F4 Ethical conicts and dilemmas ALL Performance measurement overview ALL

Performance measurement application ALL

Cost reduction and value

enhancement ALL

Monitoring performance and reporting ALL

STUDENT ACCOUNTANT ISSUE 06/11

04

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- MBAA DI Cabinet and RolesDocument1 pageMBAA DI Cabinet and RolesAsis KoiralaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Retail Luxury Brands Club SY Cabinet: Co-President: Co-PresidentDocument1 pageRetail Luxury Brands Club SY Cabinet: Co-President: Co-PresidentAsis KoiralaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Financial Statements ChecklistDocument1 pageFinancial Statements ChecklistAsis KoiralaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Operating Leases-Incentives: SIC Interpretation 15Document4 pagesOperating Leases-Incentives: SIC Interpretation 15Asis KoiralaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Co-Presidents:: Audrey Dotson Jordan Daniel LantzDocument1 pageCo-Presidents:: Audrey Dotson Jordan Daniel LantzAsis KoiralaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Service Concession Arrangements: Disclosures: SIC Interpretation 29Document6 pagesService Concession Arrangements: Disclosures: SIC Interpretation 29Asis KoiralaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Title Earnings and Hours Worked, Age Group by Occupation by Two-Digit SOC: ASHE Table 20Document3,334 pagesTitle Earnings and Hours Worked, Age Group by Occupation by Two-Digit SOC: ASHE Table 20Asis KoiralaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Leading From Day One: Brand ManagementDocument2 pagesLeading From Day One: Brand ManagementAsis KoiralaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Audit Universe and Risk Assessment ToolDocument10 pagesAudit Universe and Risk Assessment ToolAsis KoiralaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Guide To The Occupation MatrixDocument11 pagesGuide To The Occupation MatrixAsis KoiralaNo ratings yet

- Monthly Marketing Reporting TemplateDocument20 pagesMonthly Marketing Reporting TemplateIonuț BenaNo ratings yet

- Monthly Marketing Reporting TemplateDocument20 pagesMonthly Marketing Reporting TemplateIonuț BenaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Duke MMS - Sample - ResumesDocument2 pagesDuke MMS - Sample - ResumesAsis KoiralaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Sic25 PDFDocument4 pagesSic25 PDFAsis KoiralaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- CPD Waiver Application and Guidance FormDocument2 pagesCPD Waiver Application and Guidance FormAsis KoiralaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Math and Test StrategiesDocument2 pagesMath and Test StrategiesArturo Vergara83% (6)

- Examples of Control DeficienciesDocument4 pagesExamples of Control DeficienciesAsis KoiralaNo ratings yet

- Johnson Workbook 2015Document54 pagesJohnson Workbook 2015Asis Koirala100% (1)

- Quickbooks Setup New Company FileDocument16 pagesQuickbooks Setup New Company FileAsis KoiralaNo ratings yet

- Solomons-Proverbs - Very Clear SummaryDocument168 pagesSolomons-Proverbs - Very Clear SummaryAsis KoiralaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- RoutineDocument2 pagesRoutineAsis KoiralaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- IAS-7 Statement of Cash FlowsDocument23 pagesIAS-7 Statement of Cash FlowsAsis KoiralaNo ratings yet

- Internal Audit Roles IIDocument20 pagesInternal Audit Roles IIJuris Renier MendozaNo ratings yet

- Ifrs - 1Document17 pagesIfrs - 1Asis KoiralaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- 9287 Load SheddingDocument3 pages9287 Load SheddingAsis KoiralaNo ratings yet

- Acca p1 NotesDocument67 pagesAcca p1 NotesAsis KoiralaNo ratings yet

- Ifrs - 1Document17 pagesIfrs - 1Asis KoiralaNo ratings yet

- Internal Audit Roles IDocument20 pagesInternal Audit Roles IJuris Renier MendozaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Representation Letter 2012Document3 pagesRepresentation Letter 2012Asis KoiralaNo ratings yet

- FP008 DLSC Eng - TrabajoDocument3 pagesFP008 DLSC Eng - TrabajoRomina Paola PiñeyroNo ratings yet

- CBT POA and ROEDocument4 pagesCBT POA and ROEDzaky AtharizzNo ratings yet

- National Education Policy 2020: Presented by NithyalakshmiDocument14 pagesNational Education Policy 2020: Presented by NithyalakshmiSandya babuNo ratings yet

- Daily Lesson Log: Subject:21st Century Literature From The Philippines and The World DateDocument3 pagesDaily Lesson Log: Subject:21st Century Literature From The Philippines and The World DateAseret MihoNo ratings yet

- ScheduleDocument7 pagesScheduleapi-296878004No ratings yet

- Chapter 1 - MastersDocument11 pagesChapter 1 - MastersQueenie Gonzales-AguloNo ratings yet

- Exploring Writing Paragraphs and Essays PDFDocument2 pagesExploring Writing Paragraphs and Essays PDFAlainaNo ratings yet

- PBL - Nor Azuanee Mukhtar Mp101439Document16 pagesPBL - Nor Azuanee Mukhtar Mp101439Azuanee AzuaneeNo ratings yet

- Quota SamplingDocument6 pagesQuota SamplingKeking Xoniuqe100% (1)

- Leadership 1b 123456Document6 pagesLeadership 1b 123456api-263686337No ratings yet

- 50th 6-29-16 BookDocument60 pages50th 6-29-16 BookJim LeiphartNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- An Analysis of Deaf Culture in The PhilippinesDocument28 pagesAn Analysis of Deaf Culture in The PhilippinesAngela LeeNo ratings yet

- 11 Chapter3Document45 pages11 Chapter3Eloisa May LanuzaNo ratings yet

- Strong Interest Inventory Manual 2012 SupplementDocument129 pagesStrong Interest Inventory Manual 2012 SupplementBobby Antonio0% (1)

- Different Types of Essays ExplainedDocument3 pagesDifferent Types of Essays ExplainedFahad AhsanNo ratings yet

- 31 Days To Better PracticingDocument65 pages31 Days To Better PracticingElioenai Medina100% (6)

- 2 Historical and Societal Influences On Curriculum 1 1Document42 pages2 Historical and Societal Influences On Curriculum 1 1Ogie Achilles D TestaNo ratings yet

- Buster KPTPDocument39 pagesBuster KPTPapi-242143006No ratings yet

- Welcome Letter To Parents 2019Document2 pagesWelcome Letter To Parents 2019FarmdaleHawksNo ratings yet

- POSITION DESCRIPTION FORM - CSC Revised 2017 (Elem.-Teacher III)Document3 pagesPOSITION DESCRIPTION FORM - CSC Revised 2017 (Elem.-Teacher III)Lably Magno Ildefonso85% (13)

- MGT 3200 Syllabus-Fall 2015Document4 pagesMGT 3200 Syllabus-Fall 2015Cierra SmithNo ratings yet

- Quality Practise Templat TapasaDocument5 pagesQuality Practise Templat Tapasaapi-399088937100% (1)

- RPMS PURPLE TEMPLATE For MALE TEACHERS - Results-Based-Performance-Management-SystemDocument46 pagesRPMS PURPLE TEMPLATE For MALE TEACHERS - Results-Based-Performance-Management-SystemFretzelle Hope BadoyNo ratings yet

- Study Skills BookletDocument38 pagesStudy Skills BookletCybeleNo ratings yet

- Module A IntroductionDocument20 pagesModule A IntroductionNina MarianaNo ratings yet

- Automated Daily Lesson Log 2020-2021Document15 pagesAutomated Daily Lesson Log 2020-2021Ra MilNo ratings yet

- M Cross Tear SheetDocument44 pagesM Cross Tear SheetAngel Andres Blanco33% (3)

- LittleBookOfDoodles 160817 WEB PDFDocument10 pagesLittleBookOfDoodles 160817 WEB PDFmayi227No ratings yet

- 1 FOUNDATIONS OF EDUCATION I.ADocument27 pages1 FOUNDATIONS OF EDUCATION I.AJustin GarrovillasNo ratings yet

- Mentoring - R Hale - Career Development InternationalDocument12 pagesMentoring - R Hale - Career Development InternationalRichard Ian HaleNo ratings yet

- AP World History: Modern Premium, 2024: Comprehensive Review with 5 Practice Tests + an Online Timed Test OptionFrom EverandAP World History: Modern Premium, 2024: Comprehensive Review with 5 Practice Tests + an Online Timed Test OptionRating: 5 out of 5 stars5/5 (1)

- MCAT Biology & Biochemistry Practice Questions: High Yield MCAT QuestionsFrom EverandMCAT Biology & Biochemistry Practice Questions: High Yield MCAT QuestionsNo ratings yet

- Digital SAT Preview: What to Expect + Tips and StrategiesFrom EverandDigital SAT Preview: What to Expect + Tips and StrategiesRating: 5 out of 5 stars5/5 (3)

- GMAT Foundations of Verbal: Practice Problems in Book and OnlineFrom EverandGMAT Foundations of Verbal: Practice Problems in Book and OnlineNo ratings yet

- Digital SAT Prep 2024 For Dummies: Book + 4 Practice Tests Online, Updated for the NEW Digital FormatFrom EverandDigital SAT Prep 2024 For Dummies: Book + 4 Practice Tests Online, Updated for the NEW Digital FormatNo ratings yet

- Medical English Dialogues: Clear & Simple Medical English Vocabulary for ESL/EFL LearnersFrom EverandMedical English Dialogues: Clear & Simple Medical English Vocabulary for ESL/EFL LearnersNo ratings yet

- GMAT Prep 2024/2025 For Dummies with Online Practice (GMAT Focus Edition)From EverandGMAT Prep 2024/2025 For Dummies with Online Practice (GMAT Focus Edition)No ratings yet