Professional Documents

Culture Documents

Break-Even Analysis and CVP

Uploaded by

chaluvadiinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Break-Even Analysis and CVP

Uploaded by

chaluvadiinCopyright:

Available Formats

Chapter 9--Break-Even Point and Cost-Volume-Profit Analysis

LEARNIN !B"EC#IVE$

LO 1 Why is variable costing more useful than absorption costing in determining the

break-even point and doing cost-volume-profit analysis?

LO 2 How is the break-even point determined using the formula approach graph

approach and income statement approach?

LO ! How can a company use cost-volume-profit "#$%& analysis?

LO ' How do break-even and #$% analysis differ for single-product and multiproduct

firms?

LO ( How are margin of safety and operating leverage concepts used in business?

LO ) What are the underlying assumptions of #$% analysis?

%&E$#I!N RI'

True/False

Difficulty Level Learning Objectives

Easy Moderate Difficult LO 1 LO 2 LO 3 LO 4 LO LO !

1 x x

2 x x

3 x x

4 x x

5 x x

6 x x

7 x x

8 x x

9 x x

10 x x

11 x x

12 x x

13 x x

14 x x

15 x x

16 x x

17 x x

18 x x

19 x x

20 x x

21 x x

22 x x

23 x x

24 x x

25 x x

26 x x

27 x x

28 x x

"o#$letion

Difficulty Level Learning Objectives

Easy Moderate Difficult LO 1 LO 2 LO 3 LO 4 LO LO !

1 x x

2 x x

3 x x

4 x x

5 x x

6 x x

7 x x

Multi$le "%oice

*+

Difficulty Level Learning Objectives

Easy Moderate Difficult LO 1 LO 2 LO 3 LO 4 LO LO !

1 x x x

2 x x x

3 x x x

4 x x x

5 x x

6 x x

7 x x x

8 x x

9 x x

10 x x

11 x x

12 x x

13 x x

14 x x

15 x x

16 x x

17 x x x

18 x x

19 x x

20 x x x

21 x x x

22 x x

23 x x

24 x x

25 x x

26 x x

27 x x

28 x x

29 x x

30 x x

31 x x

32 x x

33 x x

34 x x

35 x x

36 x x

37 x x

38 x x

39 x x

40 x x

41 x x

42 x x

43 x x

44 x x

45 x x

46 x x

47 x x

48 x x

49 X x

50 x x

51 X x

52 X x

53 X x

54 x x

55 X x

56 x x

**

Difficulty Level Learning Objectives

Easy Moderate Difficult LO 1 LO 2 LO 3 LO 4 LO LO !

57 x x

58 x x

59 x x

60 x x

&%ort 'ns(er

Difficulty Level Learning Objectives

Easy Moderate Difficult LO 1 LO 2 LO 3 LO 4 LO LO !

1 x x x

2 x x

3 x x

4 x x

)roble#

Difficulty Level Learning Objectives

Easy Moderate Difficult LO 1 LO 2 LO 3 LO 4 LO LO !

1 x x

2 x x

3 x x

4 x x

5 x x

6 x x

7 x x

8 x x

9 x x

10 x x

11 x x

*,

#R&E()AL$E

1- . company/s break-even point is the level where total revenues e0ual total costs-

.123 4 5673 8asy O9:3 ,-1

2- .bsorption costing is more useful than variable costing in determining a company/s break-even point-

.123 7 5673 8asy O9:3 ,-1

!- $ariable costing is more useful than absorption costing in determining a company/s break-even point-

.123 4 5673 8asy O9:3 ,-1

'- 4otal variable costs vary directly with levels of production-

.123 4 5673 8asy O9:3 ,-1

(- $ariable costs per unit vary directly with levels of production-

.123 7 5673 8asy O9:3 ,-1

)- $ariable costs per unit remain unchanged with levels of production-

.123 4 5673 8asy O9:3 ,-1

+- 4otal fi;ed costs remain unchanged with levels of production-

.123 4 5673 8asy O9:3 ,-1

*- 4otal fi;ed costs vary inversely with levels of production-

.123 7 5673 8asy O9:3 ,-1

,- 7i;ed costs per unit vary inversely with levels of production-

.123 4 5673 8asy O9:3 ,-1

1<- 7i;ed costs per unit remain constant with levels of production-

.123 7 5673 8asy O9:3 ,-1

11- 9reak-even point may be e;pressed in terms of units or dollars-

.123 4 5673 8asy O9:3 ,-1

12- 5ividing total fi;ed costs by the contribution margin ratio yields break-even point in sales dollars-

.123 4 5673 8asy O9:3 ,-2

,<

1!- 5ividing total fi;ed costs by the contribution margin ratio yields break-even point in units-

.123 7 5673 8asy O9:3 ,-2

1'- .fter the break-even point is reached each dollar of contribution margin is a dollar of before-ta;

profit-

.123 4 5673 8asy O9:3 ,-!

1(- .fter the break-even point is reached each dollar of contribution margin is a dollar of after-ta; profit-

.123 7 5673 8asy O9:3 ,-!

1)- When using #$% analysis to determine sales level for a desired amount of profit the profit is treated

as an additional cost to be covered-

.123 4 5673 =oderate O9:3 ,-!

1+- When computing profit on an after-ta; basis it is necessary to divide the preta; profit by the effective

ta; rate-

.123 7 5673 =oderate O9:3 ,-!

1*- When computing profit on an after-ta; basis it is necessary to divide the preta; profit by "1 - effective

ta; rate&-

.123 4 5673 =oderate O9:3 ,-!

1,- On a #$% graph the total cost line intersects the y-a;is at >ero-

.123 7 5673 =oderate O9:3 ,-!

2<- On a #$% graph the total variable cost line intersects the y-a;is at >ero-

.123 4 5673 =oderate O9:3 ,-!

21- On a #$% graph the total revenue line intersects the y-a;is at >ero-

.123 4 5673 =oderate O9:3 ,-!

22- On a #$% graph the total fi;ed cost line parallels the ;-a;is-

.123 4 5673 =oderate O9:3 ,-!

2!- 6ncremental analysis focuses on factors that change from one decision to another-

.123 4 5673 8asy O9:3 ,-!

2'- 6n a multi-product environment #$% analysis makes the assumption that a company/s sales mi; is

constant-

.123 4 5673 =oderate O9:3 ,-'

,1

2(- 4he margin of safety is an effective measure of risk for a company-

.123 4 5673 =oderate O9:3 ,-(

2)- 4here is an inverse relationship between degree of operating leverage and the margin of safety-

.123 4 5673 =oderate O9:3 ,-(

2+- 4he margin of safety is computed by dividing 1 by the degree of operating leverage-

.123 4 5673 =oderate O9:3 ,-(

2*- 6n #$% analysis sales and production are assumed to be e0ual-

.123 4 5673 =oderate O9:3 ,-)

C!*PLE#I!N

1- 4he level of activity where a company/s total revenues e0ual total costs is referred to as the

??????????????????????????????-

.123 break-even point

5673 8asy O9:3 ,-1

2- #ontribution margin divided by revenue is referred to as the ???????????????????????-

.123 contribution margin ratio

5673 8asy O9:3 ,-2

!- . process that focuses only on factors that change from one course of action to another is referred to as

??????????????????????????????????-

.123 incremental analysis

5673 8asy O9:3 ,-!

'- 4he e;cess of budgeted or actual sales over sales at break-even point is referred to as

?????????????????????????????????-

.123 margin of safety

5673 =oderate O9:3 ,-(

(- 4he relationship between a company/s variable costs and fi;ed costs is referred to as its

??????????????????????????????-

.123 operating leverage

5673 =oderate O9:3 ,-(

,2

)- 4he ?????????????????????????????????? is computed by dividing the contribution margin by

profit before ta;-

.123 degree of operating leverage

5673 =oderate O9:3 ,-(

+- 4he formula for margin of safety is ????????????????????????????????????????-

.123 1 @ 5egree of Operating Leverage

5673 =oderate O9:3 ,-(

*&L#IPLE C+!ICE

1- #$% analysis re0uires costs to be categori>ed as

a- either fi;ed or variable-

b- fi;ed mi;ed or variable-

c- product or period-

d- standard or actual-

.123 . 5673 8asy O9:3 ,-1,-)

2- With respect to fi;ed costs #$% analysis assumes total fi;ed costs

a- per unit remain constant as volume changes-

b- remain constant from one period to the ne;t-

c- vary directly with volume-

d- remain constant across changes in volume-

.123 5 5673 8asy O9:3 ,-2,-)

!- #$% analysis relies on the assumptions that costs are either strictly fi;ed or strictly variable-

#onsistent with these assumptions as volume decreases total

a- fi;ed costs decrease-

b- variable costs remain constant-

c- costs decrease-

d- costs remain constant-

.123 # 5673 8asy O9:3 ,-2,-)

'- .ccording to #$% analysis a company could never incur a loss that e;ceeded its total

a- variable costs-

b- fi;ed costs-

c- costs-

d- contribution margin-

.123 # 5673 8asy O9:3 ,-2,-)

(- #$% analysis is based on concepts from

a- standard costing-

b- variable costing-

c- Aob order costing-

d- process costing-

.123 9 5673 8asy O9:3 ,-2

,!

)- #ost-volume-profit analysis is a techni0ue available to management to understand better the

interrelationships of several factors that affect a firmBs profit- .s with many such techni0ues the

accountant oversimplifies the real world by making assumptions- Which of the following is not a

maAor assumption underlying #$% analysis?

a- .ll costs incurred by a firm can be separated into their fi;ed and variable components-

b- 4he product selling price per unit is constant at all volume levels-

c- Operating efficiency and employee productivity are constant at all volume levels-

d- 7or multi-product situations the sales mi; can vary at all volume levels-

.123 5 5673 8asy O9:3 ,-2

+- 6n #$% analysis linear functions are assumed for

a- contribution margin per unit-

b- fi;ed cost per unit-

c- total costs per unit-

d- all of the above-

.123 . 5673 8asy O9:3 ,-2,-)

*- Which of the following factors is involved in studying cost-volume-profit relationships?

a- product mi;

b- variable costs

c- fi;ed costs

d- all of the above

.123 5 5673 8asy O9:3 ,-2

,- #ost-volume-profit relationships that are curvilinear may be analy>ed linearly by considering only

a- fi;ed and mi;ed costs-

b- relevant fi;ed costs-

c- relevant variable costs-

d- a relevant range of volume-

.123 5 5673 8asy O9:3 ,-2

1<- .fter the level of volume e;ceeds the break-even point

a- the contribution margin ratio increases-

b- the total contribution margin e;ceeds the total fi;ed costs-

c- total fi;ed costs per unit will remain constant-

d- the total contribution margin will turn from negative to positive-

.123 9 5673 8asy O9:3 ,-2

11- Which of the following will de,rease the break-even point?

5ecrease in

fi;ed cost

6ncrease in direct

labor cost

6ncrease in

selling price

a-

yes yes yes

b-

yes no yes

c-

yes no no

d-

no yes no

.123 9 5673 8asy O9:3 ,-2

,'

12- .t the break-even point fi;ed costs are always

a- less than the contribution margin-

b- e0ual to the contribution margin-

c- more than the contribution margin-

d- more than the variable cost-

.123 9 5673 8asy O9:3 ,-2

1!- 4he method of cost accounting that lends itself to break-even analysis is

a- variable-

b- standard-

c- absolute-

d- absorption-

.123 . 5673 8asy O9:3 ,-2

1'- Civen the following notation what is the break-even sales level in units?

2% D selling price per unit 7# D total fi;ed cost $# D variable cost per unit

a- 2%E"7#E$#&

b- 7#E"$#E2%&

c- $#E"2% - 7#&

d- 7#E"2% - $#&

.123 5 5673 8asy O9:3 ,-2

1(- #onsider the e0uation F D 2ales - G"#=E2ales& "2ales&H- What is F?

a- net income

b- fi;ed costs

c- contribution margin

d- variable costs

.123 5 5673 =oderate O9:3 ,-2

1)- 6f a firmBs net income does not change as its volume changes the firm"Bs&

a- must be in the service industry-

b- must have no fi;ed costs-

c- sales price must e0ual I<-

d- sales price must e0ual its variable costs-

.123 5 5673 =oderate O9:3 ,-2

1+- 9reak-even analysis assumes over the relevant range that

a- total variable costs are linear-

b- fi;ed costs per unit are constant-

c- total variable costs are nonlinear-

d- total revenue is nonlinear-

.123 . 5673 8asy O9:3 ,-2,-)

,(

1*- 4o compute the break-even point in units which of the following formulas is used?

a- 7#E#= per unit

b- 7#E#= ratio

c- #=E#= ratio

d- "7#J$#&E#= ratio

.123 . 5673 8asy O9:3 ,-2

1,- . firmBs break-even point in dollars can be found in one calculation using which of the following

formulas?

a- 7#E#= per unit

b- $#E#=

c- 7#E#= ratio

d- $#E#= ratio

.123 # 5673 8asy O9:3 ,-2

2<- 4he contribution margin ratio al-ays increases when the

a- variable costs as a percentage of net sales increase-

b- variable costs as a percentage of net sales decrease-

c- break-even point increases-

d- break-even point decreases-

.123 9 5673 8asy O9:3 ,-2,-)

21- 6n a multiple-product firm the product that has the highest contribution margin per unit will

a- generate more profit for each I1 of sales than the other products-

b- have the highest contribution margin ratio-

c- generate the most profit for each unit sold-

d- have the lowest variable costs per unit-

.123 # 5673 8asy O9:3 ,-',-)

22- ????????????? focuses only on factors that change from one course of action to another-

a- 6ncremental analysis

b- =argin of safety

c- Operating leverage

d- . break-even chart

.123 . 5673 8asy O9:3 ,-!

2!- 4he margin of safety would be negative if a company"Bs&

a- was presently operating at a volume that is below the break-even point-

b- present fi;ed costs were less than its contribution margin-

c- variable costs e;ceeded its fi;ed costs-

d- degree of operating leverage is greater than 1<<-

.123 . 5673 8asy O9:3 ,-(

,)

2'- 4he margin of safety is a key concept of #$% analysis- 4he margin of safety is the

a- contribution margin rate-

b- difference between budgeted contribution margin and actual contribution margin-

c- difference between budgeted contribution margin and break-even contribution margin-

d- difference between budgeted sales and break-even sales-

.123 5 5673 8asy O9:3 ,-(

2(- =anagement is considering replacing an e;isting sales commission compensation plan with a fi;ed

salary plan- 6f the change is adopted the companyBs

a- break-even point must increase-

b- margin of safety must decrease-

c- operating leverage must increase-

d- profit must increase-

.123 # 5673 =oderate O9:3 ,-(

2)- .s proAected net income increases the

a- degree of operating leverage declines-

b- margin of safety stays constant-

c- break-even point goes down-

d- contribution margin ratio goes up-

.123 . 5673 =oderate O9:3 ,-(

2+- . managerial preference for a very low degree of operating leverage might indicate that

a- an increase in sales volume is e;pected-

b- a decrease in sales volume is e;pected-

c- the firm is very unprofitable-

d- the firm has very high fi;ed costs-

.123 9 5673 =oderate O9:3 ,-(

#hompson Company

9elow is an income statement for 4hompson #ompany3

2ales

$400,000

$ariable costs

(125,000)

#ontribution margin

$275,000

7i;ed costs

(200,000)

%rofit before ta;es

$ 75,000

2*- Kefer to 4hompson #ompany- What is 4hompson/s degree of operating leverage?

a- !-)+

b- (-!!

c- 1-'(

d- 2-)+

.123 .

I"2+(<<<E+(<<<& D !-)+

5673 =oderate O9:3 ,-(

,+

2,- Kefer to 4hompson #ompany- 9ased on the cost and revenue structure on the income statement what

was 4hompson/s break-even point in dollars?

a- I2<<<<<

b- I!2(<<<

c- I!<<<<<

d- I2,<,<,

.123 5

#= %ercentage D I"2+(E'<<& D -)*+(

-)*+(; - I*<<<<< D <

; D I2,<,<,

5673 =oderate O9:3 ,-!

!<- Kefer to 4hompson #ompany- What was 4hompson/s margin of safety?

a- I2<<<<<

b- I+(<<<

c- I1<<<<<

d- I1<,<,1

.123 5

=argin of 2afety D I"'<<<<< - 2,<,<,&

D I1<,<,1

5673 8asy O9:3 ,-(

!1- Kefer to 4hompson #ompany- .ssuming that the fi;ed costs are e;pected to remain at I2<<<<< for the

coming year and the sales price per unit and variable costs per unit are also e;pected to remain

constant how much profit before ta;es will be produced if the company anticipates sales for the

coming year rising to 1!< percent of the current year/s level?

a- I,+(<<

b- I1,(<<<

c- I1(+(<<

d- . prediction cannot be made from the information given-

.123 #

#ontribution =argin L 1-2< D 1ew #ontribution =argin

I2+(<<< L 1-2< D I!(+(<<

#ontribution =argin - 7i;ed #osts D %rofit

I"!(+(<< - 2<<<<<& D I1(+(<<

5673 =oderate O9:3 ,-!

,*

Value Pro

$alue %ro produces and sells a single product- 6nformation on its costs follow3

$ariable costs3

2CM. I2 per unit

%roduction I' per unit

7i;ed costs3

2CM. I12<<< per year

%roduction I1(<<< per year

!2- Kefer to $alue %ro- .ssume $alue %ro produced and sold (<<< units- .t this level of activity it

produced a profit of I1*<<<- What was $alue %roBs sales price per unit?

a- I1(-<<

b- I11-'<

c- I,-)<

d- I1<-<<

.123 .

%rofit J 7i;ed #osts D #ontribution =argin

I1*<<< J I2+<<< D I'(<<<

I'(<<< E (<<< units D I, contribution margin per unit

#ontribution =argin J $ariable #osts D 2ales %riceENnit

I", J "' J 2&& D I1(ENnit

5673 =oderate O9:3 ,-!

!!- Kefer to $alue %ro- 6n the upcoming year $alue %ro estimates that it will produce and sell '<<< units-

4he variable costs per unit and the total fi;ed costs are e;pected to be the same as in the current year-

However it anticipates a sales price of I1) per unit- What is $alue %roBs proAected margin of safety for

the coming year?

a- I+<<<

b- I2<*<<

c- I1*'<<

d- I1!<<<

.123 9

%rofit at '<<< units

Cross 2ales D I1) L '<<< units D I)'<<<

#ontribution =argin D I"1) - )& D I1<Eunit

"I1<L'<<<& - I2+<<< D I"'<<<< - 2+<<<& D I1!<<<

9reakeven

<-)2(; - I2+<<< D I<

; D I'!2<<

I")'<<< - '!2<<& D I2<*<<

5673 =oderate O9:3 ,-(

,,

!'- Harris =anufacturing incurs annual fi;ed costs of I2(<<<< in producing and selling a single product-

8stimated unit sales are 12(<<<- .n after-ta; income of I+(<<< is desired by management- 4he

company proAects its income ta; rate at '< percent- What is the ma;imum amount that Harris can

e;pend for variable costs per unit and still meet its profit obAective if the sales price per unit is

estimated at I)?

a- I!-!+

b- I!-(,

c- I!-<<

d- I!-+<

.123 #

9efore 4a; 6ncome3 I+(<<< E <-)< D I12(<<<

7i;ed #osts3 2(<<<<

#ontribution =argin3 I!+(<<<

%roAected 2ales I+(<<<<

less3 #ontribution =argin !+(<<<

$ariable #osts I!+(<<<

I!+(<<< E 12(<<< units I!Eunit

5673 =oderate O9:3 ,-!

)olk Company

4he following information relates to financial proAections of 7olk #ompany3

%roAected sales )<<<< units

%roAected variable costs I2-<< per unit

%roAected fi;ed costs I(<<<< per year

%roAected unit sales price I+-<<

!(- Kefer to 7olk #ompany- How many units would 7olk #ompany need to sell to earn a profit before

ta;es of I1<<<<?

a- 2(+1'

b- 1<<<<

c- *(+1

d- 12<<<

.123 5

#ontribution =argin per Nnit3 I(

I(; - I(<<<< - I1<<<<

I(; D I)<<<<

; D 12<<< units

5673 =oderate O9:3 ,-!

1<<

!)- Kefer to 7olk #ompany- 6f 7olk #ompany achieves its proAections what will be its degree of operating

leverage?

a- )-<<

b- 1-2<

c- 1-)*

d- 2-'<

.123 9

1et profit D ")<<<< units L I(Eunit& - I(<<<<

D I!<<<<< - I(<<<<

D I2(<<<<

5OL D I"!<<<<<E12<<<<& D 1-2<

5673 =oderate O9:3 ,-(

!+- Nni0ue #ompany manufactures a single product- 6n the prior year the company had sales of I,<<<<

variable costs of I(<<<< and fi;ed costs of I!<<<<- Nni0ue e;pects its cost structure and sales price

per unit to remain the same in the current year however total sales are e;pected to increase by 2<

percent- 6f the current year proAections are reali>ed net income should e;ceed the prior year/s net

income by3

a- 1<< percent-

b- *< percent-

c- 2< percent-

d- (< percent-

.123 9

#ontribution margin3 I'<<<<

1et profit3 I"'<<<< - !<<<<& D I1<<<<

2<O #= increase3 I'<<<< L 1-2< D I'*<<<

1et profit3 I"'*<<< - !<<<<& D I1*<<<

6ncrease in profit I*<<<

I*<<<EI1<<<< D *<O

5673 =oderate O9:3 ,-!

E,le,ti, Corporation

8clectic #orporation manufactures and sells two products3 . and 9- 4he operating results of the

company are as follows3

%roduct . %roduct 9

2ales in units

2,000 3,000

2ales price per unit

$10 $5

$ariable costs per unit

7 3

6n addition the company incurred total fi;ed costs in the amount of I,<<<-

1<1

!*- Kefer to 8clectic #orporation-- How many total units would the company have needed to sell to break

even?

a- !+(<

b- +(<

c- !)<<

d- 1*<<

.123 .

Let 9 D 1-(.

!. J 2"1-(.& - I,<<< D I<

). - I,<<< D I<

. D 1(<<

9 D 22(<

4otal units D !+(<

5673 =oderate O9:3 ,-'

!,- Kefer to 8clectic #orporation- 6f the company would have sold a total of )<<< units consistent with

#$% assumptions how many of those units would you e;pect to be %roduct 9?

a- !<<<

b- '<<<

c- !)<<

d- !(<<

.123 #

. J 1-(. D )<<< units

2-(. D )<<< units

. D 2'<< units

9 D !)<< units

5673 =oderate O9:3 ,-'

'<- Kefer to 8clectic #orporation- How many units would the company have needed to sell to produce a

profit of I12<<<?

a- *+(<

b- 2<<<<

c- 1<<<<

d- *'<<

.123 .

!. J 2"1-(.& - I,<<< D I12<<<

). D I21<<<

. D !(<< units

9 D (2(< units

4otal D *+(< units

5673 =oderate O9:3 ,-'

1<2

Brittany Company

9elow is an income statement for 9rittany #ompany3

2ales

$300,000

$ariable costs

(150,000)

#ontribution margin

$150,000

7i;ed costs

(100,000)

%rofit before ta;es

$ 50,000

'1- Kefer to 9rittany #ompany- What was the companyBs margin of safety?

a- I(<<<<

b- I1<<<<<

c- I1(<<<<

d- I2(<<<

.123 9

=argin of safety D 2ales - 98% 2ales

#= D -(<

98% 2ales D -(<; - I1<<<<< D <

D -(<; D I1<<<<<

; D I2<<<<<

I"!<<<<< - 2<<<<<& D I1<<<<<

5673 =oderate O9:3 ,-(

'2- Kefer to 9rittany #ompany- 6f the unit sales price for 9rittany/s sole product was I1< how many units

would it have needed to sell to produce a profit of I'<<<<?

a- 2+(<<

b- 2,<<<

c- 2*<<<

d- canBt be determined from the information given

.123 #

#ontribution =argin at I'<<<< profit3 I"'<<<< J 1<<<<<& D I1'<<<<

#ontribution =argin Katio3 <-(<

I1'<<<< E -(< D I2*<<<<

I2*<<<< E I1< D 2*<<< units

5673 =oderate O9:3 ,-!

1<!

'!- . firm estimates that it will sell 1<<<<< units of its sole product in the coming period- 6t proAects the

sales price at I'< per unit the #= ratio at )< percent and profit at I(<<<<<- What is the firm

budgeting for fi;ed costs in the coming period?

a- I1)<<<<<

b- I2'<<<<<

c- I11<<<<<

d- I1,<<<<<

.123 5

%rofit J 7i;ed #ost D "1<<<<< units L I)<Eunit #=&

7i;ed #ost D "1<<<<< units L I2'Eunit #=& - %rofit

D I2'<<<<< - I(<<<<<

D I1,<<<<<

5673 =oderate O9:3 ,-!

''- 2ombrero #ompany manufactures a western-style hat that sells for I1< per unit- 4his is its sole product

and it has proAected the break-even point at (<<<< units in the coming period- 6f fi;ed costs are

proAected at I1<<<<< what is the proAected contribution margin ratio?

a- *< percent

b- 2< percent

c- '< percent

d- )< percent

.123 9

7i;ed #ostsD#ontribution =argin at 9reakeven %oint

D I1<<<<<

9reakeven 2ales3 I(<<<<<

#= Katio3 I"1<<<<<E(<<<<<& D 2<O

5673 =oderate O9:3 ,-!

Brandon Company

9randon #ompany manufactures a single product- 8ach unit sells for I1(- 4he firmBs proAected costs

are listed below3

$ariable costs per unit3

%roduction I(

2CM. I1

7i;ed costs3

%roduction I'<<<<

2CM. I)<<<<

8stimated volume 2<<<< units

1<'

'(- Kefer to 9randon #ompany- What is 9randonBs proAected margin of safety for the current year?

a- I1!!!!!

b- I1(<<<<

c- I*<<<<

d- I1<<<<<

.123 .

#ontribution =argin D I,Eunit

#ontribution =argin Katio D )<O

9reakeven %oint D I1<<<<<E-)< D I1))))+

2ales $olume D 2<<<< units L I1(Eunit D I!<<<<<

=argin of 2afety D I"!<<<<< - 1))))+& D I1!!!!!

5673 =oderate O9:3 ,-(

')- Kefer to 9randon #ompany- What is 9randonBs proAected degree of operating leverage for the current

year?

a- 2-2(

b- 1-*<

c- !-+(

d- 1-)+

.123 .

#ontribution =argin D I1*<<<<

1et 6ncome D *<<<<

5egree of Operating Leverage D I1*<<<<E*<<<< D 2-((

5673 =oderate O9:3 ,-(

Alpha. Beta. and Epsilon Companies

9elow are income statements that apply to three companies3 .lpha 9eta and 8psilon3

.lpha #o- 9eta #o- 8psilon #o-

2ales

$100 $100 $100

$ariable costs

(10) (20) (30)

#ontribution margin

$ 90 $ 80 $ 70

7i;ed costs

(30) (20) (10)

%rofit before ta;es

$ 60 $ 60 $ 60

'+- Kefer to .lpha 9eta and 8psilon #ompanies- Within the relevant range if sales go up by I1 for each

firm which firm will e;perience the greatest increase in profit?

a- .lpha #ompany

b- 9eta #ompany

c- 8psilon #ompany

d- canBt be determined from the information given

.123 .

.lpha #ompany will have the greatest increase in profit because it has the

greatest contribution margin per unit-

5673 8asy O9:3 ,-!

1<(

'*- Kefer to .lpha 9eta and 8psilon #ompanies- Within the relevant range if sales go up by one unit for

each firm which firm will e;perience the greatest increase in net income?

a- .lpha #ompany

b- 9eta #ompany

c- 8psilon #ompany

d- canBt be determined from the information given

.123 5

%rice per unit is not given-

5673 8asy O9:3 ,-!

',- Kefer to .lpha 9eta and 8psilon #ompanies- .t sales of I1<< which firm has the highest margin of

safety?

a- .lpha #ompany

b- 9eta #ompany

c- 8psilon #ompany

d- 4hey all have the same margin of safety-

.123 #

8psilon #ompany has the lowest amount of fi;ed costs to be

covered-

5673 =oderate O9:3 ,-!

(<- =ike is interested in entering the catfish farming business- He estimates if he enters this business his

fi;ed costs would be I(<<<< per year and his variable costs would e0ual !< percent of sales- 6f each

catfish sells for I2 how many catfish would =ike need to sell to generate a profit that is e0ual to 1<

percent of sales?

a- '<<<<

b- '1))+

c- !(<<<

d- 1o level of sales can generate a 1< percent net return on sales-

.123 9

Let ; D sales in dollars

; - -!<; - I(<<<< D -1<;

-)<; D I(<<<<

; D I*!!!! Nnits D I*!!!!EI2 per unit D '1))+ units

5673 5ifficult O9:3 ,-!

1<)

(1- 4he following information pertains to 2aturn #ompany/s cost-volume-profit relationships3

9reak-even point in units sold

1,000

$ariable costs per unit

$500

4otal fi;ed costs

$150,000

How much will be contributed to profit before ta;es by the 1<<1st unit sold?

a- I)(<

b- I(<<

c- I1(<

d- I<

.123 #

7i;ed #ost D #ontribution =argin

D I1(<<<<

#ontribution =arginENnit D #ontribution =arginENnits

I1(<<<<E1<<< units D I1(<Eunit

5673 =oderate O9:3 ,-!

(2- 6nformation concerning .verie #orporationBs %roduct . follows3

2ales

$300,000

$ariable costs

240,000

7i;ed costs

40,000

.ssuming that .verie increased sales of %roduct . by 2< percent what should the profit from %roduct

. be?

a- I2<<<<

b- I2'<<<

c- I!2<<<

d- I*<<<<

.123 #

#ontribution margin at I!<<<<< in sales D I)<<<<

6ncrease contribution margin by 2<O D I)<<<< L 1-2< D I+2<<<

#ontribution margin - fi;ed costs D %rofit

I"+2<<< - '<<<<& D I!2<<<

5673 =oderate O9:3 ,-!

1<+

(!- Ledbetter #ompany reported the following results from sales of (<<< units of %roduct . for :une3

2ales

$200,000

$ariable costs

(120,000)

7i;ed costs

(60,000)

Operating income

$ 20,000

.ssume that Ledbetter increases the selling price of %roduct . by 1< percent in :uly- How many units

of %roduct . would have to be sold in :uly to generate an operating income of I2<<<<?

a- '<<<

b- '!<<

c- '('(

d- (<<<

.123 .

6f sales price per unit is increased by 1< percent less units will have to be sold to generate

gross revenues of I2<<<<<-

2ales price per unit D I2<<<<<E(<<< units D I'<Eunit

I'<Eunit L 1-1< D I''Eunit

I"2<<<<< E ''Eunit& D '('( units

5673 =oderate O9:3 ,-!

('- On a break-even chart the break-even point is located at the point where the total

a- revenue line crosses the total fi;ed cost line-

b- revenue line crosses the total contribution margin line-

c- fi;ed cost line intersects the total variable cost line-

d- revenue line crosses the total cost line-

.123 5 5673 8asy O9:3 ,-!

((- 6n a #$% graph the slope of the total revenue line indicates the

a- rate at which profit changes as volume changes-

b- rate at which the contribution margin changes as volume changes-

c- ratio of increase of total fi;ed costs-

d- total costs per unit-

.123 9 5673 =oderate O9:3 ,-!

()- 6n a #$% graph the area between the total cost line and the total revenue line represents total

a- contribution margin-

b- variable costs-

c- fi;ed costs-

d- profit-

.123 5 5673 8asy O9:3 ,-!

(+- 6n a #$% graph the area between the total cost line and the total fi;ed cost line yields the

a- fi;ed costs per unit-

b- total variable costs-

c- profit-

d- contribution margin-

.123 9 5673 8asy O9:3 ,-!

1<*

(*- 6f a companyBs fi;ed costs were to increase the effect on a profit-volume graph would be that the

a- contribution margin line would shift upward parallel to the present line-

b- contribution margin line would shift downward parallel to the present line-

c- slope of the contribution margin line would be more pronounced "steeper&-

d- slope of the contribution margin line would be less pronounced "flatter&-

.123 9 5673 =oderate O9:3 ,-!

(,- 6f a companyBs variable costs per unit were to increase but its unit selling price stays constant the

effect on a profit-volume graph would be that the

a- contribution margin line would shift upward parallel to the present line-

b- contribution margin line would shift downward parallel to the present line-

c- slope of the contribution margin line would be pronounced "steeper&-

d- slope of the contribution margin line would be less pronounced "flatter&-

.123 5 5673 8asy O9:3 ,-!

)<- 4he most useful information derived from a cost-volume-profit chart is the

a- amount of sales revenue needed to cover enterprise variable costs-

b- amount of sales revenue needed to cover enterprise fi;ed costs-

c- relationship among revenues variable costs and fi;ed costs at various levels of activity-

d- volume or output level at which the enterprise breaks even-

.123 # 5673 8asy O9:3 ,-!

$+!R# AN$/ER

1- How do changes in volume affect the break-even point?

.123

Within the relevant range the break-even point does not change- 4his is due to the linearity

assumptions that apply to total revenues fi;ed costs and variable costs-

5673 =oderate O9:3 ,-2,-)

2- What maAor assumption do multi-product firms need to make in using #$% analysis that single-

product firms need not make?

.123

4he assumption that must be imposed is a constant sales mi;- . multi-product firm assumes that

"within the relevant range& the sales mi; is constant- 4his permits #$% analysis to be performed using

a unit of the constant sales mi;-

5673 =oderate O9:3 ,-'

!- What important information is conveyed by the margin of safety calculation in #$% analysis?

.123

4he break-even point in #$% analysis is critical because it divides profitable levels of operation from

unprofitable levels of operation- 4he margin of safety gives managers an idea of the e;tent to which

sales can fall before operations will become unprofitable-

5673 =oderate O9:3 ,-(

1<,

'- What are the maAor assumptions of #$% analysis?

.123

1- .ll revenue and variable cost behavior patterns are constant per unit

and linear within the relevant range-

2- 4otal contribution margin "total revenue divided by total variable cost& is linear

within the relevant range and increases proportionally with output-

!- 4otal fi;ed cost is constant within the relevant range- 4his assumption

in part indicates that no capacity additions will be made during

the period under consideration-

'- =i;ed costs can be accurately separated into their fi;ed and variable elements-

(- 2ales and production are e0ualP thus there is no material fluctuation in inventory

levels- 4his assumption is necessary because fi;ed cost can be allocated

to inventory at a different rate each year- 4hus variable costing

information must be available- 9ecause #$% and variable costing both focus

on cost behavior they are distinctly compatible with one another-

)- 6n a multi-product firm the sales mi; remains constant- 4his assumption is necessary

so that a weighted average contribution margin can be computed-

+- Labor productivity production technology and market conditions will not

change- 6f any of these changes were to occur costs would change correspondingly

and selling prices might change

5673 =oderate O9:3 ,-)

PR!BLE*

1- 4he #oont> #ompany sells two products . and 9 with contribution margin ratios of '< and !<

percent and selling prices of I( and I2-(< a unit- 7i;ed costs amount to I+2<<< a month- =onthly

sales average !<<<< units of product . and '<<<< units of product 9-

Re0uired1

a- .ssuming that three units of product . are sold for every four units of product 9

calculate the dollar sales volume necessary to break even-

b- .s part of its cost accounting routine #oont> #ompany assigns I!)<<< in fi;ed

costs to each product each month- #alculate the break-even dollar sales volume for

each product-

c- #oont> #ompany is considering spending an additional I,+<< a month on

advertising giving more emphasis to product . and less emphasis to product 9- 6f its

analysis is correct sales of product . will increase to '<<<< units a month but sales

of product 9 will fall to !2<<< units a month- Kecalculate the break-even sales

volume in dollars at this new product mi;- 2hould the proposal to spend the

additional I,+<< a month be accepted?

.123

a- #= D "! I2& J "' I-+(& D I,

2% D "! I(& D "' I2-(<& D I2(

98 D I+2<<< D I'<<<<<

I,EI2(

b- . D I!)<<< D I,<<<< 9 D I!)<<< D I12<<<<

11<

-' -!

c- #= D "( I2& J "' I-+(& D I1!

2% D "( I(& J "' I2-(<& D I!(

98 D I+2<<< J I,+<< D I21,,)2

I1!E!(

OL5 18W

#= . D !<<<< I2 D

$60,000 CM

. D '<<<< I2 D

$ 80,000

9 D '<<<< I-+( D

30,000

9 D !2<<< I-+(

24,000

$90,000 $104,000

- 7#

(72,000)

- 7#

(81,700)

O6

$18,000

O6

$ 22,300

.t current sales levels increase advertising-

5673 =oderate O9:3 ,-'

2- 4he Craves #ompany makes three products- 4he cost data for these three products is as follows3

%roduct . %roduct 9 %roduct #

2elling price

$10 $20 $40

$ariable costs

7 12 16

4otal annual fi;ed costs are I*'<<<<- 4he firmBs e;perience has been that about 2< percent of dollar

sales come from product . )< percent from 9 and 2< percent from #-

Re0uired1

a- #ompute break-even in sales dollars-

b- 5etermine the number of units to be sold at the break-even point-

.123

. 9 #

a- 2%

$10 $20 $40

- $#

(7) (12) (16)

D #=

$ 3 $ 8 $24

#=K

30% 40% 60%

#=K D "-2 !<O& J "-) '<O& J "-2 )<O& D '2O

98 D I*'<<<<E-'2 D I2<<<<<<

b- . "I2<<<<<< -2<&EI1< D '<<<< units

9 "I2<<<<<< -)<&EI2< D )<<<< units

# "I2<<<<<< -2<&EI'< D 1<<<< units

5673 =oderate O9:3 ,-'

111

!- .nderson #ompany produces and sells two products3 . and 9 in the ratio of !. to (9- 2elling prices

for . and 9 are respectively I12<< and I2'<P respective variable costs are I'*< and I1)<- 4he

companyBs fi;ed costs are I1*<<<<< per year-

#ompute the volume of sales in units of each product needed to3

Re0uired1

a- break even-

b- earn I*<<<<< of income before income ta;es-

c- earn I*<<<<< of income after income ta;es assuming a !< percent ta; rate-

d- earn 12 percent on sales revenue in before-ta; income-

e- earn 12 percent on sales revenue in after-ta; income assuming a !< percent ta; rate-

.123

. 2%

$1,200

9 2%

$240

- $#

(480)

- $#

(160)

#=

$ 720

#=

$ 80

Weighted #= D "! I+2<& J "( I*<& D I2()<

a- $1,800,000 = 703.125 A = 704 3 = 2,112 units

$2,560 B = 704 5 = 3,520

b-

$1,800,000 + $800,000 = 1015.625 A = 1,016 3 = 3,048 units

$2,560 B = 1,016 5 = 5,080

c-

$800,0001 ! .3 = $1,142,857

$1,800,000 + $1,142,857 = 1,149.55 A = 1,150 3 = 3,450 units

$2,560 B = 1,150 5 = 5,750

d- "# = (3 $1,200) + (5 $240) = $4,800

$ = $1,800,000 + $.12$ = $4,354,839

$2,560$4,800

A = ($4,354,839 .75)$1200 = 2,722 units

B = ($4,354,839 .25$240 = 4,537

e-

$ = $1,800,000 + $.12$

1 ! .3 = $4,973,684

$2,560$4,800

A = ($4,973,684 .75)$1,200 = 3,109 units

B = ($4,973,684 .25$240 = 5,181

5673 =oderate O9:3 ,-'

112

Bradley Corporation

6nformation relating to the current operations of 9radley #orporation follows3

2ales

$120,000

$ariable costs

(36,000)

#ontribution margin

$ 84,000

7i;ed costs

(70,000)

%rofit before ta;es

$ 14,000

'- Kefer to 9radley #orporation- 9radleyBs break-even point was 1<<< units- #ompute 9radleyBs sales

price per unit-

.123

4he break-even point is found by dividing the fi;ed costs by the #= ratio-

4he #= ratio is3

I*'<<<EI12<<<< D +<O- 9reakeven would then be3

I+<<<<E-+< D I1<<<<<- 2ince we also know that the break-even point is defined as 1<<< units it

must follow that the unit sales price is I1<<<<<E1<<< D I1<<-

5673 =oderate O9:3 ,-!

(- Kefer to 9radley #orporation- #ompute 9radleyBs degree of operating leverage-

.123

4he degree of operating leverage is computed as the contribution margin divided by profit before

ta;es3 I*'<<<EI1'<<< D )-

5673 =oderate O9:3 ,-(

*,2inney Corporation

=cQinney #orporation manufactures and sells two products3 . and 9- 4he proAected information on

these two products for the coming year is presented below3

%roduct . %roduct 9

2ales in units

4,000 1,000

2ales price per unit

$12 $8

$ariable costs per unit

8 4

4otal fi;ed costs for the company are proAected at I1<<<<-

)- Kefer to =cQinney #orporation- #ompute =cQinney #orporationBs proAected break-even point in total

units-

.123

4he company anticipates a sales mi; consisting of ' units of %roduct . and 1 unit of %roduct 9- 4he

total contribution margin for one unit of sales mi; would be I2<- 4his consists of I1) of contribution

margin from the ' units of %roduct . and I' of contribution margin from 1 unit of %roduct 9-

11!

4he overall company break-even point is found by dividing total fi;ed costs by the contribution

margin on one unit of sales mi;3 I1<<<<EI2< D (<< units- 4he (<< units of sales mi; contain (<< (

units of product for a total of 2(<<- Of the 2(<< total units 2<<< are units of %roduct . and (<< are

units of %roduct 9-

5673 =oderate O9:3 ,-'

+- Kefer to =cQinney #orporation- How many units would the company need to sell to produce an

income before income ta;es e0ual to 1( percent of sales?

.123

.gain using a unit of sales mi; as the unit of analysis one unit of sales mi; sells for I()- 2ince the

contribution margin is I2< on one unit of sales mi; the #= ratio on one unit of sales mi; is I2<EI() D

-!(+1- 4his implies that variable costs as a percentage of sales are e0ual to 1 - -!(+1 D -)'2,- 6ncome

before income ta;es e0ual to 1( percent of sales can be found by solving a formula of the following

type3

2ales - $# - 7# D 6ncome before income ta;es

6n this particular case we solve the following formula3

2ales - "-)'2, 2ales& - I1<<<< D "-1( 2ales&

2olving for 2ales we get I'*2*)- We can find out how many units of sales mi; are re0uired to

generate sales of I'*2*) by dividing I'*2*) by I() D *)!- 4hese *)! units of sales mi; each contain

( units of product so the correct answer would be *)! ( D '!1( units of product !'(2 of %roduct .

and *)! of %roduct 9-

5673 =oderate O9:3 ,-'

Perry Corporation

%erry #orporation predicts it will produce and sell '<<<< units of its sole product in the current year-

.t that level of volume it proAects a sales price of I!< per unit a contribution margin ratio of '<

percent and fi;ed costs of I( per unit-

*- Kefer to %erry #orporation- What is the companyBs proAected breakeven point in dollars and units?

.123

Civen the #= ratio of '< percent and the 2ales price per unit of I!< the #= per unit must be I!< -

'< D I12- 4he total fi;ed costs would be proAected at I( '<<<< D I2<<<<<- 9reakeven would be3

I2<<<<<EI12 D 1)))+ units- 4his would also e0uate to I(<<<<< of sales-

5673 =oderate O9:3 ,-!

,- Kefer to %erry #orporation- What would the companyBs proAected profit be if it produced and sold

!<<<< units?

.123

%roAected profit would be3

2ales "!<<<< I!<&

$900,000

$ariable costs "!<<<< I1*&

(540,000)

11'

#ontribution margin

$360,000

7i;ed costs

(200,000)

%rofit

$160,000

5673 =oderate O9:3 ,-!

Castle Corporation

4he following 0uestions are based on the following data pertaining to two types of products

manufactured by #astle #orporation3

%er unit

2ales price $ariable costs

%roduct R

$120 $ 70

%roduct S

$500 $200

7i;ed costs total I!<<<<< annually- 4he e;pected mi; in units is )< percent for %roduct R and '<

percent for %roduct S-

1<- Kefer to #astle #orporation- How much is #astle/s break-even point sales in units?

.123

98% units D 7#E"unit 2% - unit $#& or unit #="N=#&

7or multiple products use the weighted #= with weights based on units of sales weights-

98% D 7# E G)<O "I12< - I+<& J '<O "I(<< - I2<<&H

D I!<<<<<E "I!<Eu J I12<Eu& D 2<<< units

5673 =oderate O9:3 ,-'

11- Kefer to #astle #orporation- What is #astle/s break-even point in sales dollars?

.123

98% dollars D 7#E#=K

7or multiple products use weighted #=K with weights based on sales dollars as weights or sales mi;-

2ales mi; is )< percent and '< percent in units or in dollars-

Weighted average #=K D W.#=EW.2ale

W.#=K D G)<O "I12< - I+<& J '<O "I(<< - I2<<&H @ ")<O I12<& J "'<O I(<<&

W.#=K D GI!< J I12<H @ GI+2 J I2<<H D -((1

98% sales D 2<<< I2+2 D I(''<<<

5673 =oderate O9:3 ,-'

11(

You might also like

- Chapter 10-Relevant Information For Decision-Making: LO1 LO2 LO3 LO4 LO5 LO6 LO7 LO8Document37 pagesChapter 10-Relevant Information For Decision-Making: LO1 LO2 LO3 LO4 LO5 LO6 LO7 LO8Suzette EstiponaNo ratings yet

- TB Raiborn - Activity-Based Management and Activity-Based CostingDocument31 pagesTB Raiborn - Activity-Based Management and Activity-Based Costingjayrjoshuavillapando100% (1)

- Chapter 12 RaibornDocument20 pagesChapter 12 RaibornSuzette Estipona100% (1)

- TB-Raiborn - Capital BudgettingDocument43 pagesTB-Raiborn - Capital BudgettingkheymiNo ratings yet

- Calculating The Hamming CodeDocument26 pagesCalculating The Hamming Codevinod_tu2425% (4)

- 4.1.1.A StatisticalDataExplorationDocument6 pages4.1.1.A StatisticalDataExplorationErick MoralesNo ratings yet

- Minimum Degree Algorithm for Solving Sparse Linear SystemsDocument11 pagesMinimum Degree Algorithm for Solving Sparse Linear SystemsmayNo ratings yet

- Chapter 14Document43 pagesChapter 14Maryane AngelaNo ratings yet

- Materi Conditional Formating 2Document5 pagesMateri Conditional Formating 2Ersa ShasqiaNo ratings yet

- Finding Limits AlgebraicallyDocument4 pagesFinding Limits AlgebraicallyPammy Poerio PierettiNo ratings yet

- Limitsinfinity2 1Document1 pageLimitsinfinity2 1api-314332531No ratings yet

- Chapter 14Document43 pagesChapter 14Dominic RomeroNo ratings yet

- Chapter 12-Introduction To Cost Management Systems: LO1 LO2 LO3 LO4 LO5Document20 pagesChapter 12-Introduction To Cost Management Systems: LO1 LO2 LO3 LO4 LO5Dominic RomeroNo ratings yet

- Limits of Functions ExplainedDocument42 pagesLimits of Functions ExplainedKaren Dela TorreNo ratings yet

- Analisis Item Komponen Standar Akreditasi Madrasah MI Ruhama Jambik Ruhama Jambik 2019/2010Document5 pagesAnalisis Item Komponen Standar Akreditasi Madrasah MI Ruhama Jambik Ruhama Jambik 2019/2010Zaidin MasyhudiNo ratings yet

- Llavero de Las Tablas Multiplicar - UnlockedDocument4 pagesLlavero de Las Tablas Multiplicar - Unlockedlalahol15mNo ratings yet

- Llavero de Las Tablas Multiplicar (1) UnlockedDocument4 pagesLlavero de Las Tablas Multiplicar (1) UnlockedMildred Helen Mendoza MaitaNo ratings yet

- Lesson 5 - Multiplication of Whole NumbersDocument14 pagesLesson 5 - Multiplication of Whole NumbersChristian TabalanNo ratings yet

- Chapter 11 - Allocation of Joint Costs and Accounting For By-ProductsDocument46 pagesChapter 11 - Allocation of Joint Costs and Accounting For By-ProductsVictoria CadizNo ratings yet

- Capstone Week 4Document2 pagesCapstone Week 4Keshav SinghNo ratings yet

- Chapter 16Document22 pagesChapter 16Dominic RomeroNo ratings yet

- Test Bank Cost Accounting 6e by Raiborn and Kinney Chapter 6 PDFDocument68 pagesTest Bank Cost Accounting 6e by Raiborn and Kinney Chapter 6 PDFNerissa Bangui0% (1)

- H4 forex trading opportunities across 28 currency pairsDocument4 pagesH4 forex trading opportunities across 28 currency pairsThanh TranNo ratings yet

- CHAPTER 4 - Job Order Costing: Learning ObjectivesDocument3 pagesCHAPTER 4 - Job Order Costing: Learning Objectivesyes yesnoNo ratings yet

- Lesson 1 - LIMITS OF FUNCTIONSDocument59 pagesLesson 1 - LIMITS OF FUNCTIONSJohn Roi AlanoNo ratings yet

- Toaz - Info Test Bank Cost Accounting 6e by Raiborn and Kinney Chapter 1 PRDocument15 pagesToaz - Info Test Bank Cost Accounting 6e by Raiborn and Kinney Chapter 1 PRjustmine castroNo ratings yet

- Test Bank Cost Accounting 6e by Raiborn and Kinney Chapter 1Document15 pagesTest Bank Cost Accounting 6e by Raiborn and Kinney Chapter 1Kyrie IrvingNo ratings yet

- Midterm TestbankDocument78 pagesMidterm TestbankAubrey Shaiyne OfianaNo ratings yet

- 01 - Python Basics: 'Logo - PNG'Document15 pages01 - Python Basics: 'Logo - PNG'Mmk ReddyNo ratings yet

- A Generalization of Synthetic Division and A General Theorem of Division of Polynomials (Lianghuo Fan)Document8 pagesA Generalization of Synthetic Division and A General Theorem of Division of Polynomials (Lianghuo Fan)Bivek Singh BasnyatNo ratings yet

- Sampel Latihan Ujian Praktikum Kimia OrganikDocument3 pagesSampel Latihan Ujian Praktikum Kimia OrganikAdam Aulia RahmanNo ratings yet

- Chapter 19-Performance Measurement, Balanced Scorecards, and Performance RewardsDocument42 pagesChapter 19-Performance Measurement, Balanced Scorecards, and Performance RewardsDominic RomeroNo ratings yet

- Name - Syllabus We Will Most Likely Have A Mini-Quiz or Two This UnitDocument24 pagesName - Syllabus We Will Most Likely Have A Mini-Quiz or Two This UnitMark Joel FortunatoNo ratings yet

- Test Bank Cost Accounting 6e by Raiborn and Kinney Chapter 2Document29 pagesTest Bank Cost Accounting 6e by Raiborn and Kinney Chapter 2PauNo ratings yet

- Chapter 17 - Inventory and Production Management: LO1 LO2 LO3 LO4 LO5 LO6 LO7 LO8 LO9Document35 pagesChapter 17 - Inventory and Production Management: LO1 LO2 LO3 LO4 LO5 LO6 LO7 LO8 LO9Kyrie IrvingNo ratings yet

- Inequalities IM'sDocument8 pagesInequalities IM'sRobert TorresNo ratings yet

- GITAM Institute of Management MBA Quantitative Methods - I Model PaperDocument3 pagesGITAM Institute of Management MBA Quantitative Methods - I Model PaperEswarFICONo ratings yet

- 1 - Limits of Functions - DefinitionDocument22 pages1 - Limits of Functions - DefinitionRamon Jonathan Sapalaran100% (1)

- Date Deposit Withdraw LOT Pair Gross Profit Commision Nett Profit $30.00 Total BalanceDocument4 pagesDate Deposit Withdraw LOT Pair Gross Profit Commision Nett Profit $30.00 Total BalancezicareNo ratings yet

- Number Greenwhich Shakeys Pizza Hut NumberDocument11 pagesNumber Greenwhich Shakeys Pizza Hut NumberGrace LeeNo ratings yet

- Chapter 15 - Managing Costs and Uncertainty: LO1 LO2 LO3 LO4 LO5 LO6 LO7 LO8 LO9Document21 pagesChapter 15 - Managing Costs and Uncertainty: LO1 LO2 LO3 LO4 LO5 LO6 LO7 LO8 LO9Kyrie IrvingNo ratings yet

- Managing Costs and Uncertainty QuestionsDocument21 pagesManaging Costs and Uncertainty QuestionsDominic RomeroNo ratings yet

- Math - Double Dose! Two Digit MultiplicationDocument25 pagesMath - Double Dose! Two Digit MultiplicationAllan EvangelistaNo ratings yet

- StickerDocument2 pagesStickerxajaloy678No ratings yet

- FreebitcoDocument1 pageFreebitcozizou londonNo ratings yet

- Week 1 HW - Whole NumbersDocument3 pagesWeek 1 HW - Whole Numbersapi-292889624No ratings yet

- Seminar 3 EPI scoring resultsDocument3 pagesSeminar 3 EPI scoring resultsIonela PintilieNo ratings yet

- Absolute Value Equations 4 KEYDocument2 pagesAbsolute Value Equations 4 KEYNadya QrNo ratings yet

- Address Calculator PDFDocument5 pagesAddress Calculator PDFvictorNo ratings yet

- Tablasdemultiplicar PCDocument2 pagesTablasdemultiplicar PCSERENDIPITY 1306No ratings yet

- Go For 2 Kill The ClockDocument1 pageGo For 2 Kill The ClockCoach BrownNo ratings yet

- Lerchs-Grossman MethodDocument12 pagesLerchs-Grossman MethodGabrielNo ratings yet

- Unit 2: Algebraic ExpressionDocument3 pagesUnit 2: Algebraic ExpressionJerline Jane AntioquiaNo ratings yet

- BP002 - General MathematicsDocument353 pagesBP002 - General MathematicshamidalhadieNo ratings yet

- Maths Note P1 and P3Document188 pagesMaths Note P1 and P3Afeefa SaadatNo ratings yet

- Limites Trigonométricos e Limites InfinitosDocument4 pagesLimites Trigonométricos e Limites InfinitosAna Laura ValerianoNo ratings yet

- Abc 1Document2 pagesAbc 1margeNo ratings yet

- Chapter 6 Security Analysis PDFDocument46 pagesChapter 6 Security Analysis PDFchaluvadiinNo ratings yet

- Case Study: Itc LimitedDocument2 pagesCase Study: Itc LimitedchaluvadiinNo ratings yet

- SAPMDocument11 pagesSAPMchaluvadiinNo ratings yet

- Chapter 12 Cost Sheet or Statement of CostDocument16 pagesChapter 12 Cost Sheet or Statement of CostNeelesh MishraNo ratings yet

- Continuous-Time Mean-Variance Portfolio Selection With Inflation in An Incomplete MarketDocument10 pagesContinuous-Time Mean-Variance Portfolio Selection With Inflation in An Incomplete MarketchaluvadiinNo ratings yet

- Project ReportDocument86 pagesProject ReportchaluvadiinNo ratings yet

- MallikDocument88 pagesMallikchaluvadiinNo ratings yet

- Marketing Management NotesDocument63 pagesMarketing Management NotesDr Rushen SinghNo ratings yet

- Leases Slides FinalDocument34 pagesLeases Slides FinalchaluvadiinNo ratings yet

- IJREMDocument56 pagesIJREMchaluvadiinNo ratings yet

- Marketing Management NotesDocument63 pagesMarketing Management NotesDr Rushen SinghNo ratings yet

- MarketingDocument13 pagesMarketingchaluvadiinNo ratings yet

- The Insurance Act 1938Document123 pagesThe Insurance Act 1938chaluvadiinNo ratings yet

- Mutual Funds Vs Gold Saving FundsDocument19 pagesMutual Funds Vs Gold Saving Fundschaluvadiin100% (1)

- DerivativesDocument64 pagesDerivativeschaluvadiinNo ratings yet

- Anitha HDFCDocument84 pagesAnitha HDFCchaluvadiinNo ratings yet

- ReportDocument87 pagesReportchaluvadiinNo ratings yet

- DerivativesDocument64 pagesDerivativeschaluvadiinNo ratings yet

- Principles: of ManagementDocument22 pagesPrinciples: of ManagementHemaprasanthNo ratings yet

- Financial Statement Analysis1Document100 pagesFinancial Statement Analysis1chaluvadiinNo ratings yet

- ALM ProjectDocument84 pagesALM ProjectchaluvadiinNo ratings yet

- Understanding Investors and Equity MarketsDocument81 pagesUnderstanding Investors and Equity Marketschaluvadiin100% (2)

- DerivativesDocument64 pagesDerivativeschaluvadiinNo ratings yet

- Asset Lib MGT AbstractDocument1 pageAsset Lib MGT AbstractchaluvadiinNo ratings yet

- Priya ProjectDocument77 pagesPriya ProjectchaluvadiinNo ratings yet

- Harish Mba ProjectDocument72 pagesHarish Mba ProjectchaluvadiinNo ratings yet

- HDFC Bank Annual Report 2009 10Document137 pagesHDFC Bank Annual Report 2009 10yagneshroyalNo ratings yet

- ProjectDocument115 pagesProjectchaluvadiinNo ratings yet

- Tender Report For Construction Contracts - Designing BuildingsDocument5 pagesTender Report For Construction Contracts - Designing BuildingsIsiaka Ozovehe SuleimanNo ratings yet

- Nafdac Nigeria GMP 2021Document116 pagesNafdac Nigeria GMP 2021Dilawar BakhtNo ratings yet

- Chap 009Document21 pagesChap 009Kedia Rama50% (2)

- Test Bank For Strategic Management of Technological Innovation 6th Edition Melissa SchillingDocument13 pagesTest Bank For Strategic Management of Technological Innovation 6th Edition Melissa Schillingnicholaswileyirzojkpbsc100% (19)

- IBM Network and Service Management Solutions Help SBB Keep Trains On ScheduleDocument2 pagesIBM Network and Service Management Solutions Help SBB Keep Trains On ScheduleIBMTransportationNo ratings yet

- Amazon in Emerging Markets CaseDocument36 pagesAmazon in Emerging Markets CaseSpandan BhattacharyaNo ratings yet

- Haystack Syndrome (Eliyahu M. Goldratt) (Z-Library)Document270 pagesHaystack Syndrome (Eliyahu M. Goldratt) (Z-Library)jmulder1100% (3)

- SM AssignmentDocument17 pagesSM AssignmentElvinNo ratings yet

- Assignment 1 Student: Sidad Ibrahim: Hasbro OverviewDocument2 pagesAssignment 1 Student: Sidad Ibrahim: Hasbro OverviewSidad KurdistaniNo ratings yet

- EFFECTS OF ECONOMIC GROWTH AND GST RISEDocument41 pagesEFFECTS OF ECONOMIC GROWTH AND GST RISESebastian ZhangNo ratings yet

- PM January 2021 Lecture 4 Worked Examples Questions (Drury (2012), P. 451, 17.17)Document6 pagesPM January 2021 Lecture 4 Worked Examples Questions (Drury (2012), P. 451, 17.17)KAY PHINE NGNo ratings yet

- Brand Book AmChamDocument16 pagesBrand Book AmChamDraganescu OanaNo ratings yet

- Forensic Accounting Notes - Lesson 1 2Document11 pagesForensic Accounting Notes - Lesson 1 2wambualucas74No ratings yet

- Case Study BookDocument106 pagesCase Study BookshubhaomNo ratings yet

- Capital Market, Consumption and Investment RelationshipsDocument22 pagesCapital Market, Consumption and Investment RelationshipsKamran Kamran100% (1)

- Solved Twelve Accounting and Financial Services Professionals Opt To Form ADocument1 pageSolved Twelve Accounting and Financial Services Professionals Opt To Form AAnbu jaromiaNo ratings yet

- How To Think Like A Marketing Genius - Table of ContentsDocument10 pagesHow To Think Like A Marketing Genius - Table of Contentsbuymenow2005No ratings yet

- Marico's journey as a leading FMCG company in IndiaDocument13 pagesMarico's journey as a leading FMCG company in IndiaYuktesh PawarNo ratings yet

- Application OF THE Balanced Scorecard IN Strategy Implementation by Unilever Tea Kenya LimitedDocument50 pagesApplication OF THE Balanced Scorecard IN Strategy Implementation by Unilever Tea Kenya LimitedShokry AminNo ratings yet

- Extended Warranties-Scope As Insurance Under Indian Contract ActDocument4 pagesExtended Warranties-Scope As Insurance Under Indian Contract ActPISAPATI VISHNUVARDHAN 1950221No ratings yet

- Food or Restaurant POS PDFDocument18 pagesFood or Restaurant POS PDFMohd KamranNo ratings yet

- Orientation and TrainingDocument28 pagesOrientation and TrainingSunny Ramesh SadnaniNo ratings yet

- Technical DetailsDocument3 pagesTechnical DetailsKimberly NorrisNo ratings yet

- Project Analyst in Los Angeles CA Resume Saide NikkarDocument3 pagesProject Analyst in Los Angeles CA Resume Saide NikkarSaideNikkarNo ratings yet

- Cestui Que Vie TERMINATION THE PERMANENT ESCAPE FROM SLAVERYDocument1 pageCestui Que Vie TERMINATION THE PERMANENT ESCAPE FROM SLAVERYQiydar The KingNo ratings yet

- SITXFIN002 Assignment 1Document23 pagesSITXFIN002 Assignment 1mishal chNo ratings yet

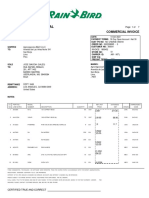

- Rain Bird International: 6991 E. Southpoint Road Tucson, AZ 85756 United States Fed Tax ID: 95-2402826Document7 pagesRain Bird International: 6991 E. Southpoint Road Tucson, AZ 85756 United States Fed Tax ID: 95-2402826Alejandra JamboNo ratings yet

- 9 External Environment Factors That Affect BusinessDocument5 pages9 External Environment Factors That Affect BusinessHasan NaseemNo ratings yet

- Aus Tin 20104493Document166 pagesAus Tin 20104493david_llewellyn_smithNo ratings yet

- Economic ServicesDocument34 pagesEconomic ServicesTUMAUINI TOURISMNo ratings yet