Professional Documents

Culture Documents

Calculating Stockholders' Equity for Multiple Companies

Uploaded by

beccafabbriOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Calculating Stockholders' Equity for Multiple Companies

Uploaded by

beccafabbriCopyright:

Available Formats

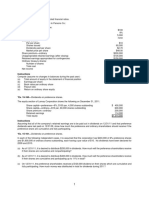

CHAPTER 11 ALTERNATE PROBLEMS

Problem 11.1A

Stockholders Equt! " # B#l#"ce Sheet

Early in 1999, Delstar, Inc. was organized with authorization to issue 10,000 shares of $50 par

value preferred stoc and 100,000 shares of $1 par value co!!on stoc. "ive thousand shares of

the preferred stoc were issued at par, and #0,000 shares of co!!on stoc were sold of $1$ per

share. %he preferred stoc pays a 10& cu!ulative dividend and is calla'le at $55.

During the first four years of operations (1999 through $00$), the corporation earned a

total of $1,*00,000 and paid dividends of $5 cents per share in each year on its outstanding

co!!on stoc.

Instructions

a. +repare the stocholders, e-uity section of the 'alance sheet at Dece!'er *1, $00$.

Include a supporting schedule showing your co!putation of the a!ount of retained

earnings reported. (.int/ Inco!e increases retained earnings, whereas dividends decrease

retained earnings.)

b. 0re there any dividends in arrears on the co!pany,s preferred stoc at Dece!'er *1,

$00$1 E2plain your answer.

c. 0ssu!e that interest rates increase steadily fro! 1999 through $00$. 3ould you e2pect

the !aret price of the co!pany,s preferred stoc to 'e higher or lower than its call price

of $55 at Dece!'er $1, $00$1

Alternate Problems for use with Financial and Managerial Accounting, 1$e 1141

5 %he 6c7raw4.ill 8o!panies, $00$

Problem 11.$A

Stockholders Equt! Secto"

"lag +u'lications was organized early in 1999 with authorization to issue 5,000 shares of $100

par value preferred stoc and 1 !illion shares of $$ par value co!!on stoc. 0ll of the

preferred stoc was issued at par, and $00,000 shares of co!!on stoc were sold for $1# per

share. %he preferred stoc pays a 10& cu!ulative dividend as is calla'le at $110.

During the first five years of operations (1999 through $001) the corporation earned a

total of $*,$00,000 and paid dividends of $1 per share each year on the co!!on stoc. In $00$,

however, the corporation reported a net loss of $1,*00,000 and paid no dividends.

Instructions

a. +repare the stocholder,s e-uity section of the 'alance sheet at Dece!'er *1, $00$.

Include a supporting schedule showing your co!putation of retained earrings at the

'alance sheet date. (.int/ Inco!e increases retained earnings, whereas dividends and net

losses decrease retained earnings.)

b. Draft a note to acco!pany the financial state!ents disclosing any dividends in arrears at

the end of $00$.

c. Do the dividends in arrears appear as a lia'ility of the corporation as of the end of $00$1

E2plain.

114$ Alternate Problems for use with Financial and Managerial Accounting, 1$e

5 %he 6c7raw4.ill 8o!panies, $00$

Problem 11.%A

Stockholders Equt! " # B#l#"ce Sheet

:ophia Dueno organized ;ewtown %ype, Inc. in <anuary 1999. %he corporation i!!ediately

issued at $1$ per share one4half of its 150,000 authorized shares of $1 par value co!!on stoc.

=n <anuary $, 2000, the corporation sold at par value the entire 10,000 authorized shares of 10&,

$100 par value, cu!ulative preferred stoc. =n <anuary $, 2001, the co!pany again needed

!oney and issued 5,000 shares of an authorized 10,000 shares of no4par, cu!ulative preferred

stoc for a total of $5>0,000. %he no4par shares have a stated dividend of $? per share.

%he co!pany declared no dividends in 1999 and $000. 0t the end of $000, its retained

earnings were $$$0,000. During $001 and $00$ co!'ined, the co!pany earned a total of

$9*0,000. Dividends of #0 cents per share in $001 and $1.50 per share in $00$ were paid on the

co!!on stoc.

Instructions

a. +repare the stocholder,s e-uity section of the 'alance sheet at Dece!'er *1, $00$.

Include a supporting schedule showing your co!putation of retained earrings at the

'alance sheet date. (.int/ Inco!e increases retained earnings, whereas dividends and net

losses decrease retained earnings.)

b. 0ssu!e that on <anuary $, $00$, the corporation could have 'orrowed $1,000,000 at 10&

interest on a long4ter! 'asis instead of issuing the 10,000 shares of the $100 par value

cu!ulative preferred stoc. Identify two reasons a corporation !ay choose to issue

cu!ulative preferred stoc rather than finance operations with long4ter! de't.

Alternate Problems for use with Financial and Managerial Accounting, 1$e 114*

5 %he 6c7raw4.ill 8o!panies, $00$

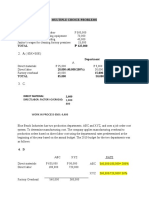

Problem 11.&A

Stockholders Equt!' A Short Com(rehe"s)e Problem

Early in the year :usan 0nthony and several trends organized a corporation called E-ual %i!e,

Inc. %he corporation was authorized to issue 100,000 shares of $100 par value, ?& cu!ulative

preferred stoc and 500,000 shares of $1 par value co!!on stoc. %he following transactions

(a!ong others) occurred during the year/

Jan. 4 Issued for cash >0,000 shares of co!!on stoc at $? per share. %he shares were

issued to 0nthony and * other investors.

Jan. 10 Issued an additional 1,$50 shares of co!!on stoc to 0nthony in e2change for

his services in organizing the corporation. %he stocholders agreed that these

services were worth $10,000.

Jan. 15 Issued *,000 shares of preferred stoc for cash of $*00,000.

Aug. 12 0c-uired land as a 'uilding site in e2change for $0,000 shares of co!!on stoc.

In view of the appraised value of the land and the progress of the co!pany, the

directors agreed that the co!!on stoc was to 'e valued for purposes of this

transaction at $10 per share.

Nov. 25 %he first annual divided of $? per share was declared on the preferred stoc to 'e

paid Dece!'er 11.

Dec. 11 +aid the cash dividend declared on ;ove!'er $5.

Dec. 31 0fter the revenue and e2penses were closed into the Inco!e :u!!ary account,

that a!ount indicated a net inco!e of $$19,500.

Instructions

a. +repare @ournal entries in general @ournal for! to record the a'ove transactions. Include

entries at Dece!'er *1 to close the Inco!e :u!!ary account and the Dividends account.

b. +repare the stocholders, e-uity section of the E-ual %i!e, Inc., 'alance sheet at

Dece!'er *1.

114> Alternate Problems for use with Financial and Managerial Accounting, 1$e

5 %he 6c7raw4.ill 8o!panies, $00$

Problem 11.*A

A"#l!ss o+ #" Equt! Secto" o+ # B#l#"ce Sheet

%he year4end 'alance sheet of :ocial :yste!s, Inc. includes the following stocholders, e-uity

section (with certain details o!itted)/

Stockholders e!uit"#

?& cu!ulative preferred stoc, $100 par value,

calla'le at $10>, 100,000 shares authorized............................................$*,$00,000

8o!!on stoc, $* par value, 1,000,000 shares

authorized................................................................................................. 1,$00,000

0dditional paid4in capital/ 8o!!on stoc.................................................... $,?00,000

Donated capital.............................................................................................. #10,000

Aetained earnings........................................................................................... *,>90,000

%otal stocholders, e-uity..................................................................... $11,$?0,000

Instructions

"ro! this infor!ation, co!pute answers to the following -uestions/

a. .ow !any shares of preferred stoc have 'een issued1

b. 3hat is the total a!ount of the annual dividends paid to preferred stocholders1

c. .ow !any shares of co!!on stoc are outstanding1

d. 3hat was the average issuance price per share of co!!on stoc1

e. 3hat is the a!ount of legal capital1

$. 3hat is the total a!ount of paid4in capital1

g. 3hat is the 'oo value per share of co!!on stoc1 (%here are no dividends in arrears.)

h. 0ssu!e that retained earnings at the 'eginning of the year a!ounted to $?15,000 and the

net inco!e for the year was $>,$00,000. 3hat was the dividend declared during the year

on each share of co!!on stoc1 (.int/ ;et inco!e increases retained earnings, whereas

dividends decrease retained earnings.)

Alternate Problems for use with Financial and Managerial Accounting, 1$e 1145

5 %he 6c7raw4.ill 8o!panies, $00$

Problem 11.,A

A"#l!ss o+ #" Equt! Secto" - More Com(rehe"s)e

6el'a 8orporation is a pu'licly owned co!pany. %he following infor!ation is e2cerpted fro! a

recent 'alance sheet. Dollar a!ounts (e2cept for per share a!ounts) are stated in thousands.

Stockholders e!uit"#

8onverti'le $1$ preferred stoc, no par

value, 1,000,000 shares authorizedB $>0,000 shares

issued and outstandingB $$00 per share li-uidation

preference (call price).............................................................................. $ >?,000

8o!!on stoc, par value $$B 50,000,000 shares

authorized................................................................................................. 5,$#0

0dditional paid4in capital.............................................................................. 9$,*>0

Aetained earnings........................................................................................... >9,$>0

%otal stocholders, e-uity........................................................................ $19$,?>0

Instructions

"ro! this infor!ation, co!pute answers to the following -uestions/

a. .ow !any shares of preferred stoc have 'een issued1

b. 3hat is the total a!ount of the annual dividends paid to preferred stocholders1

c. 3hat is the total a!ount of paid4in capital1

d. 3hat is the 'oo value per share of co!!on stoc1

e. Criefly e2plain the advantages and disadvantages to 6el'a of 'eing pu'licly owned

rather than operating as a closely held corporation.

$. 3hat is !eant 'y the ter! convertible used in the caption of the preferred stoc1 Is there

any !ore infor!ation that investors need to now to evaluate this conversion feature1

g. 0ssu!e that the preferred stoc currently is selling at $195 per share. Does this provide

a higher or lower dividend yield than a 9&, $50 par value preferred with a !aret price

of $5$ per share1 :how co!putations. E2plain why one preferred stoc !ight yield less

than another.

114# Alternate Problems for use with Financial and Managerial Accounting, 1$e

5 %he 6c7raw4.ill 8o!panies, $00$

Problem 11..A

P#r/ Book/ #"d M#rket 0#lues

6indless 8orporation is the producer of popular video ga!es. Aecently, an invest!ent service

pu'lished the following per4share a!ounts relating to the co!pany,s only class of stoc/

+ar value......................................................................................................... $ 0.01

Coo value (esti!ated).................................................................................. ?.00

6aret value.................................................................................................. ?$.00

Instructions

a. 3ithout reference to dollar a!ounts, e2plain the nature and significance of par value,

book value, and arket value.

b. 8o!!ent on the relationships, if any, a!ong the per4share accounts shown for the

co!pany. 3hat do these a!ounts i!ply a'out 6indless and its operations1 8o!!ent

on what these a!ounts i!ply a'out the security of creditors! clai!s against the co!pany.

Alternate Problems for use with Financial and Managerial Accounting, 1$e 1149

5 %he 6c7raw4.ill 8o!panies, $00$

Problem 11.1A

Re(ort"2 Stockholders Equt! 3th Tre#sur! Stock

Early in $000, :teel 8orporation was for!ed with authorization to issue 100,000 shares of $$ par

value co!!on stoc. 0ll shares were issued at a price of $1$ per share. %he corporation

reported net inco!e of $1>0,000 in $000, $#0,000 in $001, and $90,000 in $00$. ;o dividends

were declared in any of these three years.

In $001, the co!pany purchased $50,000 of its own shares in the open !aret. In $00$,

it reissued all of its treasury stoc for $#$,000.

Instructions

a. +repare the stocholder,s e-uity section of the 'alance sheet at Dece!'er *1, $00$.

Include a supporting schedule showing your co!putation of retained earrings at the

'alance sheet date. (.int/ Inco!e increases retained earnings.)

b. 0s of Dece!'er *1, co!pute the co!pany,s 'oo value per share of co!!on stoc.

c. E2plain how the treasury stoc transactions in $001 and $00$ were reported in the

co!pany,s state!ent of cash flows.

114? Alternate Problems for use with Financial and Managerial Accounting, 1$e

5 %he 6c7raw4.ill 8o!panies, $00$

Problem 11.4A

Re(ort"2 Stockholders Equt! 3th Tre#sur! Stock #"d Stock S(lts

Early in 199?, "ess Industries was for!ed with authorization to issue 100,000 shares of $$5 par

value co!!on stoc and $0,000 shares of $100 par value cu!ulative preferred stoc. During

199?, all the preferred stoc was issued at par, and #0,000 shares of co!!on stoc were sold for

$>0 per share. %he preferred stoc is entitled to a dividend e-ual to ?& of its par value 'efore

any dividends are paid on the co!!on stoc.

During its first five years of 'usiness (199? through $00$), the co!pany earned inco!e

totaling $>,500,000 and paid dividends of 95 cents per share each year on the co!!on stoc

outstanding.

=n <anuary $, $000, the co!pany purchased 1,000 shares of its own co!!on stoc in the

open !aret for $>5,000. =n <anuary $, $00$, it reissued 500 shares of this treasury stoc for

$$#,000. %he re!aining 500 were still held in treasury at Dece!'er *1, $00$.

Instructions

a. +repare the stocholder,s e-uity section of the 'alance sheet at Dece!'er *1, $00$.

Include a supporting schedule showing (1) your co!putation of any paid4in capital on

treasury stoc and ($) retained earrings at the 'alance sheet date. (.int/ Inco!e increases

retained earnings, whereas dividends reduce retained earnings. Dividends are not paid on

shares of stoc held in treasury.)

b. 0s of Dece!'er *1, co!pute the co!pany,s 'oo value per share of co!!on stoc.

(.int/ Coo value per share is co!puted only on the shares of stoc outstanding.)

c. 0t Dece!'er *1, $00$, shares of the co!pany,s co!!on stoc were trading at $5>.

E2plain what would have happened to the !aret price per share had the co!pany split

its stoc $4for41 at this date. 0lso e2plain what would have happened to the par value of

the co!!on stoc and to the nu!'er of co!!on shares outstanding.

Alternate Problems for use with Financial and Managerial Accounting, 1$e 1149

5 %he 6c7raw4.ill 8o!panies, $00$

11410 Alternate Problems for use with Financial and Managerial Accounting, 1$e

5 %he 6c7raw4.ill 8o!panies, $00$

You might also like

- Assignment 4 FA 03062021 102154pmDocument3 pagesAssignment 4 FA 03062021 102154pmMuhammad ArhamNo ratings yet

- Account for Par, No Par and Stated Value StockDocument19 pagesAccount for Par, No Par and Stated Value StockShaheer KhurramNo ratings yet

- Chapter 11-Part 1 Share Transaction Soal 1Document2 pagesChapter 11-Part 1 Share Transaction Soal 1Nicko Arisandiy0% (1)

- ACC 291 Week 4 ProblemsDocument8 pagesACC 291 Week 4 ProblemsGrace N Demara BooneNo ratings yet

- Exercise Chapter 12Document1 pageExercise Chapter 12Fatima BeenaNo ratings yet

- MULTIPLE CHOICE-CPA AdaptedDocument4 pagesMULTIPLE CHOICE-CPA AdaptedEdiane QuilezaNo ratings yet

- Review Sw4tgession 5 TEXTDocument9 pagesReview Sw4tgession 5 TEXTMelissa WhiteNo ratings yet

- Chapter 11 ExercisesDocument2 pagesChapter 11 ExercisesAreeba QureshiNo ratings yet

- Problems: Set B: InstructionsDocument2 pagesProblems: Set B: InstructionsflrnciairnNo ratings yet

- Crown Corporation Stockholders' Equity PracticeDocument3 pagesCrown Corporation Stockholders' Equity PracticeMeraj Ali100% (1)

- Bab 3 - Soal-Soal No. 4 SD 10Document4 pagesBab 3 - Soal-Soal No. 4 SD 10Vanni LimNo ratings yet

- Uas AKMDocument14 pagesUas AKMThorieq Mulya MiladyNo ratings yet

- Corporations: Organization and Capital Stock Transactions ProblemsDocument2 pagesCorporations: Organization and Capital Stock Transactions ProblemsvivienNo ratings yet

- Assignment Intermediate Accounting 14,15Document4 pagesAssignment Intermediate Accounting 14,15melodi pretNo ratings yet

- Working 6Document7 pagesWorking 6Hà Lê DuyNo ratings yet

- Tutorial - Corporation Stock - StudentsDocument3 pagesTutorial - Corporation Stock - StudentsBerwyn GazaliNo ratings yet

- Tolbert Enterprises Inc Manufactures Bathroom Fixtures The Sto PDFDocument1 pageTolbert Enterprises Inc Manufactures Bathroom Fixtures The Sto PDFAnbu jaromiaNo ratings yet

- 010164071Document2 pages010164071Sheep ersNo ratings yet

- Problem Sets Finacc Chapter 9Document19 pagesProblem Sets Finacc Chapter 9Reg Lagarteja100% (1)

- EPS Practice ProblemsDocument8 pagesEPS Practice ProblemsmikeNo ratings yet

- ch11 2Document58 pagesch11 2X YlmarixeNo ratings yet

- RECORDING Shares 1 Issue & DividendsDocument4 pagesRECORDING Shares 1 Issue & DividendsDonald SNo ratings yet

- Introduction To SHE and Issuance of SharesDocument1 pageIntroduction To SHE and Issuance of Shareslei dcNo ratings yet

- The Ledger of Nakona Corporation at December 31 2011 AfterDocument1 pageThe Ledger of Nakona Corporation at December 31 2011 AfterM Bilal SaleemNo ratings yet

- Stockholder's EquityDocument8 pagesStockholder's EquityKaila stinerNo ratings yet

- 110.stockholders Equity ExercisesDocument4 pages110.stockholders Equity ExercisesRosalinda DacayoNo ratings yet

- Accounting HW Chapter 15Document4 pagesAccounting HW Chapter 15chiaraar88No ratings yet

- Soal Latihan Minggu 4Document9 pagesSoal Latihan Minggu 4Alifia AprizilaNo ratings yet

- Problems Chapter 11Document29 pagesProblems Chapter 11Incia100% (1)

- Accounting II Chapters 12, 13, 14 ReviewDocument10 pagesAccounting II Chapters 12, 13, 14 ReviewJacKFrost1889No ratings yet

- Problem Sets Finacc Chapter 9Document19 pagesProblem Sets Finacc Chapter 9Reg LagartejaNo ratings yet

- Demo Problem For Chapter 11: Question #1Document5 pagesDemo Problem For Chapter 11: Question #1Isaac RosenbergNo ratings yet

- Audit of Equity ONLYDocument2 pagesAudit of Equity ONLYAstika Tamala Br TinjakNo ratings yet

- Kuis UTS Genap Lab AKM II DoskoDocument4 pagesKuis UTS Genap Lab AKM II DoskoYokka FebriolaNo ratings yet

- Problems: Set B: InstructionsDocument2 pagesProblems: Set B: InstructionsflrnciairnNo ratings yet

- Quiz - Inter 2 UTS - Wo AnsDocument3 pagesQuiz - Inter 2 UTS - Wo AnsNike HannaNo ratings yet

- FINANCE EXAM 3 The Hasting Company Began Operations On January 1, 2003Document7 pagesFINANCE EXAM 3 The Hasting Company Began Operations On January 1, 2003Mike Russell50% (2)

- ch.13 Practice QuestionsDocument4 pagesch.13 Practice QuestionsAshNo ratings yet

- Latihan Soal Chapter 5 SD 7Document6 pagesLatihan Soal Chapter 5 SD 7Andy warholNo ratings yet

- Chapter 13 14 Review QuestionsDocument6 pagesChapter 13 14 Review QuestionsHERSINo ratings yet

- Normito Company shareholders' equity transactionsDocument2 pagesNormito Company shareholders' equity transactions-No ratings yet

- 6941 Ais - Database.model - file.LampiranLain TUGAS PERTEMUAN 12Document4 pages6941 Ais - Database.model - file.LampiranLain TUGAS PERTEMUAN 12Amirah rasyidahNo ratings yet

- Assignment AFA IDocument4 pagesAssignment AFA IAbebeNo ratings yet

- 432 Chapter 15 Notes 2015Document68 pages432 Chapter 15 Notes 2015AoranKanNo ratings yet

- Pryor Company Receives Net Proceeds ofDocument4 pagesPryor Company Receives Net Proceeds ofAulia HidayatiNo ratings yet

- Compilation of ProblemsDocument9 pagesCompilation of ProblemsCorina Mamaradlo CaragayNo ratings yet

- Dokumen Tips Advanced Accounting Test Bank Chapter 07 Susan HamlenDocument61 pagesDokumen Tips Advanced Accounting Test Bank Chapter 07 Susan Hamlenamira samirNo ratings yet

- Hope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentDocument6 pagesHope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentShumebeza BaylleNo ratings yet

- Final Review ProblemsDocument17 pagesFinal Review ProblemsEvan KlineNo ratings yet

- Financial Reporting Multiple Choice QuestionsDocument2 pagesFinancial Reporting Multiple Choice QuestionsJohn Mark PalapuzNo ratings yet

- ACC1002X Optional Questions - SOLUTIONS CHP 10Document5 pagesACC1002X Optional Questions - SOLUTIONS CHP 10edisonctrNo ratings yet

- Question and Answer - 34Document31 pagesQuestion and Answer - 34acc-expertNo ratings yet

- At The Beginning of 2011 Greene Inc Showed The Following: Unlock Answers Here Solutiondone - OnlineDocument1 pageAt The Beginning of 2011 Greene Inc Showed The Following: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- At The Beginning of 2011 Greene Inc Showed The Following: Unlock Answers Here Solutiondone - OnlineDocument1 pageAt The Beginning of 2011 Greene Inc Showed The Following: Unlock Answers Here Solutiondone - OnlineAmit PandeyNo ratings yet

- Chapter 18-Practice ExsercisesDocument18 pagesChapter 18-Practice ExsercisesThiNo ratings yet

- CH 16Document3 pagesCH 16vivienNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Muslim Investor: The Stock Market Made SimpleFrom EverandMuslim Investor: The Stock Market Made SimpleRating: 5 out of 5 stars5/5 (1)

- Censorship, Freedom of Expression, Trust-Revised 2-7-14Document18 pagesCensorship, Freedom of Expression, Trust-Revised 2-7-14beccafabbriNo ratings yet

- CH 6 Cost Volume Profit Revised Mar 18Document84 pagesCH 6 Cost Volume Profit Revised Mar 18beccafabbriNo ratings yet

- Quiz 3 Study Guide 3 25 14-2Document4 pagesQuiz 3 Study Guide 3 25 14-2beccafabbriNo ratings yet

- Production Possibilities Essay Problem Notes-3Document3 pagesProduction Possibilities Essay Problem Notes-3beccafabbriNo ratings yet

- Felix MendelssohnDocument6 pagesFelix MendelssohnbeccafabbriNo ratings yet

- Quiz 3 Study Guide 3 25 14-2Document4 pagesQuiz 3 Study Guide 3 25 14-2beccafabbriNo ratings yet

- Quiz 2 Study GuideDocument2 pagesQuiz 2 Study GuidebeccafabbriNo ratings yet

- Accounting 200 Final Exam Study Guide Chapters 1-4Document1 pageAccounting 200 Final Exam Study Guide Chapters 1-4beccafabbriNo ratings yet

- Accrual Accounting Requires Adjusting EntriesDocument4 pagesAccrual Accounting Requires Adjusting EntriesbeccafabbriNo ratings yet

- CH 12Document9 pagesCH 12beccafabbriNo ratings yet

- Data Analysis BasicDocument29 pagesData Analysis BasicTrần Anh TúNo ratings yet

- Fashion PDFDocument3 pagesFashion PDFbeccafabbriNo ratings yet

- Accrual Accounting Requires Adjusting EntriesDocument4 pagesAccrual Accounting Requires Adjusting EntriesbeccafabbriNo ratings yet

- Julian Allwood Sustainable Materials With Both Eyes Open SoSL12 LowDocument3 pagesJulian Allwood Sustainable Materials With Both Eyes Open SoSL12 LowbeccafabbriNo ratings yet

- Financial Sector 1-10Document6 pagesFinancial Sector 1-10beccafabbriNo ratings yet

- Frankensteins Parallels With GodDocument3 pagesFrankensteins Parallels With GodbeccafabbriNo ratings yet

- Writers Statement SampleDocument7 pagesWriters Statement SamplebeccafabbriNo ratings yet

- SampleChapter3 MassMediaDocument13 pagesSampleChapter3 MassMediagogirl23No ratings yet

- Re Sum 742Document4 pagesRe Sum 742beccafabbriNo ratings yet

- Chapter 26Document69 pagesChapter 26beccafabbriNo ratings yet

- Vanity Fair Tennis Ad 1Document1 pageVanity Fair Tennis Ad 1beccafabbriNo ratings yet

- LTC vs-1. Lac ChartDocument4 pagesLTC vs-1. Lac ChartbeccafabbriNo ratings yet

- Republicanism QuizDocument2 pagesRepublicanism QuizbeccafabbriNo ratings yet

- Assembly LineDocument1 pageAssembly LinebeccafabbriNo ratings yet

- Becca's Homecoming ApplicationDocument1 pageBecca's Homecoming ApplicationbeccafabbriNo ratings yet

- Albert Parson's AutoDocument4 pagesAlbert Parson's AutobeccafabbriNo ratings yet

- Product Planning and Pricing ElementsDocument3 pagesProduct Planning and Pricing ElementsTrish Bernabe100% (1)

- The Best of Guerrilla Marketing Jay Levinson, Bigwig Briefs Staff, Aspatore Bo Bigwig BriefsDocument146 pagesThe Best of Guerrilla Marketing Jay Levinson, Bigwig Briefs Staff, Aspatore Bo Bigwig BriefsrealshireshopNo ratings yet

- Types of Retail Formats and Stores ExplainedDocument8 pagesTypes of Retail Formats and Stores ExplainedSystech SysNo ratings yet

- Chap3 Internal AnalysisDocument37 pagesChap3 Internal AnalysisDeepali GargNo ratings yet

- 2015-16 F.4 Form Test 2Document18 pages2015-16 F.4 Form Test 2廖籽藍No ratings yet

- Resume Frank Rothaermel - Strategic Management Chapter 3 - Dani Yustiardi 1906419822Document3 pagesResume Frank Rothaermel - Strategic Management Chapter 3 - Dani Yustiardi 1906419822Dani Yustiardi MunarsoNo ratings yet

- Cash BookDocument2 pagesCash BookYin Liu100% (1)

- Chapter 3 Information Systems, Organizations, and StrategyDocument31 pagesChapter 3 Information Systems, Organizations, and StrategyPragyan RoutNo ratings yet

- 20.00 Points: AwardDocument5 pages20.00 Points: AwardMikulas HarvankaNo ratings yet

- Introduction To Economics: By: Marlon D. Saliot Teacher I Jhs Kitubo National High SchoolDocument29 pagesIntroduction To Economics: By: Marlon D. Saliot Teacher I Jhs Kitubo National High SchoolMel Froilan ArregloNo ratings yet

- Retail MGMT 1 - MergedDocument188 pagesRetail MGMT 1 - MergedasniNo ratings yet

- VII Financial PlanDocument36 pagesVII Financial PlanAndrea Jane FaustinoNo ratings yet

- Multiple Choice-Problems 1. A: Direct MaterialDocument11 pagesMultiple Choice-Problems 1. A: Direct MaterialIT GAMINGNo ratings yet

- SW One DXP Cost Sheet (4.5BHK+Utility) Phase 2Document1 pageSW One DXP Cost Sheet (4.5BHK+Utility) Phase 2assetcafe7No ratings yet

- Stretch Your Data Management CapabilitiesDocument13 pagesStretch Your Data Management Capabilities123assisNo ratings yet

- Cru Rental StudentDocument19 pagesCru Rental StudentRowann AwsmmNo ratings yet

- Interest TheoryDocument167 pagesInterest TheoryHaydarRPNo ratings yet

- Eyelash Extension Business PlanDocument44 pagesEyelash Extension Business PlanJoseph Quill0% (1)

- Brief History of BrandingDocument22 pagesBrief History of Brandingloaz0% (1)

- Apayao Glassworks BusinessDocument4 pagesApayao Glassworks BusinessvicentaNo ratings yet

- Economics of Strategy: Fifth EditionDocument44 pagesEconomics of Strategy: Fifth EditionSachin SoniNo ratings yet

- Industry Profile: GRANDS MOULINS DE PARISDocument2 pagesIndustry Profile: GRANDS MOULINS DE PARISMilling and Grain magazineNo ratings yet

- Shemaroo Entertainment LTDDocument16 pagesShemaroo Entertainment LTDsheetalsamantNo ratings yet

- Financial Reporting Quality and Outsourcing of Accounting TasksDocument10 pagesFinancial Reporting Quality and Outsourcing of Accounting TasksDiana IstrateNo ratings yet

- Calculate Customer Lifetime Value for SaaS BusinessDocument20 pagesCalculate Customer Lifetime Value for SaaS Businesskamalapati tiwariNo ratings yet

- Make My TripDocument11 pagesMake My TripSamyak GajbhiyeNo ratings yet

- Basel NormsDocument42 pagesBasel NormsBluehacksNo ratings yet

- FAR2 BANK RECONCILIATION StudentDocument7 pagesFAR2 BANK RECONCILIATION StudentCHRISTIAN BETIANo ratings yet

- Role of the Operations Manager in Coordinating ResourcesDocument3 pagesRole of the Operations Manager in Coordinating ResourcesRahul ItankarNo ratings yet

- Answer To Assignment #2 - Variable Costing PDFDocument14 pagesAnswer To Assignment #2 - Variable Costing PDFVivienne Rozenn LaytoNo ratings yet