Professional Documents

Culture Documents

Module 3 Answers To End of Module Questions

Uploaded by

YanLi100%(3)100% found this document useful (3 votes)

633 views40 pagesOriginal Title

Module 3 Answers to End of Module Questions

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

100%(3)100% found this document useful (3 votes)

633 views40 pagesModule 3 Answers To End of Module Questions

Uploaded by

YanLiCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 40

Module 3

Profitability Analysis and Interpretation

DISCUSSION QUESTIONS

Q3-! "eturn on in#est$ent $easures profitability in relation to t%e

a$ount of in#est$ent t%at %as been $ade in t%e business! A

&o$pany &an al'ays in&rease dollar profit by in&reasin( t%e

a$ount of in#est$ent )assu$in( it is a profitable in#est$ent*! So+

dollar profits are not ne&essarily a $eanin(ful 'ay to loo, at

finan&ial perfor$an&e! Usin( return on in#est$ent in our analysis+

'%et%er as in#estors or business $ana(ers+ re-uires us to fo&us

not only on t%e in&o$e state$ent+ but also on t%e balan&e s%eet!

Q3-.!

A

In&reasin( le#era(e in&reases "OE as lon( as t%e assets earn a

(reater operatin( return t%an t%e &ost of t%e additional debt!

/inan&ial le#era(e is also related to ris,0 t%e ris, of potential

ban,rupt&y and t%e ris, of in&reased #ariability of profits!

Co$panies $ust+ t%erefore+ balan&e t%e positi#e effe&ts of

finan&ial le#era(e a(ainst t%eir potential ne(ati#e &onse-uen&es! It

is for t%is reason t%at 'e do not 'itness &o$panies entirely

finan&ed 'it% debt!

Q3-3! 1ross profit $ar(ins &an de&line be&ause * t%e industry %as

be&o$e $ore &o$petiti#e+ and2or t%e fir$3s produ&ts %a#e lost

t%eir &o$petiti#e ad#anta(e so t%at t%e &o$pany %as redu&ed

sellin( pri&es or is sellin( fe'er units or .* produ&t &osts %a#e

in&reased+ or 3* t%e sales $i4 %as &%an(ed fro$ %i(%er-

$ar(in2slo'ly turnin( produ&ts to lo'er-$ar(in2%i(%er turnin(

produ&ts! De&linin( (ross profit $ar(ins are usually #ie'ed

ne(ati#ely! On t%e ot%er %and+ &ost in&reases t%at refle&t broader

e&ono$i& e#ents or &ertain strate(i& produ&t $i4 &%an(es $i(%t

not be #ie'ed as ne(ati#ely!

Cambridge Business Publishers, 2013

Solutions Manual, Module 3

3-1

Q3-5! "edu&in( ad#ertisin( or "6D e4penditures &an in&rease &urrent

operatin( profit at t%e e4pense of t%e lon(-ter$ &o$petiti#e

position of t%e fir$! E4penditures on ad#ertisin( or "6D often

&reate lon(-ter$ e&ono$i& benefits!

Q3-7! Asset turno#er $easures t%e a$ount of re#enue &o$pared 'it%

t%e in#est$ent in an asset! 1enerally spea,in(+ 'e 'ant turno#er

to be %i(%er rat%er t%an lo'er! Turno#er $easures produ&ti#ity

and an i$portant &o$pany ob8e&ti#e is to $a,e assets as

produ&ti#e as possible! 9e&ause turno#er is one of t%e

&o$ponents of "OE )#ia "NOA*+ in&reasin( turno#er in&reases

s%are%older #alue! Turno#er is+ t%erefore+ #ie'ed as a #alue dri#er!

Q3-:! "OE;"NOA i$plies a positi#e return on nonoperatin( a&ti#ities!

T%is results fro$ borro'ed funds bein( in#ested in operatin(

assets '%ose return )"NOA* e4&eeds t%e &ost of borro'in(! In t%is

&ase+ borro'in( $oney in&reases "OE!

Q3-<!

A

On&e a business se($ent %as been sold or desi(nated for sale+ it

is &lassified as a dis&ontinued operation! Conse-uently+ sales and

e4penses related to t%e business se($ent are reported separately+

T%us+ t%e in&o$e state$ent reports in&o$e fro$ &ontinuin(

operations+ dis&ontinued operations+ and net in&o$e )'%i&%

in&ludes bot% &ontinuin( and dis&ontinued operations*! On t%e

balan&e s%eet+ t%e business se($ent3s assets and liabilities are

si$ilarly se(re(ated! 9e&ause t%e business se($ent 'as or 'ill

be sold+ it no lon(er &ontributes to t%e operatin( a&ti#ities of t%e

&o$pany! One of t%e pri$ary uses of finan&ial infor$ation is to

pro8e&t future finan&ial results so t%at in#estors and ot%ers &an

properly pri&e t%e &o$pany3s se&urities and e#aluate strate(i&

plans! T%e dis&ontinued operations 'ill not affe&t future results

)ot%er t%an #ia in#est$ent of t%e pro&eeds fro$ t%e sale*+ and+

t%erefore+ s%ould not be &onsidered as a &o$ponent of operatin(

a&ti#ities!

Cambridge Business Publishers, 2013

Financial Statement Analsis ! "aluation, 3rd #dition

3-2

Q3-=! T%e interest ta4 s%ield arises be&ause interest e4pense is

dedu&tible for ta4 purposes! T%us+ interest e4pense >s%ields?

in&o$e fro$ ta4es by redu&in( ta4able in&o$e! T%e after-ta4 &ost

of interest is+ t%erefore+ t%e preta4 &ost $ultiplied by $inus t%e

appropriate ta4 rate )typi&ally t%e su$ of t%e federal and state ta4

rates*!

Q3-@! T%e >net? in net operatin( assets+ $eans operatin( assets >net? of

operatin( liabilities! T%is nettin( re&o(niAes t%at a portion of t%e

&osts of operatin( assets is funded by t%ird parties! /or e4a$ple+

payables and a&&rued e4penses %elp fund in#entories+ 'a(es+

utilities+ and ot%er operatin( &osts! Si$ilarly+ lon(-ter$ operatin(

liabilities also %elp fund t%e &ost of lon(-ter$ operatin( assets!

T%us+ t%ese lon(-ter$ operatin( liabilities are dedu&ted fro$ lon(-

ter$ operatin( assets!

Q3-B! Co$panies $ust $ana(e bot% t%e in&o$e state$ent and t%e

balan&e s%eet in order to $a4i$iAe "NOA! T%is is i$portant+ as

too often $ana(ers loo, only to t%e in&o$e state$ent and do not

fully appre&iate t%e #alue added by effe&ti#e balan&e s%eet

$ana(e$ent! T%e disa((re(ation of "NOA into its profit and

turno#er &o$ponents fo&uses analysis on bot% of t%ese areas!

Q3-! T%ere are an infinite nu$ber of possible &o$binations of profit

$ar(in and asset turno#er t%at 'ill yield a (i#en le#el of "NOA!

T%e relati#e 'ei(%tin( of profit $ar(in and asset turno#er is dri#en

in lar(e part by t%e &o$pany3s business $odel! As a result+ sin&e

&o$panies in an industry tend to adopt si$ilar business $odels+

industries 'ill (enerally trend to'ard points alon( t%e

$ar(in2turno#er &ontinuu$!

Q3-.! Ci-uidity refers to &as%0 %o' $u&% &as% a &o$pany %as+ %o'

$u&% &as% is &o$in( in t%e door+ and %o' $u&% &as% &an be

raised -ui&,ly! Co$panies $ust (enerate &as% in order to pay

t%eir debts+ pay t%eir e$ployees+ and pro#ide t%eir s%are%olders a

return on in#est$ent! Cas% is+ t%erefore+ &riti&al to a &o$pany3s

sur#i#al!

Cambridge Business Publishers, 2013

Solutions Manual, Module 3

3-3

Q3-3! "atio analysis uses t%e balan&e s%eet+ in&o$e state$ent and

state$ent of &as% flo's! It is+ t%erefore+ dependent on t%e -uality

of t%ose state$ents! Differen&es in t%e appli&ation of 1AAP a&ross

&o$panies or 'it%in t%e sa$e &o$pany a&ross ti$e &an affe&t t%e

reliability of t%e analysis! Ci$itations of 1AAP itself )e!(!+

i$$ediate e4pensin( of "6D+ non-re&o(nition of assets t%at

&annot be reliably $easured* and differen&es in t%e $a,eup of t%e

&o$pany )e!(!+ types of produ&ts or industries in '%i&% t%e

&o$pany &o$petes* &an also affe&t t%e usefulness of ratio

analysis!

Q3-5!

A

Net nonoperatin( obli(ations )NNO* &onsist of t%e e4&ess of

)interest-bearin(* debt o#er in#est$ents in nonoperatin( assets!

Net nonoperatin( obli(ations &an be eit%er positi#e )e4&ess of

debt* or ne(ati#e )e4&ess of in#est$ents*! Net nonoperatin(

e4pense )NNE* is t%e e4&ess of NOPAT o#er net in&o$e! Net

nonoperatin( e4pense &an also be positi#e )nonoperatin(

e4penses e4&eed nonoperatin( in&o$e* or ne(ati#e! If a &o$pany

reports non&ontrollin( interest+ 'e ad8ust NNO by addin( t%e

non&ontrollin( interest reported on t%e balan&e s%eet+ and 'e

ad8ust NNE by addin( t%e non&ontrollin( interest reported on t%e

in&o$e state$ent!

Cambridge Business Publishers, 2013

Financial Statement Analsis ! "aluation, 3rd #dition

3-$

MINI EDE"CISES

M3-7 )7 $inutes*

)E $illions*

NOA .BB= F E5B+.7 - E757 - )EB+.. - E+B5.* - E.+37 - .<. F E.=+B@3

%ote& In t%e absen&e of infor$ation about >ot%er? &urrent and lon(-ter$ assets and liabilities+ 'e

assu$e t%at t%ese >ot%er? assets and liabilities are operatin( in nature!

M3-: )7 $inutes*

)E $illions*

Tar(et3s net operatin( profit be'ore ta4 F E:<+@@< - E55+:@3 - E7+=5@ - E+::

F E7+=3@!

%ote& Ge treat net &redit &ard re#enues+ and t%e related &redit &ard e4pense+ as operatin( be&ause

Tar(et $aintains its o'n proprietary &redit &ard to support in-store sales! T%e assu$ption+ t%en+

is t%at t%e &redit &ard operations are an inte(ral part of its operatin( a&ti#ities! 1i#en t%is

treat$ent+ t%e a&&ounts re&ei#able relatin( to t%ese &redit &ards is also in&luded as an operatin(

&urrent asset in M3-7!

NOPAT F E7+=3@ H IE+@37 J )E7:: K B!3<*L F E3+:@7!

M3-< ).B $inutes*

)E $illions*

a! "NOA F NOPAT 2 A#era(e net operatin( assets )NOA*

F E:@3 2 I)E3+.@: J E3+3@B*2.L F .B!<3M

b! NOPM F NOPAT 2 "e#enues F E:@3 2 E@+<BB F <!5M

NOAT F Sales 2 A#era(e NOA

F E@+<BB 2 I)E3+.@: J E3+3@B*2.L F .!@B

"NOA F NOPM K NOAT F <!5M K .!@B F .B!<M )B!B.M roundin( differen&e*

Cambridge Business Publishers, 2013

Solutions Manual, Module 3

3-(

M3-= )7 $inutes*

)E $illions*

NOA F E33+:@@ - E:7. - E5< - E+BB= - )E<+@ - E3:* - E5:< - E:3 - E=33

F E..+775

M3-@ )7 $inutes*

)E $illions*

NOPAT F )E5=+=7 - E3+::3 - E.+BB: - E+7=:* - IE+.= J )E33. K B!3<*L

F E.+.@

M3-.B

9

).B $inutes*

)E $illions*

a! "OE F Net in&o$e 2 A#era(e e-uity

F E=5< 2 I)E7+73B J E5+:73*2.L

F :!:5M

b! PM F Net in&o$e 2 Sales F E=5< 2 E.7+BB3 F 3!3@M

AT F Sales 2 A#era(e assets F E.7+BB3 2 I)E.B+:3 J E.+3BB*2.L

F !@

/C F A#era(e assets 2 A#era(e e-uity

F I)E.B+:3 J E.+3BB*2.L 2 I)E7+73B J E5+:73*2.L

F 5!.

"OA PM K AT K /C F 3!3@M K !@ K 5!. F :!:.M

)B!B.M roundin( differen&e*

Cambridge Business Publishers, 2013

Financial Statement Analsis ! "aluation, 3rd #dition

3-)

M3-. )7 $inutes*

)E $illions*

a! AN/ "NOA F E7. 2 I)E+B3. J E+B77* 2 .L F 5!7<M

TND "NOA F E+3:5 2 I)E.+B<. J E+@3<* 2 .L F :=!B7M

b! AN/ NOPM F E 7. 2 E 3+5:@ F 5!3=M

TND NOPM F E+3:5 2 E.+@5. F :!..M

AN/ NOAT F E 3+5:@ 2 I)E+B3. J E+B77* 2 .L F 3!3.

TND NOAT F E.+@5. 2 I)E.+B<. J E+@3<* 2 .L F B!@7

AN/ "NOA F 5!3=M K 3!3. F 5!75M )B!B3M roundin( differen&e*

TND "NOA F :!..M K B!@7 F :=!M )B!B:M roundin( differen&e*

&! TND3s "NOA is 5!< ti$es t%at of AN/! TND+ despite operatin( in t%e #alue-

pri&ed se($ent of its industry+ reports a %i(%er NOPM t%an does AN/!

As is typi&al of #alue-pri&ed retailers+ TND3s asset turno#er is %i(%0

NOAT is o#er 3 ti$es t%at of AN/3s! On balan&e+ TND3s business $odel

appears to be $ore su&&essful in .B in t%at t%e &o$pany is able to

$aintain bot% a %i(% NOPM and a %i(% NOAT relati#e to AN/+ resultin( in

a "NOA t%at is &onsiderably (reater t%an AN/3s in t%is year!

Cambridge Business Publishers, 2013

Solutions Manual, Module 3

3-*

M3-.. )7 $inutes*

)E $illions*

a! .BB total liabilities-to-e-uity F E33+B@3 2 E=:+@. F !73

.BB@ total liabilities-to-e-uity F E5.+<:5 2 E=5+53 F !<B

OeriAon3s total liabilities-to-e-uity ratio %as de&lined so$e'%at+ and is

less t%an t%e !:< a#era(e for &o$panies in t%e tele&o$$uni&ations

industry in .BB!

b! OeriAon is &arryin( a si(nifi&ant a$ount of debt! Alt%ou(% its profitability

and operatin( &as% flo' are fairly stron(+ neit%er is parti&ularly %i(% in

relation to t%e &o$pany3s liabilities and interest &osts! T%ere is so$e

-uestion+ t%erefore+ re(ardin( t%e a$ount of additional debt t%at t%e

&o$pany &an ta,e on! 1i#en its si(nifi&ant &apital e4penditure

re-uire$ents and its &urrent debt load+ OeriAon $ay %a#e to fund future

&apital e4penditures 'it% %i(%er-&ost e-uity! And+ to t%e e4tent t%at its

&o$petitors are not as %i(%ly le#era(ed+ t%is $ay ne(ati#ely i$pa&t

OeriAon3s &o$petiti#e position!

Cambridge Business Publishers, 2013

Financial Statement Analsis ! "aluation, 3rd #dition

3-+

M3-.3 )3B $inutes*

a! Po$e Depot .B NOPAT F E7+=3@ - IE+@37 J )E7:: K B!3<*L F E3+:@7

Co'e3s .B NOPAT F E3+7:B - IE+.= J )E33. K B!3<*L F E.+.@

b! Po$e Depot NOPAT as a per&enta(e of sales F E3+:@7 2 E:<+@@< F 7!53M

Co'e3s NOPAT as a per&enta(e of sales F E.+.@ 2 E5=+=7 F 5!77M

M3-.5

9

)37 $inutes*

a!

Profit $ar(in )Net in&o$e 2 Sales* E5+B=7 2 E.:+::. F 7!3.M

Asset turno#er )Sales 2 A#era(e assets* )E.:+::. 2 IE3B+7: J

E.<+.7BL2.* F B!@3

/inan&ial le#era(e )A#era(e assets 2 A#era(e

e-uity*

))E3B+7: J E.<+.7B*2.* 2

))E7+::3 J E.+<:5*2.*

F .!B.

b!

"OE )Net in&o$e 2 A#era(e e-uity* E5+B=7 2 ))E7+::3 J E.+<:5*2.* F

.=!<5M

Confir$ation 7!3.M K B!@3 K .!B. F .=!<=M

)B!B5M roundin( differen&e*

&! Ad8ust$ents to "OA typi&ally fo&us on t%e nu$erator )spe&ifi&ally+

addin( after-ta4 interest e4pense to net in&o$e*! /or 3M+ t%is ad8ust$ent

follo's0

Ad8usted "OA F )E5+B=7 J E:3 K I - B!3<L* 2 )E3B+7: J E.<+.7B*2. F

5!7@M

Cambridge Business Publishers, 2013

Solutions Manual, Module 3

3-,

EDE"CISES

E3-.7 )3B $inutes*

a!

)E $illions* "NOA

COS!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! E3+<<< 2 I )E5:+3:B J E57+==@* 2 .L F =!@M

Gal(reen!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! E.+57 2 I)E5+@.JE5+5B*2 .L F 5!<:M

b!

)E $illions* NOPM F NOPAT 2 Sales NOAT F Sales 2 A#era(e NOA

COS!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! E3+<<< 2 E@:+53 F 3!@.M E@:+53 2 I)E5:+3:B J E57+==@* 2 .L

F .!B@

Gal(reen!!!!!!!!!!!!!!!!!!!!!!! E.+57 2 E:<+5.B F 3!=M E:<+5.B 2 I)E5+@. J E5+5B* 2 .L

F 5!:5

&! Gal(reen3s "NOA is $u&% %i(%er t%an COS3s+ dri#en pri$arily by a

$u&% %i(%er turno#er rate for NOA as its net operatin( profit $ar(in is

less t%an COS3s! T%is e4a$ple %i(%li(%ts t%e i$portan&e of $ana(in(

t%e balan&e s%eet!

Cambridge Business Publishers, 2013

Financial Statement Analsis ! "aluation, 3rd #dition

3-10

E3-.: )3B $inutes*

a!

)E $illions* "NOA

Aber&ro$bie 6 /it&%!!!!!!!!!!!!!!!!!!!!! E 7. 2 I)E+B3. J E+B77* 2 .L F 5!7<M

T%e 1ap+ In&!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! E+@7 2 I)E.+5@ J E.+3=* 2 .L F 7B!57M

b!

)E $illions* NOPM F NOPAT 2 Sales NOATF Sales 2 A#era(e NOA

Aber&ro$bie 6

/it&%!!!!!!!!!!!!!!!!!!!!!!!!!!!

E 7. 2 E 3+5:@

F 5!3=M

E 3+5:@ 2 I)E+B3. J E+B77* 2 .L

F 3!3.

T%e 1ap+ In&!!!!!!!!!!!!!!!!!! E+@7 2 E5+::5

F =!7M

E5+::5 2 I)E.+5@ J E.+3=* 2 .L

F :!@

&! T%e 1AP3s "NOA is $ore t%an t%ree ti$es t%at of A6/! T%is %i(%er

"NOA is t%e result of a $u&% %i(%er net operatin( profit $ar(in and a

$u&% %i(%er net operatin( asset turno#er rate in &o$parison 'it%

Aber&ro$bie 6 /it&% in t%is year!

Cambridge Business Publishers, 2013

Solutions Manual, Module 3

3-11

E3-.< )3B $inutes*

a!

)E $illions* "NOA

Nordstro$!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! E:@3 2 I)E3+.@: J E3+3@B* 2 .L F .B!<3M

Ci$ited 9rands!!!!!!!!!!!!!!!!!!!!!!!!!!! E=.: 2 I)E.+=75 J E3+B3* 2 .L F .<!<3M

b!

)E $illions* NOPM F NOPAT 2 Sales NOAT F Sales 2 A#era(e NOA

Nordstro$!!!!!!!!!!!!!!!!!!!!! E:@32E@+<BB

F <!5M

E@+<BB2I)E3+.@: J E3+3@B*2.L

F .!@B

Ci$ited

9rands!!!!!!!!!!!!!!!!!!!!!!!!!!!

E=.:2E@+:3

F =!7@M

E@+:32I)E.+=75 J E3+B3*2.L

F 3!.3

&! T%e Ci$ited 9rands3 %i(%er "NOA is dri#en by bot% a %i(%er net

operatin( profit $ar(in and a %i(%er turno#er of net operatin( assets!

Cambridge Business Publishers, 2013

Financial Statement Analsis ! "aluation, 3rd #dition

3-12

E3-.= )3B $inutes*

-nstructor note& -ntel has ./#0.%/A due to its substantial in1estment in mar2etable securities3

a!

)E $illions*

"OE!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! E+5:5 2 I)E5@+53BJE5+<B5* 2 .L F .7!:M

"NOA!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! E+.7B 2 I)E.=+:7. J E.@+.3.* 2 .L F 3=!=<M

b!

)E $illions* NOPM F NOPAT 2 Sales NOAT F Sales 2 A#era(e NOA

Intel!!!!!!!!!!!!!! E+.7B 2 E53+:.3

F .7!<@M

E53+:.3 2 I)E.=+:7. J E.@+.3.*2.L

F !7

T%e NOPM of .7!<@M $eans t%at Intel earns operatin( profit after all

e4penses+ in&ludin( ta4 of $ore t%an .:Q for e#ery dollar of sales! T%is

is a si(nifi&ant profit $ar(in! T%e NOAT of !7 i$plies t%at t%e &o$pany

(enerates $ore t%an E!7B of sales for ea&% dollar of net operatin(

assets! T%e &o$pany is bot% profitable and produ&ti#e!

&! "NOA is !7K "OE0 3=!=<M 2 .7!:M F !7! Ge &an infer Intel3s

nonoperatin( return by &al&ulatin( t%e differen&e bet'een "OE and

"NOA0 .7!:M - 3=!=<M F -3!<M! A ne(ati#e nonoperatin( return li,ely

o&&urs be&ause Intel %as a substantial a$ount of in#est$ents+ per%aps

in $ar,etable se&urities! T%is is not un&o$$on for t%e %i(%-te&%

industry '%ere &o$panies need to $aintain a (reater le#el of li-uid

assets to ta,e ad#anta(e of opportunities or to respond -ui&,ly to

strate(i& $o#es by &o$petitors! T%is li-uidity re-uire$ent adds a layer

of &osts t%at depresses Intel3s "OE! Anot%er 'ay of t%in,in( of it is t%at

t%e $ar,etable se&urities are earnin( a return t%at3s lo' &o$pared to t%e

return on t%e &o$pany3s operatin( assets!

Cambridge Business Publishers, 2013

Solutions Manual, Module 3

3-13

E3-.@ )3B $inutes*

a!

)E $illions*

"OE!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! E =5< 2 I)E7+73B J E5+:73* 2 .L F :!:5M

"NOA!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! E+.B@2 I)E+5@JE+::7*2 .L F B!55M

b!

)E $illions* NOPM F NOPAT 2 Sales NOAT F Sales 2 A#era(e NOA

Ma&y3s!!!!!!!!! E+.B@ 2 E.7+BB3

F 5!=5M

E.7+BB32 I)E+5@JE+::7*2.L

F .!:

Ma&y3s NOPM is %i(%er and its NOAT is lo'er t%an t%e $edians for

apparel retailers of 5!5:M and .!=+ respe&ti#ely )see e4%ibit 5!5*! Its

"NOA is belo' t%e $edian for apparel retailers of .!33M!

&! T%e ratio of "NOA to "OE is :3M )B!55M2:!:5M*! Ma&y3s debt is

finan&in( assets t%at earn a return in e4&ess of t%e &ost of debt+ t%us

i$pro#in( t%e returns to s%are%olders! In t%is &ase+ finan&ial le#era(e is

in&reasin( t%e return to s%are%olders! Ge &an &o$pute t%e

nonoperatin( return as follo's0 "OE H "NOA F :!:5M - B!55M F :!.BM!

Cambridge Business Publishers, 2013

Financial Statement Analsis ! "aluation, 3rd #dition

3-1$

E3-3B )3B $inutes*

-nstructor note& Cisco has ./#0.%/A due to its substantial in1estment in mar2etable securities3

a!

)E $illions*

"OE!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! E<+<:< 2 I)E55+.:< J E3=+:5<* 2 .L F =!<5M

"NOA!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! E<+:B@ 2 I)E@+<B= J E3+@<* 2 .L F 57!@M

b!

)E $illions* NOPM F NOPAT 2 Sales NOAT F Sales 2 A#era(e NOA

Cis&o!!!!!!!!!!!! E<+:B@ 2 E5B+B5B

F @!BBM

E5B+B5B2I)E@+<B= J E3+@<*2.L

F .!3=

&! T%e ratio of "NOA to "OE is .!54 )57!@M 2 =!<5M*! A ratio (reater t%an

!B $eans t%at "NOA e4&eeds "OE! T%is is atypi&al! One e4planation for

t%is relation is t%at Cis&o is %oldin( si(nifi&ant nonoperatin(

in#est$ents li,ely in $ar,etable se&urities! T%is is not un&o$$on for

t%e %i(%-te&% industry in '%i&% &o$panies need to $aintain li-uidity to

ta,e ad#anta(e of opportunities or to respond -ui&,ly to strate(i&

$o#es by &o$petitors! T%is li-uidity+ '%i&% only earns a $ar,et rate of

return+ $ust be funded by %i(%-&ost e-uity &apital! T%is depresses its

"OE!

Cambridge Business Publishers, 2013

Solutions Manual, Module 3

3-1(

E3-3 )3B $inutes*

a!

)E $illions* Ciabilities-to-e-uity

.BB!!!!!!!!!!!!!! E<5+BB 2 E55+535 F !:<

.BB@!!!!!!!!!!!!!! E:@+@.. 2 E5.+= F !:3

Co$&ast3s total liabilities-to-sto&,%olders3 e-uity ratio of !:< is at

$edian for &o$$uni&ations &o$panies )see E4%ibit 3!:*+ and %as

re$ained fairly &onstant o#er t%e t'o-year period!

b! Co$&ast %as an a&&eptable le#el of debt+ but its li-uidity is lo'! T%at is

so$e &ause for &on&ern about t%e &o$pany3s ability to in&rease its debt

load! T%is is espe&ially troubleso$e (i#en t%e substantial le#els of

&apital e4penditures t%at 'ill be re-uired to up(rade its infrastru&ture in

order to re$ain &o$petiti#e 'it% OeriAon!

Cambridge Business Publishers, 2013

Financial Statement Analsis ! "aluation, 3rd #dition

3-1)

E3-3. )3B $inutes*

a!

)E $illions* Ciabilities-to-e-uity

.BB!!!!!!!!!!!!!! E33+B@3 2 E=:+@. F !73

.BB@!!!!!!!!!!!!!! E5.+<:5 2 E=5+53 F !<B

OeriAon3s liabilities-to-e-uity ratio %as de&lined fro$ .BB@ as OeriAon %as

used a#ailable &as% flo's to redu&e t%e le#el of debt relati#e to e-uity!

T%e .BB ratio is !73+ sli(%tly belo' t%e $edian for &o$$uni&ations

&o$panies of !:: )see E4%ibit 3!:*!

b! OeriAon %as an a&&eptable le#el of debt relati#e to e-uity+ '%i&%

$iti(ates any &on&ern about its finan&ial le#era(e! 1i#en t%e substantial

le#els of &apital e4penditures t%at 'ill be re-uired to up(rade its

infrastru&ture to re$ain &o$petiti#e 'it% Co$&ast+ %o'e#er+ it is

doubtful '%et%er OeriAon 'ill be able to $ar,edly in&rease its debt! T%is

&ould be proble$ati& for t%e fir$!

Cambridge Business Publishers, 2013

Solutions Manual, Module 3

3-1*

E3-33 )3B $inutes*

a!

)E $illions* Ciabilities-to-e-uity

Industrial!!!!!!!!!!!!!! E@7+<.@ 2 E.3+B35 F B!<=

/inan&ial!!!!!!!!!!!!!! E73=+73B 2 E<B+5= F <!:=

Total!!!!!!!!!!!!!!!!!!!!!! E:.<+B= 2 E.5+@= F 7!B7

b! 1E3s liabilities-to-e-uity ratio of 7!B7 is relati#ely %i(%! Most of t%e

debt+ %o'e#er+ is &on&entrated in t%e finan&ial ser#i&es se($ent! T%is

se($ent %as t%e profile of a typi&al finan&ial institution+ 'it% %i(% debt

le#els and relati#ely lo' operatin( $ar(ins! As lon( as 1E3s loans and

leases are of (ood -uality )t%at is+ t%ey are &olle&tible*+ t%e finan&ial

subsidiary s%ould %a#e no proble$ $eetin( its debt re-uire$ents as t%e

&as% flo's re&ei#ed fro$ its loans2leases are typi&ally 'ell $at&%ed 'it%

t%e debt pay$ent re-uire$ents!

&! Consolidated finan&ial state$ents &o$bine t%e perfor$an&e and

finan&ial position of t%e parent &o$pany and all of its subsidiaries! As

su&%+ t%ey are a blend of finan&ial state$ents fro$ a #ariety of

>&o$panies!? Se($ent analysis is often useful to e#aluate t%e finan&ial

stru&ture of ea&% se($ent a(ainst its respe&ti#e business $odel! In t%is

&ase+ t%e relati#ely %i(% debt le#el for 1E as a '%ole is a 'ei(%ted

a#era(e of t%e less-finan&ially-le#era(ed $anufa&turin( subsidiary 'it%

t%e %i(%ly-le#era(ed finan&ial ser#i&es subsidiary!

Cambridge Business Publishers, 2013

Financial Statement Analsis ! "aluation, 3rd #dition

3-1+

E3-35

A

)3B $inutes*

a! To &al&ulate /CEO 'e $ust first &al&ulate NNO! "e&all t%at NNO is t%e

differen&e bet'een NOA and Sto&,%olders3 e-uity! T%en to &al&ulate

Spread+ 'e re-uire NNEP )NNE 2 A#era(e NNO*! "e&all t%at NNE is t%e

differen&e bet'een NOPAT and Net in&o$e attributable to t%e Gal$art

sto&,%olders!

NNO .B F E5+B5B - E:=+75. F E57+5@=

NNO .BB F EB:+3.B - E<B+5:= F E37+=7.

/CEO F A#era(e NNO 2 A#era(e Sto&,%olders3 e-uity

F I)E57+5@= J E37+=7.* 2 .L 2 I)E:=+75. J E<B+5:=* 2 .L F B!7=7

NNE F E<+... - E:+3=@ F E=33

NNEP F E=33 2 I)E57+5@= J E37+=7.* 2 .L F .!B5=M

Spread F 7!:3M - .!B5=M F 3!7=.M

b! "OE F 7!:3M J )B!7=7 K 3!7=.M* F .3!7<7M

T%e "OE &al&ulated 'it% /CEO and SP"EAD is .3!7<7M and t%e "OE

fro$ t%e $id-$odule re#ie' is .3!7=M! T%e differen&e of B!BB7M

)B!BBBB7* is a roundin( differen&e!

E3-37 ).B $inutes*

T%e /ederal and State ta4 rate for .B as reported in TND3s ta4 footnote is

3@!M )37M J 5!M*! Usin( t%is /ederal and State ta4 rate+ TND3s NOPAT is

&o$puted as follo's )a$ounts in Et%ousands*0

TND .B NOPAT F )E.+@5.+@3 - E:+B5B+5: - E3+<B+B73 J E+77B* H

)E=.5+7:. J B!3@ K E3@+3<*

F E+3:3+3:5

Cambridge Business Publishers, 2013

Solutions Manual, Module 3

3-1,

P"O9CEMS

P3-3: )57 $inutes*

)E $illions*

a! .BB NOPAT F E7+@= - IE+7@. J )E:3 K B!3<*L F E5+.::

b! .BB NOA F

)E3B+7: - E3+3<< - E+B- E75B - E5:* - )E:+B=@ - E+.:@* - E.+B3 - E+=75

F E:+3B7

.BB@ NOA

F )E.<+.7B - E3+B5B - E<55 - E=.7 - EB3* - )E5+=@< - E:3* - E.+..< - E+<.<

F E5+3BB

&! .BB "NOA F E5+.:: 2 I)E:+3B7 J E5+3BB* 2 .L F .<!==M

.BB NOPM F E5+.:: 2 E.:+::. F :!BBM

.BB NOAT F E.:+::. 2 I)E:+3B7 J E5+3BB* 2 .L F !<5

.BB "NOA F :!BBM K !<5 F .<!=5M )B!BBB5 roundin( error*

d! .BB NNO F )E+.:@ J E5+=3* - )E3+3<< J E+BJ E75B J E5:* J E375

F E:5.

Confir$0

.BB NOA F NNO J SE )3M s%are%olders*

E:+3B7 F E:5. J E7+::3

.BB@ NNO F )E:3 J E7+B@< J E73=* - )E3+B5B J E<55 J E=.7 J EB3*

F E+73:

Confir$0

.BB@ NOA F NNO J SE )3M s%are%olders*

E5+3BB F E+73: J E.+<:5

e! .BB "OE F E5+B=7 2 I)E7+::3 J E.+<:5* 2 .L F .=!<5M

f! .BB nonoperatin( return F "OE H "NOA F .=!<5M - .<!==M F B!=:M

(! "OE;"NOA i$plies t%at 3M is able to borro' $oney to fund operatin(

assets t%at yield a return (reater t%an t%e &ost of t%e debt! T%e e4&ess

a&&rues to t%e benefit of 3M3s sto&,%olders!

Cambridge Business Publishers, 2013

Financial Statement Analsis ! "aluation, 3rd #dition

3-20

P3-3< )3B $inutes*

a! .BB total liabilities-to-e-uity F E5+3@ 2 E:+B< F B!==

.BB@ total liabilities-to-e-uity F E3+@5= 2 E3+3B. F !B7

3M3s total liabilities-to-e-uity de&reased durin( .BB and is 'ell belo'

t%e $edian for publi&ly traded &o$panies! T%is ratio indi&ate $odest

finan&ial le#era(e!

b! 3M is fairly li-uid )&urrent ratio near . and -ui&, ratio (reater t%an * and

is not %i(%ly finan&ially le#era(ed! T%e &o$pany3s ability to $eet its

debt re-uire$ents is not at issue!

P3-3=

A

)5B $inutes*

a! .BB NNO F NOA H 3M s%are%olders sto&,%olders3 e-uity

F E:+3B7 - E7+::3

F E:5.

.BB@ NNO F E5+3BB - E.+<:5

F E+73:

.BB /CEO F I)E:5. J E+73:* 2 .L 2 I)E7+::3 J E.+<:5* 2 .L F B!B=

.BB NNE F NOPAT H Net in&o$e attributable to 3M s%are%olders

F E5+.:: - E5+B=7

F E=

NNEP F E= 2 )IE:5. J E+73:L 2 .*

F :!:.M

Spread F "NOA - NNEP

F .<!==M - :!:.M

F !.:M

Cambridge Business Publishers, 2013

Solutions Manual, Module 3

3-21

P3-3=

A

)&on&luded*

b! "OE F .<!==M J )B!B= K !.:M*

F .=!<=M )!BBB5 roundin( error*

&! 3M is able to borro' funds and in#est t%e pro&eeds in operatin( assets

yieldin( a return in e4&ess of t%e &ost of its debt! T%e e4&ess )>spread?*

a&&rues to 3M3s sto&,%olders!

P3-3@ )57 $inutes*

)E $illions*

a! .B NOPAT F )E.+5 J E.* - IE<5 J )E=< - E7* K B!3<*L F E+3=@

b! .B NOA F E<+=5@ - E+B3 - E.. - )E=+::3 - E77< - E55* - E+=3

F E<+=<:

.BB NOA F E=+3B. - E+=.: - E@B - )E=+@<= - E::3 - E37* - E+.7:

F E:+=7B

&! .B "NOA F E+3=@ 2 I)E<+=<: J E:+=7B* 2 .L F =!=:M

.B NOPM F E+3=@ 2 E7B+.<. F .!<:M

.B NOAT F E7B+.<. 2 I)E<+=<: J E:+=7B* 2 .L F :!=3

.B "NOA F .!<:M K :!=3 F =!=7M )!BBB roundin( error*

99R3s "NOA of =!=:M is si(nifi&antly %i(%er t%an t%e industry $edian

of about M! It is dri#en pri$arily by t%e #ery %i(% turno#er of net

operatin( assets of :!=3+ 'ell in e4&ess of t%e industry $edian of 3!.<!

99R3s NOPM is sli(%tly belo' t%e $edian of 3!3.M! 99R3s %i(%

perfor$an&e is dri#en by its e4&eptional $ana(e$ent of its balan&e

s%eet!

Cambridge Business Publishers, 2013

Financial Statement Analsis ! "aluation, 3rd #dition

3-22

P3-3@ )&on&luded*

d! .B NNO F )E77< J E55 J E<* H )E+B3 J E..* J E:@B F E+.<5

Confir$0

.B NOA F NNO J 99R3s s%are%olders sto&,%olders3 e-uity

E<+=<: F E+.<5 J E:+:B.

.BB NNO F )E::3 J E37 J E+B5* H )E+=.: J E@B* J E:55 F E73B

Confir$0

.BB NOA F NNO J 99R3s s%are%olders sto&,%olders3 e-uity

E:+=7B F E73B J E:+3.B

e! .B "OE F E+.<< 2 I)E:+:B. J E:+3.B* 2 .L F @!<:M

f! .B nonoperatin( return F "OE H "NOA F @!<:M - =!=:M F B!@BM

(! "OE ; "NOA i$plies t%at 9est 9uy is able to borro' $oney to fund

operatin( assets t%at yield a return (reater t%an t%e &ost of its debt! T%e

e4&ess a&&rues to t%e benefit of 99R3s sto&,%olders!

P3-5B )3B $inutes*

a!

.B liabilities-to-e-uity F )E=+::3 J E+=3 J E<* 2 E<+.@.

F !57

.BB liabilities-to-e-uity F )E=+@<= J E+.7: J E+B5* 2 E:+@:5

F !:3

)Note0 Ge &o$puted t%is ratio usin( total )&onsolidated* sto&,%olders3 e-uity+ not 8ust t%e

e-uity of 99R3s s%are%olders be&ause t%e liabilities in t%e nu$erator in&lude total

&onsolidated liabilities!*

9est 9uy3s liabilities-to-e-uity ratio is at t%e $edian for publi&ly-traded

&o$panies! Ge %a#e no &on&erns about 9est 9uy3s ability to $eet its

debt obli(ations!

b! 9est 9uy is not parti&ularly li-uid )&urrent ratio near !. and -ui&, ratio

near B!5*+ but is not finan&ially le#era(ed! T%e &o$pany (enerates

siAeable operatin( profits and &as% flo'! In su$+ no sol#en&y &on&erns

are e#ident for 9est 9uy!

Cambridge Business Publishers, 2013

Solutions Manual, Module 3

3-23

P3-5

A

)5B $inutes*

a! .B NNO F )E77< J E55 J E<* - )E+B3 J E..* J E:@B F E+.<5

.BB NNO F )E::3 J E37 J E+B5* - )E+=.: J E@B* J E:55 F E73B

.B /CEO F I)E+.<5 J E73B* 2 .L 2 )IE:+:B. J E:+3.BL 2 .* F B!5

.B NOPAT F )E.+5 J E.* - IE<5 J )E=< - E7* K B!3<*L F E+3=@

.B NNE F NOPAT H Net in&o$e to 99R s%are%olders F E+3=@ - E+.<<

F E.

.B NNEP F E. 2 I)E+.<5 J E73B* 2 .L F .!5.M

.B Spread F "NOA H NNEP F =!=:M - .!5.M F :!55M

b! "OE F =!=:M J )B!5 K :!55M* F @!<:M

&! 9est 9uy is able to borro' funds and in#est t%e pro&eeds in operatin(

assets yieldin( a return in e4&ess of t%e &ost of its debt! T%e e4&ess

a&&rues to t%e benefit of its sto&,%olders!

Cambridge Business Publishers, 2013

Financial Statement Analsis ! "aluation, 3rd #dition

3-2$

P3-5. )3B $inutes*

)Note to instru&tor0 Intel3s "OES"NOA! T%is is an e4a$ple of e-uity supportin( t%e strate(i&

in#est$ent in li-uidity at so$e &ost to "OE!*

a! .BB NOPAT F )E7+7== J E<* - )E5+7= - B!3< K )EB@ J E.3**L

F E+.7B

)Note0 Ge treat (ains on e-uity $et%od in#est$ents of E< as operatin( sin&e t%e

in#est$ents are treated t%at 'ay in NOA! T%ese in#est$ents are $ore strate(i& in nature! See

Module < for a des&ription of t%ese in#est$ents! T%e ot%er e-uity in#est$ents are typi&al

in#est$ents in $ar,etable se&urities and are+ t%erefore+ &lassified as nonoperatin(!*

b! .BB NOA F )E:3+=: - E7+5@= - E+.@5 - E7+B@3 - E+BB=* - )E@+3.< -

E3=* - E@B - E@.: - E+.3:

F E.=+:7.

.BB@ NOA F )E73+B@7 - E3+@=< - E7+.=7 - E5+:5= - E<<3* - )E<+7@ -

E<.* - E@3 - E777 - E+BB3

F E.@+.3.

&! .BB "NOA F E+.7B 2 I)E.=+:7. J E.@+.3.* 2 .L F 3=!=<M

.BB NOPM F E+.7B 2 E53+:.3 F .7!<@M

.BB NOAT F E53+:.3 2 I)E.=+:7. J E.@+.3.*2.L F !7

d! .BB NNO F E3= J E.+B<< - E7+5@= - E+.@5 - E7+B@3 - E+BB=

F )E.B+<<=*

Confir$0 E.=+:7. F E).B+<<=* J E5@+53B

.BB@ NNO F E<. J E.+B5@ - E3+@=< - E7+.=7 - E5+:5= - E<<3

F )E.+5<.*

Confir$0 E.@+.3. F E).+5<.* J E5+<B5

e! .BB "OE F E+5:5 2 I)E5@+53BJE5+<B5* 2 .L F .7!:M

f! .BB nonoperatin( return F "OE H "NOA F .7!:M - 3=!=<M F )3!<M*

(! "NOA ; "OE i$plies t%at Intel3s sto&,%olders are fundin( a siAeable

a$ount of li-uidity in t%e for$ of in#est$ents in $ar,etable se&urities!

T%is is not un&o$$on for t%e %i(%-te&% industry '%ere &o$panies need

to $aintain a suffi&ient le#el of li-uidity to ta,e ad#anta(e of

opportunities or to respond to strate(i& $o#es by &o$petitors! T%is

li-uidity re-uire$ent adds a layer of &osts t%at depresses its "OE!

Cambridge Business Publishers, 2013

Solutions Manual, Module 3

3-2(

P3-53 )57 $inutes*

)E in $illions*

a! .B NOPAT F E+= - )E3<= J )E.< K B!3<* F E:@3

b! .B NOA F E<+5:. - E+7B: - E=5: - E3<7 - E:7. - E5@7 - E.@.

F E3+.@:

.BB NOA F E:+7<@ - E<@7 - E<.: - E33: - E7@: - E5:@ - E.:<

F E3+3@B

&! .B "NOA F E:@3 2 I)E3+.@: J E3+3@B* 2 .L F .B!<3M

.B NOPM F E:@3 2 E@+<BB F <!5M

.B NOAT F E@+<BB 2 I)E3+.@: J E3+3@B* 2 .L F .!@B

.B "NOA F <!5M K .!@B F .B!<M )B!BBB. roundin( error*

Nordstro$3s net operatin( profit $ar(in is si(nifi&antly abo#e t%e

industry $edian of 5!5:M+ '%i&% is not surprisin( (i#en t%e &o$pany3s

%i(%-end produ&t! Nordstro$3s net operatin( asset turno#er rate is also

%i(%er t%an t%e $edian of .!=! Nordstro$ is $ana(in( bot% its in&o$e

state$ent and its balan&e s%eet #ery 'ell!

d! .B NNO F E: J E.+<<7 - E+7B: F E+.<7

Confir$0 E3+.@: F E+.<7 J E.+B.

.BB NNO F E37: J E.+.7< - E<@7 F E+==

Confir$0 E3+3@B F E+== J E+7<.

e! .B "OE F E:3 2 I)E.+B. J E+7<.* 2 .L F 35!.M

f! .B nonoperatin( return F "OE H "NOA F 35!.M - .B!<3M F 3!3@M

(! "OE;"NOA i$plies t%at Nordstro$ is able to borro' $oney to fund

operatin( assets t%at yield a return (reater t%an t%e &ost of its debt! T%e

e4&ess a&&rues to t%e benefit of Nordstro$3s sto&,%olders!

Cambridge Business Publishers, 2013

Financial Statement Analsis ! "aluation, 3rd #dition

3-2)

P3-55 )3B $inutes*

)E $illions*

a! .BB NOPAT F E7+::: H )E+5< J B!3< K E.+B.5* F E3+<<B

)Note0 'e %a#e treated t%e earnin(s fro$ and (ain on t%e sale of t%e dis&ontinued operations

as nonoperatin(! On&e t%e de&ision is $ade to sell t%e operatin( entity+ it is re&lassified as

nonoperatin( and any net assets and earnin(s related to t%at entity are &lassified as

nonoperatin(!*

b! .BB NOA F E@7+.=@ - E.+5= - )E7+::B - E<7B - E+7* - E<+@=5 - E.+3=.

- E3+B5: - E3+5: F E:.+=7

.BB@ NOA F E::+<5 - E.+B - )E+5@ - E573 - E73* - 5+7B= - E+<:7

- E.+=: - E.+3= F E5.+=:

&! .BB "NOA F E3+<<B 2 I)E:.+=7 J E5.+=:* 2 .L F <!=M

.BB NOPM F E3+<<B 2 E5@+.B< F <!::M

.BB NOAT F E5@+.B< 2 I)E:.+=7 J E5.+=:* 2 .L F B!@5

.BB "NOA F <!::M K B!@5 F <!.BM )B!BBB. roundin( error*

Traft3s net operatin( profit $ar(in is si(nifi&antly abo#e t%e industry

$edian of :!..M+ but its net operatin( asset turno#er rate is $u&% lo'er

t%an t%e $edian of !::! O#erall+ t%e lo' turno#er of net operatin(

assets is resultin( in a "NOA t%at is lo'er t%an t%e industry $edian of

o#er @M!

d! .BB NNO F E<7B J E+7 J E.:+=7@ - E.+5= J EB= F E.:+37

Confir$0 E:.+=7 F E.:+37 J E37+=35

.BB@ NNO F E573 J E73 J E=+B.5 - E.+B J E@: F E:+@=7

Confir$0 E5.+=: F E:+@=7 J E.7+=<:

e! .BB "OE F E5+5 2 I)E37+=35 J E.7+=<:* 2 .L F 3!33M

f! .BB nonoperatin( return F "OE H "NOA F 3!33M - <!=M F :!7M

(! "OE;"NOA i$plies t%at Traft is able to borro' $oney to fund operatin(

assets t%at yield a return (reater t%an t%e &ost of its debt! T%e e4&ess

a&&rues to t%e benefit of Traft3s sto&,%olders!

Cambridge Business Publishers, 2013

Solutions Manual, Module 3

3-2*

P3-57 ).B $inutes*

)E in $illions*

a!

.BB liabilities-to-e-uity F E7@+3=< 2 E37+@5. F !:7

.BB: liabilities-to-e-uity F E5B+<5. 2 E.7+@<. F !7<

T%e liabilities-to-e-uity %as in&reased+ but t%is ratio re$ains at

&o$fortable le#els! T%ere are no i$$ediate &on&erns about Traft3s

ability to $eet its debt obli(ations!

b! Alt%ou(% Traft is not parti&ularly li-uid+ it is not %i(%ly finan&ially

le#era(ed! T%ere are no i$$ediate &on&erns about its sol#en&y!

P3-5:

A

)3B $inutes*

)EUs in $illions*

a! .BB NNO F E<7B J E+7 J E.:+=7@ - E.+5= J EB= F E.:+37

.BB@ NNO F E573 J E73 J E=+B.5 - E.+B J E@: F E:+@=7

.BB /CEO F A#(! NNO 2 A#(! Traft3s Sto&,%olders3 e-uity

F I)E.:+37 J E:+@=7* 2 .L 2 I)E37+=35 J E.7+=<:* 2 .L

F B!<B

NNEP F NNE )NOPAT H Net in&o$e to Traft s%are%olders* 2 A#(! NNO

F )E3+<<B - E5+5* 2 I)E.:+37 J E:+@=7* 2 .L

F )!7@*M

Spread F "NOA H NNEP F <!=M J !7@M F =!<<M

b! "OE F "NOA J )/CEO K Spread* F <!=M J )B!<B K =!<<M* F 3!3.M

)B!BBB roundin(*

&! "OE;"NOA i$plies t%at Traft is able to borro' $oney to fund operatin(

assets t%at yield a return (reater t%an t%e &ost of its debt! T%e e4&ess

a&&rues to t%e benefit of Traft3s sto&,%olders! T%is year+ Traft %as a

ne(ati#e NNE be&ause dis&ontinued operations (enerated in&o$e and

or a (ain durin( .BB!

Cambridge Business Publishers, 2013

Financial Statement Analsis ! "aluation, 3rd #dition

3-2+

P3-5< )3B $inutes*

a!

T%is (rap% is si$ilar to t%e one in t%e $odule and re#eals t%e trade-off

bet'een profit $ar(in and asset turno#er! 9asi& e&ono$i&s su((est t%at

&o$panies 'it% %i(% turno#er %a#e lo' $ar(in and #i&e #ersa!

b! Pi(% perfor$in( &o$panies are t%ose t%at e4%ibit a %i(%er profit

$ar(in '%en %oldin( asset turno#er &onstant+ and %a#e a %i(%er

turno#er '%en %oldin( profit $ar(in &onstant! T%us+ in&reasin( "NOA

re-uires $ana(ers to $ana(e bot% t%e in&o$e state$ent and t%e

balan&e s%eet!

Cambridge Business Publishers, 2013

Solutions Manual, Module 3

3-2,

P3-5=

9

)37 $inutes*

a!

Net profit $ar(in )Net in&o$e 2 sales* E+.<< 2 E7B+.<. F .!75M

Asset turno#er )Sales 2 A#era(e

assets*

E7B+.<. 2 )IE<+=5@ J E=+3B.L2.*

F .!<=

/inan&ial le#era(e )A#era(e assets 2

A#era(e e-uity*

)IE<+=5@ J E=+3B.L2.* 2

)IE:+:B. J E:+3.BL2.

F .!=B

b!

"OE )Net in&o$e 2 A#era(e e-uity* E+.<< 2 )IE:+:B. J E:+3.BL2. F @!<:M

Confir$ation .!75M K .!<= K .!=B F @!<<M

)B!BBB roundin( error*

&! Ad8ust$ents to "OA typi&ally fo&us on t%e nu$erator )spe&ifi&ally+ 'e

add ba&, after-ta4 interest e4pense to net in&o$e*! /or 9est 9uy+ t%is

ad8ust$ent follo's0

Ad8usted "OA F )E+.<< J IE3: K ) - B!3<*L* 2 )IE<+=5@ J E=+3B.L2.*

F <!@M

Cambridge Business Publishers, 2013

Financial Statement Analsis ! "aluation, 3rd #dition

3-30

P3-5@

9

)37 $inutes*

a!

Net profit $ar(in )Net in&o$e 2 Sales* E5+3@ 2 E5@+.B< F =!5M

Asset turno#er )Sales 2 A#era(e

assets*

E5@+.B< 2 )IE@7+.=@ J E::+<5L 2 .*

F B!:B<

/inan&ial le#era(e )A#era(e assets 2

A#era(e e-uity*

)IE@7+.=@ J E::+<5L 2 .* 2

)IE37+=35 J E.7+=<:L 2 .*

F .!:.7

b!

"OE )Net in&o$e 2 A#era(e e-uity* E5+3@ 2 )IE37+=35 J E.7+=<:L 2 .*

F 3!5M

Confir$ation =!5M K B!:B< K .!:.7 F 3!5BM

)B!BB roundin( error*

&! Ad8ust$ents to "OA typi&ally fo&us on t%e nu$erator )spe&ifi&ally+

addin( after-ta4 interest e4pense to net in&o$e*! /or Traft+ ad8usted

"OA is0 E5+3@ J ) - B!3<* K E.+B.5 2 )IE@7+.=@ J E::+<5L 2 .* F :!:=M

T%e unad8usted "OA is0 E5+3@ 2 )IE@7+.=@ J E::+<5L 2 .* F 7!M

T%e differen&e bet'een t%e t'o is fairly si(nifi&ant )!7<M*! T%is

represents t%e effe&t of debt finan&in( H t%e "OA of 7!M refle&ts t%e

interest e4pense on borro'ed $oney! T%e ad8usted "OA of :!:=M is t%e

return on t%e assets %oldin( apart t%e $anner in '%i&% t%ey 'ere

funded!

Cambridge Business Publishers, 2013

Solutions Manual, Module 3

3-31

I/"S APPCICATIONS

I3-7B )7 $inutes*

a!

)E $illions* "NOA

S%ell E+<@3 2 I)E:@+.@5 J E5=+B<B*2 .L F <!5M

9P E:+=BB 2 I)E3=+.<7 J E.7+=35* 2 .L F .!<M

b!

)E $illions* NOPM F NOPAT 2 Sales NOAT F Sales 2 A#era(e NOA

S%ell E+<@32E.=3+:5 F 5!.M E.=3+:52I)E:@+.@5JE5=+B<B*2.L

F!<=

9P E:+=BB2E.53+<3 F :!@M E.53+<32I)E3=+.<7JE.7+=35*2.L

F!=5

&! 9P3s "NOA of .!<M is si(nifi&antly %i(%er t%an S%ell3s "NOA of <!5M+

for t'o reasons! /irst+ 9P %as a %i(%er net operatin( profit $ar(inV :5M

(reater t%an S%ell3s NOPM ):!@M &o$pared to 5!.M*! Se&ond+ 9P is

$ore effi&ient 'it% its net operatin( asset turno#er+ '%i&% $a,es t%e

&o$pany $ore profitable o#erall!

Cambridge Business Publishers, 2013

Financial Statement Analsis ! "aluation, 3rd #dition

3-32

I3-7 )7 $inutes*

a!

)W t%ousands*

"OE W<:+@3 2 I)WB+B35+<=7 J W@+3:3+.53* 2 .L F <!5M

"NOA W7.:+B5 2 I)W3+BB.+37B J W.+B.=+B.5* 2 .L F 5!.M

b!

)Wt%ousands* NOPM F NOPAT 2 Sales NOAT F Sales 2 A#era(e NOA

OMO 1roup W7.:+B5 2 W<+@<+.:<

F .!@M

W<+@<+.:< 2 I)W3+BB.+37B J

W.+B.=+B.5*2.L

F !53

&! "NOA is 7<M of "OE+ &al&ulated as follo's0 5!.M 2 <!5M F B!7< )or 7<M*!

Ge &an infer OMO3s nonoperatin( return by &al&ulatin( t%e differen&e

bet'een "OE and "NOA0 <!5M - 5!.M F 3!.M!

I3-7. )7 $inutes*

)W $illions*

a!

)W $illions* Ciabilities-to-e-uity

.BB= W3+<7: 2 W+B7 F !.5

.BB@ W3+<: 2 W+=== F !:

S&%neider Ele&tri&3s total liabilities-to-sto&,%olders3 e-uity ratio is

$oderate to %i(% bet'een !: and !.5+ but %as de&reased sli(%tly fro$

.BB= to .BB@! To $a,e a $ore infor$ed assess$ent+ 'e 'ould li,e to

,no' t%e ratio for fir$s in t%is industry and (eo(rap%i& area!

b! S&%neider Ele&tri&3s debt le#el is not e4&essi#e! It %as (ood li-uidity

and %i(% earnin(s! It %as a stron( $ar(in to &o#er its interest e4penses!

Ge 'ould &on&lude t%at t%e &o$pany is li-uid and sol#ent!

Cambridge Business Publishers, 2013

Solutions Manual, Module 3

3-33

I3-73 )57 $inutes*

)X $illions*

a! .BB NOPAT F X7@= J )X:B H X* K ) H B!37@* F X:.@

.BB@ NOPAT F X5:B J )X:B H X55* K ) H B!3:B* F X5<B

b! .BB NOA F )X<+::: H X..@ J X+B@5 H X< H X.57*

H )X.+7. H X.3 J X+:7@ H X+B.<* F X7+:55

.BB@ NOA F )X<+:B H X.5. H X= J X+B:: H X3.<*

H )X.+B.5 H X J X+:=. H X+B5@* F X5+@.B

&! .BB "NOA F X:.@ 2 I)X7+:55 J X5+@.B* 2 .L F !@M

.BB@ "NOA F X5<B 2 I)X5+@.B J X5+:::* 2 .L F @!=M

.BB NOPM F X:.@ 2 X7+5B F 5!M

.BB@ NOPM F X5<B 2 X5+7.= F 3!.M

.BB NOAT F X7+5B 2 I)X7+:55 J X5+@.B* 2 .L F .!@.

.BB@ NOAT F X5+7.= 2 I)X5+@.B J X5+:::* 2 .L F 3!B3

Morrison3s "NOA in&reased fro$ .BB@ to .BB! Its NOPM in&reased by

B!@ per&enta(e points '%i&% in&reased "NOA! Po'e#er+ t%e NOAT

de&reased sli(%tly fro$ 3!B3 to .!@.+ '%i&% de&reased "NOA! T%e net

effe&t of t%e t'o 'as to in&rease "NOA!

d! .BB NNO F )X.3 J X+B.<* H )X..@ J X<J X.57* F X:@7

.BB@ NNO F )X J X+B5@* H )X.5. J X= J X3.<* F X5BB

Confir$0

.BB NOA F NNO J SE

X7+:55 F X:@7 J X5+@5@

.BB@ NOA F NNO J SE

X5+@.B F X5BB J X5+7.B

e! .BB "OE F X7@= 2 I)X5+@5@ J X5+7.B* 2 .L F .!:M

.BB@ "OE F X5:B 2 I)X5+7.B J X5+3<=* 2 .L F B!3M

f! .BB nonoperatin( return F "OE H "NOA F .!:M H !@M F B!<M

.BB@ nonoperatin( return F "OE H "NOA F B!3M H @!=M F B!7M

(! "OE;"NOA i$plies t%at Morrison3s is able to borro' $oney to fund

operatin( assets t%at yield a return (reater t%an t%e &ost of t%e debt! T%e

e4&ess a&&rues to t%e benefit of Morrison3s sto&,%olders!

Cambridge Business Publishers, 2013

Financial Statement Analsis ! "aluation, 3rd #dition

3-3$

I3-75 ).7 $inutes*

)X $illions*

a!

.BB total liabilities-to-e-uity F )X+:7@ J X.+7.* 2 X5+@5@ F B!<<

.BB@ total liabilities-to-e-uity F )X+:=. J X.+B.5* 2 X5+7.B F B!=.

Morrison3s total liabilities-to-e-uity de&reased sli(%tly!

b! Morrison3s is fairly illi-uid )&urrent ratio and -ui&, ratio less t%an *+ but

t%is $ay not a bi( &on&ern if t%e &o$pany is able to turn o#er its

in#entory of foodstuffs )sto&,s* #ery -ui&,ly! T%e &o$pany is not %i(%ly

finan&ially le#era(ed! T%e &o$pany3s ability to $eet its debt

re-uire$ents is not at issue!

Cambridge Business Publishers, 2013

Solutions Manual, Module 3

3-3(

DISCUSSION POINTS

D3-77 )3B $inutes*

a! "aisin( pri&es and2or redu&in( $anufa&turin( &osts are not ne&essarily

independent solutions+ and are li,ely related to ot%er fa&tors! T%e effe&t

of a pri&e in&rease on (ross profit is a fun&tion of t%e de$and &ur#e for

t%e &o$pany3s produ&t! If t%e de$and &ur#e is relati#ely elasti&+

&usto$ers are sensiti#e to pri&e %i,es! T%us+ a pri&e in&rease &ould

si(nifi&antly redu&e de$and+ t%ereby de&reasin(+ rat%er t%an in&reasin(+

(ross profit )an e4a$ple is a BM in&rease in pri&e and a .BM de&rease

in de$and*! A pri&e in&rease 'ill %a#e a $ore desired effe&t if t%e

de$and &ur#e is relati#ely inelasti& )an e4a$ple is a BM pri&e in&rease

'it% a 3M de&rease in de$and*!

Cuttin( $anufa&turin( &osts 'ill in&rease (ross profit )#ia redu&tion of

CO1S* if t%e $ore ine4pensi#ely $ade produ&t is not per&ei#ed to be of

lesser -uality+ t%ereby redu&in( de$and!

b! "aisin( pri&es is diffi&ult in &o$petiti#e $ar,ets! As t%e nu$ber of

produ&t substitutes in&reases+ &o$panies are less able to raise pri&es!

"at%er+ t%ey $ust be able to effe&ti#ely differentiate t%eir produ&ts in

so$e $anner in order to redu&e &onsu$ers3 substitution! T%is &an be

a&&o$plis%ed+ for e4a$ple+ by produ&t desi(n and2or ad#ertisin(! T%ese

efforts+ %o'e#er+ li,ely entail additional &ost+ and+ '%ile (ross profit

$i(%t be in&reased as a result+ S16A e4pense $ay also in&rease 'it%

little effe&t on t%e botto$ line!

Manufa&turin( &osts &onsist of ra' $aterials+ labor and o#er%ead! Ea&%

&an be tar(eted for &ost redu&tion! A redu&tion of ra' $aterials &osts

(enerally i$plies so$e redu&tion in produ&t -uality+ but not ne&essarily!

It $i(%t be t%e &ase t%at t%e produ&t &ontains features t%at are not in

de$and by &onsu$ers! Eli$inatin( t%ose features 'ill redu&e produ&t

&osts 'it% little effe&t on sellin( pri&e!

Si$ilarly+ &o$panies &an utiliAe less e4pensi#e sour&es of labor )off-

s%ore produ&tion+ for e4a$ple*+ t%at &an si(nifi&antly redu&e produ&t

&osts and in&rease (ross profit+ pro#ided t%at produ&t -uality is

$aintained!

Cambridge Business Publishers, 2013

Financial Statement Analsis ! "aluation, 3rd #dition

3-3)

D3-77 )&on&luded*

/inally+ $anufa&turin( o#er%ead &an be redu&ed by $ore effi&ient

produ&tion! Ga(es and depre&iation e4pense are t'o si(nifi&ant

&o$ponents of $anufa&turin( o#er%ead! T%ese are lar(ely fi4ed &osts+

and t%e per unit produ&t &ost &an often be redu&ed by in&reasin(

&apa&ity utiliAation of $anufa&turin( fa&ilities )pro#ided+ of &ourse+ t%at

t%e in&reased in#entory produ&ed &an be sold*!

T%e botto$ line is t%at in&reasin( (ross profit is a diffi&ult pro&ess t%at

&an only be a&&o$plis%ed by effe&ti#e $ana(e$ent and inno#ation!

D3-7: )3B $inutes*

a! Gor,in( &apital $ana(e$ent is an i$portant &o$ponent of t%e

$ana(e$ent of a &o$pany! 9y redu&in( t%e le#el of 'or,in( &apital+

&o$panies redu&e t%e &osts of &arryin( e4&ess assets! T%is &an %a#e a

si(nifi&antly positi#e effe&t on finan&ial perfor$an&e! Co$$on 'ays to

de&rease re&ei#ables and in#entories+ and in&rease payables+ in&lude

t%e follo'in(0

"edu&e re&ei#ables

Constri&tin( t%e pay$ent ter$s on produ&t sales

9etter &redit poli&ies t%at li$it &redit to %i(%-ris, &usto$ers

9etter reportin( to identify delin-uen&ies

Auto$ated noti&es to delin-uent a&&ounts

In&reased &olle&tion efforts

Prepay$ent of orders or billin( as $ilestones are rea&%ed

Use of ele&troni& )ACP* pay$ent

Use of t%ird-party (uarantors+ in&ludin( ban, letters of &redit

"edu&e in#entories

"edu&e in#entory &osts #ia less &ostly &o$ponents )of e-ual

-uality*+ produ&e 'it% lo'er 'a(e rates+ eli$inate produ&t features

)&osts* not #alued by &usto$ers

Outsour&e produ&tion to redu&e produ&t &ost and2or

in#entories t%e &o$pany $ust &arry on its balan&e s%eet

"edu&e ra' $aterials in#entories #ia 8ust-in-ti$e deli#eries

Eli$inate bottlene&,s in $anufa&turin( to redu&e 'or,-in-

pro&ess in#entories

"edu&e finis%ed (oods in#entories by produ&in( to order

rat%er t%an produ&in( to esti$ated de$and

In&rease payables

Cambridge Business Publishers, 2013

Solutions Manual, Module 3

3-3*

E4tend t%e ti$e for pay$ent of lo' or no-&ost payablesYso

lon( as t%e relations%ip 'it% suppliers is not %ar$ed

Cambridge Business Publishers, 2013

Financial Statement Analsis ! "aluation, 3rd #dition

3-3+

D3-7: )&on&luded*

b! Pay$ent ter$s to &usto$ers are a $ar,etin( tool+ si$ilar to produ&t

pri&e and ad#ertisin( pro(ra$s! Many &o$panies pro$ote pay$ent

ter$s separately fro$ ot%er pro$otions )no pay$ent for si4 $ont%s or

interest-free finan&in(+ for e4a$ple*! As &o$panies restri&t &redit ter$s+

t%e le#el of re&ei#ables 'ill li,ely de&rease+ t%ereby redu&in( 'or,in(

&apital! T%e restri&tion of &redit ter$s $ay also %a#e t%e undesirable

effe&t of redu&in( de$and for t%e &o$pany3s produ&ts! T%e &ost of

&redit ter$s $ust be 'ei(%ed a(ainst t%e benefits+ and &redit ter$s

$ust be $ana(ed 'it% &are so as to opti$iAe &osts rat%er t%an $ini$iAe

t%e$! Credit poli&y is as $u&% art as it is s&ien&e!

Ci,e'ise+ t%e dept% and breadt% of t%e in#entories t%at &o$panies &arry

i$pa&t &usto$er per&eption! At t%e e4tre$e+ in#entory sto&,-outs result

in not only t%e loss of &urrent sales+ but also t%e potential loss of future

sales as &usto$ers are introdu&ed to &o$petitors and $ay de#elop an

i$pression of t%e &o$pany as >t%inly sto&,ed!? In#entories are &ostly to

$aintain+ as t%ey $ust be finan&ed+ insured+ sto&,ed+ $o#ed+ and so

fort%! "edu&tion in in#entory le#els &an redu&e t%ese &osts! On t%e ot%er

%and+ t%e a$ount and type of in#entories &arried is a $ar,etin( de&ision

and $ust be $ana(ed 'it% &are so as to opti$iAe t%e le#el in#entories+

not ne&essarily to $ini$iAe t%e$!

One &o$pany3s a&&ount payable is anot%er3s a&&ount re&ei#able! So+

8ust as one &o$pany see,s to e4tend t%e ti$e of pay$ent to redu&e its

'or,in( &apital+ so does t%e ot%er &o$pany see, to redu&e t%e a#era(e

&olle&tion period to a&&o$plis% t%e sa$e ob8e&ti#e! Capable+

dependable suppliers are a #aluable resour&e for t%e &o$pany+ and t%e

supplier relation $ust be %andled 'it% &are! All &o$panies ta,e as lon(

to pay t%eir a&&ounts payable as t%e supplier allo's in its &redit ter$s!

E4tendin( t%e pay$ent ter$s beyond t%at point be(ins to ne(ati#ely

i$pa&t t%e supplier relation+ ulti$ately resultin( in t%e loss of t%e

supplier! T%e supplier relation $ust be $ana(ed 'it% &are so as to

opti$iAe t%e ter$s of pay$ent+ rat%er t%an ne&essarily to $ini$iAe

t%e$!

Cambridge Business Publishers, 2013

Solutions Manual, Module 3

3-3,

D3-7< )3B $inutes*

a! T%e parties affe&ted by s&%e$es to $ana(e earnin(s is often $u&%

broader t%an first t%ou(%t! It in&ludes t%e follo'in( affe&ted parties0

! e$ployees abo#e and belo' t%e le#el at '%i&% t%e s&%e$e is

i$ple$ented

.! sto&,%olders and ele&ted $e$bers of t%e board of dire&tors

3! &reditors of t%e &o$pany )suppliers and lenders* and t%eir

e$ployees+ sto&,%olders+ and board of dire&tors

5! &o$petitors of t%e &o$pany

7! t%e &o$pany3s independent auditors

:! re(ulators and ta4in( aut%orities

b! Mana(ers often belie#e t%at earnin(s $ana(e$ent a&ti#ities 'ill be

s%ort-li#ed+ and 'ill be &urtailed on&e its operations >turn around!?

Often+ t%is does not pro#e to be t%e &ase! Inter#ie's 'it% $ana(ers and

e$ployees '%o %a#e en(a(ed in t%is a&ti#ity often re#eal t%at t%ey

started rat%er inno&uously )8ust $ana(in( earnin(s to >$a,e t%e

nu$bers? in one -uarter*+ but+ -ui&,ly+ earnin(s $ana(e$ent be&a$e a

slippery slope! Ulti$ately+ t%e parties t%e &o$pany 'as tryin( to prote&t

)s%are%olders+ for e4a$ple* are %urt $ore t%an t%ey 'ould %a#e been

%ad t%e &o$pany reported its results &orre&tly+ e4posin( proble$s early

so t%at &orre&ti#e a&tion &ould be ta,en )possibly by re$o#in(

$ana(ers* to prote&t t%e broader sta,e%olders in t%e &o$pany!

&! Co$pany $ana(ers are 8ust ordinary people! T%ey desire to i$pro#e

t%eir &o$pensation+ '%i&% is often lin,ed to finan&ial perfor$an&e!

Mana(ers $ay a&t to $a4i$iAe t%eir &urrent &o$pensation at t%e

e4pense of lon(-ter$ (ro't% in s%are%older #alue! T%e redu&tion in t%e

a#era(e e$ploy$ent period at all le#els of t%e &o$pany %as

e4a&erbated t%e proble$!

d! Unfortunately+ t%e separation of o'ners%ip and &ontrol often leads to

less infor$ed s%are%olders '%o are unable to effe&ti#ely $onitor t%e

a&tions of t%e $ana(ers t%ey %a#e %ired! To t%e e4tent t%at

&o$pensation pro(ra$s are lin,ed to finan&ial $easures+ $ana(ers &an

use t%e fle4ibility (i#en to t%e$ under 1AAP to t%eir benefit+ e#en

'it%out #iolatin( 1AAP per se! T%ese a&tions &an only be un&o#ered by

effe&ti#e auditin( and enfor&ed by an effe&ti#e audit &o$$ittee of t%e

board! Corporate (o#ernan&e %as (ro'n &onsiderably in i$portan&e

follo'in( t%e a&&ountin( s&andals of t%e early .BBBs! T%e Sarbanes-

O4ley A&t $andates ne' le#els of &orporate (o#ernan&e! T%e sto&,

$ar,et and t%e &ourts are %elpin( to enfor&e t%is $andate!

Cambridge Business Publishers, 2013

Financial Statement Analsis ! "aluation, 3rd #dition

3-$0

You might also like

- Solutions To Module 2 Exercises and Problems PDFDocument39 pagesSolutions To Module 2 Exercises and Problems PDFAnonymous QRyGC6jm100% (3)

- Module 2 HW SolutionsDocument7 pagesModule 2 HW SolutionsJeff MercerNo ratings yet

- Midterm 2ADocument20 pagesMidterm 2AAlexNo ratings yet

- FSAV3eModules 5-8Document26 pagesFSAV3eModules 5-8bobdoleNo ratings yet

- Analyzing and Interpreting Financial Statements: Learning Objectives - Coverage by QuestionDocument37 pagesAnalyzing and Interpreting Financial Statements: Learning Objectives - Coverage by QuestionpoollookNo ratings yet

- Fae3e SM ch04 060914Document23 pagesFae3e SM ch04 060914JarkeeNo ratings yet

- Module 3 EXTRA SolutionsDocument17 pagesModule 3 EXTRA SolutionsJeff MercerNo ratings yet

- Mod08 - 09 10 09Document37 pagesMod08 - 09 10 09Alex100% (1)

- Famba 8e - SM - Mod 08 - 040920 1Document41 pagesFamba 8e - SM - Mod 08 - 040920 1Shady Mohsen MikhealNo ratings yet

- Module 4Document59 pagesModule 4Radhi PandyaNo ratings yet

- Ejercicio 7.5Document6 pagesEjercicio 7.5Enrique M.No ratings yet

- PHT and KooistraDocument4 pagesPHT and KooistraNilesh PrajapatiNo ratings yet

- Operating and Financial LeverageDocument21 pagesOperating and Financial LeverageKeval KamaniNo ratings yet

- Analysis of Financial Statements: QuestionsDocument44 pagesAnalysis of Financial Statements: QuestionsgeubrinariaNo ratings yet

- Fae3e SM ch03Document19 pagesFae3e SM ch03JarkeeNo ratings yet

- Valuation of EquityDocument14 pagesValuation of EquityJarna MehtaNo ratings yet

- GN Cover and Case 2015Document7 pagesGN Cover and Case 2015Đức Bình NguyễnNo ratings yet

- Chapter 4 SolvedDocument21 pagesChapter 4 SolvedQuế Hoàng Hoài ThươngNo ratings yet

- CRU Computer Rental Case Study: Improving Profitability Through Longer Rental CyclesDocument5 pagesCRU Computer Rental Case Study: Improving Profitability Through Longer Rental CyclesVijay KoushalNo ratings yet

- Sample Quiz 2 Statistics Essentials of Business DevelopmentDocument15 pagesSample Quiz 2 Statistics Essentials of Business DevelopmentJessica BoehmNo ratings yet

- Chapter 11 Quiz Connect CampDocument25 pagesChapter 11 Quiz Connect CampaksNo ratings yet

- Stock Price Number of Shares Outstanding Stock A $ 4 0 2 0 0 Stock B $ 7 0 5 0 0 Stock C $ 1 0 6 0 0Document8 pagesStock Price Number of Shares Outstanding Stock A $ 4 0 2 0 0 Stock B $ 7 0 5 0 0 Stock C $ 1 0 6 0 0likaNo ratings yet

- BBBY VlmaDocument5 pagesBBBY VlmaDaniel MedeirosNo ratings yet

- Https Doc 0k 0s Apps Viewer - GoogleusercontentDocument4 pagesHttps Doc 0k 0s Apps Viewer - GoogleusercontentAnuranjan Tirkey0% (1)

- Body GloveDocument2 pagesBody Glovesusan15785100% (3)

- 12 Corporate Restructuring and BankruptcyDocument5 pages12 Corporate Restructuring and BankruptcyMohammad DwidarNo ratings yet

- Famba 8e - SM - Mod 03 - 040320 1Document77 pagesFamba 8e - SM - Mod 03 - 040320 1Shady Mohsen MikhealNo ratings yet

- Final Practice QuestionsDocument32 pagesFinal Practice Questions282487239No ratings yet

- Solutions - Chapter 5Document21 pagesSolutions - Chapter 5Dre ThathipNo ratings yet

- ACC 1110 Introductory Managerial Accounting Practice Final ExamDocument24 pagesACC 1110 Introductory Managerial Accounting Practice Final ExamMariela CNo ratings yet

- Understanding Income Statements EPS CalculationsDocument39 pagesUnderstanding Income Statements EPS CalculationsKeshav KaplushNo ratings yet

- Capital Structure Test QuestionsDocument28 pagesCapital Structure Test QuestionsSardonna FongNo ratings yet

- Debt and Policy Value CaseDocument6 pagesDebt and Policy Value CaseUche Mba100% (2)

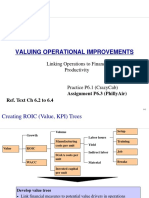

- 2 Linking Operations To Finance and ProductivityDocument14 pages2 Linking Operations To Finance and ProductivityAidan HonnoldNo ratings yet

- Chapter 5 Financial Decisions Capital Structure-1Document33 pagesChapter 5 Financial Decisions Capital Structure-1Aejaz MohamedNo ratings yet

- Case Study 1 Week 3 A BoorDocument3 pagesCase Study 1 Week 3 A BoorABoor092113No ratings yet

- Jun18l1-Ep04 QDocument18 pagesJun18l1-Ep04 QjuanNo ratings yet

- Extra Ratio Analysis Questions MBADocument3 pagesExtra Ratio Analysis Questions MBAYasser MaamounNo ratings yet

- Chapter 7 SolutionsDocument8 pagesChapter 7 SolutionsAustin LeeNo ratings yet

- Coba BDocument4 pagesCoba BCesar Felipe UauyNo ratings yet

- MRC Inc Case Study on Acquiring ARI for its Liquid AssetsDocument7 pagesMRC Inc Case Study on Acquiring ARI for its Liquid AssetsКирилл Манько100% (3)

- Case BBBYDocument7 pagesCase BBBYgregordejong100% (1)

- FIN300 Homework 4Document4 pagesFIN300 Homework 4John0% (2)

- Managerial Economics 1Document6 pagesManagerial Economics 1Chitrakalpa SenNo ratings yet

- Cachon, Problems and Solutions, Chapter 2Document5 pagesCachon, Problems and Solutions, Chapter 2Claudia100% (2)

- eco 文書Document19 pageseco 文書Cindy LamNo ratings yet

- Free Cash Flow To Firm ModelDocument7 pagesFree Cash Flow To Firm ModelddengrNo ratings yet

- Bond ExcelDocument35 pagesBond ExcelUsman Khan57% (7)

- Pre AssessmentDocument16 pagesPre Assessmentaboulazhar50% (2)

- Financial Statement ManipulationDocument10 pagesFinancial Statement Manipulationssimi137No ratings yet

- Central Florida Computer CompanyDocument6 pagesCentral Florida Computer CompanyDinesh J Vatani100% (1)

- WK - 7 - Relative Valuation PDFDocument33 pagesWK - 7 - Relative Valuation PDFreginazhaNo ratings yet

- Finance Chapter 15Document34 pagesFinance Chapter 15courtdubs100% (1)

- Beta Management QuestionsDocument1 pageBeta Management QuestionsbjhhjNo ratings yet

- Module 9 Inter Corporate InvestmentsDocument24 pagesModule 9 Inter Corporate Investmentsdsantin84No ratings yet

- Francisco Partners CaseDocument32 pagesFrancisco Partners CaseJose M Terrés-NícoliNo ratings yet

- Bond Price and Yield RelationshipDocument13 pagesBond Price and Yield Relationshipdscgool1232No ratings yet

- PROJ 410 Week 5 Case Study 2 Do It Yourself OutsourcingDocument9 pagesPROJ 410 Week 5 Case Study 2 Do It Yourself OutsourcingMicahBittner100% (1)

- Module 2 SolutionsDocument61 pagesModule 2 Solutionsrasmussen123456No ratings yet

- Module 3 Financial Statement Analysis and Valuation 3EDocument51 pagesModule 3 Financial Statement Analysis and Valuation 3EYanLi100% (2)

- Module 2 Financial Statement Analysis and Valuation 3EDocument52 pagesModule 2 Financial Statement Analysis and Valuation 3EYanLi100% (1)

- Module 1 Financial Statement Analysis and Valuation 3EDocument62 pagesModule 1 Financial Statement Analysis and Valuation 3EYanLiNo ratings yet

- Module 1 Answers To End of Module QuestionsDocument41 pagesModule 1 Answers To End of Module QuestionsYanLi100% (1)

- Notes FMDocument42 pagesNotes FMSneha JayalNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- ITI Multi-Cap Fund HighlightsDocument48 pagesITI Multi-Cap Fund HighlightsRAHULNo ratings yet

- Title 4. Powers of Corporations - RCCDocument5 pagesTitle 4. Powers of Corporations - RCCJezen Esther PatiNo ratings yet

- CH 03Document20 pagesCH 03BensonChiu100% (2)

- IPSAS in Your Pocket April 2017 PDFDocument63 pagesIPSAS in Your Pocket April 2017 PDFMuhamad Riza El HakimNo ratings yet

- Regulatory FrameworkDocument10 pagesRegulatory FrameworkkingjaspeNo ratings yet

- C14 CHP 12 2 Homework Sol S CorpsDocument6 pagesC14 CHP 12 2 Homework Sol S CorpsRimpy SondhNo ratings yet

- Response To SGX Queries and Letter To The Editor of Business TimesDocument5 pagesResponse To SGX Queries and Letter To The Editor of Business TimesWeR1 Consultants Pte LtdNo ratings yet

- Underreaction to News Due to Disposition EffectDocument30 pagesUnderreaction to News Due to Disposition EffectSteven Hyosup KimNo ratings yet

- Everlof PDocument56 pagesEverlof PBhavneesh ShuklaNo ratings yet

- DLF Ar +2009 10Document195 pagesDLF Ar +2009 10Muthamil Selvan DNo ratings yet

- Basic Accounting Concepts and ConventionDocument12 pagesBasic Accounting Concepts and ConventionParul TandanNo ratings yet

- Grasim Industries, Aditya Birla Nuvo About To MergeDocument3 pagesGrasim Industries, Aditya Birla Nuvo About To MergeSubham MazumdarNo ratings yet

- CH 18Document40 pagesCH 18Louina YnciertoNo ratings yet

- Impact of Merger and AcquisitionDocument11 pagesImpact of Merger and Acquisitionmonu67% (3)

- Comprehensive comparison of old and new Companies Act provisionsDocument3 pagesComprehensive comparison of old and new Companies Act provisionsgnsr_1984No ratings yet

- Financial Assistance CasesDocument4 pagesFinancial Assistance CasesNajmi ArifNo ratings yet

- Chapter - 01 ACCOUNTING AND THE BUSINESS ENVIRONMENTDocument66 pagesChapter - 01 ACCOUNTING AND THE BUSINESS ENVIRONMENTRajesh Arora100% (1)

- AR Aperam 2016 Annual ReportDocument181 pagesAR Aperam 2016 Annual ReportDionysius Septian Cahya OlivianoNo ratings yet

- Motilal Oswal 23rd Annual Wealth Creation Study - Detailed ReportDocument43 pagesMotilal Oswal 23rd Annual Wealth Creation Study - Detailed ReportRajeshPandeyNo ratings yet

- Xacc280 Chapter 2Document46 pagesXacc280 Chapter 2jdcirbo100% (1)

- Financial Accounting - Wiley (ch01)Document79 pagesFinancial Accounting - Wiley (ch01)Aji Sasio100% (4)

- Banker's Customers - Special TypesDocument28 pagesBanker's Customers - Special TypesShafeer KhanNo ratings yet

- 018.ASX IAW Feb 1 2008 Appendix 4C QuarterlyDocument10 pages018.ASX IAW Feb 1 2008 Appendix 4C QuarterlyASX:ILH (ILH Group)No ratings yet

- AvianCorp Fall 2013Document2 pagesAvianCorp Fall 2013braveusmanNo ratings yet

- ESOP & Sweat Equity FeaturesDocument26 pagesESOP & Sweat Equity FeaturesjayatheerthavNo ratings yet

- Drafting Shareholders' Agreements ChecklistDocument6 pagesDrafting Shareholders' Agreements ChecklistMarius Angara100% (1)

- Objectives and ConflictDocument39 pagesObjectives and Conflictsaly_888No ratings yet

- Beams10e Ch03 An Introduction To Consolidated Financial StatementsDocument44 pagesBeams10e Ch03 An Introduction To Consolidated Financial StatementsLeini TanNo ratings yet