Professional Documents

Culture Documents

BIR issues electronic letters of authority

Uploaded by

AatDeskHelperOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR issues electronic letters of authority

Uploaded by

AatDeskHelperCopyright:

Available Formats

BDB Laws Tax Law For Business appears in the opinion section of Business Mirror every

Thursday.

Issuance of electronic letter of authority

With the increasing demand for the computerization of almost all government processes

and in line with the objective of the Bureau of Internal Revenue (BIR) to improve its

operational efficiency and to provide up-to-date information of its audit activities, the BIR

recently issued Revenue Memorandum Order (RMO) No. 44-2010 for the electronic

issuance of letters of authority.

The RMO prescribes the documentary requirements and enhanced automation

procedures for the issuance of Letter of Authority, which serves as the embodiment of

the mandate of the tax authorities to initiate its tax investigations. A valid electronic

Letter of Authority (LA) shall contain the following features:

1. The electronic LA shall bear the name, designation and the electronic signature

of the approving BIR official.

The authorized signatories are the following:

(a) Assistant Commissioner for Large Taxpayers Service (LTS) for investigation

of large taxpayers by revenue officers assigned at LTS and its Divisions;

(b) Deputy Commissioner for Legal and Inspection Group for LAs issued by

Enforcement Services and its Divisions;

(c) The Regional Director for those taxpayers within his regional jurisdiction

(Revenue District Offices); and

(d) The Commissioner himself, or his duly authorized representative, for

investigations to be conducted by duly created task forces and special teams

2. The serial number of the LA shall be system-generated, and the date thereof

shall be the date when the same was printed. The original copy of the said LA

should be transmitted to the taxpayer under investigation.

3. The names of the Revenue Officers assigned to the case shall be printed on the

corresponding LA. The first name on the space provided shall be the lead

Revenue Officer.

As such, taxpayers should note that the authority to conduct the examination of

the companys books shall be limited only those revenue officers named in the

LA and accordingly, those officers whose name do not appear in the LA shall not

be allowed to participate or assist in the audit.

4. The tax types and the taxable period to be covered by the audit shall be reflected

on the LA.

The LA should indicate the scope of the tax audit, referring to the kinds of tax and

the taxable period to be covered. Generally, a letter of authority shall cover only

one taxable year, except in tax fraud and excise cases, where the issuance of LA

covering more than one taxable year may be allowed. Moreover, a letter of

authority issued for a certain taxable year and all unverified prior years is

likewise prohibited.

As to the tax types under investigation, the LA generally covers all internal

revenue taxes.

5. The electronic LA shall also include the basis for the audit (i.e., regular audit,

special, etc.).

6. Electronic LA with manually-written character (alphabetical or numeric), notation

or erasure shall be rendered invalid.

7. The LA shall also include a notation stating that the taxpayer is requested to

verify the validity of the LA with the authorized BIR official, at the address and the

contact information provided therein.

Another salient provision of this RMO is the withdrawal, effective June 1, 2010, of the

requirement of the revalidation of LAs for failure by the revenue officers to complete their

audit. Under the old regulations, a letter of authority which is over 120 days from the

date of its issuance shall lose its validity and must therefore be revalidated to be

effective. Under the present rules, however, there is no longer any need to revalidate the

LA even if the prescribed audit period has been exceeded. However, the revenue

officers who failed to complete the audit within the prescribed period shall be subject to

administrative sanctions.

With these issuances by the tax authorities particularly those geared towards aggressive

monitoring and conduct of its tax audit, it is incumbent upon the taxpayers to know their

tax obligations and ensure compliance with tax regulations, and be prepared and vigilant

of their rights in case of tax audit or investigation.

The author is a senior associate of Du-Baladad and Associates Law Offices (BDB Law).

If you have any comments or questions concerning the article, you can e-mail the author

at deo.saludario@bdblaw.com.ph or call 403-2001 local 320.

You might also like

- Solution Manual For Financial Reporting and Analysis 7th Edition by RevsineDocument33 pagesSolution Manual For Financial Reporting and Analysis 7th Edition by Revsinea619353646100% (1)

- Corperate GovernanceDocument21 pagesCorperate Governancesakthimani1973No ratings yet

- Contract To Sell Juan Dela CruzDocument4 pagesContract To Sell Juan Dela Cruzkim dahyunNo ratings yet

- Letter To BODDocument1 pageLetter To BODAure CarilloNo ratings yet

- Information For HomicideDocument2 pagesInformation For HomicideNor-ainah Mangondaya DaraganganNo ratings yet

- Archibald Sarmiento RamosDocument2 pagesArchibald Sarmiento RamosArchie RamosNo ratings yet

- Public Officers' Right To Retirement PayDocument5 pagesPublic Officers' Right To Retirement PayMiguel AlagNo ratings yet

- Digest AgencyDocument4 pagesDigest AgencyMoraga AnjoNo ratings yet

- Articles of Incorporation for Non-Profit Kabataang FOGE FoundationDocument10 pagesArticles of Incorporation for Non-Profit Kabataang FOGE FoundationenzoNo ratings yet

- Vargas v. RillorazaDocument1 pageVargas v. RillorazaDaphne RodriguezNo ratings yet

- SaftDocument20 pagesSaftCarolinaCostaTeodoroNo ratings yet

- Litton Wins Against Santos' Non-Profit ShieldDocument9 pagesLitton Wins Against Santos' Non-Profit ShieldJP De La PeñaNo ratings yet

- ROLE OF BIG DATA IN ACCOUNTING & AUDITINGDocument7 pagesROLE OF BIG DATA IN ACCOUNTING & AUDITINGParadox 94No ratings yet

- City of Davao v. Randy Allied Ventures, Inc.Document4 pagesCity of Davao v. Randy Allied Ventures, Inc.L.A. ManlangitNo ratings yet

- 5 - GARCIA v. DRILONDocument2 pages5 - GARCIA v. DRILONClarebeth Recaña RamosNo ratings yet

- Brickman & Joyner, Cpas Room Revenue Analytical: PurposeDocument2 pagesBrickman & Joyner, Cpas Room Revenue Analytical: PurposeDendy BossNo ratings yet

- ESTIPONA vs. LOBRIGO G.R. No. 226679Document3 pagesESTIPONA vs. LOBRIGO G.R. No. 226679SuzieNo ratings yet

- Letter of GuaranteeDocument1 pageLetter of GuaranteeAtEt Sioco PascualNo ratings yet

- LEG RES Case DigestDocument16 pagesLEG RES Case Digestquejarra de asis100% (1)

- Risk Management and Internal Control System - Reference Framework PDFDocument42 pagesRisk Management and Internal Control System - Reference Framework PDFChinh Lê Đình100% (1)

- Emigration Clearance Certificate No. - : Bureau of ImmigrationDocument1 pageEmigration Clearance Certificate No. - : Bureau of ImmigrationAnna PierceNo ratings yet

- Public Corp NotesDocument51 pagesPublic Corp NotesRaymund CallejaNo ratings yet

- Chapter 14 Budget GuideDocument45 pagesChapter 14 Budget GuideJessa MartinezNo ratings yet

- Articles of Incorporation Ala EhDocument3 pagesArticles of Incorporation Ala EhPinky De Castro AbarquezNo ratings yet

- 1st Week of March, 2016 15-Aug-16: General Information Sheet (Gis)Document4 pages1st Week of March, 2016 15-Aug-16: General Information Sheet (Gis)Lustre JeromeNo ratings yet

- Natelco Vs CADocument10 pagesNatelco Vs CAcharmdelmoNo ratings yet

- Issues, Problems and Solutions in Tax Audit and Investigation (1-10-13)Document184 pagesIssues, Problems and Solutions in Tax Audit and Investigation (1-10-13)marygrace_apaitan100% (2)

- Sample SMRDocument3 pagesSample SMRArjam B. BonsucanNo ratings yet

- RUFINO LOPEZ & SONS, INC., Petitioner, The Court of Tax Appeals, RespondentDocument3 pagesRUFINO LOPEZ & SONS, INC., Petitioner, The Court of Tax Appeals, RespondentMj BrionesNo ratings yet

- The Validity of Perpetual Alienation of Property Imposed by The Donee or DonorDocument10 pagesThe Validity of Perpetual Alienation of Property Imposed by The Donee or Donoraya5monteroNo ratings yet

- 2018 Doj Bail GuidelinesDocument5 pages2018 Doj Bail GuidelinesLia LBNo ratings yet

- Admin 11 15 DigestDocument9 pagesAdmin 11 15 DigestRosalia L. Completano LptNo ratings yet

- Reduction (NHTS-PR), An Information Management System That Employs Geographic Targeting, HouseholdDocument3 pagesReduction (NHTS-PR), An Information Management System That Employs Geographic Targeting, HouseholdLloyd Ian FongfarNo ratings yet

- CREATION and DISSOLUTION OF MUNICIPAL CORPORATIONSDocument62 pagesCREATION and DISSOLUTION OF MUNICIPAL CORPORATIONSNica PineNo ratings yet

- Articles of General PartnershipDocument4 pagesArticles of General PartnershipHazel Angeline C. BazarNo ratings yet

- Walking a Tightrope: Biography of Honorable Mayor Catalino Gabot Hermosilla Sr.From EverandWalking a Tightrope: Biography of Honorable Mayor Catalino Gabot Hermosilla Sr.No ratings yet

- Psalm Uc Guidelines PDFDocument19 pagesPsalm Uc Guidelines PDFRj FashionhouseNo ratings yet

- Gaoiran Vs AlcalaDocument11 pagesGaoiran Vs AlcalaMonique LhuillierNo ratings yet

- Cases PaleDocument38 pagesCases PaleJayzel LaureanoNo ratings yet

- CASE-Pangasinan Transportation Co. v. The Public Service CommissionDocument7 pagesCASE-Pangasinan Transportation Co. v. The Public Service CommissionJosh GatusNo ratings yet

- Aaa v. BBB Gr212448Document7 pagesAaa v. BBB Gr212448Zen JoaquinNo ratings yet

- Pro-Life Phil vs. Office of The PresidentDocument81 pagesPro-Life Phil vs. Office of The PresidentproliferakoNo ratings yet

- Public OfficersDocument48 pagesPublic OfficersDon Sumiog100% (1)

- International Corporate Bank vs. Gueco (SCRA 516)Document156 pagesInternational Corporate Bank vs. Gueco (SCRA 516)DARLENENo ratings yet

- ASEAN Integration 2015 and The Imperative For Reforms in The Legal Profession and The Legal Education in The Philippines by Dean Joan S. LargoDocument28 pagesASEAN Integration 2015 and The Imperative For Reforms in The Legal Profession and The Legal Education in The Philippines by Dean Joan S. LargoHornbook Rule100% (1)

- RA - Republic Act No. 10883Document6 pagesRA - Republic Act No. 10883Kaye ArendainNo ratings yet

- 6 Purefoods Vs NLRC G.R. No. 122653Document5 pages6 Purefoods Vs NLRC G.R. No. 122653Lonalyn Avila Acebedo100% (1)

- Cta Eb CV 01590 D 2017dec18 AssDocument25 pagesCta Eb CV 01590 D 2017dec18 AssaudreydqlNo ratings yet

- Revised VAT Guidelines for Philippine TaxpayersDocument15 pagesRevised VAT Guidelines for Philippine Taxpayersdencave1No ratings yet

- 34 US V Ah SingDocument2 pages34 US V Ah SingKEDNo ratings yet

- SpecPro - Venue and Jurisdiction - Settlement of Estate - MdabarcomaDocument9 pagesSpecPro - Venue and Jurisdiction - Settlement of Estate - MdabarcomaMa. Danice Angela Balde-BarcomaNo ratings yet

- Court erred in granting name change in adoptionDocument2 pagesCourt erred in granting name change in adoptionEdgar Joshua TimbangNo ratings yet

- Rules for Investigating Violations of Housing LawsDocument2 pagesRules for Investigating Violations of Housing LawsCeline-Maria JanoloNo ratings yet

- Affidavit - For ZoningDocument1 pageAffidavit - For ZoningEunica Mae AngelesNo ratings yet

- Madamba v. Lara (2009)Document1 pageMadamba v. Lara (2009)neneneneneNo ratings yet

- DENR Administrative Order No 99-14Document3 pagesDENR Administrative Order No 99-14Vivian Escoto de BelenNo ratings yet

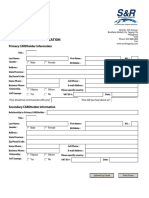

- SNR MembershipDocument1 pageSNR MembershipGenesaMarieChoiNo ratings yet

- Judge prohibited from provincial justice committee roleDocument1 pageJudge prohibited from provincial justice committee roleCJ MillenaNo ratings yet

- Vinuya vs. Executive Secretary GR 182230 (2010)Document25 pagesVinuya vs. Executive Secretary GR 182230 (2010)YuriiSisonNo ratings yet

- Patent Search HKDocument4 pagesPatent Search HKAcs Anisha DuttaNo ratings yet

- Philippine Postal Corporation: Business Mailer Return Registry ReceiptDocument1 pagePhilippine Postal Corporation: Business Mailer Return Registry ReceiptValentino C. Bacalso Jr.No ratings yet

- Complaint Revenue CodeDocument2 pagesComplaint Revenue CodeBar2012No ratings yet

- Cauton v. Comelec, 19 Scra 911Document5 pagesCauton v. Comelec, 19 Scra 911newin12No ratings yet

- Eg. Class Notes, Research Papers, Presentations: My Heart Went OpsDocument2 pagesEg. Class Notes, Research Papers, Presentations: My Heart Went OpsEnzoGarciaNo ratings yet

- Summary of Significant CTA Decisions (February 2011)Document2 pagesSummary of Significant CTA Decisions (February 2011)ShaneBeriñaImperialNo ratings yet

- Crim Reviewer Section 00224 PDFDocument1 pageCrim Reviewer Section 00224 PDFLawStudent101412No ratings yet

- Updates On Accounting and Auditing Reforms PDFDocument85 pagesUpdates On Accounting and Auditing Reforms PDFkenvysNo ratings yet

- S3. Ethiopian Health Center Reform Implementation Guidelines (EHCRIG)Document5 pagesS3. Ethiopian Health Center Reform Implementation Guidelines (EHCRIG)Yohannes Negasi Tsegaw85% (13)

- Public Sector Audit: BY Rocke AlexDocument49 pagesPublic Sector Audit: BY Rocke AlexJUMA PARUTUNo ratings yet

- Manisana Wage Board - Journalists and Non-JournalistsDocument1 pageManisana Wage Board - Journalists and Non-JournalistsAnilkumar ParameswaranNo ratings yet

- Financial Accounting: Professional Stage Application LevelDocument6 pagesFinancial Accounting: Professional Stage Application Levelswarna dasNo ratings yet

- QUESTIONS Acp307 Part 2Document5 pagesQUESTIONS Acp307 Part 2Ma. Hazel Donita DiazNo ratings yet

- TZNQSXDocument114 pagesTZNQSXSumit100% (1)

- Article 11 Internal Audit of Quality in 5s Environment PDFDocument11 pagesArticle 11 Internal Audit of Quality in 5s Environment PDFTayyab TariqNo ratings yet

- Audit of Current LiabilitiesDocument4 pagesAudit of Current LiabilitiesMark Anthony TibuleNo ratings yet

- COA Laguna PSAO Building BidDocument101 pagesCOA Laguna PSAO Building BidJayLord Mico PacisNo ratings yet

- Major Vs Minor NonconformityDocument2 pagesMajor Vs Minor NonconformitySouha Alhallak AlhallakNo ratings yet

- Excise Audit Manual 2008Document182 pagesExcise Audit Manual 2008Priya Manu AroraNo ratings yet

- Mathur Sir Classes - Howrah Branch Audit NotesDocument28 pagesMathur Sir Classes - Howrah Branch Audit NotesRajat SardarNo ratings yet

- Roll Forward Analysis2Document4 pagesRoll Forward Analysis2CJ alandyNo ratings yet

- DO_s2024_004Document23 pagesDO_s2024_004baglintotNo ratings yet

- Cima c02 Mock-2Document13 pagesCima c02 Mock-2Samiuddin Bukhari100% (1)

- CV Salsabila ThahirahDocument6 pagesCV Salsabila Thahirahmedia bnsNo ratings yet

- Planning and Control For Managers September 2020Document10 pagesPlanning and Control For Managers September 2020muwowo1No ratings yet

- Fe Cereñado Obe: #37C Hornbill St. Sitio Veterans, Area 3 Brgy. Bagong Silangan, Quezon CityDocument2 pagesFe Cereñado Obe: #37C Hornbill St. Sitio Veterans, Area 3 Brgy. Bagong Silangan, Quezon CityJoanna PaulaNo ratings yet

- AT Quizzer 13 - Reporting Issues (2TAY1718) PDFDocument10 pagesAT Quizzer 13 - Reporting Issues (2TAY1718) PDFWihl Mathew Zalatar0% (1)

- Performance Assesment-A Shift From Intangibles To TangiblesDocument25 pagesPerformance Assesment-A Shift From Intangibles To Tangibles2005ravi100% (1)

- WOU Student Handbook 2013Document154 pagesWOU Student Handbook 2013De Book100% (1)

- Tennessee Board of DentistryDocument27 pagesTennessee Board of DentistryAnonymous GF8PPILW5No ratings yet

- My Dream JobDocument2 pagesMy Dream Jobapi-481732337No ratings yet