Professional Documents

Culture Documents

Financial Statements

Uploaded by

Anakin AmeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Statements

Uploaded by

Anakin AmeCopyright:

Available Formats

Profit and loss statement

Expenses

The profit and loss statement is a summary of a businesss income and expenses over a

specific period. It should be prepared at regular intervals (usually monthly and at financial

year end) to show the results of operations for a given period. Profit or loss is calculated in

the following way:

Less

Sales Discounts

Sales Commissions

Equals

Gross Profit

Less

Expenses

(Fixed & Variable)

Opening Stock

Equals

Plus

Stock Purchases

Equals

Stock available for sale

Less

Cost of Goods Sold

Less

Equals

Sales

Net Sales

HINT

Only those businesses that

have goods (products) to

sell will use the calculation

of cost of goods sold

Net Profit

TIP

Regularly produce profit and loss

information (monthly) and compare

against previous months activities to

ensure your profit expectations are

being met.

Closing Stock

Calculating the cost of

goods sold varies

depending on whether the

business is retail, wholesale,

manufacturing, or a service

business. In retailing and

wholesaling, computing the

cost of goods sold during

the reporting period involves

beginning and ending

inventories. This, of course,

includes purchases made

during the reporting period.

In manufacturing, it involves

finished-goods inventories,

plus raw materials

inventories, goods-in

process inventories, direct

labour, and direct factory

overhead costs.

In the case of a service

business, the revenue is

being derived from the

activities of individuals

rather than the sale of a

product and hence the

calculation of cost of goods

sold is a smaller task due to

the low-level use of

Equals

sold is a smaller task due to

the low-level use of

materials required to earn

the income.

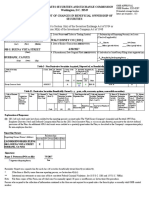

Income

Sales $52,000

Total Sales $52,000

Opening Stock $ -

Stock Purchases $34,320

Less Closing Stock $3,120

$20,800

Expenses

Advertising $500

Bank Service Charges $120

Insurance $500

Payroll $13,000

Professional Fees (Legal, Accounting) $200

Utilities & Telephone $800

Other: Computer Software $480

Expenses total $15,600

$5,200

Profit and Loss Statement

For the Period ended Year One

Where a business is a service business, that is, you are selling services not goods or

products, then the profit and loss statement will generally not have a cost of goods sold

calculation. In some instances, where labour costs can be directly attributed to sales, then

you may consider including these costs as a cost of goods (services) sold.

Joes Cost of Goods Calculation

Opening Stock Nil

Add Stock Purchased during the year $34,320 (1100 tyres @ 31.20 each)

Equals Stock available to sell $34,320

Less Stock on hand at end of year $ 3,120 (100 tyres @ 31.20 each)

Cost of Goods Sold $31,200

Note; Cost of Goods Sold calculation:

Towards the end of the year, Joe manages to purchase 100 more tyres on credit from his

supplier for an order in the new year. This leaves him with $3,120 of stock on hand at the

end of the year.

Cost of Goods Sold

Total Cost of Goods Sold(COGS)

$31,200

Gross Profit

Net Profit before Tax

Joes Motorbike Tyres

Calculating the cost of

goods sold varies

depending on whether the

business is retail, wholesale,

manufacturing, or a service

business. In retailing and

wholesaling, computing the

cost of goods sold during

the reporting period involves

beginning and ending

inventories. This, of course,

includes purchases made

during the reporting period.

it involves

goods inventories,

plus raw materials

inventories, goods-in-

process inventories, direct

labour, and direct factory

In the case of a service

business, the revenue is

being derived from the

activities of individuals

rather than the sale of a

product and hence the

calculation of cost of goods

sold is a smaller task due to

level use of

sold is a smaller task due to

level use of

materials required to earn

( 1,000 tyres @ $ 52

each)

( See note below)

Profit and Loss Statement

For the Period ended Year One

Where a business is a service business, that is, you are selling services not goods or

products, then the profit and loss statement will generally not have a cost of goods sold

calculation. In some instances, where labour costs can be directly attributed to sales, then

you may consider including these costs as a cost of goods (services) sold.

Joes Cost of Goods Calculation

Opening Stock Nil

Add Stock Purchased during the year $34,320 (1100 tyres @ 31.20 each)

Equals Stock available to sell $34,320

Less Stock on hand at end of year $ 3,120 (100 tyres @ 31.20 each)

Cost of Goods Sold $31,200

Note; Cost of Goods Sold calculation:

Towards the end of the year, Joe manages to purchase 100 more tyres on credit from his

supplier for an order in the new year. This leaves him with $3,120 of stock on hand at the

end of the year.

Joes Motorbike Tyres

Small Business Victoria: Information sheet

Profit & Loss Statement

Jan 13 Feb 13 Mar 13 Apr 13 May 13 Jun 13 Jul 13 Aug 13 Sep 13 Oct 13 Nov 13 Dec 13

Sales

Sale of goods/services

Sundry Income (e.g. Commission earned,

frachise fees etc.)

Etc.

Total Sales 0 0 0 0 0 0 0 0 0 0 0 0

Less Discounts/Commissions

Sales Discounts given

Sales Commissions paid

Total Discounts/ Commissions 0 0 0 0 0 0 0 0 0 0 0 0

Total Net Income 0 0 0 0 0 0 0 0 0 0 0 0

Opening Stock

Stock Purchased

0 0 0 0 0 0 0 0 0 0 0 0

Less Closing Stock

Total Cost of Sales 0 0 0 0 0 0 0 0 0 0 0 0

Gross Profit 0 0 0 0 0 0 0 0 0 0 0 0

Bank charges

Credit card commission

Consultant fees

Office Supplies

License fees

Business insurance

Etc.

Total General & Administrative 0 0 0 0 0 0 0 0 0 0 0 0

Advertising

Promotion - General

Promotion - Other

Etc.

Total Marketing & Promotional 0 0 0 0 0 0 0 0 0 0 0 0

Newspapers & magazines

Parking/Taxis/Tolls

Entertainment/Meals

Travel/Accomodation

Laundry/dry cleaning

Cleaning & cleaning products

Sundry supplies

Equipment hire

Etc.

Total Operating Expenses 0 0 0 0 0 0 0 0 0 0 0 0

How to use it: Give careful thought to the headings. Expand the sales income and expenses area if your business has distinct categories (e.g. a restaurant may have food sales and beverage sales listed separately

and cost of sales for each also separated).

General & Administrative

Marketing & Promotional

Operating Expenses

Month

Income

Cost of Sales

Expenses

Fuel

Vehicle service costs

Tyres & other replacement costs

Insurance

Registrations

Total Motor Vehicle Expenses 0 0 0 0 0 0 0 0 0 0 0 0

Domain name registration

Hosting expenses

etc

Total Website Expenses 0 0 0 0 0 0 0 0 0 0 0 0

Permanent

Salaries/Wages

PAYE

Superannuation

Other - Employee Benefits

Recruitment costs

Total Perm. Employment Expenses 0 0 0 0 0 0 0 0 0 0 0 0

Casual

Salaries/Wages

PAYE

Superannuation

Other - Employee Benefits

Recruitment costs

Total Casual Employment Expenses 0 0 0 0 0 0 0 0 0 0 0 0

Workcover Insurance

Total Employment Expenses 0 0 0 0 0 0 0 0 0 0 0 0

Electricity/Gas

Telephones

Property Insurance

Rates

Rent

Repair & maintenance

Waste removal

Water

Etc.

Total Occupancy Costs 0 0 0 0 0 0 0 0 0 0 0 0

Total Other Expenses 0 0 0 0 0 0 0 0 0 0 0 0

0 0 0 0 0 0 0 0 0 0 0 0

Month Net Profit / (Loss) 0 0 0 0 0 0 0 0 0 0 0 0

0 0 0 0 0 0 0 0 0 0 0 0 Total Year to Date Net Profit / (Loss)

Total Expenses

Employment Expenses

Motor Vehicle Expenses

Website Expenses

Other Expenses

Occupancy Costs

Small Business Victoria: Information sheet

Profit & Loss Statement

Jan 13 Feb 13 Mar 13 Apr 13 May 13 Jun 13 Jul 13 Aug 13 Sep 13 Oct 13 Nov 13

Income

Total Sales 0 0 0 0 0 0 0 0 0 0 0

Less Total Disc/Comm 0 0 0 0 0 0 0 0 0 0 0

Total Net Income 0 0 0 0 0 0 0 0 0 0 0

0 0 0 0 0 0 0 0 0 0 0

Gross Profit 0 0 0 0 0 0 0 0 0 0 0

Expenses

General & Administrative 0 0 0 0 0 0 0 0 0 0 0

Marketing & Promotional 0 0 0 0 0 0 0 0 0 0 0

Operating Expenses 0 0 0 0 0 0 0 0 0 0 0

Motor Vehicle Expenses 0 0 0 0 0 0 0 0 0 0 0

Website Expenses 0 0 0 0 0 0 0 0 0 0 0

Total Employment Expenses 0 0 0 0 0 0 0 0 0 0 0

Occupancy Costs 0 0 0 0 0 0 0 0 0 0 0

Other Expenses 0 0 0 0 0 0 0 0 0 0 0

0 0 0 0 0 0 0 0 0 0 0

Monthly Net Profit / (Loss) 0 0 0 0 0 0 0 0 0 0 0

0 0 0 0 0 0 0 0 0 0 0

Total Expenses

How to use it: Give careful thought to the headings. Expand the sales income and expenses area if your business has distinct categories (e.g. a restaurant may have food sales and

beverage sales listed separately and cost of sales for each also separated).

Month

Total Year to Date Net Profit

/ (Loss)

Less Total Cost of Gooods Sold

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Profit and Loss Ratios

Mark Up

((Net Income Less Cost of Goods Sold) /

(Cost of Goods Sold)) x 100

Break Even (

Expenses/

((1-(Cost of Goods Sold/ Net Income))

Gross Margin

(Gross Profit / Net Income)

Net Margin (Net

Profit / Net Income)

Dec 13

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

Cash $5,100

Debtors $18,000

Stock $3,120

$26,220

Computer $5,500

Store Fit Out $8,100

$28,600

$54,820

Credit Card $5,500

Creditors $4,120

$9,620

$9,620

$45,200

Owners Funds $40,000

Current Year Profit $5,200

$45,200

TOTAL LIABILITIES

NET ASSETS

Shareholders Equity

TOTAL SHAREHOLDERS EQUITY

Non-current Liabilities

Total Non-current Liabilities

Total Current Assets

Non-current Assets

Office Equipment $15,000

Total Non-current Assets

TOTAL ASSETS

Current Liabilities

Total Current Liabilities

Joes Motorbike Tyres

Balance Sheet

As at end of Year One

Current Assets

Small Business Victoria: Information sheet

Start of

Business Jun 13 Dec 13

General

Rates

Workcover

Insurance

Etc.

Total Prepaid expenses 0 0 0

Tyres

Parts

Etc.

Total Inventory 0 0 0

0 0 0

Computer

Store Fit Out

Office Equipment

Leasehold

Buildings & improvements

Furniture & Fixtures

Etc.

0 0 0

Total Assets 0 0 0

Bank Overdraft

Credit Card Debt

Current Assets

Total Current Assets

Liabilities

Debtors

Inventory

Fixed Assets

Total Fixed Assets

Balance Sheet

Prepare a balance sheet for the start of the business, six months later and then at the end of the first year. Draw

the information from the Profit & Loss Statement and the Cash Flow Statement. A Balance Sheet brings together

the results from the Profit & Loss Statement and the Cash Flow Statement. (Download it from the Financial

Management section of the Business Victoria website at www.business.vic.gov.au.)

This statement shows the financial position of

the business "as at " a point in time

Prepaid Expenses

Cash on hand

How to use it: Fill in the figures below, expanding or reducing the assets, liabilities and shareholders equity areas.

Month

Short term Investments

Other current assets

Assets

Current Liabilities

Creditors

GST collected

Etc.

0 0 0

Motor Vehicle Loan

Equipment Finance

Long term Loans

0 0 0

Total Liabilities 0 0 0

0 0 0

Owners Funds

Retained Earnings

Current Year Profit

0 0 0

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

0 0 0

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

Current Ratio (Current Assets / Current Liabilities)

Quick Ratio ( Current Assets less inventory) / (Current

Liabilities less bank overdraft)

Shareholders Funds ( Equity)

Current portion of long term debt

Net Assets

Debt to Equity Ratio (Total

Liabilities / Total Shareholders Funds)

Total Current Liabilities

Long Term Liabilities

Total Long Term Liabilities

Total Shareholders Funds (Equity)

Balance Sheet Ratios

Working Capital Funds (Current

Assets Less Current Liabilities)

Leverage Ratio (Total Liabilities / Total Assets)

Superannuation

PAYG Witholding Payable

Workcover Insurance Payable

Za period 01. - 31.Juli

Za poslovnicu arija / Bravadiluk 15

Cashflows from Operations

Cash receipts from customers

(enter positive amounts) Cash Sales

Cash collected from customers (debtors)

Funding from Creditors

Stock purchased, not yet paid

Cash paid for

(enter negative amounts) Total Expenses

Inventory (stock)purchases

Funding to Debtors

Sales made not yet collected

Net Cash Flow from Operations -

Investing Activities

Cash receipts from

(enter positive amounts) Sale of property and equipment

Matured Investments

Cash paid for

(enter negative amounts) Purchase of property and equipment

Purchase of investments

Net Cash Flow from Investing Activities -

[42]

Financing Activities

Cash receipts from

(enter positive amounts) Increase in short term debt

Increase in long term debt

Increase in equity (proceeds from owners)

Cash paid for

(enter negative amounts) Repayment of loans

Dividends

Net Cash Flow from Financing Activities -

Net Increase in Cash -

Cash at End of Year -

Cash Flow Statement

You might also like

- The Key Performance Indicators (Kpis) and Their Impact On Overall Organizational PerformanceDocument18 pagesThe Key Performance Indicators (Kpis) and Their Impact On Overall Organizational PerformanceAnakin AmeNo ratings yet

- Nesto Interesantno..Kraca Analiza FirmeDocument12 pagesNesto Interesantno..Kraca Analiza FirmeAnakin AmeNo ratings yet

- Strategy Customer CentricityDocument15 pagesStrategy Customer CentricityAnakin AmeNo ratings yet

- 101 Keto RecipesDocument148 pages101 Keto Recipesnakarsha67% (3)

- Finansijska Analiza PrimjerDocument9 pagesFinansijska Analiza PrimjerAnakin AmeNo ratings yet

- Graphic BundleDocument101 pagesGraphic BundleAnakin AmeNo ratings yet

- Compass Spending PlanDocument12 pagesCompass Spending PlanAnakin AmeNo ratings yet

- CV StaffDocument16 pagesCV StaffAnakin AmeNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 9.1 Overview of The Cost of CapitalDocument21 pages9.1 Overview of The Cost of CapitalTawan VihokratanaNo ratings yet

- Inventory Management at KFILDocument51 pagesInventory Management at KFILSaikumar KalalNo ratings yet

- Abmbrc Assignment 1Document14 pagesAbmbrc Assignment 1walsondevNo ratings yet

- Cost of Capital ChapterDocument57 pagesCost of Capital ChapterVina 비나 Pedro100% (4)

- Regulatory Framework of M&ADocument5 pagesRegulatory Framework of M&ARaghuramNo ratings yet

- Fundamentals OF Investment: As Per CBCS SyllabusDocument31 pagesFundamentals OF Investment: As Per CBCS Syllabus2018 01097No ratings yet

- Vertical and Trend AnalysisDocument18 pagesVertical and Trend AnalysisAnonymous 8yu6DvANteNo ratings yet

- Case Study Practice For Investment Banking Assessment Centers 2011/12 EditionDocument33 pagesCase Study Practice For Investment Banking Assessment Centers 2011/12 EditionFanny ChanNo ratings yet

- Infibeam RHPDocument397 pagesInfibeam RHPJenil ShahNo ratings yet

- CFA Institute Ethics CasesDocument49 pagesCFA Institute Ethics CasesTrần Đức TàiNo ratings yet

- 103-Monserrat vs. CeranDocument5 pages103-Monserrat vs. Ceranenan_intonNo ratings yet

- MahalanobisDocument14 pagesMahalanobisLinda FreemanNo ratings yet

- Chap 5-Pages-45-46,63-119Document59 pagesChap 5-Pages-45-46,63-119RITZ BROWNNo ratings yet

- Auditing Share Capital: Assertions, Risks and Procedures - 1620034489284Document8 pagesAuditing Share Capital: Assertions, Risks and Procedures - 1620034489284Farhan Osman ahmedNo ratings yet

- Term Paper - CB 604 - Section A - Financial Institutions and MarketsDocument22 pagesTerm Paper - CB 604 - Section A - Financial Institutions and MarketsISTIAK Mahmud MitulNo ratings yet

- A Study On Working Women and Their InvestmentDocument70 pagesA Study On Working Women and Their InvestmentRITIKA PATHAKNo ratings yet

- Wise Holdings Vs GarciaDocument2 pagesWise Holdings Vs GarciaMir Solaiman100% (2)

- Nism Ii B - Registrar - Practice Test 4Document19 pagesNism Ii B - Registrar - Practice Test 4HEMANSH vNo ratings yet

- Shareholdersx27 Equity Prac 1 PDF FreeDocument10 pagesShareholdersx27 Equity Prac 1 PDF FreeIllion IllionNo ratings yet

- Amendment To The Commercial Code in Slovakia - News FlashDocument4 pagesAmendment To The Commercial Code in Slovakia - News FlashAccaceNo ratings yet

- Gladiator Indicator: IntroducingDocument5 pagesGladiator Indicator: IntroducingDhiraj RawatNo ratings yet

- 1 REPUBLIC VS COCOFED G.R. No. 147062-64 PDFDocument29 pages1 REPUBLIC VS COCOFED G.R. No. 147062-64 PDFJanMarkMontedeRamosWongNo ratings yet

- Chapter 5 - Risk and ReturnDocument50 pagesChapter 5 - Risk and ReturnkjNo ratings yet

- NISM V A Sample 500 Questions - PDF - Bonds (Finance) - Mutual FundsDocument73 pagesNISM V A Sample 500 Questions - PDF - Bonds (Finance) - Mutual FundsVineetNo ratings yet

- Cash Flow Ratio Analysis - Company BankruptcyDocument4 pagesCash Flow Ratio Analysis - Company BankruptcyhartinahNo ratings yet

- Chapter 1 Corporate FinanceDocument11 pagesChapter 1 Corporate FinanceYuk SimNo ratings yet

- Form 4Document1 pageForm 4Ђорђе МалешевићNo ratings yet

- Bullet Revision Chapter 3Document33 pagesBullet Revision Chapter 3mrkabir1600No ratings yet

- Chapter 1 - Buyback of SecuritiesDocument13 pagesChapter 1 - Buyback of SecuritiesKitrakleog 03052002No ratings yet

- Tally Erp 9.0 Material Creating Inventory Masters in Tally Erp 9.0Document20 pagesTally Erp 9.0 Material Creating Inventory Masters in Tally Erp 9.0Raghavendra yadav KMNo ratings yet