Professional Documents

Culture Documents

Adjusting Entry For Accounting

Uploaded by

Thanh Huyen NguyenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adjusting Entry For Accounting

Uploaded by

Thanh Huyen NguyenCopyright:

Available Formats

1

The Inter-relationship between the Income Statement and the Balance Sheet

Income Statement The Balance Sheet

ASSETS = LIABILITIES + EQUITY

Revenue

Expenses

2

Misc. Confusing Topic

1. Sale of property, plant, and equipment versus the sale of inventory.

a. Sold inventory that cost $60 for $100.

b. Sold land that cost $800 for $1,000.

60

Balance Sheet Income Statement

Cash Inventory Revenue Cost of goods sold

800

Cash Land Gain on sale (IS)

3

The final accounting tool the journal entry

Accounts Debits Credits

4

= +

Dr. Cr. Dr. Cr. Dr. Cr.

+ - - + - +

Contributed Capital

Dr. Cr. Dr. Cr.

- + - +

Income

Statement Dr. Cr. Dr. Cr.

Accounts

- + + -

Revenues Expenses

Retained Earnings

Assets Liabilities Owners' Equity

The Balance Sheet Accounts

5

Analyzing Income Statements using Common Size Income Statements

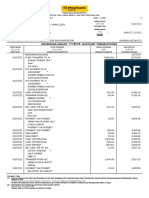

Geo Group Inc. For the Years Ended December 31, Common Size

Income Statement 2005 2004 2003 2005 2004 2003

Revenue:

Revenue $ 612,900 $ 593,994 $ 549,238 100% 100% 100%

Expenses:

Operating 540,128 495,226 467,018 88.13% 83.37%

85.03%

General and administrative 48,958 45,879 39,379 7.99% 7.72% 7.17%

Depreciation and amortization 15,876 13,898 13,341 2.59% 2.34% 2.43%

Total expenses 604,962 555,003 519,738 98.70% 93.44%

94.63%

Operating income 7,938 38,991 29,500 1.30% 6.56% 5.37%

Other (income) expense:

Interest expense, net 23,016 22,138 17,896 3.76% 3.73% 3.26%

Other (income) expense (9,131) (8,541) (61,623) -1.49% -1.44% -11.22%

13,885 13,597 (43,727) 2.27% 2.29% -7.96%

Income before tax (5,947) 25,394 73,227 -0.97% 4.28% 13.33%

Income tax (expense) benefit 11,826 (8,231) (36,852) 1.93% -1.39% -6.71%

Income from continuing operations 5,879 17,163 36,375 0.96% 2.89% 6.62%

Special items 1,127 (348) 3,644 0.18% -0.06%

0.66%

Net income (loss) $ 7,006 $ 16,815 $ 40,019

1.14% 2.83% 7.29%

=________

=________

6

Step One: Compute every item on the IS as a percentage of Sales.

Step Two: Any percentage that increases (decreases) from the previous year is growing faster (slower) than revenues.

7

The Accounting Cycle

During the Accounting Year End of the Accounting Year

General

J ournal

General

Ledger

Trial Balance Adjusted

Trial Balance

Financial

Statements

Adjusting

Entries

8

Adjusting Entries

Accrual accounting requires adjustments at the end of the reporting period (primarily because of

matching and revenue realization).

1. Some items have not been recorded.

2. Some items need to be updated.

Objective:

To make sure that the proper amount of revenues and expenses have been recognized in the correct

accounting period.

Financial Statements affected

1. Balance sheet primarily current asset and current liability accounts

2. Income statement primarily revenue and expense accounts

9

Example

J une 1: purchased $500 of office supplies

J une 30: Supplies costing $425 are left at the end of the month.

How does this affect our J une Income Statement and the J une 30 Balance Sheet?

Balance Sheet Income Statement

(end of J une) (for the month of J une)

Supplies Supply Expense

10

Five types of adjusting entries

1. Prepaid items

2. Unearned or deferred revenues

3. Accrued expenses

4. Accrued revenues

5. Estimated items

Three Characteristics of Adjusting Entries

1.

2.

3.

Cash amount

previously recorded

Cash amount NOT

yet recorded

Non-Cash

11

List the accounts that are likely to need adjustments.

InfoLogix Inc

Balance Sheet ($ thousands) December 31,

2009 2008 Change

ASSETS

Currents assets:

Cash and cash equivalents $1,018 $3,037

Accounts receivables (net of uncollectible accounts)

14,158 22,610

Unbilled revenue 252 1,498

Inventory, net

1,089 1,775

Prepaid expenses 674 1,228

Total current assets 17,191 30,148

Property and equipment, net 600 944

Intangible assets, net 7,343 8,709

Goodwill 10,337 10,540

Deferred financing costs 471 501

Total assets $35,942 $50,842

12

LIABILITIES AND STOCKHOLDERS EQUITY

Accounts payable $7,591 $11,099

Line of credit 7,559 9,000

Current portion of long-term debt

12,417 12,163

Sales tax payable 276 477

Accrued expenses payable 3,183

3,090

Accrued earn out payable 1,958 1,958

Deferred revenue 1,690 276

Other liabilities 900

Total current liabilities 34,674 38,963

Long-term debt, net of current maturities 345 4,401

Warrant liabilities 3,467

Total liabilities 38,486 43,364

Stockholders (deficit) equity:

Common stock, issued and outstanding

3,722,156 shares and 1,024,091 shares

Additional paid in capital 38,132 25,766

Accumulated deficit (40,676) (18,288)

Total stockholders (deficit) equity (2,544) 7,478

Total liabilities and stockholders (deficit) equity $35,942 $50,842

13

Deferrals: Cash transaction has occurred prior to year-end

1. Prepaid Expenses (allocate expired assets to expense)

J anuary 1: Prepaid one-year rent on equipment, $1,500

J uly1: Accounting year-end

Balance Sheet Asset Accounts Income statement account

Prepaid Expense (BS) Cash Rent Expense

BB 0

1/1: 1,500 1/1: 1,500

EB

Jan. 1 Prepaid expense (BS) 1,500

Cash 1,500

Adjust. 7/1

14

2. Unearned or deferred revenue (allocate earned portion of unearned revenue to revenue)

J anuary 1: Rented a building to a customer, two years in advance, $2,000

J uly 1: Accounting year-end

Balance Sheet Accounts Income statement account

Deferred revenue (BS-liability) Cash Rent Revenue

BB 0

1/1: 2,000 1/1: 2,000

EB

Jan. 1 Cash 2,000

Deferred Revenue (BS) 2,000

Adjust. 7/1

15

3. Accrued expense (record expenses to reflect expenses, not paid, but incurred during the year)

Dec. 15 Dec. 31 J an. 15

Year-end is December 31.

Wages are earned $3,000 a month, but are paid on the 15

th

of each month. At December 31, $1,500

is owed the workers.

Balance Sheet Accounts Income statement account

Accrued Payable (BS lia.) Cash Wage Expense

BB 0

EB

12/31 Adjustment:

Jan 15, payment:

16

4. Accrued revenue (record revenue to reflect revenue earned but not yet collected)

On November 1, you invested in a $10,000 1-year 6% CD. The accounting year ends on December

31.

Balance Sheet Accounts Income statement account

Accrued revenue (BS-asset) Cash Interest Income (IS)

BB 0

EB

12/31 Adjustment:

17

InfoLogix Deferrals: Cash transaction has occurred prior to year-end

(Cash amount XX unknown, YY expense or revenue unknown)

1. Prepaid Expenses (allocate expired assets to expense)

Balance Sheet Asset Account

Prepaid Expense (BS)

BB 1,228

Cash Expense

Paid Recognized

EB 674

Prepay: Prepaid expense (BS) XX

Cash XX

Adjustment: Expense (IS) YY

Prepaid expense (BS) YY

18

2. Unearned or deferred revenue (allocate earned portion of unearned revenue to revenue)

Balance Sheet liability Account

Deferred revenue (BS-liability)

BB 276

Revenue Cash in

Recognized advance

EB 1,690

In advance: Cash XX

Deferred Revenue (BS) XX

Adjustment: Deferred Revenue (BS) YY

Revenue (IS) YY

19

InfoLogix Accruals: Cash transaction has not yet occurred prior to year-end

3. Accrued Expenses (record expenses to reflect expenses, not paid, but incurred during the year)

As of December 31, incurred $3,183 of expenses not yet paid.

Balance Sheet Liability Account

Accrued Expense Payable (BS)

BB 3,090

Expense recognized

Cash paid before cash paid

EB 3,183

12/31 Adjustment: Expense (IS) YY

Accrued expense payable (BS) YY

Payments during yr: Accrued expense payable (BS) XX

Cash XX

20

4. Accrued revenue (record revenue to reflect revenue earned but not yet collected)

Balance Sheet Asset Accounts

Unbilled revenue (BS-asset)

BB 1,498

Revenue earned Cash

not collected collected .

EB 252

12/31 Adjustment: Unbilled Revenue (BS) YY

Revenue (IS) YY

Collections during yr: Cash (BS) XX

Unbilled Revenue (BS) XX

21

Revenue: The Relationship between the Income Statement and the Balance Sheet Accounts

$XXX

$XXX

$XXX

$XXX

Current period

Future period (receivables)

Prior period (unearned or deferred revenue)

Cash Collected in:

Receivables

Deferred Revenues

Unearned or

Income Statement

Revenue (is recognized)

Balance Sheet

Current Assets Current Liabilities

Cash

1

2

3

1

2

3

22

The Impact of revenues on the financial statements:

Debit Credit

Cash (BS) XXX

Receivable (BS) XXX

Unearned Revenue (BS-CL) XXX

Revenue on IS XXX

Revenues result in a:

Credit to the IS

Debit to the BS

23

Expenses: The Relationship between the Income Statement and the Balance Sheet Accounts

$XXX

$XXX

$XXX

$XXX

Cash Paid in:

Current period

Prior period (prepaid item)

Future period (paid in the future)

Prepaid item

Accrued Payable

Income Statement

Expense (is recognized)

Balance Sheet

Current Assets Current Liabilities

Cash

1

2

3

1

2

3

24

The impact of expenses on the financial statements

Debit Credit

Expense (IS) XXX

Cash (BS) XXX

Prepaid item (BS) XXX

Accrued payable (BS-CL) XXX

Expenses result in a:

Debit to the IS

Credit to the BS

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Bill French Case StudyDocument3 pagesBill French Case StudyCresente Siglos100% (1)

- Supply Chain Management TutorialDocument52 pagesSupply Chain Management Tutorialterjun rustiaNo ratings yet

- CORPORATE INCOME TAX (Answer Key)Document5 pagesCORPORATE INCOME TAX (Answer Key)Rujean Salar AltejarNo ratings yet

- Calculate Working Capital and Prepare Balance SheetDocument18 pagesCalculate Working Capital and Prepare Balance SheetQUYNHNo ratings yet

- Introduction To SAP S4 HANA FICODocument25 pagesIntroduction To SAP S4 HANA FICOVennkatt ReddyNo ratings yet

- Chapter 01 - 21st Century LogisticsDocument34 pagesChapter 01 - 21st Century LogisticsJoshua MartinezNo ratings yet

- Case 1 Dan Case 2 Job Order CostingDocument6 pagesCase 1 Dan Case 2 Job Order CostingChantika JustiaraNo ratings yet

- Laporan Keuangan Bulanan KosDocument64 pagesLaporan Keuangan Bulanan KosRyan PratamaNo ratings yet

- L2 - ABFA1173 POA (Lecturer)Document21 pagesL2 - ABFA1173 POA (Lecturer)Tan SiewsiewNo ratings yet

- Jawaban Sesi 1 Ujikom Pt. BoombasstikDocument12 pagesJawaban Sesi 1 Ujikom Pt. BoombasstikNada NadyaNo ratings yet

- PACE Sample ExamDocument13 pagesPACE Sample ExamjhouvanNo ratings yet

- Chapter 7 PurchasingDocument5 pagesChapter 7 PurchasingKamble AbhijitNo ratings yet

- MBBsavings - 164017 212412 - 2022 07 31 PDFDocument3 pagesMBBsavings - 164017 212412 - 2022 07 31 PDFAdeela fazlinNo ratings yet

- Basic Accounting for Non-Accountants Part 1Document34 pagesBasic Accounting for Non-Accountants Part 1Elsa Mendoza0% (1)

- AA2 Chapter 11 SolDocument16 pagesAA2 Chapter 11 SolJoan RomeroNo ratings yet

- App 11 BDocument55 pagesApp 11 Bdoyeonkim21No ratings yet

- CSS Accounting & Auditing Topic-wise Past Papers: Marginal & Absorption CostingDocument3 pagesCSS Accounting & Auditing Topic-wise Past Papers: Marginal & Absorption CostingMasood Ahmad AadamNo ratings yet

- AFP Procurement SystemDocument28 pagesAFP Procurement SystemAngelMedranoViceraNo ratings yet

- WELS FARGO Bank - Statement - 123123Document7 pagesWELS FARGO Bank - Statement - 123123Alex Nezi50% (2)

- Introduction To CRM: Dr. Bhumija ChouhanDocument79 pagesIntroduction To CRM: Dr. Bhumija ChouhanPreetam JainNo ratings yet

- SAP - FI - Basics ConceptsDocument37 pagesSAP - FI - Basics Conceptsarjunasahu1986No ratings yet

- Accounts Receivable Vs Accounts PayableDocument12 pagesAccounts Receivable Vs Accounts PayableRaviSankarNo ratings yet

- Remittance Advise - $1111Document2 pagesRemittance Advise - $1111Samrat MazumderNo ratings yet

- P5-4, 6 Dan 8Document18 pagesP5-4, 6 Dan 8ramaNo ratings yet

- Elements of Accounting LectureDocument43 pagesElements of Accounting LectureRaissa Mae100% (1)

- Accounting EquationDocument6 pagesAccounting EquationFayaz MohammedNo ratings yet

- HOBADocument20 pagesHOBAJaira ClavoNo ratings yet

- Variable Costing and Absorption Costing Income StatementsDocument6 pagesVariable Costing and Absorption Costing Income StatementsSid Chaudhary100% (1)

- ACCA Paper F3 Financial Accounting Mock Exam QuestionsDocument23 pagesACCA Paper F3 Financial Accounting Mock Exam QuestionsOrion0088No ratings yet

- Business Blueprint for Roulands Braking India ProjectDocument262 pagesBusiness Blueprint for Roulands Braking India ProjectRohit shahiNo ratings yet